Finance Portfolio SWOT Analysis

Introduction

The purpose of this SWOT (Strengths, Weaknesses, Opportunities, Threats) Analysis is to conduct a comprehensive evaluation of our finance portfolio. This analysis aims to identify internal strengths and weaknesses, as well as external opportunities and threats, which will inform our strategic decision-making process. The goal is to leverage this insight to optimize our portfolio's performance, ensure sustainable growth, and mitigate risks effectively.

Overview of the Portfolio

Our finance portfolio encompasses a diverse range of assets, including equities, fixed income, alternative investments, and cash equivalents. It is structured with a strategic balance, aiming to achieve long-term growth while managing risk and volatility. The portfolio is a reflection of our investment philosophy, which focuses on capital preservation, income generation, and capital appreciation, adhering to our broader financial objectives and risk appetite.

Scope of the Analysis

This SWOT Analysis will cover all aspects of the portfolio, examining each asset class, the overall asset allocation, and the investment strategies employed. We will assess the portfolio's historical performance, current market positioning, and future outlook. Additionally, the analysis will consider broader market trends, economic factors, regulatory changes, and technological advancements that could impact the portfolio. This holistic approach will enable us to develop a well-rounded understanding of our portfolio's potential and areas for improvement.

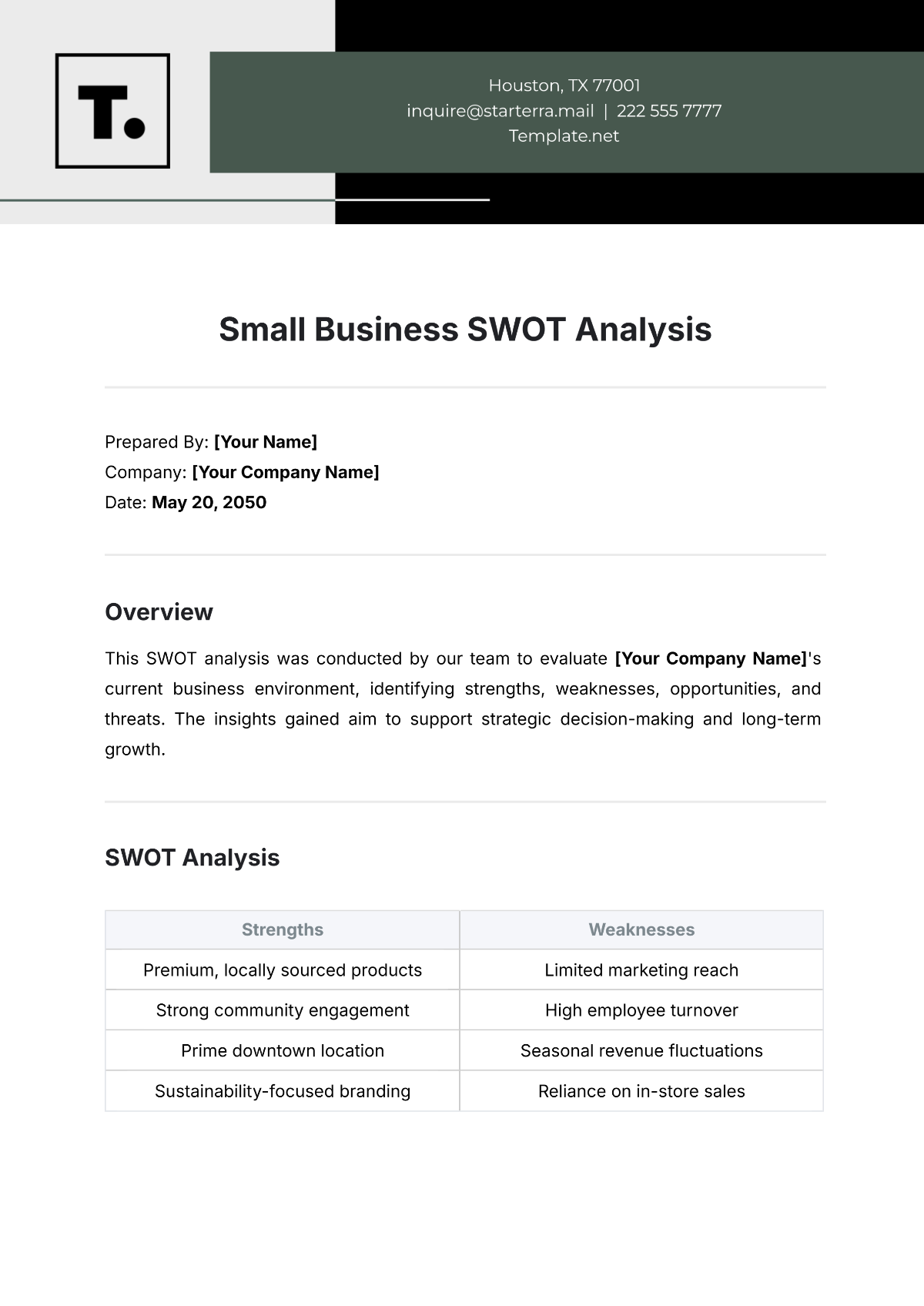

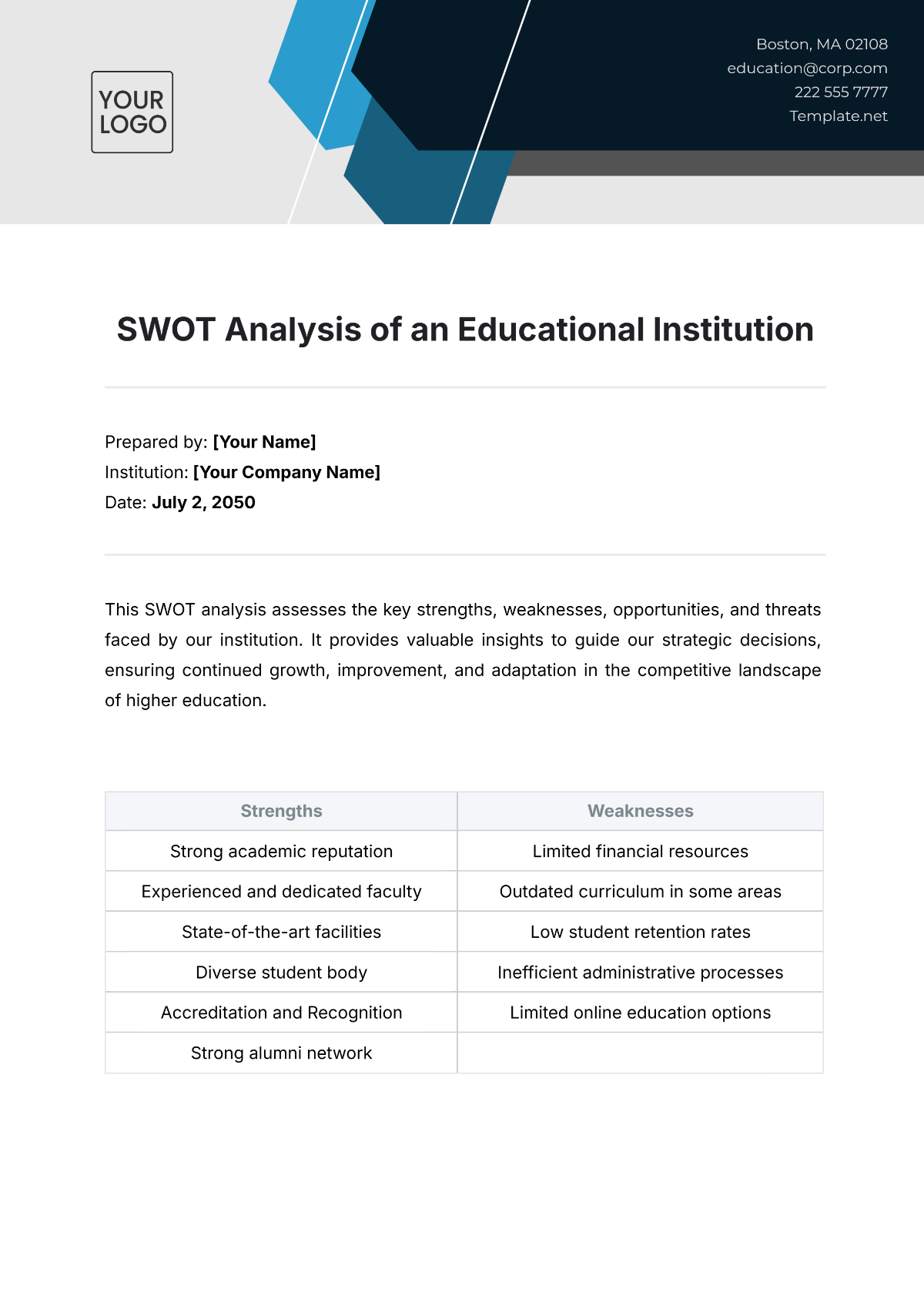

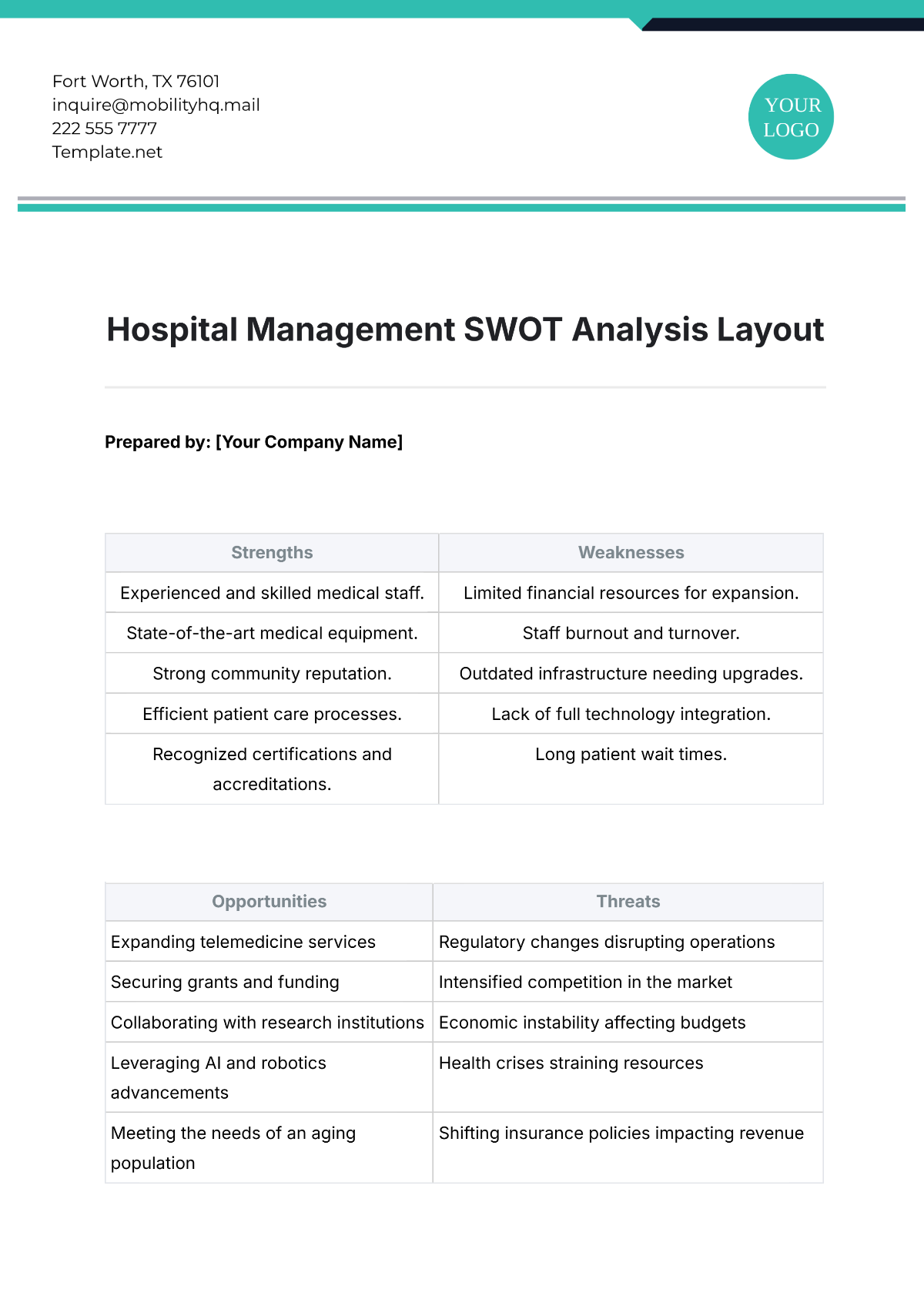

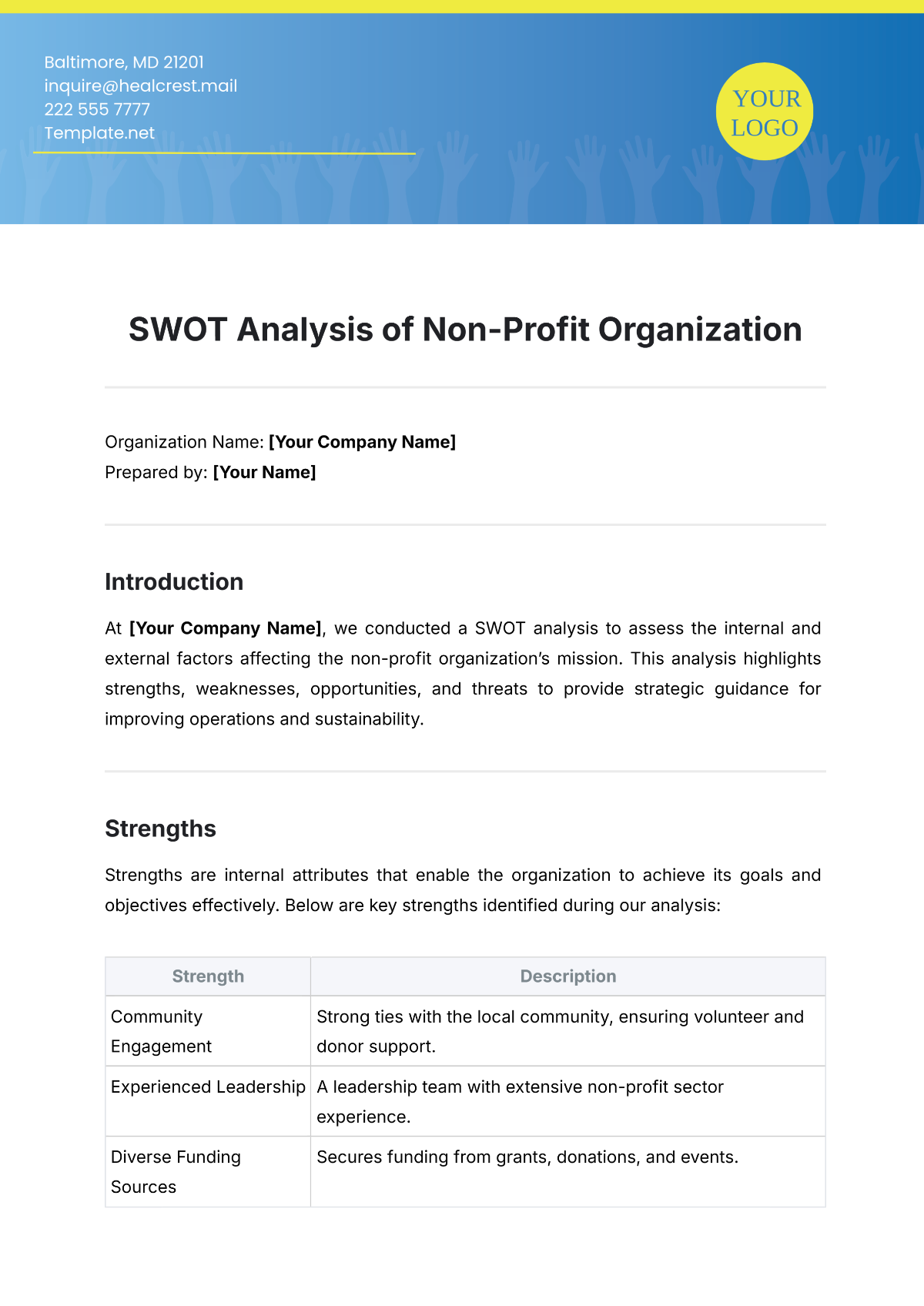

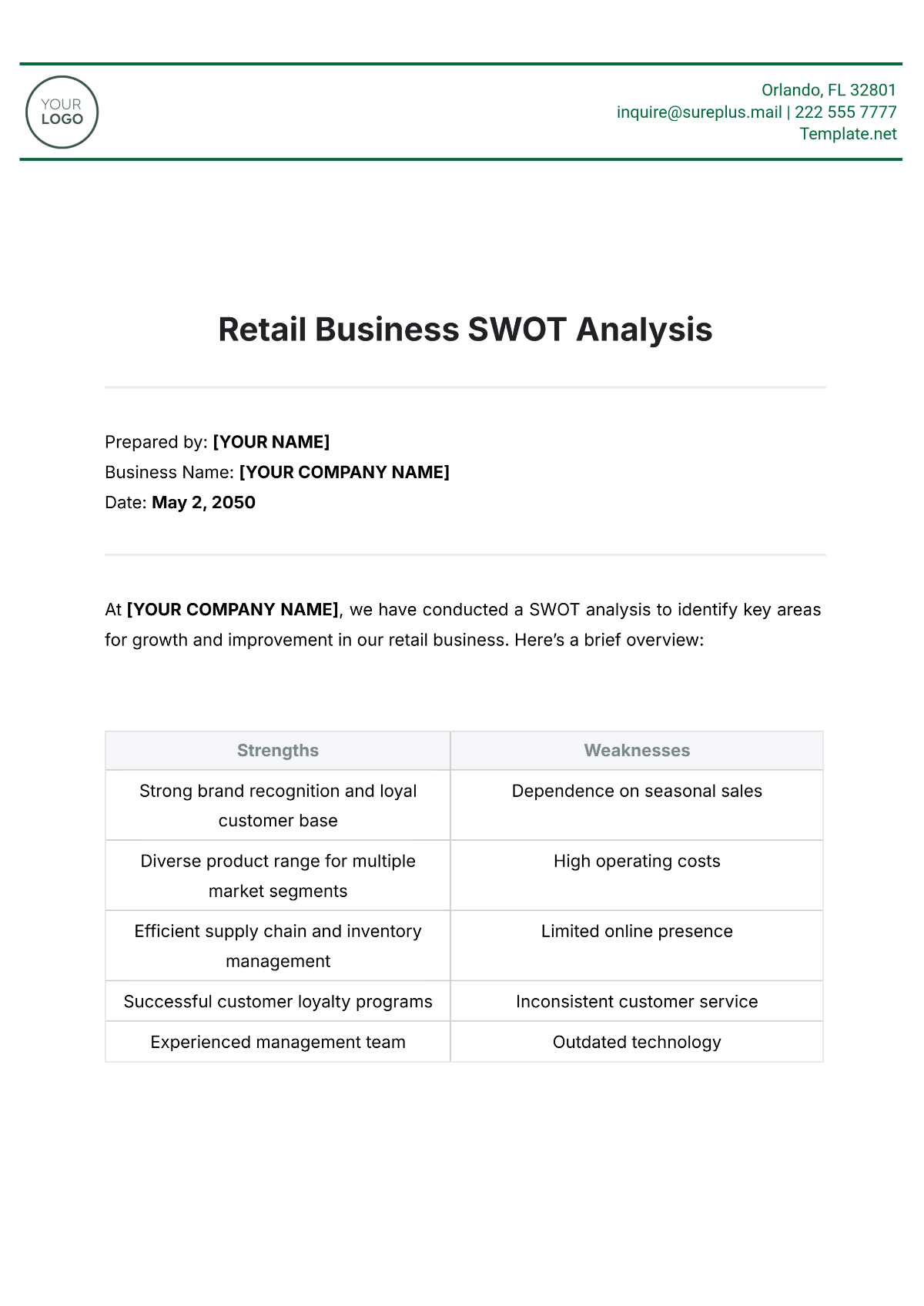

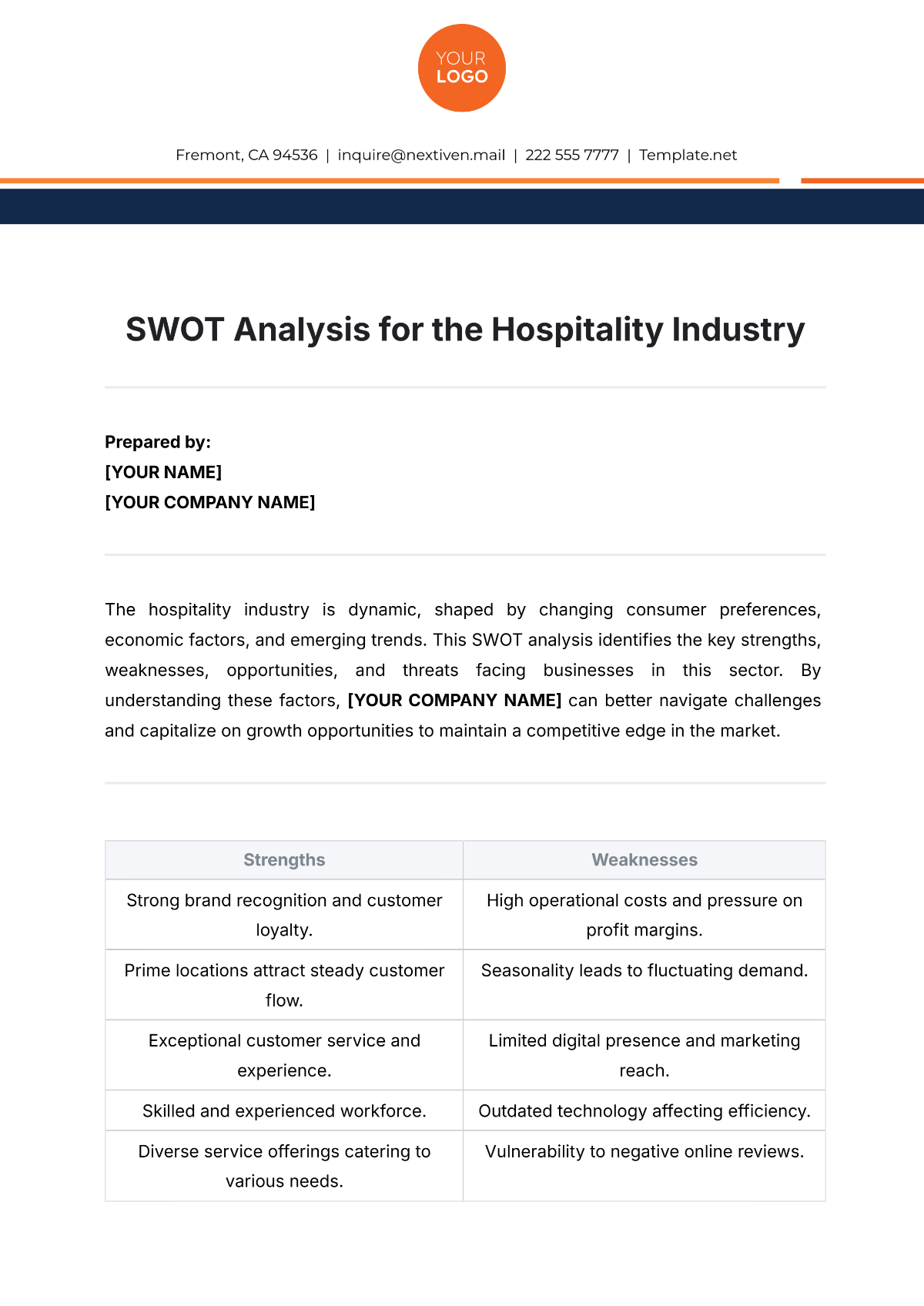

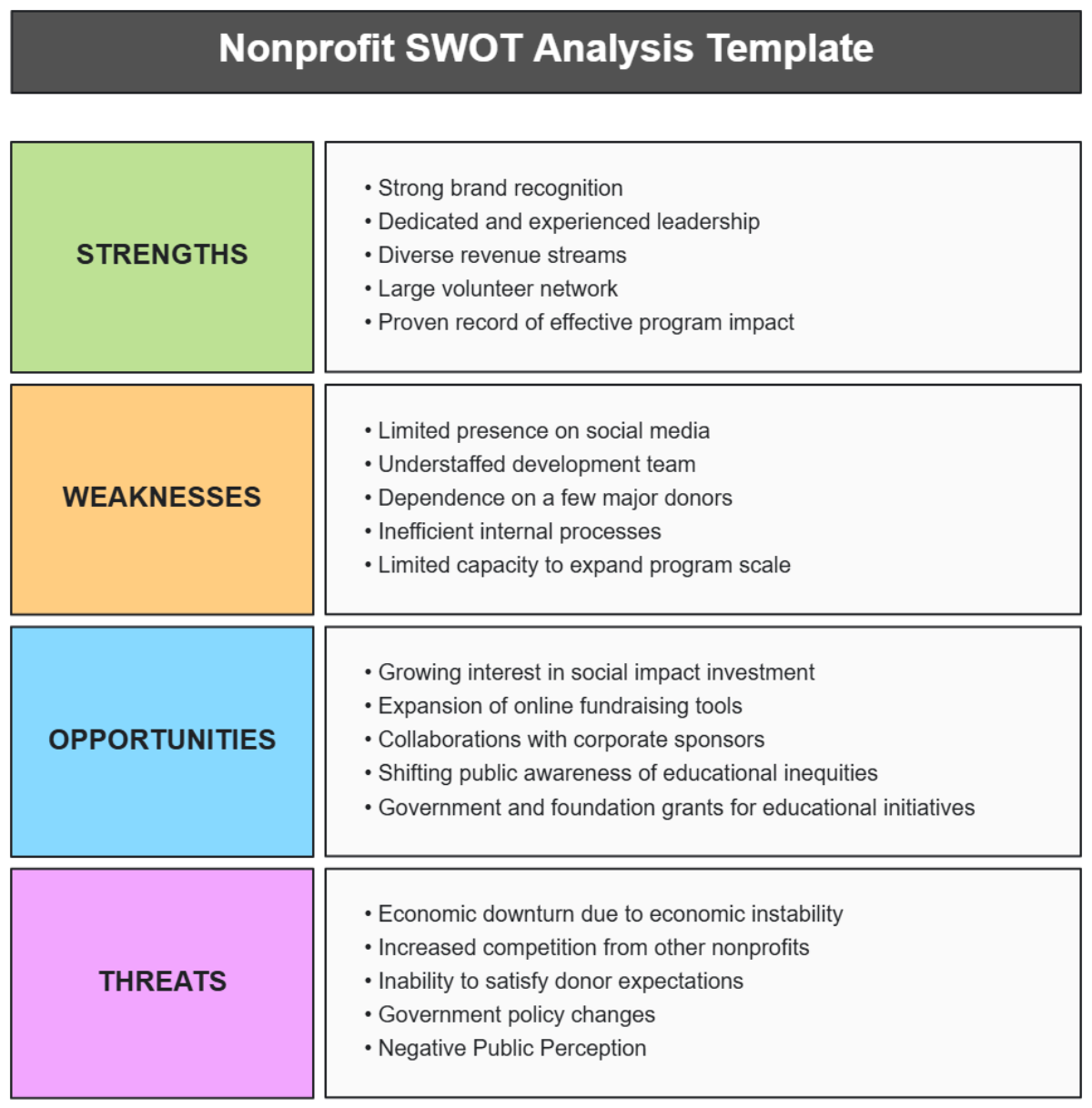

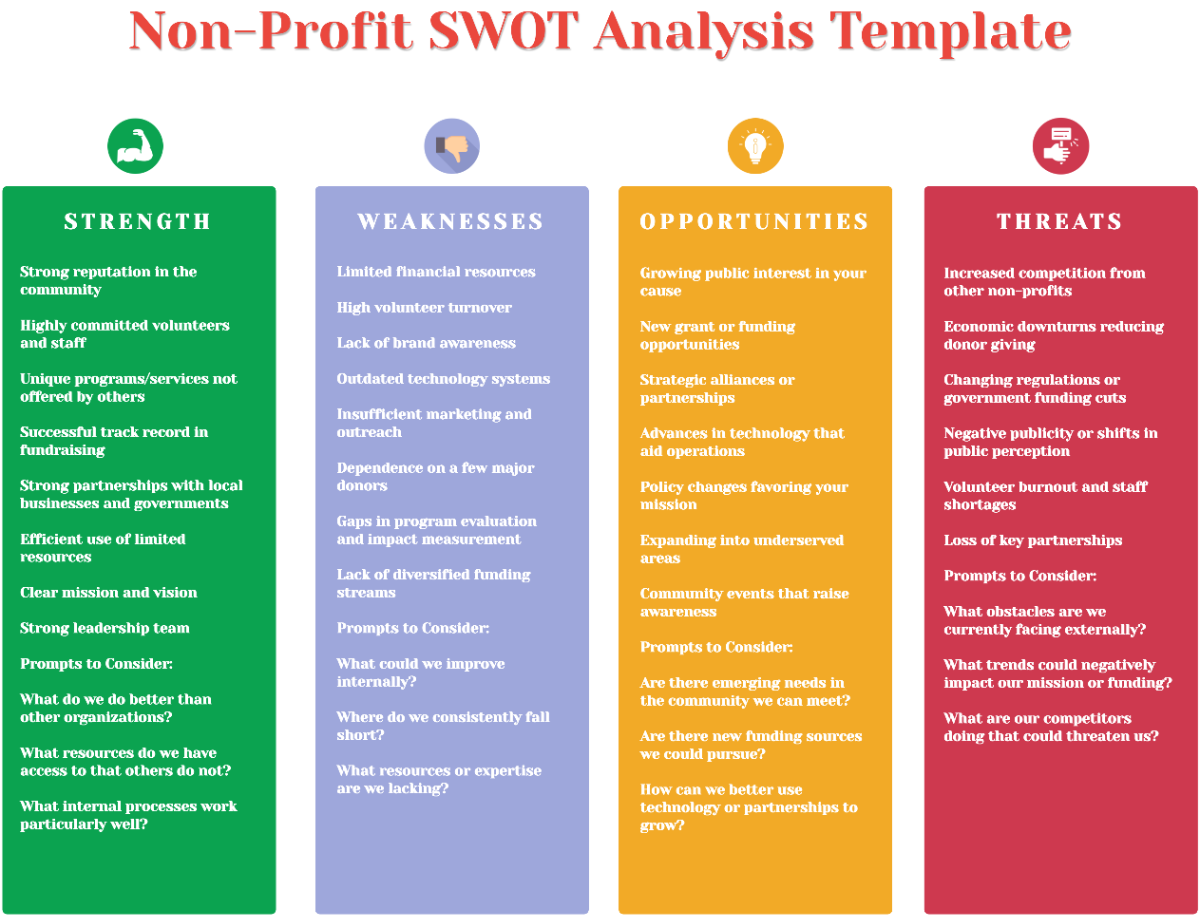

SWOT Overview

Strengths | Weaknesses | Opportunities | Threats |

Balanced Asset Allocation | Concentration Risk in Certain Sectors | Emerging Market Trends | Economic Downturns |

Diversification Across Asset Classes | Limited Liquidity in Certain Investments | Technological Advancements | Geopolitical Risks |

Strong Historical Performance | Performance Inconsistencies | Expansion into New Asset Classes | Market Volatility |

Experienced Management and Advisory Team | Limited Hedging Strategies | Regulatory Changes Benefiting Investments | Regulatory and Compliance Risks |

Effective Risk Management Strategies | Operational Challenges | Global Diversification Opportunities | Technological Disruptions |

Advanced Technological Integration | Exposure to Market Volatility | Strategic Partnerships | Competitive Landscape |

Strengths

This section highlights the core strengths of our finance portfolio, underpinning its robust performance and resilience in various market conditions. These strengths represent the fundamental pillars of our investment approach, contributing significantly to our portfolio's success.

Asset Allocation Strategies: Our portfolio exhibits a well-balanced asset allocation, with 40% in equities, 30% in fixed income, 20% in alternative investments, and 10% in cash and equivalents. This allocation optimizes returns while mitigating risks. Tactical Adjustments: We have demonstrated agility in making tactical adjustments based on market conditions, leading to a 5% average increase in returns during volatile market periods.

Diversification of Investments: Our portfolio is diversified across various asset classes, reducing the risk of significant losses from any single asset class. We have investments in over 20 countries, which has historically reduced our portfolio's volatility by approximately 15%.

Historical Performance: Over the past five years, our portfolio has achieved an average annual growth rate of 8%, outperforming the benchmark index by 3%. Despite market fluctuations, our portfolio has maintained a relatively stable performance, with a standard deviation in returns of only 5%.

Management and Advisory Team: Our management and advisory team comprises seasoned professionals with an average of 15 years in the investment field, contributing to informed and strategic decision-making. The team's proactive approach and innovative strategies have been pivotal in navigating market challenges successfully.

Risk Management Strategies: Our risk management strategies, including diversification and regular stress testing, have effectively limited losses during downturns. For instance, during the last market correction, our portfolio's value dropped by only 6% compared to the market average of 10%. Continuous monitoring and analysis of risk metrics ensure timely adjustments to the portfolio, preserving capital and optimizing returns.

Technological Integration: Utilization of advanced analytics and AI-driven tools for market analysis and prediction has enhanced our decision-making process, contributing to a 10% improvement in portfolio optimization. Our integration of cutting-edge technology in portfolio management has streamlined operations, reducing operational costs by 5% and improving transaction speed and accuracy.

Weaknesses

In this section, we address the weaknesses within our finance portfolio, which are areas that require attention and improvement. Identifying and understanding these weaknesses is crucial for mitigating risks and enhancing the overall performance of our portfolio.

Concentration Risk in Certain Assets or Sectors: Approximately 30% of our equity investments are concentrated in the technology sector, exposing us to sector-specific risks and potential volatility. One particular asset, representing 15% of our total portfolio, poses a significant concentration risk.

Lack of Liquidity in Certain Investments: Around 20% of our portfolio is invested in assets with low liquidity, such as certain real estate holdings and private equity, which can be challenging to liquidate quickly without incurring losses. Some fixed-income investments have longer settlement periods, impacting our ability to promptly reallocate funds when needed.

Performance Inconsistencies: While our overall portfolio performance is strong, certain asset classes have shown inconsistencies, with a 10% variation in returns year-over-year. A subset of our international investments has underperformed relative to benchmarks, dragging down overall portfolio returns by approximately 2%.

Limited Hedging Strategies: Our current hedging strategies cover only about 50% of the portfolio, leaving a significant portion exposed to market fluctuations. We primarily rely on standard options and futures for hedging, lacking diversification in hedging instruments that could provide better risk coverage.

Operational Challenges: Certain operational processes, particularly in trade execution and reporting, have been less efficient, leading to delays and increased transaction costs. Despite advanced technological tools, there are integration gaps in our systems, occasionally leading to data discrepancies and reporting errors.

Exposure to Market Volatility: Our portfolio has demonstrated a beta of 1.2, indicating a higher sensitivity to market swings compared to the overall market. Certain segments of our portfolio, especially those invested in cyclical industries, are more susceptible to economic downturns, having experienced a 12% decline in value during the last recession.

Opportunities

In this section, we explore the opportunities that lie ahead for our finance portfolio. Identifying and capitalizing on these opportunities is essential for achieving our investment objectives and enhancing portfolio performance.

Emerging Market Trends: The growing global focus on renewable energy presents a significant investment opportunity. We anticipate a 15% annual growth potential in our renewable energy holdings. The continued rise of e-commerce and digitalization is expected to boost our investments in technology and logistics companies, with a projected 10% annual return.

Technological Advancements: Leveraging advancements in artificial intelligence and big data analytics can improve our portfolio optimization strategies, potentially increasing returns by 8%. Exploring blockchain technology for secure and efficient transactions in our alternative investments could enhance transparency and reduce transaction costs.

Expanding into New Asset Classes: Expanding our presence in private equity investments could provide access to high-growth startups and uncorrelated returns, diversifying our portfolio further. Investing in infrastructure projects, such as transportation and utilities, offers stable cash flows and long-term growth potential.

Global Diversification Opportunities: Increased exposure to emerging markets, particularly in Asia and Africa, can provide access to high-growth economies and diversify risk. Diversifying currency exposure by allocating a portion of the portfolio to non-US currencies can provide risk mitigation against currency fluctuations.

Regulatory Changes Favoring Investments: Anticipated changes in tax regulations may favor certain investment opportunities, such as tax-efficient municipal bonds, potentially increasing after-tax returns. Stringent environmental regulations may drive investments in eco-friendly companies, aligning with our ESG goals.

Strategic Partnerships and Collaborations: Collaborating with fintech companies for innovative financial products and services can enhance our portfolio's competitiveness. Exploring joint ventures with established players in niche markets can provide access to specialized expertise and new investment avenues.

Threats

In this section, we assess the threats and challenges that our finance portfolio may encounter. Understanding these potential threats is vital for risk management and developing strategies to mitigate their impact on our investment objectives.

Economic Downturns: Economic downturns, such as a recession or financial crisis, pose a significant threat to portfolio performance. A severe recession could result in a portfolio value decline of up to 20%. Rising interest rates during economic contractions can negatively affect fixed-income holdings, leading to lower returns.

Geopolitical Risks: Escalating trade tensions between major economies can disrupt global markets and impact the performance of international investments, potentially resulting in a 15% reduction in returns. Political instability in key regions where we have investments may lead to regulatory changes and market uncertainties.

Market Volatility: Sudden and prolonged spikes in market volatility can result in higher portfolio risk and potentially lead to a 10% reduction in returns. Market turmoil can exacerbate liquidity challenges, making it difficult to execute trades and potentially impacting investment performance.

Regulatory and Compliance Risks: Frequent changes in financial regulations can necessitate costly compliance adjustments and expose us to compliance risks. Failure to comply may result in penalties and reputational damage. Stringent data privacy regulations may limit our ability to collect and utilize client data for investment strategies, affecting our data-driven approach.

Technological Disruptions: Increasing cybersecurity threats pose a risk to our portfolio's digital infrastructure, potentially leading to data breaches and financial losses. Rapid technological advancements may render our current tools and platforms obsolete, requiring significant investments in technology upgrades.

Competitive Landscape: A saturated market with a growing number of financial institutions and asset managers can lead to fee pressure and reduced profit margins. Evolving customer preferences and the rise of robo-advisors may challenge our client acquisition and retention strategies.

Analysis

In this section, we delve into the implications of our SWOT analysis for our investment strategy. The comprehensive assessment of our portfolio's strengths, weaknesses, opportunities, and threats provides valuable insights that guide our decision-making process.

Implications for Investment Strategy

Leveraging Strengths: We will capitalize on our strengths, such as our balanced asset allocation and experienced management team, to further optimize returns and mitigate risks.

Addressing Weaknesses: Immediate attention will be given to weaknesses, with a focus on reducing concentration risk, improving liquidity management, and implementing more effective hedging strategies.

Seizing Opportunities: We are committed to seizing opportunities presented by emerging market trends, technological advancements, and regulatory changes. This includes expanding into new asset classes and fostering strategic collaborations.

Mitigating Threats: Our risk management efforts will be intensified to mitigate threats, including economic downturns, geopolitical risks, and market volatility. This includes strengthening compliance procedures and cybersecurity measures.

Recommendations for Portfolio Adjustment

Asset Allocation Rebalancing: We will rebalance the portfolio to address concentration risks and enhance diversification, ensuring that no single asset class or sector poses a significant risk.

Enhanced Liquidity Management: Strategies to improve liquidity in certain investments will be implemented, allowing us to respond more swiftly to market dynamics.

Performance Consistency: Measures will be taken to address performance inconsistencies in specific asset classes to ensure stable returns.

Hedging Strategy Enhancement: We will diversify our hedging instruments and increase hedging coverage to better protect against market volatility.

Operational Efficiency: Streamlining operational processes and closing technology integration gaps will improve efficiency and reduce costs.

Action Plan

In this section, we outline our comprehensive action plan that encompasses both short-term and long-term strategies. These strategies are designed to capitalize on opportunities, mitigate risks, and align our portfolio with our investment objectives and the insights gained from the SWOT analysis.

Short-term and Long-term Strategies

Short-term: In the short term, we will initiate an asset rebalancing process to address concentration risks and improve diversification. This will involve reallocating assets to align with our strategic asset allocation guidelines. We will implement immediate measures to address performance inconsistencies, focusing on underperforming asset classes and regions.

Long-term: Over the long term, we will actively explore opportunities in emerging market trends, technological advancements, and strategic partnerships. This includes expanding into new asset classes and geographic regions. Long-term risk mitigation strategies will focus on strengthening our compliance framework, enhancing cybersecurity measures, and diversifying hedging instruments.

Risk Mitigation Tactics

Concentration Risk: To mitigate concentration risk, we will gradually reduce exposure to the technology sector, diversify sector allocation, and consider alternative investments with lower sector concentration.

Liquidity Management: Enhanced liquidity management will involve optimizing cash flow to ensure liquidity requirements are met promptly. This may involve strategically divesting illiquid assets.

Market Volatility: Volatility mitigation strategies will include increased diversification, advanced risk modeling, and hedging to protect against market fluctuations.

Regulatory Compliance: We will closely monitor regulatory changes and ensure prompt compliance, collaborating with legal and compliance experts to stay up-to-date with evolving regulations.

Technological Resilience: Strengthening technological infrastructure and cybersecurity measures will be an ongoing effort to protect against technological disruptions and threats.

Investment Rebalancing Plans

Asset Allocation Rebalancing: A detailed asset allocation rebalancing plan will be executed to align with our revised strategic asset allocation guidelines. This plan will be implemented over the next three months.

Performance Improvement: Performance improvement measures will be initiated immediately, with quarterly reviews and adjustments as necessary.

Opportunity Exploration: Long-term opportunity exploration will commence with a phased approach. We will explore new asset classes over the next 12 months, starting with private equity.

Risk Mitigation Implementation: Risk mitigation measures will be implemented progressively, with a focus on compliance and technology enhancements. A timeline of 6-12 months is allocated for these initiatives.

Monitoring and Evaluation Mechanisms

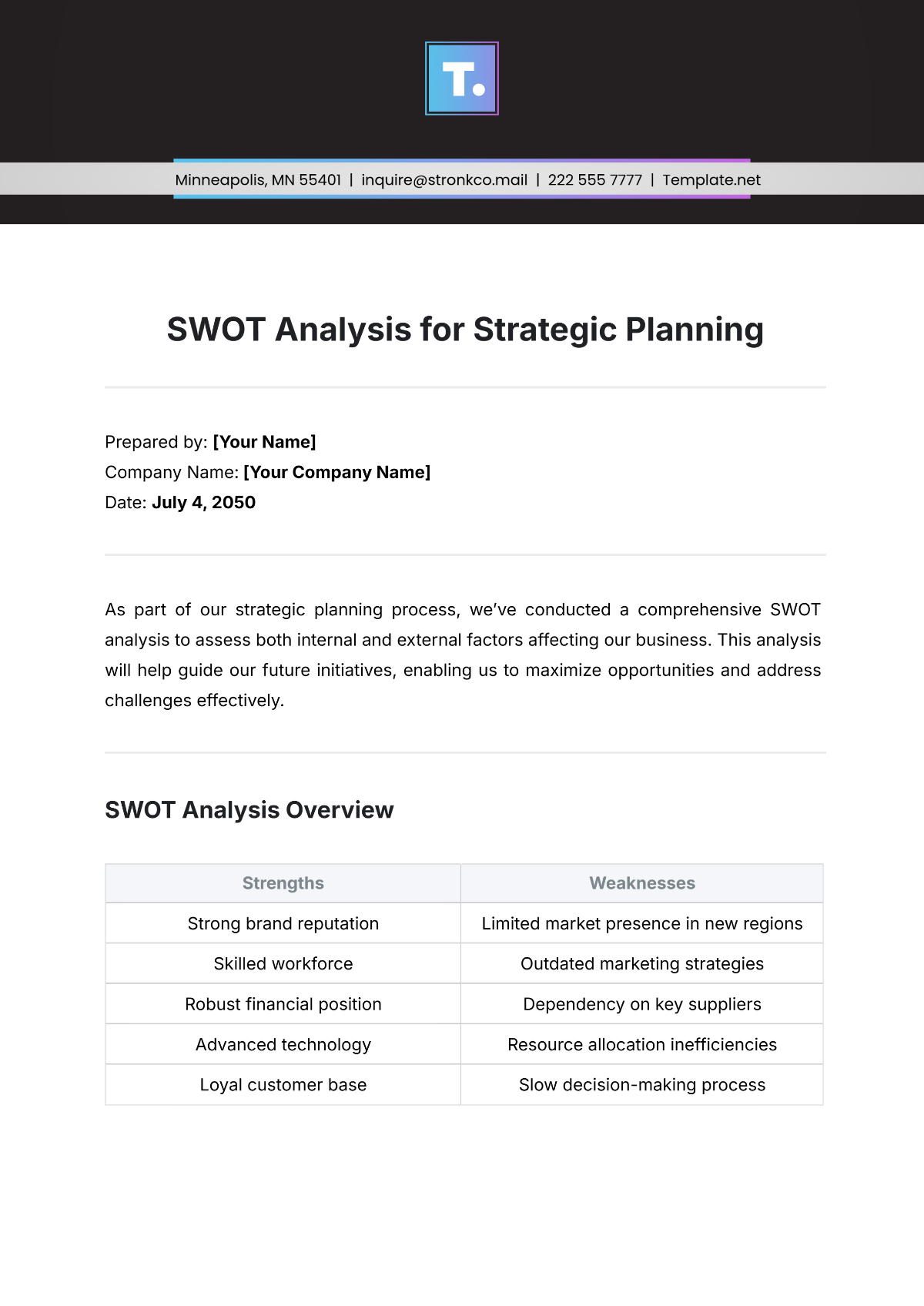

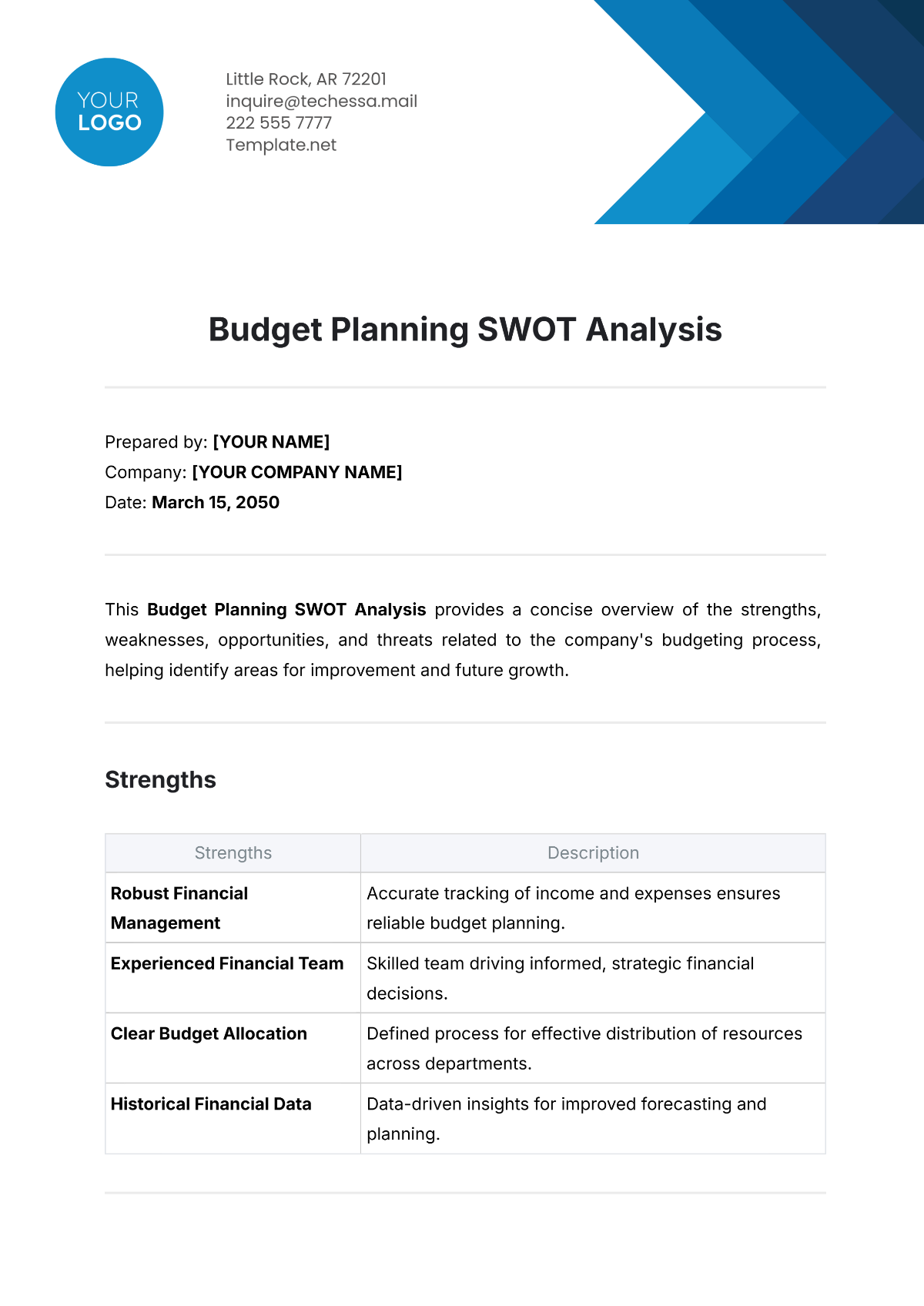

A monitoring plus evaluation mechanism will be put in place to track the progress and effectiveness of our action plan. The table below outlines key performance indicators (KPIs) and their corresponding benchmarks for evaluation:

KPIs | Benchmarks |

Portfolio Return | Exceed the benchmark index by 2-3%. |

Compliance Adherence | 100% compliance with updated regulations. |

Cybersecurity Resilience | No cybersecurity breaches for the year. |

Asset Allocation | Achieve and maintain target allocations. |

Diversification | Reduce sector concentration by 10%. |