Finance Payroll Software User Guide

I. Introduction

A. Overview

[Finance Pro] is an advanced finance payroll software meticulously designed to simplify and streamline your payroll management processes. This user guide is your comprehensive companion, providing step-by-step instructions to navigate the robust features that make this software an indispensable tool for efficient payroll processing.

B. Benefits for Users

Time Savings

Automate payroll processes and save valuable time with intuitive functionalities.

Accuracy

Minimize errors through precise calculations and meticulous data management.

Compliance

Stay effortlessly updated with tax and labor regulations, ensuring compliance at all times.

II. Getting Started

A. System Requirements

Hardware Specifications

Ensure a smooth experience by confirming your system meets the hardware prerequisites for optimal performance.

Software Dependencies

Verify compatibility with required software dependencies to guarantee seamless integration.

B. Installation

Downloading the Software

Visit the website to securely download the latest version.

Click on the download link and save the installation file to your preferred location.

Installation Steps

Locate the downloaded file and double-click to initiate the installation process.

Follow the on-screen prompts, accepting terms and conditions as necessary.

Choose installation preferences and complete the process.

License Activation Process

Upon successful installation, launch the software.

Follow the instructions to activate your license, unlocking its full potential.

III. User Interface Overview

The table below provides a comprehensive overview of key elements within the user interface, aiding users in optimizing their experience:

Section | Description |

[Main Dashboard] | [Overview of the main components and customizable widgets.] |

A user-friendly interface is the gateway to maximizing the potential of the software. The Main Dashboard serves as a command center, providing instant insights for informed decision-making. In-depth familiarity with these elements empowers users to harness the full capabilities of the software, ultimately leading to streamlined payroll processes and improved overall efficiency. By mastering the user interface, users can navigate the software with confidence, making it a powerful tool in their payroll management arsenal.

IV. User Roles and Permissions

A. Admin Role

Responsibilities and Privileges

As an administrator, access Admin Settings to configure system settings. Manage user accounts by navigating to User Management, where you can add, modify, or deactivate accounts.

Managing User Accounts

To manage user accounts, select User Management. Click on Add User to create new accounts. Edit existing accounts by selecting Modify User, and deactivate accounts using the Deactivate User option.

B. Manager Role

Access Levels and Scope

Managers can oversee payroll processes. Access Manager Dashboard for an overview. Use Approval Workflows to manage team approvals and Team Management to view and edit team details.

Supervisory Functions

Monitor team performance in the Performance section. Utilize Reports for detailed insights into team activities. Manage tasks efficiently using the Task Management feature.

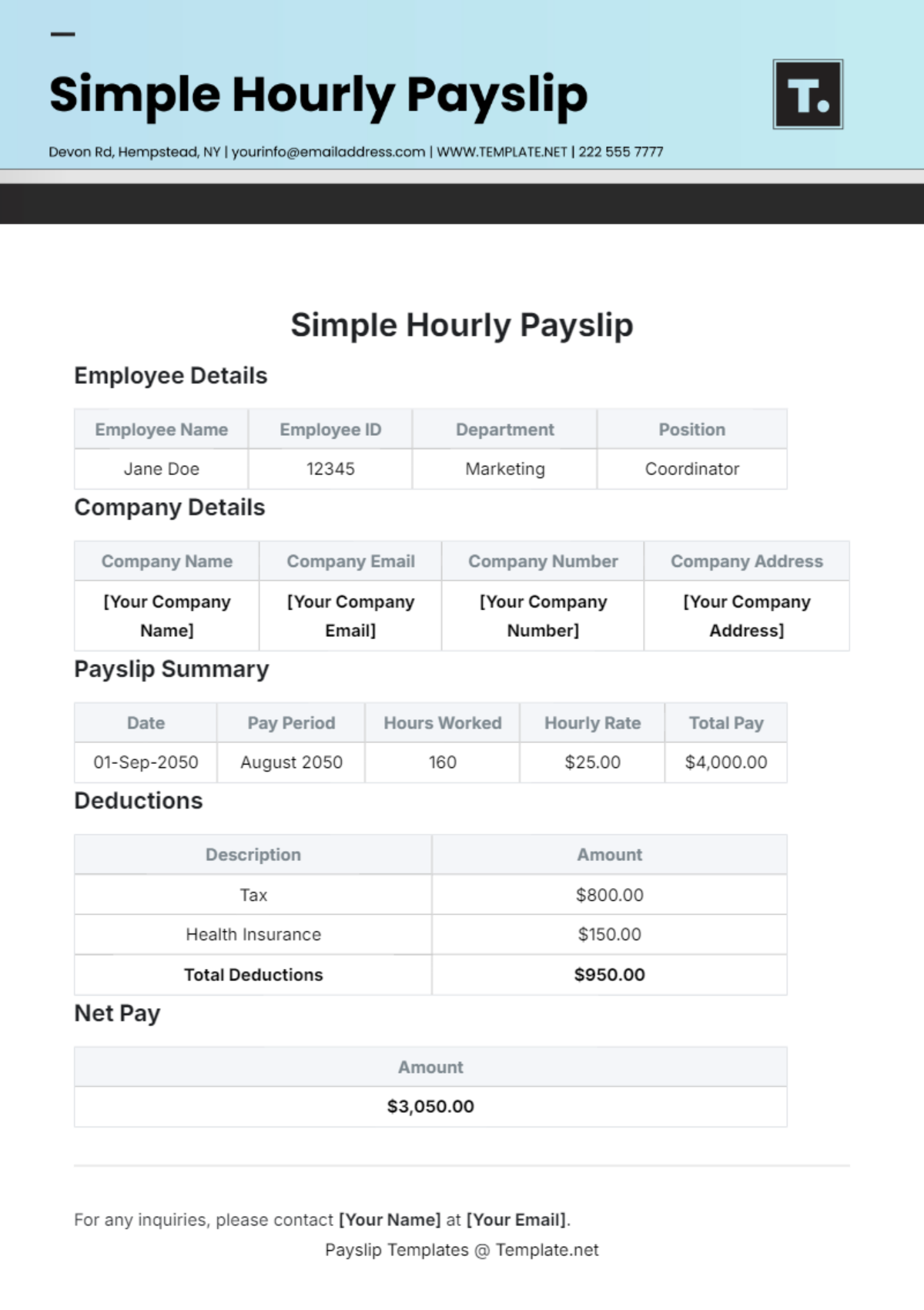

C. Employee Role

Limited Access Areas

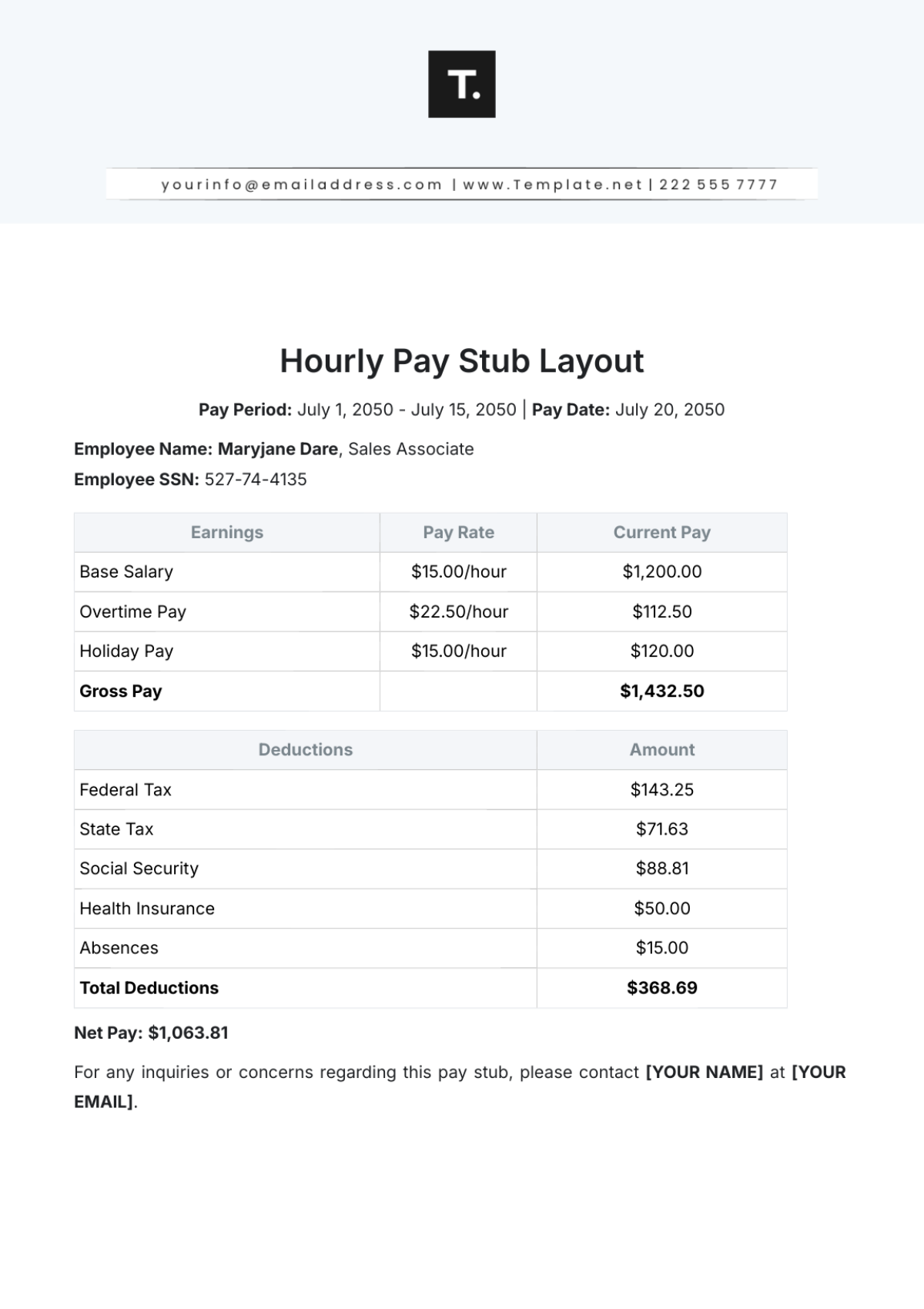

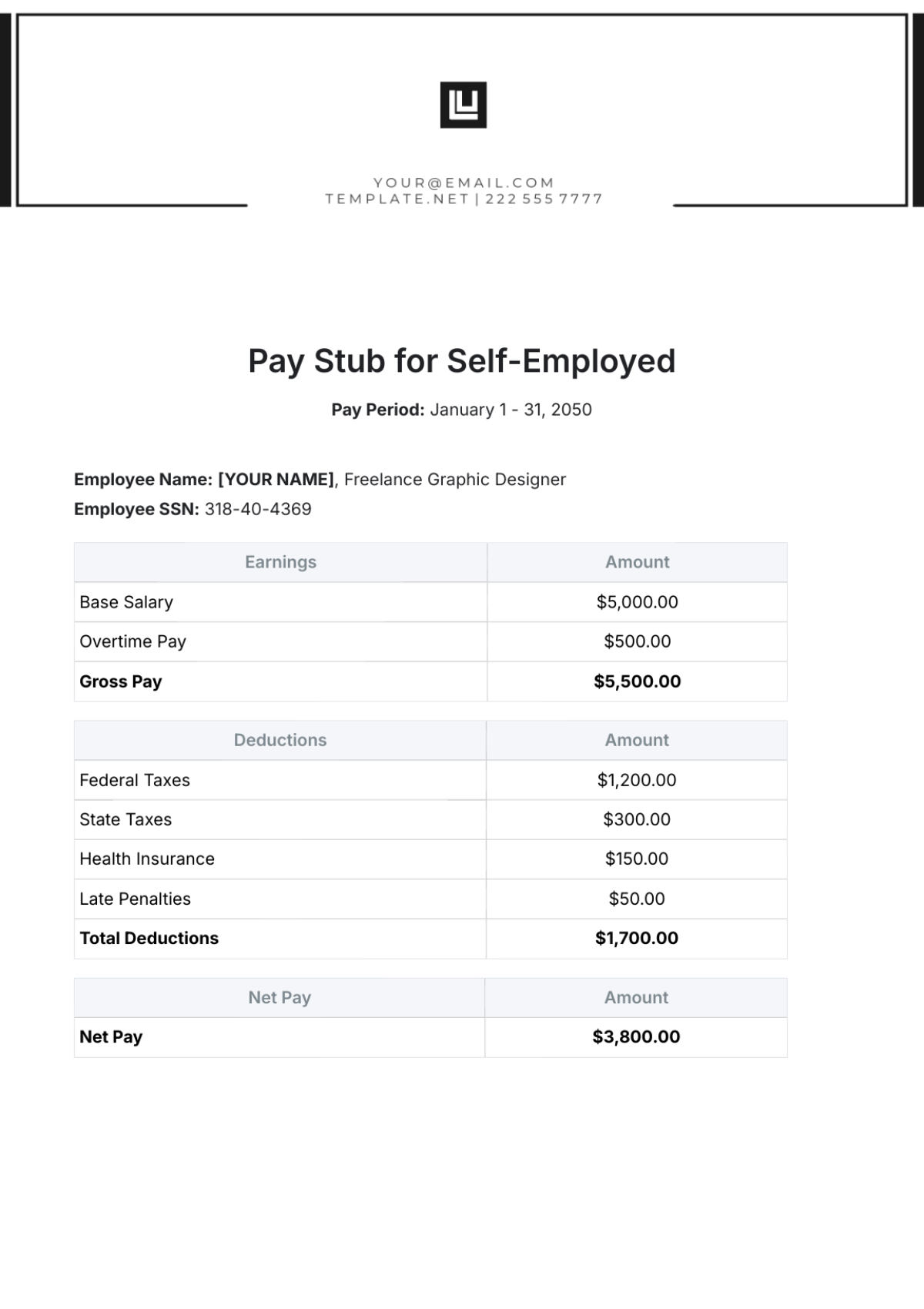

Employees have access to self-service features. Find pay stubs under Payroll Details, update personal information in My Profile, and submit time-off requests through Leave Management.

Self-Service Features

Navigate to Self-Service for additional features. Explore Training Resources for tutorials and guides. Use Support Tickets to get assistance and provide feedback.

V. Data Input and Management

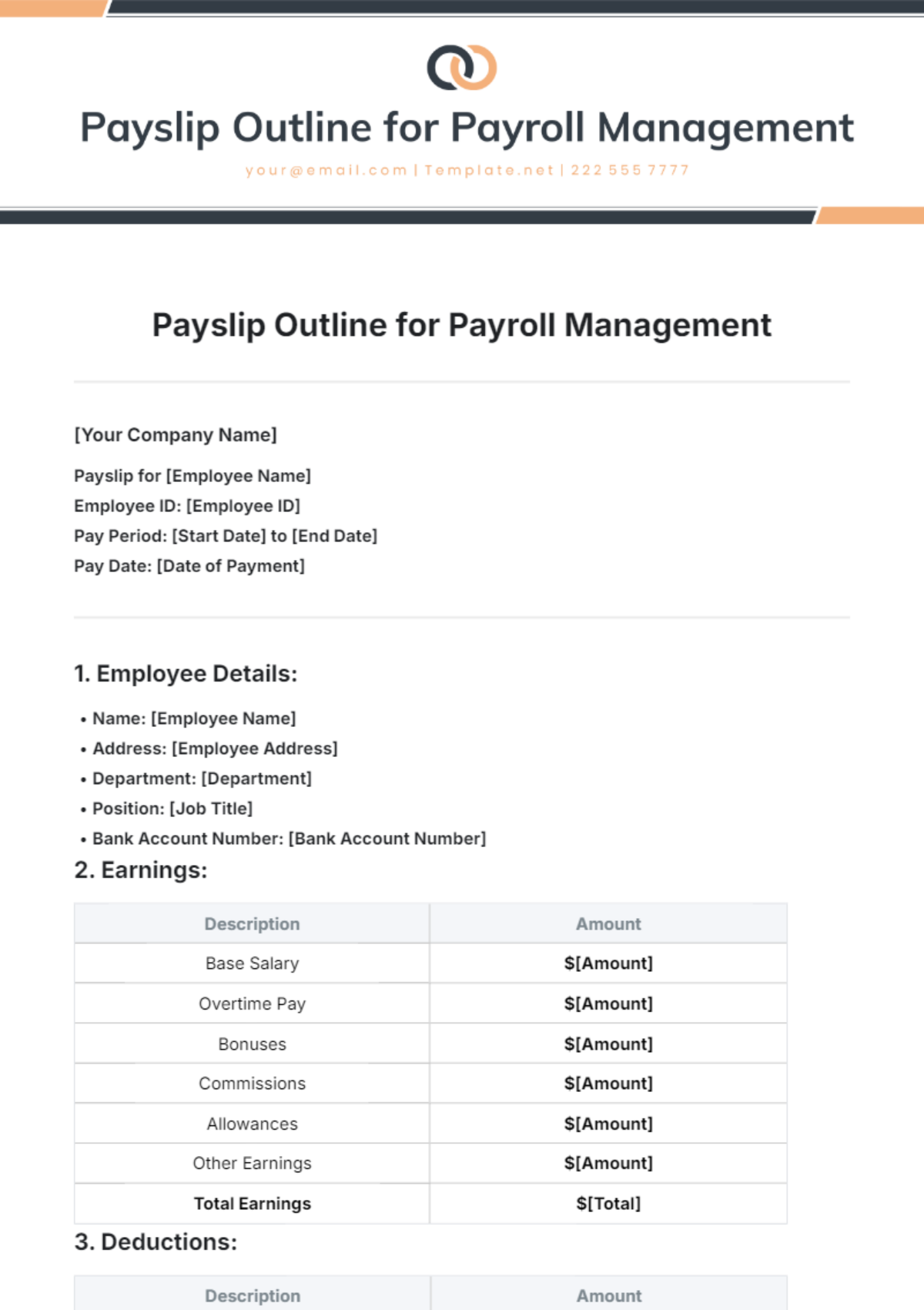

The table below outlines key areas related to data input and management, providing users with clear guidance on essential tasks:

Category | Tasks |

[Employee Information] | [Adding new employees and updating existing records.] |

Accurate employee information is the cornerstone of payroll precision. The ability to seamlessly add new employees and update existing records ensures that the system reflects the current workforce structure. A robust data input and management system ensures that payroll processes are streamlined, minimizing errors and enhancing overall efficiency. Users who master these aspects will find themselves equipped to maintain accurate and up-to-date payroll records, contributing to the overall success and compliance of their payroll management processes.

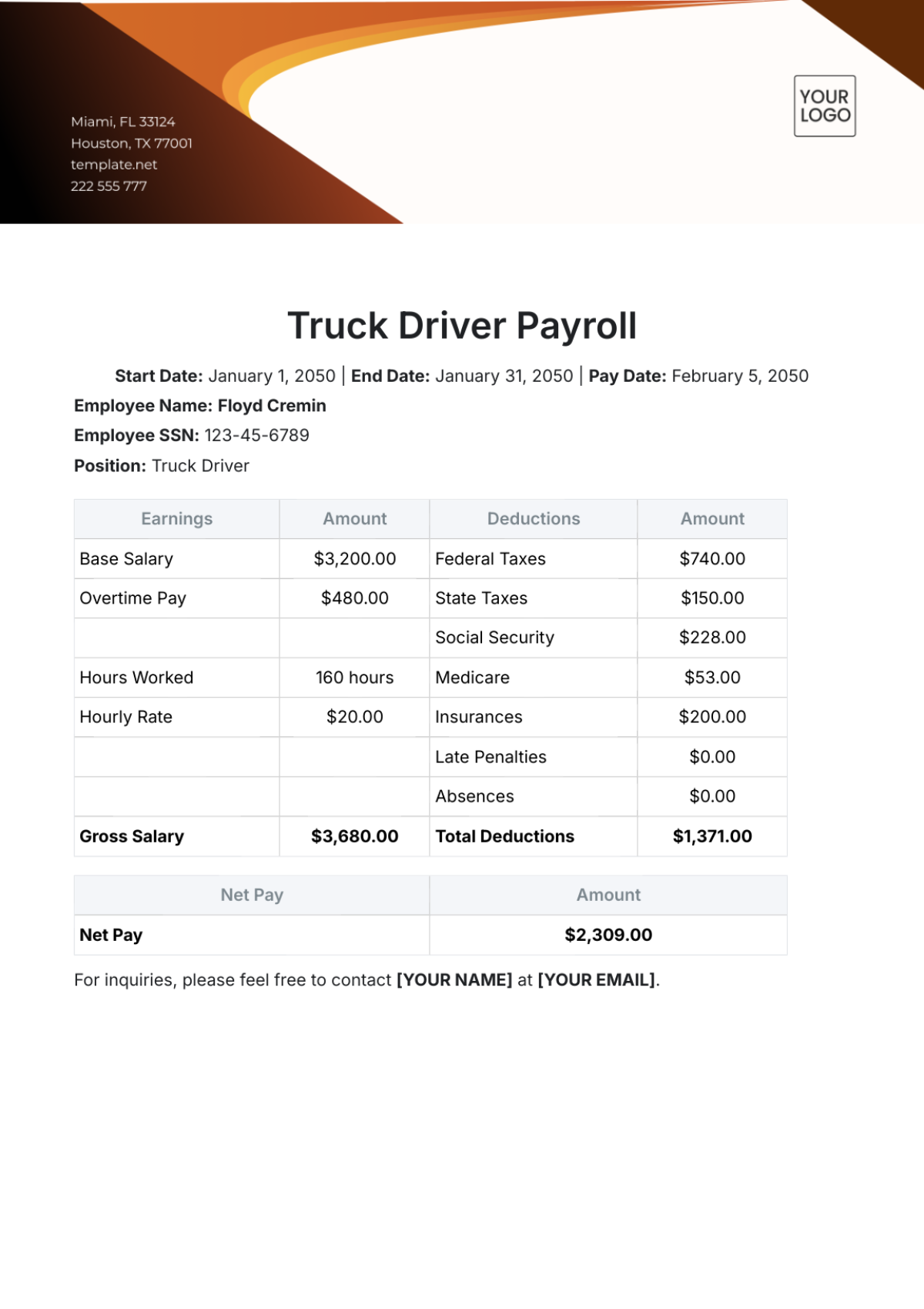

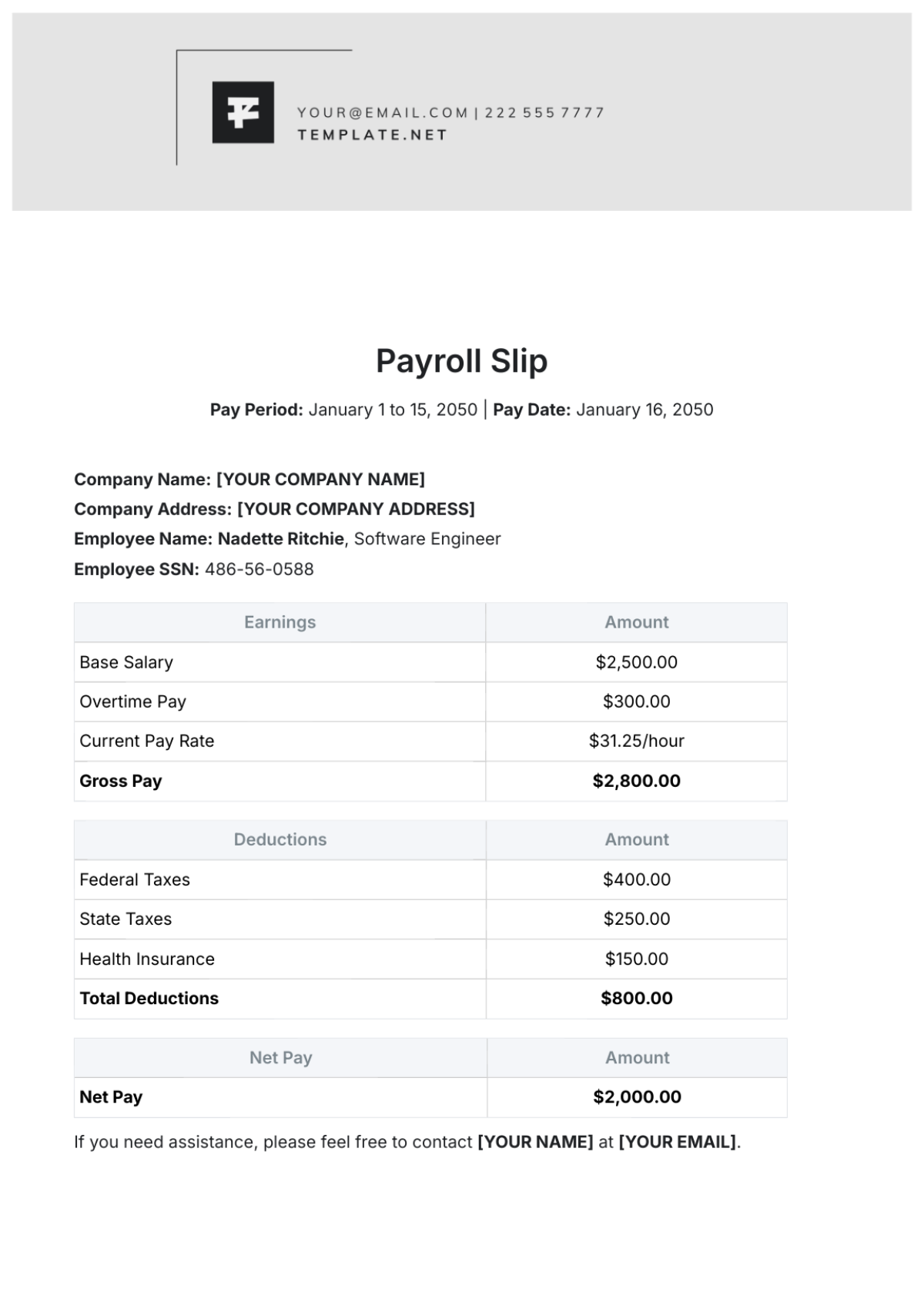

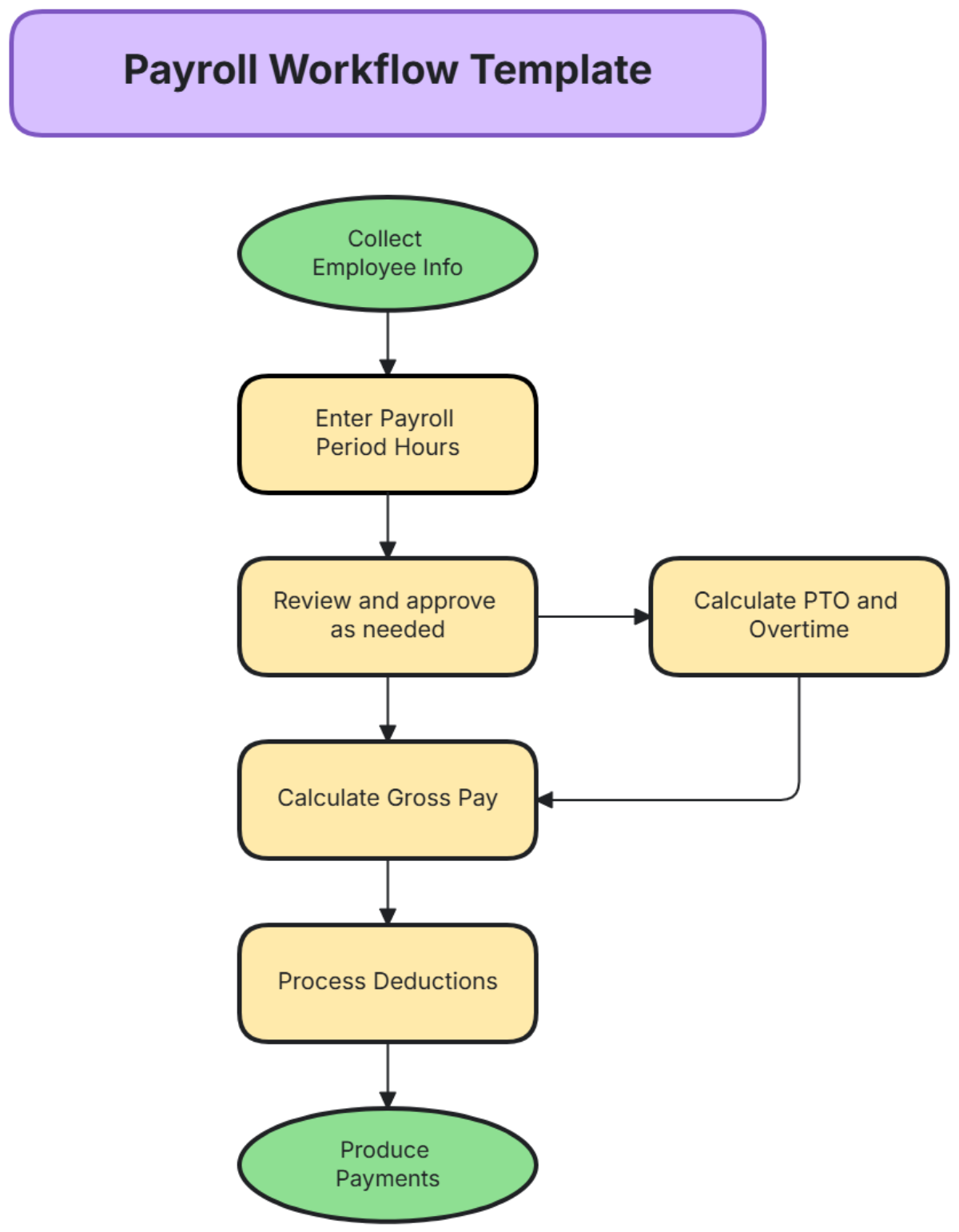

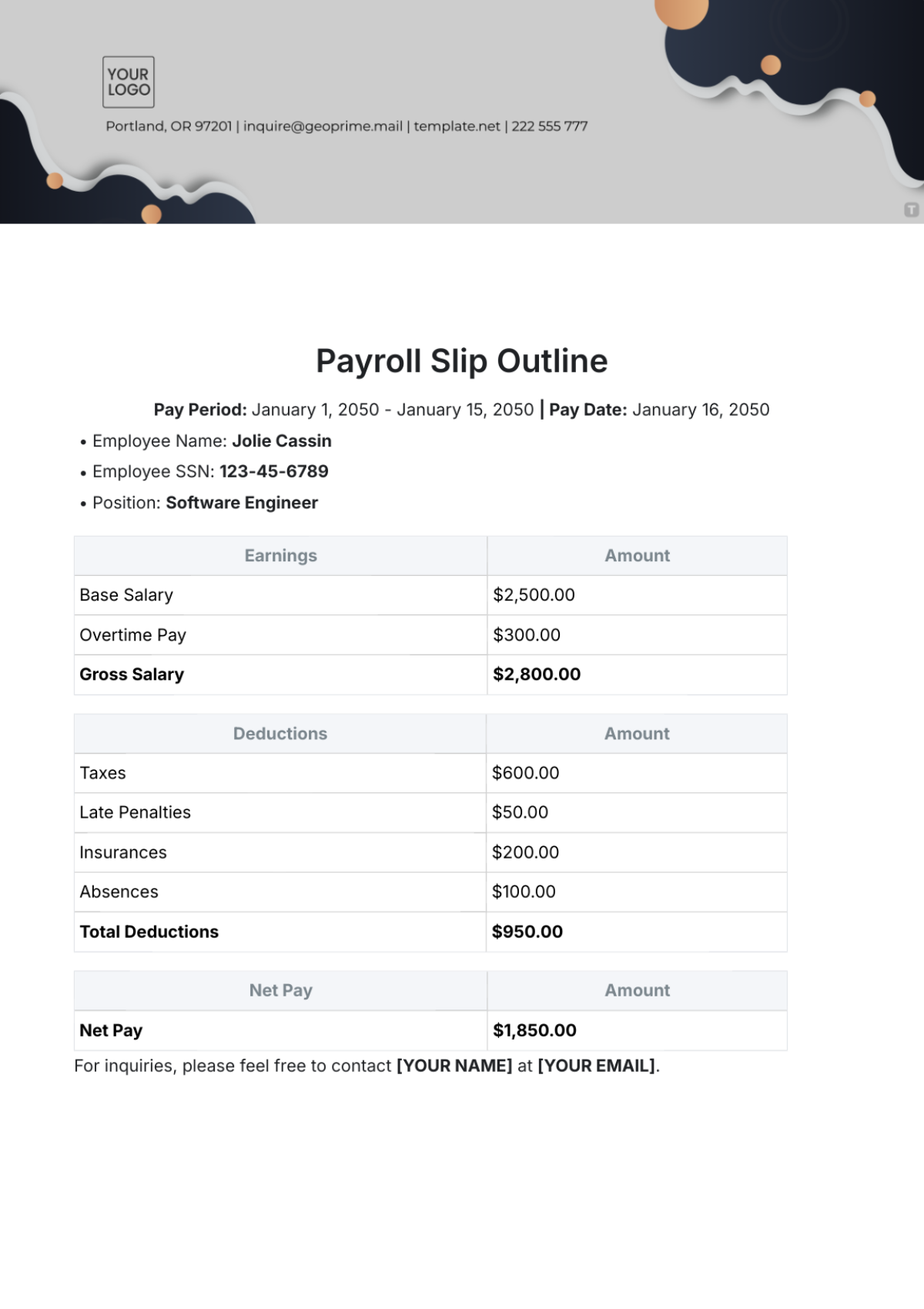

VI. Payroll Processing

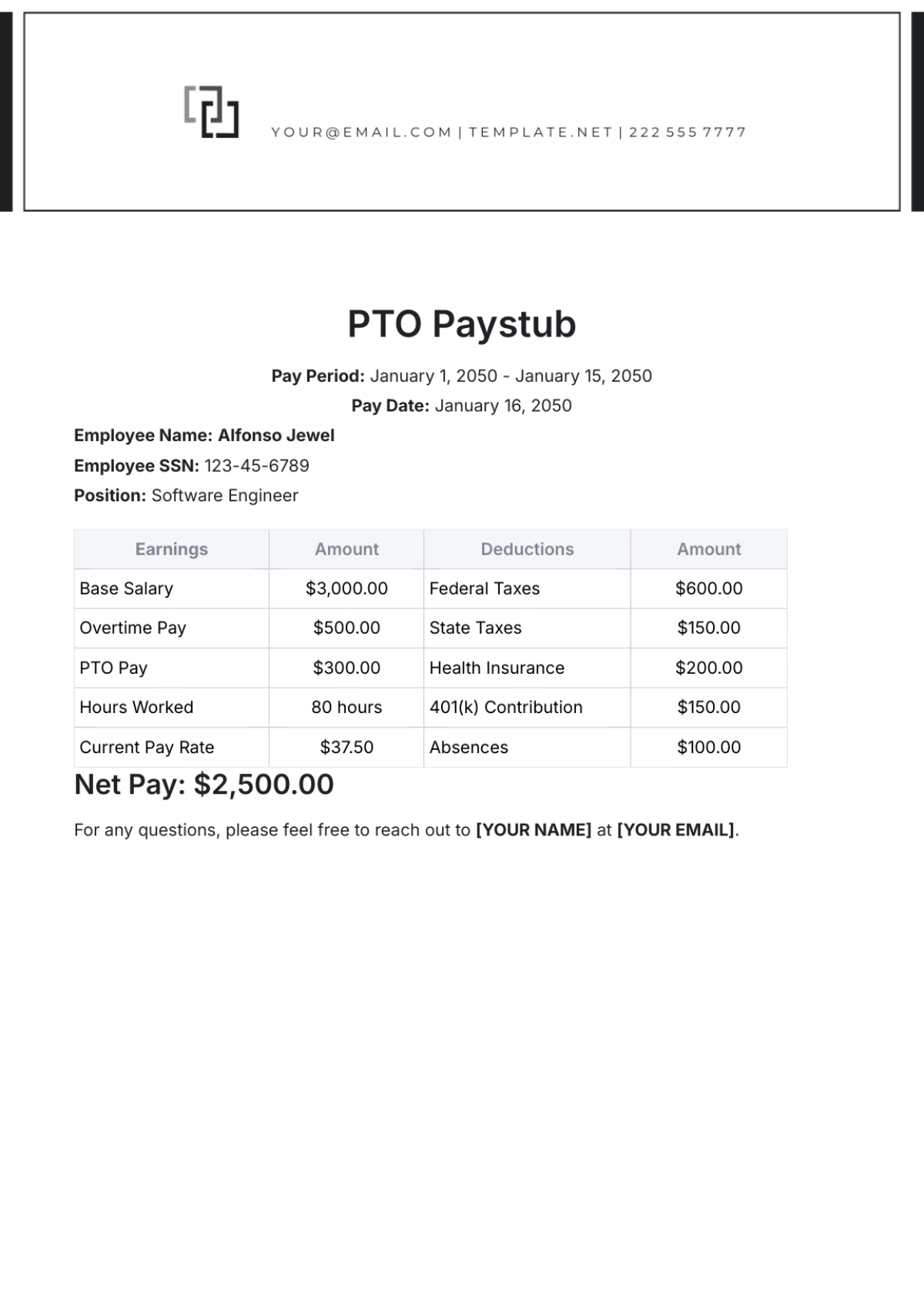

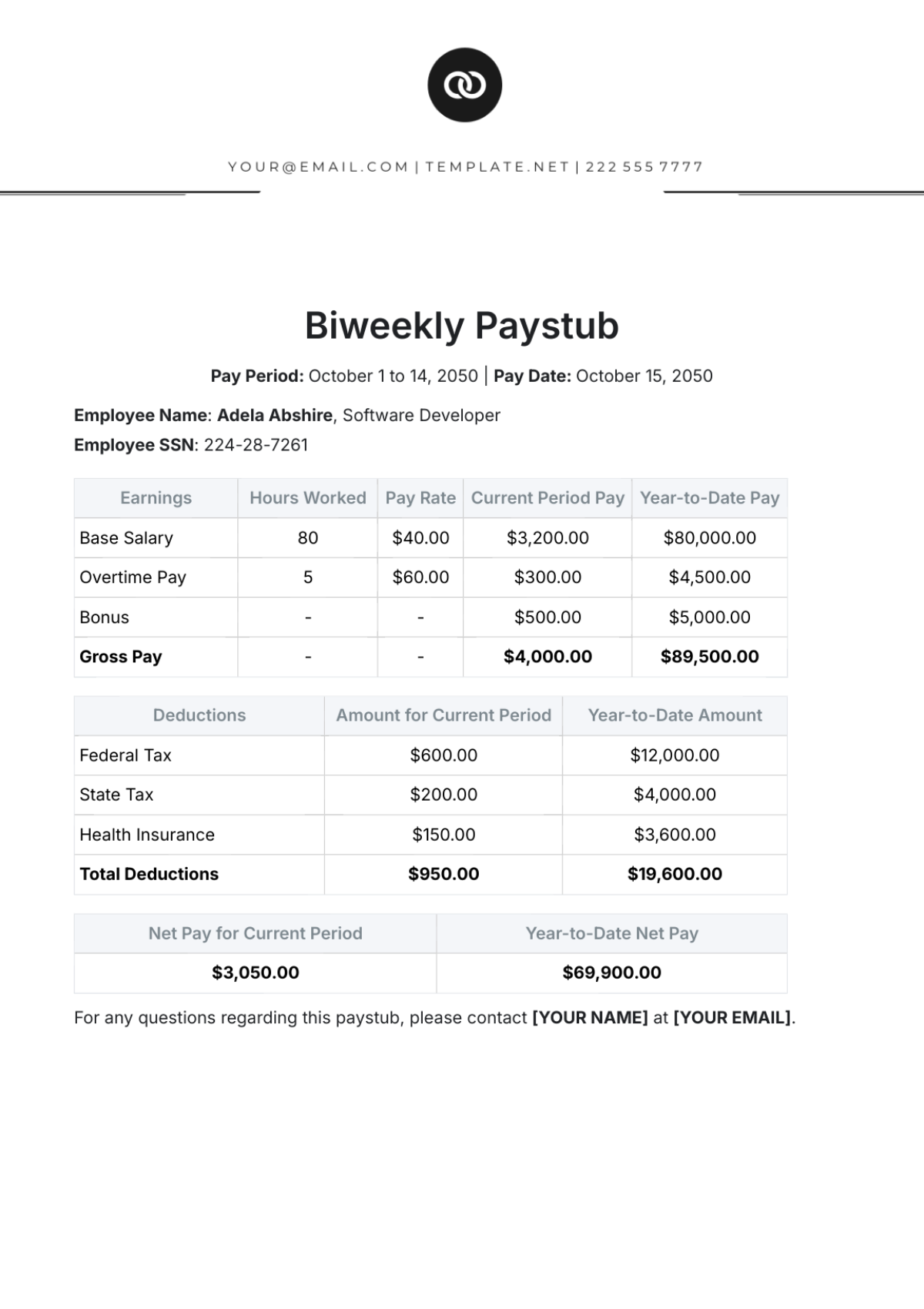

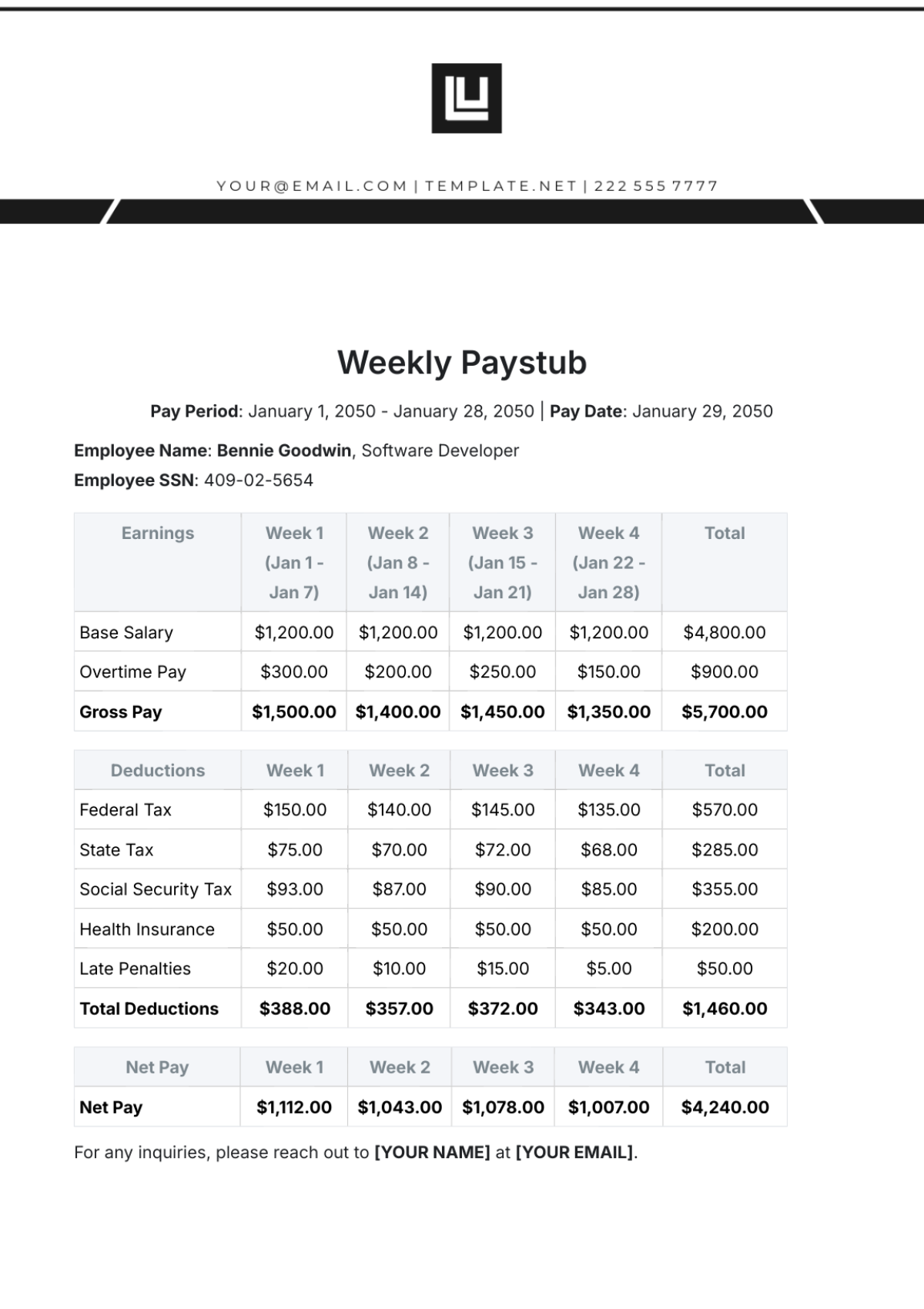

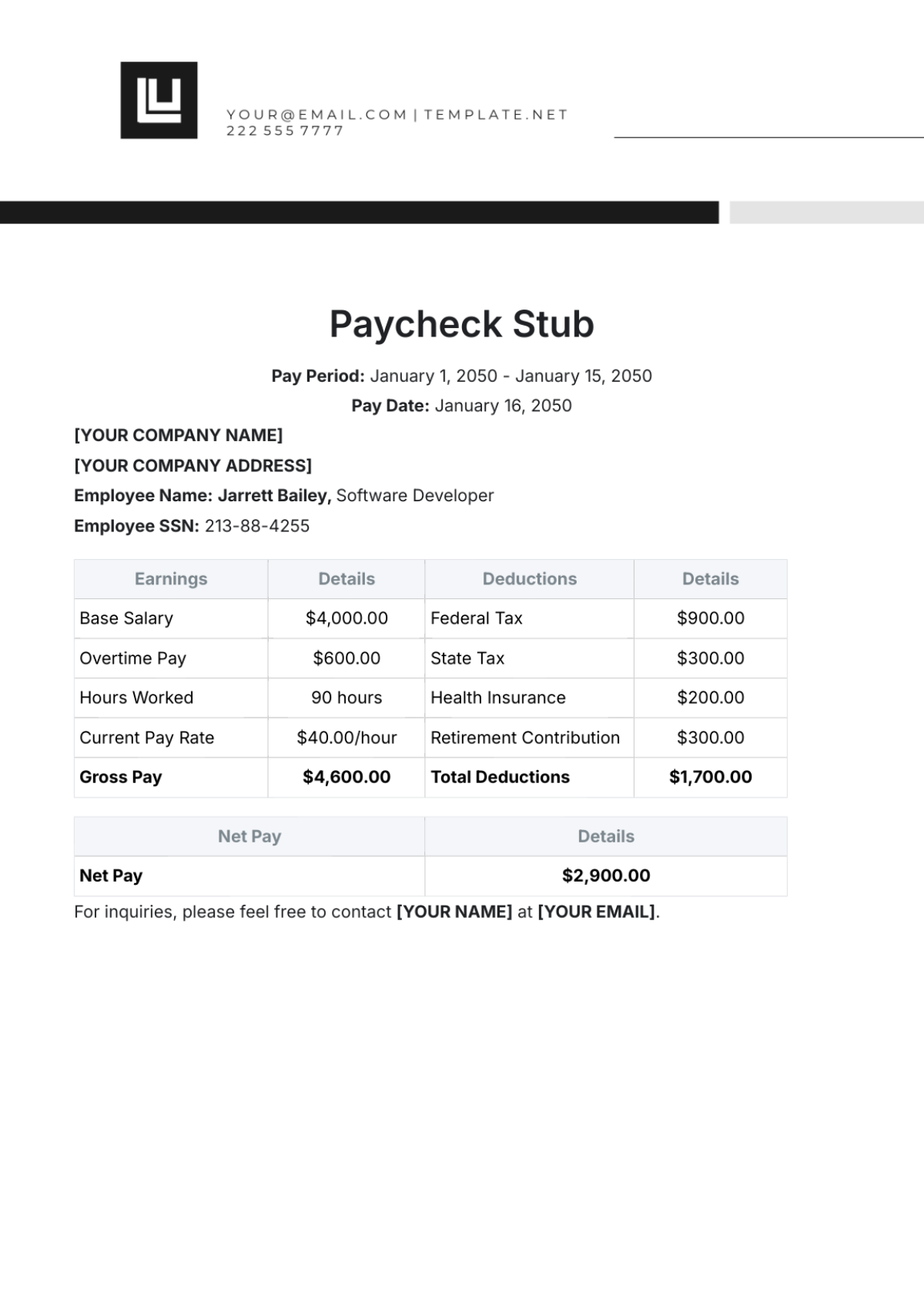

A. Payroll Components

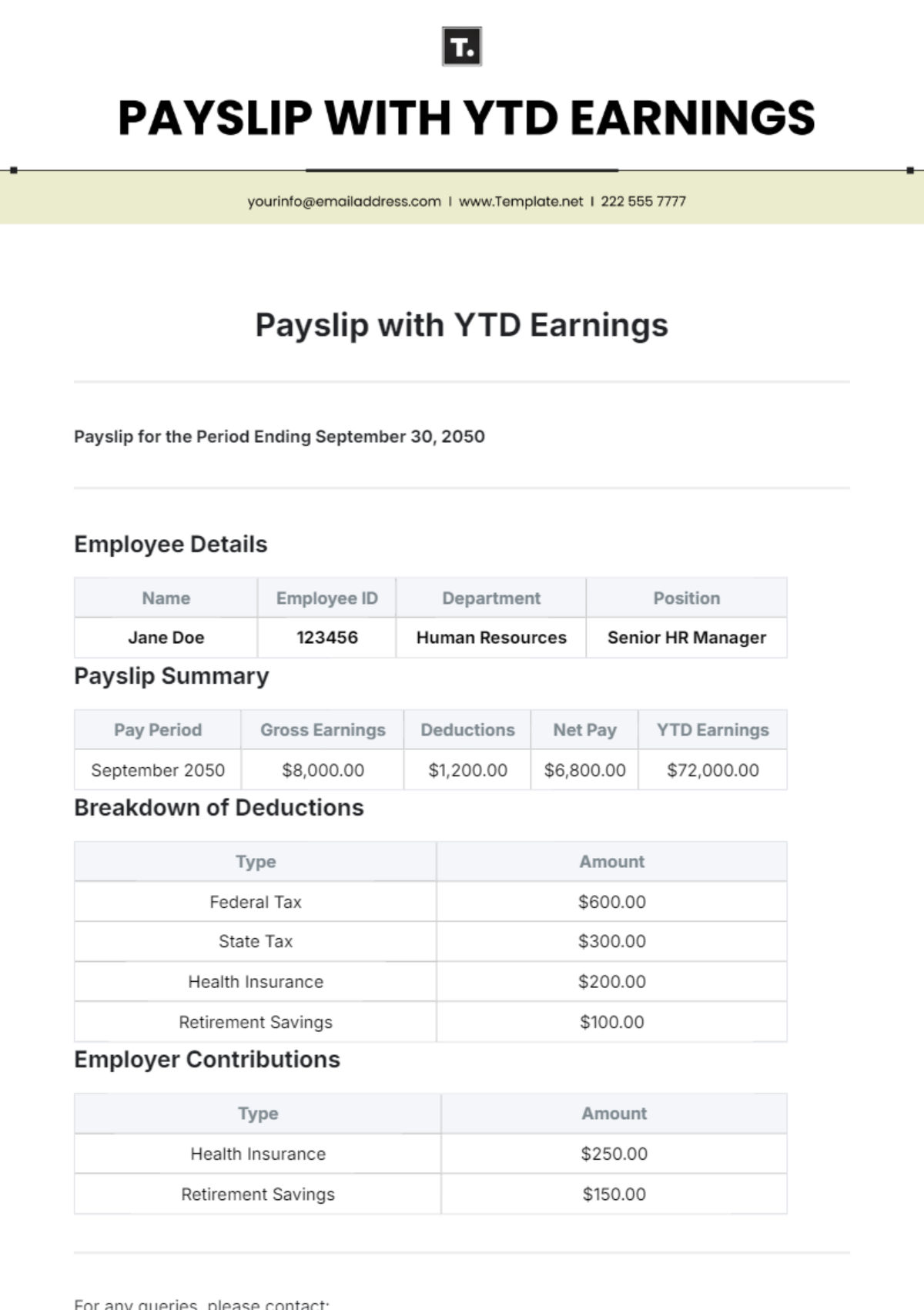

Salary Calculations

Explore Salary Management to understand how salaries are calculated. Customize salary structures and review individual employee details to ensure accurate and fair compensation.

Taxes and Deductions

Navigate to Tax Management to manage tax-related components. Ensure accurate tax calculations and deductions to comply with regulations and maintain precise payroll records.

Bonuses and Allowances

Utilize the Bonus and Allowance section to manage additional compensation components. Define bonus structures, allowances, and other incentives, ensuring transparent and fair reward systems.

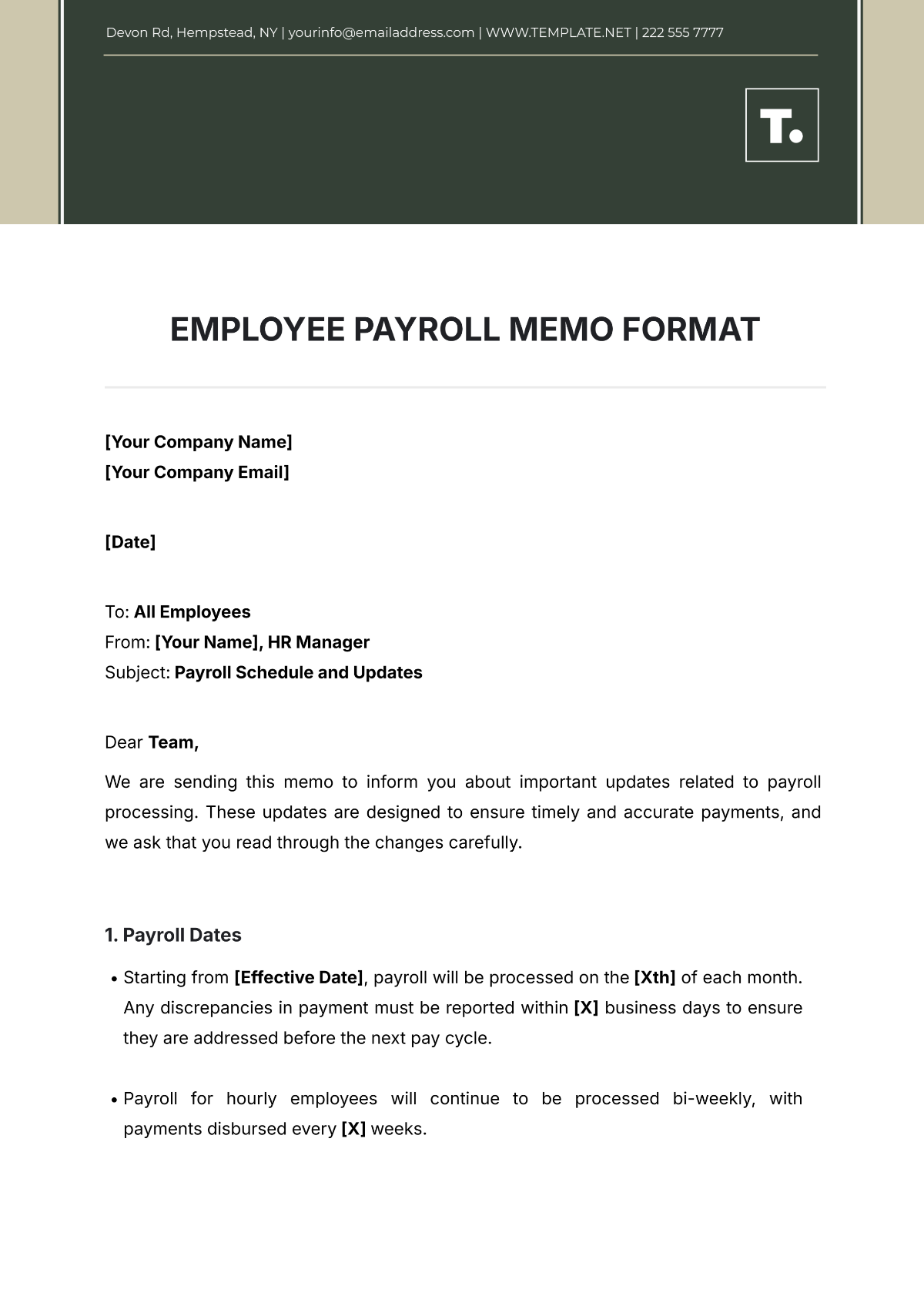

B. Initiating Payroll

Navigate to Payroll Processing and select Initiate Payroll. Follow the step-by-step guide to ensure a seamless payroll process. Input relevant parameters, review details, and confirm to initiate payroll.

Once initiated, access the Payroll Summary to review a comprehensive overview. Verify salary calculations, deductions, and allowances. Make necessary adjustments before finalizing the payroll.

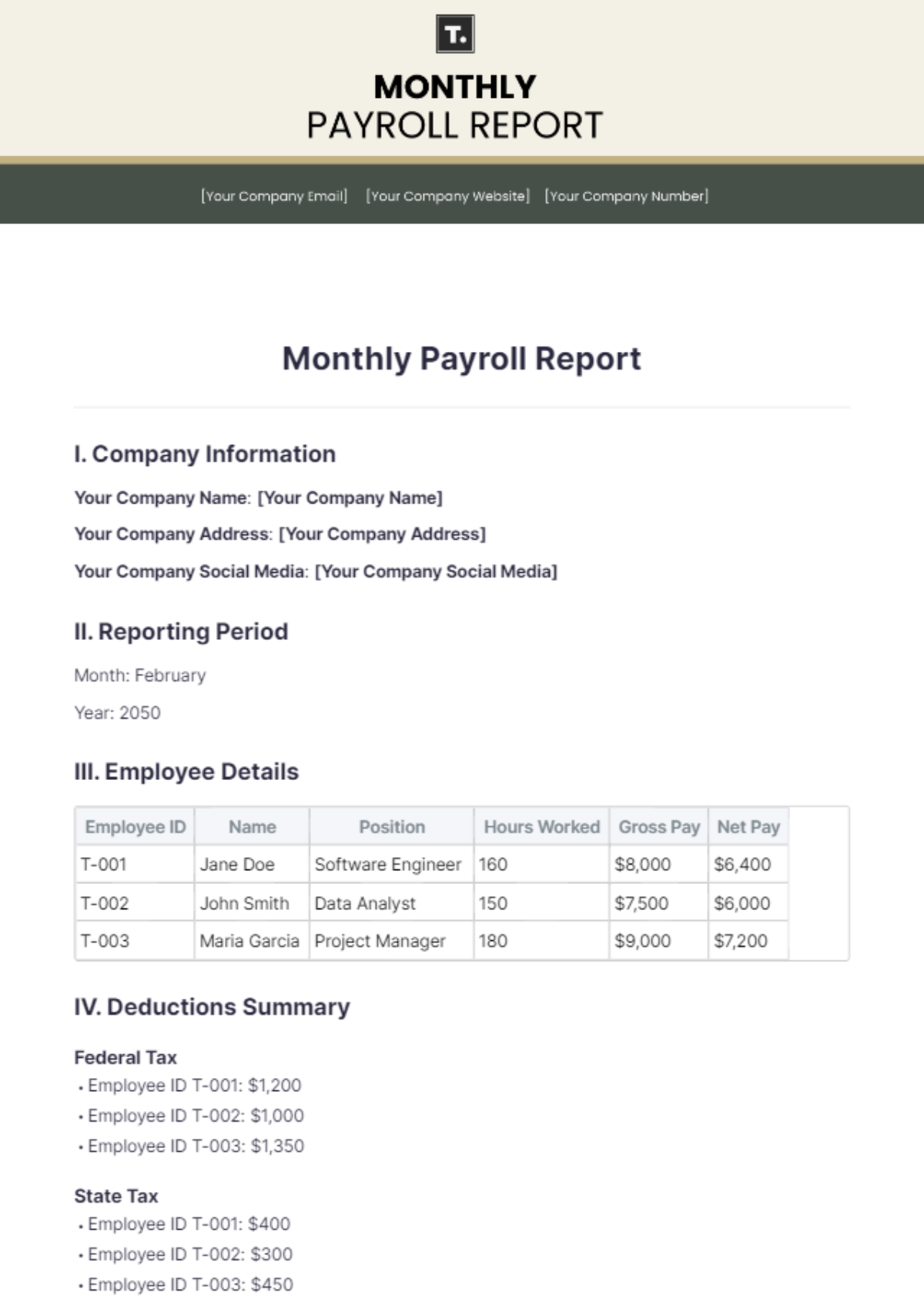

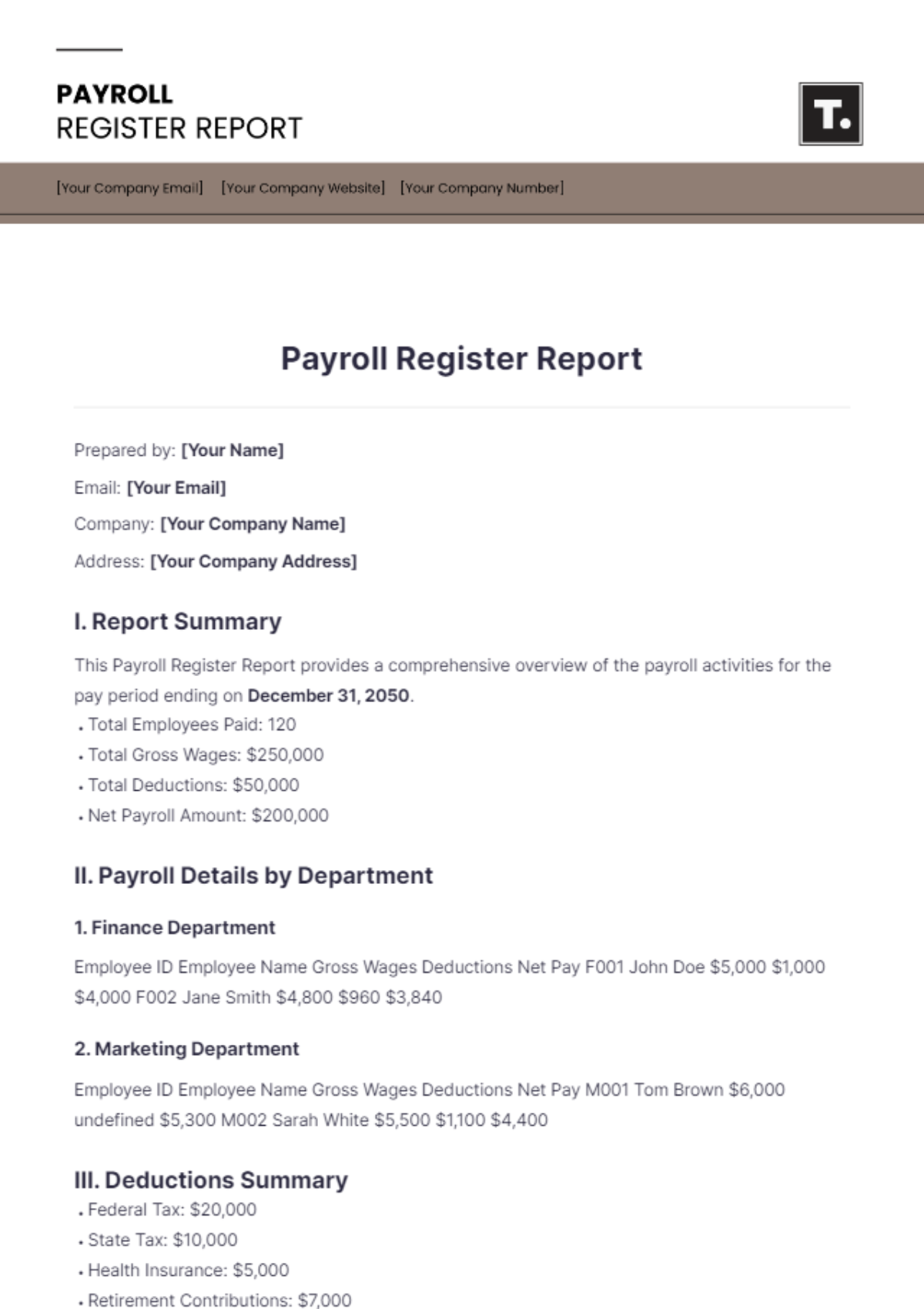

VII. Reports and Analytics

A. Available Reports

Types of Reports

Access the Reports section to explore a variety of report types. From payroll summaries to employee performance reports, familiarize yourself with the diverse range of insights available.

Generating Reports

Choose a specific report category and customize parameters for tailored results. Generate reports on-demand and export them for further analysis or sharing with relevant stakeholders.

B. Analytics Features

Data Visualization Tools

Dive into Analytics to access data visualization tools. Leverage graphs, charts, and dashboards to gain actionable insights from your payroll and employee data.

Interpreting Analytical Insights

Utilize tooltips, legends, and filters to extract valuable insights, helping in informed decision-making for payroll management.

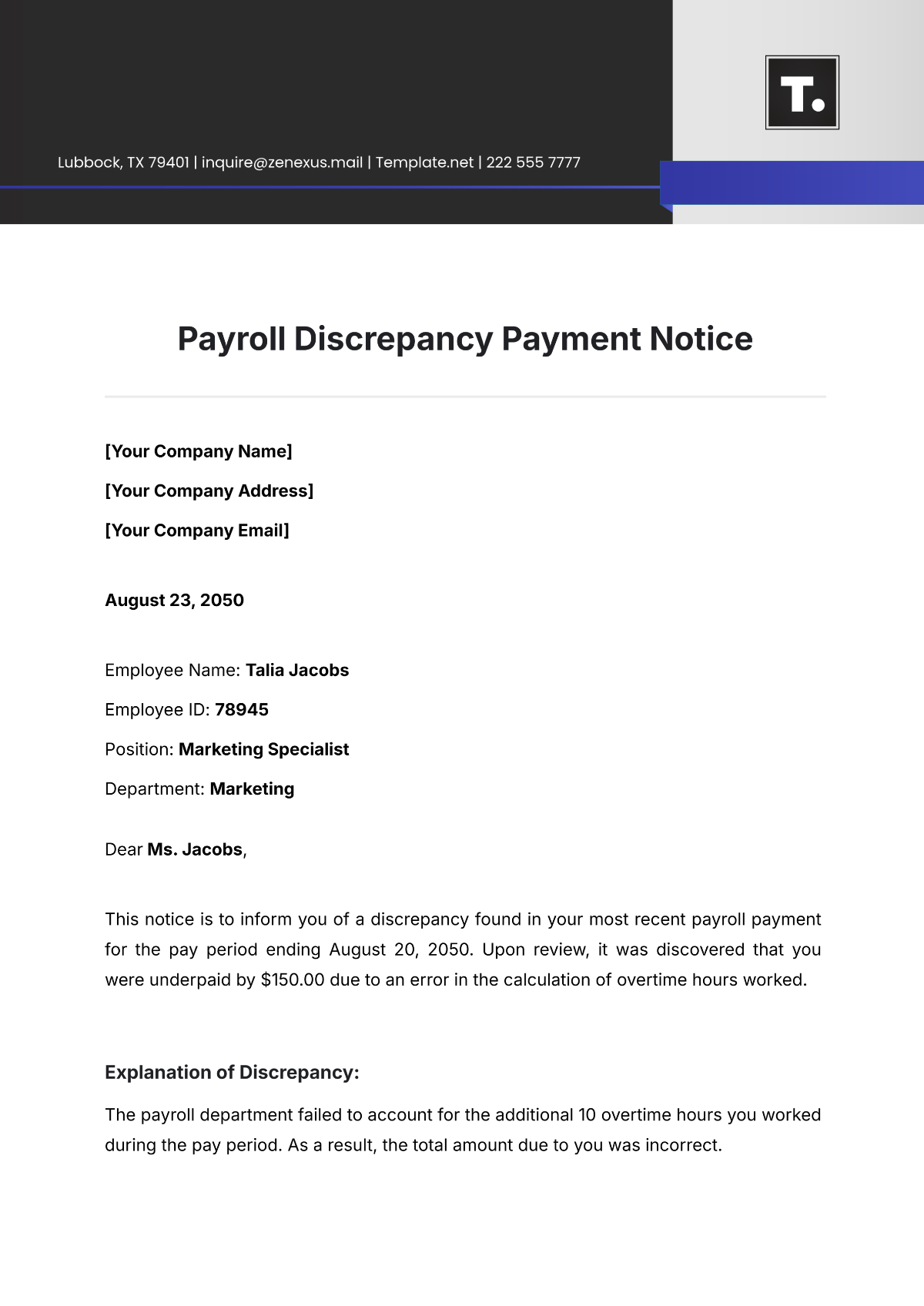

VIII. Troubleshooting

A. Common Issues

Identifying Issues

Troubleshoot common issues by accessing the Troubleshooting section. Identify potential problems related to data input, processing, or system configuration.

Troubleshooting Steps

From error messages to system glitches, learn how to navigate and resolve challenges effectively by following the outlined troubleshooting steps in that section to address identified issues.

B. Customer Support

Contact Information

Reach out for assistance, providing detailed information about the issue you're facing to the Help section.

Support Ticket Submission

Use the Submit Support Ticket feature to document and submit specific issues. Include screenshots or additional details to expedite the support process. Track the status of your support ticket for timely resolution.

IX. Security and Data Privacy

A. User Access Security

Account Protection Measures

Understand the account protection measures in place. From secure login procedures to multi-factor authentication, ensure that user access is safeguarded against unauthorized use.

Access Logs and Monitoring

Access Security Logs to monitor user access. Regularly review access logs to identify any suspicious activities and maintain the integrity of user accounts.

B. Data Privacy Measures

User Data Protection

Delve into the Data Privacy section to explore measures in place for user data protection. Understand encryption methods and data anonymization practices implemented to safeguard sensitive information.

Compliance with Privacy Laws

Ensure compliance with privacy laws by adhering to the guidelines outlined in the Privacy Compliance section. Familiarize yourself with data retention policies and user consent procedures.

X. Updates and Maintenance

A. Software Updates

Update Notifications

Stay informed about software updates through the Update Notifications feature. Regularly check for notifications and implement updates promptly to access new features and ensure system stability.

Updating Procedures

Click the update button. Follow the outlined procedures to seamlessly implement updates, minimizing disruptions to your payroll processes.

B. Maintenance Best Practices

Routine Maintenance Tasks

Access Routine Maintenance to discover essential tasks for ongoing system health. From database optimization to log reviews, understand the routine maintenance practices that contribute to optimal software performance.

Scheduled Downtime

Stay informed about scheduled downtime for maintenance purposes. Plan your payroll activities accordingly to avoid disruptions during maintenance windows.

XI. Glossary

Data Anonymization

The process of removing personally identifiable information from data, ensuring that individual user identities are protected.

Encryption

The method of converting data into a code to prevent unauthorized access, providing a secure layer for sensitive information.

Multi-Factor Authentication (MFA)

A security system requiring users to verify their identity through multiple authentication methods, enhancing access control.

Payroll Processing

The systematic calculation and distribution of employee salaries, including tax deductions, bonuses, and allowances.

Privacy Compliance

Adherence to privacy laws and regulations governing the collection, storage, and processing of user data.

Security Logs

Records that document user activities within the software, aiding in monitoring and identifying potential security threats.

Time and Attendance

The tracking and recording of employee work hours, facilitating accurate payroll calculations and attendance management.

Troubleshooting

The process of identifying, analyzing, and resolving issues or challenges that may arise during software usage.

User Roles

The assigned responsibilities and permissions granted to different users within the software, determining their access and functions.