Finance Audit SWOT Analysis Template

Executive Summary

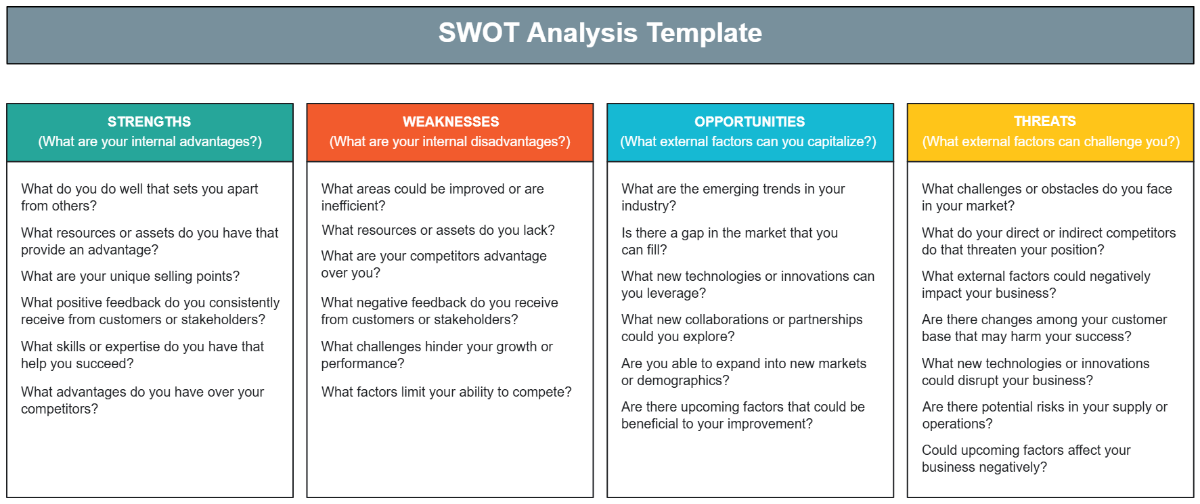

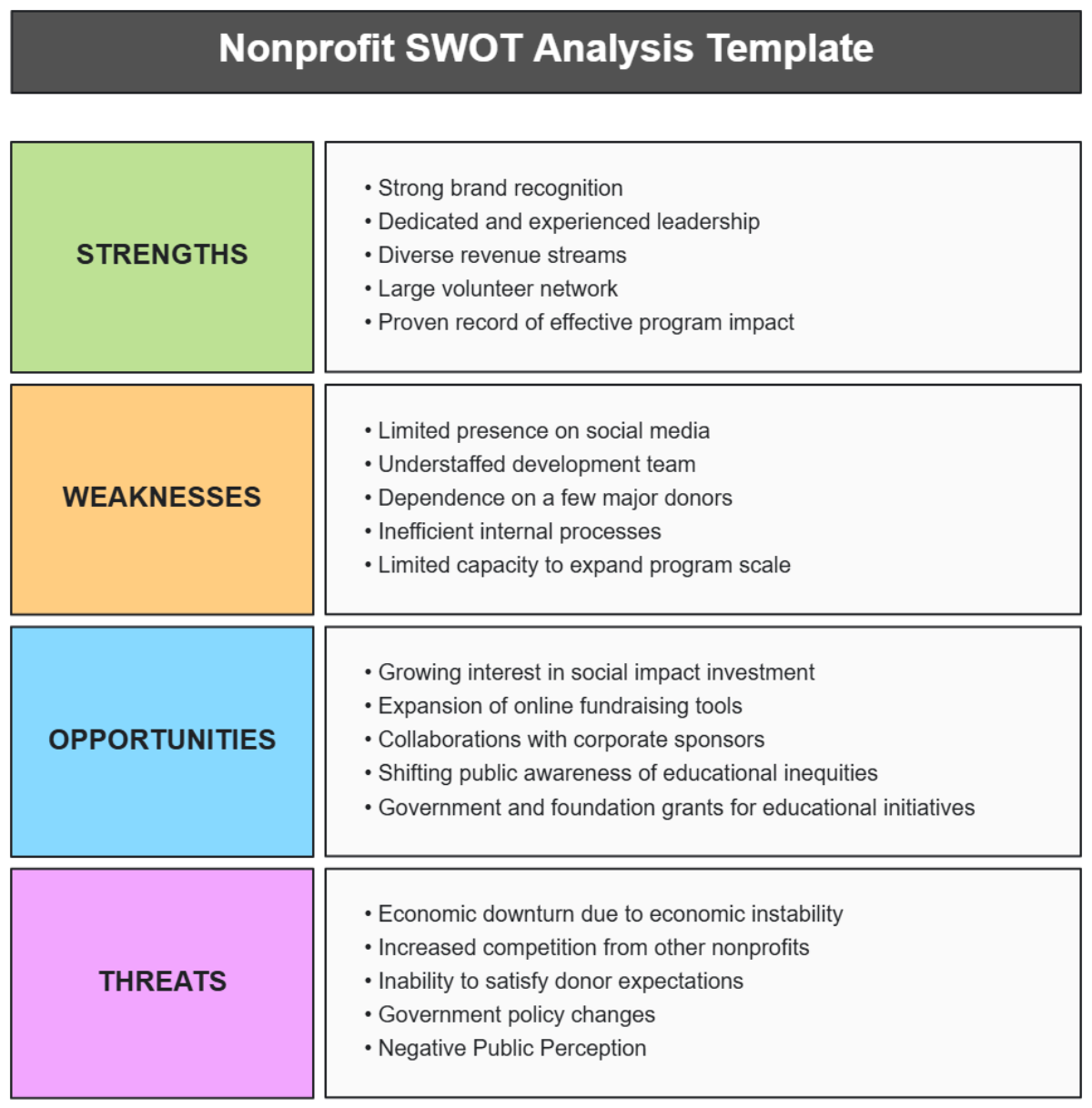

The Finance Audit SWOT Analysis underscores the critical importance of evaluating the internal and external factors shaping the finance audit function. Through a comprehensive examination of strengths, weaknesses, opportunities, and threats, this analysis aims to provide actionable insights that contribute to the continuous improvement of our financial audit processes. The key recommendations outlined herein are geared towards leveraging our strengths, addressing weaknesses, capitalizing on opportunities, and mitigating potential threats, all with the overarching goal of enhancing the overall effectiveness and resilience of our finance audit endeavors.

Introduction

As a pivotal function within our organization, the finance audit team plays a crucial role in safeguarding financial integrity and ensuring compliance. In light of the dynamic business environment and evolving regulatory landscape, this SWOT Analysis is undertaken to systematically assess the internal and external factors influencing our finance audit practices. By gaining a deeper understanding of our strengths, weaknesses, opportunities, and threats, we can strategically position ourselves to navigate challenges effectively and capitalize on emerging prospects, ultimately fortifying our commitment to excellence in financial audit procedures.

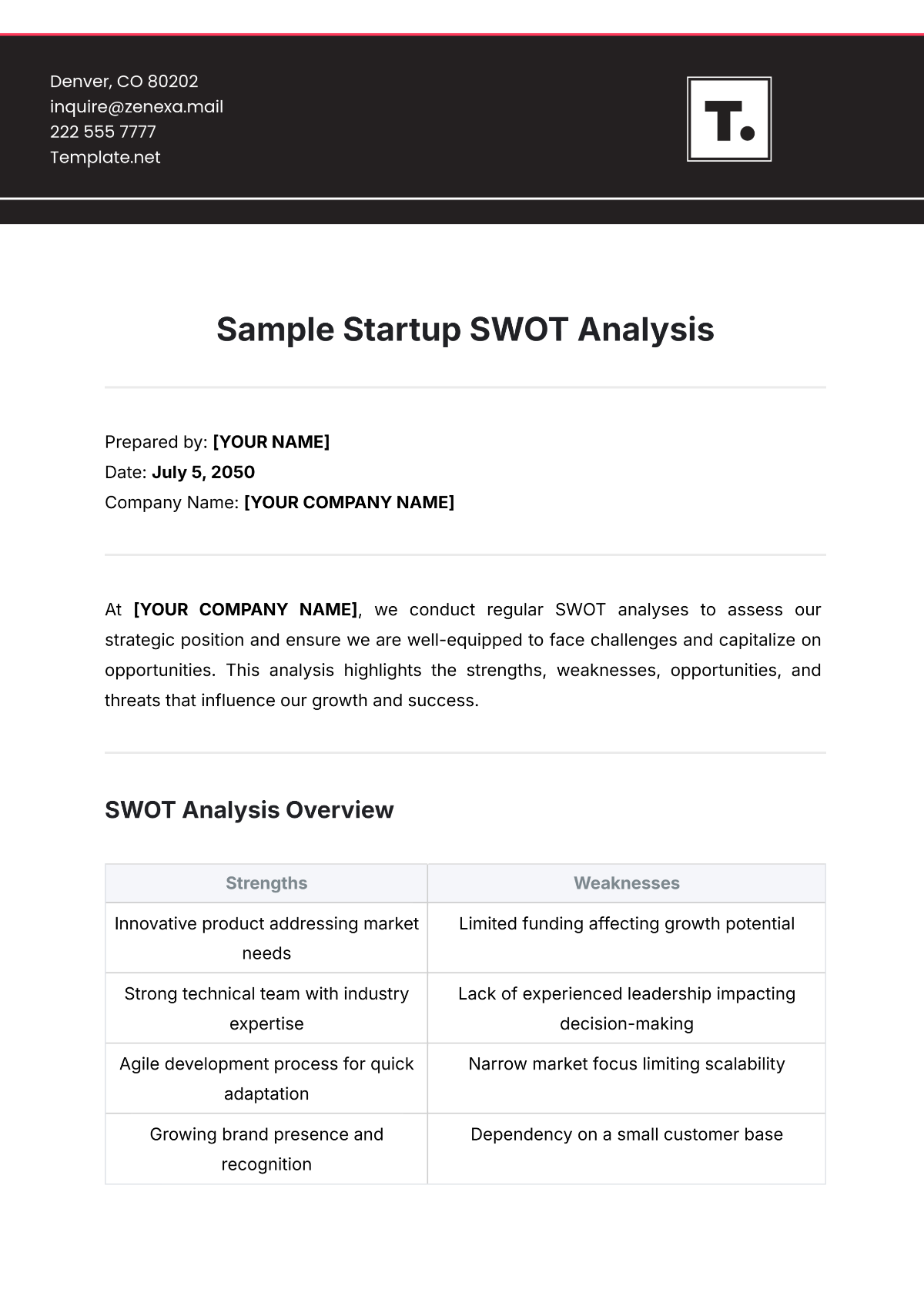

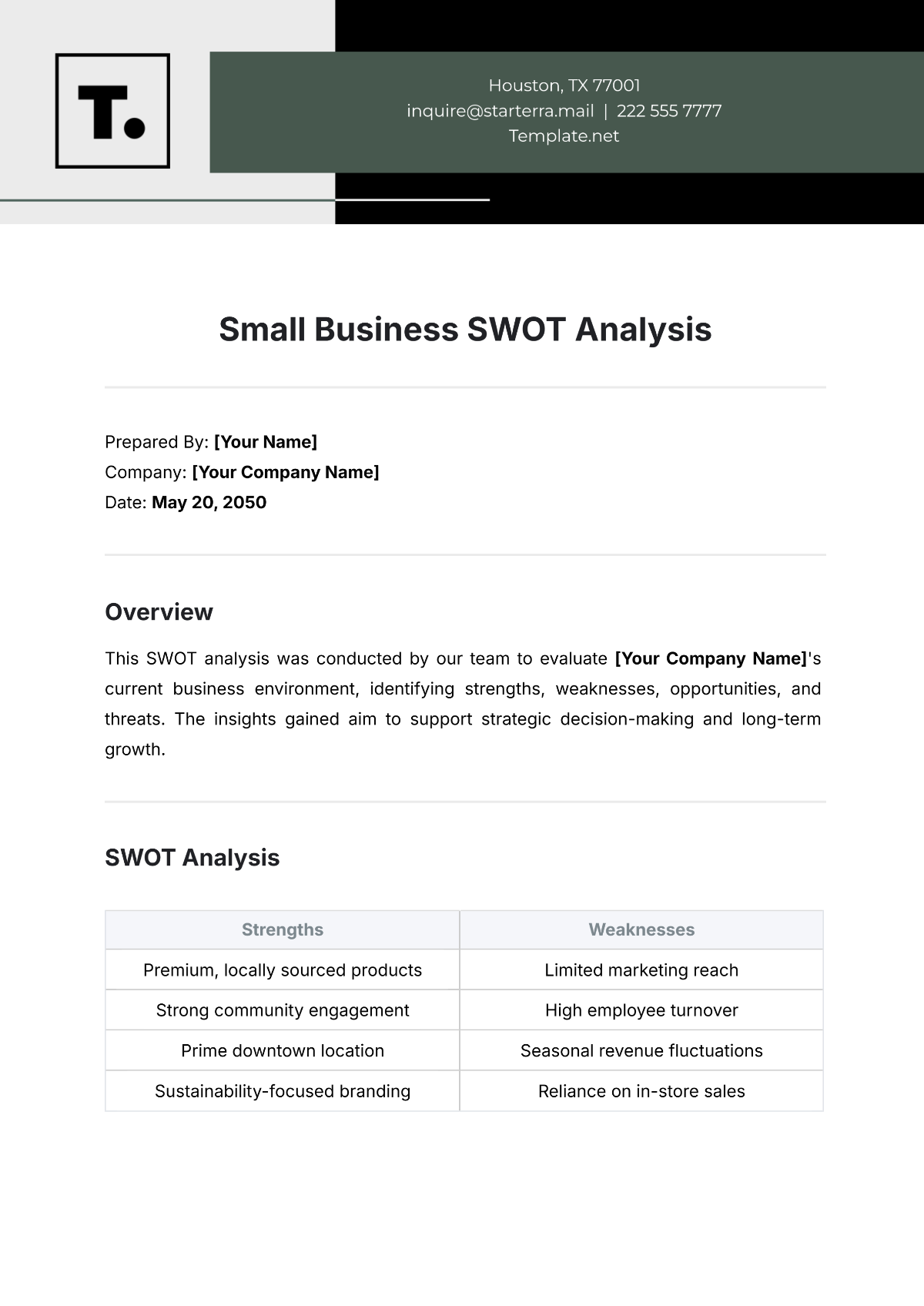

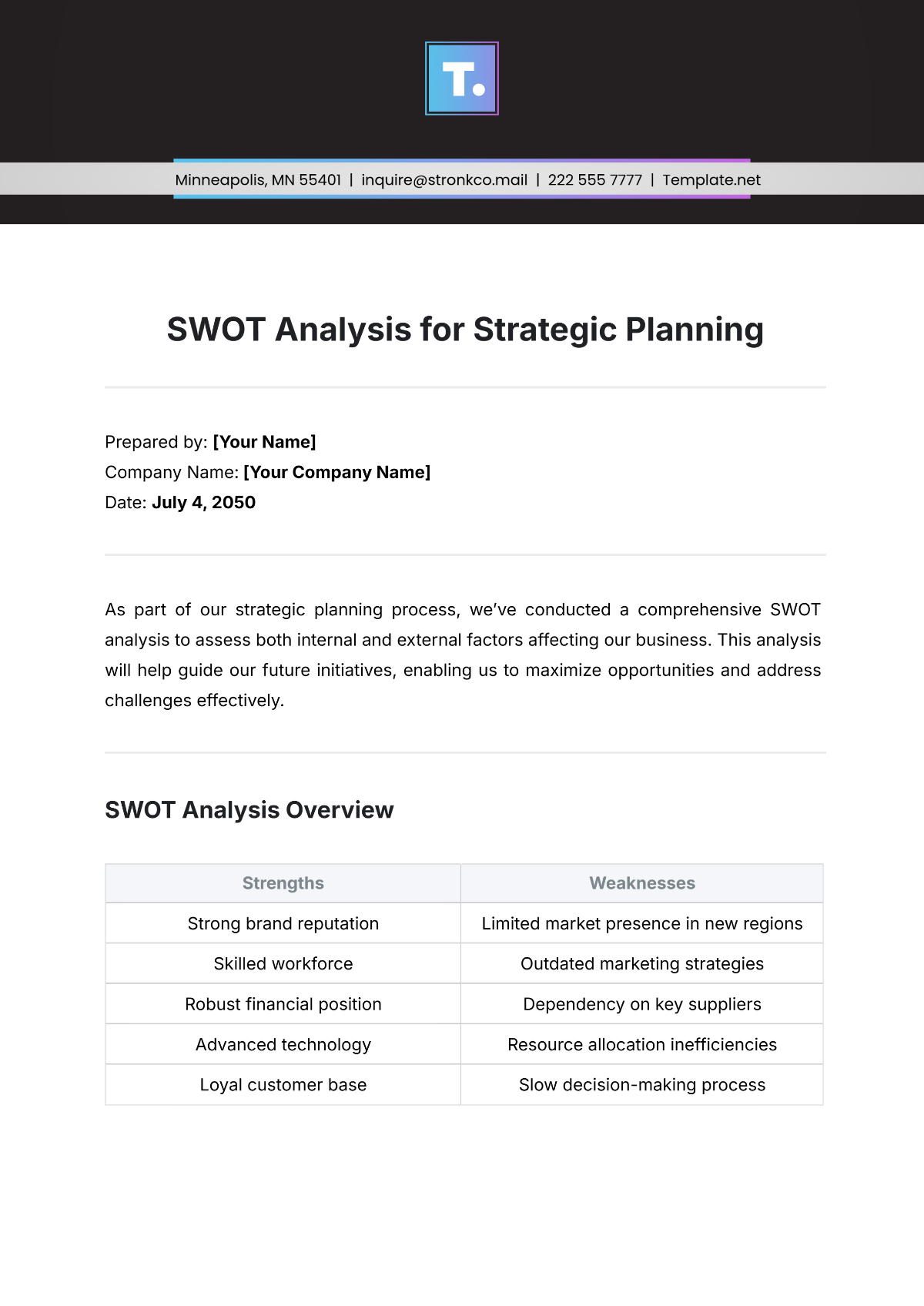

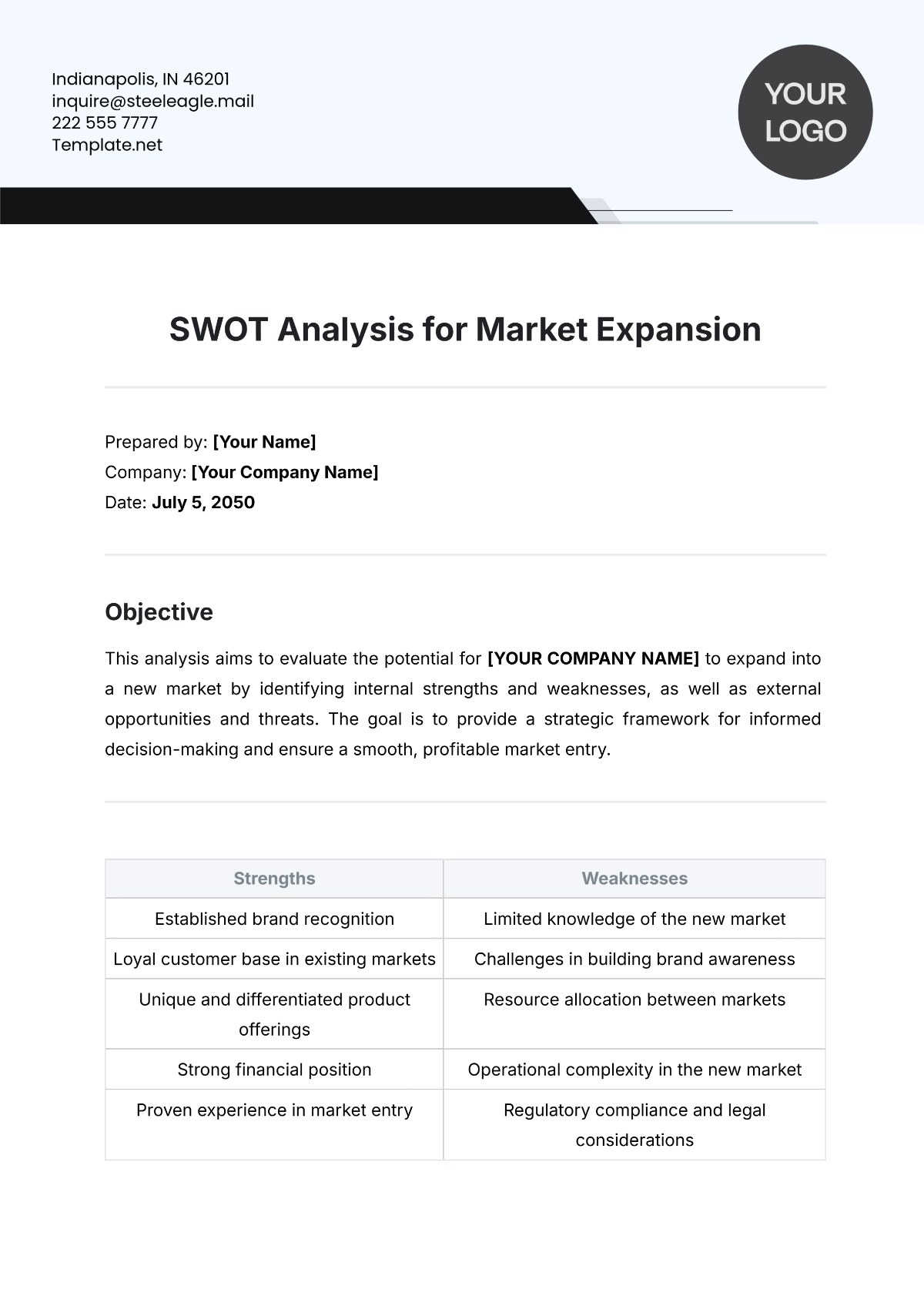

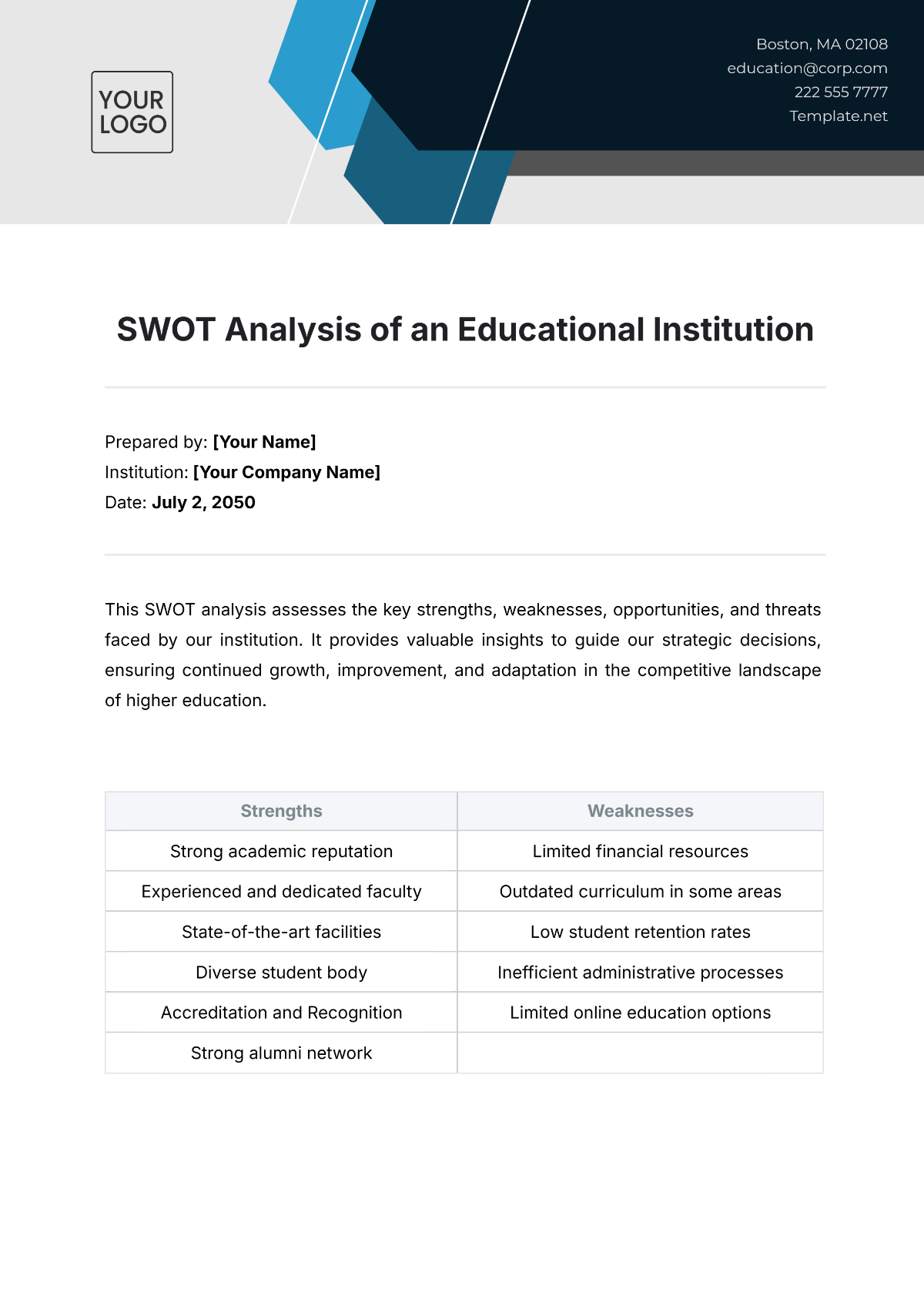

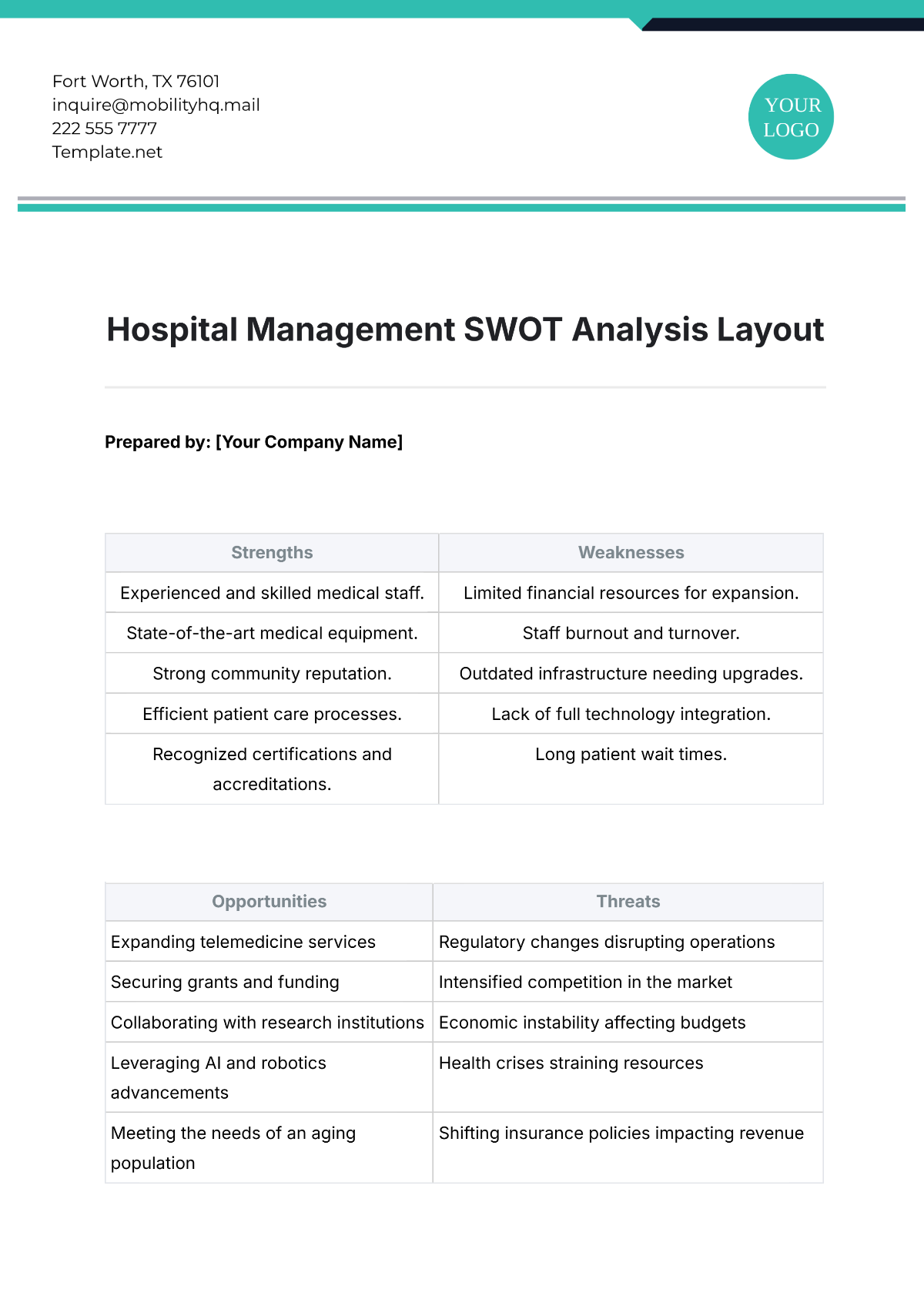

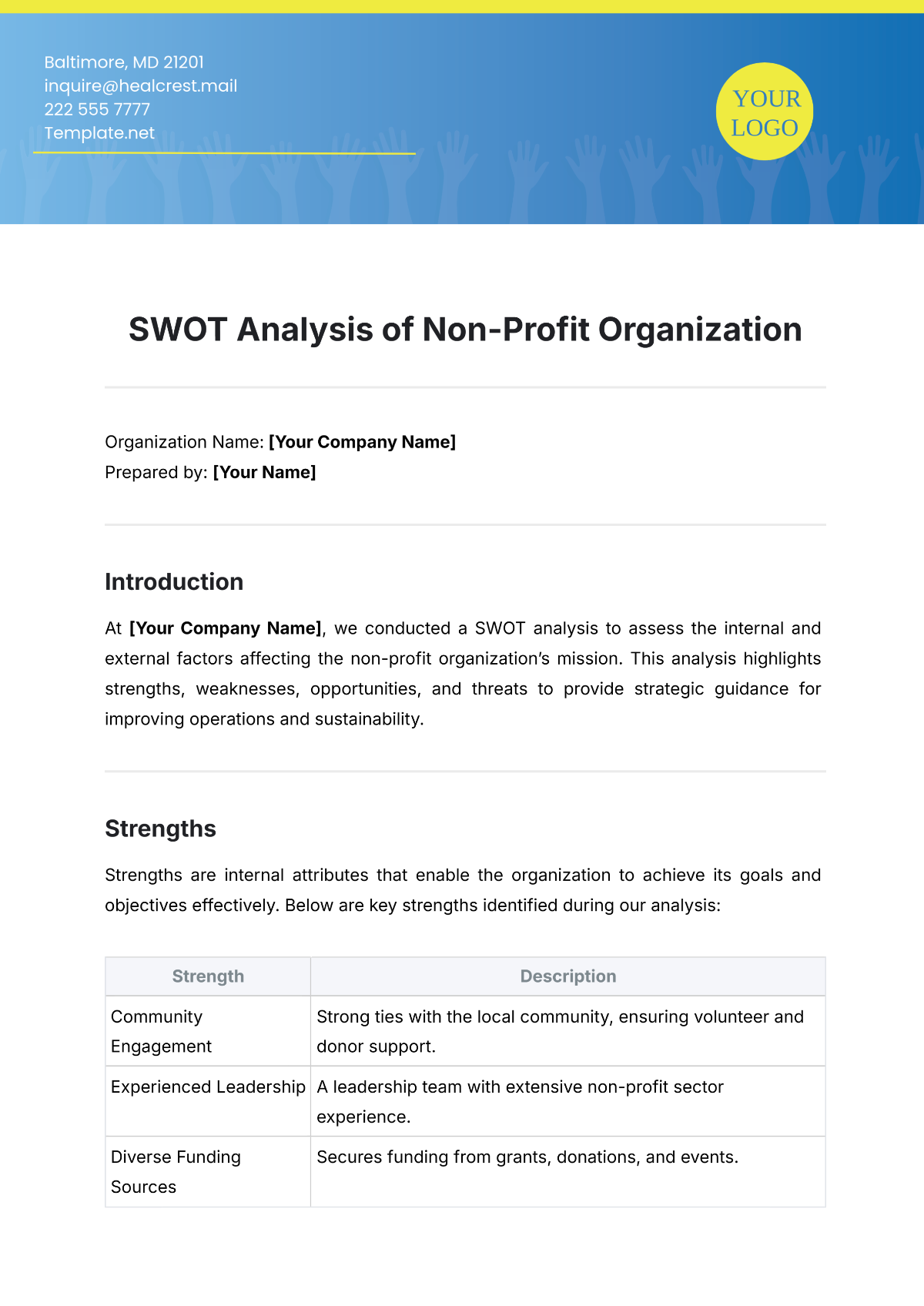

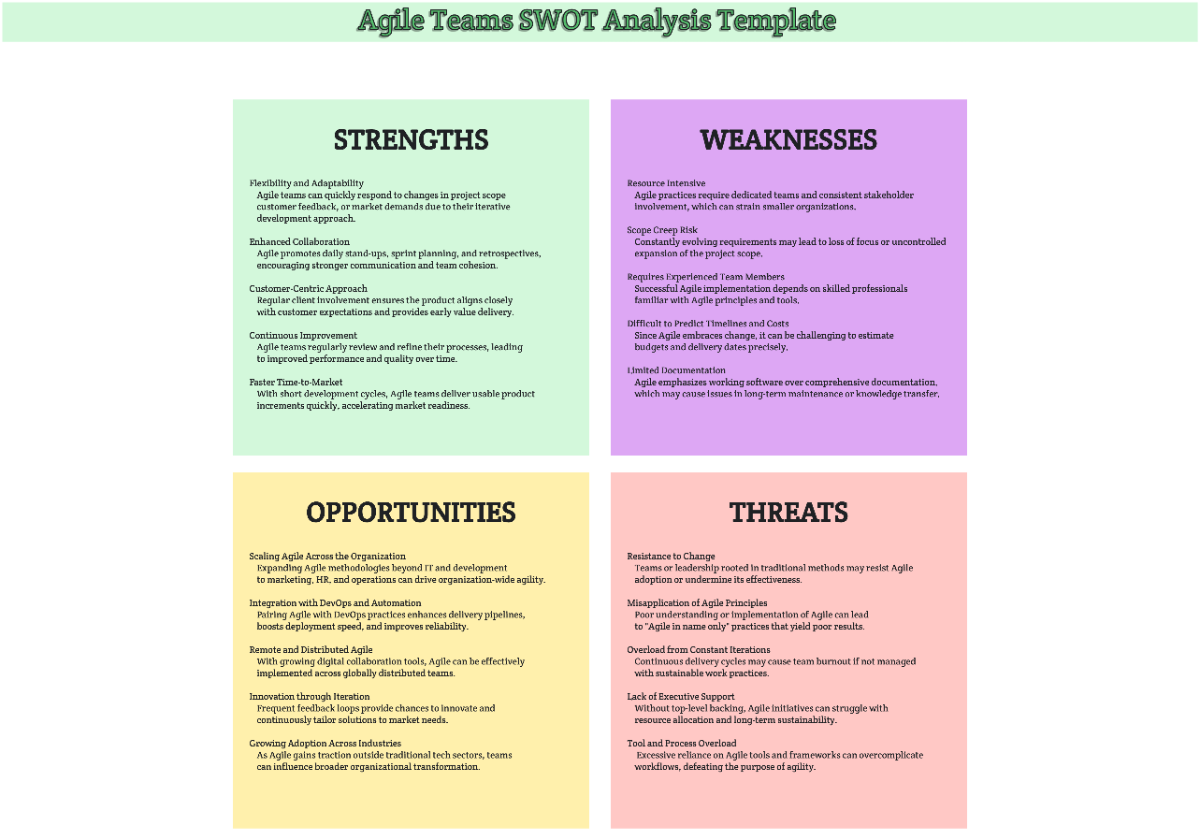

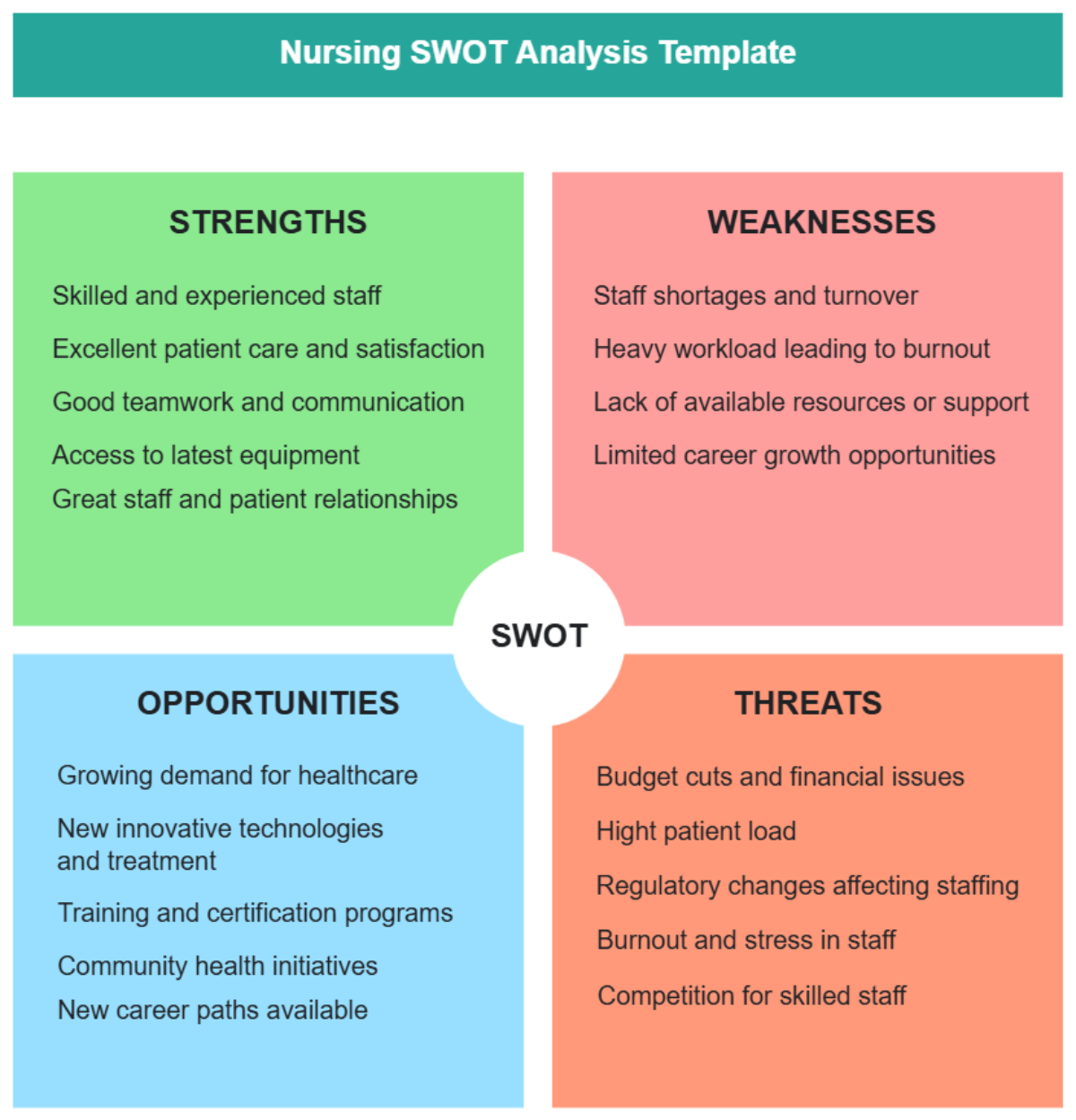

Internal Factors (Strengths and Weaknesses)

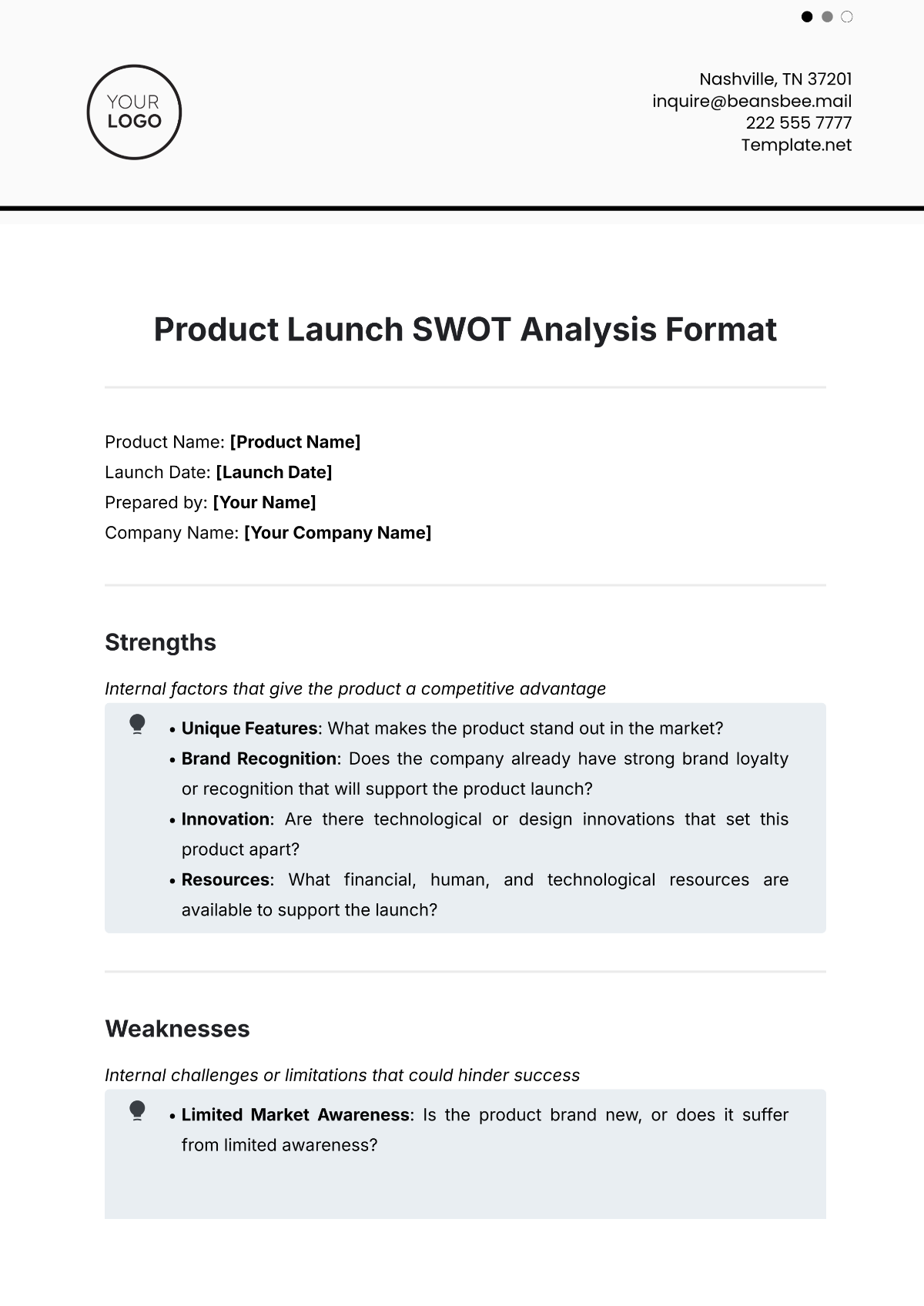

Strengths:

Expertise and Skills:

Our internal audit team is a pillar of strength, comprising professionals with diverse backgrounds and holding certifications such as Certified Internal Auditor (CIA) and Certified Public Accountant (CPA). Their extensive experience and continuous professional development contribute to a robust skill set, enabling the team to navigate complex audit scenarios effectively. Additionally, regular training programs foster a culture of learning and knowledge-sharing within the team.

Technology and Tools:

Embracing advanced audit technologies, our team utilizes cutting-edge software and data analytics tools. This technology-driven approach enhances the speed and accuracy of our audit processes, allowing for a more thorough examination of financial data. Integration with these tools has streamlined workflows and empowered our auditors to extract meaningful insights, promoting a data-driven audit culture within the organization.

Internal Controls:

Our organization maintains a robust system of internal controls designed to ensure the accuracy and reliability of financial information. These controls, meticulously implemented and monitored, have consistently demonstrated their effectiveness in mitigating risks. Regular assessments and updates to internal control mechanisms demonstrate our commitment to maintaining a strong control environment and safeguarding the integrity of financial reporting.

Weaknesses:

Resource Limitations:

While our internal audit team is highly skilled, resource limitations, particularly budget constraints, have impacted our ability to recruit additional personnel. This has resulted in an increased workload for existing staff, potentially affecting the depth and coverage of our audits. Addressing these resource limitations is crucial for sustaining the quality and thoroughness of our audit processes.

Process Inefficiencies:

Despite our team's proficiency, certain audit processes exhibit inefficiencies, leading to delays and an increased risk of errors. Identifying and addressing these bottlenecks is essential for optimizing our audit procedures. Process optimization initiatives, including the integration of automated workflows, will contribute to enhanced efficiency and effectiveness.

Compliance Risks:

While our organization generally maintains compliance, there have been instances where evolving regulatory requirements posed challenges. These instances highlight the need for a more proactive approach to staying abreast of regulatory changes and investing in ongoing training programs to ensure our team's readiness to address compliance risks.

External Factors (Opportunities and Threats)

Opportunities:

Technological Advancements:

The rapid evolution of technology presents an opportunity for our finance audit function to leverage emerging tools such as artificial intelligence and machine learning. Investing in and adopting these technologies will enable our team to conduct more sophisticated data analyses, identify patterns, and enhance the overall effectiveness of our audit processes.

Training and Development:

Opportunities for continuous training and development programs abound, providing a pathway to further enhance the skills of our audit team. Focused training on emerging accounting and audit standards, coupled with cross-functional learning initiatives, will empower our team to adapt to evolving industry best practices and emerging trends.

Process Improvement:

Initiatives focused on process improvement offer substantial opportunities to optimize our audit procedures. By applying Lean Six Sigma principles and fostering a culture of continuous improvement, we can streamline workflows, reduce redundancies, and enhance the overall efficiency of our audit processes, ultimately delivering greater value to the organization.

Threats:

Regulatory Changes:

The dynamic nature of regulatory landscapes poses a threat to our compliance efforts. Rapid changes in regulatory requirements demand a proactive monitoring system to promptly adopt policies and procedures. Maintaining a keen awareness of regulatory updates and establishing agile response mechanisms will be critical to mitigating this threat effectively.

Emerging Risks:

Emerging risks, such as cybersecurity threats and changes in the business environment, pose challenges to the integrity of financial information. Strengthening our internal controls and investing in cybersecurity measures are imperative to safeguard against these risks. A comprehensive risk management strategy that encompasses both traditional and emerging threats is essential for resilience.

Competitive Landscape:

The increasing competition in the audit services sector necessitates a proactive approach to understanding client needs and emerging trends. Regular market analyses and strategic positioning will be crucial to maintaining our competitive edge. A focus on client satisfaction and innovative service offerings will contribute to our sustained success in a competitive environment.

Integration and Recommendations

Integration of Findings:

The synergy between internal strengths and weaknesses and external opportunities and threats underscores the interconnected nature of our finance audit function. Recognizing these interdependencies allows for a more holistic approach to strategic planning, where internal improvements align with external market dynamics.

Recommendations:

Strategic Technology Investment:

Investment Prioritization: Allocate budgetary resources to prioritize strategic investments in advanced audit technologies. Identify and implement tools that align with our organizational goals, enhancing data analytics, automation, and overall efficiency in the audit process. This proactive approach will position our finance audit function at the forefront of technological advancements, ensuring sustained relevance and effectiveness.

Holistic Training Framework:

Tailored Training Programs: Develop a holistic training framework that includes both technical and soft skills training. Tailor programs address the specific needs and aspirations of our audit team, fostering a culture of continuous learning. By investing in the professional development of our auditors, we can ensure they remain adaptive to evolving industry standards and are equipped with the diverse skills necessary for comprehensive financial auditing.

Comprehensive Process Optimization:

Lean Six Sigma Implementation: Launch a comprehensive process optimization initiative based on Lean Six Sigma principles. Conduct a thorough analysis of existing workflows, identifying inefficiencies and redundancies. Implement streamlined and standardized processes, emphasizing continuous improvement. This initiative will not only enhance the overall efficiency of our audit procedures but also contribute to a culture of continuous improvement within the finance audit function.

Proactive Regulatory Compliance Measures:

Regulatory Monitoring System: Establish a proactive regulatory compliance monitoring system to stay ahead of changes in the regulatory landscape. Regularly update policies and procedures in response to evolving requirements, ensuring our finance audit function remains in full compliance. By anticipating regulatory shifts, we can minimize the risk of non-compliance issues and maintain the integrity of our audit processes.

Integrated Risk Management Strategy:

Cybersecurity Enhancement: Develop and implement an integrated risk management strategy that prioritizes cybersecurity measures. Strengthen internal controls to safeguard against emerging risks, particularly in the digital space. Collaborate with IT and cybersecurity experts to fortify our defenses, ensuring the confidentiality, integrity, and availability of financial information. This comprehensive approach will not only mitigate threats but also enhance the resilience of our finance audit function in the face of an evolving risk landscape.

Conclusion

In conclusion, the Finance Audit SWOT Analysis offers a comprehensive understanding of the current state of our finance audit function. By strategically aligning internal strengths with external opportunities and addressing weaknesses to mitigate potential threats, we can position ourselves for sustained success. The roadmap outlined in this analysis emphasizes the importance of embracing technological advancements, investing in continuous training, and implementing process improvements. Proactive measures to navigate regulatory changes, anticipate emerging risks, and stay ahead in a competitive landscape are integral to our strategic direction. As we embark on this journey of improvement, the Finance Audit SWOT Analysis serves as a guide, empowering our organization to adapt, innovate, and enhance the effectiveness of our finance audit function in a dynamic and challenging environment.