Free Financial Risk Management SWOT Analysis

Introduction

In an ever-evolving financial landscape, proactive risk management remains a cornerstone of sustainable business growth and resilience. Recognizing this critical need, [Your Company Name] has commissioned a detailed SWOT (Strengths, Weaknesses, Opportunities, Threats) Analysis, focusing specifically on our financial risk management strategies. This analysis is not just a reflection of our current state but a strategic tool designed to illuminate our path forward.

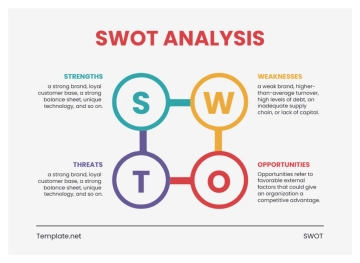

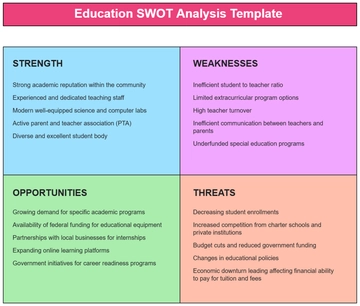

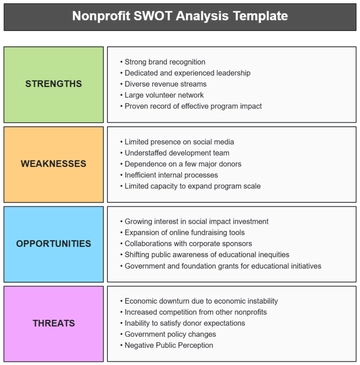

At the heart of this document lies a thorough examination of our financial risk management framework, dissected through the lens of SWOT to unearth key insights. Strengths showcase our robust capabilities and successful practices that have fortified our financial stability. Weaknesses are addressed with unvarnished honesty, acknowledging areas where improvement is not just beneficial, but necessary. Opportunities are identified with an eye towards emerging markets, technological advancements, and shifts in global economic patterns, presenting potential avenues for strategic growth and diversification. Lastly, the analysis confronts potential threats, ranging from market volatility to regulatory changes, that could impact our financial operations.

This comprehensive approach ensures that [Your Company Name]'s financial risk management strategies are not only aligned with current industry best practices but are also robustly positioned to adapt to future challenges and leverage potential growth opportunities. This document serves as a testament to our commitment to financial excellence and strategic foresight, guiding us towards informed decision-making and sustained business success.

SWOT Analysis

The SWOT Analysis provides a strategic overview of [Your Company Name]'s financial risk management capabilities and challenges. This analysis is instrumental in developing robust strategies for the future by leveraging strengths, addressing weaknesses, seizing opportunities, and mitigating threats.

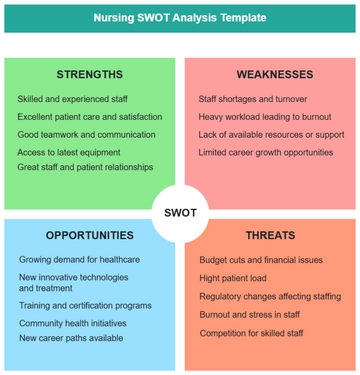

Strengths

Strengths form the foundation of [Your Company Name]'s financial risk management strategy. They represent the internal capabilities and resources that give the company a competitive edge.

Diverse Investment Portfolio: Our diverse range of investments is a key strength, significantly reducing potential risks and enhancing stability. The Portfolio Diversity Index stands at an impressive 85%, indicating a well-balanced and resilient investment strategy.

Robust Risk Assessment Tools: The efficiency and effectiveness of our risk assessment tools are a testament to our commitment to innovation in risk management. With a Risk Mitigation Efficiency of 90%, these tools play a critical role in identifying and managing financial risks proactively.

Experienced Financial Team: Our team's average experience of 12 years in the field is a substantial asset. This experience underpins our ability to navigate complex financial landscapes and manage risks effectively.

Strengths | Description | Figures/Data |

|---|---|---|

Diverse Investment Portfolio | A broad range of investments reduces potential risks. | Portfolio Diversity Index: 85% |

Robust Risk Assessment Tools | Advanced tools for identifying and managing risks. | Risk Mitigation Efficiency: 90% |

Experienced Financial Team | Skilled team with a track record in risk management. | Average Experience: 12 years |

Weaknesses

Identifying and acknowledging weaknesses allows [Your Company Name] to develop strategies to address these areas and enhance overall financial risk management.

Limited Global Market Exposure: Currently, our Global Market Share is limited to 20%, indicating a concentration in domestic markets. This poses a risk by limiting our exposure to diverse global market dynamics.

Dependency on Traditional Risk Models: A bi-annual update frequency of our risk models points to a potential over-reliance on traditional methods. This could lead to a gap in identifying and responding to new and emerging financial risks.

Weaknesses | Description | Figures/Data |

|---|---|---|

Limited Global Market Exposure | Concentration in domestic markets increases risk. | Global Market Share: 20% |

Dependency on Traditional Risk Models | Over-reliance on conventional models may overlook new risks. | Model Update Frequency: Bi-annually |

Opportunities

Opportunities highlight potential areas for growth and improvement in our financial risk management approach.

Emerging Markets: Expanding into emerging markets offers a significant opportunity to diversify risks and tap into new growth areas, with a potential growth rate of 15% annually.

Technology Advancements: Embracing advancements in AI and ML for predictive analysis could revolutionize our approach to financial risk management. This shift is expected to increase efficiency by 25%.

Opportunities | Description | Figures/Data |

|---|---|---|

Emerging Markets | Expanding into new markets can diversify risks. | Potential Growth Rate: 15% annually |

Technology Advancements | Utilizing AI and ML for predictive analysis. | Expected Efficiency Increase: 25% |

Threats

Threats are external factors that could negatively impact our financial risk management strategy.

Market Volatility: Our Historical Volatility Index stands at 30%, indicating that sudden market shifts could significantly impact our assets and financial stability.

Regulatory Changes: An anticipated annual increase of 10% in Regulatory Compliance Costs due to new financial regulations highlights the need for adaptive strategies to navigate these changes effectively.

Threats | Description | Figures/Data |

|---|---|---|

Market Volatility | Sudden market shifts can impact assets. | Historical Volatility Index: 30% |

Regulatory Changes | New financial regulations could impact operations. | Regulatory Compliance Cost Increase: 10% annually |

SWOT analysis provides a comprehensive and nuanced understanding of the various elements that shape [Your Company Name]'s financial risk management strategy. Through an honest appraisal of our strengths, we recognize the solid foundation upon which our current strategies are built. Our weaknesses, while challenging, present clear areas for improvement and strategic development. The opportunities identified offer exciting prospects for growth and innovation, particularly in the realms of emerging markets and technological advancements. However, we must remain vigilant of external threats such as market volatility and regulatory changes, which require continuous monitoring and adaptive strategies.

This analysis not only serves as a reflection of where we stand today but also as a roadmap for our future endeavors. It underlines our commitment to evolving and strengthening our financial risk management practices in a way that aligns with both our immediate and long-term business objectives. By staying true to this strategic direction, [Your Company Name] is well-positioned to navigate the complexities of the financial landscape with confidence and resilience, driving sustained growth and success.

Conclusion

This SWOT analysis has meticulously dissected the various aspects of [Your Company Name]'s financial risk management strategy, illuminating a path characterized by both challenges and opportunities. Our in-depth review underscores the company's robust approach, leveraging strengths to foster growth and stability, even as we confront inherent weaknesses and external threats.

We recognize that our diverse investment portfolio and advanced risk assessment tools are formidable assets, offering a strong buffer against financial uncertainties. Equally important is our experienced financial team, whose expertise is instrumental in navigating complex risk landscapes. These strengths form a solid foundation for [Your Company Name]'s continued success and should be continuously nurtured.

However, addressing our weaknesses is paramount. The limited global market exposure and dependency on traditional risk models call for a strategic shift. We recommend a more aggressive expansion into global markets to diversify risk and embrace innovative risk assessment methodologies that incorporate contemporary models and technologies.

Opportunities in emerging markets and technology advancements, particularly in AI and ML, are ripe for exploration. We advise investing in these areas to enhance our predictive analysis capabilities and expand our market reach. This proactive approach could significantly boost our operational efficiency and open new avenues for growth.

Mindful of the external threats of market volatility and regulatory changes, we must remain agile. Developing flexible strategies that can adapt to market fluctuations and regulatory demands will be crucial in maintaining our competitive edge.

In summary, while [Your Company Name] faces challenges, our inherent strengths and the identified opportunities provide a strong platform for growth. By addressing our weaknesses and strategically harnessing our strengths, we can not only mitigate risks but also capitalize on new prospects. This balanced approach will ensure our continued resilience and success in the dynamic financial landscape.

Contact Information

For further information, clarifications, or discussions regarding this SWOT analysis, [Your Company Name] welcomes your inquiries and feedback. Our dedicated team is available to provide detailed insights and engage in constructive dialogue to foster collaborative growth and understanding. Below is our comprehensive contact information for your convenience:

Company Name: [Your Company Name]

We invite you to reach out to us under our official company name for any corporate inquiries, partnership discussions, or business opportunities.

Email: [Your Company Email]

For detailed queries or to send us your thoughts and suggestions electronically, please use our official email address.

Website: [Your Company Website]

Visit our website for an in-depth look at our company profile, services, and the latest updates about our activities and achievements.

Address: [Your Company Address]

Our office is open for visits during business hours. Feel free to drop by for face-to-face consultations or to arrange a meeting with our team.

Phone Number: [Your Company Phone Number]

For immediate assistance or to speak with our customer service representatives, please call our official phone number.

Social Media: [Your Social Media]

Follow us on social media to stay updated on our latest news, insights, and events. Engage with us and be part of our online community.

Contact Person: [Your Name]

As the primary point of contact, [Your Name] is available to address specific queries related to this SWOT analysis or other related matters.

Personal Email: [Your Personal Email]

For direct communication with [Your Name], use this personal email address for a more tailored response.

Phone: [Your User Phone]

Reach [Your Name] directly via this phone number for urgent inquiries or detailed discussions.

Date: [Month Day Year]

This document was last updated on [Month Day Year], ensuring that the information provided is current and relevant.

We encourage you to utilize these contact points as needed. [Your Company Name] is committed to maintaining open lines of communication and building lasting relationships with our stakeholders. Your feedback and inquiries are invaluable to us, and we look forward to engaging with you.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's editable Financial Risk Management SWOT Analysis Template! This comprehensive tool empowers your business to assess its strengths, weaknesses, opportunities, and threats in the context of financial risk. Customize and analyze with ease using our AI editor tool, enabling informed decision-making to safeguard your financial future. Don't miss out on this essential resource for strategic planning!