Free Financial Cost Management Journal

Executive Summary

A. Overview

In this financial cost management journal, we delve into the intricacies of cost management at [Your Company Name]. Over the past fiscal year, our focus has been on optimizing fixed and variable costs to ensure sustainable growth and profitability. This executive summary provides a snapshot of the key highlights and challenges encountered in our pursuit of effective cost management.

B. Key Highlights:

Implemented targeted cost reduction initiatives.

Analyzed cost trends to identify areas for optimization.

Explored efficiency improvements across various departments.

C. Challenges:

External market fluctuations impacting variable costs.

Balancing cost reduction without compromising operational efficiency.

Introduction

A. Background

At [Your Company Name], we recognize the critical role effective cost management plays in maintaining a competitive edge and fostering financial sustainability. The backdrop for our financial cost management efforts involves adapting to market dynamics, regulatory changes, and evolving customer expectations.

In the recent past, [Your Company Name] has witnessed a surge in operational costs due to expanding business operations. This journal aims to provide a comprehensive overview of our journey in managing costs efficiently, outlining the strategies employed to mitigate challenges and capitalize on opportunities.

B. Objectives

Our primary objectives in the realm of financial cost management include:

Optimizing Fixed Costs:

Streamlining administrative expenses without compromising workforce well-being.

Evaluating long-term commitments to ensure alignment with strategic goals.

Addressing Variable Costs:

Analyzing and responding to market fluctuations affecting raw material prices.

Enhancing agility in cost structures to adapt swiftly to changing business environments.

Enhancing Cost Analysis and Control:

Implementing robust analytical tools for real-time cost tracking.

Instituting effective control measures to prevent cost overruns.

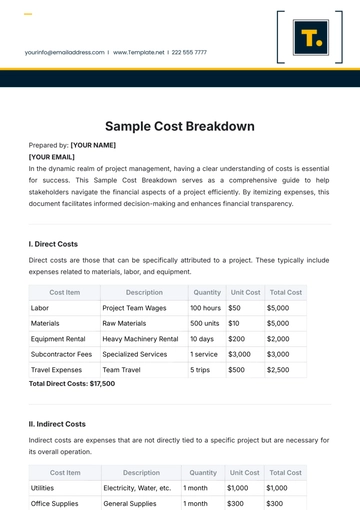

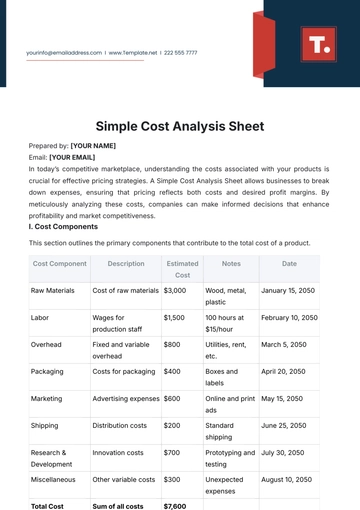

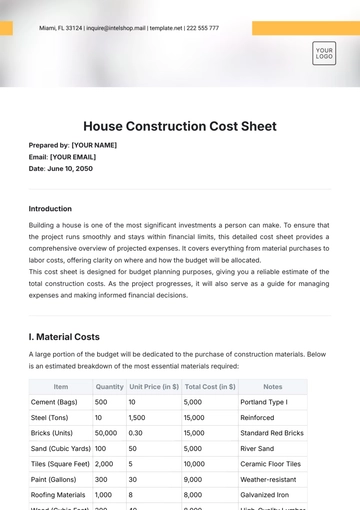

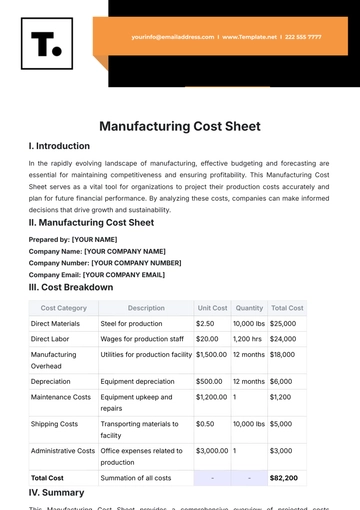

Cost Identification

A. Fixed Costs

Fixed costs at [Your Company Name] encompass essential expenses that remain relatively constant, irrespective of production levels. A meticulous examination of our financial reports reveals key components contributing to fixed costs:

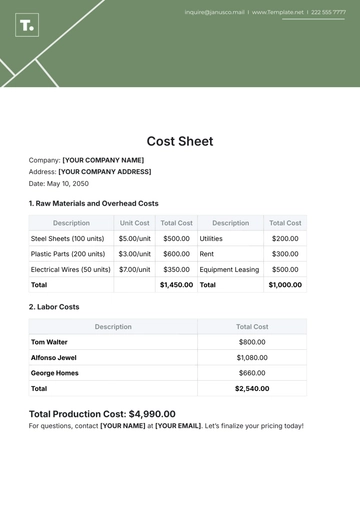

Expense Category | Amount |

|---|---|

Salaries | [$500,000] |

Salaries: Representing a significant portion of fixed costs, salaries encompass employee compensation. A careful evaluation of salary structures ensures a balance between retaining top talent and managing costs.

Rent: The cost associated with leasing our office space is a stable fixed expense. We continually assess our space requirements and negotiate lease terms to optimize this cost.

Insurance: Safeguarding against unforeseen risks, insurance costs are a crucial fixed component. Regular assessments of coverage and policy premiums are conducted to ensure cost-effectiveness.

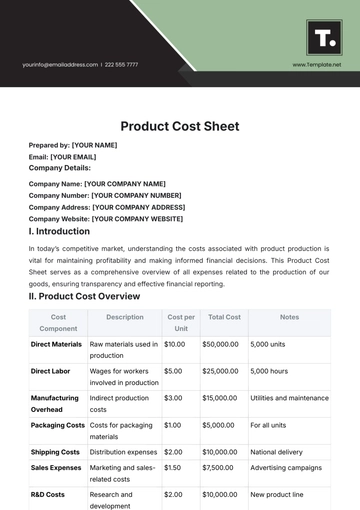

B. Variable Costs

Variable costs, subject to fluctuations based on production or operational changes, form another dimension of our cost structure. The following breakdown highlights key variable costs:

Expense Category | Amount |

|---|---|

Raw Materials | [$120,000] |

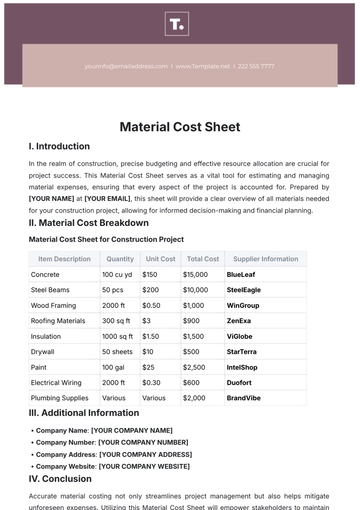

Raw Materials: As a manufacturing-centric company, the cost of raw materials is directly linked to production volumes. Constant monitoring of market prices and supplier negotiations aid in managing this variable cost.

Utilities: Costs associated with energy consumption and other utilities vary based on operational activities. Implementing energy-efficient practices and technologies helps mitigate these costs.

Marketing: Variable costs related to marketing initiatives fluctuate with campaign intensities. Evaluating the return on investment (ROI) for marketing expenditures guides our decision-making in optimizing this variable cost.

Cost Analysis

A. Cost Trends

Analyzing cost trends is imperative for strategic decision-making. The following represents the trajectory of our costs over the past fiscal year:

The upward trend in operational costs during Q2 corresponds to increased production demands.

A subsequent decline in Q3 reflects successful cost containment measures initiated during that period.

Q4 demonstrates a stabilization of costs, showcasing the efficacy of our strategic adjustments.

B. Cost Breakdown

A detailed breakdown of costs by department provides valuable insights into areas where cost optimization measures may be applied:

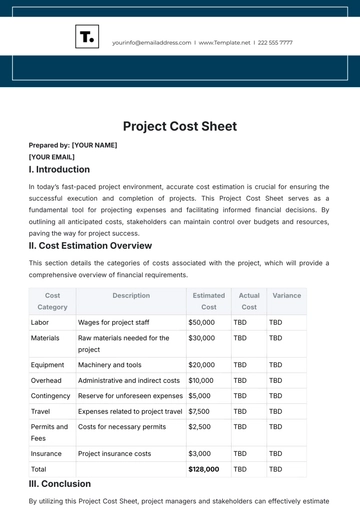

Department | Total Cost | Percentage of Total Cost |

|---|---|---|

Operations | [$300,000] | [30%] |

Operations: Representing the core of our business, operational costs include production, logistics, and other key functions. Ongoing process optimizations contribute to cost efficiency in this department.

Marketing: An essential component for brand visibility and revenue generation, marketing costs are strategically allocated to campaigns with proven success rates.

R&D: Investing in research and development ensures our products remain innovative and competitive. Close scrutiny of R&D costs ensures a balance between innovation and cost control.

Cost Control Strategies

A. Cost Reduction Initiatives

In response to the challenges identified in the cost analysis, [Your Company Name] implemented targeted cost reduction initiatives aimed at preserving profitability without compromising the quality of products or services. The following strategies were instrumental in achieving our cost reduction objectives:

Operational Streamlining: Conducted a comprehensive review of operational processes, identifying redundancies, and streamlining workflows. This led to a more efficient allocation of resources and a reduction in operational costs.

Vendor Negotiations: Engaged in proactive negotiations with key vendors and suppliers to secure favorable terms. Renegotiating contracts and exploring alternative suppliers helped mitigate the impact of fluctuating raw material prices on variable costs.

Technology Integration: Embraced technology solutions to automate manual processes, reducing the need for human intervention in repetitive tasks. This not only improved operational efficiency but also contributed to long-term cost savings.

B. Efficiency Improvements

Efficiency improvements were a focal point in our cost management strategy, with a focus on optimizing resource utilization and enhancing overall productivity:

Employee Training and Development: Invested in training programs to enhance the skills of our workforce. A skilled workforce contributes to higher productivity, reducing the overall cost per unit of production.

Energy-Efficient Practices: Implemented energy-efficient technologies and practices to reduce utility costs. This not only aligns with our commitment to sustainability but also positively impacts the bottom line.

Supply Chain Optimization: Conducted a thorough analysis of the supply chain, identifying areas for optimization. This included minimizing lead times, reducing excess inventory, and improving overall supply chain resilience.

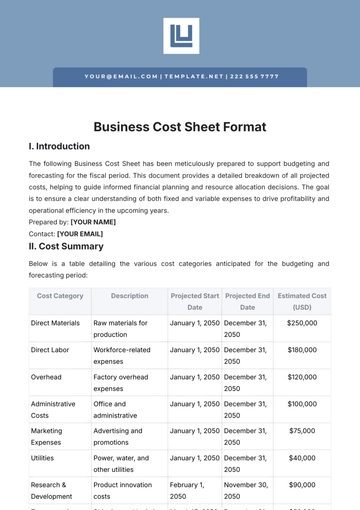

Future Outlook

A. Forecasted Costs

Looking ahead, our financial projections indicate both challenges and opportunities. The forecasted costs for the upcoming fiscal year are based on a meticulous analysis of market trends, internal projections, and anticipated changes in operations:

Expense Category | Forecasted Amount |

|---|---|

Salaries | [$520,000] |

Salaries: The forecasted increase in salaries reflects planned expansions in key departments to support business growth.

Raw Materials: A conservative estimate for raw material costs considering potential market fluctuations and supply chain uncertainties.

Marketing: A slight increase in the marketing budget is projected to support new product launches and promotional campaigns.

B. Cost Management Strategy Adjustments

To proactively address future challenges, [Your Company Name] is prepared to make necessary adjustments to the cost management strategy. These adjustments may include:

Continuous Monitoring: Implementing real-time monitoring systems to promptly identify and address cost variances.

Agile Responses: Developing agile responses to market changes, enabling swift adjustments to cost structures as needed.

Innovation Investments: Allocating resources to innovative solutions that not only enhance product or service offerings but also contribute to long-term cost efficiencies.

Risk Mitigation Strategies

A. Identifying Financial Risks

In any financial cost management strategy, it is crucial to identify potential risks that may impact cost structures. This section focuses on recognizing and understanding financial risks that could pose challenges to [Your Company Name].

Market Fluctuations: Analyzing market trends and foreseeing potential fluctuations in raw material prices, interest rates, or currency exchange rates that may affect costs.

Regulatory Changes: Staying vigilant about regulatory updates that could lead to increased compliance costs or necessitate adjustments in operational practices.

Supply Chain Disruptions: Identifying vulnerabilities in the supply chain that may result in delays, shortages, or increased costs due to unforeseen circumstances.

B. Mitigation Strategies

Once risks are identified, [Your Company Name] implements proactive strategies to mitigate their impact on financial costs.

Diversification: Diversifying suppliers and markets to reduce dependence on a single source, minimizing the impact of supply chain disruptions.

Hedging Strategies: Implementing financial instruments to hedge against currency fluctuations or volatile commodity prices, safeguarding against unexpected cost increases.

Regular Compliance Audits: Conducting regular audits to ensure compliance with evolving regulations, preventing potential financial penalties.

Scenario Planning: Developing scenario-based strategies to respond swiftly to unexpected events, ensuring agility in cost management.

Conclusion

In conclusion, this Financial Cost Management Journal reflects the dedicated efforts of [Your Company Name] in navigating the complex landscape of cost management. Through meticulous analysis, strategic initiatives, and adaptability, we have achieved significant milestones in optimizing our cost structures. Here, we summarize the key findings and outcomes of our financial cost management journey:

Cost Optimization Success: The implementation of targeted cost reduction initiatives and efficiency improvements has resulted in a commendable reduction in overall operational costs.

Strategic Adaptability: The ability to adapt our cost management strategy to changing market dynamics and internal needs has proven to be a crucial factor in maintaining financial resilience.

Forecasted Planning: Our forecasted costs for the upcoming fiscal year reflect a balanced approach to resource allocation, considering potential challenges and opportunities.

Continuous Improvement: [Your Company Name] remains committed to a culture of continuous improvement. The lessons learned from this financial cost management journal will inform future strategies and enhance our overall financial sustainability.

As we move forward, [Your Company Name] will continue to focus on innovation, operational efficiency, and strategic cost management. Our commitment to delivering value to our stakeholders remains unwavering, and we look forward to the challenges and opportunities that the future holds.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance cost management insights with the Financial Cost Management Journal Template on Template.net. This editable and customizable journal simplifies data recording. Tailor content effortlessly using our Ai Editor Tool, ensuring adaptability and precision. Elevate your financial documentation with this user-friendly template, offering a comprehensive approach to crafting personalized cost management journals for effective financial record-keeping.