Free Annual Finance Budget Strategy Plan

TABLE OF CONTENTS

I. Financial Goals and Objectives

II. Revenue Forecasting and Analysis

A. Revenue Projections

B. Market Analysis

III. Expenditure Planning

A. Budget Allocation

B. Cost Management Strategies

IV. Risk Assessment and Contingency Planning

A. Risk Analysis

B. Contingency Plans

V. Performance Monitoring and Review

A. Performance Metrics and KPIs

B. Regular Review Schedule

I. Financial Goals and Objectives

Defining Financial Goals

At [Your Company Name], our financial goals for the upcoming fiscal year are ambitiously set yet firmly grounded in realistic assessments. We aim to increase our net revenue by 15%, a target derived from both historical performance and projected market opportunities. This goal reflects our focus on expanding sales, enhancing product offerings, and entering new markets. Simultaneously, we are committed to reducing our operational costs by 10%, which will be achieved through streamlining processes, adopting cost-effective technologies, and negotiating better terms with suppliers.

Furthermore, a robust 20% return on investment is targeted for all new projects, emphasizing our focus on high-value, high-return initiatives. These goals are meticulously quantified, allowing for precise tracking and measurement, ensuring that every financial decision is aimed at achieving these targets.

Alignment with Business Objectives

The financial goals of [Your Company Name] are intricately aligned with our overarching business objectives. Our revenue growth goal supports our ambition for market expansion, ensuring we have the necessary capital to invest in new market entries and marketing campaigns. Reducing operational costs aligns with our objective to enhance efficiency and productivity, thereby maximizing profitability.

The targeted return on investment for new projects is in harmony with our commitment to innovation and quality, ensuring that new initiatives contribute significantly to our business growth and uphold our standards of excellence. This strategic alignment ensures that our financial planning is not just a series of numbers but a cohesive part of our broader business strategy, geared towards sustainable growth and customer satisfaction.

II. Revenue Forecasting and Analysis

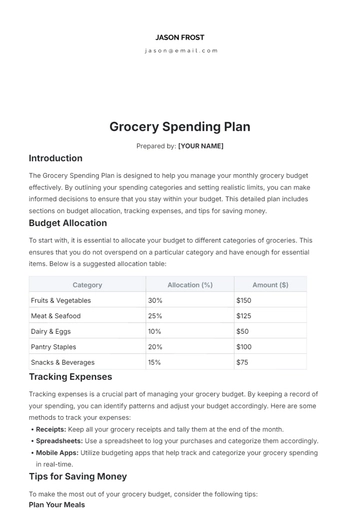

In this section, we delve into [Your Company Name]'s revenue forecasting and market analysis, providing detailed projections and insights. These projections are informed by market research, historical performance, and current market trends, helping us strategically position ourselves for revenue growth in the upcoming fiscal year.

A. Revenue Projections

We project a diversified revenue stream, with an emphasis on expanding into new markets and leveraging emerging technologies. Detailed sales forecasts are based on market research, historical data, and sales trends. Other income sources, such as investments and partnerships, are also factored into our revenue projections.

Revenue Source | Projected Growth | Key Drivers | Remarks |

Product Sales | 18% increase | Expansion into new markets | Growth driven by entering into untapped markets |

Service Revenue | 15% increase | Enhanced service offerings | Focus on customer satisfaction and service diversity |

Online Sales | 25% increase | E-commerce and digital platforms | Increased investment in digital marketing strategies |

Licensing Revenue | 10% increase | New partnerships | Expansion of intellectual property and licensing deals |

Investment Income | 5% increase | Diversified investment portfolio | Conservative growth in line with market predictions |

B. Market Analysis

Our market analysis indicates a growing demand in specific sectors relevant to our operations. We have identified potential opportunities and challenges in these areas and have tailored our revenue strategies to capitalize on these market trends. This analysis informs our sales tactics, pricing strategies, and promotional efforts.

Market Sector | Demand Trend | Opportunities | Challenges | Strategic Response |

Technology | Rising | Adoption of new technologies | Fast-paced innovation | Investing in R&D and collaborations |

Healthcare | Steadily growing | Aging population, health awareness | Regulatory changes | Focus on health-related products |

Consumer Goods | Fluctuating | Changing consumer preferences | Competitive market | Tailored marketing and new product lines |

E-commerce | Rapidly growing | Increased online shopping trends | High competition, customer loyalty | Strengthening online presence and platforms |

Green Energy | Emerging | Environmental sustainability focus | Technological and policy risks | Sustainable practices and investments |

III. Expenditure Planning

In this section, we outline [Your Company Name]'s strategy for expenditure planning for the upcoming fiscal year. This includes a meticulous allocation of the budget across various departments and the implementation of cost management strategies to optimize spending and enhance overall efficiency.

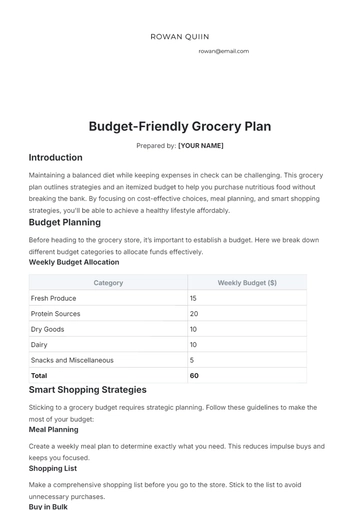

A. Budget Allocation

For the next fiscal year, [Your Company Name] has meticulously planned the budget allocation to ensure each dollar spent aligns with our strategic priorities. A significant portion of the budget is earmarked for research and development, emphasizing our commitment to innovation and staying ahead in the market.

Another key area of investment is digital transformation, which is crucial for modernizing our operations and enhancing customer engagement. Marketing also receives a substantial allocation, reflecting our strategy to expand market reach and brand awareness.

Each department's allocation is carefully calculated based on the anticipated return on investment and its strategic relevance to our long-term goals. This strategic allocation not only ensures efficient use of resources but also supports the company's growth trajectory and competitive positioning.

B. Cost Management Strategies

In parallel to strategic budget allocation, [Your Company Name] is implementing robust cost management strategies. These include process optimization initiatives aimed at streamlining operations, thus reducing overheads and improving efficiency. We are also engaging in strategic vendor negotiations to secure more favorable terms and pricing, which will significantly contribute to cost savings. Regular audits of our expenditure will be conducted, focusing on identifying and eliminating non-essential costs.

These audits will provide insights into potential areas of overspending and enable us to make data-driven decisions on cost reduction. By adopting these strategies, we aim to create a leaner financial structure, maximizing value from each expenditure and ensuring financial stability and sustainability for [Your Company Name].

IV. Risk Assessment and Contingency Planning

Risk management is a critical component of [Your Company Name]'s Annual Finance Budget Strategy Plan. This section details a thorough risk analysis, identifying key financial uncertainties, and outlines strategic contingency plans to mitigate these risks, ensuring the company's resilience in various scenarios.

A. Risk Analysis

A comprehensive risk analysis identifies potential financial uncertainties, including market volatility, regulatory changes, and operational risks. Each risk is evaluated for its likelihood and potential impact on our financial goals.

Risk Category | Likelihood | Potential Impact | Key Indicators |

Market Volatility | High | Moderate to High | Fluctuations in market demand, changes in consumer behavior |

Regulatory Changes | Medium | High | New industry regulations, compliance requirements |

Operational Disruptions | Medium | Moderate | Supply chain issues, production delays |

Technological Risks | Low | High | Cybersecurity threats, system failures |

Financial Market Changes | Medium | Moderate to High | Interest rate fluctuations, currency exchange rate variations |

B. Contingency Plans

For each identified risk, a contingency plan is developed. These plans include maintaining a reserve fund, diversifying income sources, and having flexible operational strategies to quickly adapt to changing market conditions.

Risk Category | Contingency Plan | Implementation Strategy |

Market Volatility | Diversify product offerings, expand into new markets | Market research, product development initiatives |

Regulatory Changes | Regular compliance audits, engage with legal advisors | Stay updated on regulations, legal consultations |

Operational Disruptions | Develop alternative supply chain routes, stockpile essential materials | Supplier diversification, inventory management |

Technological Risks | Invest in robust cybersecurity measures, regular system backups | Cybersecurity training, IT infrastructure upgrades |

Financial Market Changes | Hedge against currency risks, maintain diverse investment portfolio | Financial market analysis, investment strategy adjustments |

V. Performance Monitoring and Review

Effective monitoring and regular reviews are crucial for the success of [Your Company Name]'s Annual Finance Budget Strategy Plan. This section focuses on establishing performance metrics and a schedule for reviews, ensuring that our financial strategy remains dynamic, responsive, and aligned with our goals.

A. Performance Metrics and KPIs

In order to effectively gauge the success of our budget strategy, [Your Company Name] has established a set of key performance indicators (KPIs) that are closely monitored throughout the fiscal year. These KPIs include a detailed analysis of revenue growth, tracking our progress in expanding market share and increasing sales. We also closely monitor our cost efficiency metrics, ensuring that our expenditure aligns with our strategic cost-saving goals.

Additionally, the return on investment (ROI) for major projects and initiatives is rigorously evaluated to ascertain their financial viability and strategic value. By regularly tracking these KPIs, we maintain a clear view of our financial health and are able to make informed decisions that drive us towards our financial objectives.

B. Regular Review Schedule

To ensure that our financial strategy remains relevant and effective, [Your Company Name] has instituted a bi-annual review schedule. During these reviews, we assess our financial performance against the established goals and KPIs. This includes a comprehensive evaluation of revenue trends, expenditure efficiency, and the ROI of our strategic initiatives.

These reviews provide an opportunity to make necessary adjustments to our budget strategy, responding proactively to any deviations from our financial targets. They also allow us to adapt to emerging market trends and changing business conditions, ensuring that our financial strategy supports the company’s long-term objectives and market position. This structured approach to performance reviews is a cornerstone of our commitment to financial prudence and strategic growth.

Created by: [Your Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover smarter budgeting with Template.net's Annual Finance Budget Strategy Plan. Our easily editable, customizable template offers superior planning proficiency. Unleash your strategizing power and gain financial clarity now. Transcend excel norms; editable in our unique Ai Editor Tool. Stay ahead with precise planning and professional strategy execution. Make your strategic decisions count with us.

You may also like

- Finance Plan

- Construction Plan

- Sales Plan

- Development Plan

- Career Plan

- Budget Plan

- HR Plan

- Education Plan

- Transition Plan

- Work Plan

- Training Plan

- Communication Plan

- Operation Plan

- Health And Safety Plan

- Strategy Plan

- Professional Development Plan

- Advertising Plan

- Risk Management Plan

- Restaurant Plan

- School Plan

- Nursing Home Patient Care Plan

- Nursing Care Plan

- Plan Event

- Startup Plan

- Social Media Plan

- Staffing Plan

- Annual Plan

- Content Plan

- Payment Plan

- Implementation Plan

- Hotel Plan

- Workout Plan

- Accounting Plan

- Campaign Plan

- Essay Plan

- 30 60 90 Day Plan

- Research Plan

- Recruitment Plan

- 90 Day Plan

- Quarterly Plan

- Emergency Plan

- 5 Year Plan

- Gym Plan

- Personal Plan

- IT and Software Plan

- Treatment Plan

- Real Estate Plan

- Law Firm Plan

- Healthcare Plan

- Improvement Plan

- Media Plan

- 5 Year Business Plan

- Learning Plan

- Marketing Campaign Plan

- Travel Agency Plan

- Cleaning Services Plan

- Interior Design Plan

- Performance Plan

- PR Plan

- Birth Plan

- Life Plan

- SEO Plan

- Disaster Recovery Plan

- Continuity Plan

- Launch Plan

- Legal Plan

- Behavior Plan

- Performance Improvement Plan

- Salon Plan

- Security Plan

- Security Management Plan

- Employee Development Plan

- Quality Plan

- Service Improvement Plan

- Growth Plan

- Incident Response Plan

- Basketball Plan

- Emergency Action Plan

- Product Launch Plan

- Spa Plan

- Employee Training Plan

- Data Analysis Plan

- Employee Action Plan

- Territory Plan

- Audit Plan

- Classroom Plan

- Activity Plan

- Parenting Plan

- Care Plan

- Project Execution Plan

- Exercise Plan

- Internship Plan

- Software Development Plan

- Continuous Improvement Plan

- Leave Plan

- 90 Day Sales Plan

- Advertising Agency Plan

- Employee Transition Plan

- Smart Action Plan

- Workplace Safety Plan

- Behavior Change Plan

- Contingency Plan

- Continuity of Operations Plan

- Health Plan

- Quality Control Plan

- Self Plan

- Sports Development Plan

- Change Management Plan

- Ecommerce Plan

- Personal Financial Plan

- Process Improvement Plan

- 30-60-90 Day Sales Plan

- Crisis Management Plan

- Engagement Plan

- Execution Plan

- Pandemic Plan

- Quality Assurance Plan

- Service Continuity Plan

- Agile Project Plan

- Fundraising Plan

- Job Transition Plan

- Asset Maintenance Plan

- Maintenance Plan

- Software Test Plan

- Staff Training and Development Plan

- 3 Year Plan

- Brand Activation Plan

- Release Plan

- Resource Plan

- Risk Mitigation Plan

- Teacher Plan

- 30 60 90 Day Plan for New Manager

- Food Safety Plan

- Food Truck Plan

- Hiring Plan

- Quality Management Plan

- Wellness Plan

- Behavior Intervention Plan

- Bonus Plan

- Investment Plan

- Maternity Leave Plan

- Pandemic Response Plan

- Succession Planning

- Coaching Plan

- Configuration Management Plan

- Remote Work Plan

- Self Care Plan

- Teaching Plan

- 100-Day Plan

- HACCP Plan

- Student Plan

- Sustainability Plan

- 30 60 90 Day Plan for Interview

- Access Plan

- Site Specific Safety Plan