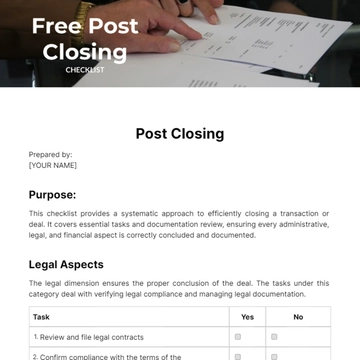

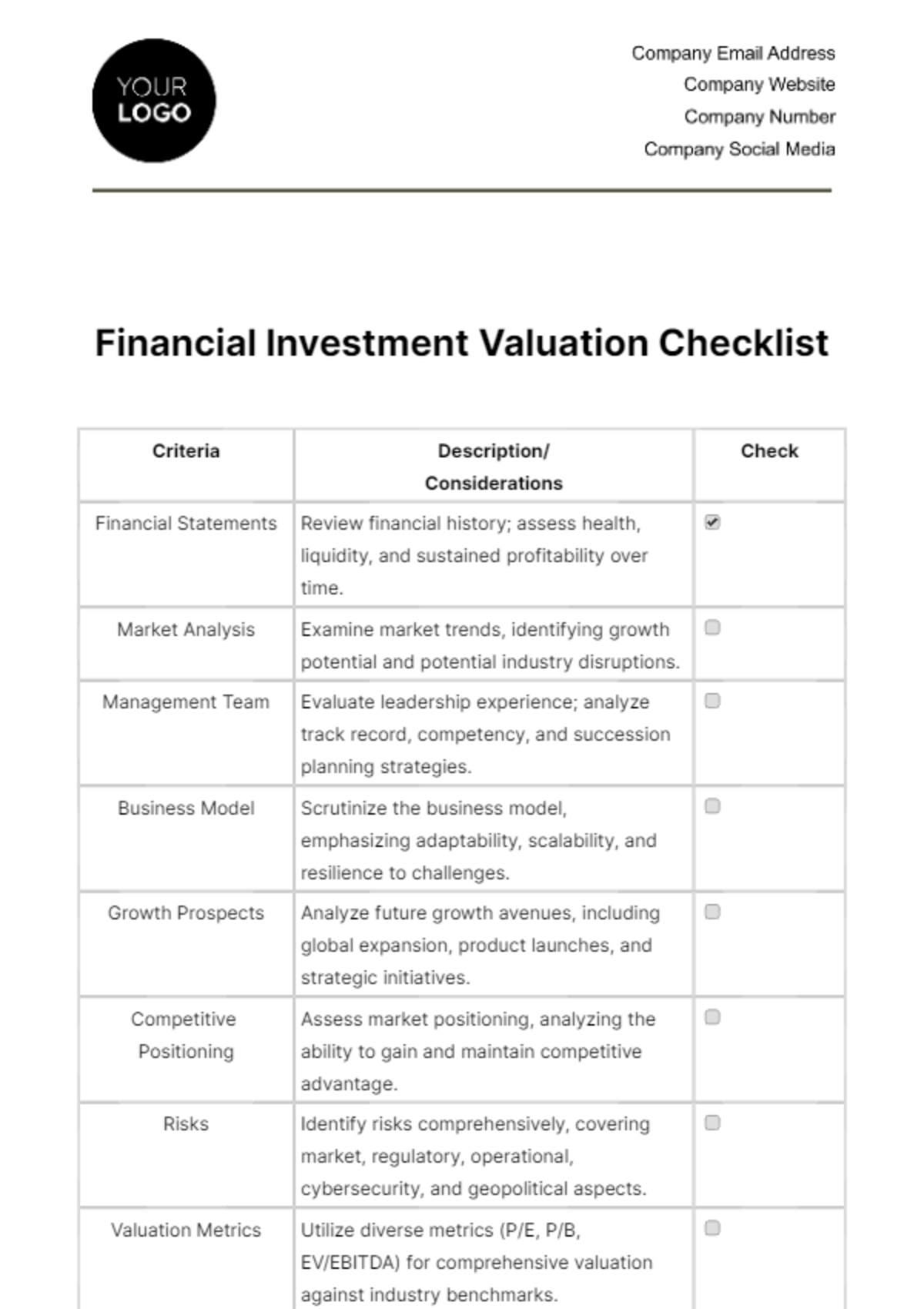

Free Financial Investment Valuation Checklist

Criteria | Description/ Considerations | Check |

Financial Statements | Review financial history; assess health, liquidity, and sustained profitability over time. | |

Market Analysis | Examine market trends, identifying growth potential and potential industry disruptions. | |

Management Team | Evaluate leadership experience; analyze track record, competency, and succession planning strategies. | |

Business Model | Scrutinize the business model, emphasizing adaptability, scalability, and resilience to challenges. | |

Growth Prospects | Analyze future growth avenues, including global expansion, product launches, and strategic initiatives. | |

Competitive Positioning | Assess market positioning, analyzing the ability to gain and maintain competitive advantage. | |

Risks | Identify risks comprehensively, covering market, regulatory, operational, cybersecurity, and geopolitical aspects. | |

Valuation Metrics | Utilize diverse metrics (P/E, P/B, EV/EBITDA) for comprehensive valuation against industry benchmarks. | |

Dividends and Returns | Consider long-term returns, evaluating historical dividend payouts and total shareholder returns. | |

Exit Strategy | Develop clear exit plans, exploring potential scenarios and identifying suitable exit channels. | |

Regulatory Environment | Understand the regulatory landscape, ensuring compliance, and anticipating potential regulatory changes. | |

Macroeconomic Factors | Assess broader economic factors, including interest rates, inflation, and economic cycles. | |

Sustainability and ESG Factors | Evaluate environmental, social, and governance practices, impacting long-term sustainability and performance. | |

Technological Trends | Examine technological impacts, assessing the company's adaptability and investment in innovation. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Evaluate investment value with our Financial Investment Valuation Checklist Template from Template.net! This editable and customizable template ensures a thorough valuation process ensuring precision. Optimize decision-making, ensuring your company's investments align with targeted financial goals, all within your control. Tailor the content effortlessly using our AI Editor Tool right away!

You may also like

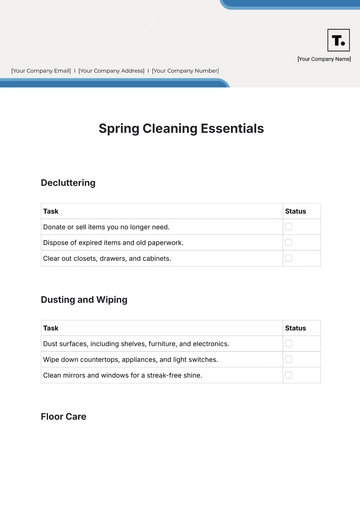

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

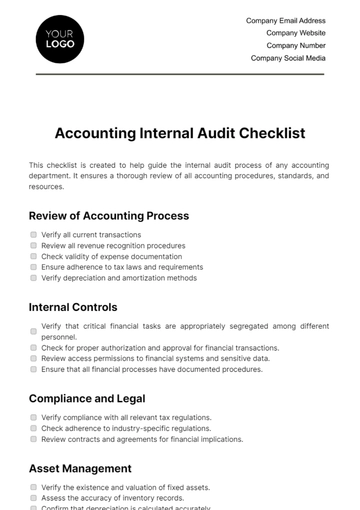

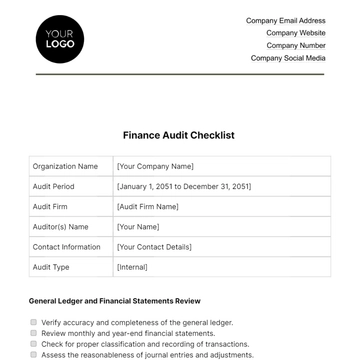

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

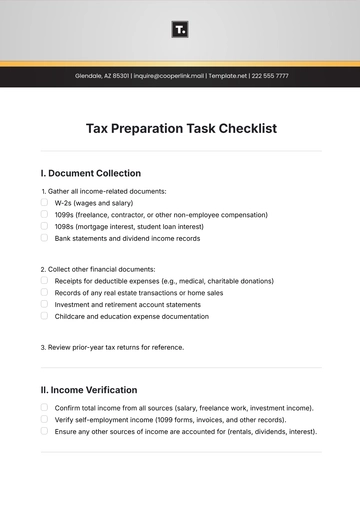

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

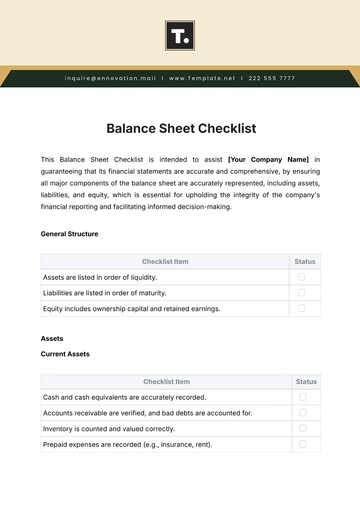

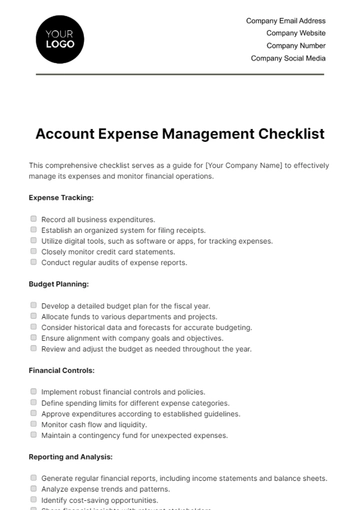

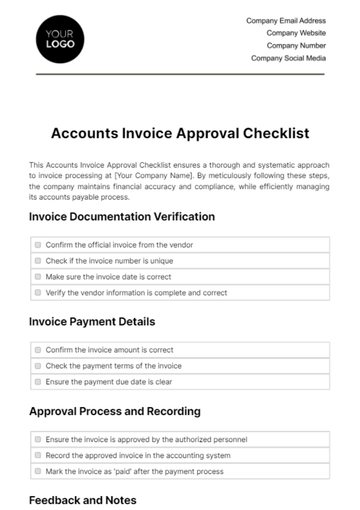

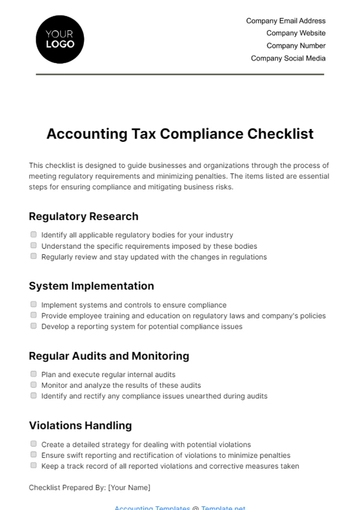

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

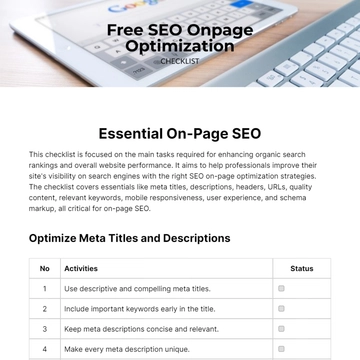

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

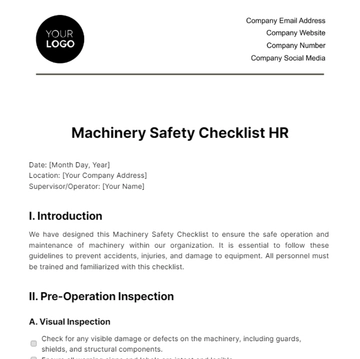

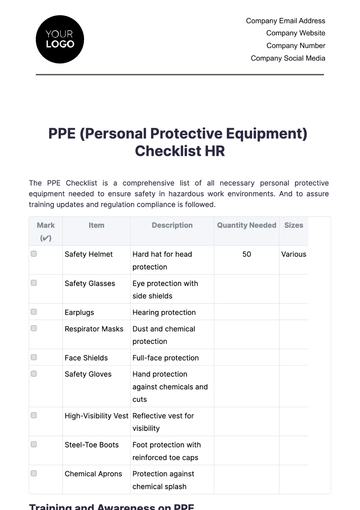

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist