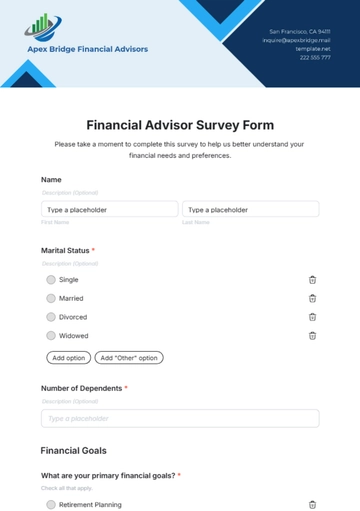

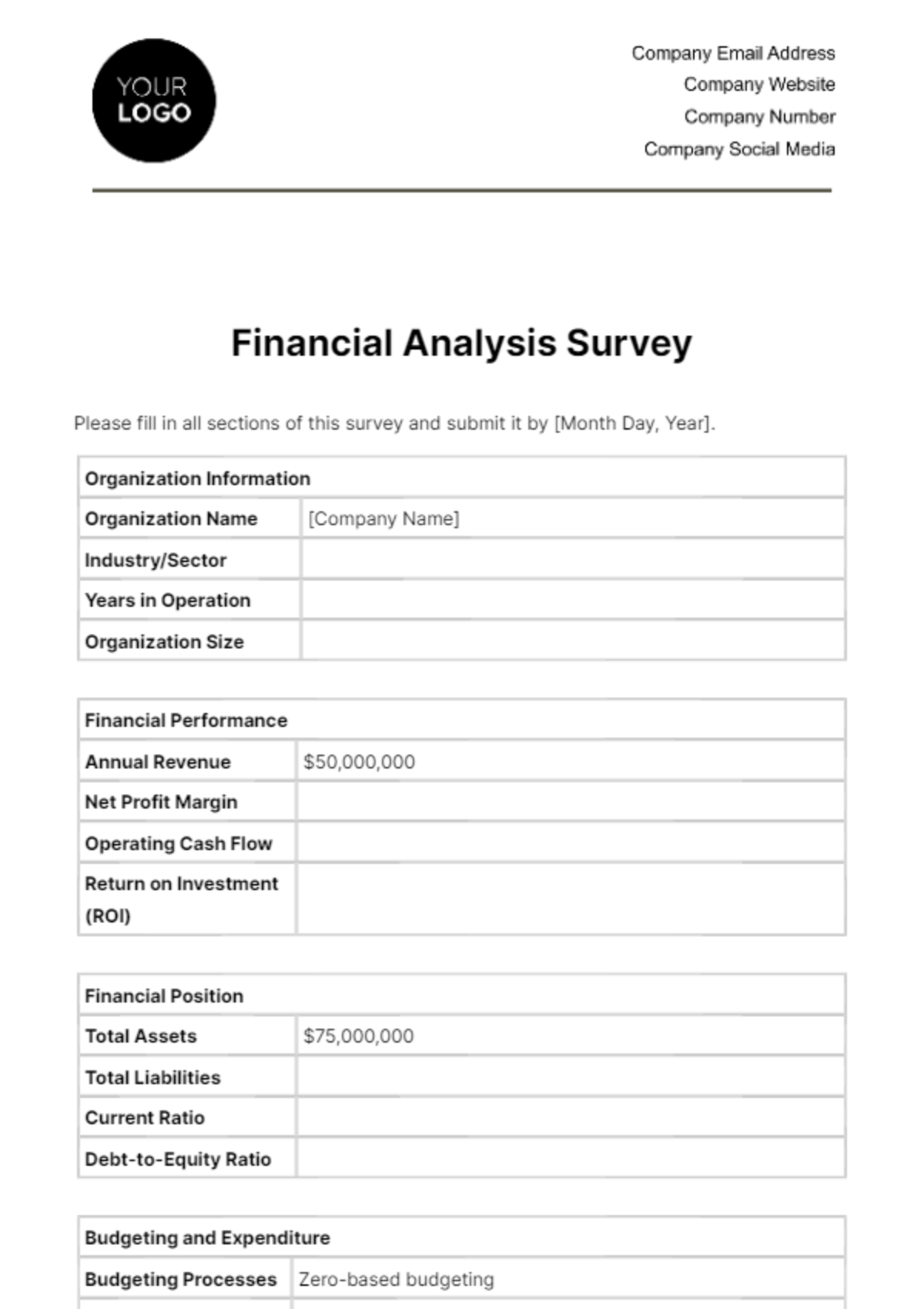

Free Financial Analysis Survey

Please fill in all sections of this survey and submit it by [Month Day, Year].

Organization Information | |

Organization Name | [Company Name] |

Industry/Sector | |

Years in Operation | |

Organization Size | |

Financial Performance | |

Annual Revenue | $50,000,000 |

Net Profit Margin | |

Operating Cash Flow | |

Return on Investment (ROI) | |

Financial Position | |

Total Assets | $75,000,000 |

Total Liabilities | |

Current Ratio | |

Debt-to-Equity Ratio | |

Budgeting and Expenditure | |

Budgeting Processes | Zero-based budgeting |

Major Expenditure Categories | |

Variance Analysis | |

Investment and Capital Allocation | |

Capital Investment Strategy | Focus on technology upgrades |

Allocation of Funds Across Projects | |

ROI Analysis | |

Risk Assessment | |

Debt Management | |

Outstanding Debts and Loans | $15,000,000 loans |

Debt Repayment Schedules | |

Interest Rates and Terms | |

Financial Decision-Making | |

Decision-Making Processes | Decisions based on ROI and strategic alignment |

Criteria for Selecting Investments | |

Use of Financial Advisors | |

Risk Management | |

Identification of Financial Risks | Risk identification meetings are conducted on a monthly basis to identify risks. |

Risk Mitigation Strategies | |

Insurance Coverage | |

Financial Policies and Compliance | |

Overview of Financial Policies | The organization's financial policies serve as a comprehensive framework to ensure a structured and transparent approach to financial operations. |

Compliance with Financial Regulations | |

Internal Control Mechanisms | |

Economic Outlook and Industry Trends | |

Perception of Current Economic Conditions | Stable economic conditions with moderate growth |

Anticipation of Future Economic Trends | |

Industry-Specific Challenges and Opportunities | |

Financial Satisfaction and Stakeholder Views | |

Overall Satisfaction with Financial Performance | Generally satisfied, but room for improvement |

Stakeholder Satisfaction | |

Feedback on Financial Reporting Transparency | |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Uncover profound financial insights effortlessly with the Financial Analysis Survey Template from Template.net! Empower your analysis with an unparalleled level of customization using the AI Editor Tool, ensuring an editable and customizable survey tailored to your unique needs. Elevate your financial scrutiny, making data-driven decisions with confidence and precision today!