Financial Risk Management Program

The objective of the Financial Risk Management Program at [Your Company Name] is to identify, assess, and mitigate financial risks that could impact our business operations, profitability, and market position. This includes risks related to market changes, credit, operations, and legal factors.

A. Risk Identification:

Market Risk: Fluctuations in market prices, interest rates, and foreign exchange rates.

Credit Risk: The risk of loss from a borrower's or counterparty's inability to repay a loan or meet contractual obligations.

Operational Risk: Risks arising from failed internal processes, people, systems, or external events.

Legal and Regulatory Risk: Risks related to non-compliance with laws, regulations, or prescribed practices.

B. Risk Assessment:

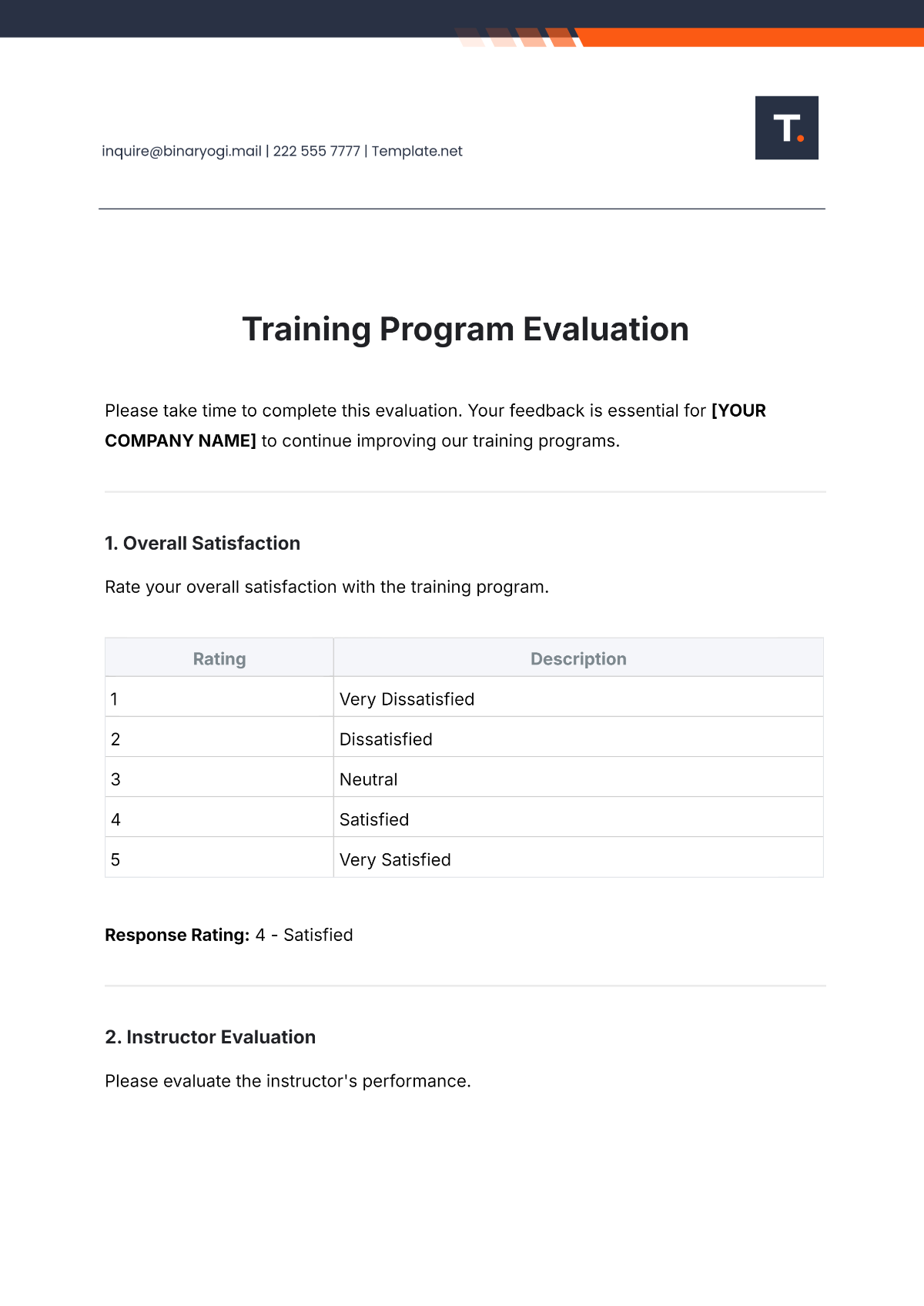

Risk Type | Description | Impact | Current Controls |

|---|---|---|---|

Market Risk | Changes in market conditions | High | Hedging, Diversification |

Credit Risk | Defaults on loans issued | High | Credit Scoring, Collateral |

Operational Risk | System failures, human errors | Medium | Insurance, Audits |

Legal Risk | Non-compliance with laws | High | Compliance Team, Regular Audits |

C. Risk Mitigation Strategies:

Market Risk: Utilize financial instruments like futures, options, and swaps to hedge against market volatility.

Credit Risk: Implement strict credit analysis and approval processes, and maintain a high-quality credit portfolio.

Operational Risk: Strengthen internal controls, conduct regular audits, and provide staff training.

Legal Risk: Keep abreast of legal changes, and enforce strict compliance procedures.

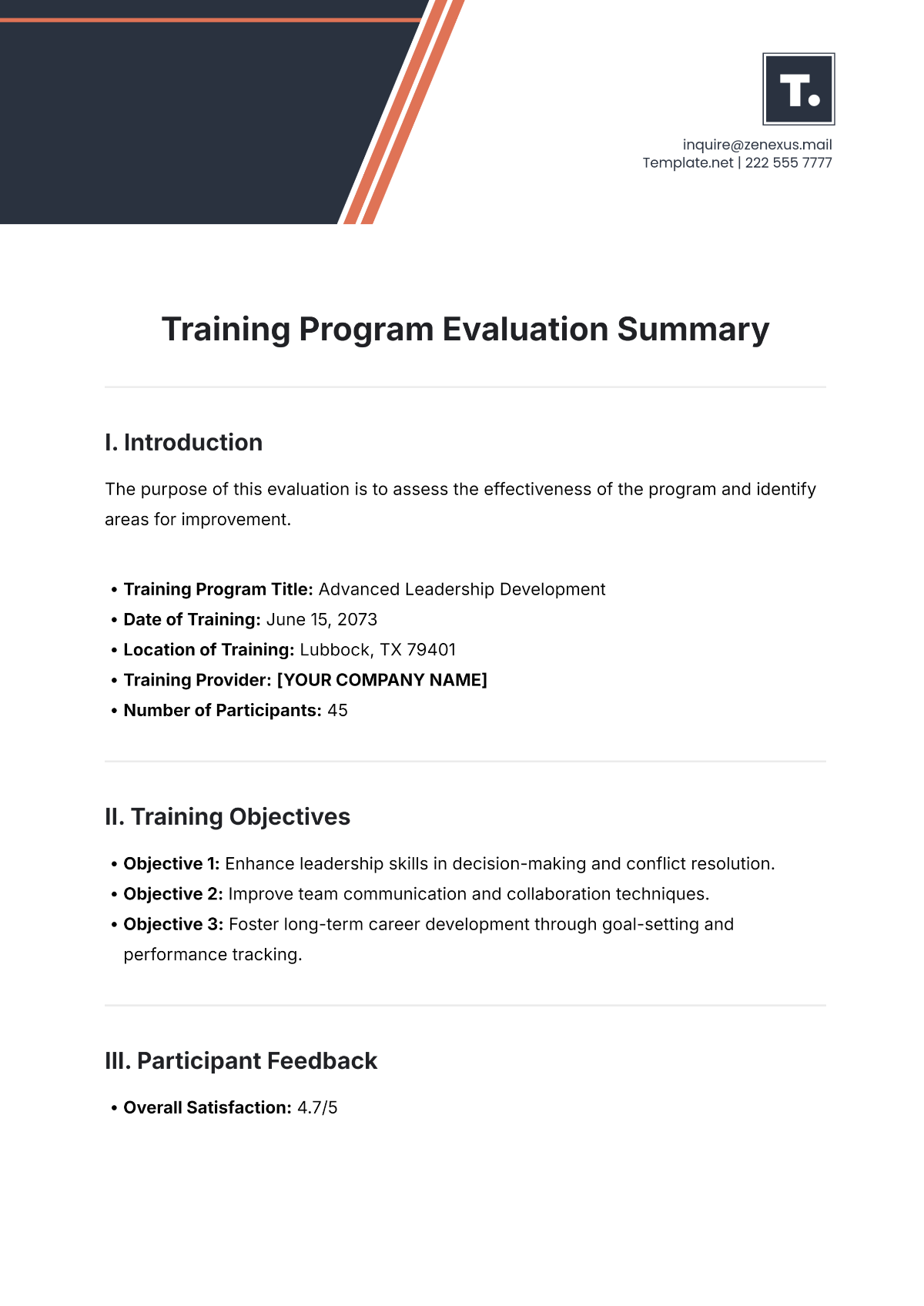

D. Financial Risk Reporting:

The primary objective of financial risk reporting is to ensure that key stakeholders are kept informed about the company's risk exposure, incidents, and management effectiveness. It involves the systematic tracking and communication of key risk indicators to enable timely decision-making.

Components:

Risk Metrics and Thresholds: Regular reporting on specific risk metrics such as value at risk (VaR), stress testing outcomes, and exposure limits. Each metric has predefined thresholds that, when breached, trigger alerts or corrective actions.

Incident Reports: Detailed documentation and analysis of any risk events or near-misses, including the cause, impact, and corrective measures taken. This helps in learning from past events and strengthening risk controls.

Performance Review: A periodic (usually quarterly) review of the risk management process's effectiveness, including an assessment of strategy, tools, and team performance.

E. Program Review and Update:

Components:

Annual Review: At least once a year, the entire program is reviewed for its effectiveness and relevance. This involves reassessing the risk landscape, evaluating the success of mitigation strategies, and examining the incident history.

Update Mechanism: Based on the review findings, the program is updated. This might include revising risk appetite, incorporating new types of risks, updating risk assessment methodologies, or enhancing reporting tools.

Stakeholder Feedback: Incorporating feedback from various stakeholders, including management, employees, and external partners, to ensure the program remains comprehensive and practical.

F. Appendices:

Glossary of Terms

Contact Information for Risk Management Team

Historical Data and Risk Incident Reports