Free Financial Overhead Cost Analysis

I. Introduction

In navigating the intricacies of financial management, our organization recognizes the pivotal role of overhead costs in shaping our operational and financial landscape. Overhead costs constitute the indirect expenses necessary for our day-to-day operations but are not directly attributable to specific products or services. This encompasses a broad spectrum, including rent, utilities, administrative salaries, and depreciation. Conducting this meticulous analysis is imperative for informed decision-making and strategic financial planning. It allows us to dissect and manage these indirect costs, enhancing operational efficiency and ensuring sustainable financial health.

II. Identification of Overhead Costs

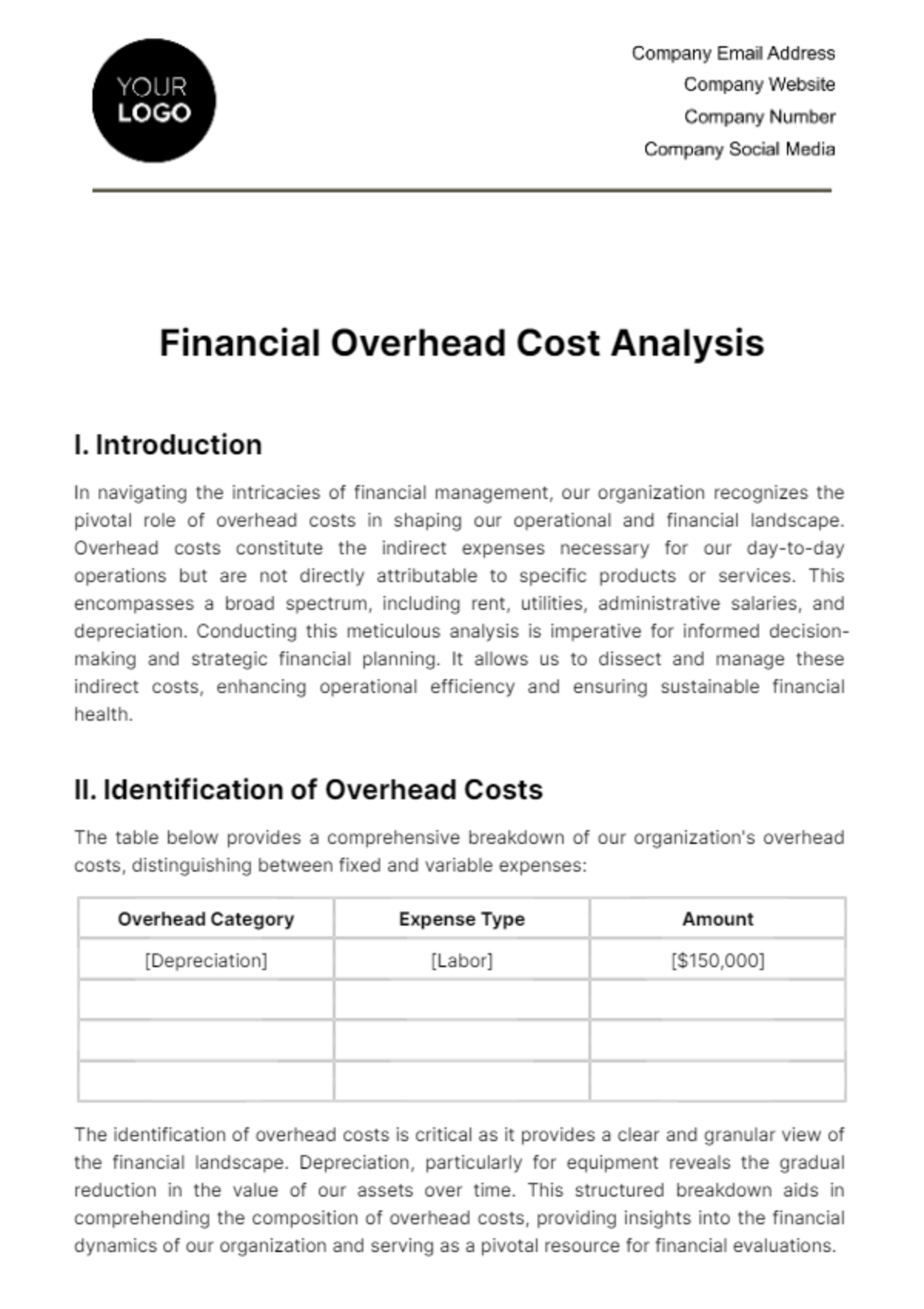

The table below provides a comprehensive breakdown of our organization's overhead costs, distinguishing between fixed and variable expenses:

Overhead Category | Expense Type | Amount |

[Depreciation] | [Labor] | [$150,000] |

The identification of overhead costs is critical as it provides a clear and granular view of the financial landscape. Depreciation, particularly for equipment reveals the gradual reduction in the value of our assets over time. This structured breakdown aids in comprehending the composition of overhead costs, providing insights into the financial dynamics of our organization and serving as a pivotal resource for financial evaluations.

III. Findings

A. Identification of Overhead Cost Drivers

The analysis reveals that the primary drivers of asset depreciation are wear and tear resulting from operational usage, technological obsolescence, and changes in market conditions affecting the residual value of assets.

B. Variance Analysis and Trend Identification

A variance analysis comparing actual depreciation costs against budgeted figures exposes notable trends. For instance, the analysis uncovers a higher-than-expected depreciation in certain categories, possibly indicating accelerated wear on specific equipment.

IV. Analysis of Overhead Costs

A. Opportunities for Optimization

The analysis identifies opportunities for optimization, particularly in adopting predictive maintenance strategies to extend the lifespan of high-value assets and reduce premature depreciation.

B. Comparative Analysis of Trends

Comparative analysis over various periods highlights trends such as an increasing rate of depreciation in technology assets, suggesting a need for more frequent upgrades or a reassessment of the useful life of these assets.

V. Recommendations

A. Implement Predictive Maintenance Strategies

Develop and implement predictive maintenance programs for high-value assets to proactively identify and address issues before they lead to accelerated depreciation.

Leverage sensor technologies and data analytics to monitor equipment health and schedule maintenance activities based on real-time performance data.

B. Review and Adjust Asset Replacement Policies

Conduct a thorough review of existing asset replacement policies to ensure alignment with the actual condition and technological advancements in the industry.

Adjust replacement timelines for assets based on the findings of the analysis, considering factors like wear patterns and technological obsolescence.

C. Enhance Employee Training on Asset Handling

Invest in comprehensive training programs for employees responsible for operating and maintaining assets.

Well-trained personnel can contribute to prolonged asset life by ensuring proper handling, reducing the risk of premature wear and tear.

D. Regularly Update Residual Value Assessments

Conduct periodic assessments of the residual values assigned to assets at the end of their useful life.

Stay informed about market trends, technological advancements, and industry benchmarks to ensure accurate and up-to-date residual value estimates, minimizing the risk of unexpected depreciation.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Delve into intricate cost analysis with the Financial Overhead Cost Analysis Template from Template.net! Explore advanced features using the AI Editor Tool, strategically positioned within this editable template. Tailor it dynamically for nuanced insights into overhead costs. Craft a clearer financial picture for optimal decision-making by editing your customizable copy!