Free Financial Review

Review Date: [Month Day, Year]

This Financial Review provides a concise and comprehensive analysis of [Your Company Name]'s financial performance and position as of [Month Day, Year]. It is designed to offer stakeholders essential insights and guidance for understanding our financial health.

Executive Summary

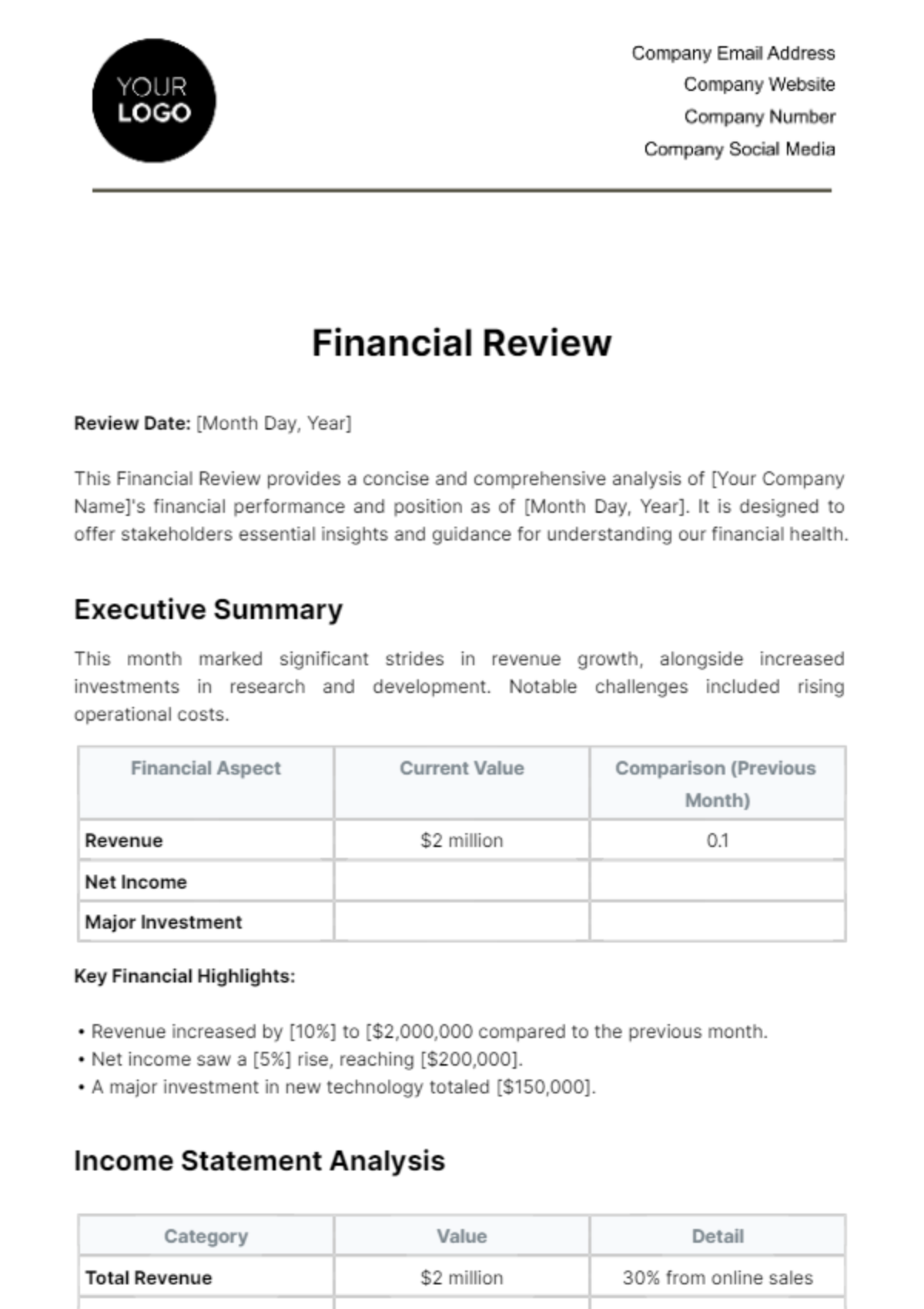

This month marked significant strides in revenue growth, alongside increased investments in research and development. Notable challenges included rising operational costs.

Financial Aspect | Current Value | Comparison (Previous Month) |

|---|---|---|

Revenue | $2 million | 0.1 |

Net Income | ||

Major Investment |

Key Financial Highlights:

Revenue increased by [10%] to [$2,000,000 compared to the previous month.

Net income saw a [5%] rise, reaching [$200,000].

A major investment in new technology totaled [$150,000].

Income Statement Analysis

Category | Value | Detail |

|---|---|---|

Total Revenue | $2 million | 30% from online sales |

Growth |

Total revenue was [$2,000,000], with a notable increase in online sales contributing to [30%] of the total revenue. Comparison with the previous month shows a [10%] increase, primarily driven by expanded marketing efforts.

Balance Sheet Assessment

Asset Evaluation:

Asset Type | Value | Details |

|---|---|---|

Current Assets | $1.5 million | Including $500,000 in cash reserves |

Non-current Assets |

Current assets stood at [$1,500,000], with cash reserves contributing [$500,000].

Non-current assets were valued at [$3,000,000], including recent technology investments.

Liabilities and Equity Analysis:

Aspect | Value | Details |

|---|---|---|

Total Liabilities | $1.2 million | Long-term loan: $600,000 |

Shareholder’s Equity |

Total liabilities was [$1,200,000], with a notable long-term loan accounting for [$600,000]. Shareholder’s equity increased to [$3,300,000], reflecting retained earnings and capital infusion.

Cash Flow Statement Review

Activity Type | Amount | Details |

|---|---|---|

Investing Activities | $150,000 | Directed towards technology upgrades |

Financing Activities | $100,000 | Primarily through new equity issuance |

Cash used in investing activities was [$150,000], directed towards technology upgrades. Financing activities generated [$100,000], primarily through new equity issuance.

Concluding Remarks and Future Outlook

[Your Company Name] demonstrates strong financial health with robust revenue growth and effective cost management. The investment in technology, though impacting short-term cash flow, positions the company for future growth.

This Financial Review encapsulates [Your Company Name]'s solid financial performance and promising outlook. The company’s strategic investments and effective financial management are pivotal in driving sustainable growth and enhancing shareholder value.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Financial Review becomes effortless with Template.net's editable and customizable templates. Delve into concise and clear financial insights generated by your review. Boasting seamless integration with our Ai Editor Tool, these templates let your business thrive. Maximize financial potential. Increase efficiency. Excel with Template.net's financial review templates.