Finance Payroll Processing Journal

Introduction

A. Purpose

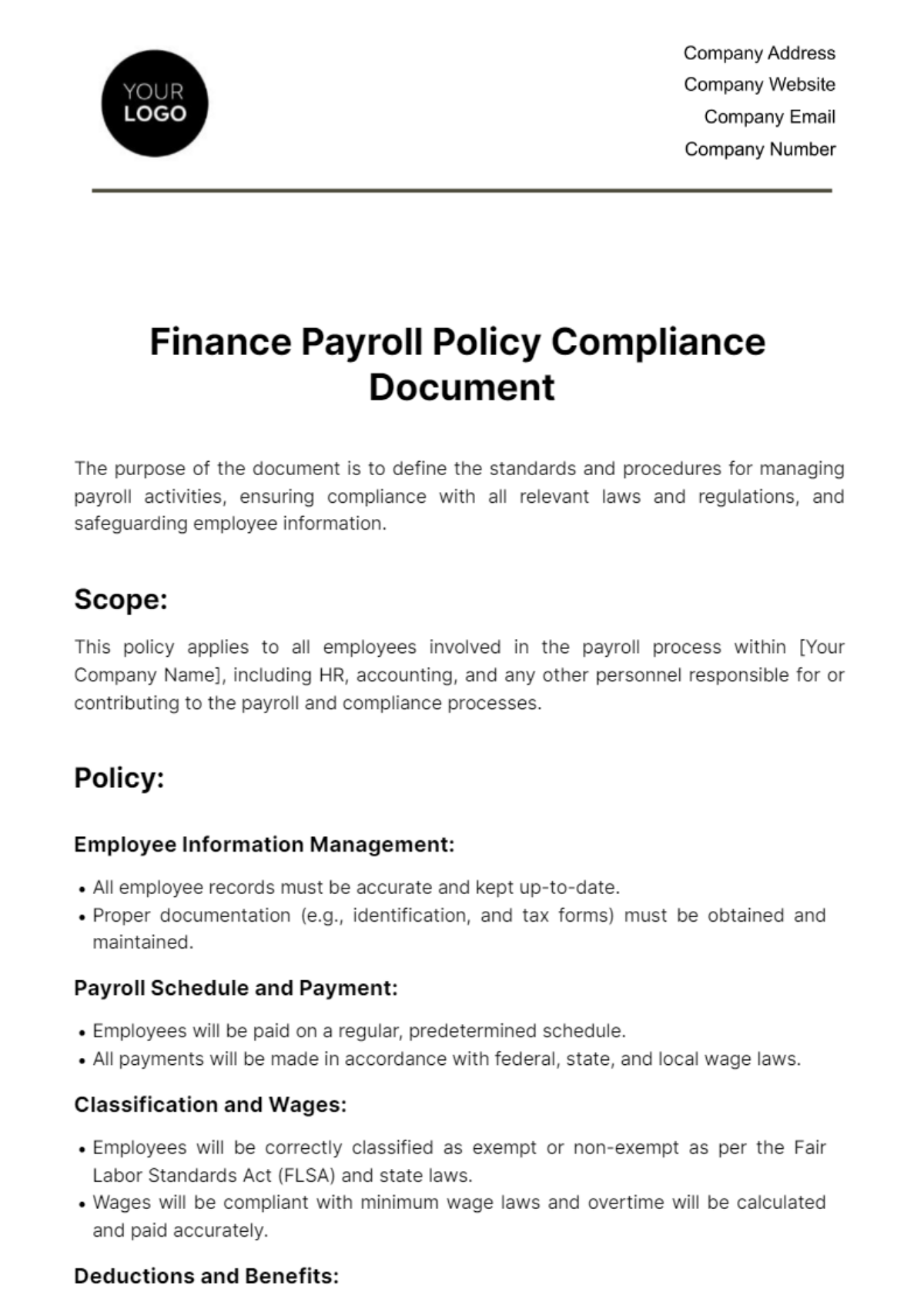

The Finance Payroll Processing Journal is a crucial document within [Your Company Name], serving a multifaceted purpose. Its primary objective is to systematically record and track all financial transactions associated with the payroll process. By maintaining this comprehensive journal, [Your Company Name] aims to achieve the following:

Internal Auditing: The journal acts as a meticulous record, facilitating internal audits to ensure accuracy, transparency, and adherence to financial protocols in the payroll process.

Regulatory Compliance: In the ever-evolving landscape of employment and financial regulations, maintaining a detailed payroll journal is essential for complying with local, state, and federal laws.

Financial Analysis: The recorded data provides a valuable resource for financial analysis. Trends, patterns, and insights derived from the journal contribute to informed decision-making and strategic financial planning.

B. Scope

The scope of the Finance Payroll Processing Journal at [Your Company Name] is all-encompassing, covering various aspects of the payroll cycle. This includes, but is not limited to:

Salary Disbursements: Documenting the methods employed for salary disbursements, whether through direct deposit, checks, or other means.

Tax Deductions: Recording and detailing the calculation and processing of tax deductions, ensuring compliance with tax regulations at different levels.

Employee Benefits: Documenting the various benefits offered to employees, such as health insurance, retirement plans, and other perks.

Financial Transactions: Capturing any other financial transactions related to payroll, providing a holistic view of the financial impact of payroll processes.

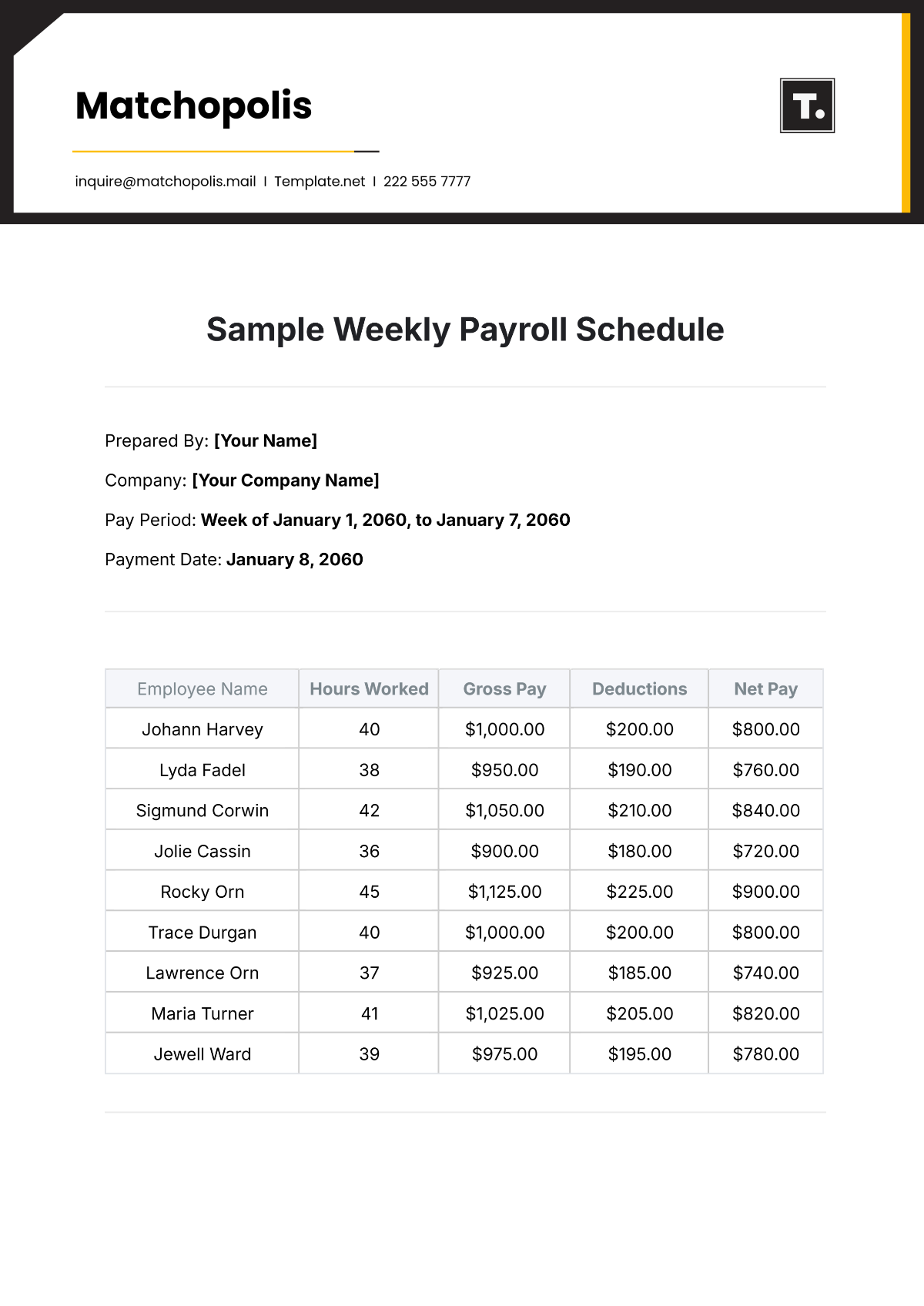

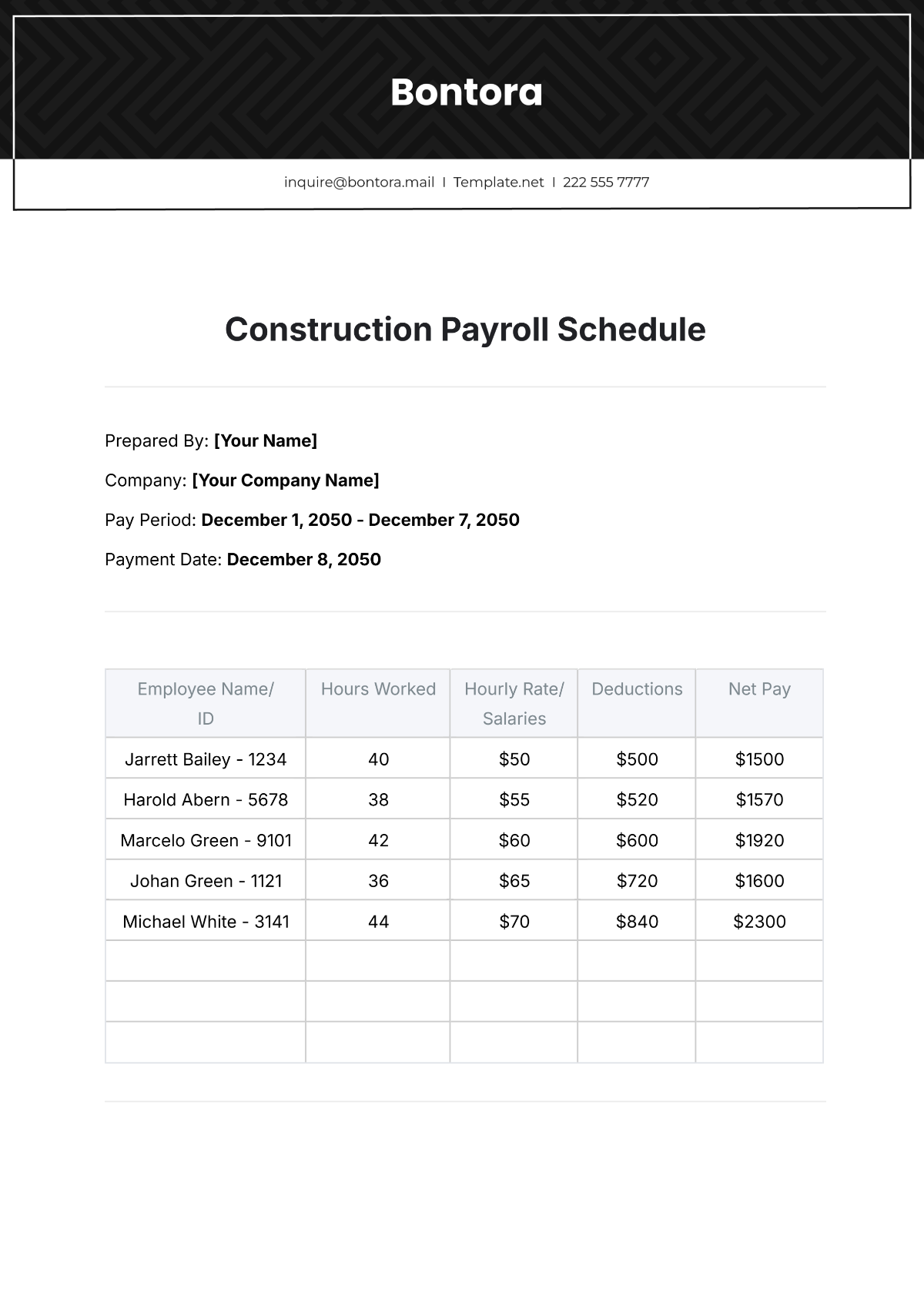

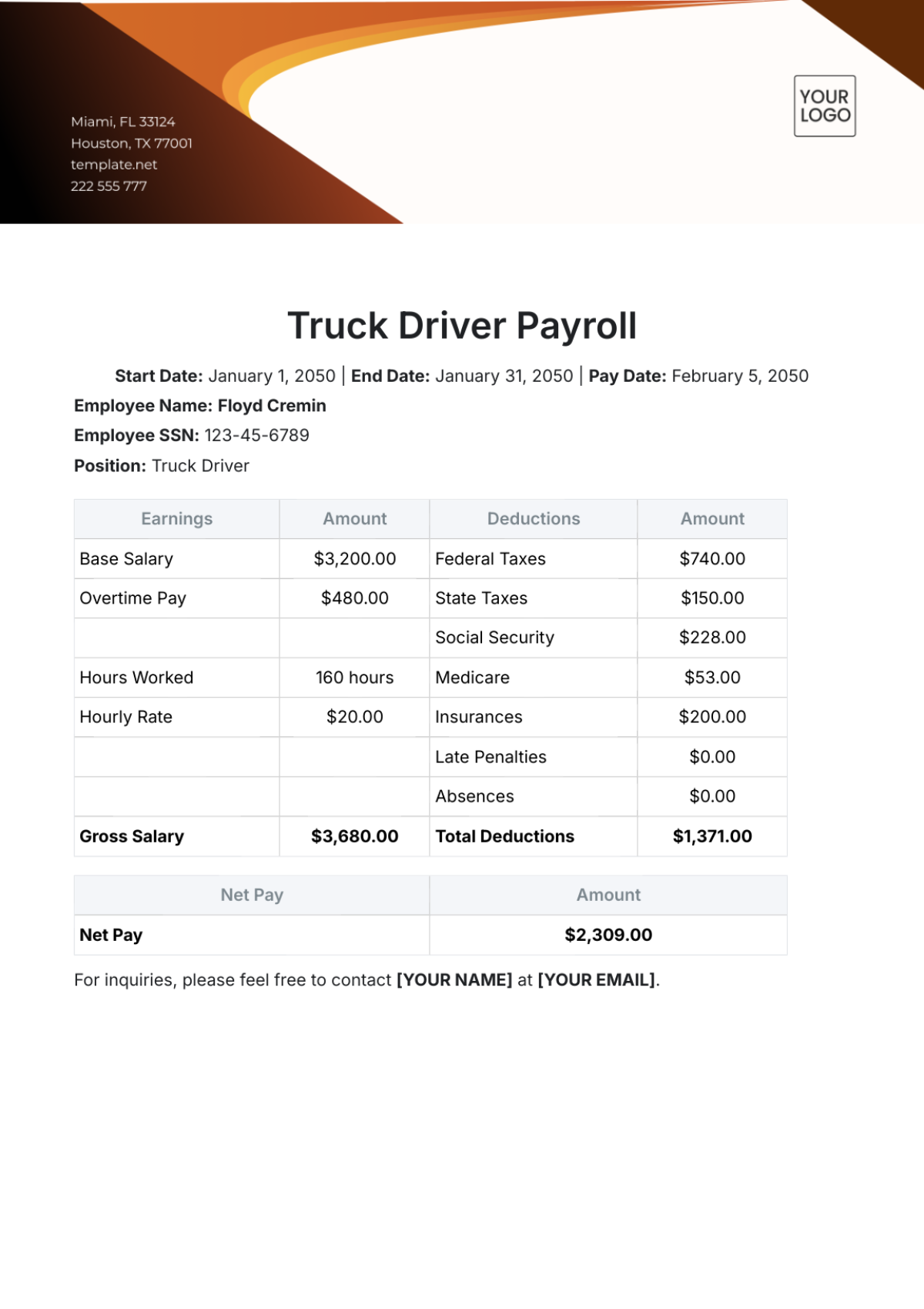

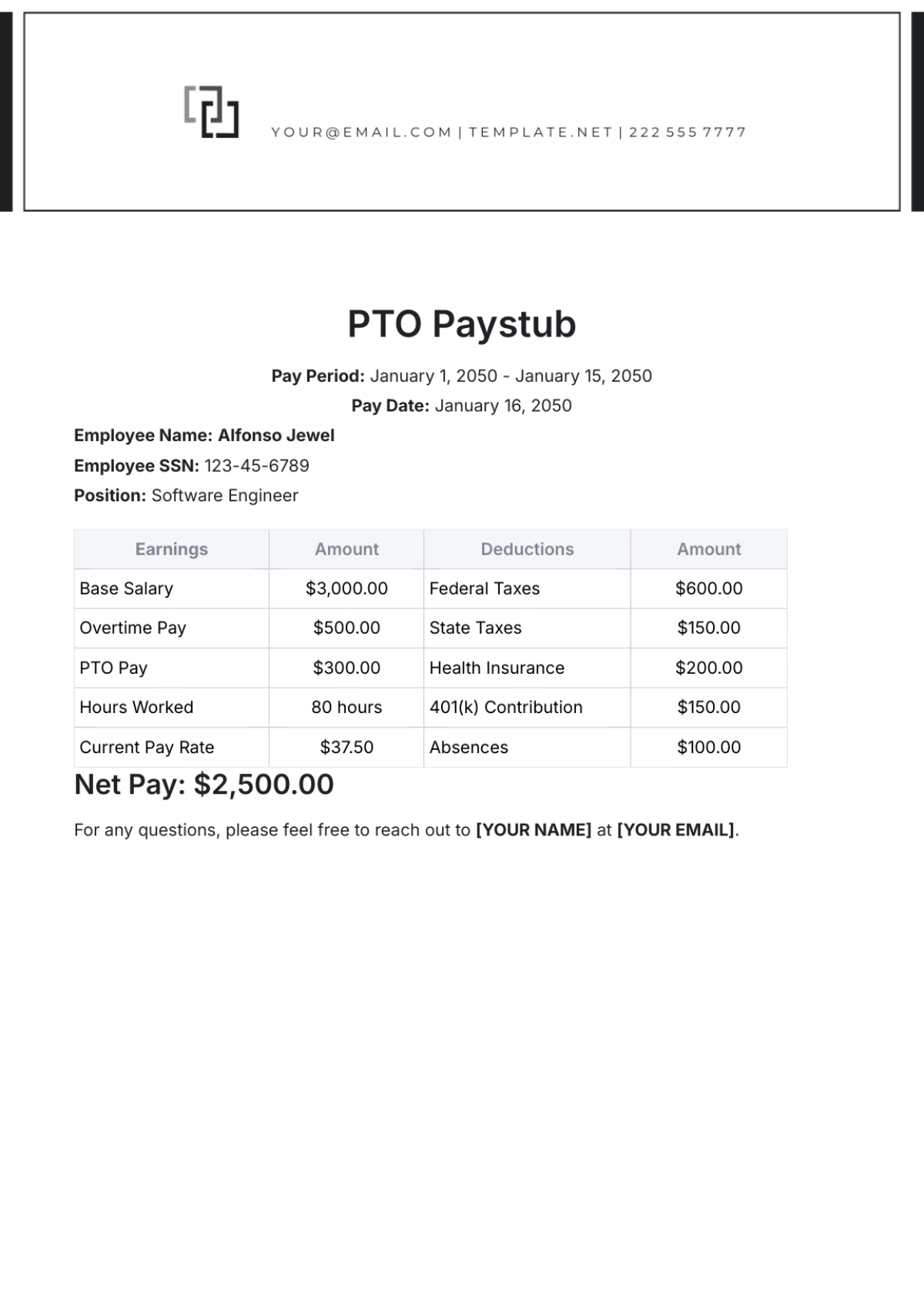

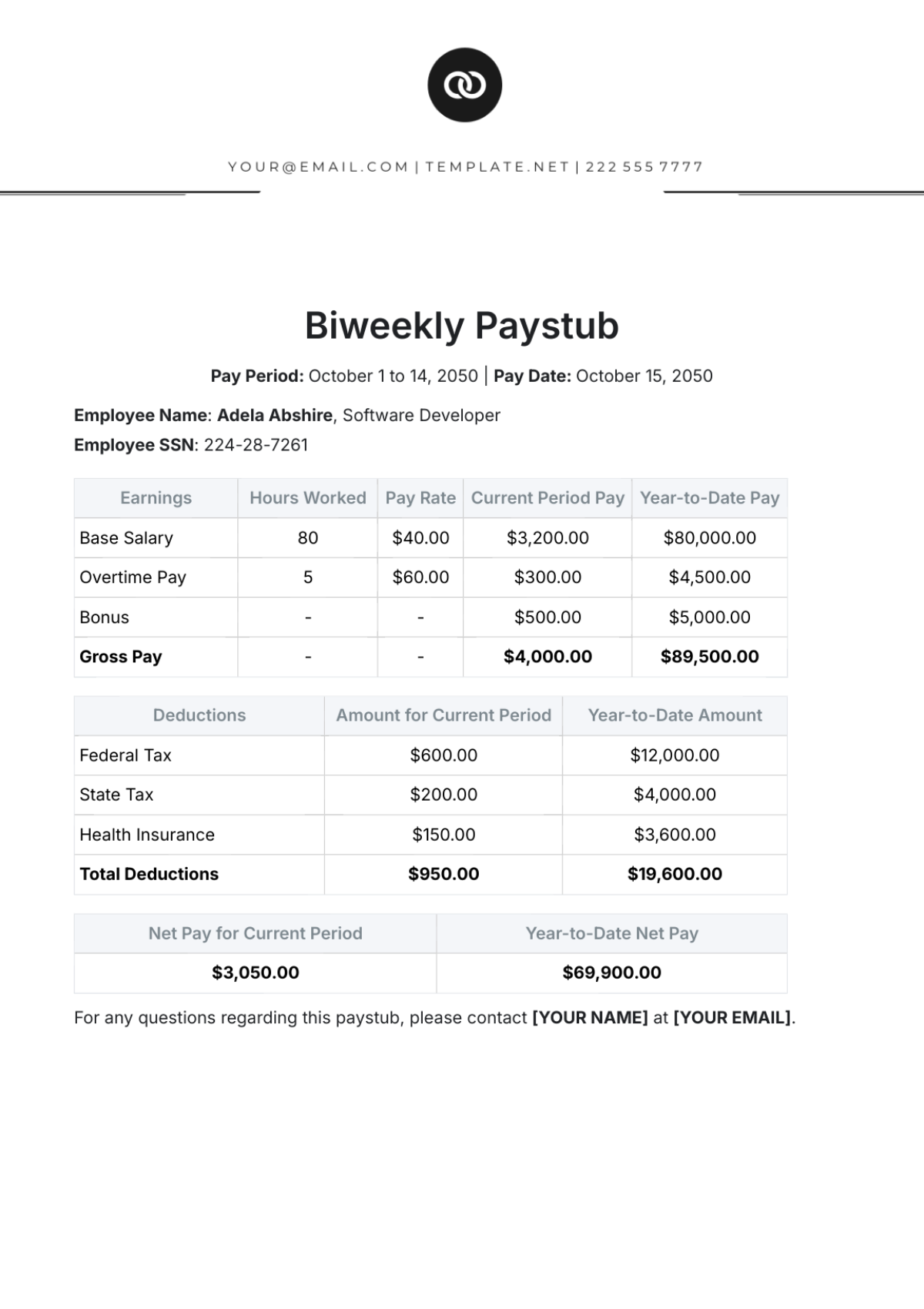

Salary Disbursements

A. Overview

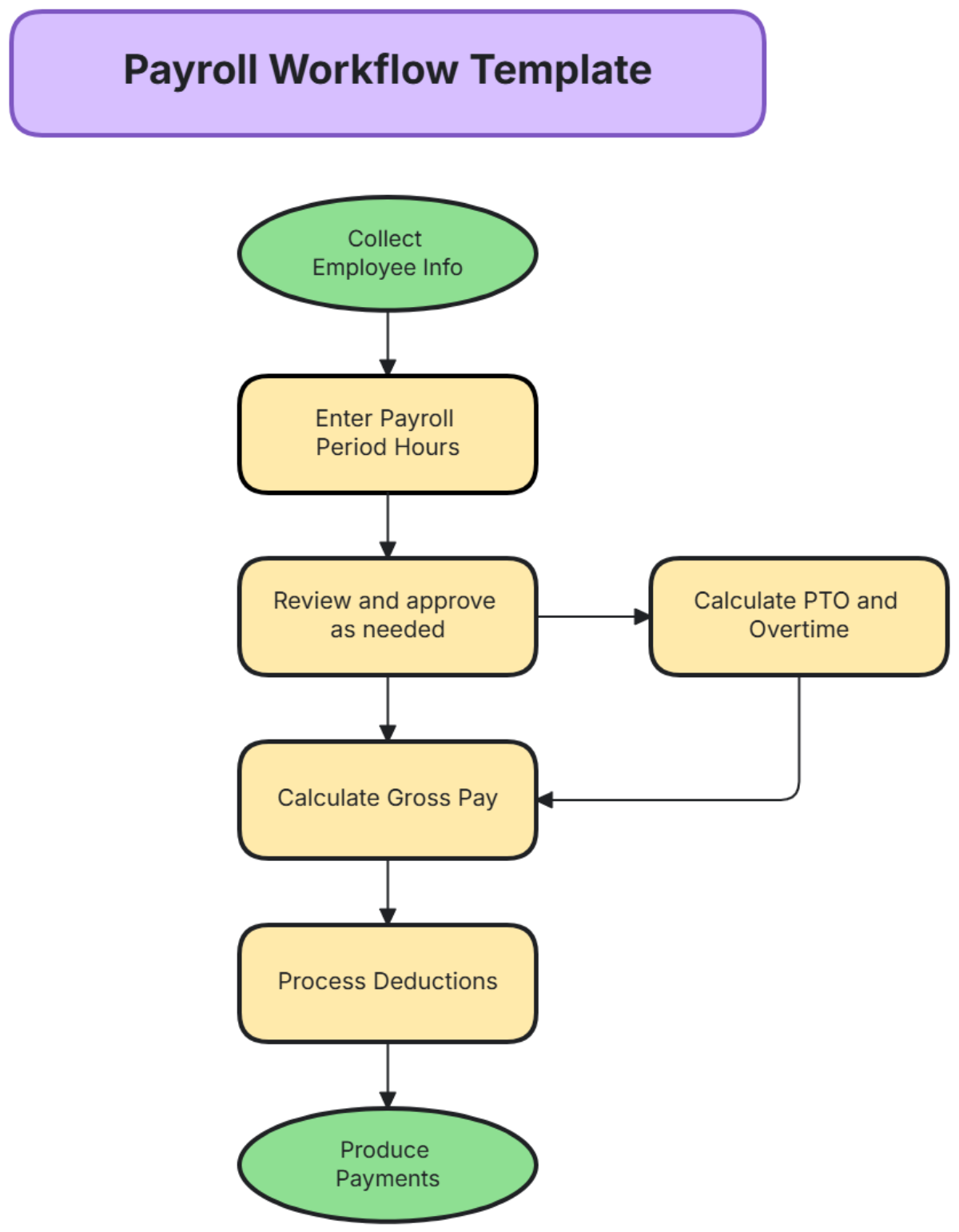

The salary disbursement process at [Your Company Name] involves a well-organized system to ensure accuracy and efficiency. This includes:

Payment Methods: Detailing the methods utilized for salary disbursements, such as direct deposit, which enhances convenience and expedites the payment process.

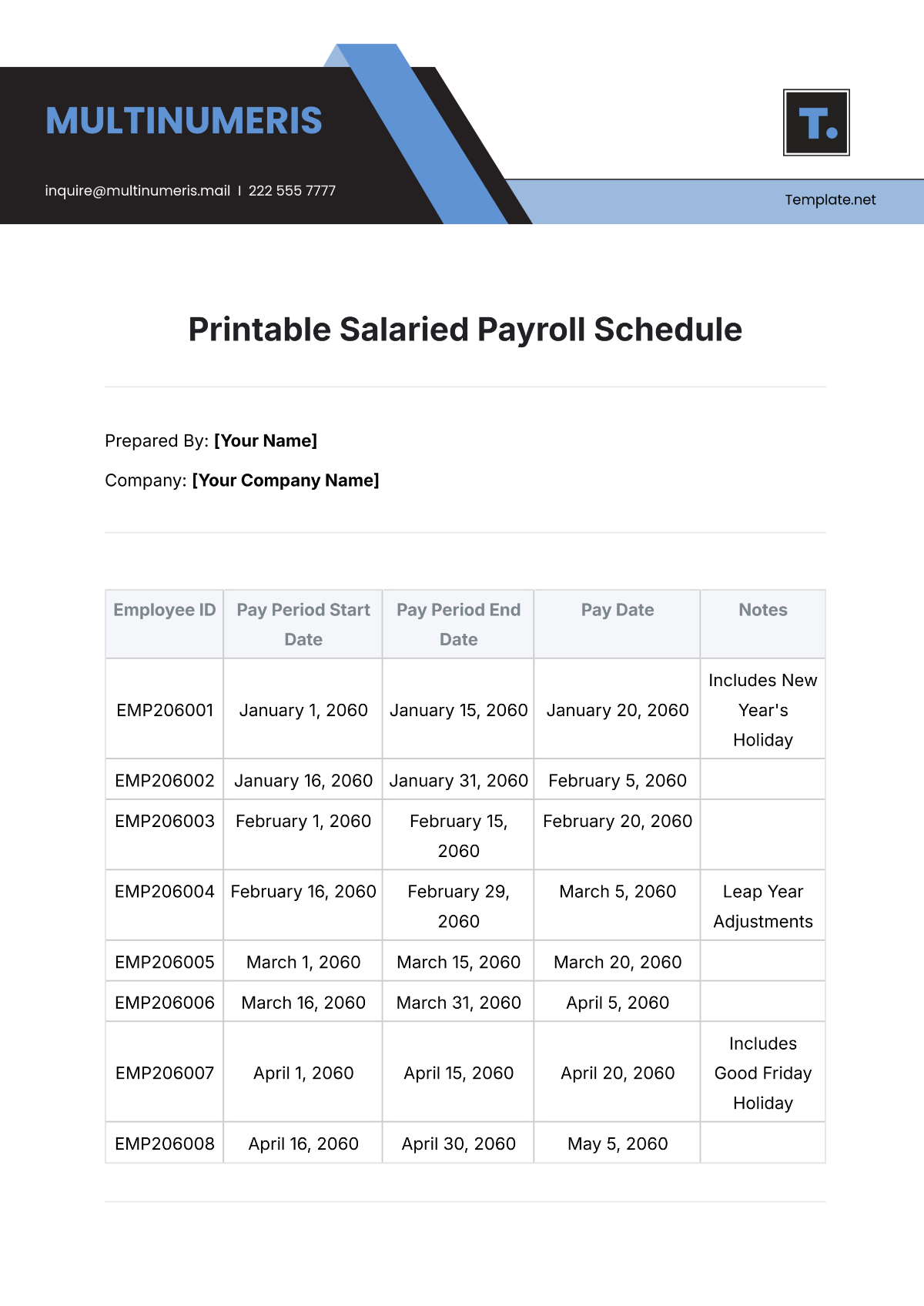

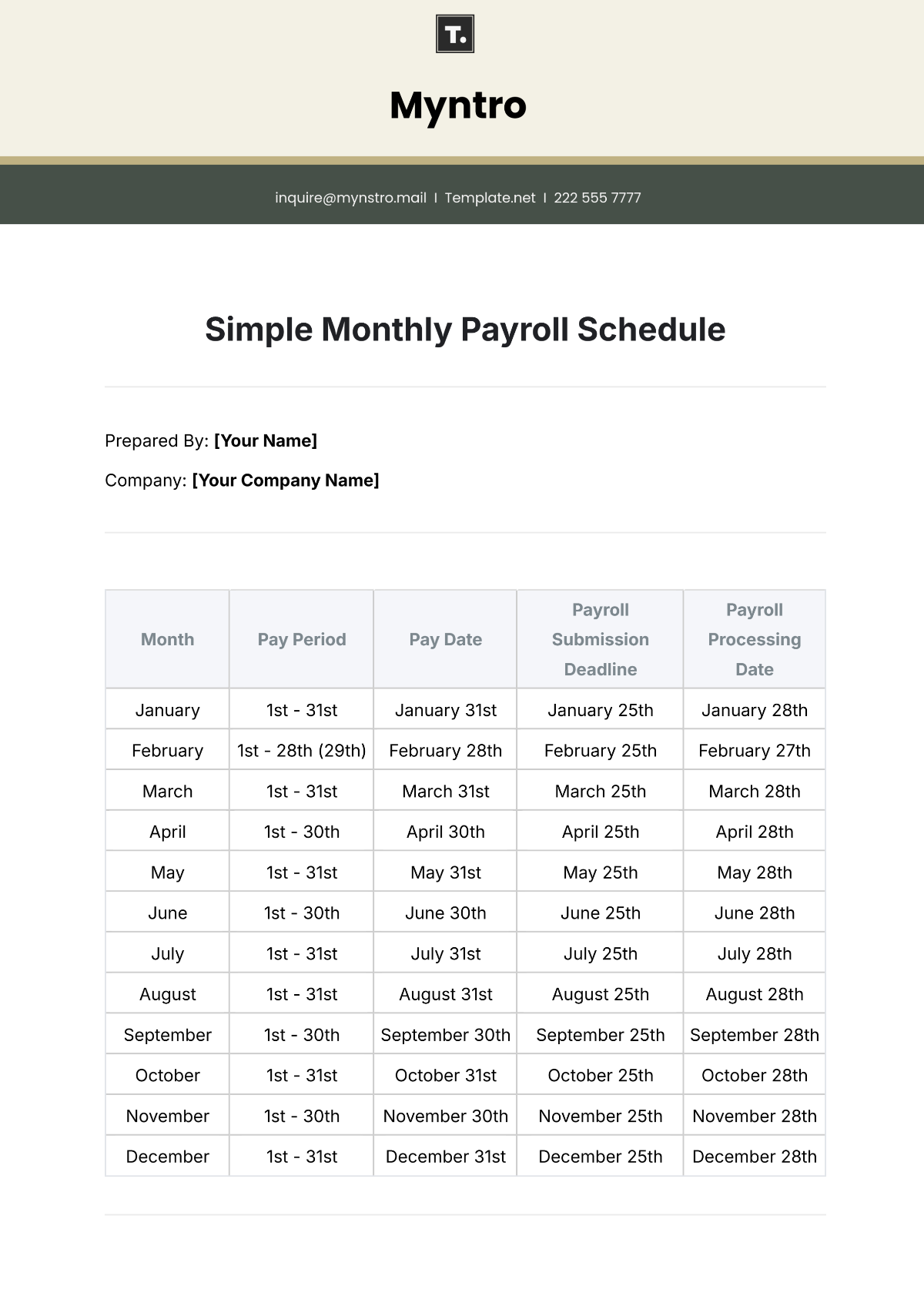

Timing: Highlighting the frequency and timing of salary disbursements, whether bi-weekly, monthly, or following a custom schedule.

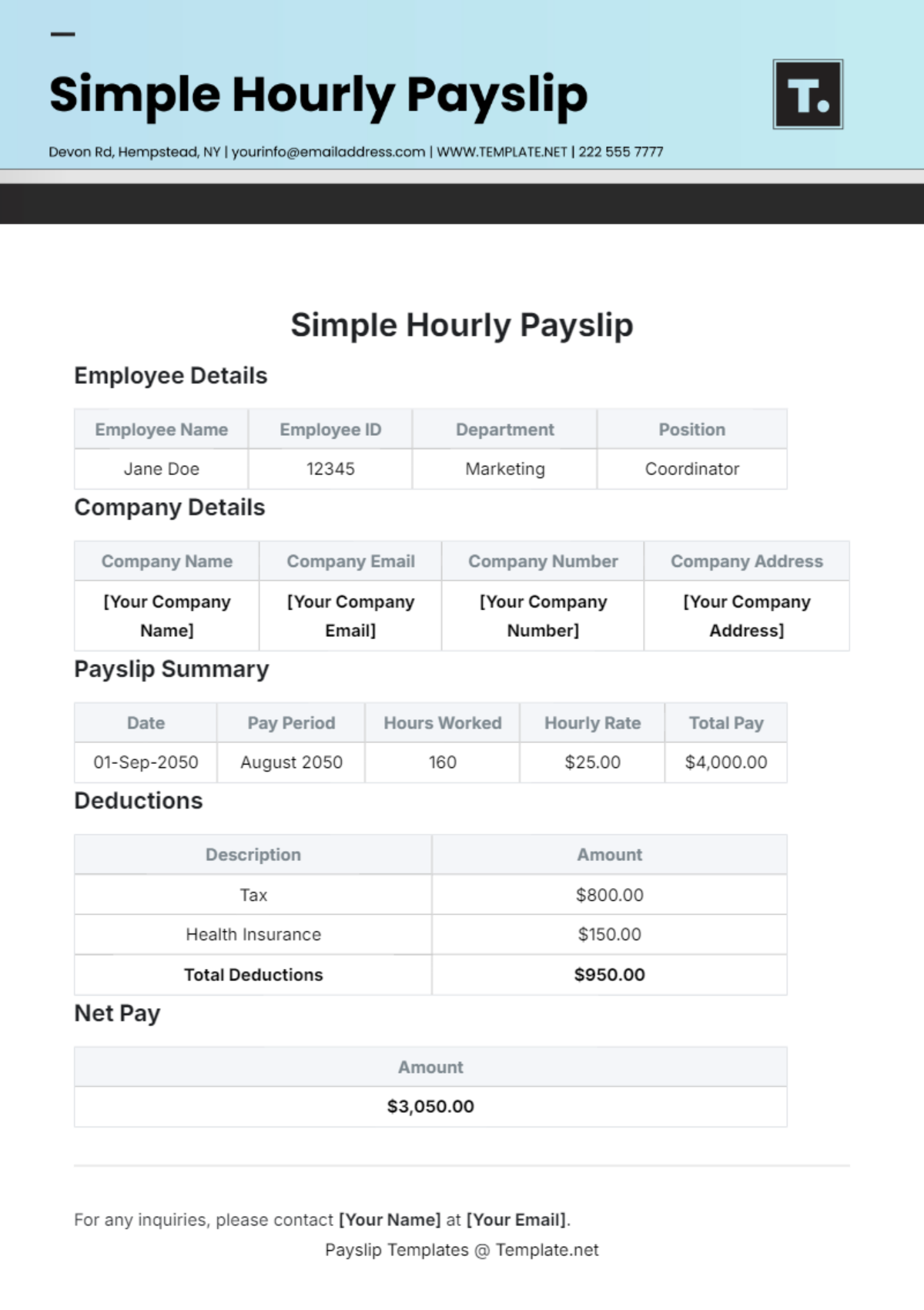

B. Journal Entries

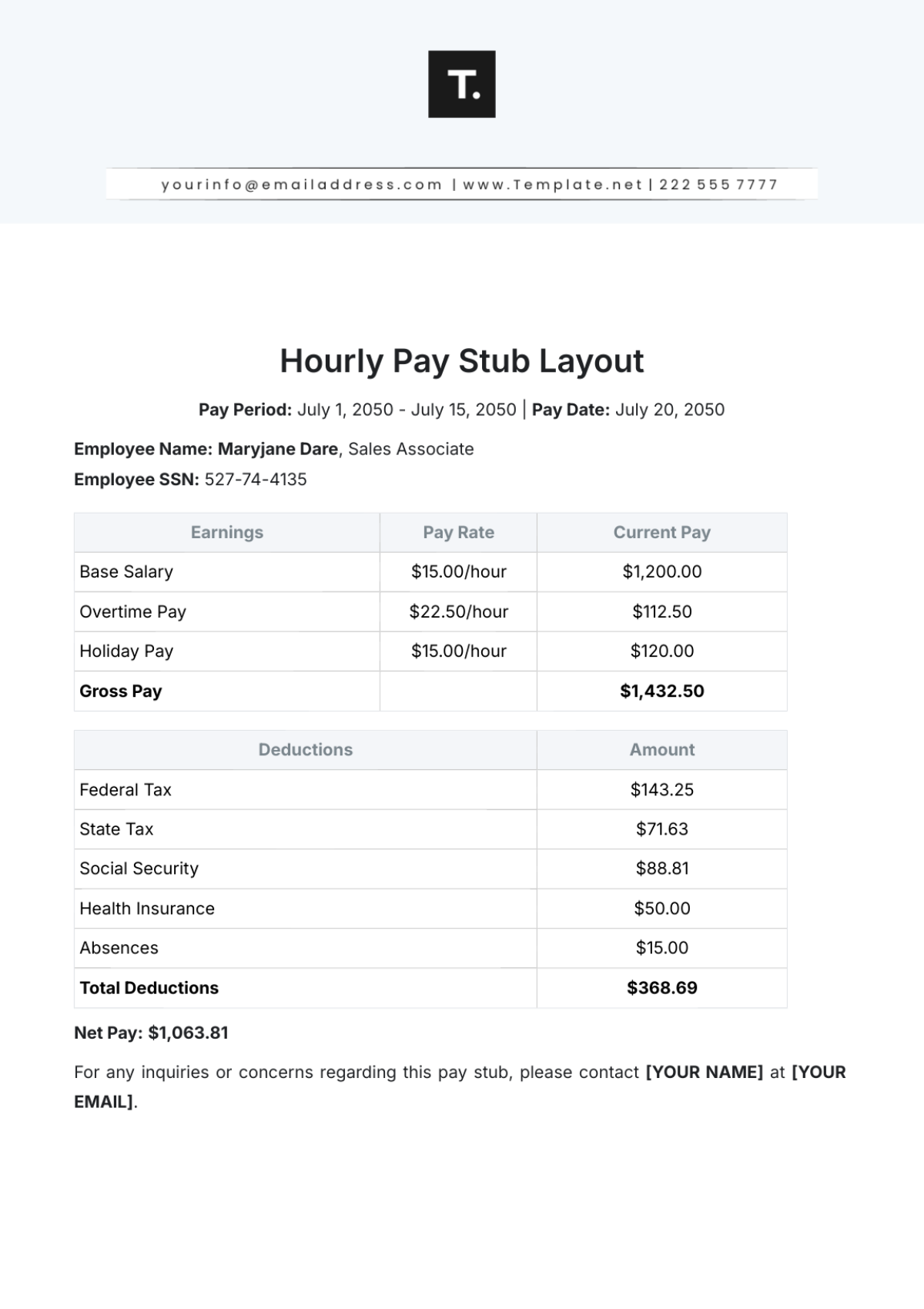

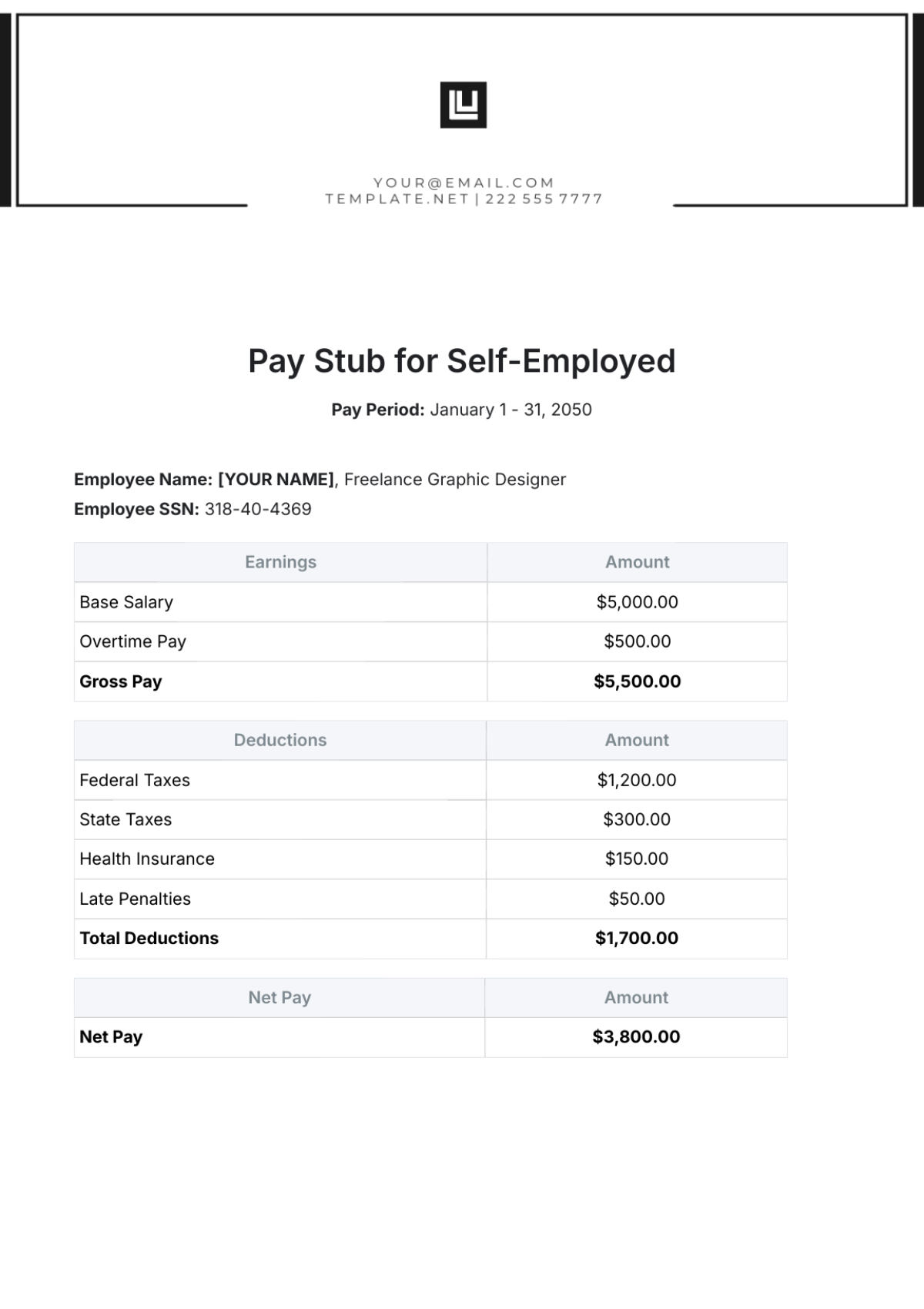

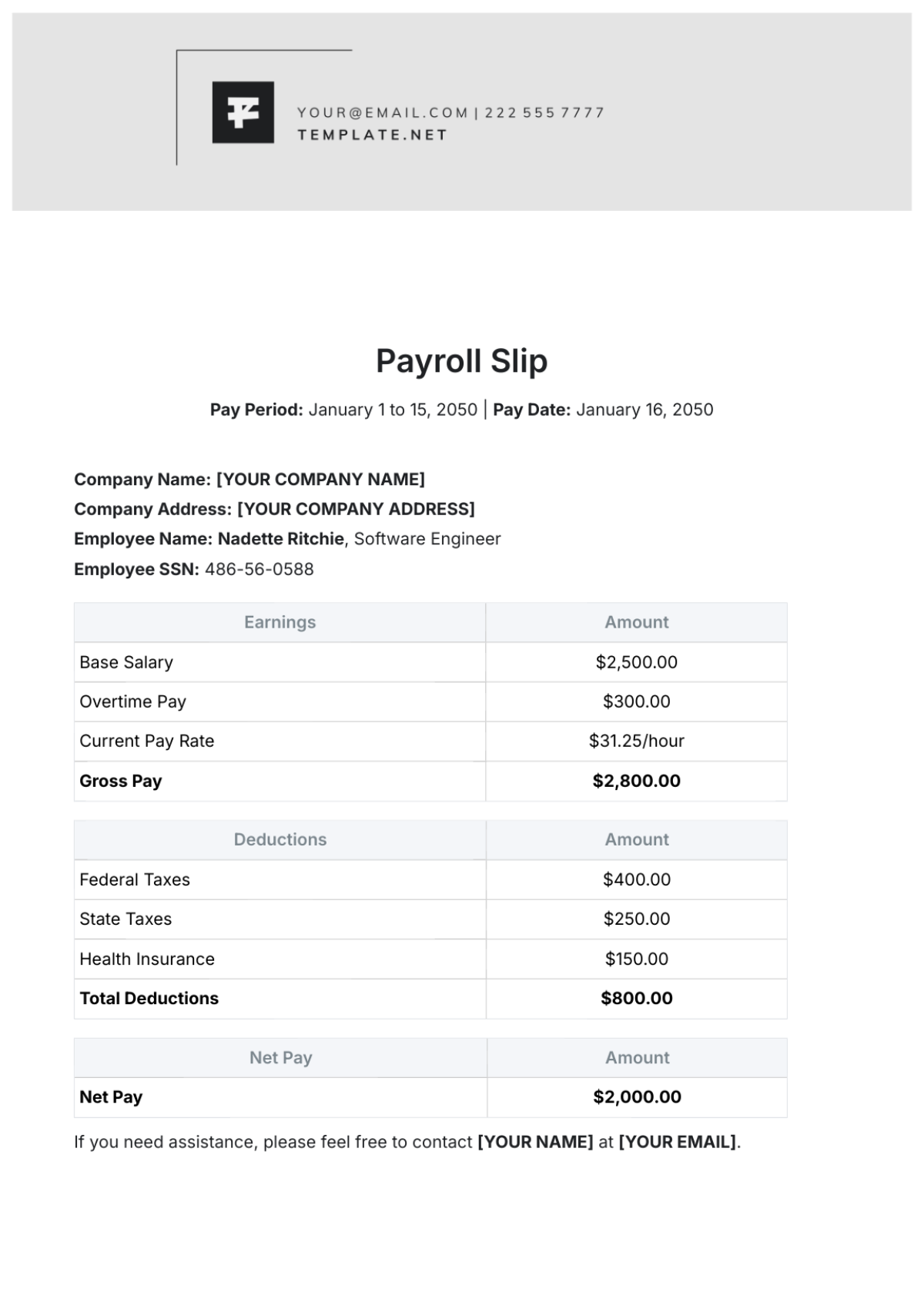

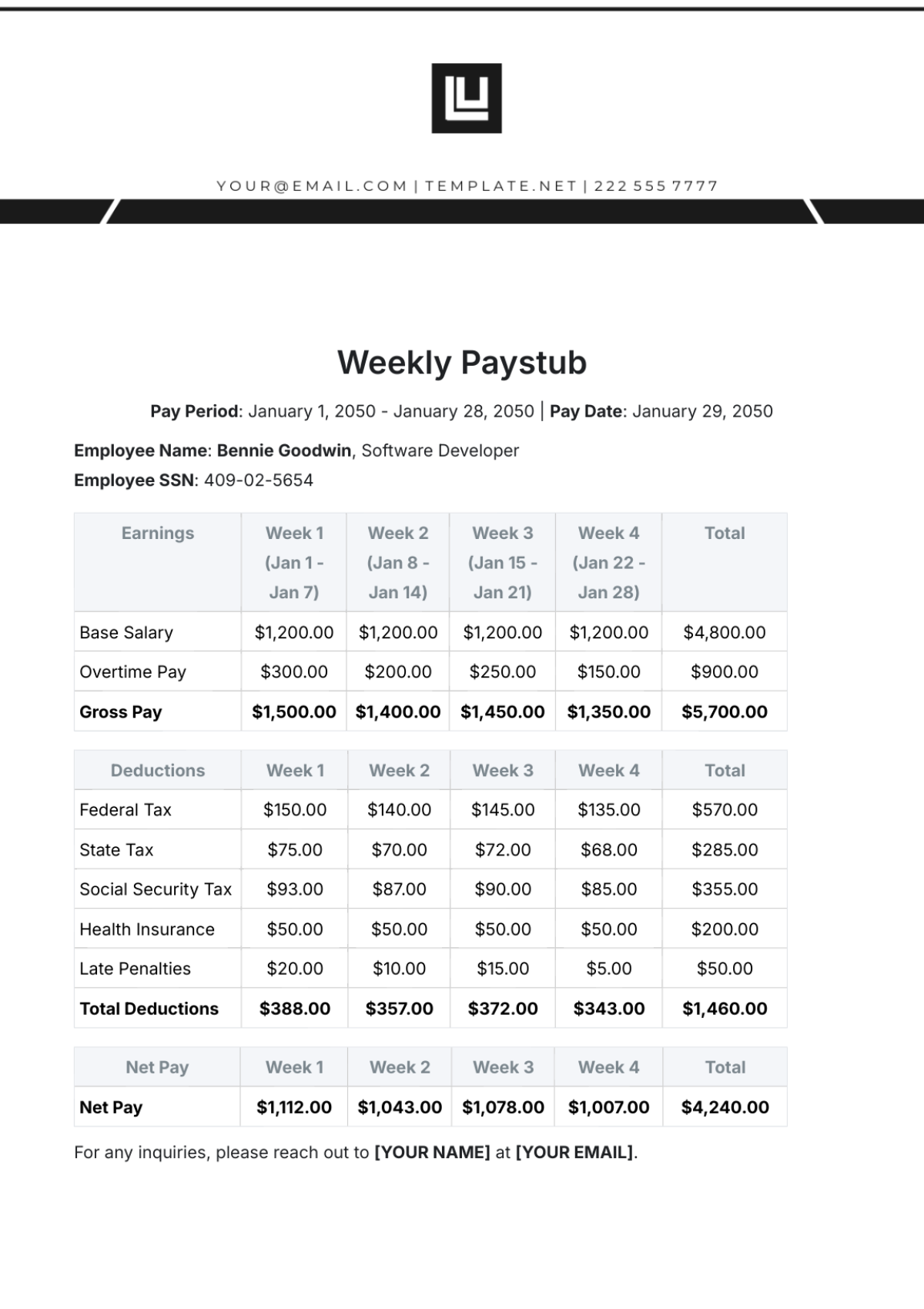

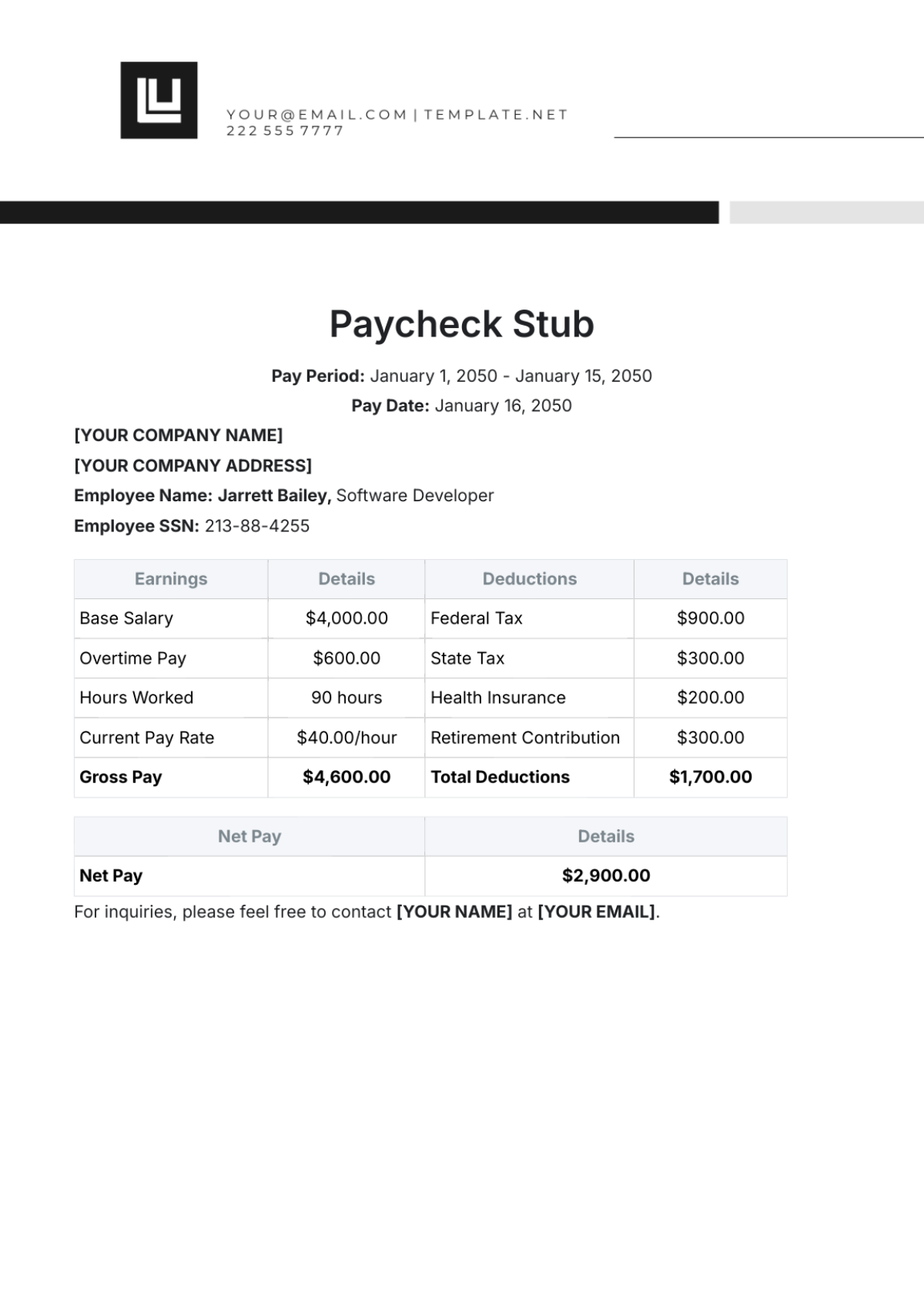

The core of the Finance Payroll Processing Journal lies in the detailed journal entries for salary disbursements. Each entry is meticulously crafted to capture essential information:

Date: Specifies the date of the transaction, ensuring a chronological and organized record.

Employee ID and Name: Identifies the employee receiving the salary, linking the transaction to the individual.

Department: Records the department to which the employee belongs, aiding in department-specific financial analysis.

Gross Salary: Represents the total salary amount before any deductions.

Deductions: Breaks down the various deductions, such as taxes and other withholdings.

Net Salary: Indicates the final amount disbursed to the employee after all deductions.

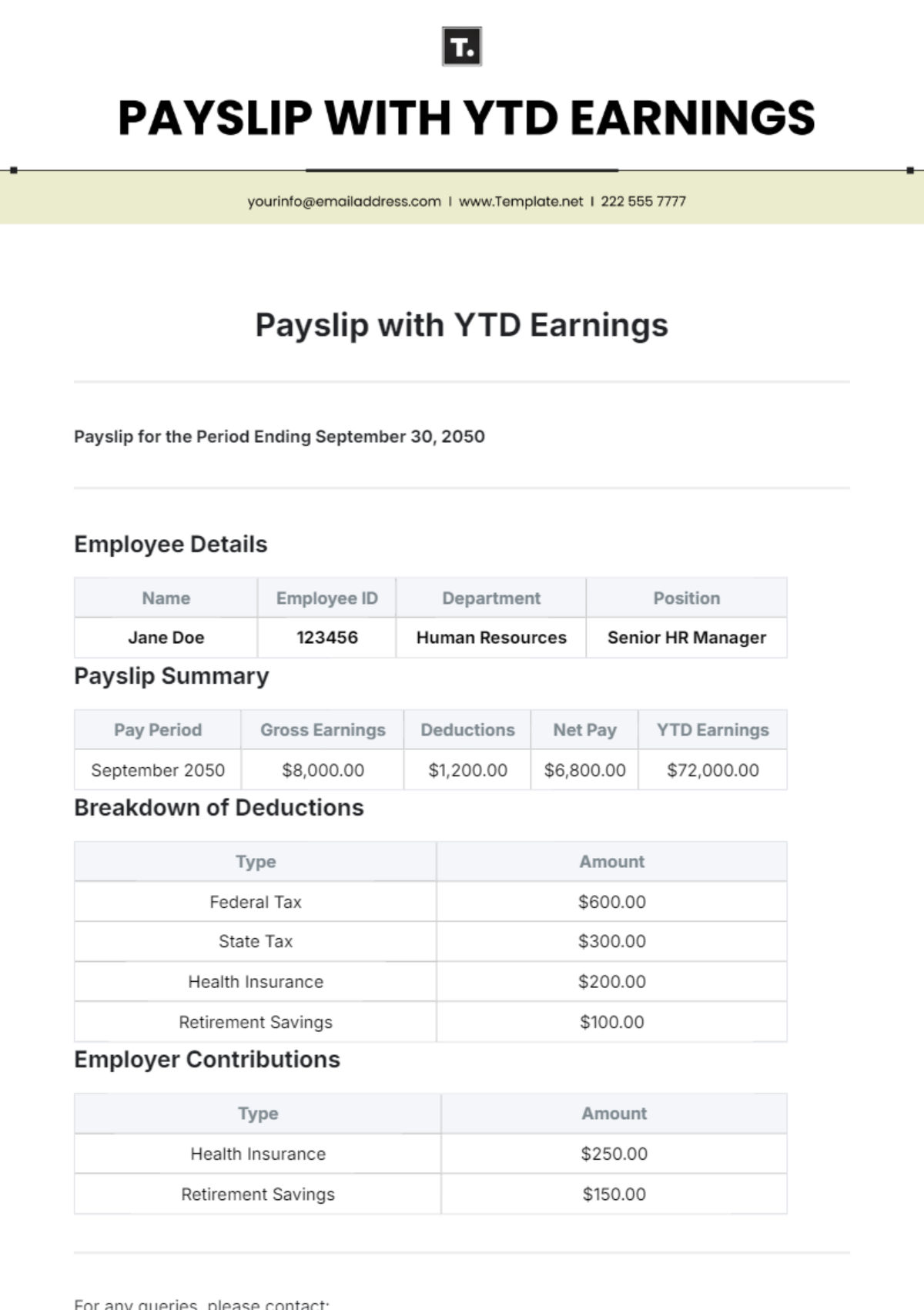

Tax Deductions

A. Overview

Within [Your Company Name], the tax deduction process is meticulously managed to ensure adherence to local, state, and federal tax regulations. This involves a comprehensive approach that includes:

Accurate Calculations: The calculation of tax deductions is conducted with precision, taking into account various factors such as income levels, allowances, and exemptions. This accuracy is crucial for complying with tax laws and ensuring employees' tax liabilities are appropriately accounted for.

Up-to-Date Compliance: [Your Company Name] stays informed about changes in tax laws at all levels. This proactive approach guarantees that the payroll system is consistently updated to reflect the latest legal requirements, reducing the risk of non-compliance.

B. Journal Entries

The Finance Payroll Processing Journal meticulously captures each tax deduction, offering a detailed breakdown of the financial impact on both the employee and the company. Sample entries, with detailed explanations, include:

Entry 1: Federal Income Tax Deduction

Date | Employee ID | Name | Tax Type | Deduction Amount |

|---|---|---|---|---|

[2050-01-15] | [EMP001] | [John Dale] | Federal | [$500] |

In this entry, on [January 15, 2050], employee [John Dale] (EMP001) experiences a federal income tax deduction of [$500]. This deduction is calculated based on his taxable income and the prevailing federal tax rate.

Entry 2: State Income Tax Deduction

Date | Employee ID | Name | Tax Type | Deduction Amount |

|---|---|---|---|---|

[2050-01-15] | [EMP002] | [Jane Curtis] | State | [$200] |

Similarly, on [January 15, 2050][, employee [Jane Curti]s (EMP002) underwent a state income tax deduction of [$200]. This deduction aligns with the applicable state tax regulations and ensures compliance.

Entry 3: Local Tax Deduction

Date | Employee ID | Name | Tax Type | Deduction Amount |

|---|---|---|---|---|

[2050-01-15] | [EMP003] | [Robert Johnson] | Local | [$50] |

On the same date, [Robert Johnson] (EMP003) experiences a local tax deduction of [$50]. This deduction is specific to the locality in which the employee resides, complying with regional tax requirements.

These detailed entries not only provide a transparent record of tax deductions but also serve as an invaluable resource for audits and analyses.

Benefits

A. Overview

Employee benefits at [Your Company Name] are designed to create a supportive and enriching work environment. The benefits administration process encompasses:

Health Insurance Coverage: [Your Company Name] offers robust health insurance coverage to employees and their dependents, prioritizing the well-being of the workforce.

Retirement Planning Support: Retirement benefits, including 401(k) plans, are provided to empower employees in building a secure financial future beyond their active work years.

Additional Perks: A range of supplementary benefits, from wellness programs promoting employee health to educational assistance fostering continuous learning, contributes to a holistic and fulfilling work experience.

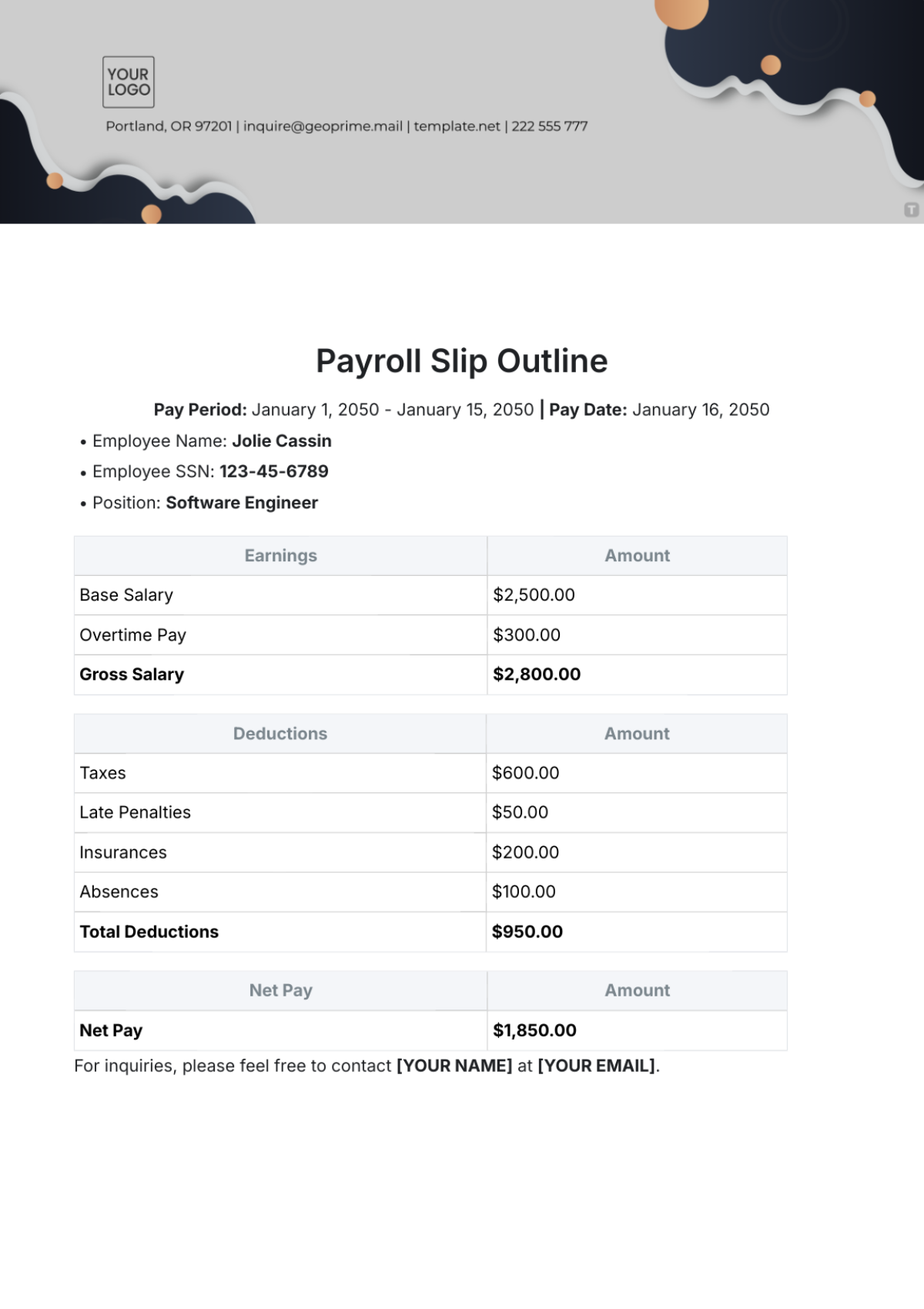

B. Journal Entries

The Finance Payroll Processing Journal meticulously documents each benefit, shedding light on the financial implications for both [Your Company Name] and its employees. Sample entries with detailed explanations include:

Entry 1: Health Insurance Benefit

Date | Employee ID | Name | Benefit Type | Benefit Amount |

|---|---|---|---|---|

[2050-01-15] | [EMP001] | [John Dale] | Health Ins | [$300] |

In this entry, dated [January 15, 2050], employee [John Dale] (EMP001) receives a health insurance benefit of [$300]. This amount reflects the employer's contribution to John's health coverage, promoting the well-being of the employee and their dependents.

Entry 2: 401(k) Retirement Plan Contribution

Date | Employee ID | Name | Benefit Type | Benefit Amount |

|---|---|---|---|---|

[2050-01-15] | [EMP002] | [Jane Curtis] | 401(k) | [$400] |

Similarly, on the same date, [Jane Curtis] (EMP002) enjoys a 401(k) retirement plan contribution benefit of [$400]. This contribution assists Jane in building a secure financial future, aligning with [Your Company Name]'s commitment to employee welfare.

Entry 3: Educational Assistance Benefit

Date | Employee ID | Name | Benefit Type | Benefit Amount |

|---|---|---|---|---|

[2050-01-15] | [EMP003] | [Robert Johnson] | Education | [$200] |

Employee [Robert Johnson] (EMP003) experiences an educational assistance benefit of [$200] on [January 15, 2050]. This benefit supports Robert's continuous learning and development, contributing to both individual growth and organizational knowledge enrichment.

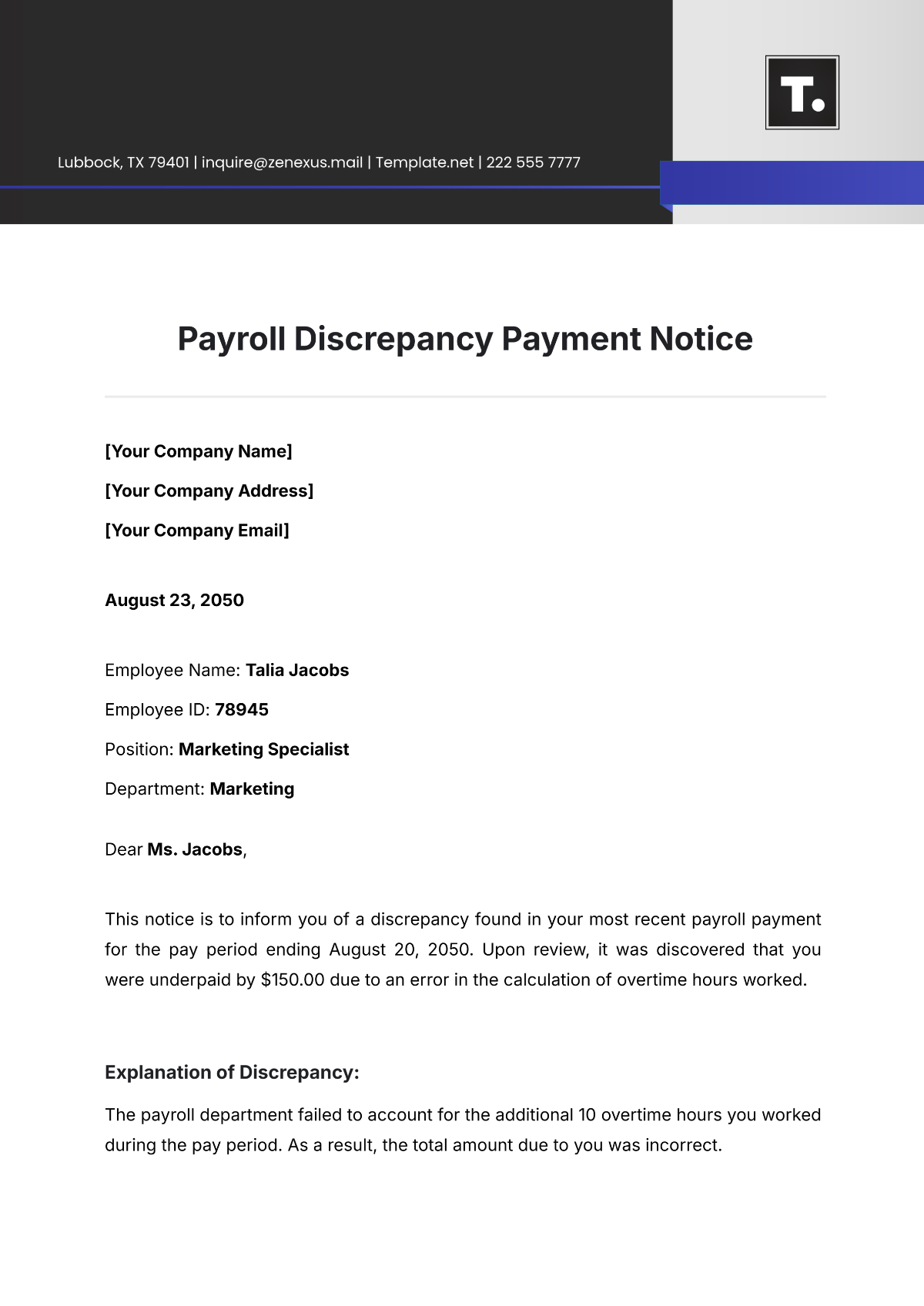

Reconciliation

A. Bank Reconciliation

The reconciliation process is crucial to ensure the accuracy and integrity of payroll transactions. [Your Company Name] follows a meticulous bank reconciliation process, which includes:

Regular Reviews: Regular reviews of bank statements are conducted to identify any discrepancies between the recorded payroll transactions and actual bank transactions.

Adjustments: If variances are identified during the reconciliation process, necessary adjustments are made to the payroll accounts and bank statements to bring them into alignment.

B. Reconciliation Report

To provide a clear overview of the reconciliation process, [Your Company Name] generates a comprehensive reconciliation report. Sample entries in the report include:

Entry 1: Payroll Account Adjustment

Date | Description | Debit | Credit |

|---|---|---|---|

[2050-01-15] | Payroll Account Adjustment | - | [$500] |

In this entry, dated [January 15, 2050], a payroll account adjustment of [$500] is made to rectify a discrepancy identified during the reconciliation process.

Entry 2: Bank Statement Adjustment

Date | Description | Debit | Credit |

|---|---|---|---|

[2050-01-15] | Bank Statement Adjustment | [$500] | |

Concurrently, a corresponding bank statement adjustment of [$500] is made to align the bank statement with the corrected payroll account.

This reconciliation report serves as a transparent record of adjustments made during the reconciliation process, ensuring financial accuracy.

Regulatory Compliance

A. Tax Filings

[Your Company Name] is committed to meeting all tax filing requirements at local, state, and federal levels. The tax filing process includes:

Timely Filings: Ensuring that all required tax filings are submitted punctually to the respective tax authorities to avoid penalties or legal implications.

Accuracy Checks: Conducting thorough accuracy checks to verify the precision of the information provided in tax filings, reducing the risk of errors or discrepancies.

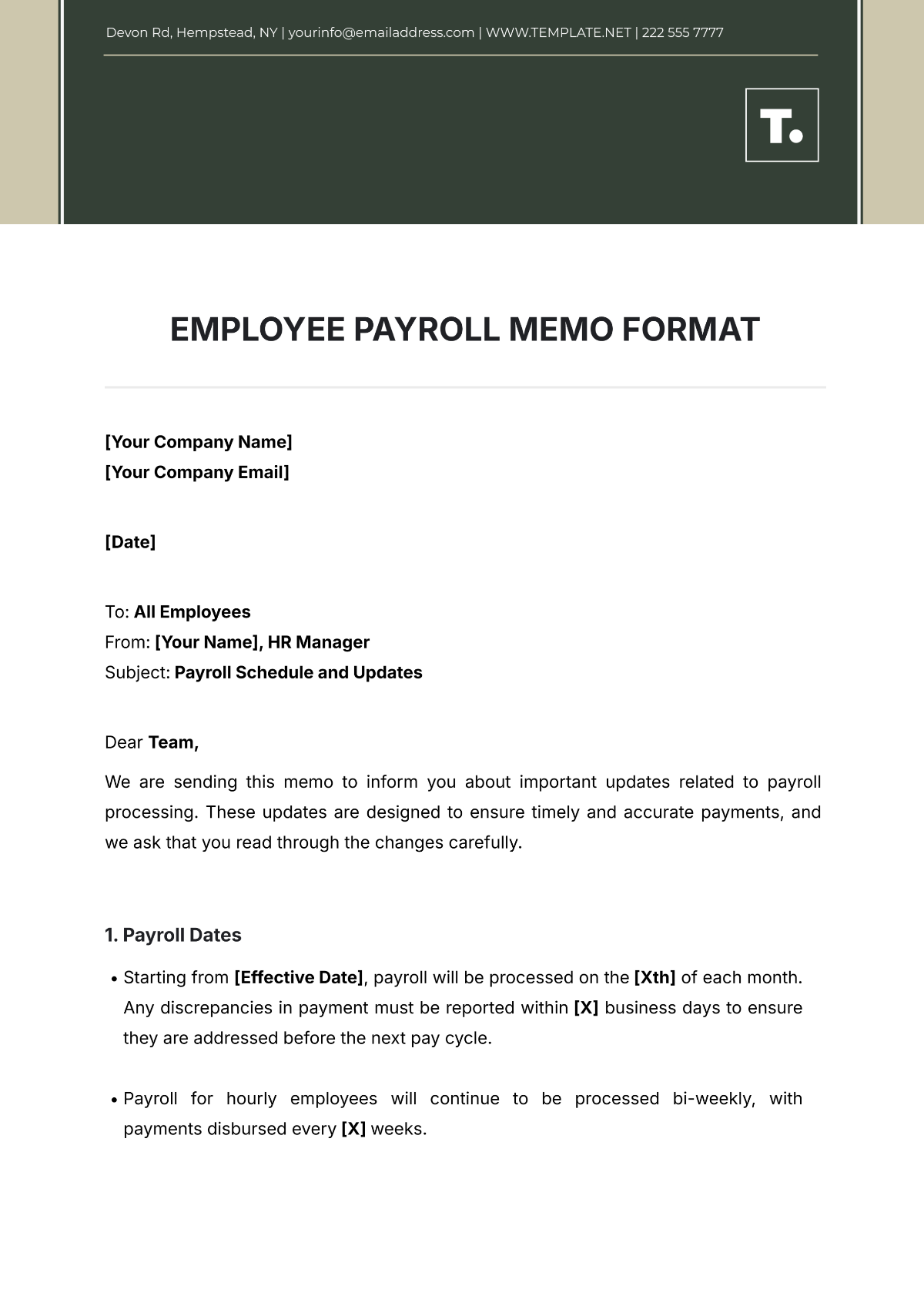

B. Financial Reporting

Financial reporting is a key component of regulatory compliance, providing a transparent overview of [Your Company Name]'s financial status. This involves:

Periodic Reports: Generating periodic financial reports that include payroll expenses, tax liabilities, and other relevant financial data.

Distribution: Ensuring the timely distribution of financial reports to internal stakeholders, regulatory bodies, and other relevant parties.

Financial Reporting

A. Overview

Financial reporting within [Your Company Name] serves as a cornerstone for transparent communication of the organization's financial health. The process involves a meticulous approach to data aggregation, analysis, and presentation:

Data Aggregation: The financial reporting team collates data from various sections of the Finance Payroll Processing Journal. This includes salary disbursements, tax deductions, benefits, and reconciliation reports. This comprehensive approach ensures that the financial report provides a holistic view of the organization's payroll-related financial activities.

Analysis: A detailed analysis is conducted on the aggregated data. This involves identifying trends, patterns, and outliers in payroll expenses, tax liabilities, and benefits expenses. The analysis aims to derive meaningful insights that assist in strategic decision-making and financial planning.

Conclusion

A. Key Findings

Trend Analysis

Throughout the reporting period, [Your Company Name] observed a consistent upward trend in total salaries disbursed. This trend aligns with the company's strategic expansion efforts, indicating a growing workforce.

Compliance Adherence

Tax deductions and benefits expenses remained well within the expected ranges, showcasing the effectiveness of our financial management and adherence to regulatory standards.

Process Efficiency

The implementation of automated reconciliation tools significantly reduced the time required for bank reconciliation, streamlining the process and minimizing the risk of errors.

B. Improvements

Automation Initiatives

The successful integration of automated reconciliation tools not only increased efficiency but also reduced the likelihood of human errors in the reconciliation process. This improvement aligns with [Your Company Name]'s commitment to leveraging technology for operational excellence.

Training Programs

The initiation of a comprehensive training program aimed at enhancing the team's understanding of evolving tax regulations has already shown positive results. Team members are better equipped to navigate the complexities of tax compliance, fostering a culture of continuous learning and improvement.

C. Actions Taken

Process Optimization

Based on the observed trends, [Your Company Name] is proactively exploring further process optimization opportunities. This includes a review of payroll disbursement methods and potential enhancements to benefits administration to better align with employee needs and industry benchmarks.

Compliance Reviews

To ensure ongoing compliance, [Your Company Name] is instituting regular reviews of tax regulations. This proactive approach aims to identify and address any upcoming changes promptly, minimizing the risk of non-compliance.

Communication Initiatives

Recognizing the importance of transparent communication, [Your Company Name] will implement initiatives to enhance communication channels with employees regarding changes in payroll processes, benefits, and compliance updates.

D. Next Steps

Looking ahead, [Your Company Name] is committed to maintaining a dynamic and responsive payroll processing system. Regular evaluations, ongoing training, and strategic enhancements will remain at the forefront of our approach to ensure that payroll activities align with organizational goals and industry best practices.