Free Financial Cost Impact Study

I. Introduction

A. Background

Embarking on a transformative project is a critical decision for any organization. The decision to undertake this initiative stems from the company's strategic vision to enhance operational efficiency and stay ahead in an evolving market. The project is a response to identified challenges in the industry, and its successful execution aligns with the company's commitment to innovation and growth.

B. Objectives

The study is crafted to meet the following objectives:

Assess the projected costs associated with the implementation of the initiative.

Quantify the anticipated benefits that may accrue from successful project execution.

Determine whether the benefits outweigh the costs, establishing the financial viability of the initiative and ensuring a positive return on investment.

C. Scope

This study will focus on the financial aspects of the initiative, emphasizing:

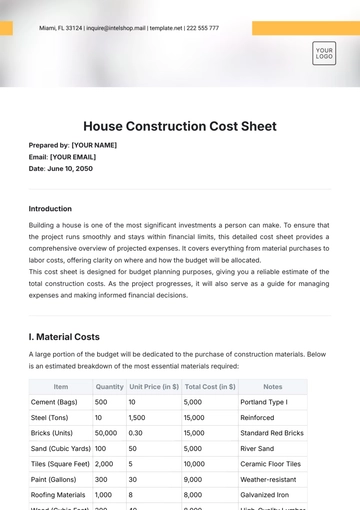

Identification and analysis of specific cost categories, including initial investments, operational costs, and maintenance expenses.

Estimation and evaluation of anticipated benefits, such as revenue generation, cost savings, and efficiency improvements.

Analysis over a defined time period, considering potential risks and uncertainties that may impact financial outcomes.

II. Project Description

A. Overview

The initiative, [Project Insight], is a strategic endeavor designed to revolutionize our data analytics capabilities. By implementing advanced algorithms and machine learning models, it aims to enhance decision-making processes across the organization. This represents a significant step forward in our efforts to adapt to changing market dynamics and deliver enhanced value to stakeholders.

B. Project Scope and Deliverables

The scope and deliverables of this project includes the following:

Development of a new predictive analytics software platform.

Implementation of an automated data processing and visualization system.

III. Cost Identification and Estimation

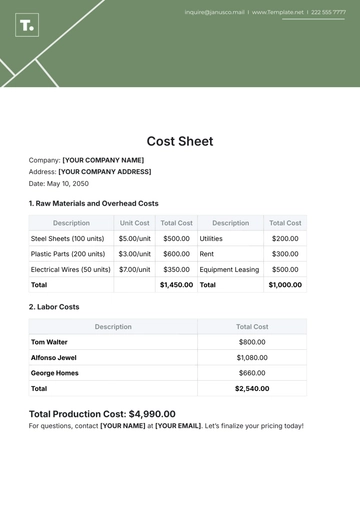

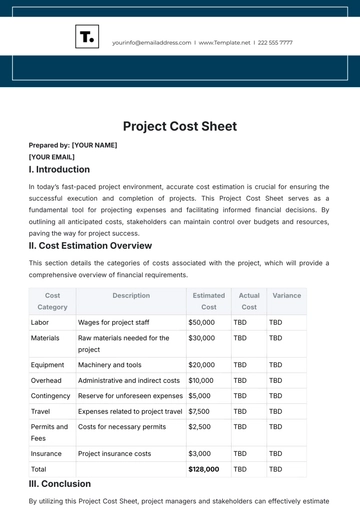

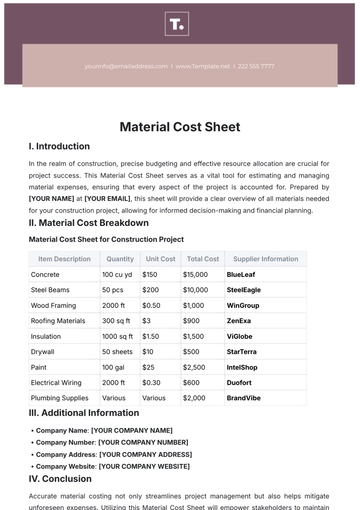

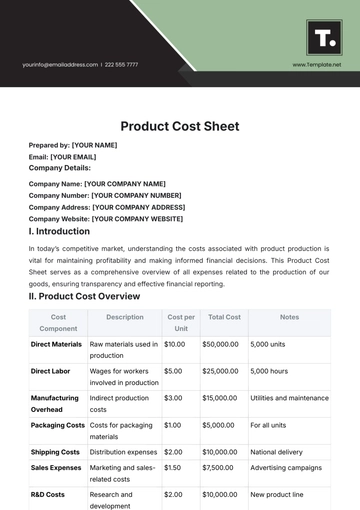

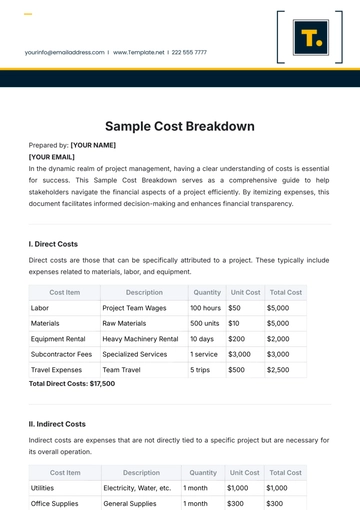

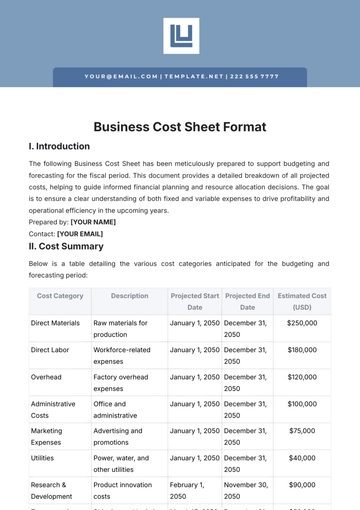

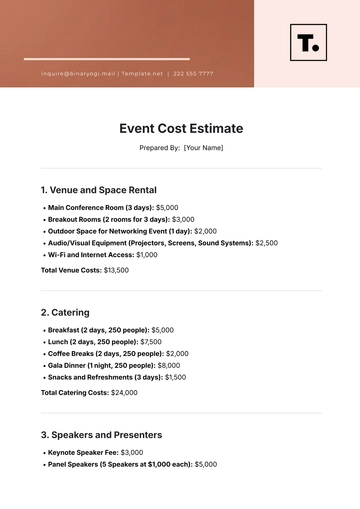

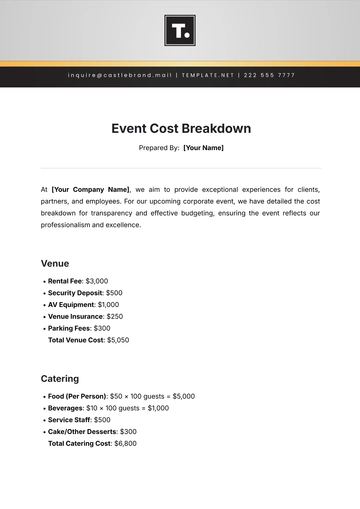

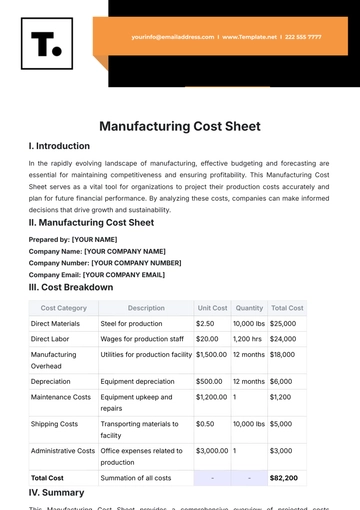

Identifying and estimating costs is a pivotal aspect of the study. The table below outlines the estimated costs associated with the project:

Cost Category | Estimated Cost |

[Initial Investments] | [$1,200,000] |

The estimated costs cover various aspects of the initiative, contributing to understanding the financial commitment required for the project. These figures collectively reflect the investment required in technology, infrastructure development, ongoing operational expenses, maintenance, and workforce preparedness. Understanding these diverse cost categories is crucial for assessing the comprehensive financial impact of the initiative.

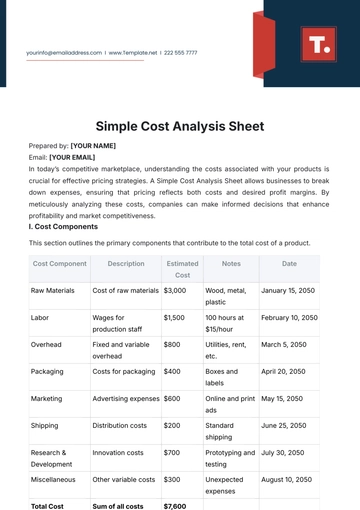

IV. Benefit Identification and Estimation

The anticipated benefits cover a spectrum of areas, contributing to the overall positive impact on organizational effectiveness. The following table outlines the anticipated benefits and the respective estimated values:

Benefit Category | Estimated Value |

[Revenue Generation] | [$2,500,000] |

These diverse benefits collectively reflect the strategic and operational advantages the initiative aims to bring, emphasizing a holistic approach to success measurement. By focusing on strategic and operational advantages, as well as qualitative measures, the initiative aims to bring about a well-rounded impact on organizational effectiveness.

V. Timeframe

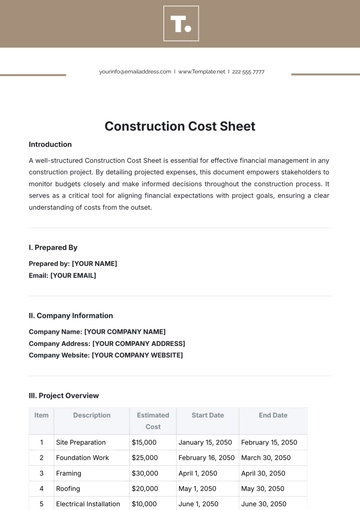

Establishing a clear and well-defined timeframe is crucial for the successful execution of the initiative. The table below outlines the major milestones and phases of the initiative:

Phase | Duration |

[Planning and Initiation Phase] | [3 months] |

Commencing with the planning and initiation phase, the initiative establishes a strong foundation. The subsequent phases, executed over specified durations, cover key aspects of the project's life cycle. This approach ensures adaptability and effective project management throughout the initiative.

VI. Results

A. Financial Viability

Net Present Value (NPV)

The calculated NPV indicates a positive financial outcome of $1,000,000.

A positive NPV suggests that the initiative is financially viable.

Return on Investment (ROI)

The ROI, expressed as a percentage, demonstrates a 15% return expected on the initial investment.

A higher ROI indicates a potentially higher return relative to the initial investment.

B. Benefit Realization

Revenue Generation

The anticipated revenue generation aligns with projections, contributing to increased financial inflows of $2,000,000.

Revenue streams from the initiative are expected to strengthen the organization's overall financial position.

Cost Savings and Efficiency

The projected cost savings and efficiency improvements are in line with expectations, resulting in anticipated operational cost reductions of $500,000.

Operational processes are anticipated to become highly efficient, contributing to potential cost reductions.

C. Risk Mitigation Effectiveness

Risk Mitigation Strategies

The implemented risk mitigation strategies have successfully addressed identified risks, minimizing potential negative impacts.

Contingency plans have effectively mitigated unforeseen challenges during project execution.

Probability and Impact Management

Probability assessments aligned with actual occurrences, demonstrating the accuracy of risk predictions.

Impact management strategies successfully mitigated the effects of identified risks on project outcomes.

D. Overall Project Outlook

Project Timeline Adherence

The initiative adhered to the established timeline, meeting key milestones within the defined phases.

Timely execution contributes to the overall successful progression of the initiative.

Stakeholder Satisfaction

Stakeholder satisfaction, as per qualitative assessments, indicates a high level of contentment with the initiative's progress and outcomes.

VII. Sensitivity Analysis

The following analysis explores the sensitivity of the study to changes in critical variables:

A. Discount Rate Sensitivity

A sensitivity analysis was performed by varying the discount rate within a reasonable range. Results indicate that the NPV is most sensitive to changes in the discount rate. A higher discount rate results in a lower NPV, emphasizing the importance of accurately assessing the cost of capital.

B. Revenue Projections Sensitivity

The study assessed the impact of variations in revenue projections on overall financial outcomes. Sensitivity analysis indicates that the initiative remains financially viable even with a moderate decrease in projected revenue. This highlights the resilience of the project to potential fluctuations in revenue streams.

C. Cost Estimation Sensitivity

Sensitivity to changes in cost estimations was evaluated to gauge the robustness of the financial model. The initiative demonstrates resilience to moderate increases in operational and maintenance costs. However, careful monitoring and control of costs are crucial to maintaining the project's financial health.

D. Timeline Sensitivity

The impact of potential delays in project timelines was assessed to understand the resilience of the initiative to schedule variations. Sensitivity analysis indicates that while minor delays may have a limited impact, prolonged delays can negatively affect the NPV. This underscores the importance of adhering to the established timeline.

E. Risk Mitigation Sensitivity

The study considered the effectiveness of risk mitigation strategies in various scenarios. Sensitivity analysis reveals that robust risk mitigation plans significantly contribute to the project's resilience. Well-executed risk management positively influences financial outcomes, emphasizing the importance of proactive risk planning.

F. Benefit Realization Sensitivity

The study explored the sensitivity of financial outcomes to variations in benefit realization. Results indicate that even with a moderate reduction in anticipated benefits, the initiative maintains positive financial viability.

VIII. Recommendations

Here are the recommendations from the findings of the study, providing targeted guidance to enhance the initiative's financial performance:

A. Refined Cost Estimations

Refine cost estimation models based on the sensitivity analysis, ensuring that operational and maintenance costs align with potential variations.

Implement continuous monitoring mechanisms to promptly identify and address any deviations from the estimated cost figures.

B. Strategic Revenue Diversification

Strategically diversify revenue streams based on the identified sensitivity to variations in benefit realization.

Explore additional revenue sources or optimize existing ones to maximize financial resilience.

C. Timeline Adherence Strategies

Implement strategies to minimize potential delays based on the sensitivity of the initiative to timeline variations.

Enhance project management practices to proactively address challenges and adhere to the established timeline.

D. Maximized Benefit Realization

Implement targeted strategies to maximize benefit realization, focusing on areas identified as most impactful in the study.

Engage stakeholders in collaborative efforts to enhance the extraction of anticipated advantages.

E. Dynamic Discount Rate Adjustments

Implement a dynamic approach to adjusting the discount rate, considering changes in the organization's cost of capital.

Conduct periodic sensitivity analyses to assess the impact of varying discount rates on NPV and overall financial viability.

F. Iterative Risk Mitigation Plans

Iteratively update and strengthen risk mitigation plans based on the identified effectiveness in the study.

Regularly reassess identified risks and adjust mitigation strategies to align with evolving project conditions.

G. Targeted Training and Development Investments

Target investments in training and development programs based on the sensitivities to workforce proficiency.

Align training initiatives with specific technological advancements and industry best practices highlighted in the study.

H. Transparent Stakeholder Communication

Implement a transparent communication plan to elevate stakeholder satisfaction.

Tailor communication strategies to address concerns proactively and maintain stakeholder confidence.

I. Continuous Monitoring and Evaluation Framework

Establish a continuous monitoring and evaluation framework emphasizing on regular project assessments.

Periodically review and adapt the framework to identify areas for improvement and ensure ongoing project success.

J. Scenario-Based Contingency Planning

Develop scenario-based contingency plans anticipating potential variations in external factors.

Create detailed contingency plans for different scenarios to enhance organizational resilience.

IX. Conclusion

In conclusion, the study has provided a comprehensive analysis of the initiative, offering valuable insights into its financial dynamics. The study's findings underscore the initiative's overall financial viability, emphasizing its positive Net Present Value (NPV) and Return on Investment (ROI). Sensitivity analyses have highlighted critical areas such as the impact of discount rates, revenue variations, and cost estimation adjustments on the financial outcomes. Based on these insights, targeted recommendations have been proposed to refine cost estimations, optimize revenue diversification, and enhance risk mitigation plans. Additionally, the study underscores the importance of continuous monitoring, dynamic adjustments, and scenario-based planning to ensure the initiative's financial resilience. Overall, this study serves as a foundation for informed decision-making, guiding strategic actions to maximize financial success and mitigate potential risks throughout the initiative's lifecycle.

X. Limitations and Assumptions

While the study provides valuable insights, it is essential to acknowledge certain limitations and assumptions that may influence the study's scope and outcomes. One key limitation arises from the inherent uncertainties in future projections, such as revenue generation and cost estimations, which are susceptible to external market dynamics. Additionally, the study assumes a stable discount rate accurately reflecting the organization's cost of capital, and any unforeseen changes in financial structures could impact NPV calculations. The effectiveness of risk mitigation strategies is another assumption, and real-world success may deviate from anticipated outcomes. Moreover, qualitative assessments of stakeholder satisfaction, while informative, may not capture the full spectrum of evolving expectations. These limitations underscore the importance of interpreting the study's results with a nuanced understanding, fostering a proactive approach to address potential challenges throughout the project's lifecycle.

XI. Appendices

A. Financial Models

Detailed financial models used for projections, including cost estimations, revenue forecasts, and Net Present Value (NPV) calculations.

B. Risk Mitigation Plan

Detailed documentation of risk mitigation strategies, including contingency plans and responses to identified project risks.

C. Stakeholder Survey Data

Raw data and analyses from stakeholder surveys, providing insights into qualitative assessments and satisfaction levels.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Assess financial costs impact with precision using the Financial Cost Impact Study Template brought to you by Template.net! This editable template transcends the superficial, offering a customizable study for your unique cost impact assessment needs. Streamline your analysis process for effective cost management. Effortlessly customize using the AI Editor Tool!