Free Financial Cost SWOT Analysis

I. Introduction and Overview

Purpose

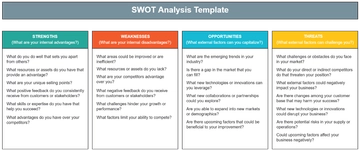

This SWOT Analysis serves as a crucial tool for [Your Company Name] in evaluating our current practices in financial cost management. It is meticulously designed to dissect and understand the various facets of our cost structure, and to pinpoint strategic areas ripe for improvement, enhancement, and growth. The objective is to foster a deep understanding of how our cost management impacts our overall financial health and to identify opportunities that can propel us toward greater efficiency and market competitiveness.

Current Financial Cost Structure Overview

At [Your Company Name], our financial architecture is characterized by a well-balanced interplay of fixed and variable costs, a strategy that has been pivotal in cushioning the company against market fluctuations. Our substantial investments in advanced technology and a skilled workforce form the backbone of this structure, providing us with a robust platform for operational efficiency and innovation. However, this blend of cost elements, while beneficial in many aspects, requires continuous and meticulous evaluation to ensure it aligns with the evolving market demands and internal strategic shifts. We must maintain this balance, as it not only impacts our immediate financial performance but also shapes our long-term sustainability and growth in an increasingly competitive and dynamic business landscape.

II. Strengths in Cost Management

This section highlights [Your Company Name]'s strengths in cost management, detailing our effective practices and the competitive advantages they bring.

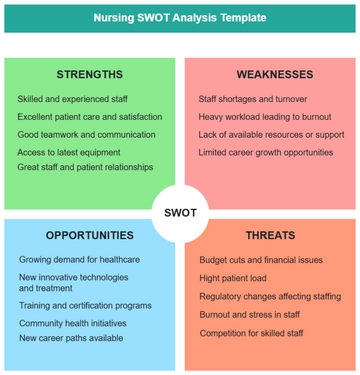

A. Effective Cost Management Practices

One of our core strengths lies in our robust procurement process, which ensures cost-effectiveness while maintaining quality. Additionally, our adoption of technology has automated various processes, leading to reduced labor costs and increased efficiency.

Practice | Sample Implementation | Benefit |

Robust Procurement Process | Strategic sourcing and bulk purchasing agreements. | Reduces material costs and ensures quality. |

Technology Automation | Implementing ERP systems for finance and operations. | Increases efficiency, reduces labor costs. |

Energy Efficiency Initiatives | Installing solar panels and energy-saving equipment. | Lowers utility bills, eco-friendly approach. |

Lean Manufacturing | Adopting lean principles in production. | Reduces waste, improves operational efficiency. |

Flexible Work Arrangements | Implementing remote work options where feasible. | Decreases office maintenance and utility costs. |

B. Competitive Cost Advantages

Our strategic vendor partnerships have allowed us to negotiate favorable terms, giving us a competitive edge in cost savings. Moreover, our investment in renewable energy sources has significantly reduced our utility costs.

Advantage | Description | Impact on Business |

Favorable Vendor Terms | Negotiated discounts and extended payment terms. | Lowers procurement costs. |

Renewable Energy Investment | Investment in renewable energy sources. | Reduces long-term energy costs. |

Economies of Scale | Utilizing scale of operations to negotiate better prices. | Lowers per unit cost of production. |

Efficient Supply Chain | Streamlined logistics and inventory management. | Reduces transportation and storage costs. |

Strategic Outsourcing | Outsourcing non-core activities to specialized firms. | Focuses resources on key business areas. |

Advanced Data Analytics | Using data analytics for cost management insights. | Identifies cost-saving opportunities. |

Continuous Process Improvement | Ongoing efforts to refine and optimize processes. | Ensures sustainable cost efficiency. |

III. Weaknesses in Cost Management

This section identifies and analyzes the key areas where [Your Company Name] faces challenges in cost management, including high-cost areas and the factors contributing to cost overruns.

A. High Cost Areas

Despite overall efficiency, certain areas, such as marketing and R&D, consistently run over budget. These departments face challenges in controlling costs without compromising on innovation and market presence.

High Cost Area | Description | Impact on Budget |

Marketing and Advertising | Extensive spending on digital and traditional advertising campaigns. | Often exceeds budget due to high campaign costs. |

Research and Development | Investment in innovation, product development, and market research. | High costs incurred in developing new products and technologies. |

IT Infrastructure | Upgrading and maintaining advanced IT systems and cybersecurity. | Regular updates and security measures lead to substantial expenses. |

Employee Benefits | Comprehensive benefits packages for employees. | Higher-than-average costs in maintaining competitive benefits. |

Legal and Compliance | Costs related to legal advice, patents, and compliance with regulations. | Unpredictable legal expenses and compliance costs can escalate quickly. |

B. Factors Leading to Cost Overruns

The primary factors contributing to these overruns include fluctuating market rates for raw materials and a tendency towards overstaffing in project teams, leading to inflated payroll expenses.

Factor | Description | Impact on Budget |

Fluctuating Market Rates | Variability in prices of raw materials and components. | Leads to unpredictable procurement costs. |

Overstaffing | Maintaining more staff than necessary for projects. | Increases payroll expenses, impacting overall budget. |

Unplanned Expenses | Incidental expenses not accounted for in the budget. | Causes budget overruns in various projects. |

Inefficient Processes | Outdated or inefficient operational processes. | Leads to higher operational costs and time delays. |

Technological Upgrades | Frequent and sometimes unnecessary technology upgrades. | Results in increased and often unexpected IT costs. |

IV. Opportunities for Cost Optimization

This section delves into the potential areas and external opportunities for cost reduction, providing a roadmap for [Your Company Name] to enhance financial efficiency.

A. Cost Saving Areas

Potential opportunities for cost reduction include outsourcing non-core activities and renegotiating leases and utility contracts. Additionally, shifting more operations to digital platforms could further reduce operational costs.

Area for Cost Saving | Description | Potential Outcome |

Outsourcing Non-core Activities | Delegating administrative and support functions to external partners. | Reduces in-house costs, focusing resources on core business areas. |

Renegotiating Leases | Revisiting terms of property leases for more favorable rates. | Decreases long-term facility and operational expenses. |

Utility Contract Renegotiation | Negotiating better rates with utility providers. | Lowers recurring utility costs. |

Digital Transformation | Transitioning more operations to digital and cloud-based platforms. | Reduces paper use and streamlines processes, cutting operational costs. |

Workforce Optimization | Implementing flexible staffing models and remote work policies. | Reduces office space requirements and associated costs. |

B. External Cost Reduction Opportunities

The current market offers opportunities to invest in more cost-effective technologies and tap into emerging markets where operational costs are lower.

Opportunity | Sample Initiative | Potential Outcome |

Advanced Technologies | Investing in AI and automation for efficiency. | Reduces labor costs and increases productivity. |

Emerging Market Expansion | Expanding operations into countries with lower operational costs. | Access to cost-effective labor and resources. |

Green Energy Solutions | Adopting renewable energy sources like solar power. | Long-term savings on energy costs and benefits from green incentives. |

Collaborative Ventures | Forming strategic alliances for shared services and resources. | Shared costs lead to overall expense reduction for all parties. |

Government Incentives | Leveraging tax incentives and grants for certain business activities. | Reduces costs through financial incentives for qualifying activities. |

For [Your Company Name], these areas and opportunities present a significant potential for cost savings. By strategically focusing on these domains, we can optimize our operational costs, enhance profitability, and maintain a competitive edge in the market.

V. Threats to Cost Management

This section outlines the various external market and economic threats, as well as internal challenges that [Your Company Name] faces in managing costs effectively.

A. Market and Economic Threats

Volatility in global markets, particularly in raw material prices, poses a significant threat to our cost structure. Economic downturns could also lead to reduced consumer spending, impacting our revenue and cost management.

Threat | Analysis and Impact on Cost Management |

Raw Material Price Volatility | Fluctuating prices can significantly impact production costs, affecting overall budgeting and pricing strategies. |

Global Economic Downturns | Recessions can lead to decreased consumer spending, impacting revenue and straining cost management efforts. |

Exchange Rate Fluctuations | Variability in currency exchange rates can affect the cost of imported materials and overseas operations. |

Supply Chain Disruptions | Global events like pandemics or political instability can disrupt supply chains, leading to increased costs. |

Inflation | Rising inflation rates can escalate operational costs, particularly in wages and raw materials. |

Competitive Market Pressures | Intense competition may force price reductions, impacting profit margins and cost management strategies. |

Environmental Regulatory Changes | New environmental regulations could increase operational costs due to compliance requirements. |

B. Internal Cost Management Challenges

Internally, resistance to change in cost management practices and potential regulatory changes in our industry could hinder our ability to maintain cost efficiency.

Challenge | Analysis and Impact on Cost Management |

Resistance to Change | Employee or managerial resistance can hinder the implementation of new, more efficient cost management practices. |

Legacy Systems and Processes | Outdated systems and processes can lead to inefficiencies and increased operational costs. |

Inadequate Cost Tracking Systems | Lack of robust cost tracking and reporting systems can lead to unmonitored and uncontrolled spending. |

Skills and Knowledge Gaps | Gaps in employee training and expertise can lead to inefficient cost management and decision-making. |

Internal Communication Barriers | Poor communication within the organization can lead to misalignment and inefficiencies in cost management. |

Regulatory Compliance Costs | Adapting to new regulations or compliance standards can incur unexpected costs. |

Technological Adaptation Costs | Investments in new technology, while beneficial in the long run, can pose short-term financial challenges. |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unveiling Template.net's Financial Cost SWOT Analysis template! Remarkably customizable and fully editable through our advanced Ai Editor Tool. Combines detailed financial insight with comprehensive SWOT analysis functionality. Simplify your financial projections while strategically planning for uncertainties. Start making smart, data-driven business decisions today. Elevate your strategic planning now!