Finance Payroll System Feasibility Study

Executive Summary

A. Background

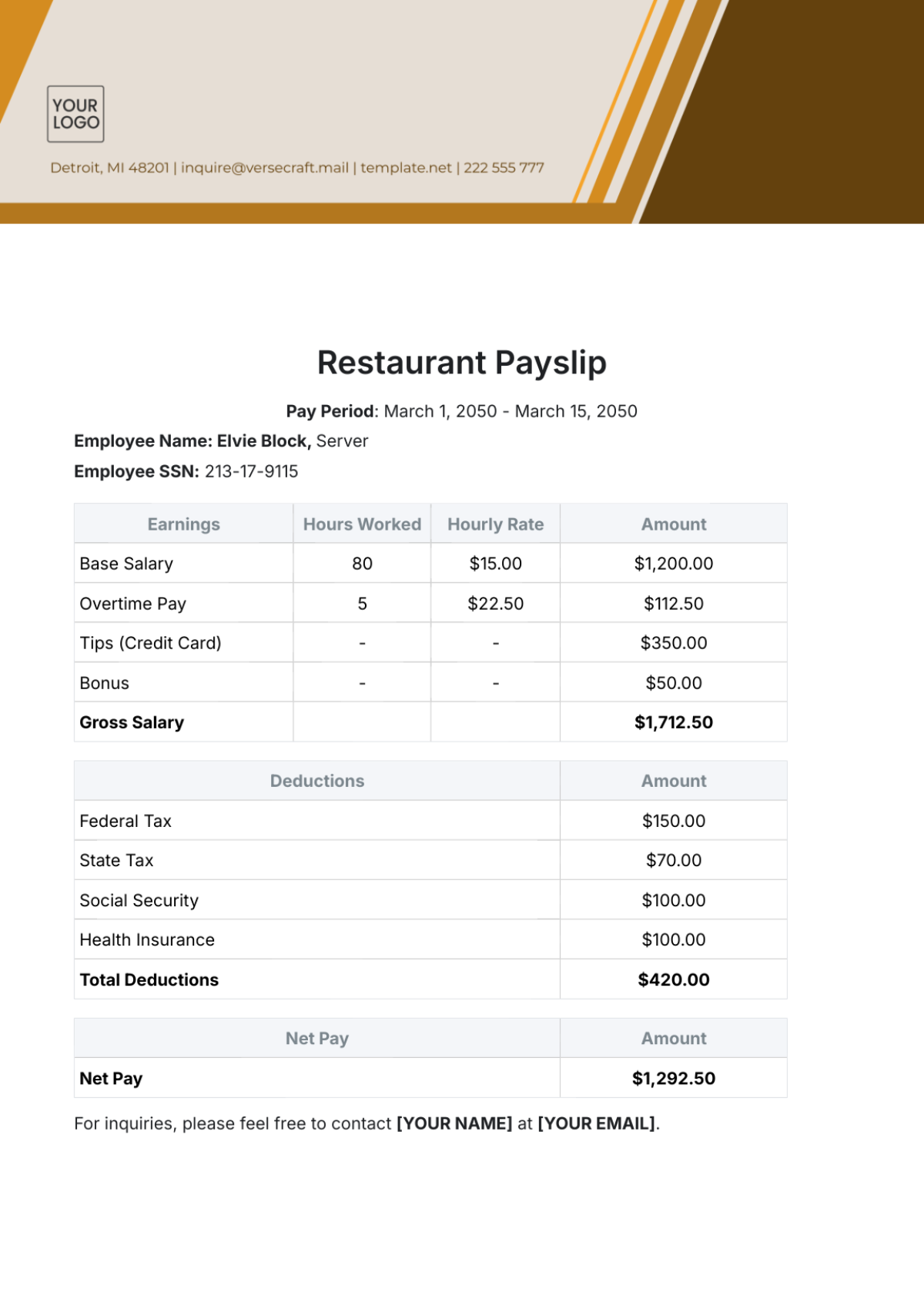

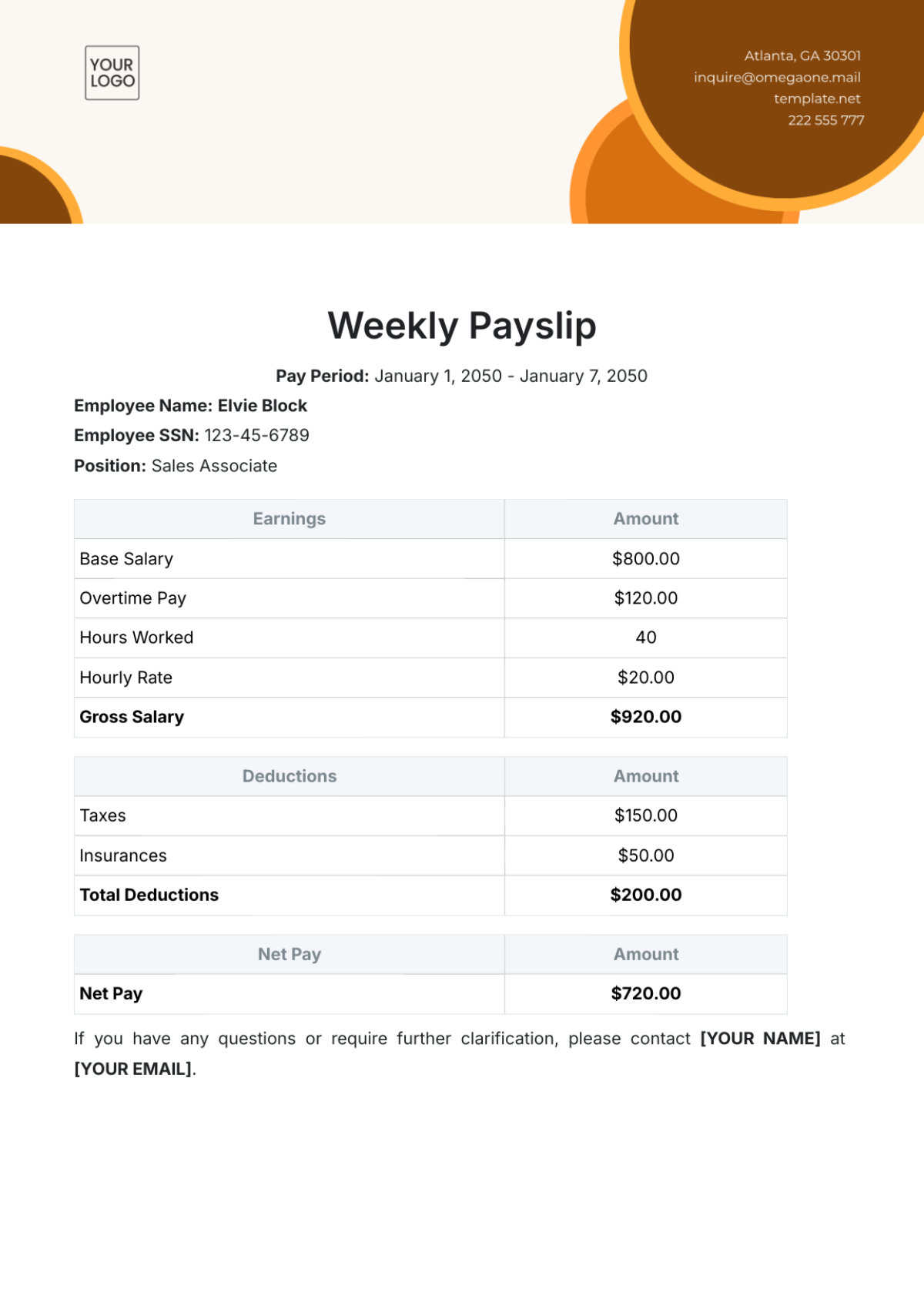

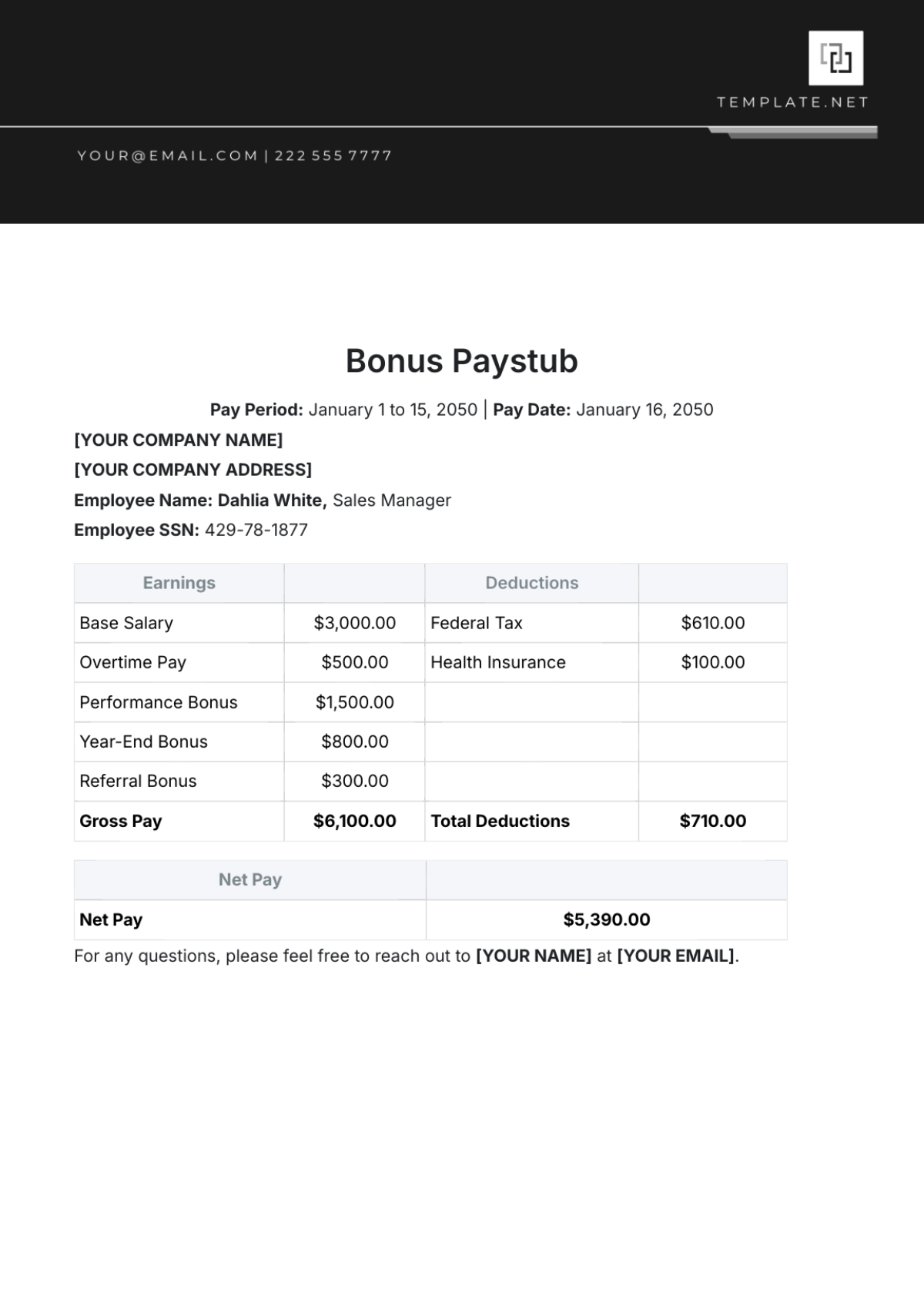

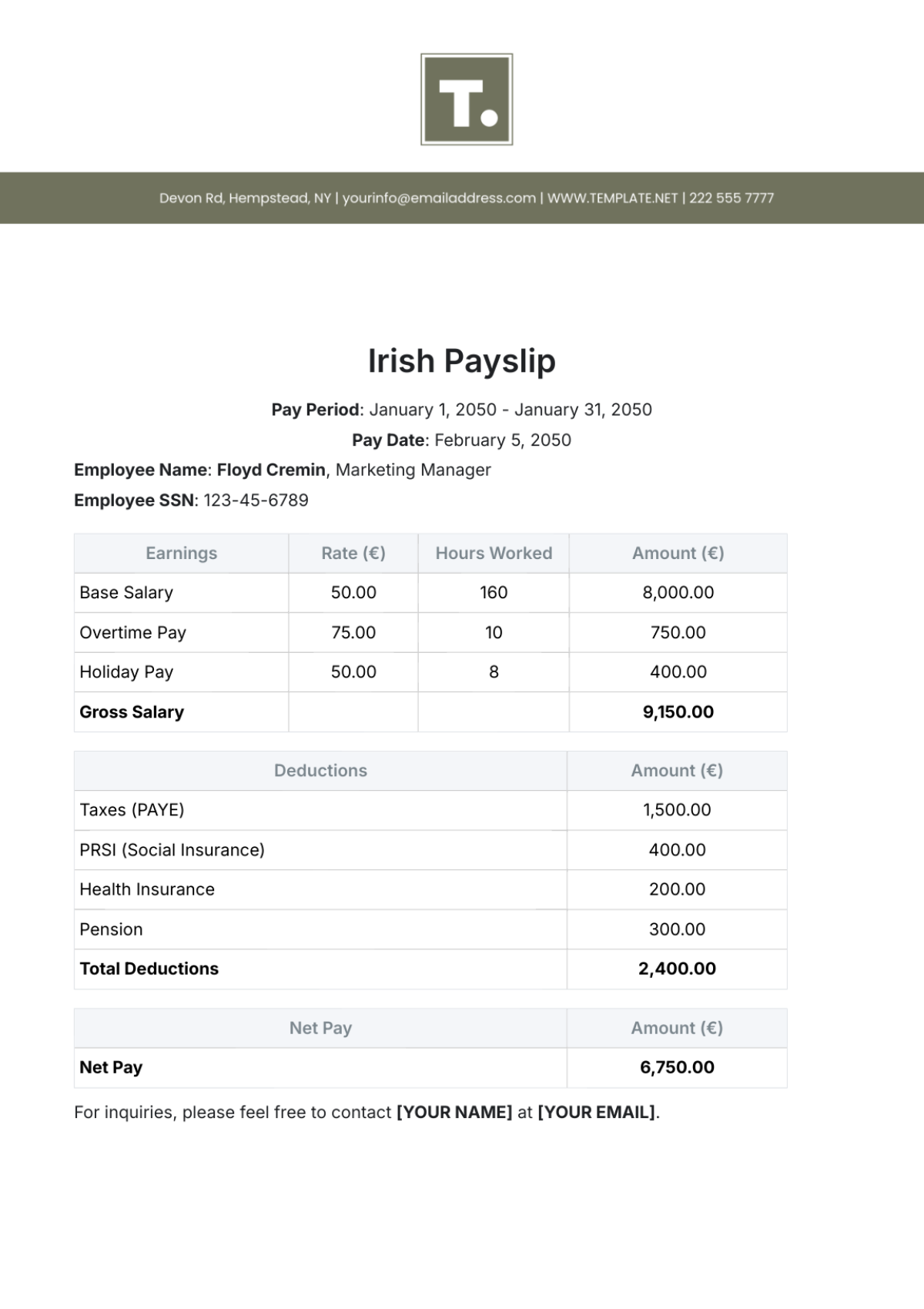

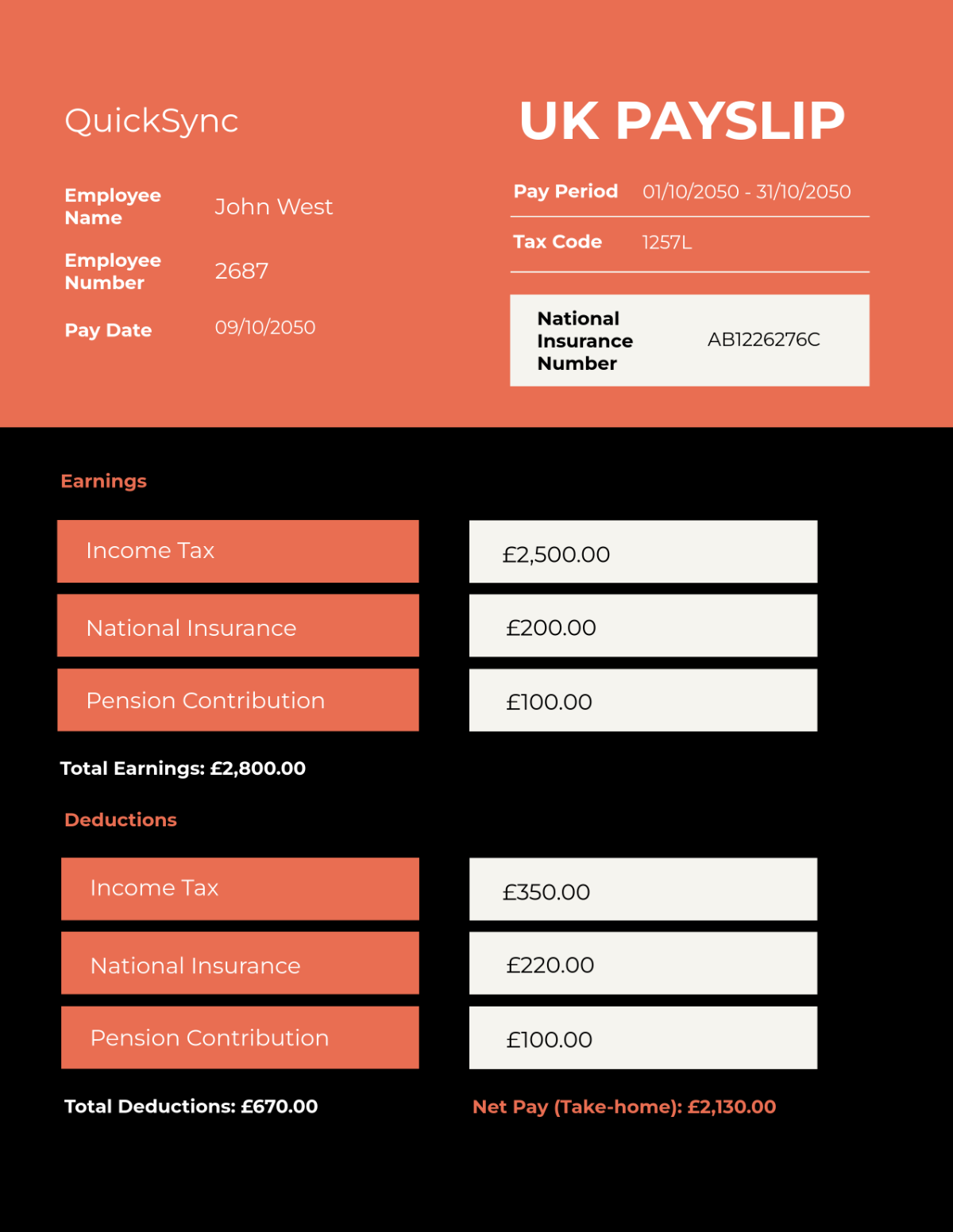

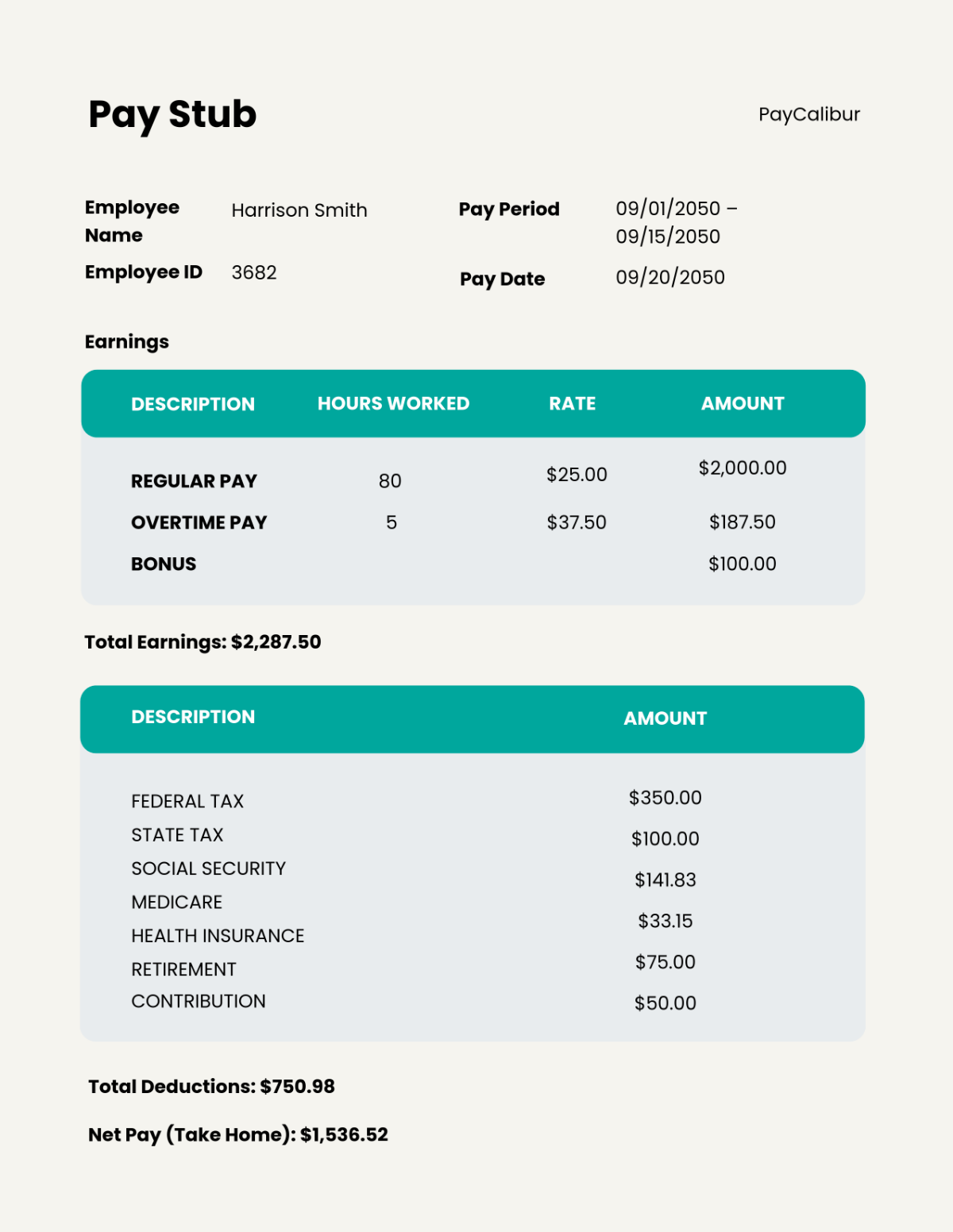

The current payroll system at [Your Company Name] has proven to be inefficient and prone to errors, leading to delays and dissatisfaction among employees. Recognizing the need for a modernized and streamlined solution, [Your Company Name] is considering the implementation of the Finance Payroll System (FPS). The objective is to enhance payroll processing, reduce errors, and improve overall operational efficiency.

B. Project Scope

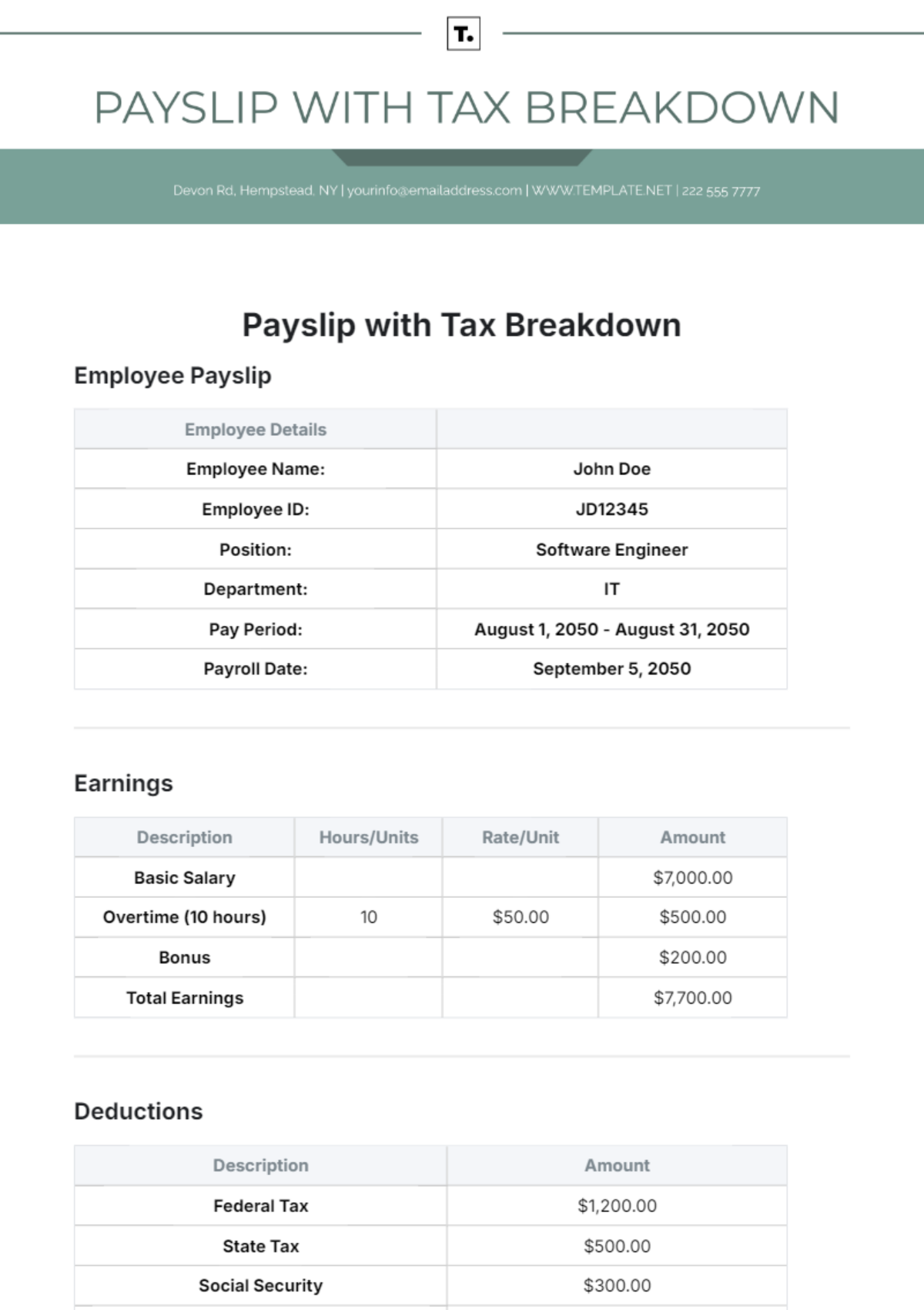

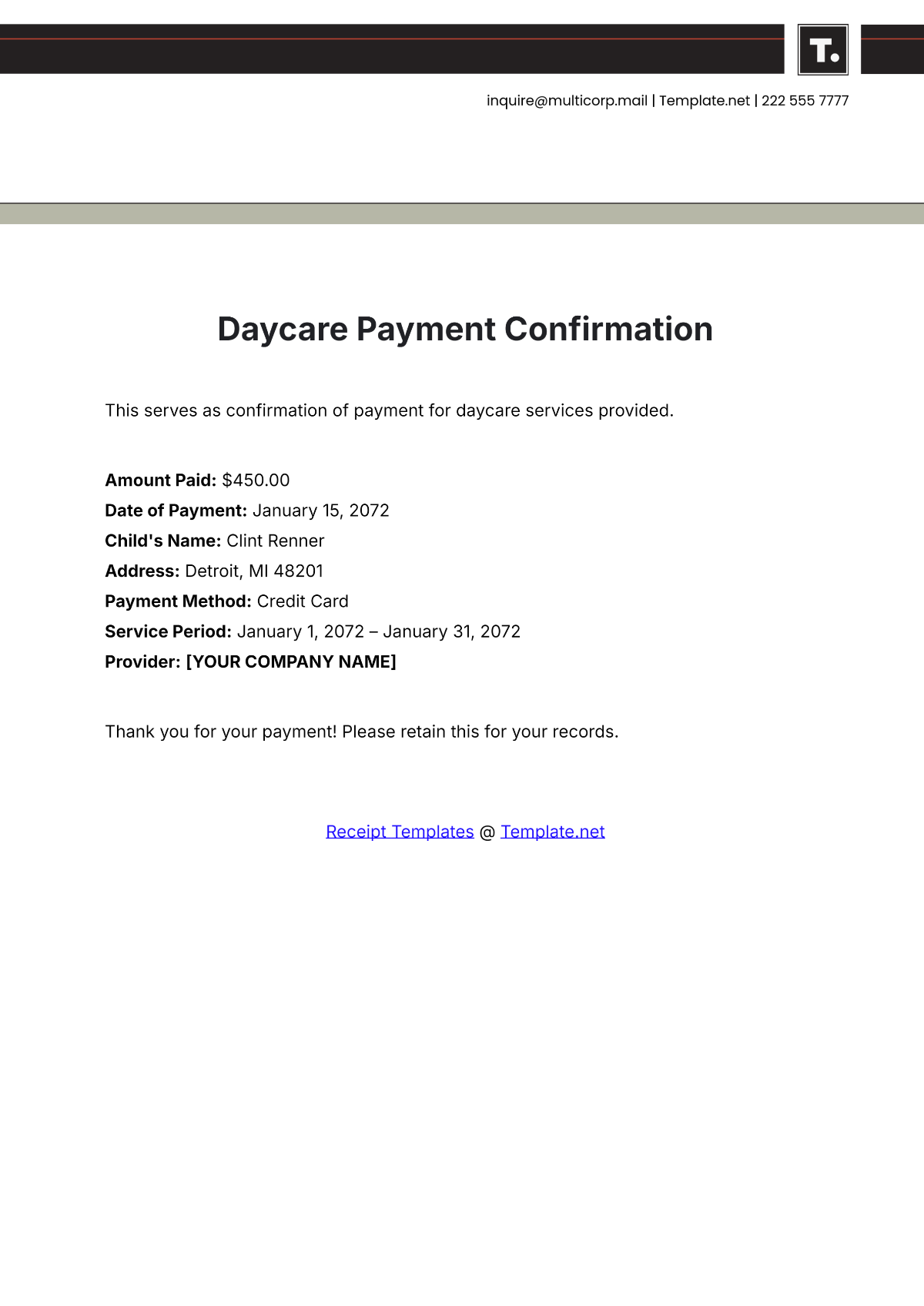

The Finance Payroll System will cover the entire payroll process, including employee data management, time and attendance tracking, tax calculations, and disbursement. It aims to automate manual tasks, provide real-time insights, and ensure compliance with all relevant regulations. The project also includes comprehensive training programs for employees transitioning to the new system.

C. Business Objectives

The primary objectives of implementing the Finance Payroll System are:

Streamline payroll processes to reduce processing time by [15%] by March 1, 2050.

Minimize errors and discrepancies in payroll calculations to less than [2%].

Enhance data security and compliance with applicable regulations.

Improve employee satisfaction through timely and accurate payroll disbursements.

Achieve a return on investment within [12] months of system implementation.

D. Project Timeline

The Finance Payroll System project is anticipated to span 12 months, with key milestones including system design, development, testing, and implementation. The detailed timeline is as follows:

Milestone | Start Date | End Date |

|---|---|---|

System Design | January 1, 2050 | March 1, 2050 |

Introduction

A. Purpose

The purpose of this feasibility study is to assess the viability and potential success of implementing the Finance Payroll System at [Your Company Name]. The study will provide a comprehensive analysis of the current payroll system, evaluate the technical and financial requirements of the new system, and offer recommendations for a successful implementation.

B. Stakeholders

Stakeholders involved in the Finance Payroll System project include:

[Your Name], Project Manager

[Finance Department], End-users

[IT Department], Technical Support

[External Regulatory Body], Compliance Oversight

C. Regulatory Environment

The Finance Payroll System will adhere to applicable regulations governing payroll processing and data privacy. Compliance with these regulations is critical to ensure legal and ethical payroll operations.

System Analysis

A. Current System Assessment

The current payroll system at [Your Company Name] involves manual data entry, leading to errors and delays in payroll processing. The assessment reveals that approximately [20%] of payroll-related tasks are prone to mistakes, impacting both accuracy and employee satisfaction. Manual tracking of employee attendance further contributes to inefficiencies. This necessitates the implementation of the Finance Payroll System to automate these processes, reduce errors, and improve overall payroll management.

B. Technology Infrastructure

The existing technology infrastructure at [Your Company Name] includes aging servers and outdated software versions. While these components have supported the current payroll system, they may require upgrades or modifications to seamlessly integrate with the Finance Payroll System. The Finance Payroll System will be designed to operate efficiently within the current technology environment, with an emphasis on scalability for future enhancements.

C. User Requirements

End-users, primarily the finance department, have expressed the need for a user-friendly interface and seamless integration with other organizational systems. The Finance Payroll System must provide real-time reporting, easy data retrieval, and intuitive navigation. Employees expect self-service options for accessing their payroll information and updating personal details. These requirements will be addressed to ensure a smooth transition to the new system.

Technical Requirements

A. Hardware

The Finance Payroll System will require upgraded hardware components, including servers with enhanced processing capabilities and storage capacity. Estimated costs for hardware upgrades are [$50,000].

B. Software

Key software components for the Finance Payroll System include a robust payroll processing software, security tools, and integration platforms. Licensing costs for these software components are estimated at [$80,000]. Additionally, ongoing software maintenance is budgeted at [$15,000] annually.

C. Security and Compliance

To ensure data security, the Finance Payroll System will implement encryption protocols and role-based access controls. Compliance with applicable regulations will be a priority, with regular audits and assessments to guarantee adherence to industry standards. The estimated cost for implementing security measures is [$30,000].

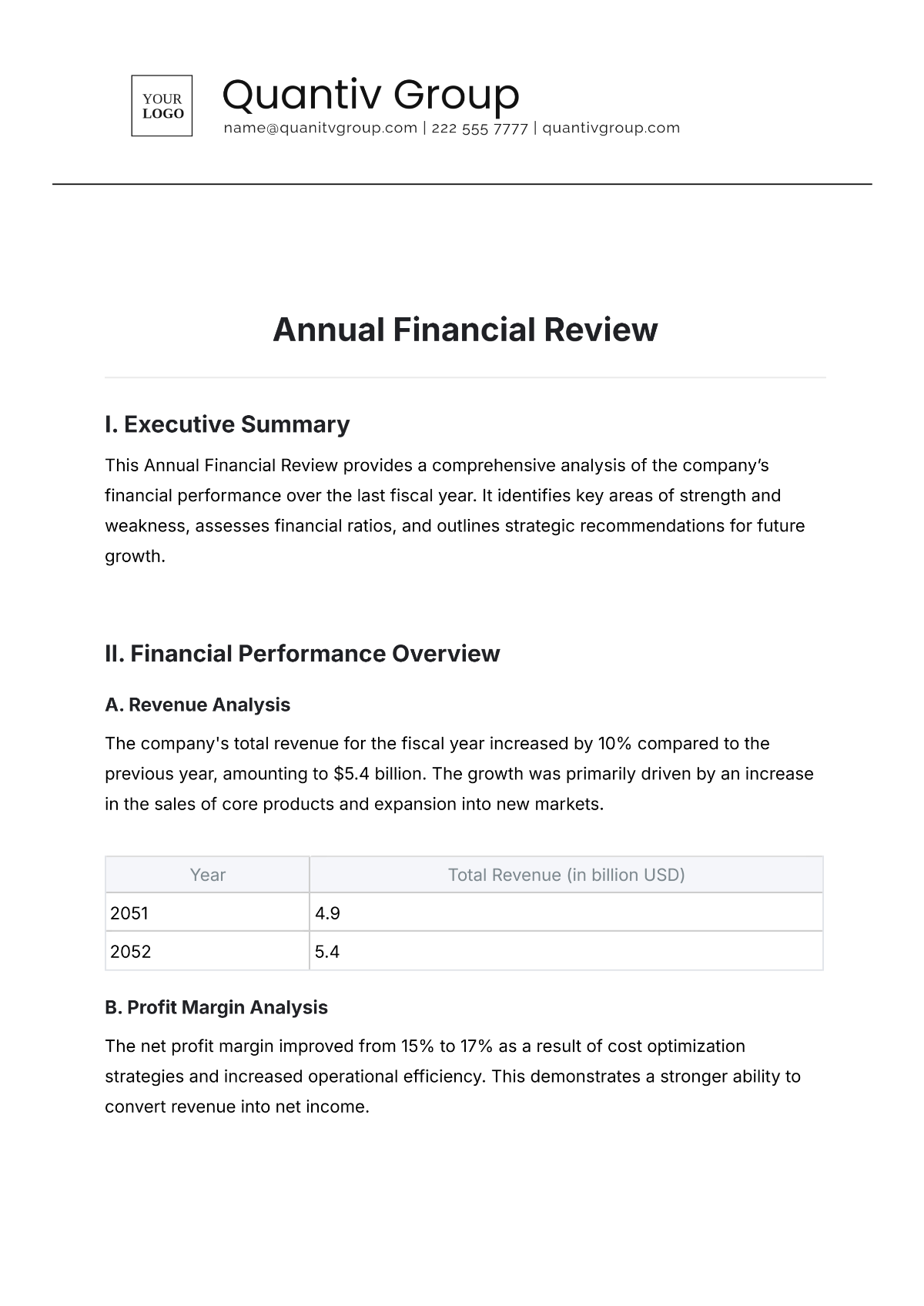

Cost-Benefit Analysis

A. Cost Overview

The implementation of the Finance Payroll System involves various costs. The estimated breakdown is as follows:

Cost Category | Estimated Amount |

|---|---|

Development | [$150,000] |

B. Benefits Analysis

The Finance Payroll System is anticipated to yield several benefits:

Increased Efficiency: Automation of payroll processes is expected to reduce processing time by [25%].

Error Reduction: The system aims to minimize errors to less than [1%], ensuring accurate payroll calculations.

Improved Compliance: Stringent security measures and adherence to applicable regulations will enhance data security and compliance.

Employee Satisfaction: Timely and accurate payroll disbursements will contribute to increased employee satisfaction.

C. Return on Investment (ROI)

Based on the projected benefits and costs, the anticipated ROI for the Finance Payroll System is expected to be achieved within [12] months. The formula used for ROI calculation is:

ROI = (Net Benefits−Project Costs) / Project Costs × 100

Risks and Mitigation Strategies

A. Identification of Risks

Several risks are associated with the Finance Payroll System implementation, including potential data breaches, system integration challenges, and resistance from employees to adapt to the new system.

B. Mitigation Strategies

To mitigate these risks:

Data breaches will be addressed through robust security measures and regular audits.

System integration challenges will be minimized through thorough testing and phased implementation.

Employee resistance will be mitigated through comprehensive training programs and ongoing support.

Implementation Plan

A. Project Phases and Milestones

The implementation plan outlines the various phases and milestones for deploying the Finance Payroll System.

Phase | Description | Timeline |

|---|---|---|

Phase 1: Planning | Define project scope, objectives, and resources. | January 1, 2050 - January 15, 2050 |

B. Resource Allocation

Allocate resources including personnel, technology, and budget for each phase of the implementation plan.

Resource | Phase 1 | Phase 2 | Phase 3 | Phase 4 | Phase 5 |

|---|---|---|---|---|---|

Project Manager | [Name] | [Name] | [Name] | [Name] | [Name] |

C. Communication Plan

Develop a communication plan to keep all stakeholders informed about the progress of the Finance Payroll System implementation. Regular updates through meetings, emails, and training sessions will ensure transparency and collaboration.

D. Contingency Planning

Identify potential risks during the implementation phase and develop contingency plans to address unforeseen challenges promptly. This includes having backup systems, alternative communication channels, and strategies for quick issue resolution.

Post-Implementation Evaluation

A. Evaluation Metrics

To gauge the success of the Finance Payroll System post-implementation, the following key performance indicators (KPIs) and metrics will be monitored:

Processing Time: Targeting a [20%] reduction in processing time compared to the previous system.

Error Rates: Aiming for a decrease in error rates to less than [1%].

User Satisfaction: Regular surveys and feedback sessions to measure user satisfaction, aiming for a score of [90%] or higher.

Compliance Adherence: Regular audits to ensure ongoing compliance with applicable regulations.

B. User Feedback and Training Enhancement

User feedback will be actively collected through surveys, focus groups, and helpdesk inquiries. Identified challenges and areas for improvement will be addressed through enhanced training programs, tutorials, and support resources. This iterative process ensures that user needs are continually met.

C. Continuous Improvement Strategies

The Finance Payroll System will have a roadmap for continuous improvement, with scheduled updates and feature enhancements. Regular evaluations will be conducted to incorporate emerging technologies and industry best practices. This ensures the system remains adaptable and aligned with organizational goals.

D. Return on Investment (ROI) Monitoring

Ongoing monitoring of ROI will involve comparing actual benefits, such as efficiency gains and error reduction, against projected benefits outlined in the feasibility study. Any deviations will prompt a review of strategies to optimize financial outcomes.

E. Reporting and Documentation

Regular reports will be generated to provide stakeholders with updates on the system's performance, including achievements and areas for improvement. Comprehensive documentation will be maintained for auditing purposes and to facilitate future system enhancements.

Conclusion

The feasibility study for the Finance Payroll System underscores the critical need for its implementation at [Your Company Name]. The assessment of the current payroll system has revealed inefficiencies that can be addressed through the proposed system. With the identified benefits, including increased efficiency, error reduction, improved compliance, and enhanced employee satisfaction, the Finance Payroll System emerges as a strategic investment.

The comprehensive analysis of costs indicates a total project cost of [$360,000], encompassing development, hardware and software investments, maintenance, security implementation, training programs, and contingency. The expected benefits, including efficiency gains and error reduction, outweigh the costs, positioning the Finance Payroll System as a financially sound investment.

Recommendations

Based on the findings of the feasibility study, it is recommended that [Your Company Name] proceed with the implementation of the Finance Payroll System. The anticipated return on investment within [12] months further validates the viability of the project. To ensure a successful implementation, the following recommendations are made:

Allocate resources for the timely execution of each project milestone as outlined in the project timeline.

Prioritize the training programs to facilitate a smooth transition for end-users.

Implement robust security measures to safeguard payroll data and ensure compliance with applicable regulations.

Regularly monitor and evaluate the system's performance, making necessary adjustments to optimize its functionality.

The Finance Payroll System is poised to revolutionize payroll processing at [Your Company Name], bringing about efficiency, accuracy, and compliance. This strategic initiative aligns with [Your Company Name]'s commitment to technological innovation and employee satisfaction.

For more information, please contact:

[Your Name]

[Your Company Name]

[Your Company Email]