Free Financial Investment Reconciliation Statement

Reconciliation Statement

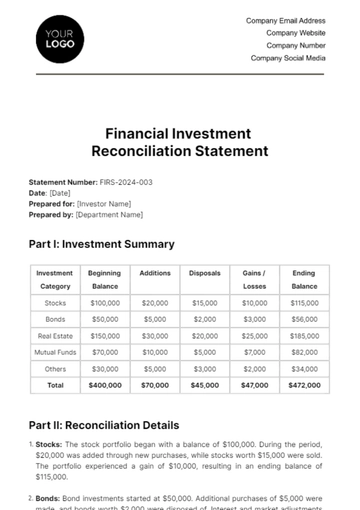

Statement Number: FIRS-2024-003

Date: [Date]

Prepared for: [Investor Name]

Prepared by: [Department Name]

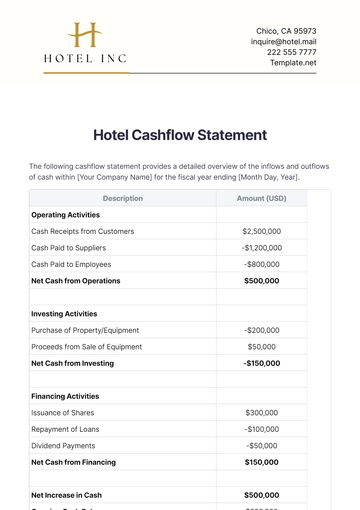

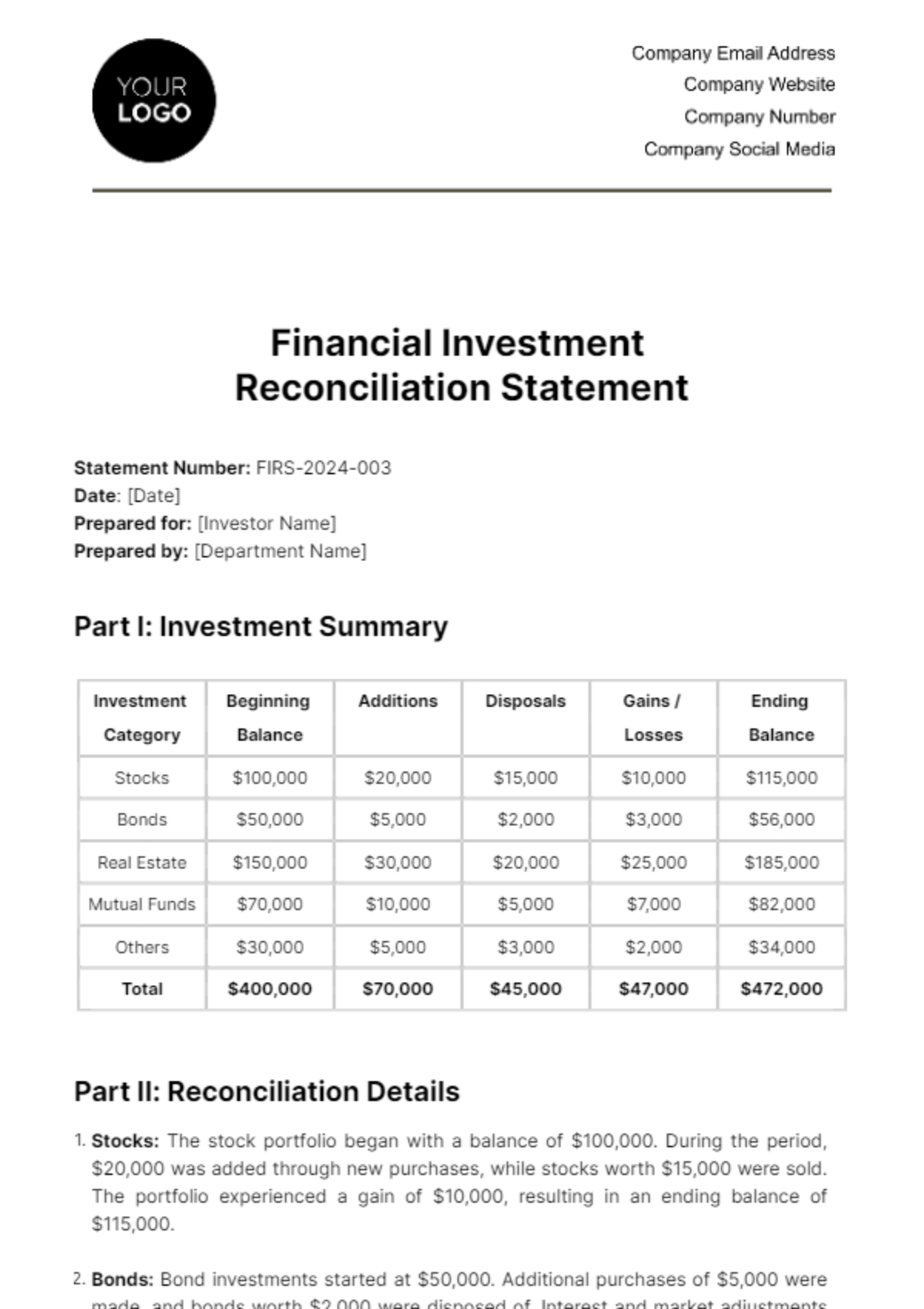

Part I: Investment Summary

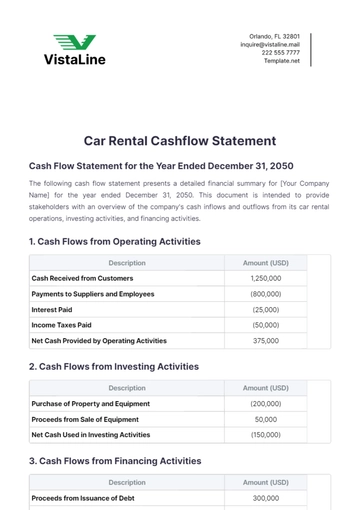

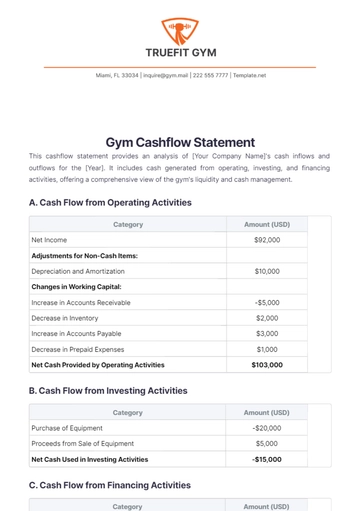

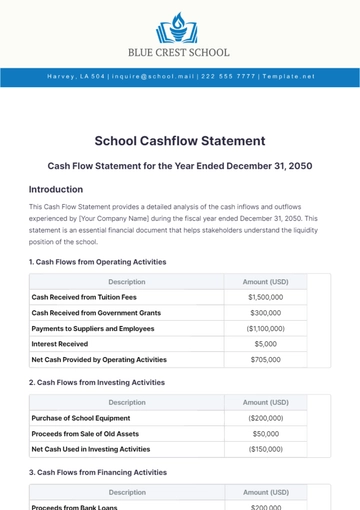

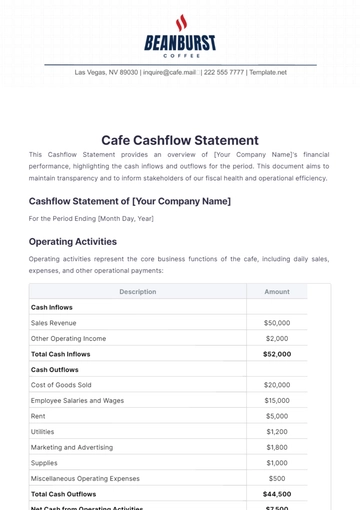

Investment Category | Beginning Balance | Additions | Disposals | Gains / Losses | Ending Balance |

Stocks | $100,000 | $20,000 | $15,000 | $10,000 | $115,000 |

Bonds | $50,000 | $5,000 | $2,000 | $3,000 | $56,000 |

Real Estate | $150,000 | $30,000 | $20,000 | $25,000 | $185,000 |

Mutual Funds | $70,000 | $10,000 | $5,000 | $7,000 | $82,000 |

Others | $30,000 | $5,000 | $3,000 | $2,000 | $34,000 |

Total | $400,000 | $70,000 | $45,000 | $47,000 | $472,000 |

Part II: Reconciliation Details

Stocks: The stock portfolio began with a balance of $100,000. During the period, $20,000 was added through new purchases, while stocks worth $15,000 were sold. The portfolio experienced a gain of $10,000, resulting in an ending balance of $115,000.

Bonds: Bond investments started at $50,000. Additional purchases of $5,000 were made, and bonds worth $2,000 were disposed of. Interest and market adjustments led to gains of $3,000, bringing the ending balance to $56,000.

Real Estate: The real estate investment began at $150,000. New investments amounting to $30,000 were made, and sales of $20,000 occurred. Property value appreciation contributed to a gain of $25,000, resulting in an ending balance of $185,000.

Mutual Funds: The mutual fund portfolio had an initial value of $70,000. Contributions totaling $10,000 and redemptions of $5,000 were recorded. The funds gained $7,000 in value, ending the period at $82,000.

Other Investments: Other types of investments, starting at $30,000, saw additions of $5,000 and disposals totaling $3,000. The category experienced a gain of $2,000, ending at $34,000.

Part III: Performance Analysis

The investment portfolio showed a robust performance, with an overall net gain of $47,000. This represents a combined increase of approximately 11.75% from the beginning balance. Realized gains, primarily from stock and real estate sales, contributed significantly to the portfolio's growth, accounting for $35,000 of the net gain. Unrealized gains, particularly in stocks and mutual funds, added $12,000 to the portfolio's value.

When compared to the relevant market benchmarks, the portfolio's performance was favorable. The stock component outperformed the S&P 500 index, while the real estate investments surpassed regional property value growth rates. The bond investments aligned closely with the Bloomberg Barclays US Aggregate Bond Index, reflecting a stable and risk-averse strategy. Mutual funds performance was on par with their respective fund benchmarks, indicating sound fund selection.

Reviewed By:

[Reviewer's Name]

[Reviewer's Position]

[Date]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Financial Investment Reconciliation Statement Template from Template.net streamlines the process of reconciling investment accounts. Editable and customizable in our AI tool, it is designed for accuracy and clarity in matching investment records with financial statements. This template is essential for investors and finance professionals seeking to ensure consistency and transparency in their financial reporting and investment tracking activities.