Free Finance Payroll SLA

This Finance Payroll Service Level Agreement (hereinafter referred to as the "Agreement") is entered into and made effective as of the [1st day of January, 2050] (the "Effective Date"), by and between [Your Company Name], a [State/Country] Corporation with its principal place of business at [Your Address] (hereinafter referred to as the "Company") and [Your Partner Company Name], a [State/Country] Corporation with its principal place of business at [Partner's Address] (hereinafter referred to as the "Service Provider"). Both are collectively referred to herein as the "Parties".

I. Introduction

A. Parties Involved

This Financial Payroll Service Level Agreement ("SLA") is established on [Date], formalizing a partnership between [Your Company Name], headquartered at [Your Company Address], represented by [Your Name], [Your Position], and [Your Partner Company Name], headquartered at [Partner Company Address], represented by [Partner Representative Name], [Partner Position]. This agreement solidifies the commitment of both parties to efficient payroll management, aiming for a seamless collaboration.

B. Objective

The objective of this SLA is to create a transparent framework for [Your Company Name] to deliver accurate and timely financial payroll services to [Your Partner Company Name], ensuring a smooth and reliable payroll process for employees. This agreement serves as a blueprint for mutual success in financial operations.

II. Scope of Services

A. Inclusions

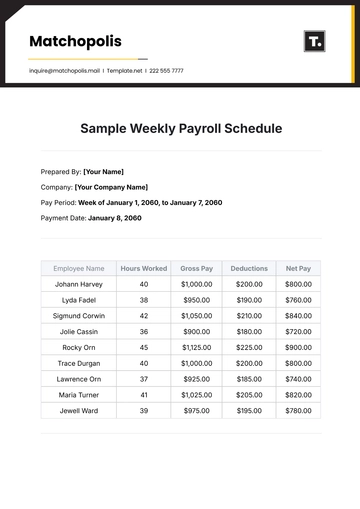

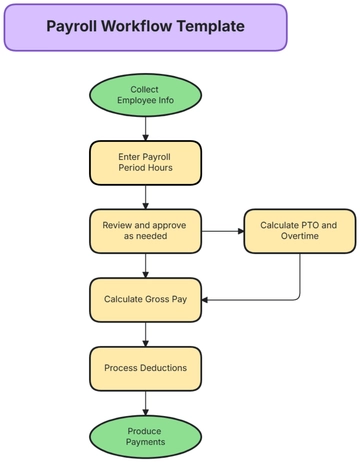

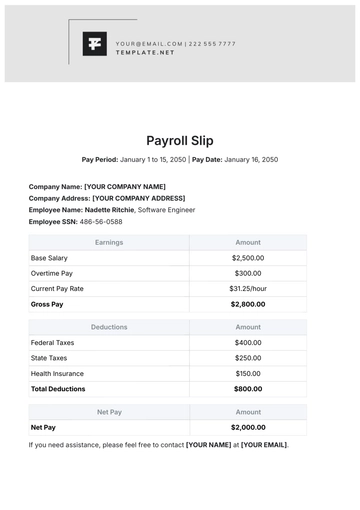

[Your Company Name] commits to providing comprehensive financial payroll services, covering payroll processing, accurate tax calculations, compliance monitoring, and customized reporting. These inclusions aim to streamline financial processes for [Your Partner Company Name], enhancing operational efficiency and accuracy in payroll management.

B. Exclusions

The services explicitly excluded from this agreement are:

Employee Benefits Administration: [Your Company Name] will not be responsible for the administration of employee benefits, including health insurance, retirement plans, and other employee welfare programs.

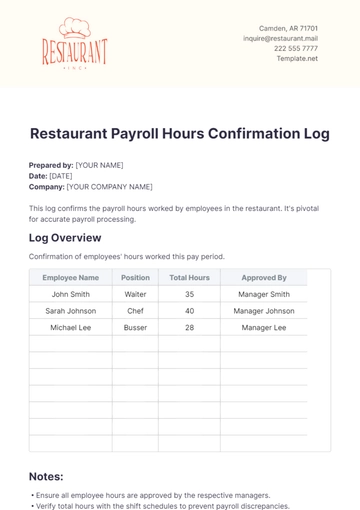

Time and Attendance Management: [Your Company Name] will not handle time and attendance tracking, including clock-in/clock-out systems or monitoring of employee work hours.

Legal Consultation: This agreement does not cover legal consultation services. [Your Company Name] will not provide legal advice or representation in matters unrelated to payroll processing.

III. Service Levels

A. Accuracy and Timeliness

[Your Company Name] guarantees payroll processing with a minimum accuracy rate of [90%], delivering the finalized payroll to [Your Partner Company Name] by [25th] of every month. This commitment ensures precise and timely salary disbursements, promoting financial stability for employees and [Your Partner Company Name].

B. Issue Resolution

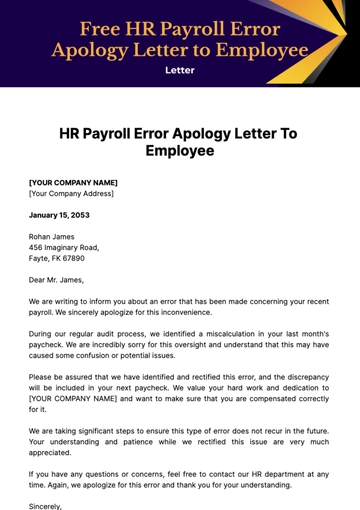

In the event of errors, [Your Company Name] pledges to address and resolve issues within [24 hours], maintaining a swift response system to rectify any discrepancies reported by [Your Partner Company Name]. This commitment underscores [Your Company Name]'s dedication to proactive issue resolution.

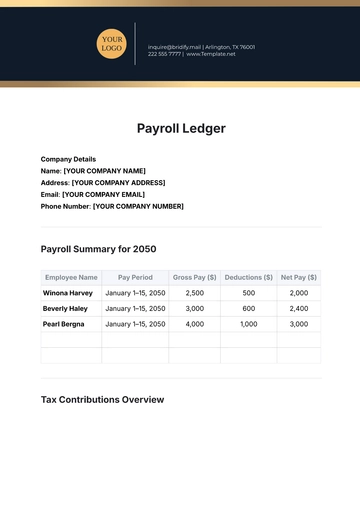

IV. Reporting

A. Regular Reports

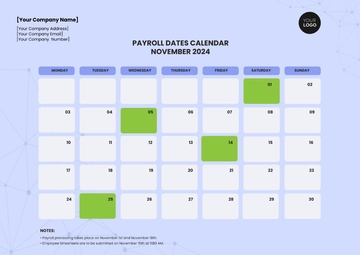

[Your Company Name] will provide regular reports, including comprehensive payroll summaries, accurate tax filings, and ongoing compliance status reports. These reports, delivered monthly, empower [Your Partner Company Name] with up-to-date financial insights, facilitating strategic decision-making and financial planning.

B. Frequency

Reports will be delivered on a monthly basis, ensuring timely access to critical financial information. This frequency is designed to support [Your Partner Company Name] in making informed business decisions, fostering transparency and collaboration in financial management.

V. Data Security

A. Confidentiality

[Your Company Name] prioritizes the confidentiality of all payroll data. Stringent measures are in place to handle and protect sensitive information, fostering trust and security for [Your Partner Company Name]. This commitment to confidentiality aligns with industry best practices and legal standards.

B. Data Backup

Regular data backups by [Your Company Name] prevent any loss of crucial payroll information. This practice ensures the integrity and availability of data, safeguarding against potential data loss for [Your Partner Company Name]. This proactive approach to data management enhances the reliability and resilience of the payroll system.

VI. Termination

A. Termination Notice

Either party may terminate this agreement by providing a written notice of [30 days] in advance. This notice period facilitates a smooth transition of payroll services, allowing both [Your Company Name] and [Your Partner Company Name] to plan accordingly. It ensures that the termination process is well-managed and minimizes disruptions to payroll operations.

VII. Compliance

A. Legal Compliance

[Your Company Name] pledges to stay abreast of changes in legislation related to payroll processing. Timely adjustments will be made to ensure full compliance with the latest legal requirements, providing [Your Partner Company Name] with assurance and adherence to regulations. This commitment underscores [Your Company Name]'s dedication to legal integrity and accountability.

VIII. Governing Law

A. Jurisdiction

Any disputes arising under this SLA will be subject to the exclusive jurisdiction of the courts in [Michigan]. This ensures a fair and efficient resolution process, maintaining a legal framework for both [Your Company Name] and [Your Partner Company Name]. The specified jurisdiction provides clarity in legal proceedings and aligns with the preferences of both parties.

IN WITNESS WHEREOF, the Parties hereto have executed this Finance Payroll Service Level Agreement as of the Effective Date.

______________________________ ______________________________

[Your Company Name] [Your Partner Company Name]

Authorized Signatory Authorized Signatory

Date: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline payroll service level agreements with the Finance Payroll SLA Template on Template.net. This editable and customizable template simplifies the SLA creation process. Tailor content effortlessly using our Ai Editor Tool, ensuring adaptability and precision. Elevate your financial agreements with this user-friendly template, offering a comprehensive approach to crafting personalized payroll SLAs for effective payroll service management.