Comprehensive Finance Payroll Analysis

I. Introduction

This Comprehensive Finance Payroll Analysis aims to provide an in-depth review and evaluation of the payroll processes at [Your Company Name]. It covers the intricacies of payroll management, including policy overview, employee classification, compliance, and strategic planning. This document serves as a guide for understanding the current payroll system's strengths and areas for improvement, ensuring alignment with the company's financial and operational goals.

II. Payroll Policy Overview

The payroll policy at [Your Company Name] is designed to ensure that all employees are compensated accurately and on time, adhering to legal standards. The policy includes details on payment schedules, which are bi-weekly for salaried employees and weekly for hourly workers. Bonuses are distributed annually and are calculated based on individual performance and company profitability. Overtime pay is calculated at 1.5 times the regular hourly rate for employees eligible under the Fair Labor Standards Act (FLSA).

III. Employee Classification and Payroll Structure

Employees at [Your Company Name] are categorized into full-time, part-time, and contract-based groups, each with distinct payroll structures. Full-time employees receive a fixed annual salary, part-time employees are paid at an hourly rate, and contractors are compensated as per the terms of their individual contracts. This classification helps in aligning payroll processes with employment types, ensuring fairness and compliance with labor laws.

IV. Payroll Processing Procedure

Our payroll processing is a multi-step procedure designed to ensure accuracy and compliance. It begins with the collection of timekeeping data, which is digitally recorded and verified for accuracy. Gross pay is then calculated, considering regular hours, overtime, bonuses, and any other compensations. Following this, appropriate deductions are made, including taxes, benefits contributions, and other statutory deductions. The final step involves the disbursement of net pay through direct bank deposits.

V. Compliance with Legal Standards

Compliance is a cornerstone of our payroll system. We adhere to all federal and state tax laws, including accurate withholding and remittance of taxes. We ensure compliance with the minimum wage laws and accurate computation of overtime pay. Regular training sessions are held for the payroll team to stay updated with the latest tax codes and labor laws.

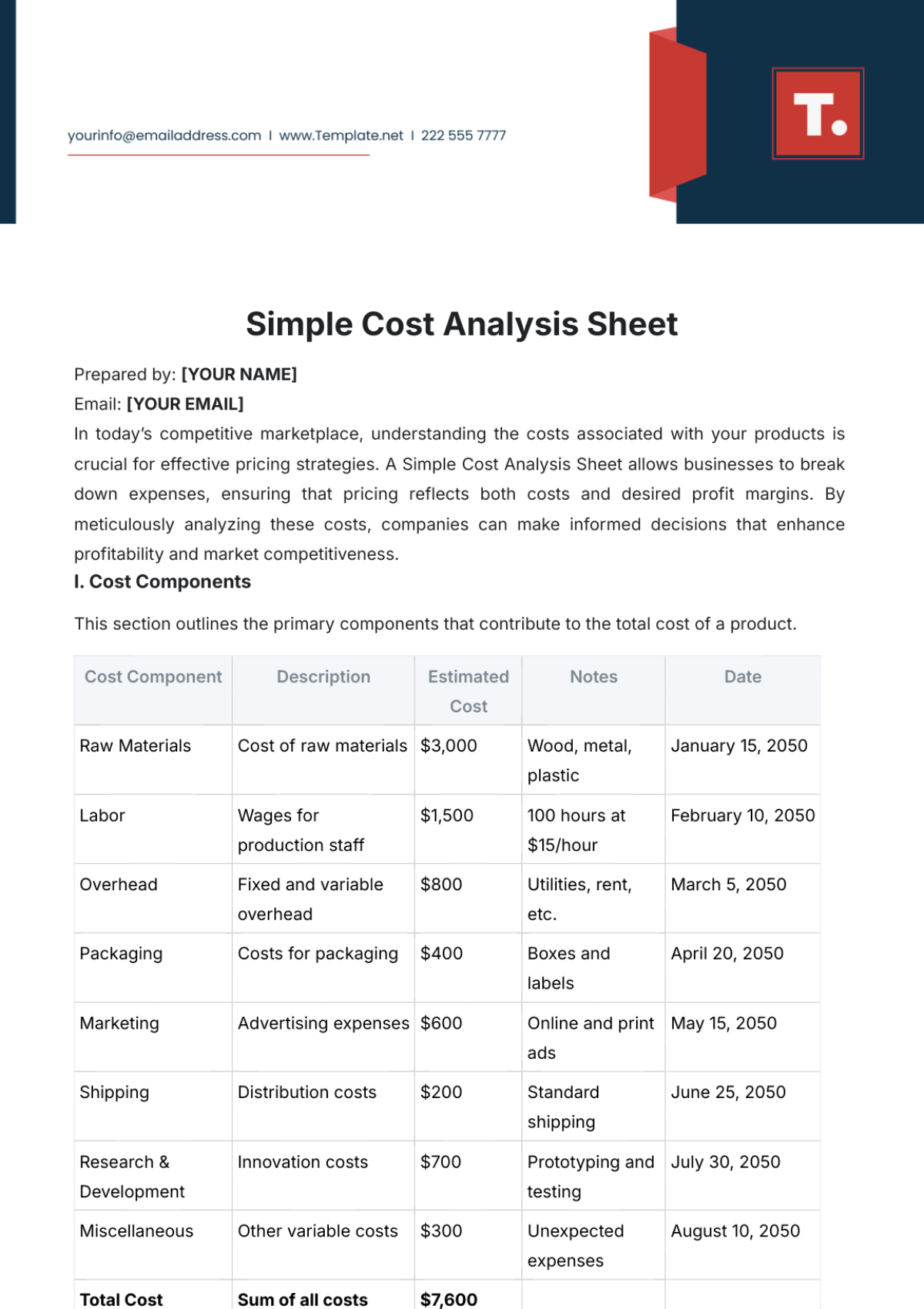

VI. Payroll Cost Analysis

The following table provides a breakdown of payroll costs by department:

Department | Total Salaries | Bonuses | Benefit Costs | Total Payroll Cost |

|---|---|---|---|---|

Sales | $[Amount] | $[Amount] | $[Amount] | $[Amount] |

Marketing | $[Amount] | $[Amount] | $[Amount] | $[Amount] |

IT | $[Amount] | $[Amount] | $[Amount] | $[Amount] |

VII. Benefits and Deductions

Benefits at [Your Company Name] include health insurance, retirement plans, and paid time off. These are detailed as follows:

Health Insurance: We contribute 70% towards employee health insurance premiums.

Retirement Plans: We offer a 401(k) plan with a 5% employer match.

Paid Time Off: Full-time employees are entitled to 15 days of paid vacation annually.

Deductions from employee payroll primarily consist of federal and state taxes, Social Security, Medicare, and individual contributions to benefits.

VIII. Timekeeping and Attendance System

Our timekeeping and attendance system is a critical component of our payroll process. It utilizes digital technology to accurately record and monitor employee hours worked, overtime, leave, and absences. The system is integrated with our payroll software, allowing for seamless transfer of data, reducing manual entry errors, and ensuring payroll accuracy. This system not only tracks standard work hours but also manages various types of leaves, such as sick leave, vacation, and personal leave. Additionally, it supports compliance with labor regulations by accurately tracking and compensating overtime work.

IX. Payroll Reconciliation and Audit Procedures

Payroll reconciliation at [Your Company Name] is a rigorous and systematic process. Monthly reconciliation involves verifying the accuracy of payroll disbursements against employee time records and ensuring that all payroll transactions are correctly recorded in the general ledger. This process helps in identifying and rectifying any discrepancies immediately. Annually, we engage an external auditor to conduct a comprehensive audit of our payroll system. This audit covers compliance with tax laws, accuracy of payroll calculations, and adherence to internal payroll policies. The findings of these audits are used to refine our payroll processes and enhance accuracy.

X. Payroll Reporting

Our payroll department generates various reports to provide insights into payroll expenses and employee compensation. The Payroll Summary Report offers an overview of total payroll costs, including wages, taxes, benefits, and other deductions. The Department-wise Payroll Report allows for a detailed view of payroll expenses by department, aiding in budget analysis and financial planning. The Employee Earnings Report is crucial for individual employees, detailing their gross earnings, deductions, and net pay, and is available through the employee self-service portal.

XI. Payroll Challenges and Solutions

A significant challenge in our payroll system is the evolving landscape of tax regulations and labor laws. To address this, we have been implementing a robust payroll software solution equipped with real-time updates on tax laws and compliance requirements. Another challenge is managing the payroll for a diverse workforce, including international employees. We plan to introduce a more flexible payroll system that can handle various tax jurisdictions and employment regulations.

XII. Employee Self-Service Portal

Our employee self-service portal is a critical tool for empowering employees and reducing the administrative load on the payroll team. Employees can access their pay stubs, tax forms, and leave balances, submit time-off requests, and update personal information. This portal is secured with encryption and multi-factor authentication, ensuring data privacy and security.

XIII. Payroll Team Structure and Responsibilities

The payroll team at [Your Company Name] consists of dedicated professionals including a Payroll Manager, Payroll Specialists, and a Human Resources liaison. The Payroll Manager oversees the entire payroll process, ensuring compliance and accuracy. Payroll Specialists handle the day-to-day processing, including timekeeping data entry, calculations, and payroll disbursements. The HR liaison works closely with the payroll team to align payroll practices with HR policies and employee benefits.

XIV. Future Payroll Strategy and Innovations

Looking ahead, we are focused on integrating advanced technologies into our payroll system. We are exploring the implementation of artificial intelligence for predictive analytics in payroll management. This will help in forecasting payroll costs and managing budgets more effectively.

Additionally, we plan to incorporate blockchain technology to enhance the security and transparency of our payroll transactions. Blockchain technology offers an immutable record of transactions, reducing the risk of fraud and errors. This technology will also streamline the audit process, as every transaction is securely and transparently recorded.

We are also considering the adoption of cloud-based payroll solutions to increase flexibility and accessibility. This move will enable our team to manage payroll remotely, which is increasingly important in today's dynamic work environment. Cloud-based systems also offer robust data backup and recovery options, ensuring business continuity in case of unforeseen events.

XV. Conclusion

The Comprehensive Finance Payroll Analysis of [Your Company Name] reflects our commitment to efficient, compliant, and employee-focused payroll management. By continuously seeking improvements in our processes and embracing technological advancements, we aim to maintain a payroll system that not only meets the current needs of our workforce but also anticipates future challenges and opportunities. Our focus remains on accuracy, compliance, and operational excellence, ensuring that our payroll system is a reliable pillar supporting the broader financial health and strategic objectives of our organization.