Free Financial Cost Management Portfolio

Executive Summary

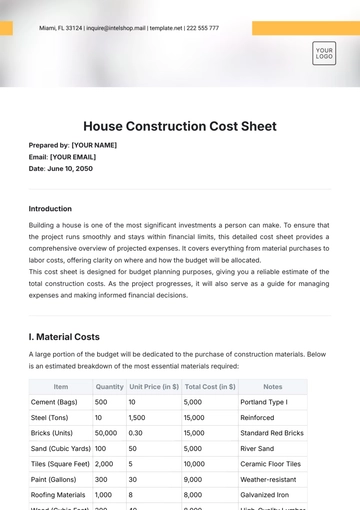

This comprehensive portfolio offers a strategic insight into our company's Financial Cost Management, with an emphasis on investment analysis and portfolio management. The objective is to bolster our financial robustness, strategically reduce costs, and amplify investment returns. We have successfully integrated advanced financial models and market analysis to identify cost-saving opportunities and profitable investment avenues. Our approach is centered around maximizing efficiency, optimizing asset allocation, and ensuring sustainable growth.

Financial Health Overview

Current Financial Status

Our company's current financial standing is strong, marked by a solid balance sheet and consistent cash flow. We have achieved this through prudent financial management and strategic investments. The financial health indicators are as follows:

Total Assets: Demonstrating a healthy growth trajectory, our total assets have reached $500 million. This growth is attributed to both operational revenue and successful investments.

Total Liabilities: We maintain a disciplined approach to debt, with total liabilities at $200 million. Our debt strategy focuses on maintaining a balance between leveraging opportunities and minimizing financial risk.

Net Income: Our net income for the last fiscal year was a robust $50 million, underlining our efficient cost management and strong revenue streams.

Historical Financial Performance

Analyzing our financial performance over the past five years reveals a pattern of consistent growth and resilience in challenging markets. We have successfully navigated market volatilities while maintaining a growth trajectory. Key performance indicators include:

Revenue Growth: Our revenue has grown consistently, with a 5-year compound annual growth rate (CAGR) of 6%. This is reflective of our expanding market share and diversification of revenue sources.

Profitability Trends: Net income has seen a CAGR of 8%, indicating effective cost control measures and improved operational efficiency.

Asset Growth: Total assets have grown at a CAGR of 7%, thanks to strategic investments and asset acquisitions.

The following table provides a snapshot of our key financial metrics over the past five years:

Year | Total Revenue | Total Assets | Total Liabilities | Net Income |

Year 1 | $300M | $350M | $150M | $30M |

Year 2 | $320M | $370M | $160M | $35M |

Year 3 | $340M | $400M | $180M | $40M |

Year 4 | $360M | $450M | $190M | $45M |

Year 5 | $400M | $500M | $200M | $50M |

Financial Ratios Analysis

To further gauge our financial health, we regularly analyze key financial ratios:

Debt-to-Equity Ratio: Our debt-to-equity ratio has been maintained at a healthy level of 0.4, indicating a balanced approach to leveraging.

Current Ratio: Our current ratio stands at 1.5, reflecting our ability to meet short-term obligations.

Return on Equity (ROE): The ROE has been consistently above 15%, showcasing the effectiveness of our investments and financial strategies.

Financial Ratios Analysis

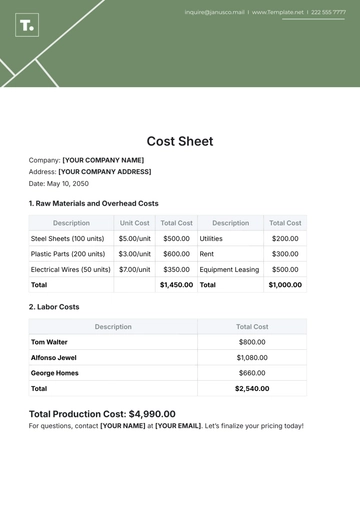

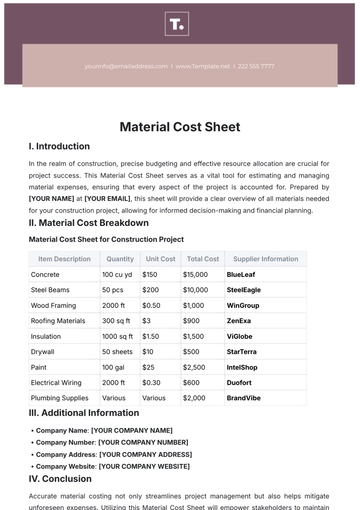

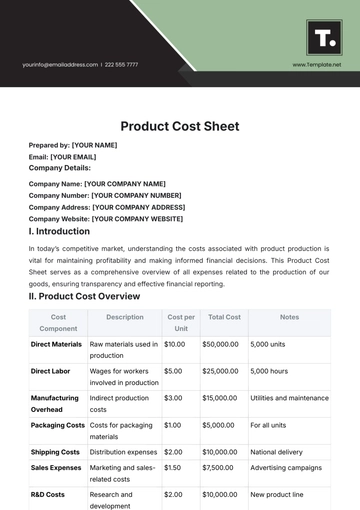

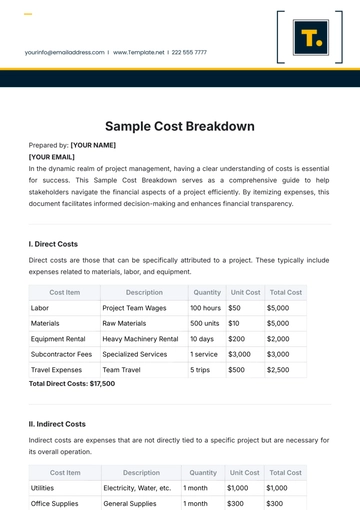

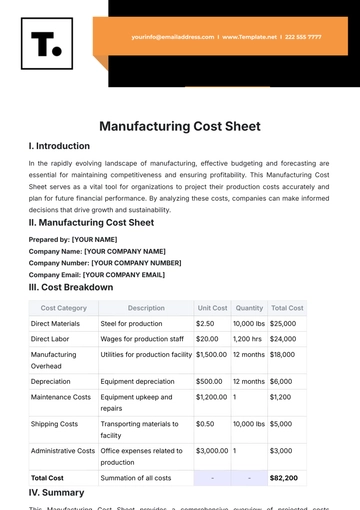

Our approach to cost management is comprehensive, targeting both direct and indirect costs to enhance overall financial efficiency. This section outlines the key strategies we have implemented to manage and optimize our costs.

Operational Cost Reduction

Our operational cost reduction initiatives have been pivotal in enhancing profitability. Significant measures include:

Supply Chain Optimization: We have re-engineered our supply chain processes, reducing logistics costs by 12% while maintaining product quality and delivery timelines.

Energy Efficiency: Investments in energy-efficient technologies have reduced our energy costs by 15%, contributing to both cost savings and environmental sustainability.

Process Automation: By automating repetitive tasks, we have reduced labor costs and improved operational efficiency. This has led to a 10% reduction in associated costs.

Strategic Cost Management

In addition to operational cost reductions, we have adopted strategic cost management practices:

Vendor Management: We have renegotiated contracts with key vendors, achieving a 5% reduction in material costs.

Overhead Cost Control: Through a thorough review of our overhead expenses, we have identified and eliminated non-essential spending, resulting in a 7% cost saving.

Cost Management Performance Metrics

The effectiveness of our cost management strategies is reflected in the following metrics:

Strategy | Cost Reduction | Impact on Profit Margin |

Supply Chain Optimization | 12% | 3% increase |

Energy Efficiency | 15% | 2% increase |

Process Automation | 10% | 2.5% increase |

Vendor Management | 5% | 1% increase |

Overhead Cost Control | 7% | 1.5% increase |

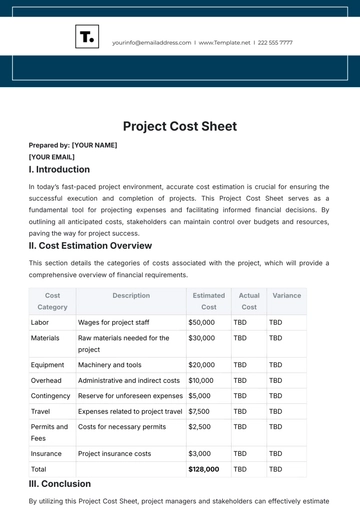

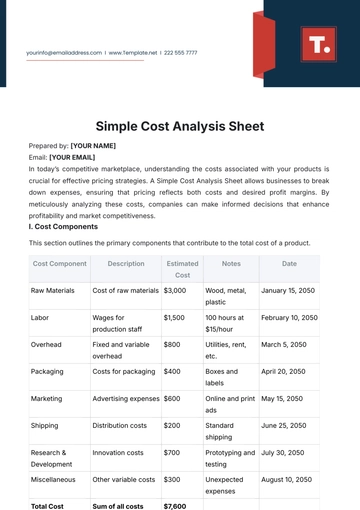

Investment Analysis

Our investment analysis approach is meticulously structured to assess opportunities and risks in our portfolio. We endeavor to strike a balance between various asset classes, optimizing for both growth and stability in diverse market conditions. The portfolio is crafted to reflect our strategic vision, aligning with the company's broader financial goals and risk tolerance.

Portfolio Composition and Strategy

The composition of our investment portfolio is a reflection of our commitment to diversification and strategic asset allocation. We allocate our investments across several asset classes, ensuring a blend that mitigates risk while seeking growth. Our current portfolio includes equities, bonds, real estate, and cash equivalents.

Equities form the cornerstone of our growth strategy, making up 40% of our portfolio. We primarily invest in high-potential growth stocks and established blue-chip companies, aiming for capital appreciation and dividends. The bond segment, comprising 30% of our portfolio, focuses on government and high-quality corporate bonds, providing stable income and reducing overall portfolio volatility. Real estate investments, accounting for 20%, are targeted towards commercial and residential properties with promising value appreciation. Lastly, cash and cash equivalents, which make up 10% of our portfolio, offer liquidity and safeguard against short-term market fluctuations.

The following table provides a breakdown of our portfolio allocation:

Asset Class | Allocation (%) | Expected Return |

Equities | 40% | 8% |

Bonds | 30% | 5% |

Real Estate | 20% | 6% |

Cash & Equivalents | 10% | 2% |

Performance Assessment

Our portfolio's performance is continuously monitored against industry benchmarks and our internal targets. The equities portfolio, with its focus on growth and value stocks, has been a strong performer, yielding an average annual return of 8%. The bond investments, selected for their stability and consistent income, have contributed a 5% return. Real estate investments, an area we've expanded in recent years, have shown a promising average return of 6%. The liquidity portion of the portfolio, though yielding a lower return of 2%, plays a crucial role in maintaining balance and providing flexibility.

Future Outlook and Adjustments

Looking ahead, we are actively monitoring global economic indicators and market trends to inform our future investment decisions. Our strategy includes adjusting the portfolio in response to changing market conditions, with a focus on emerging opportunities in technology and sustainable sectors. We are also exploring increased allocations in emerging markets to capitalize on their growth potential while closely managing the associated risks.

In conclusion, our investment analysis is a dynamic and ongoing process, aimed at achieving a well-balanced portfolio that supports the company's financial objectives. Through careful analysis, strategic asset allocation, and continuous performance monitoring, we aim to sustain and grow our investments in alignment with our long-term financial goals.

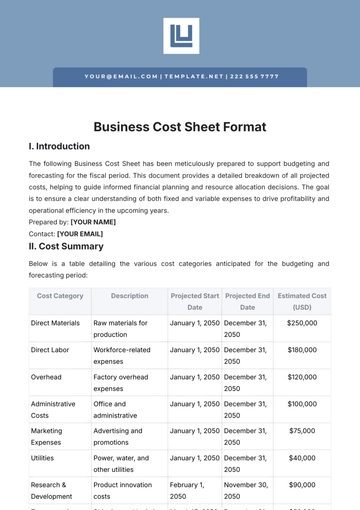

Portfolio Management

Our portfolio management strategy is focused on maximizing returns while controlling risk. This approach is fundamental in achieving our long-term financial objectives. We emphasize a disciplined and dynamic management style to navigate through market fluctuations and seize growth opportunities.

Asset Allocation Strategy

Our asset allocation is designed to reflect our risk tolerance and investment objectives. We continuously monitor market trends and adjust our allocation to optimize returns. The current allocation strategy includes:

Equities: These are primarily growth-oriented stocks, accounting for 40% of our portfolio. We focus on sectors with high growth potential.

Fixed Income: Comprising 30% of the portfolio, our fixed-income investments are a mix of corporate and government bonds, providing stability and regular income.

Real Estate and Alternatives: Making up 20%, this includes investments in commercial real estate and alternative assets like private equity and commodities.

Cash and Equivalents: 10% of our portfolio is in liquid assets to manage liquidity needs and take advantage of new investment opportunities.

Performance Monitoring and Reporting

We have an established system for monitoring and reporting on our portfolio's performance. Key performance indicators include return on investment, risk-adjusted returns, and comparison against benchmark indices. Regular reports are generated monthly to provide insights and guide decision-making.

Risk Management Techniques

Our risk management framework includes:

Diversification: We maintain a diversified portfolio across different asset classes and geographic regions to mitigate risk.

Regular Rebalancing: The portfolio is rebalanced semi-annually or in response to significant market movements to maintain the desired asset allocation.

Use of Derivatives: For hedging against market volatility, especially in our equity and foreign exchange exposures.

Conclusion

Our financial portfolio management demonstrates a strategic blend of aggressive growth tactics and conservative risk management. This balance has been key to our sustained financial success and resilience in fluctuating markets. The future focus will be on adapting to global economic changes, exploring emerging markets, and integrating sustainable and socially responsible investing principles.

Our commitment to continuous improvement in financial management practices positions us well for future challenges and opportunities. By maintaining a dynamic and flexible approach, we are confident in our ability to deliver long-term value to our stakeholders.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Manage your financial assets efficiently with the Financial Cost Management Portfolio Template from Template.net. This editable, customizable template organizes and tracks financial costs associated with various projects or departments. A valuable tool for financial analysts and managers, it aids in comprehensive cost analysis, enabling informed decision-making for financial optimization.