Free Financial Investment Statement

Prepared by: [YOUR NAME]

Introduction

The purpose of this Financial Investment Statement is to provide a comprehensive overview of our investment strategy, orientations, and principles. Our goal is to deliver long-term security and growth for our clients, while offering transparency about the risks and opportunities inherent in investing.

Investment Objectives

Our investment objectives are based on a balanced approach, focusing on both growth and income. The goal is to achieve an optimal blend of capital appreciation and income generation, while taking into account the risk tolerance level and financial needs of our clients.

Short-term Objectives: Achieving immediate financial milestones.

Long-term Objectives: Building wealth for future financial security.

Risk Tolerance: Our clients express a moderate to high risk tolerance.

Return Expectations: Targeting an annualized return of 8% based on the risk profile.

Investment Strategy

We employ a mix of active and passive investment strategies, using a data-driven approach that incorporates market trends and macroeconomic indicators. Our philosophy is to make informed investment decisions using a combination of in-depth analysis, careful risk management and robust investment processes.

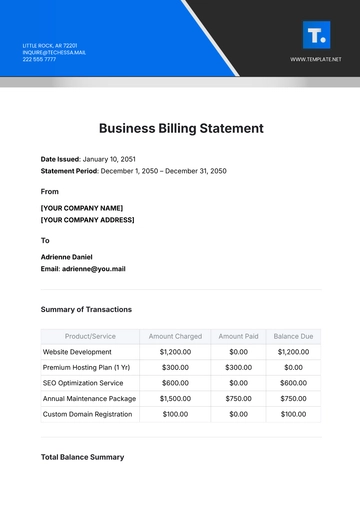

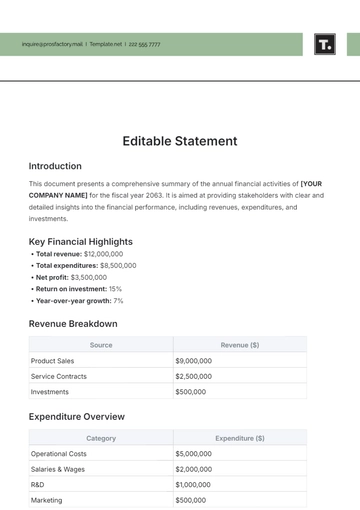

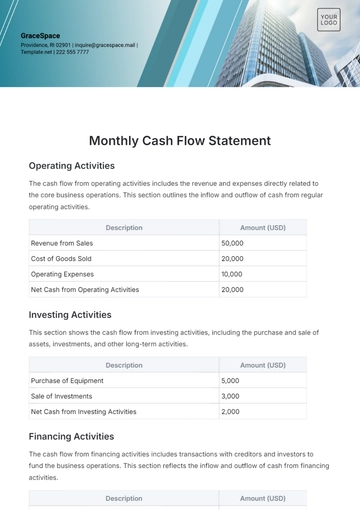

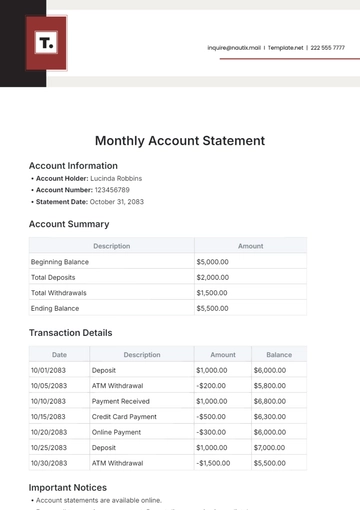

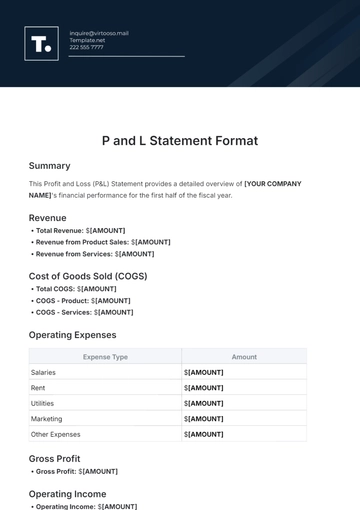

Financial Summary

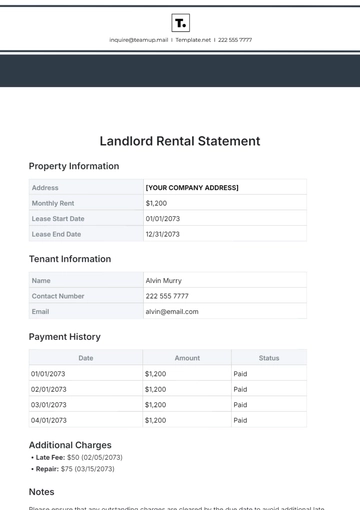

Investment Category | Allocated Assets | Return on Investment |

|---|---|---|

Equities | $2,000,000 | 7.5% |

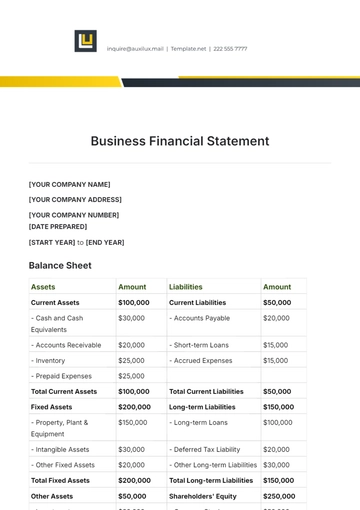

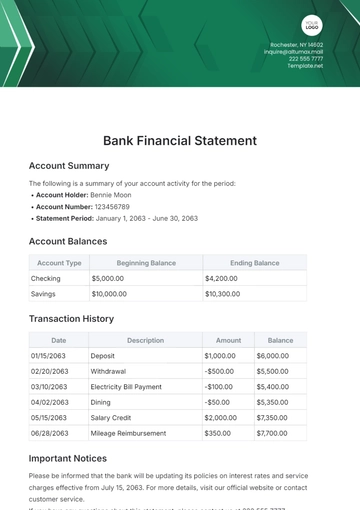

Portfolio Holdings

Our current portfolio holdings include a diverse range of securities:

Security

Security | Quantity Held | Market Value |

|---|---|---|

Stock A | [10,000] | [$5,000,000] |

Investment Outlook

As of [January 1, 2050], the market conditions indicate stability. Looking forward, we anticipate steady growth, considering global economic expansion and technological advancements.

Disclaimer

This investment statement is a reflection of the current market conditions and [Your Company Name]'s strategies. Investors are advised to carefully consider their own financial situations and, if necessary, seek advice from financial professionals.

Conclusion

In summary, our investment approach is grounded on a holistic understanding of market dynamics and a rigorous analytical framework. We are confident in our ability to deliver long-term value for our clients and are committed to maintaining the utmost transparency and professionalism in all our dealings.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover efficiency with the Financial Investment Statement Template, available on Template.net. This editable and customizable template empowers you to tailor financial statements effortlessly. Craft a personalized financial narrative using our Ai Editor Tool, ensuring precision and flexibility. Elevate your financial reporting experience with this user-friendly and adaptable template today.