Free Financial Cost Management Rubric

Introduction

A. Overview

Welcome to the Financial Cost Management Rubric for [Your Company Name]. Effective cost management is crucial for maintaining financial health and achieving long-term sustainability. This rubric serves as a comprehensive tool to assess and optimize various cost categories, providing a strategic foundation for [Your Company Name]'s fiscal responsibility and growth.

B. Purpose

The purpose of this rubric is to provide a structured approach to evaluate and manage costs across [Your Company Name]. By employing this tool, decision-makers can make informed choices, ensuring resources are allocated efficiently to support the company's strategic objectives. This aligns with [Your Company Name]'s commitment to delivering value to stakeholders while maintaining financial stability.

Key Cost Categories

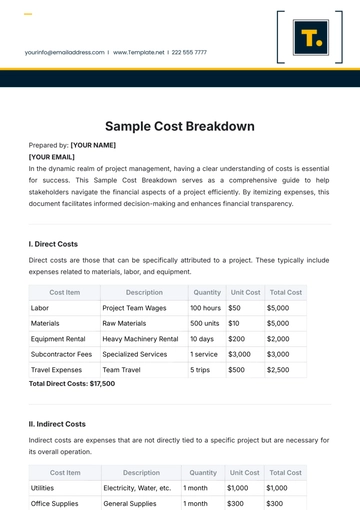

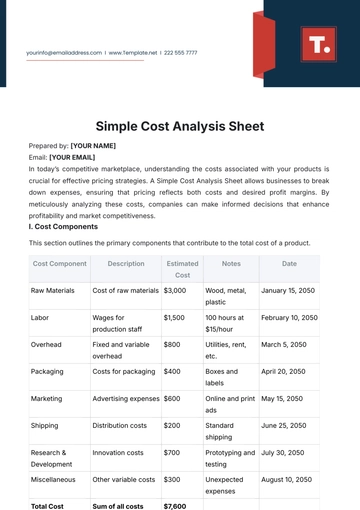

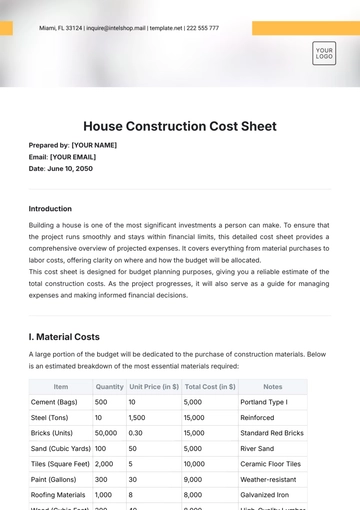

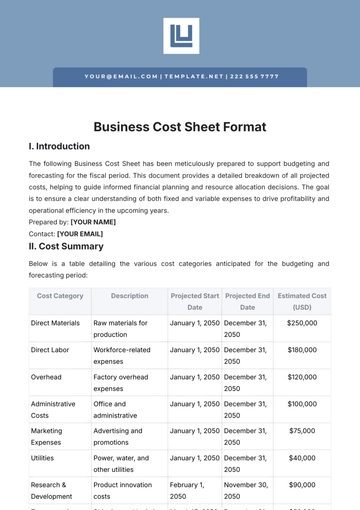

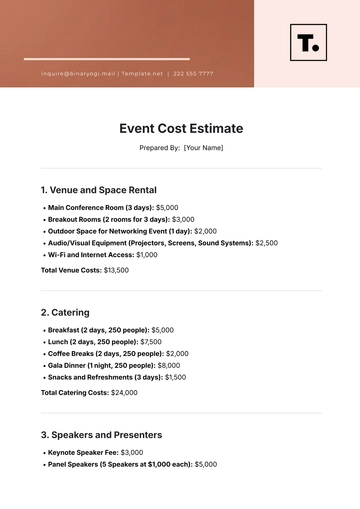

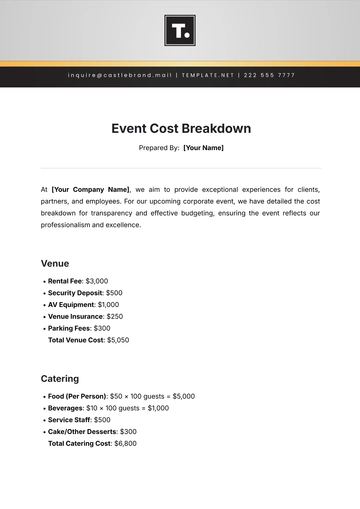

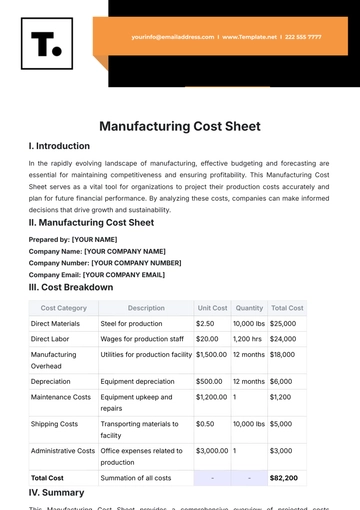

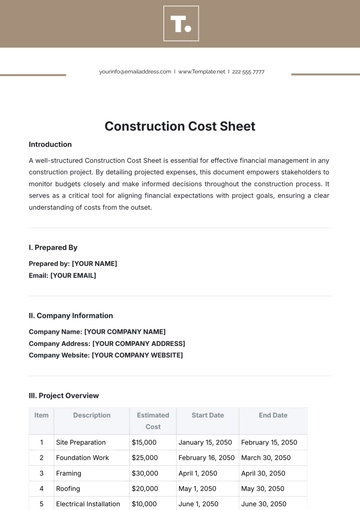

A. Direct Costs

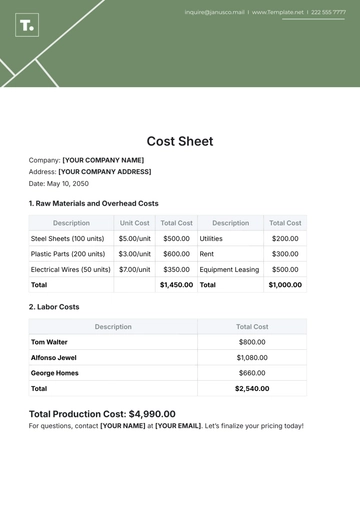

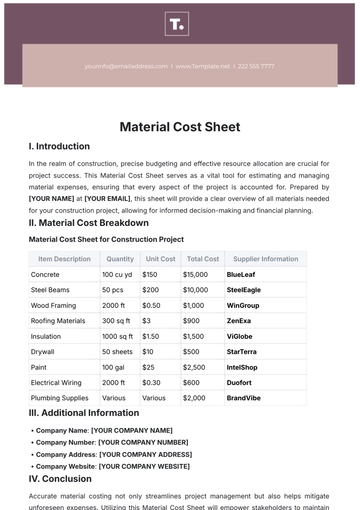

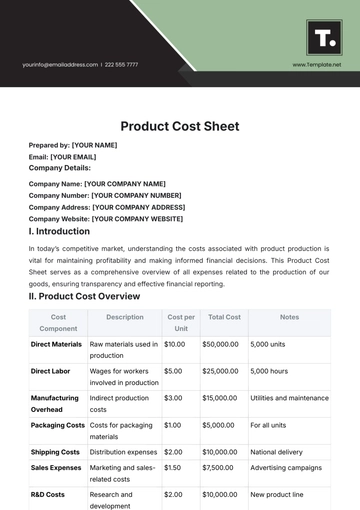

Direct costs for [Your Company Name] in [2050] amounted to [$5,000,000], encompassing production expenses, raw materials, and labor costs. Understanding the intricacies of these costs is essential for optimizing processes, enhancing product quality, and maintaining competitiveness in the market.

B. Indirect Costs

Indirect costs, including administrative expenses and utilities, totaled [$2,500,000] in [2050]. While these costs are essential for business operations, a detailed breakdown allows for targeted strategies to minimize unnecessary expenditures, ensuring maximum efficiency.

C. Fixed Costs

Fixed costs, such as rent and salaries, were [$1,200,000] in [2050]. These stable expenditures form the backbone of [Your Company Name]'s operations, and a meticulous examination facilitates proactive cost management without compromising essential functions.

D. Variable Costs

Variable costs, like marketing and utilities, fluctuated but averaged [$800,000] in [2050]. Recognizing the dynamic nature of these costs enables [Your Company Name] to adapt strategies to market changes, ensuring flexibility in resource allocation.

Cost Analysis and Trends

A. Cost Trends Over Time

Over the past five years, [Your Company Name] has observed a consistent upward trend in direct and variable costs, prompting a closer examination of cost management strategies. These trends underscore the need for proactive measures to maintain a healthy balance between revenue growth and cost containment.

B. Cost Variance Analysis

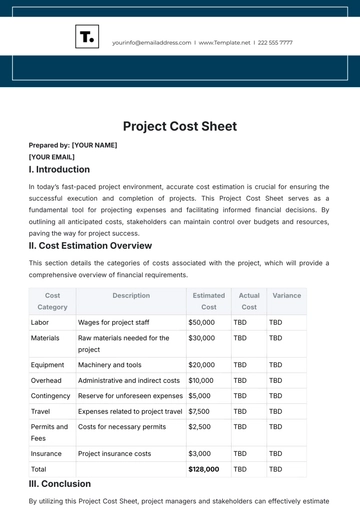

Cost Category | Budgeted Cost | Actual Cost | Variance |

|---|---|---|---|

Direct Costs | [$5,200,000] | [$5,000,000] | [-4%] |

A detailed variance analysis provides insights into budget accuracy and highlights areas for improvement. This data-driven approach empowers [Your Company Name] to make informed decisions for future budgeting and cost control initiatives.

Cost Control Measures

A. Budgetary Controls

[Your Company Name] enforces strict budgetary controls, with regular reviews and approval processes in place to ensure adherence to financial plans. These controls foster a culture of accountability and transparency, aligning every department with the company's overall financial objectives.

B. Efficiency Initiatives

Ongoing initiatives, such as process optimization and waste reduction, have already yielded [$300,000] in cost savings in the past year. These efficiency measures not only contribute to cost reduction but also enhance overall operational effectiveness, positioning [Your Company Name] for sustainable growth.

ROI Analysis

A. Return on Investment (ROI)

Project / Expense | Cost of Investment | Net Profit | ROI |

|---|---|---|---|

Project A | [$1,000,000] | [$200,000] | [+20%] |

Conducting a granular ROI analysis allows [Your Company Name] to prioritize projects with the highest returns. This strategic approach ensures that investments align with the company's financial goals and contribute significantly to the bottom line.

Recommendations and Action Plan

A. Cost Optimization Strategies

Based on the analysis, we recommend a targeted approach to reduce direct costs through renegotiating supplier contracts, aiming for a [2%] cost reduction. Additionally, exploring bulk purchasing options and strategic partnerships can further enhance cost-effectiveness.

B. Implementation Timeline

Q1 [2051]: | Contract renegotiation |

Q2 [2051]: | Implementation of efficiency initiatives |

Q3 [2051]: | Review and adjustment of budgetary controls |

A phased implementation timeline ensures a smooth integration of cost optimization strategies, minimizing disruptions to daily operations and maximizing the efficiency of the entire process.

Conclusion

This Financial Cost Management Rubric provides valuable insights into [Your Company Name]'s cost structure. Implementing the recommended strategies will not only enhance operational efficiency but also contribute to sustained financial health and growth. As [Your Company Name] continues to evolve, this rubric serves as a dynamic tool for ongoing financial management and strategic decision-making.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Optimize cost management with the Financial Cost Management Rubric Template on Template.net. This editable and customizable rubric simplifies the assessment process. Tailor content effortlessly using our Ai Editor Tool, ensuring adaptability and precision. Elevate your financial strategies with this user-friendly template, offering a comprehensive approach to crafting personalized cost management rubrics for effective financial analysis and strategic planning.