Finance Invoice Compliance Document

This document serves as a comprehensive guide for creating and processing invoices at [Your Company Name], ensuring that they comply with legal, regulatory, and organizational standards. Adherence to these guidelines is imperative for maintaining the integrity of our financial records and facilitating efficient transactions.

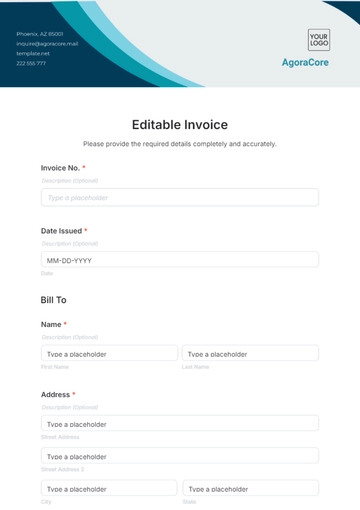

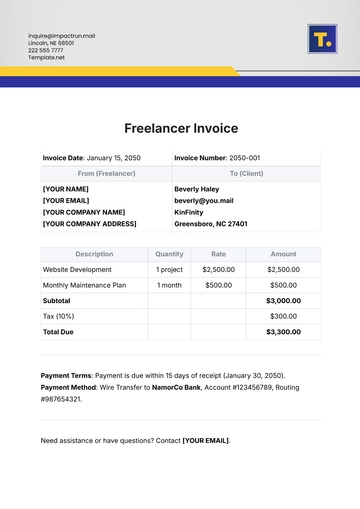

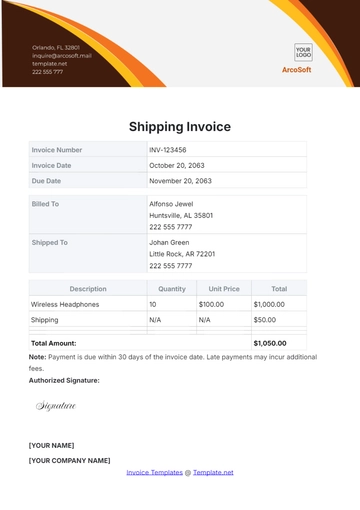

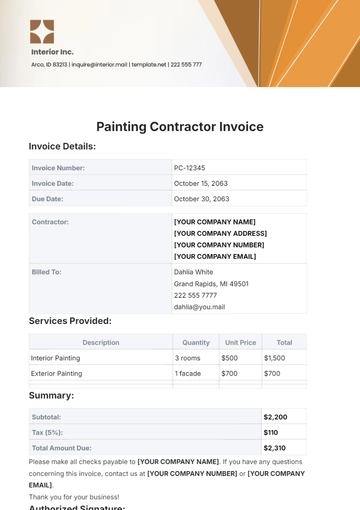

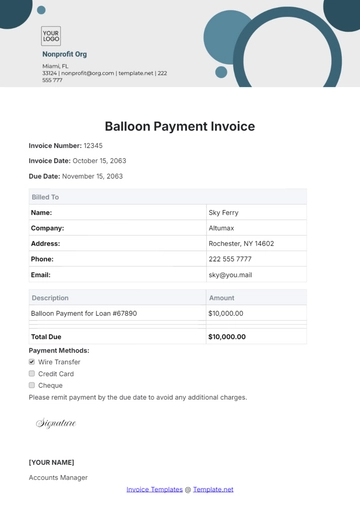

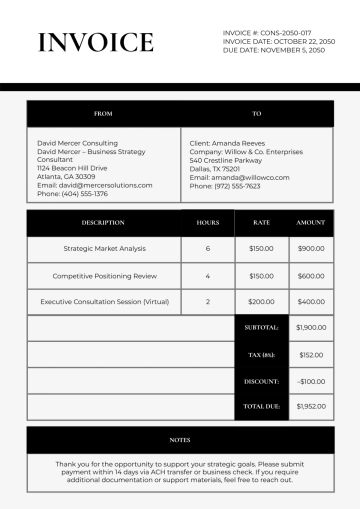

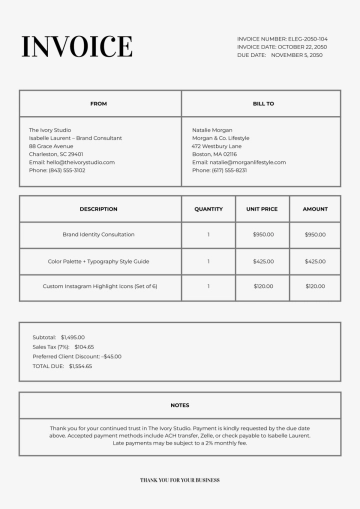

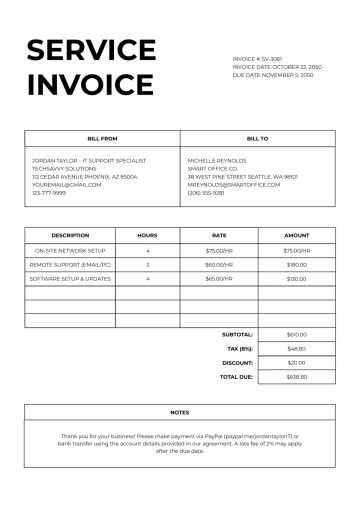

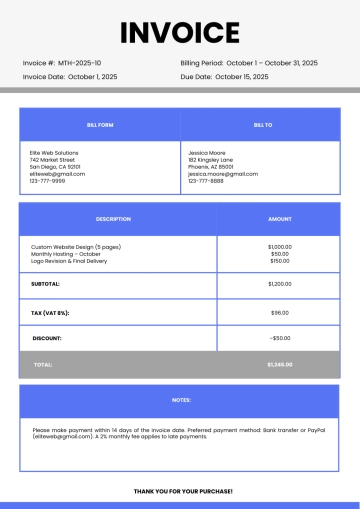

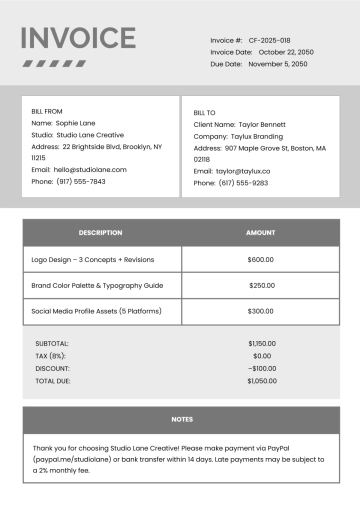

Vendor Information

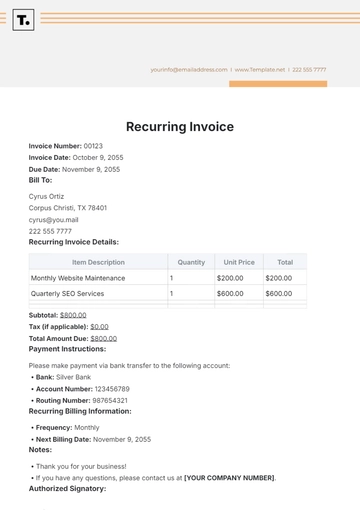

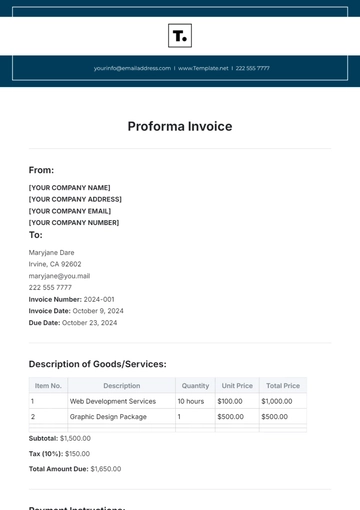

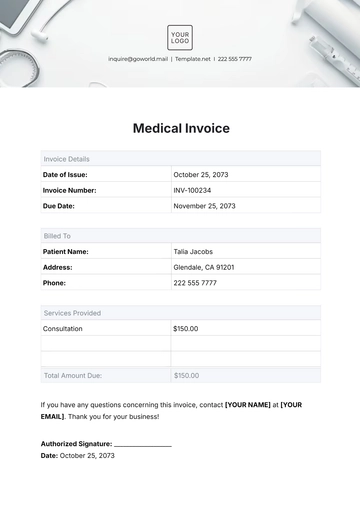

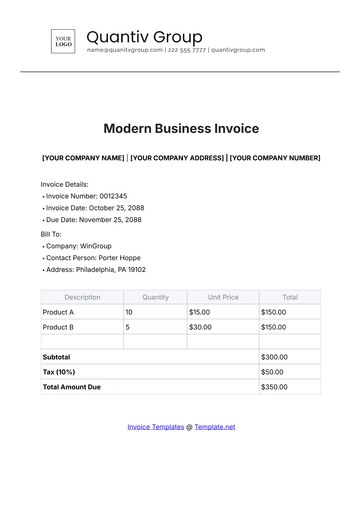

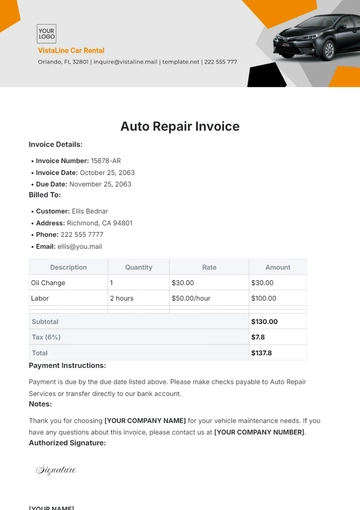

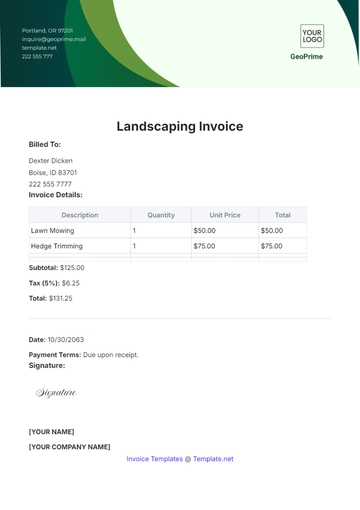

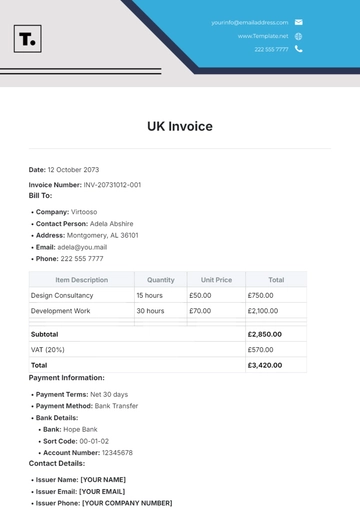

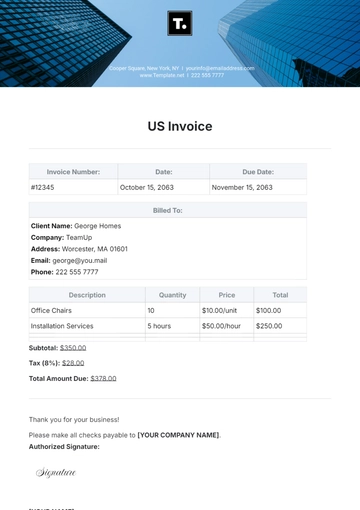

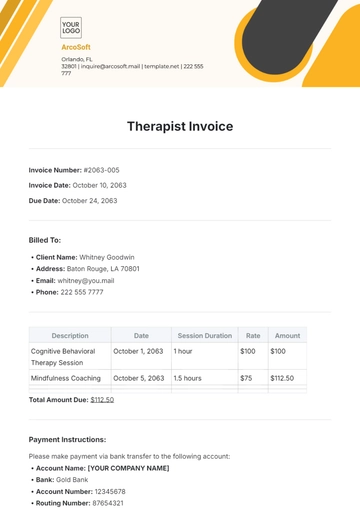

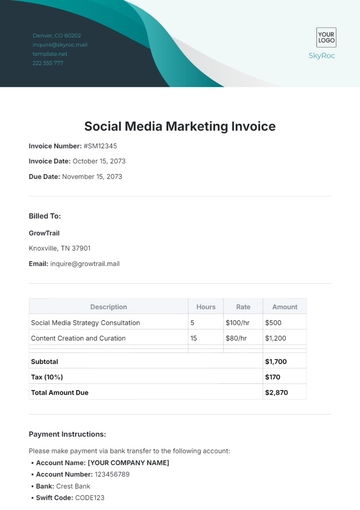

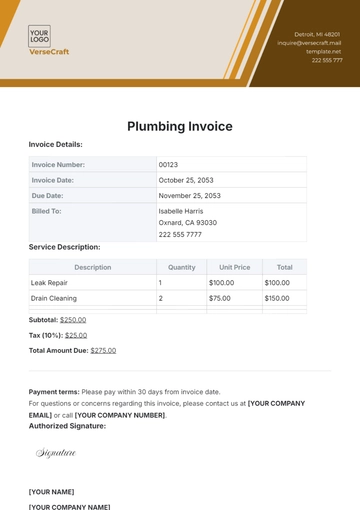

Every invoice must include the full name and address of the vendor, along with their contact details such as phone number and email address. The vendor's tax identification number or VAT number should also be clearly stated. This information is crucial for legal and financial transparency and for future communications.

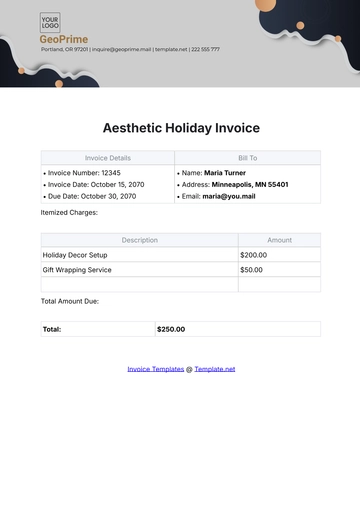

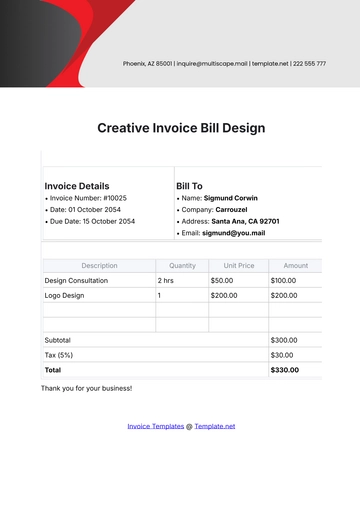

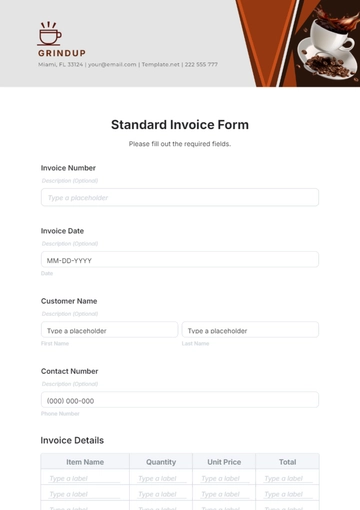

Customer Information

The invoice should accurately reflect [Your Company Name] as the customer, including our full name and address. It should specify the department or individual responsible for ordering the goods or services, along with their contact information. This ensures proper internal tracking and accountability.

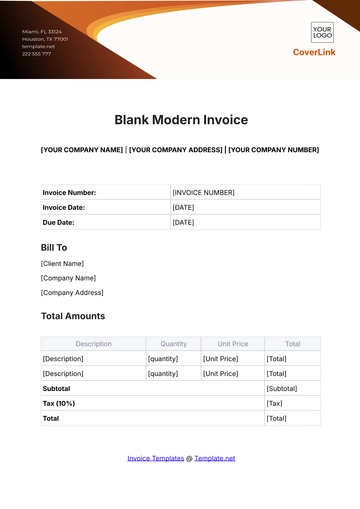

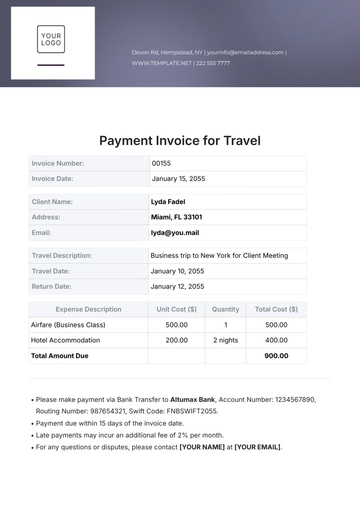

Invoice Details

Each invoice must have a unique invoice number and the date of issuance. It should contain a clear, detailed description of the goods or services provided, which is essential for verifying the transaction and for internal audits.

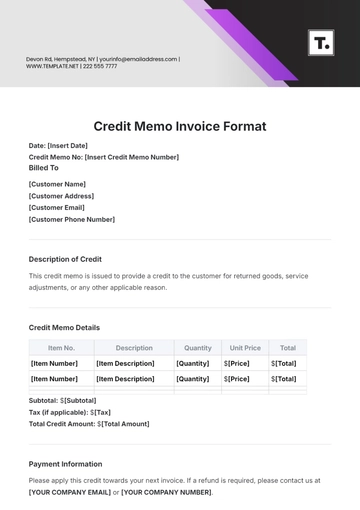

Payment Terms

The payment terms section should outline the due date for payment, acceptable methods of payment, and any details regarding late payment fees or discounts for early payments. These terms must be agreed upon in advance and clearly communicated to avoid misunderstandings.

Pricing and Taxation

The invoice must provide a detailed breakdown of the costs associated with the goods or services, including unit prices and quantities. It should clearly state any applicable taxes, such as sales tax or VAT, and the total invoice amount, inclusive of these taxes.

Legal and Regulatory Requirements

Invoices must comply with relevant industry standards or regulations. This section should include any necessary legal disclosures, contractual terms, or compliance statements. Where required, invoices should also feature signatures or electronic authorizations to validate their authenticity.

Additional Supporting Information

To further validate the transaction, the invoice might reference related purchase order numbers, contracts, or delivery notes. Including such supporting documentation or references enhances the traceability and verification of the transaction.