Finance Payroll Cost Analysis Report for [Your Company Name]

This report presents a detailed analysis of the payroll costs for [Your Company Name]. Review each section to gain insights into cost distribution, efficiency opportunities, and areas for potential savings.

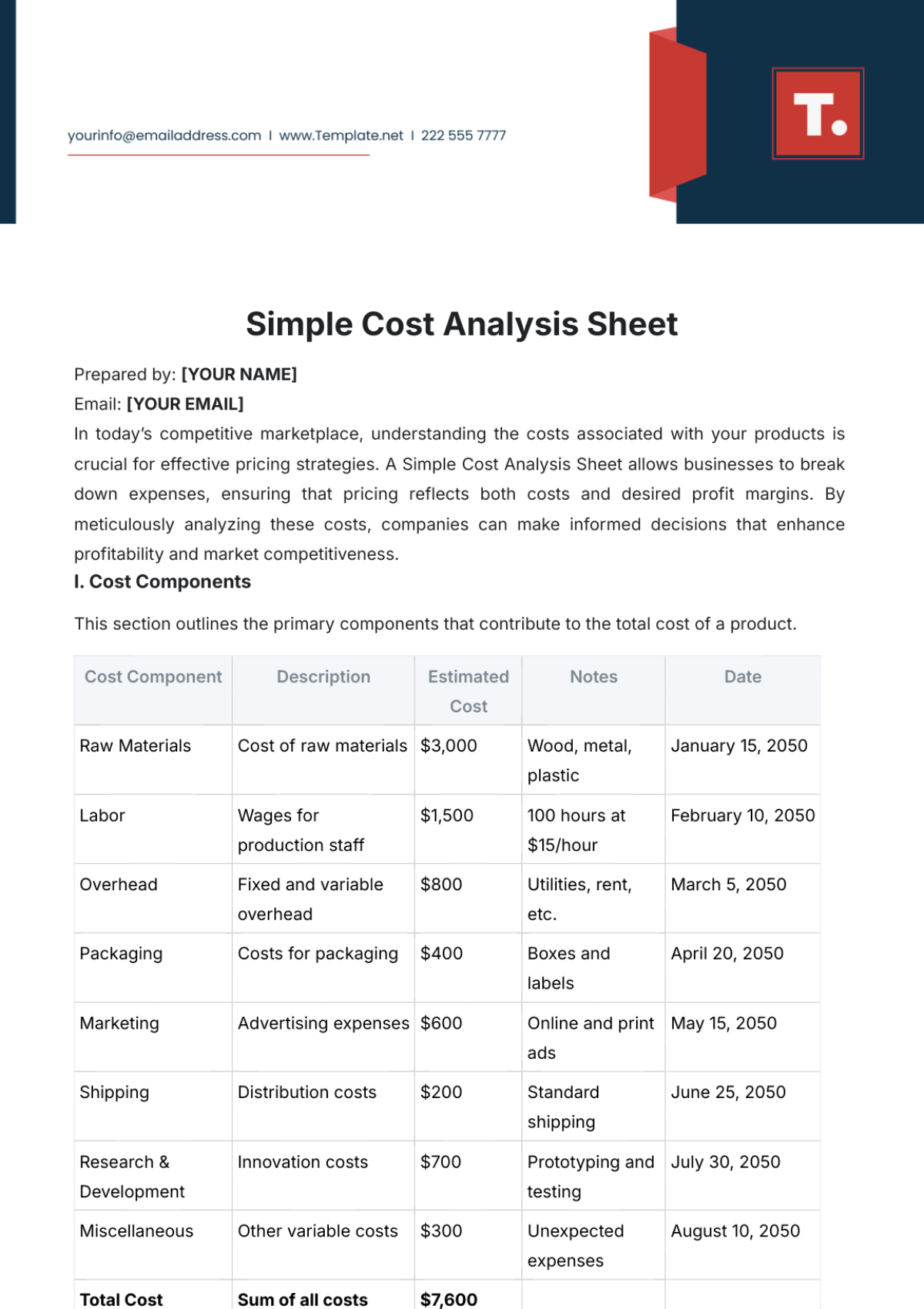

Total Payroll Expenditure | |

A breakdown of the total payroll expenditure for the current fiscal year, including gross wages, taxes, and benefits. | The total payroll expenditure for the current fiscal year amounts to $5 million, which constitutes approximately 30% of the company's total operating expenses. This figure includes $3.5 million in gross wages, $1 million in tax withholdings, and $500,000 in benefits such as health insurance and retirement contributions. |

Cost per Employee Analysis | |

An analysis of the average cost per employee, comparing it against the previous fiscal year to assess trends. | The average cost per employee stands at $50,000, marking a 5% increase from the previous year. This rise is primarily due to an increase in average wages and enhanced benefits offered to attract and retain talent in a competitive market. |

Departmental Cost Distribution | |

Examination of payroll costs distributed by department, highlighting areas with the highest expenditure. | The Sales Department accounts for the largest share of payroll costs at 35%, followed by the Research and Development Department at 25%. Administrative and support departments make up the remaining 40%. The higher costs in Sales are attributed to performance bonuses and commissions. |

Overtime and Additional Pay Analysis | |

Analysis of the costs associated with overtime, bonuses, and other additional pay elements. | Overtime payments this year increased by 10% compared to the last fiscal year, amounting to $200,000. Additional pay components, including bonuses and commissions, totaled $300,000, with a significant portion linked to sales targets achievements. |

Process Efficiency and Software Costs | |

Evaluation of the costs related to payroll processing, including software subscription fees, system maintenance, and labor costs for the payroll department. | Payroll processing costs, including software subscription and maintenance, stand at $100,000 annually. Labor costs for the payroll department are $250,000. An analysis suggests that the introduction of more advanced payroll software could increase efficiency and reduce labor costs by 15%. |

Conclusion

From this Finance Payroll Cost Analysis Report, decisions on optimizing the payroll cost can be made effectively. This will foster an environment of financial stability within the company [Your Company Name].

Prepared by:

[Your Name]

[Your Company Name]

[Your Email]