Finance Accounts Payable Management

I. Introduction

A. Importance

Finance Accounts Payable Management holds a pivotal role in our organization's financial framework, extending beyond mere transactional processes. The importance of it is underscored by its role in ensuring optimal cash flow, fostering positive vendor relationships, and contributing to transparent financial reporting.

B. Objectives

Aligned with broader financial and operational goals, the objectives include:

Timely Payments

Ensuring that all invoices are processed and paid within agreed-upon terms to avoid late fees, maintain supplier trust, and leverage early payment discounts.

Accuracy and Verification

Implementing rigorous verification procedures to prevent errors and discrepancies, safeguarding against financial losses and ensuring data integrity.

Cost Optimization

Analyzing and categorizing expenses, negotiating favorable terms, and implementing strategies for cost optimization while preserving the quality of goods and services.

Compliance and Reporting

Adhering to accounting standards, legal regulations, and providing accurate, transparent, and timely financial reporting.

II. Invoice Processing

A. Invoice Receipt and Logging

Electronic and Manual Channels

We employ a dual approach for invoice receipt, utilizing electronic platforms for efficiency and manual channels for flexibility to capture all invoices promptly.

Receipt Logging System

Our organization has implemented a sophisticated system for systematic logging of received invoices, recording crucial details such as date, time, and method of receipt.

B. Verification Procedures

Three-Way Matching

We employ a rigorous verification process through a three-way matching system, comparing invoices with corresponding purchase orders and delivery receipts to ensure accuracy and control against discrepancies.

Approval Protocols

Invoices are subjected to a structured approval process involving multiple levels of scrutiny to validate the legitimacy of expenses before proceeding to payment.

C. Matching Invoices with Purchase Orders

Automated Systems

We leverage automated systems to enhance efficiency in matching invoices with purchase orders, minimizing manual errors and streamlining the process.

Handling Discrepancies

Standardized procedures are in place to facilitate swift resolution in case of discrepancies, with clear communication channels with suppliers and internal stakeholders to ensure transparency.

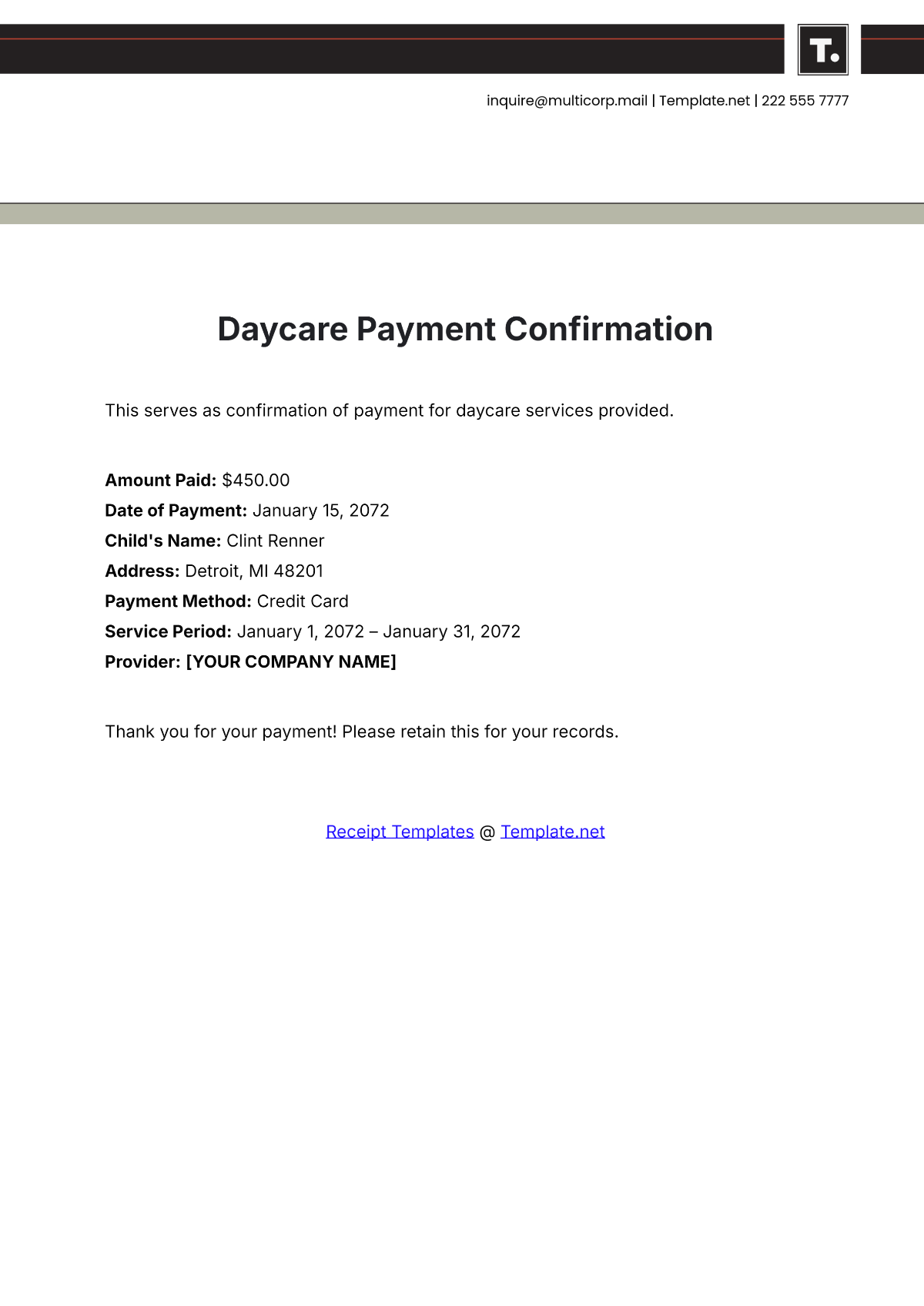

D. Receipt Confirmation and Payment Initiation

Automated Confirmation

Upon successful verification, our system generates automated confirmations, serving as a receipt acknowledgment and initiating the payment process.

Payment Scheduling

We implement a robust payment scheduling system, strategically planning payments to take advantage of early payment discounts while aligning with the overall cash flow strategy.

III. Payment Authorization

A. Approval Workflow

Hierarchical Authorization Structure

Our organization adheres to a carefully structured hierarchical approval system, delineating levels of authority for payment approvals. This framework not only ensures accountability but also aligns with our commitment to compliance with financial policies.

Thresholds for Approval

To maintain fiscal responsibility, we have established monetary thresholds, determining the level of approval required based on the amount of the payment. This strategic approach prevents delays in routine payments while maintaining heightened scrutiny for substantial financial transactions.

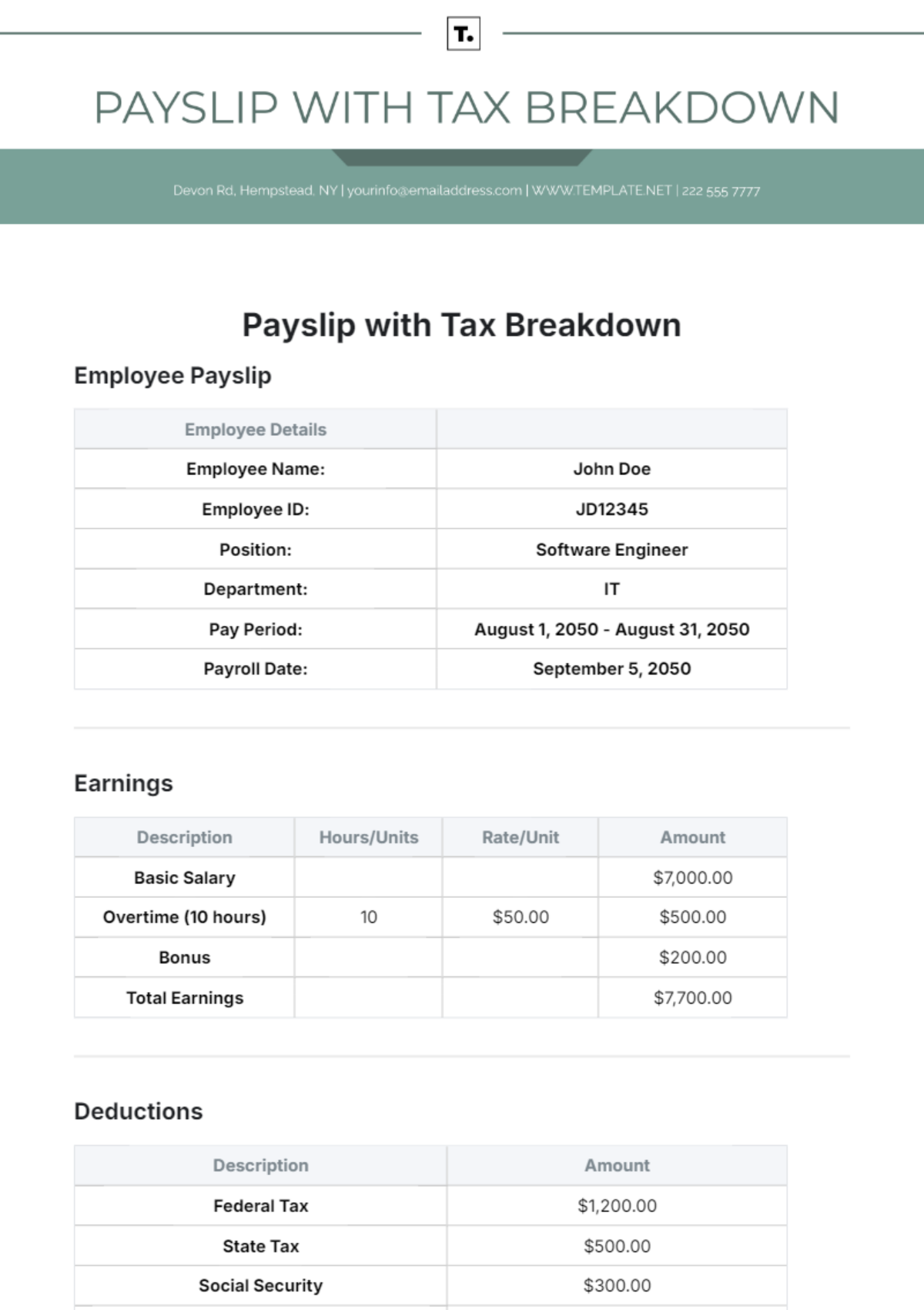

The table below illustrates the monetary thresholds for payment approval:

Threshold Range | Approval Level |

[$1 - $10,000] | [Department Manager] |

This reflects a systematic approach, ensuring that routine payments undergo efficient processing while maintaining rigorous scrutiny for significant financial transactions. The importance of setting these thresholds lies in striking a balance between operational efficiency and financial control. By categorizing payments based on amounts, we streamline routine transactions, allowing for swift processing, while simultaneously ensuring that higher-value transactions undergo thorough scrutiny. This not only enhances efficiency but also mitigates financial risks associated with larger expenditures. This strategic threshold framework aligns with our commitment to fiscal responsibility and prudent financial management.

B. Authorization Levels

Continuous Employee Training

Recognizing the critical role of well-informed employees, we emphasize continuous training for those involved in the approval process. This ongoing training ensures that personnel are proficient in financial policies and procedures, mitigating the risk of errors and unauthorized payments.

Delegation Protocols

In cases of absence or unavailability, our organization has clear delegation protocols in place to ensure a seamless flow of authorization. These protocols include:

Identification of a designated individual responsible for temporary authorization.

Clear communication to all stakeholders regarding the temporary transfer of approval responsibilities.

Periodic training and drills to ensure that designated individuals are prepared to execute authorization in the absence of primary approvers.

C. Documentation Requirements

Comprehensive Documenting

Each authorized payment is accompanied by clear documentation, providing a detailed trail of the approval process. This documentation includes the rationale for approval, enhancing transparency and accountability in our financial operations.

Robust Audit Trails

Maintaining robust audit trails is integral to our payment authorization process. These trails not only facilitate internal audits but also contribute to overall transparency, providing a comprehensive overview of the journey of each authorized payment.

IV. Expense Tracking

A. Expense Categorization

Chart of Accounts

The table below outlines categories within our Chart of Accounts:

Category | Subcategory 1 | Subcategory 2 |

[Operating Expenses] | [Office Supplies] | [Utilities] |

The data above serves as the backbone of our strategy. This is established to categorize expenses accurately. This categorization facilitates a granular understanding of resource allocation, aiding in strategic decision-making for sustainable financial practices. It provides a systematic framework for classifying and organizing expenses, ensuring accurate financial reporting and informed decision-making.

Strategic Cost Allocation

Strategies for allocating shared expenses among different departments or cost centers are implemented. This ensures that the true cost of each department's operations is accurately represented, allowing for informed resource allocation.

B. Analysis and Reporting

Utilization of Advanced Reporting Tools

Our organization employs advanced financial reporting tools to generate regular reports on expense patterns. These reports provide valuable insights into spending trends, facilitating informed decision-making for sustainable financial practices.

Monitoring Key Performance Indicators (KPIs)

The table below illustrates some key expense-related KPIs:

KPI | Formula | Target/Threshold |

[Cost per Unit] | [Total Expenses / Total Units Produced] | [$X per unit] |

These KPIs act as financial health indicators, influencing critical aspects of our business strategy. Monitoring the Cost per Unit provides insights into the cost-effectiveness of our production processes, directly influencing pricing strategies. Regular monitoring and optimization of these KPIs contribute to our financial resilience and strategic adaptability in a dynamic business landscape.

C. Strategies for Cost Optimization

Proactive Supplier Negotiations

Our organization actively engages in strategic supplier negotiations. This involves not only obtaining favorable terms but also fostering long-term partnerships that contribute to cost optimization and mutual benefits.

Continuous Process Efficiency Enhancement

Streamlining processes reduces processing costs and contributes to overall efficiency in managing expenses.

D. Supplier Relationship Management (SRM)

Implementation of SRM Strategies

SRM strategies are actively implemented to foster positive and collaborative relationships with key suppliers. This proactive approach ensures a stable supply chain, favorable terms, and mutually beneficial outcomes.

Exploration of Early Payment Discounts

Opportunities for early payment discounts are actively explored. This not only contributes to optimizing cash flow but also strengthens relationships with suppliers, creating a win-win scenario.

V. Compliance and Risk Management

A. Legal and Regulatory Compliance

Regular Compliance Audits

Our organization conducts regular audits to ensure ongoing adherence to local and international legal and regulatory standards, mitigating the risk of non-compliance and legal repercussions.

Continuous Updates on Financial Regulations

A dedicated team monitors changes in financial regulations, ensuring prompt adaptation of our accounts payable processes to remain in compliance with evolving standards.

B. Risk Mitigation Strategies

Vendor Due Diligence

Prior to engaging with new vendors, thorough due diligence is conducted to assess their financial stability, reducing the risk of disruptions due to vendor-related issues.

Implementation of Anti-Fraud Measures

Robust anti-fraud measures, including secure payment gateways and dual verification processes, are implemented to mitigate the risk of fraudulent activities in accounts payable.

C. Data Security Protocols

Encryption of Sensitive Information

All sensitive financial information within the accounts payable system is encrypted, ensuring data security and reducing the risk of unauthorized access.

Employee Training on Data Security

Continuous training programs educate employees on data security protocols, minimizing the risk of internal breaches and enhancing overall cybersecurity awareness.

VI. Technology Integration and Innovation

A. Automated Invoice Processing

Utilization of Optical Character Recognition (OCR)

OCR technology is employed for automated data extraction from invoices, reducing manual errors and enhancing the accuracy of invoice processing.

Integration with Enterprise Resource Planning (ERP) Systems

Seamless integration with ERP systems streamlines the entire accounts payable process, ensuring real-time updates and enhancing overall operational efficiency.

B. Cloud-Based Document Storage

Secure Cloud Platforms

Documents related to accounts payable are stored on secure cloud platforms, providing accessibility, scalability, and disaster recovery capabilities.

Version Control and Audit Trails

Cloud-based storage includes version control features and robust audit trails, ensuring transparency and traceability of changes made to financial documents.

C. Continuous Technological Upgrades

Regular Assessment of Technological Landscape

Our organization conducts regular assessments of emerging technologies, facilitating timely upgrades to our accounts payable systems to stay ahead of industry trends.

Employee Training on New Technologies

To maximize the benefits of technological advancements, ongoing training programs are implemented to ensure that employees are proficient in utilizing the latest features and functionalities.

VII. Continuous Improvement and Evaluation

A. Feedback Mechanisms

Continuous improvement thrives on feedback. Regularly soliciting input from stakeholders, including vendors and internal teams, allows us to pinpoint areas for enhancement and ensures a responsive and adaptive accounts payable system.

B. Benchmarking against Best Practices

Our evaluation framework includes benchmarking against industry best practices, leveraging insights from leading organizations to refine and optimize our accounts payable processes.

C. Periodic Process Audits

Conducting systematic audits at regular intervals ensures that our accounts payable procedures align with organizational goals, regulatory standards, and evolving industry requirements.

VIII. Appendices

A. Vendor Due Diligence Checklist

A detailed checklist utilized in the vendor onboarding process, ensuring a systematic and thorough assessment of potential vendors' financial stability and reliability.

B. Compliance Audit Schedule

A schedule outlining the timeline and checklist for periodic compliance audits, ensuring that our accounts payable processes consistently align with legal and regulatory standards.

Employee Training Calendar

A calendar detailing the schedule of ongoing training programs related to accounts payable processes and technologies, fostering a continuous learning environment for our staff.