Free Finance Credit Risk Assessment

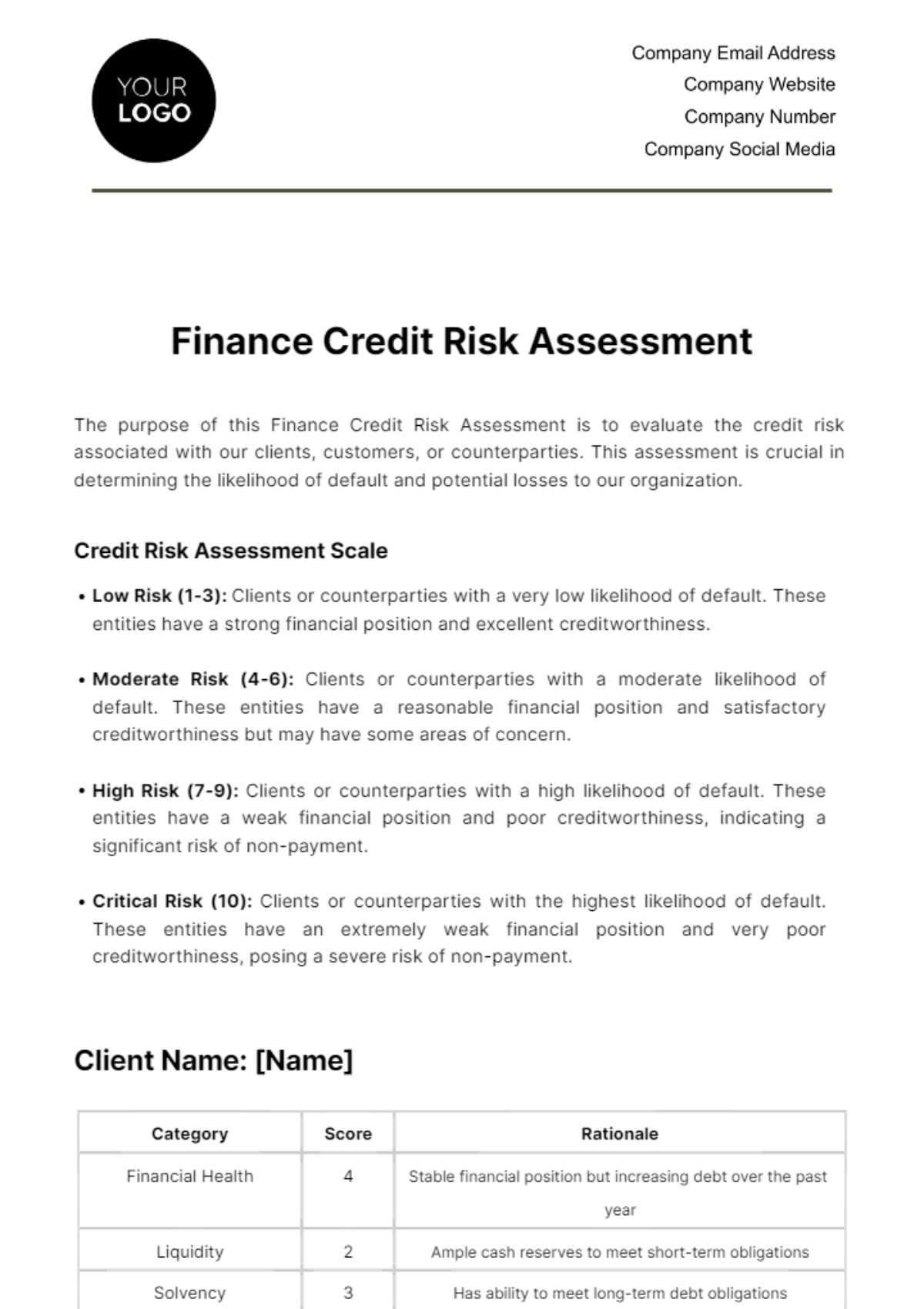

The purpose of this Finance Credit Risk Assessment is to evaluate the credit risk associated with our clients, customers, or counterparties. This assessment is crucial in determining the likelihood of default and potential losses to our organization.

Credit Risk Assessment Scale

Low Risk (1-3): Clients or counterparties with a very low likelihood of default. These entities have a strong financial position and excellent creditworthiness.

Moderate Risk (4-6): Clients or counterparties with a moderate likelihood of default. These entities have a reasonable financial position and satisfactory creditworthiness but may have some areas of concern.

High Risk (7-9): Clients or counterparties with a high likelihood of default. These entities have a weak financial position and poor creditworthiness, indicating a significant risk of non-payment.

Critical Risk (10): Clients or counterparties with the highest likelihood of default. These entities have an extremely weak financial position and very poor creditworthiness, posing a severe risk of non-payment.

Client Name: [Name]

Category | Score | Rationale |

Financial Health | 4 | Stable financial position but increasing debt over the past year |

Liquidity | 2 | Ample cash reserves to meet short-term obligations |

Solvency | 3 | Has ability to meet long-term debt obligations |

Creditworthiness | 5 | History of timely payments and a positive credit report |

Industry/Market Factors | 6 | Operates in a stable industry with moderate competition |

Client Name: [Name]

Category | Score | Rationale |

Financial Health | ||

Liquidity | ||

Solvency | ||

Creditworthiness | ||

Industry/Market Factors |

Client Name: [Name]

Category | Score | Rationale |

Financial Health | ||

Liquidity | ||

Solvency | ||

Creditworthiness | ||

Industry/Market Factors |

Conclusion

Based on the assessment questions, scores, and rationale provided, we categorize the credit risk for each client or counterparty using the Credit Risk Assessment Scale as follows:

Low Risk | Client B |

Moderate Risk | Client A |

High Risk | Client C |

Critical Risk | None |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Enhance your risk evaluation process with the Finance Credit Risk Assessment Template from Template.net. Editable and customizable in our AI Editor tool, this template is expertly designed for assessing credit risks efficiently. It assists finance professionals in analyzing borrower profiles, ensuring informed lending decisions and effective management of credit portfolios. This template is vital for robust credit risk assessment.