Free Finance Credit Evaluation Manual

I. Introduction

A. Background

Credit evaluation is a pivotal component of our financial practices, ensuring responsible lending and effective risk mitigation. At our organization, this process involves a comprehensive examination of the creditworthiness of individuals and entities, contributing significantly to the overall health of our credit portfolio. This manual serves as a comprehensive guide for our credit evaluation team, providing detailed procedures, criteria, and methodologies.

B. Purpose

The purpose of this manual is to establish a uniform and precise approach, aligning with internal policies and industry regulations to enhance consistency and accuracy in credit assessments. Emphasizing the importance of maintaining a balanced and healthy credit portfolio through proactive risk management practices, the manual sets the tone for our commitment to sound financial practices.

II. Legal and Regulatory Framework

Navigating the complex landscape of credit evaluation involves a comprehensive understanding of various laws and regulations governing our practices. These are key legal considerations:

A. Fair Credit Reporting Act (FCRA)

Ensuring accuracy, fairness, and privacy of consumer information, FCRA regulates the collection and dissemination of credit information.

B. Equal Credit Opportunity Act (ECOA)

Promoting fairness in lending, ECOA prohibits discrimination based on race, color, religion, national origin, sex, marital status, or age.

C. Gramm-Leach-Bliley Act (GLBA)

Addressing the protection of consumer financial information, GLBA mandates the development of privacy programs for financial institutions.

D. Dodd-Frank Wall Street Reform and Consumer Protection Act

Dodd-Frank addresses various aspects of financial services, including enhanced scrutiny on lending practices.

E. Payment Card Industry Data Security Standard (PCI DSS)

The PCI DSS outlines security standards for entities processing, storing, or transmitting cardholder data.

III. Credit Application Process

A. Initial Application Review

Data Collection

Collect applicant information through our designated online portal or physical forms. Ensure completeness and accuracy, covering personal details, financial history, and pertinent business information for corporate applicants.

Preliminary Eligibility Assessment

Evaluate key financial indicators using our established criteria. Consider factors such as credit scores, debt-to-income ratios, and payment histories for a preliminary assessment of applicant eligibility.

Completeness and Accuracy Checks

Conduct thorough checks to ensure all required documentation is submitted accurately. Utilize our verification process to promptly address any discrepancies or missing elements, maintaining the integrity of the credit evaluation process.

B. Documentation Requirements

Individual Applicants

Request recent Income Statements through our secure document submission link.

Obtain the latest Tax Returns uploaded in PDF or JPEG format via the online portal.

Confirm employment details through Employment Verification for a comprehensive understanding of the applicant's financial stability.

Corporate Applicants

Require comprehensive Business Financial Statements, including balance sheets and income statements, submitted through our official portal.

Obtain Tax Documentation, such as corporate tax returns, ensuring compliance with our specified file type and size limitations.

Request details about the Legal Entity Information, including legal structure and ownership, uploaded securely via the online portal.

Additional Requirements

Clearly communicate any additional documentation needs specific to the credit requested through official communication channels. This ensures a comprehensive understanding of the applicant's financial standing and contributes to more informed credit decisions.

C. Application Submission Procedures

Digital Platforms

The preferred document formats are PDF and JPEG.

The step-by-step guidelines for uploading documents through our online portal: First, navigate to the secure document submission section. Second, Select the appropriate file upload option. Third, Ensure each document adheres to specified file type and size requirements. Fourth, include a secure document submission link for a seamless online application experience.

Traditional Channels

The steps for submitting physical applications are the following:

Print and complete the application form.

Mail the printed copy to the designated address or

Drop off the application at specified locations.

Clearly communicate the submission deadline to maintain a streamlined evaluation process.

Verification Process

Verify submitted information by cross-referencing documentation with external sources, ensuring accuracy and reliability. Clarify the process for contacting applicants in case of discrepancies or for additional information, ensuring a thorough and accurate evaluation.

IV. Credit Scoring Models

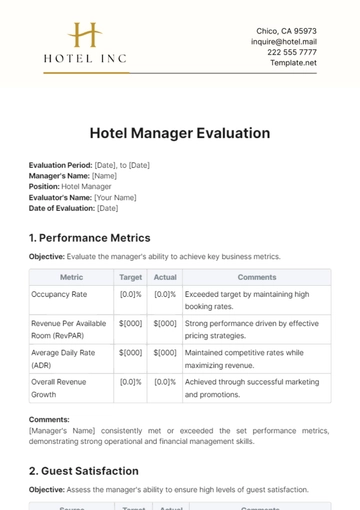

The table below outlines the credit score ranges, associated risk levels, and corresponding decisions:

Credit Score Range | Risk Level | Decision |

[300-500] | [High Risk] | [Deny Credit] |

Credit scoring models are integral to our comprehensive credit evaluation process, providing a systematic and data-driven approach to assessing the creditworthiness of applicants. A credit score falling within the [300-500] range indicates high risk, warranting a credit denial. These models leverage key financial indicators and historical data to derive credit scores, facilitating informed decision-making in evaluating the risk associated with extending credit.

V. Collateral Assessment

A. Types of Collateral

Real Property

Accept only residential or commercial properties that meet specified criteria.

Require original deeds and professional valuation reports from accredited appraisers for documentation.

Financial Assets

Accept publicly traded stocks, bonds, or certificates of deposit as eligible financial instruments.

Verify ownership through official statements or brokerage confirmations.

Personal Assets

Accept vehicles, jewelry, or collectibles as personal assets.

Assess the condition and market value of personal assets used as collateral; follow specific valuation procedures.

B. Valuation Methods

Appraisal Procedures

Use qualified appraisers approved by the company for appraising different collateral types.

Conduct appraisals every three (3) years or upon triggering events.

Market Valuation

Determine market value, particularly for financial assets, based on current market conditions.

Rely on the latest available data for market valuations.

C. Integration with Credit Decision

Credit Committee Review

Present collateral assessments to the credit committee in a clear and concise format. Emphasize that collateral assessments directly influence credit decisions.

Collateral as Risk Mitigation

Use collateral assessments to establish risk thresholds. Consider strong collateral positions as positive factors in credit terms or approval decisions.

VI. Credit Risk Mitigation

A. Overview of Risk Mitigation Strategies

Diversification of Portfolio

Maintain a diversified loan portfolio to spread risk across various sectors and borrower profiles.

Minimize the impact of sector-specific economic challenges through diversification.

Stress Testing

Conduct stress tests annually to evaluate portfolio resilience under adverse economic conditions.

Proactively identify and mitigate potential risks based on stress test results.

B. Guarantees and Collateral Requirements

Guarantees

Accept personal or corporate guarantees based on stringent criteria.

Evaluate the strength and reliability of guarantees, considering financial capacity and creditworthiness.

Collateral Requirements

Reiterate accepted collateral types, linking back to detailed collateral assessment.

Emphasize that collateral provides tangible security against potential defaults; follow specific procedures for perfecting security interests.

C. Credit Insurance

Purpose of Credit Insurance

Utilize credit insurance to mitigate the impact of unexpected events, such as borrower insolvency.

Enhance the credit risk management framework with an extra layer of protection.

Implementation Process

Integrate credit insurance into the credit evaluation and approval process systematically.

Make credit insurance mandatory based on perceived risk levels, ensuring consistent implementation.

VII. Credit Decision and Approval

A. Documentation Submission

Require complete and accurate documentation for credit committee review.

Set clear expectations for the type and format of documents to be submitted.

B. Comprehensive Review

Conduct a thorough review of all available information, including financial statements, credit reports, and collateral assessments.

Ensure that credit analysts consider both quantitative and qualitative factors in their evaluations.

C. Decision Criteria

Define decision criteria, specifying the factors that the credit committee should consider.

Ensure that credit committee decisions align with the organization's risk tolerance and overall credit strategy.

VIII. Monitoring of Credit Exposure

A. Periodic Portfolio Reviews

Regular Portfolio Analysis

Conduct regular reviews of the entire loan portfolio.

Analyze portfolio performance against predetermined benchmarks and risk thresholds.

Identification of Warning Signs

Train monitoring teams to identify early warning signs of potential credit issues.

Establish protocols for escalating concerns to the appropriate levels within the organization.

B. Credit Exposure Limits

Setting Limits

Set clear credit exposure limits for different segments of the portfolio.

Base exposure limits on the organization's risk appetite and the nature of the credit facilities.

Exception Handling

Define procedures for handling exceptions to credit exposure limits.

Ensure that any exceptions undergo a rigorous review and approval process.

C. Monitoring Tools and Technology

Utilization of Technology

Implement advanced monitoring tools to track credit exposure in real-time.

Ensure that the monitoring system provides timely alerts for breaches or deviations from established limits.

Data Accuracy and Integrity

Establish protocols for maintaining data accuracy and integrity within the monitoring system.

Conduct regular audits to verify the reliability of the data used for credit exposure monitoring.

D. Client Communication

Transparent Communication

Communicate credit exposure information transparently with clients.

Provide regular updates on exposure levels and any potential impact on credit terms.

Mitigation Strategies

Collaborate with clients to develop mitigation strategies for elevated credit exposure.

Encourage proactive discussions to address potential challenges and maintain a mutually beneficial relationship.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Efficiently evaluate credit with the editable Finance Credit Evaluation Manual Template brought to you by Template.net! This dynamic manual, easily customizable with the intuitive AI Editor Tool, ensures a comprehensive credit evaluation. Ensure clarity and efficiency in financial decision-making. Gain valuable insights for effective credit management by downloading it now!