Financial Extensive Cost Analysis Guide

Executive Summary

A. Overview

In today's dynamic business environment, an in-depth financial cost analysis is imperative for [Your Company Name] to stay competitive and ensure sustainable growth. This comprehensive report delves into the intricacies of our financial landscape, aiming to provide a clear understanding of our costs, identify opportunities for optimization, and drive informed decision-making.

Through a meticulous examination of our financial ecosystem, this analysis spans across direct and indirect costs, investments, returns, and potential areas for cost-saving. The insights gained will not only enhance our financial stability but also position [Your Company Name] strategically in the market.

B. Key Objectives

The primary objectives of this financial cost analysis are multifaceted. We aim to:

Gain a comprehensive understanding of our direct and indirect costs.

Evaluate the return on investment for major projects and initiatives.

Identify potential cost-saving opportunities for enhanced efficiency.

Mitigate financial risks associated with our current cost structure.

C. Stakeholder Involvement

Stakeholder involvement is integral to the success of this analysis. Throughout the process, collaboration with [Your Partner Company Name] and engagement with [Client Name] will ensure a holistic view of our financial landscape.

Introduction

A. Background

In an era marked by rapid technological advancements and shifting market dynamics, [Your Company Name] finds itself at the forefront of the technology solutions industry. To ensure sustained success and efficiency, it becomes paramount to conduct a comprehensive financial cost analysis. This analysis is not merely a routine exercise but a strategic initiative to understand the nuances of our financial operations deeply.

B. Industry Context

Our industry, technology solutions, is characterized by constant innovation and evolving customer needs. Understanding these trends is crucial for contextualizing our financial position and making informed decisions. This section explores the current state of the industry, highlighting key trends, challenges, and opportunities.

C. [Your Company Name] in the Market

[Your Company Name] holds a significant market share, driven by our commitment to quality and innovation. With cutting-edge products and a customer-centric approach, we have established a strong presence in the technology solutions market. This sets the stage for understanding how our financial performance aligns with broader market dynamics.

D. Rationale for the Analysis

Why are we conducting this financial cost analysis now? The rationale lies in the need to adapt to emerging technologies, optimize operational costs, and maintain our competitive edge. This section outlines the specific triggers, such as market changes, internal restructuring, or technological advancements, that have prompted this thorough examination of our financial health.

Objectives and Scope

A. Objectives

The primary objectives of this financial cost analysis are to provide a comprehensive understanding of our financial landscape and guide strategic decision-making.

Comprehensive Understanding: Gain insights into both direct and indirect costs, enabling a thorough examination of our financial structure.

Return on Investment Evaluation: Evaluate the return on investment for major projects and initiatives to assess their impact on our financial health.

Cost-Saving Opportunities Identification: Identify potential areas for cost-saving, promoting operational efficiency and resource optimization.

Risk Mitigation: Mitigate financial risks associated with our current cost structure, ensuring resilience against unforeseen challenges.

B. Scope

The scope of this analysis is broad, covering various aspects of [Your Company Name]'s financial operations.

Timeframe: The analysis will encompass the financial data from the last [5] years to provide a historical perspective and capture trends.

Departments and Projects: All major departments and ongoing projects will be considered to offer a comprehensive view of our financial ecosystem.

External Collaboration: Collaboration with external entities, such as [Your Partner Company Name], ensures a holistic view of our financial landscape.

Methodology

A. Data Collection

To ensure the accuracy and reliability of the analysis, a combination of internal and external data sources will be utilized.

Internal Data Sources: Financial records, expense reports, and project budgets will be collected from [Your Company Name]'s internal databases.

External Data Sources: Collaborative data from [Your Partner Company Name] will enhance the depth and credibility of the analysis.

B. Tools and Techniques

Several tools and techniques will be employed to conduct a comprehensive financial analysis.

Cost-Benefit Analysis: A detailed examination of costs versus benefits for major projects and initiatives.

ROI Calculations: Rigorous evaluation of the return on investment for significant financial endeavors.

Benchmarking: Comparison of [Your Company Name]'s financial performance against industry benchmarks for contextual insights.

Proprietary Methods: [Your Company Name] has developed proprietary methods for specific aspects of financial analysis, enhancing the depth of our insights.

C. Quality Assurance

A rigorous quality assurance process will be implemented to verify the accuracy and consistency of the collected data. This involves cross-referencing data points, conducting internal audits, and ensuring compliance with financial reporting standards.

D. Reporting Structure

The findings will be structured in a clear and accessible format, combining narrative descriptions, visual representations, and tabular data to facilitate understanding for a diverse audience, from financial experts to stakeholders less familiar with financial intricacies.

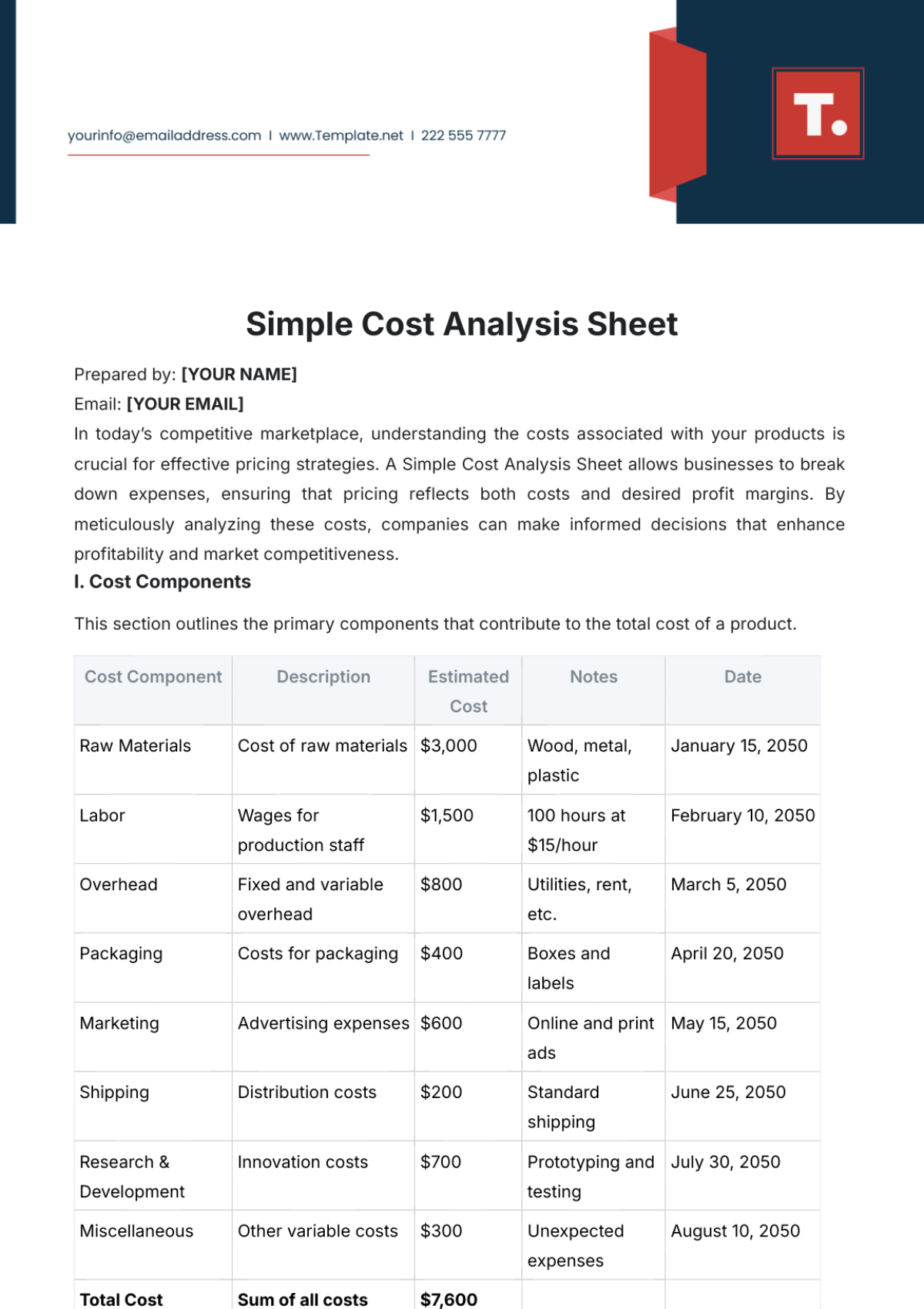

Cost Components Analysis

A. Direct Costs

Direct costs are those directly attributed to the production of goods or services. A detailed breakdown of direct costs includes:

Production Expenses: Costs related to the manufacturing process, including materials, labor, and overhead.

Category

Amount

Percentage

Raw Materials

[$350,000]

[30%]

Project-Specific Costs: For ongoing projects, delineate costs associated with each project.

Project

Amount

Percentage

Project A

[$120,000]

[12%]

B. Indirect Costs

Indirect costs, while not directly tied to production, are essential for overall operations. Breakdown includes:

Administrative Expenses: Costs related to general administration and management.

Category

Amount

Percentage

Salaries

[$150,000]

[15%]

Overhead Costs: Broader operational costs not tied to a specific project or department.

Category

Amount

Percentage

Rent

[$80,000]

[8%]

Investment and Return Analysis

A. Capital Expenditure

Detailing capital expenditures ensures a comprehensive understanding of major investments.

Project/Initiative: [Product Name] serves as an example.

Investment Type

Amount

Expected ROI

R&D Initiatives

[$500,000]

[25%]

B. Return on Investment (ROI)

Evaluating the return on investment is crucial for assessing the effectiveness of past and ongoing endeavors.

Project/Initiative: [Product Name] as an example.

Investment Type

Amount

Expected ROI

R&D Initiatives

[$500,000]

[30%]

Cost-Saving Opportunities

A. Identified Opportunities

Identification of potential cost-saving opportunities is crucial for enhancing operational efficiency. The analysis has revealed the following areas with substantial potential for cost reduction:

Process Optimization: Streamlining production processes can lead to significant savings. Initiatives such as [Your Company Name]'s Lean Manufacturing Program aim to eliminate waste and improve efficiency.

Supply Chain Management: Negotiating favorable terms with suppliers and optimizing inventory management can reduce procurement costs. Collaborating with [Your Partner Company Name Email] in supplier negotiations is a key strategy.

Technology Upgrades: Investing in technology upgrades, such as automation or improved software, can lead to long-term cost savings by increasing productivity and reducing manual labor.

B. Implementation Strategies

Having identified cost-saving opportunities, implementing strategies to realize these benefits is the next crucial step:

Cross-Functional Teams: Forming cross-functional teams involving personnel from different departments ensures a holistic approach to process optimization and efficiency improvements.

Performance Metrics: Establishing key performance indicators (KPIs) to monitor the effectiveness of cost-saving initiatives. Regular reviews and adjustments based on these metrics are essential.

Employee Training: Providing training programs to employees on new technologies and processes to ensure smooth implementation and utilization of cost-saving measures.

Risk Analysis

A. Financial Risks

Evaluating financial risks associated with the current cost structure is vital for proactive risk management.

Market Volatility: Fluctuations in the market can impact costs, especially in areas such as raw materials. Establishing contingency plans to mitigate the effects of market volatility is essential.

Regulatory Changes: Changes in regulations can lead to increased compliance costs. Regular compliance audits and staying abreast of regulatory changes are critical for risk mitigation.

Currency Fluctuations: If [Your Company Name] operates in multiple regions, currency fluctuations can impact costs. Hedging strategies and financial instruments can be employed to minimize currency-related risks.

B. Mitigation Strategies

Developing strategies to mitigate identified financial risks is crucial for ensuring financial stability:

Diversification: Diversifying suppliers and markets helps mitigate the impact of market volatility and currency fluctuations.

Continuous Monitoring: Implementing robust systems for continuous monitoring of market trends, regulatory changes, and currency fluctuations ensures timely responses to potential risks.

Insurance Coverage: Evaluating and updating insurance coverage to address potential financial risks, providing a safety net in the face of unforeseen events.

Conclusion

In synthesizing the findings and insights derived from the extensive financial cost analysis, several key points emerge, shaping the overall conclusion:

A. Key Findings

The analysis has unearthed critical insights into [Your Company Name]'s financial landscape. Key findings include:

Direct Cost Efficiency: The breakdown of direct costs highlighted areas of efficiency and potential optimization, particularly in raw material procurement and labor utilization.

Indirect Cost Rationalization: Administrative and overhead costs have been identified for rationalization, suggesting avenues for improving overall operational efficiency.

Investment Impact: The analysis of capital expenditures and return on investment has shed light on the effectiveness of past investments and guided future strategic financial decisions.

B. Recommendations

Building on the findings, recommendations are proposed to enhance financial health and ensure sustained growth:

Implementation of Cost-Saving Measures: Execute the identified cost-saving opportunities through process optimization, supply chain improvements, and strategic technology upgrades.

Continuous Monitoring: Establish a robust monitoring system to track the effectiveness of implemented measures, allowing for real-time adjustments and improvements.

Strategic Investment Planning: Based on the ROI analysis, refine future investment strategies to prioritize projects with higher potential returns.

C. Impact on Stakeholders

The conclusions drawn from this financial analysis have far-reaching implications for various stakeholders:

Shareholders: Increased efficiency and strategic investments are poised to yield higher returns, positively impacting shareholder value.

Employees: Process optimizations and technology upgrades may influence job roles, emphasizing the importance of continuous training and upskilling.

Customers: The financial health of [Your Company Name] directly influences product/service quality, pricing, and innovation, thereby affecting customer satisfaction.