Finance Audit Software User Guide

Table of Contents

I. Getting Started with the Software

II. Data Entry and Management

A. Entering Financial Data

B. Organizing Data

III. Running Audits and Generating Reports

A. Initiating Audits

B. Generating Reports

IV. Internal Controls and Compliance Features

A. Using Internal Control Functionalities

B. Compliance Monitoring

V. Troubleshooting and Support

A. Common Issues and Solutions

B. Technical Support

I. Getting Started with the Software

Introduction to Interface: The user interface of the Finance Audit Software is designed for ease of navigation and efficiency. The dashboard provides a quick overview of current audits, recent activities, and pending tasks. The data entry section is streamlined for entering financial transactions, categorized by type for simplicity.

The report generation panel allows you to create custom reports with just a few clicks. The settings area is your control center for personalizing the software experience, including theme and notification preferences. Familiarizing yourself with these key areas will significantly enhance your proficiency with the software.

Setting Up User Accounts: Creating a user account in the Finance Audit Software is a straightforward process. Access the 'Settings' panel and navigate to 'User Management.' Here, you can 'Add New User' and enter essential information like name, email, and department. Crucially, you'll assign roles – such as Auditor, Manager, or Administrator – which determine the user's access level and capabilities within the software.

This role-based access control is essential for maintaining the integrity and security of your financial data. Once the details are filled in, the new user will receive an email with login credentials and instructions.

Configuring Initial Settings: Configuring the initial settings of the Finance Audit Software is vital for a customized and effective auditing experience. Start by setting up default financial periods – this could be monthly, quarterly, or yearly, depending on your company's reporting cycle. Next, customize the audit types – for instance, operational, compliance, or financial audits – that reflect the nature of your organization's activities. Finally, set up compliance checklists based on the specific regulations and standards applicable to your industry. These checklists will be a guiding framework for all your auditing activities, ensuring consistency and compliance.

II. Data Entry and Management

This section of the Finance Audit Software User Guide focuses on the crucial tasks of entering and managing financial data. Efficient data entry and organization are fundamental for accurate audits and financial reporting. The software provides user-friendly features for these tasks, ensuring data integrity and ease of access.

A. Entering Financial Data

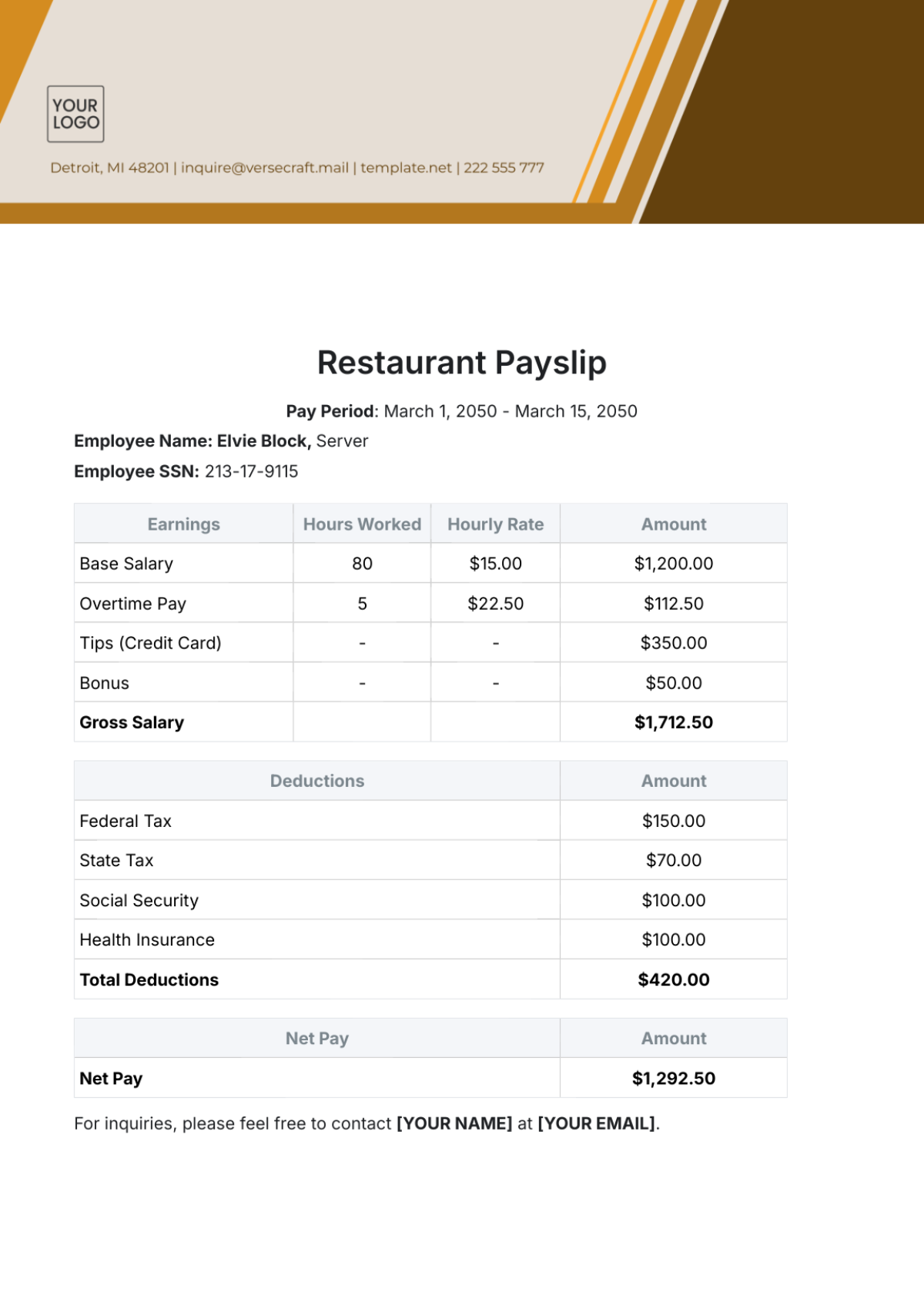

The 'Data Entry' module of our software is streamlined for accuracy and ease. Once you access it from the main menu, you'll find categories like expenses, revenues, assets, and liabilities.

Each category has a tailored input form where you can enter relevant details such as amounts, dates, and descriptions. For instance, when recording expenses, you can input the amount, and vendor information, and attach receipts.

The software also allows for bulk data entry using templates, which is particularly useful for entering repetitive transactions like monthly utility bills or regular vendor payments. This module is designed to minimize errors, with features like auto-calculation of totals and validation checks to ensure that all necessary fields are filled.

B. Organizing Data

Efficient organization of financial data is key to a successful audit process. Our software offers robust tagging and categorization features that allow you to classify data in a way that aligns with your audit objectives.

Tags can be customized for specific projects, such as 'Year-End Audit 20XX' or 'Q1 Tax Preparation', enabling quick retrieval of relevant data. Categorization allows you to group related transactions, such as classifying all utility expenses under a 'Utilities' category.

These features not only enhance the efficiency of the audit process but also simplify the task of report generation, as data can be easily filtered and sorted based on tags and categories. Regular use of these organization tools can significantly streamline the audit workflow and reduce the time spent searching for specific transactions.

III. Running Audits and Generating Reports

This section details the procedures for initiating audits and generating reports using the Finance Audit Software at [Your Company Name]. These processes are crucial for ensuring comprehensive audits and extracting meaningful insights from financial data.

A. Initiating Audits

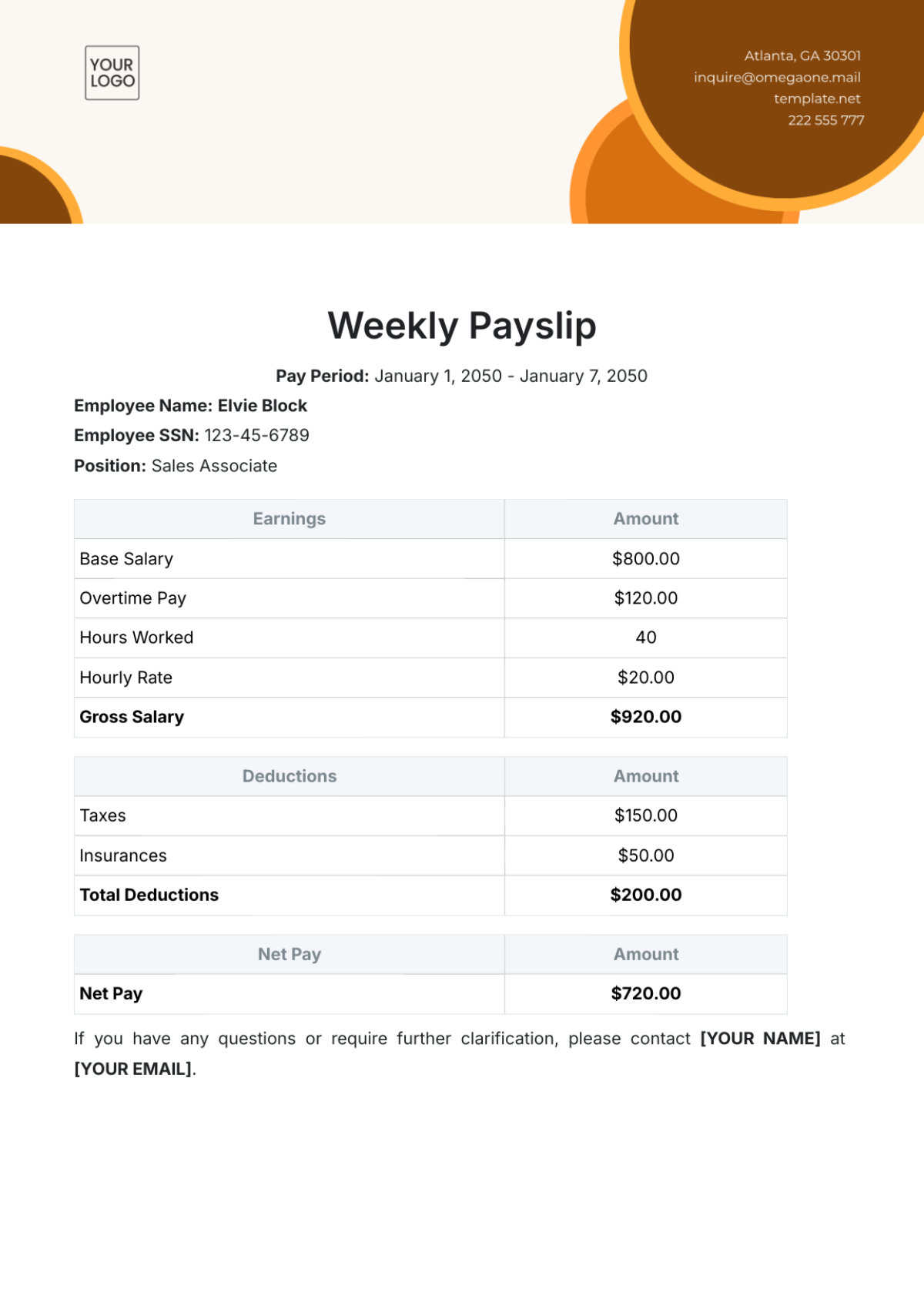

To start an audit, select 'New Audit' from the 'Audit' menu. Choose the audit type, define the scope, and select the financial period.

Action | Description |

Select 'New Audit' | Navigate to the 'Audit' menu and click on 'New Audit'. |

Choose Audit Type | Select the type of audit you wish to conduct (e.g., Operational, Financial, Compliance). |

Define Audit Scope | Specify the scope of the audit, including which departments, transactions, or processes will be audited. |

Select Financial Period | Choose the financial period for the audit (e.g., Q1 2050, FY 2050). |

Confirm and Start Audit | Review your selections and click 'Start Audit' to begin the auditing process. |

B. Generating Reports

After completing an audit, generate reports by selecting 'Report Generation.' Choose the type of report, specify parameters, and click 'Generate.' Reports can include compliance summaries, financial analyses, or detailed audit findings.

Action | Description |

Access Report Generation | After completing an audit, go to 'Report Generation' in the menu. |

Choose Report Type | Select the type of report needed (e.g., Compliance Summary, Financial Analysis). |

Specify Parameters | Set parameters such as date range, departments, and specific financial metrics. |

Generate Report | Click on 'Generate' to create the report based on the specified parameters |

Review and Export | Review the generated report for accuracy and export it in the desired format (e.g., PDF, Excel). |

IV. Internal Controls and Compliance Features

This section of the Finance Audit Software User Guide focuses on utilizing internal control functionalities and monitoring compliance effectively. These features are crucial for maintaining financial integrity and ensuring regulatory adherence at [Your Company Name].

A. Using Internal Control Functionalities

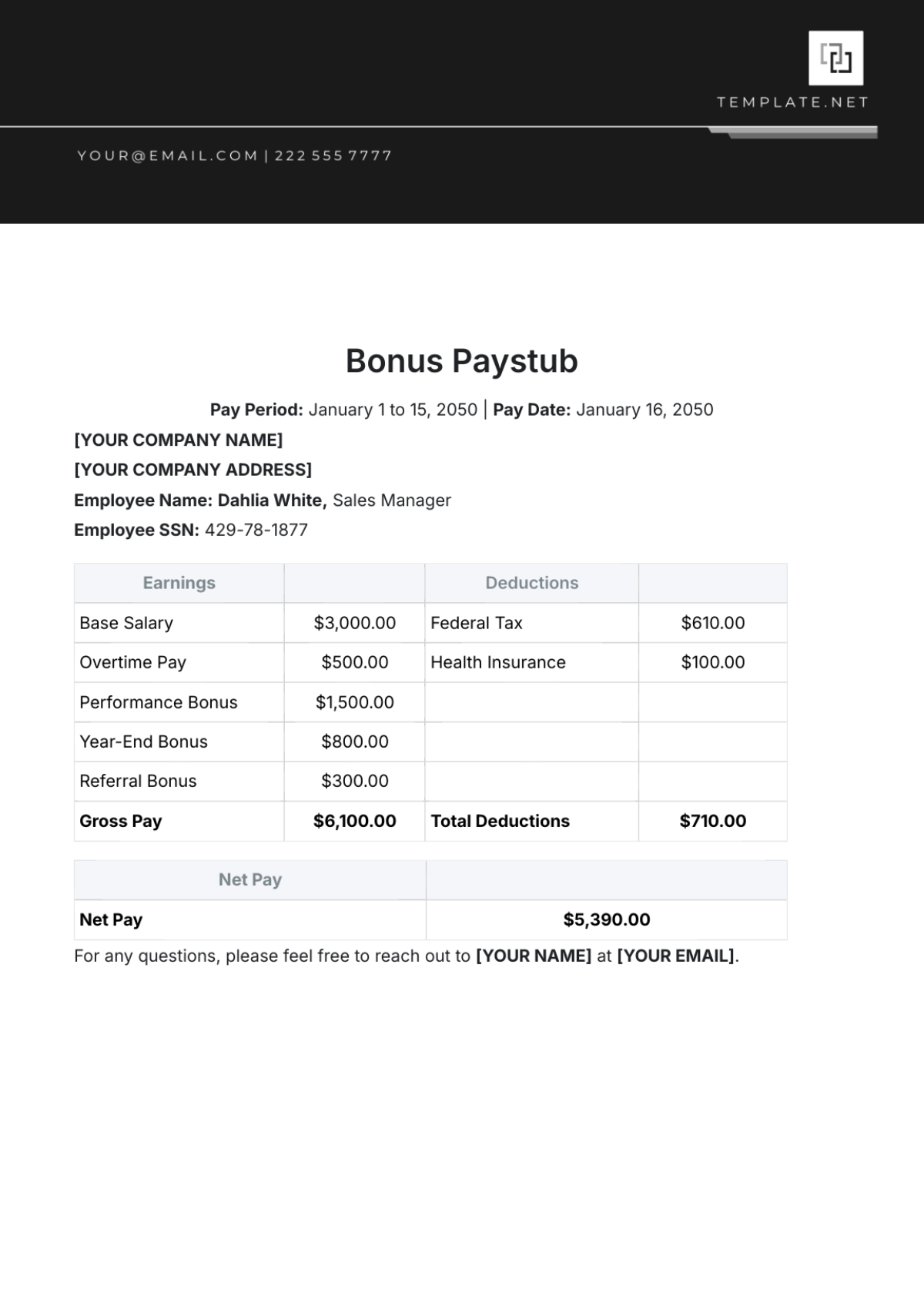

Leverage built-in internal control tools to monitor transactions and flag anomalies. Set control thresholds and alert parameters in the 'Controls' menu.

Functionality | Advantage/Use |

Duplicate Transaction Detection | Automatically flags duplicate entries, preventing overstatement of expenses or revenues. |

Authorization Controls | Ensures transactions above a certain threshold are approved by authorized personnel, enhancing oversight. |

Budget Variance Alerts | Notifies when expenditures exceed the allocated budget, facilitating prompt corrective action. |

Fraud Detection Algorithms | Identifies patterns indicative of fraudulent activity, reducing financial risk. |

Account Reconciliation Tools | Simplifies the process of reconciling bank statements with ledger entries, ensuring accuracy. |

Automated Audit Trails | Maintains records of all transaction changes, providing transparency and traceability. |

Real-Time Financial Analysis | Offers instant financial insights, enabling proactive decision-making. |

Vendor Management Controls | Monitors vendor transactions for anomalies or deviations from standard practices. |

Employee Expense Monitoring | Tracks employee expenses against policy compliance, highlighting discrepancies. |

Regulatory Compliance Checks | Regularly updates to reflect changes in financial regulations, ensuring ongoing compliance. |

B. Compliance Monitoring

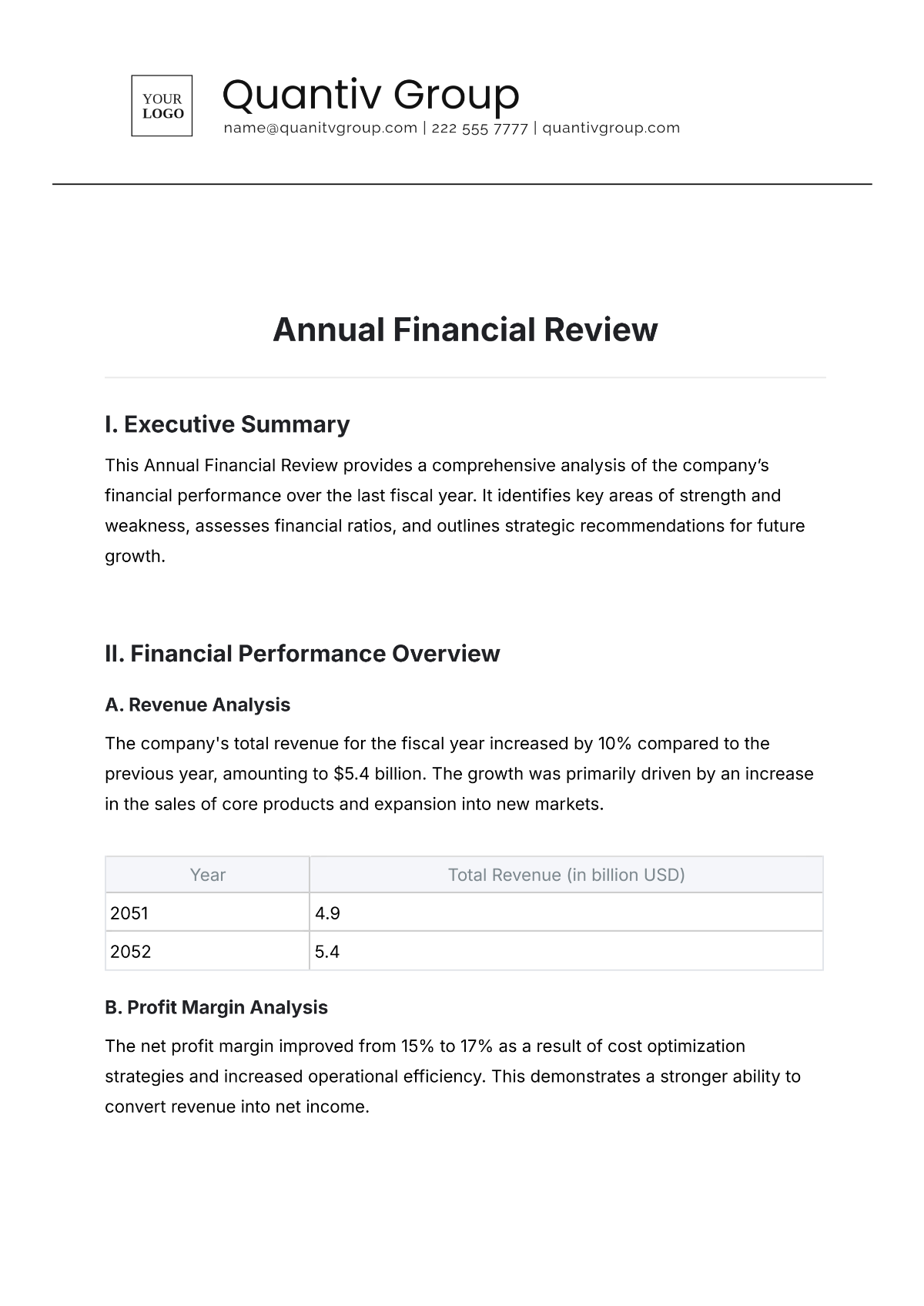

The software automatically checks for compliance with financial regulations. Access the compliance dashboard to view real-time compliance statuses and receive alerts for any discrepancies.

Monitoring Method | Description | Sample Real-Time Status |

Tax Law Adherence | Checks transactions for compliance with current tax laws. | "All transactions compliant as of [Date/Time]." |

Financial Reporting Standards | Ensures financial reports adhere to GAAP or IFRS standards. | "GAAP compliance: 100% as of [Date/Time]." |

Employee Compensation Regulations | Monitors adherence to minimum wage and overtime pay laws. | "No discrepancies in employee compensation as of [Date/Time]." |

Data Protection Compliance | Verifies compliance with data protection laws like GDPR. | "GDPR compliance check: Passed as of [Date/Time]." |

Anti-Money Laundering Checks | Screens transactions for potential money laundering activities. | "AML check: No suspicious activity detected as of [Date/Time]." |

V. Troubleshooting and Support

This section of the Finance Audit Software User Guide is dedicated to assisting users in resolving common issues and accessing technical support. It's essential to understand these resources to maintain uninterrupted, efficient use of the software at [Your Company Name].

A. Common Issues and Solutions

In the software, the 'Help' section is a comprehensive resource for troubleshooting. For instance, login problems are often resolved by checking your network connection or resetting your password using the provided link. If you encounter data syncing errors, a simple solution can be to check for software updates or restart the application.

For difficulties in report generation, ensure that all required fields are correctly filled and that your data filters are set appropriately. This section also includes step-by-step guides and FAQs to help you navigate through common operational challenges independently, allowing for quick and efficient problem resolution.

B. Technical Support

For more complex issues or personalized assistance, the 'Support' tab in the software connects you directly to our dedicated IT support team. This team is available during business hours via email, phone, or live chat, providing timely and expert help. When contacting support, it's helpful to have detailed information about the issue, including any error messages and the steps leading up to the problem. This allows our team to diagnose and resolve your issue more effectively. In addition, we offer periodic training sessions and webinars to help users stay updated on new features and best practices for using the software.

Understanding these troubleshooting and support mechanisms ensures that the finance team at [Your Company Name] can efficiently resolve any issues that arise and effectively utilize the Finance Audit Software to its full potential. This guidance is crucial for maintaining productivity and ensuring the reliability of your financial auditing processes.