Free Financial Investment Review

Introduction

Welcome to the investment review of [XYZ Growth Fund]. This report aims to provide a comprehensive look at the fund’s performance and strategies, considering major market fluctuations and trends. Indeed, it is crucial for potential investors to understand the fund's stand on risk management, asset allocation, and return on investment (ROI). All provided information adheres strictly to US laws and financial standards.

Fund Overview

The [XYZ Growth Fund] focuses on capital appreciation, investing primarily in equities of companies displaying strong growth potential across diversified sectors. The fund aims to leverage market volatility by making strategic investments in high growth industries and sectors.

Investment Strategy

The primary objective of the [XYZ Growth Fund] is capital appreciation. To achieve this, the fund primarily invests in stocks of companies that have above-average growth prospects. The fund management adopts a rigorous system of quantitative and qualitative analysis to identify these growth companies.

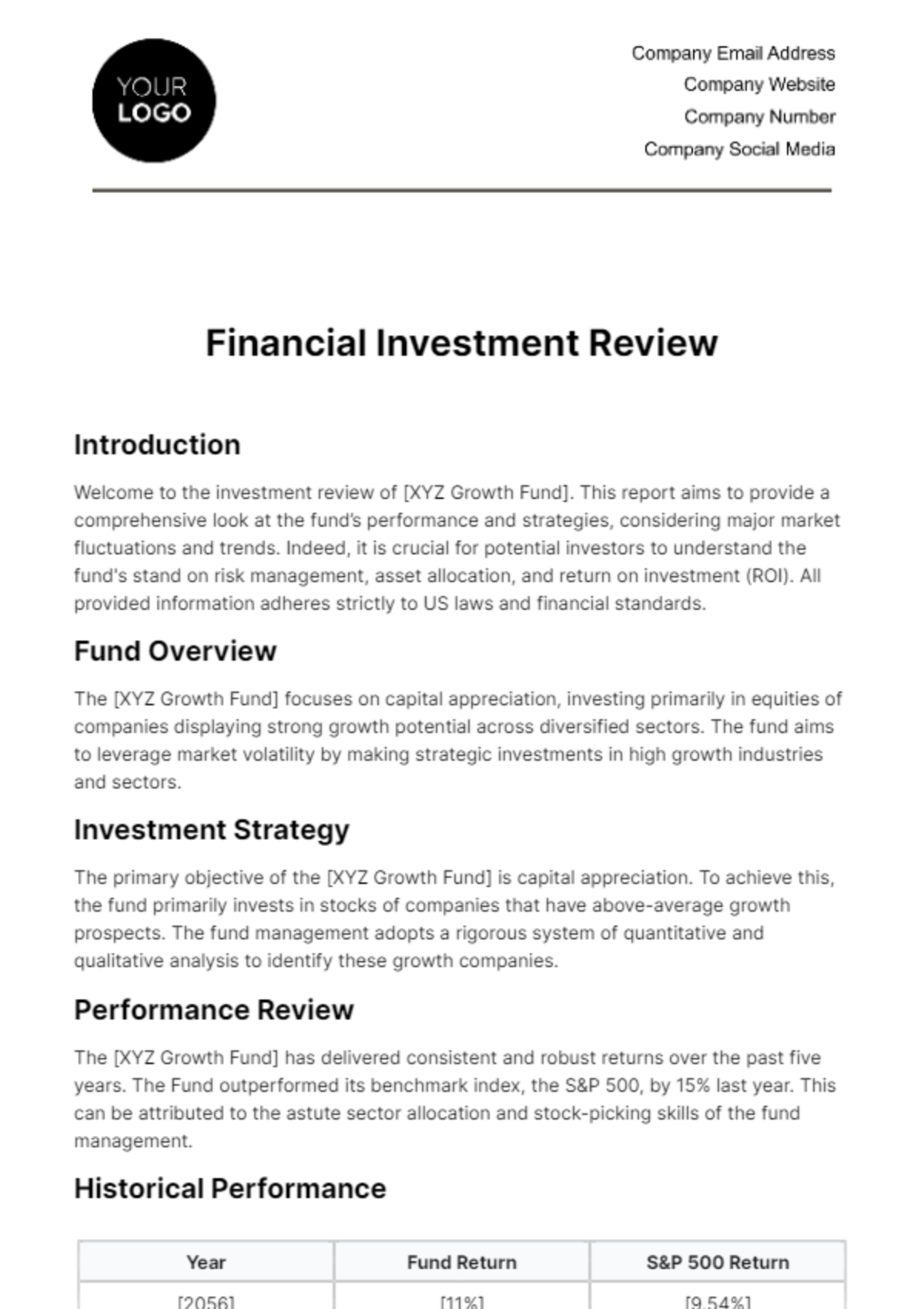

Performance Review

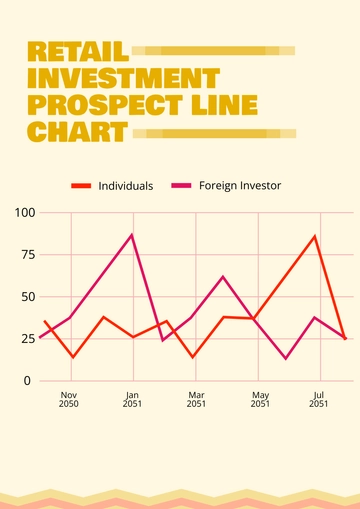

The [XYZ Growth Fund] has delivered consistent and robust returns over the past five years. The Fund outperformed its benchmark index, the S&P 500, by 15% last year. This can be attributed to the astute sector allocation and stock-picking skills of the fund management.

Historical Performance

Year | Fund Return | S&P 500 Return |

|---|---|---|

[2056] | [11%] | [9.54%] |

[2057] | [14%] | [21.82%] |

[2058] | [-6%] | [-4.38%] |

[2059] | [24%] | [31.48%] |

[2060] | [18%] | [18.40%] |

Pros and Cons

The primary benefit of the fund is its potential for high growth. The fund's aggressive growth strategy may make it an attractive option for those seeking capital appreciation. On the downside, the fund's growth-focused approach can lead to volatility, and the fund may underperform in market downturns.

Conclusion

In conclusion, the [XYZ Growth Fund] offers an exciting opportunity for investors seeking capital appreciation. However, potential investors should be comfortable with market fluctuations and should consider their personal risk tolerance and investment horizon before investing.

Document Version: [1.0]

Reviewed by: Your Name

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Upgrade your business documentations with Template.net's Financial Investment Review Template. Highly customizable and editable, this solution lets you create unique documents seamlessly editable in our Ai Editor Tool. Elevate your business communication effortlessly and efficiently with this versatile tool.