Free Financial Cost Impact Analysis

Project/Department: [Name]

Date: [Month Day, Year]

Executive Summary

The purpose of this analysis is to evaluate the financial implications of installing solar panels at our corporate headquarters. The project aims to reduce long-term energy costs and support our sustainability goals.

Cost Analysis

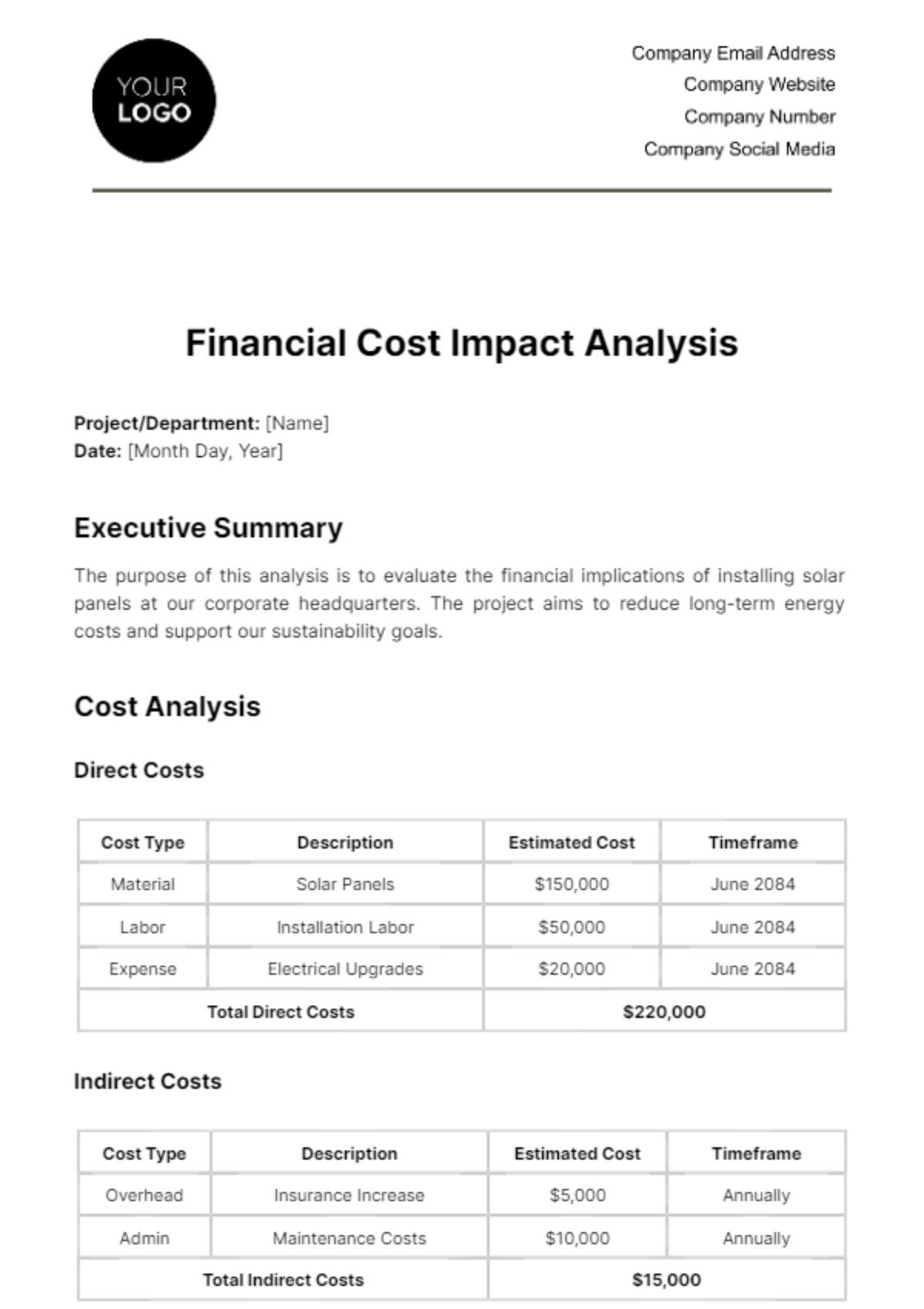

Direct Costs

Cost Type | Description | Estimated Cost | Timeframe |

Material | Solar Panels | $150,000 | June 2084 |

Labor | Installation Labor | $50,000 | June 2084 |

Expense | Electrical Upgrades | $20,000 | June 2084 |

Total Direct Costs | $220,000 | ||

Indirect Costs

Cost Type | Description | Estimated Cost | Timeframe |

Overhead | Insurance Increase | $5,000 | Annually |

Admin | Maintenance Costs | $10,000 | Annually |

Total Indirect Costs | $15,000 | ||

Total Estimated Cost | $235,000 |

Impact Analysis

Financial Impact: The project is expected to reduce our energy bills by approximately $30,000 annually, leading to a breakeven point in less than 8 years. The solar panels have a life expectancy of 20 years, providing long-term financial benefits.

Budgetary Impact: This project will require a reallocation of funds from our annual facilities maintenance budget and capital investments. The initial cost exceeds the current budget allocation by $50,000.

Risk Assessment: The primary financial risk involves potential delays in installation leading to increased labor costs. There's also a minor risk of equipment costs varying due to market fluctuations.

Recommendations

Given the long-term cost savings and alignment with our sustainability goals, it is recommended to proceed with the project. Exploring options for budget reallocation or additional funding sources for the excess $50,000 is suggested.

Prepared By: [Name]

Date: [Month Day, Year]

Reviewed By: [Name]

Date: [Month Day, Year]

APPENDICES: Attached are the detailed energy savings projections, supplier quotes for solar panels and installation, and a revised budget proposal for the fiscal year 2084-2085.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

This Financial Cost Impact Analysis Template from Template.net offers an in-depth tool for evaluating financial implications. This template simplifies the complex process of analyzing the financial impact of business decisions. Fully editable and customizable in our AI Editor tool, it caters to specific business requirements, providing a clear understanding of cost-related consequences in various scenarios. Essential for strategic financial planning.