Finance Credit SWOT Analysis

Introduction

A. Overview

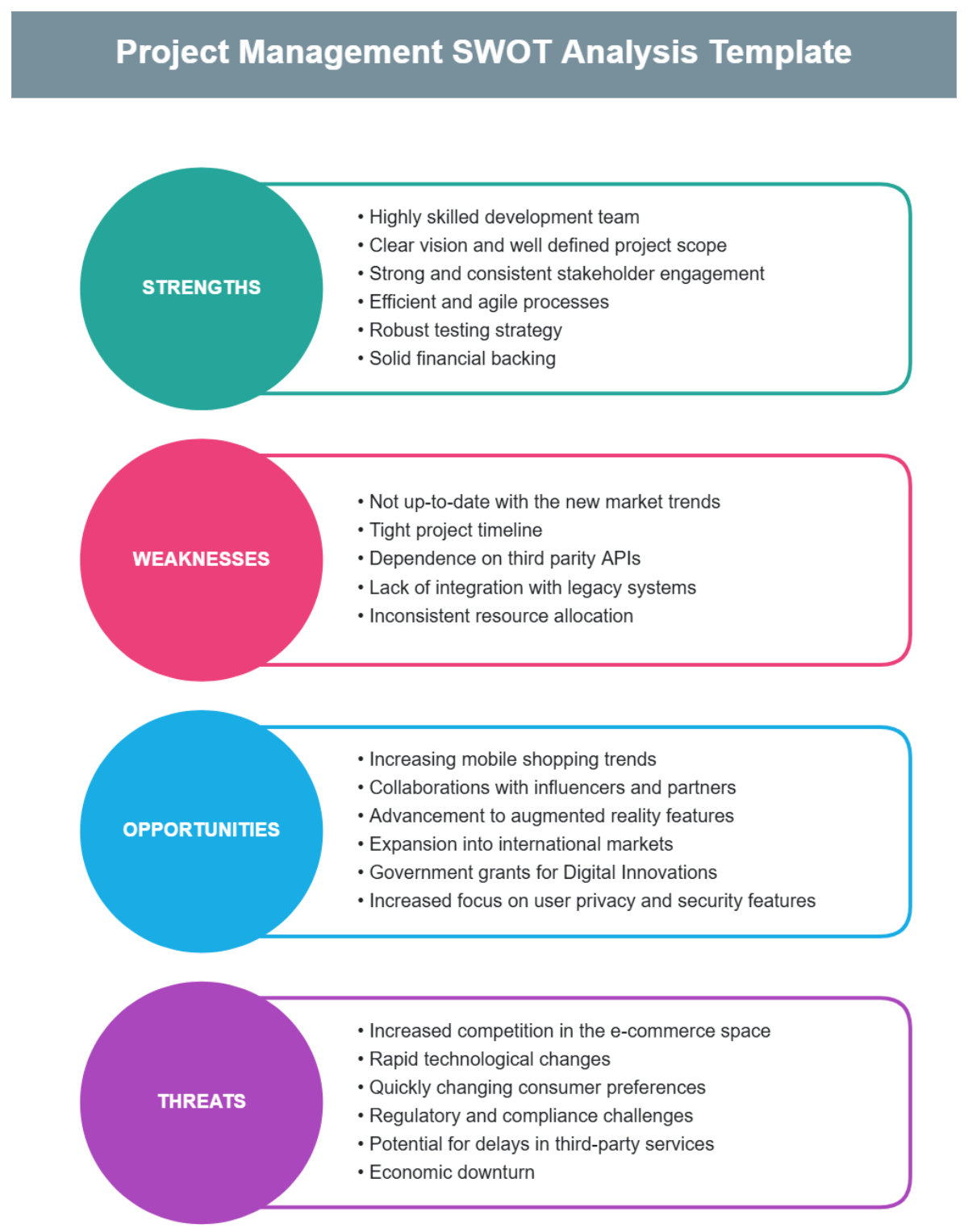

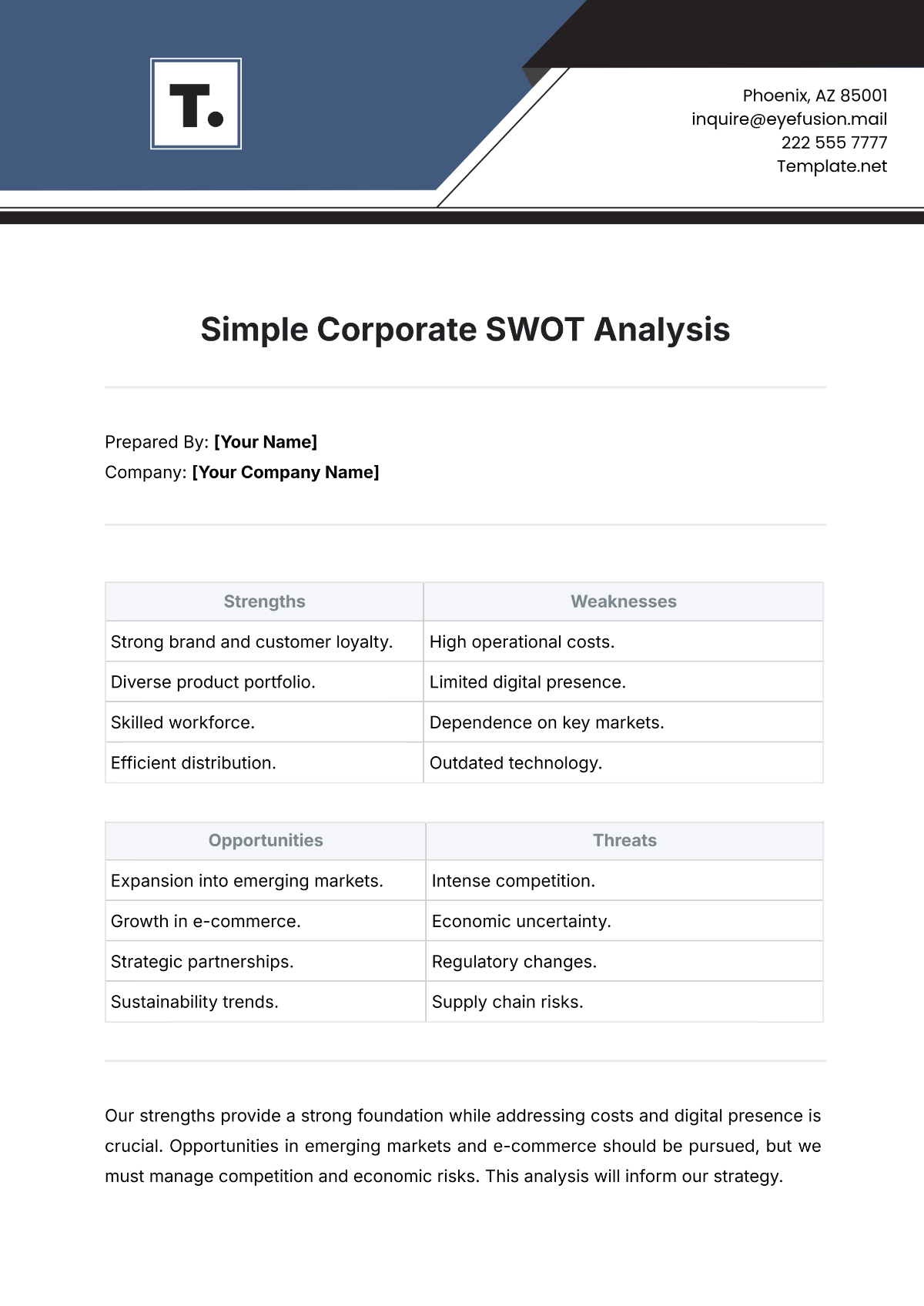

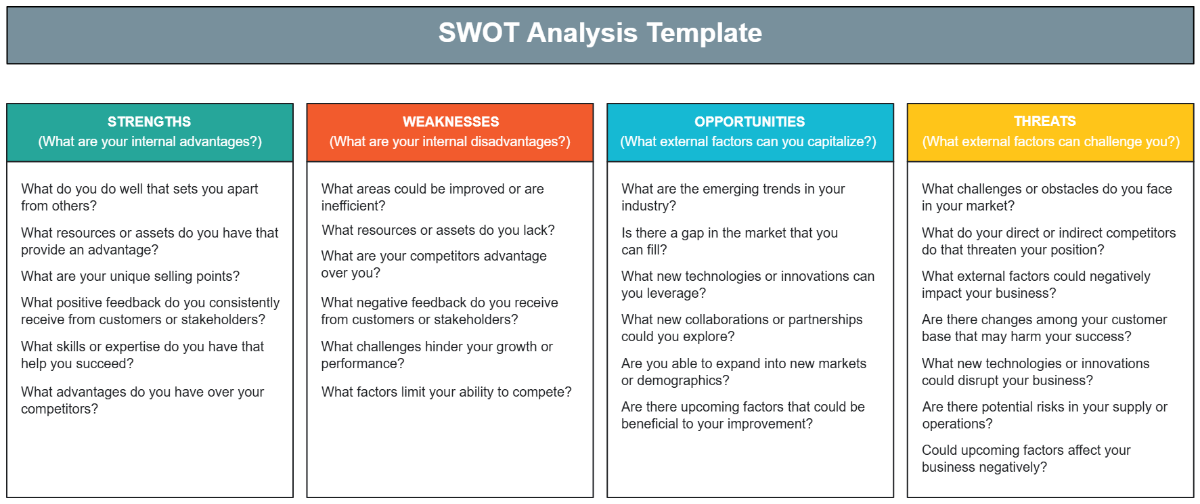

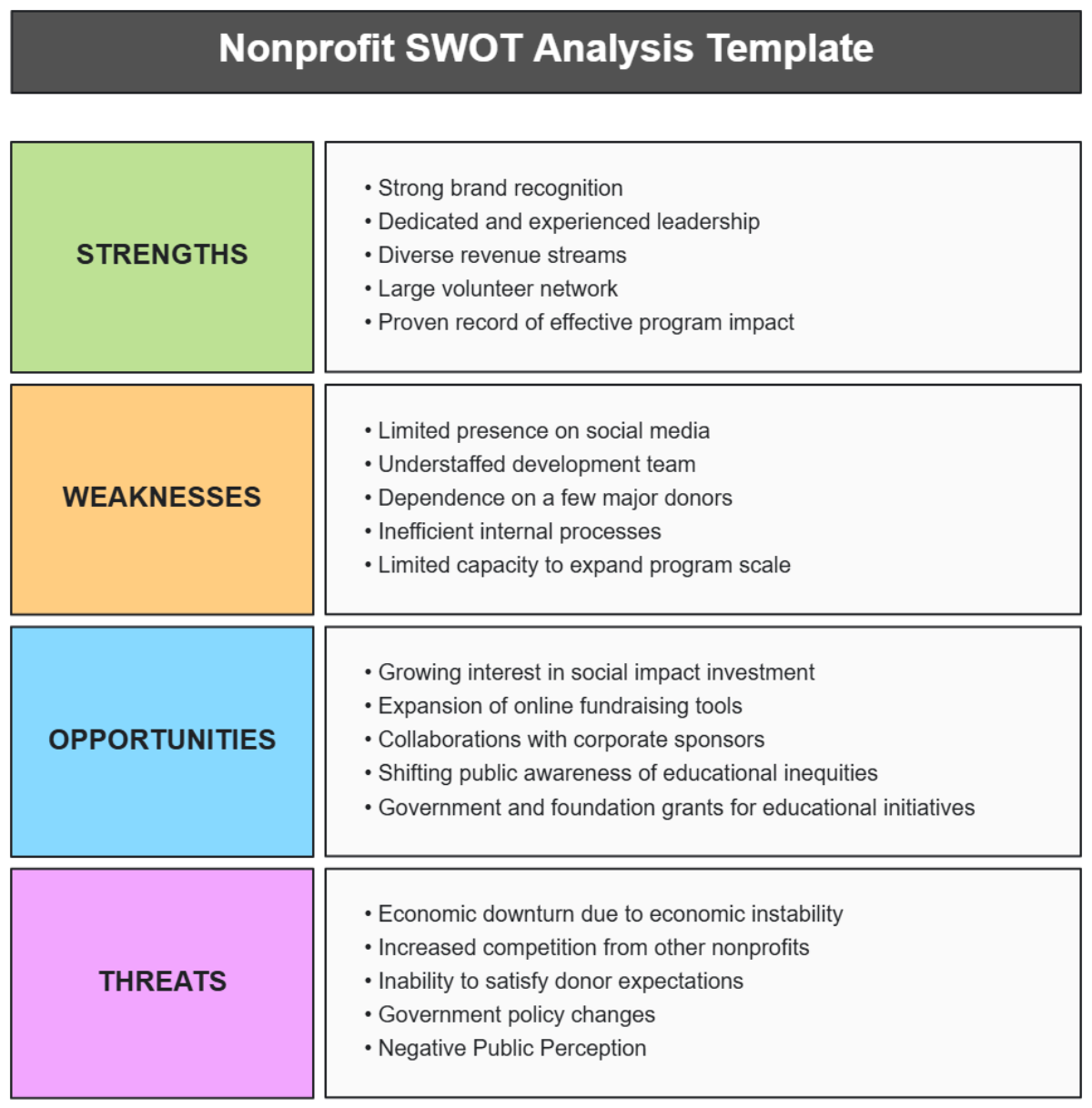

[Your Company Name] recognizes the imperative of conducting a comprehensive SWOT analysis for its finance credit operations. This analysis aims to provide a strategic assessment of internal strengths and weaknesses, as well as external opportunities and threats, to guide informed decision-making. By gaining insights into these factors, [Your Company Name] can position itself advantageously and navigate the ever-evolving financial ecosystem.

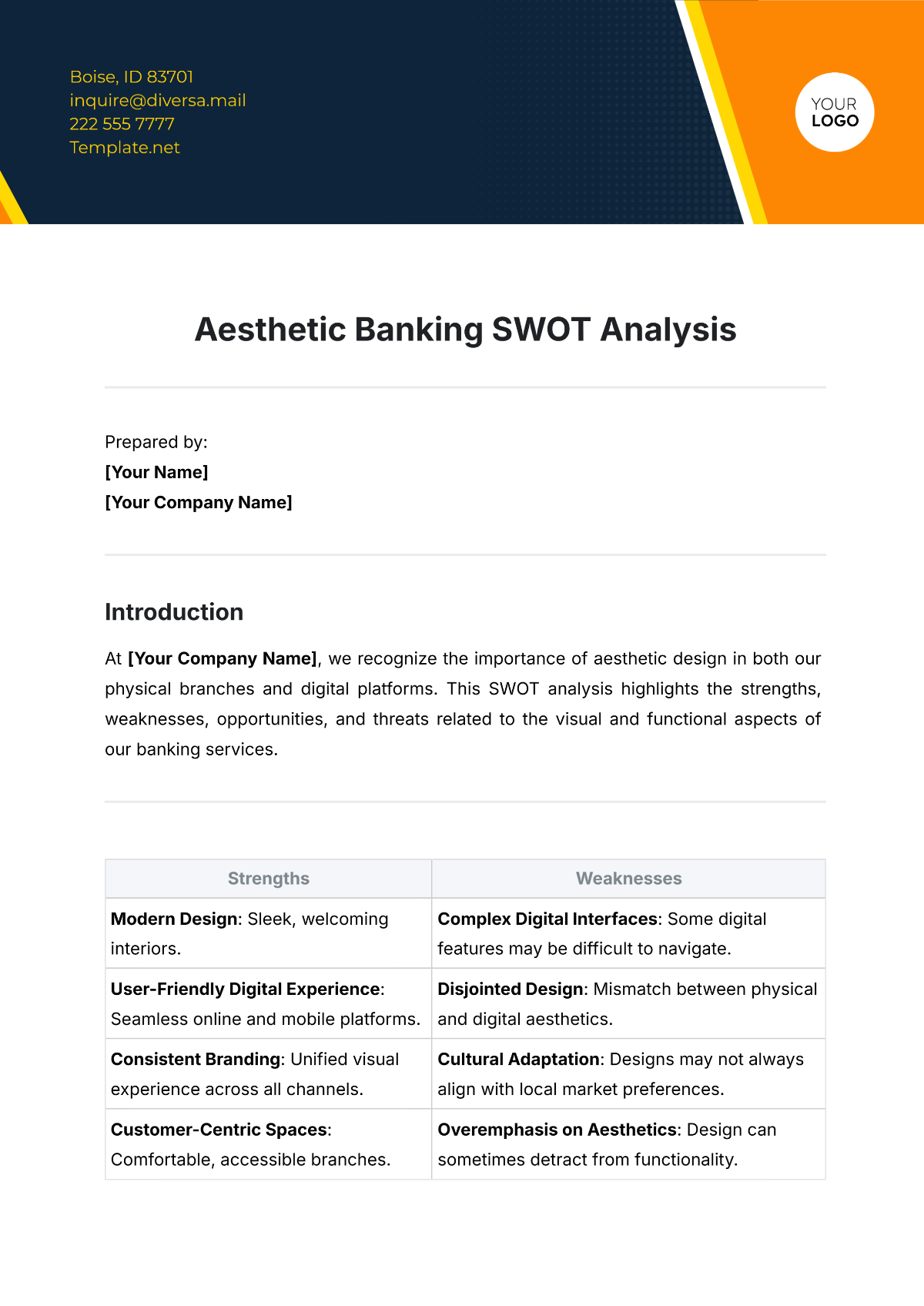

Strengths

A. Established Reputation

[Your Company Name] takes pride in its longstanding and robust reputation within the finance credit sector. With a history of [15 years] in the industry, our company has consistently delivered reliable financial solutions to our diverse customer base. Customer satisfaction surveys reveal an impressive Customer Satisfaction Score (CSAT) of [90%], underscoring the trust and confidence our clients place in [Your Company Name]. Additionally, our [500,000] social media followers on [Your Company Social Media] signify a strong online presence and engagement within the community.

B. Advanced Technology

At the forefront of innovation, [Your Company Name] leverages cutting-edge technology to enhance its finance credit operations. Our proprietary AI algorithms facilitate efficient credit assessments, enabling quicker and more accurate decision-making. The integration of blockchain technology ensures the security and transparency of financial transactions. By consistently embracing technological advancements, [Your Company Name] maintains a competitive edge in delivering modern and reliable financial services.

C. Diverse Product Portfolio

[Your Company Name] boasts a diverse product portfolio that caters to the varied needs of our clients. From traditional loans to credit cards and other financial instruments, our comprehensive offerings provide flexibility and accessibility. The array of financial products positions [Your Company Name] as a one-stop solution for individuals and businesses seeking a range of credit options. This diversity not only meets the evolving demands of our clients but also fosters customer loyalty and retention.

Weaknesses

A. Limited Geographic Presence

While [Your Company Name] has established a robust presence in several key markets, there remains an opportunity for geographical expansion. Currently operating primarily in the Midwest and Northeast regions of the United States, [Your Company Name] has identified untapped markets in the Southeast and Southwest. The limited presence in these regions accounts for [10%] of our potential market share. A strategic plan for expansion is crucial to capitalize on these opportunities and strengthen [Your Company Name]'s position in the broader finance credit market.

B. Dependency on External Factors

The finance credit sector is inherently influenced by external factors such as regulatory changes, economic conditions, and interest rate fluctuations. [Your Company Name] acknowledges its dependency on these factors and the potential impact on credit operations. Developing contingency plans, closely monitoring regulatory developments, and implementing risk mitigation strategies are essential steps to address this weakness and ensure resilience in the face of external uncertainties.

C. Customer Service Challenges

Customer service, while generally strong, has encountered challenges identified through customer feedback and support ticket analysis. The average response time to customer queries is [24 hours], which falls slightly below industry standards. [Your Company Name] is committed to enhancing customer service by implementing a more efficient ticketing system and investing in additional customer support staff to reduce response times and elevate overall customer satisfaction.

Opportunities

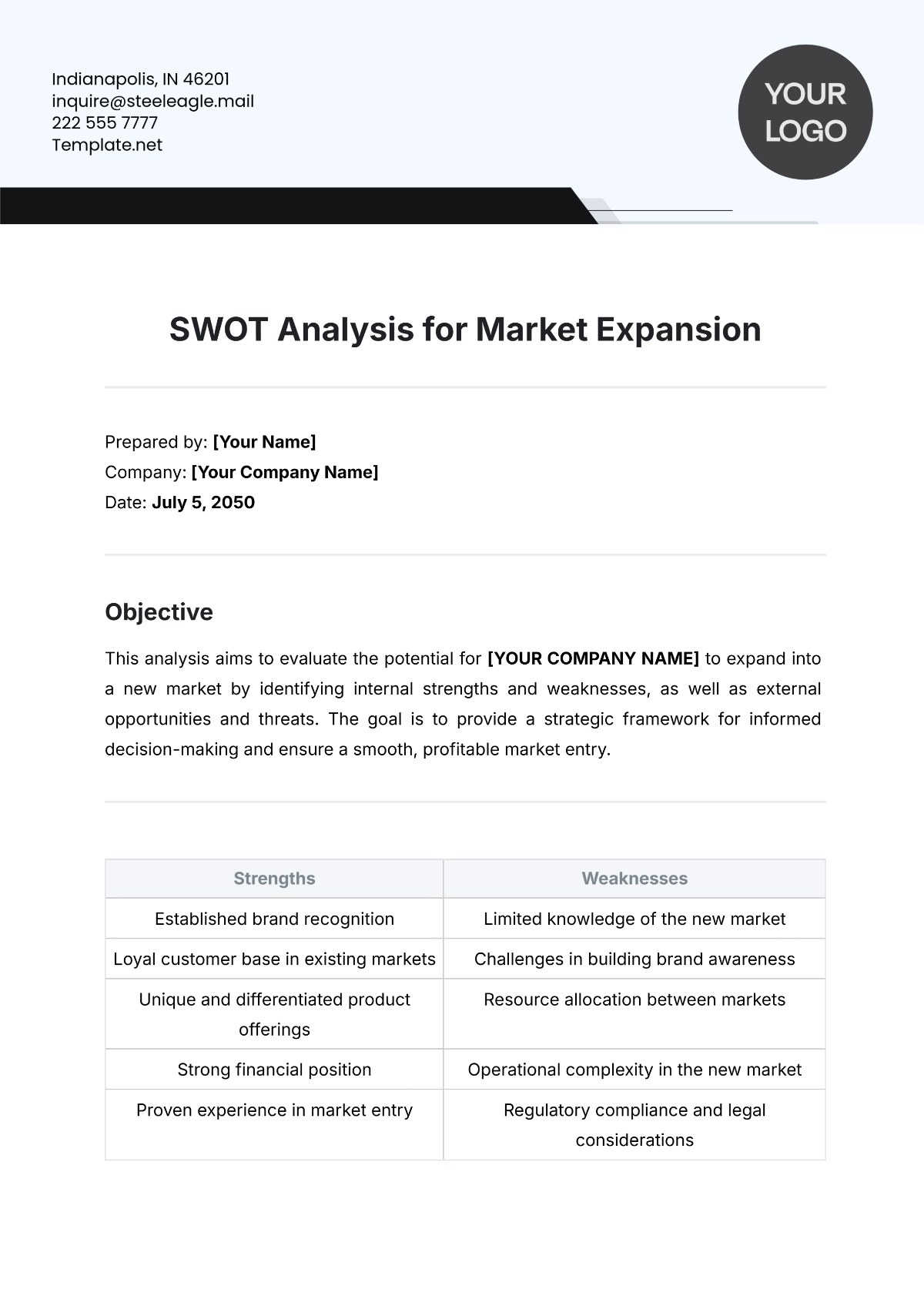

A. Market Expansion

[Your Company Name] recognizes the immense potential for market expansion beyond its current geographic reach. By entering the Southeast and Southwest regions, where demand for finance credit services is high, [Your Company Name] aims to capture an additional [15%] of the market share, translating to an estimated [$10 million] in revenue. This expansion aligns with [Your Company Name]'s growth strategy and ensures a more diversified and resilient portfolio.

B. Technological Advancements

The rapid evolution of financial technology presents [Your Company Name] with exciting opportunities. Embracing innovations such as digital wallets, mobile banking apps, and other fintech solutions can enhance customer experiences, streamline processes, and attract tech-savvy consumers. By allocating resources to research and development, [Your Company Name] aims to stay at the forefront of technological advancements, ensuring a competitive edge in the ever-changing financial landscape.

C. Collaborations with Partner Companies

Strategic collaborations with [Your Partner Company Name] offer promising opportunities for synergies in finance credit services. By leveraging the expertise of [Your Partner Company Name] in their specific industry, [Your Company Name] aims to create innovative financial products and broaden its customer base. Joint marketing initiatives and shared resources can result in a win-win scenario, driving growth for both entities.

Threats

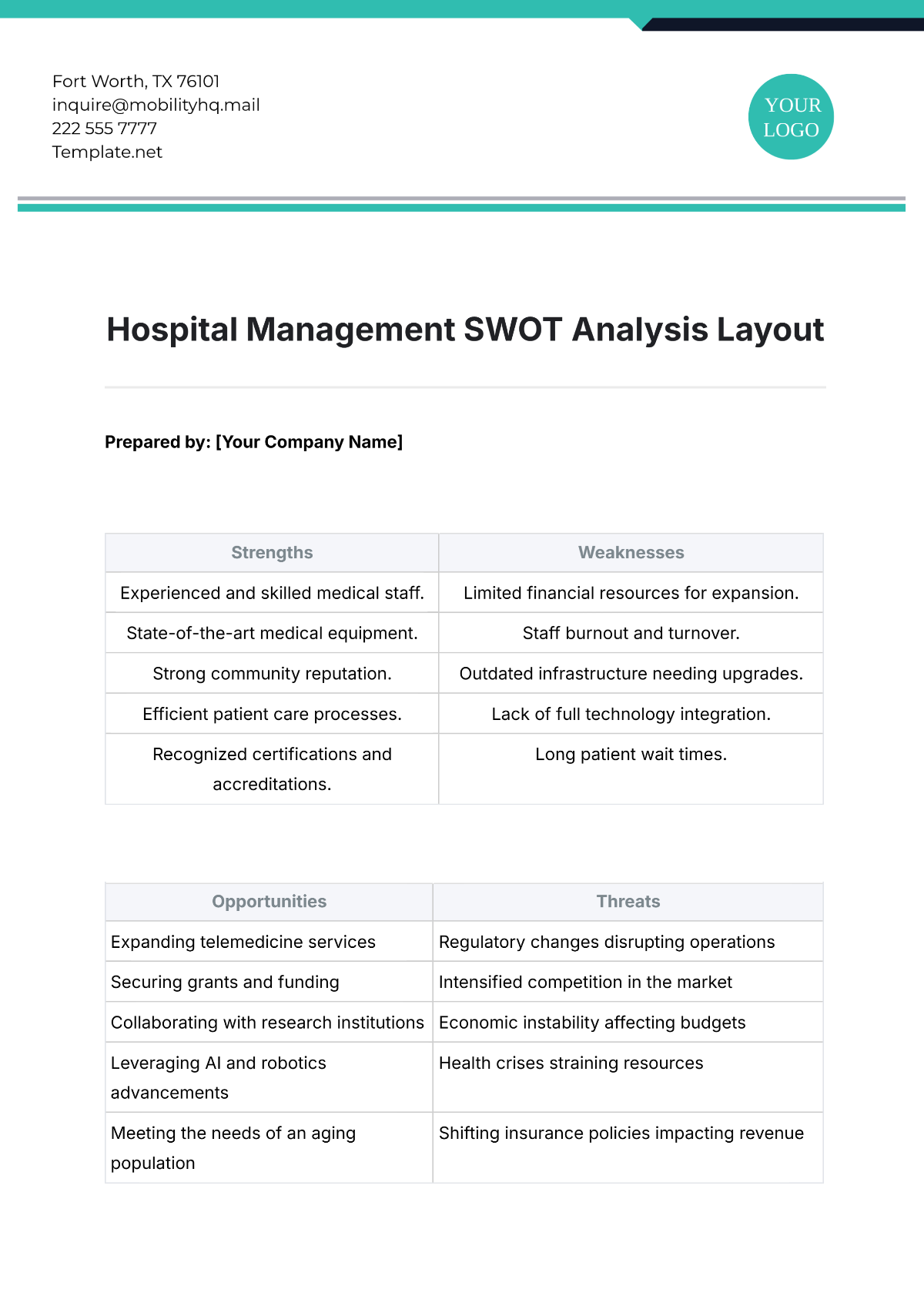

A. Regulatory Changes

The finance credit sector is susceptible to regulatory changes that can significantly impact [Your Company Name]'s operations. Recent legislative developments indicate a trend towards stricter lending regulations. [Your Company Name] will actively monitor and adapt to these changes to ensure compliance. Implementing regular training programs for staff and maintaining a proactive dialogue with regulatory bodies will be pivotal in navigating this threat effectively.

B. Economic Downturn

The potential for an economic downturn poses a significant threat to the finance credit industry. [Your Company Name] recognizes the importance of stress testing its portfolios to assess vulnerability to economic fluctuations. By diversifying credit products and enhancing risk management protocols, [Your Company Name] aims to mitigate the impact of economic downturns, ensuring financial stability and continued service to clients.

C. Intense Competition

The finance credit sector is highly competitive, with numerous players vying for market share. [Your Company Name] faces intense competition from both traditional financial institutions and emerging fintech companies. Conducting regular competitor analyses, refining marketing strategies, and differentiating our services through innovative offerings will be essential to maintain and expand [Your Company Name]'s market position.

Innovation Strategies

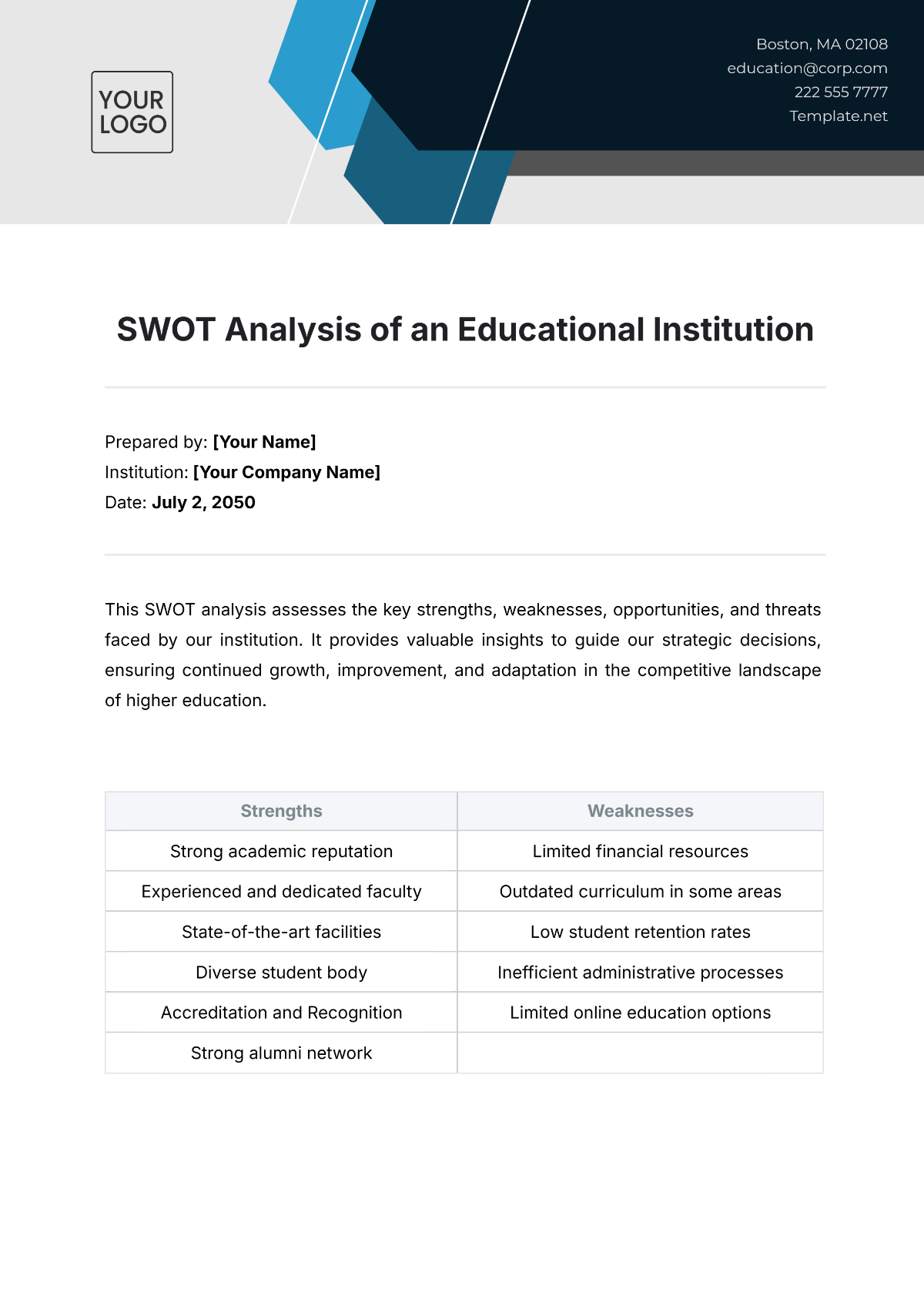

A. Technology Integration

Recognizing the fast-paced evolution of financial technology, [Your Company Name] is committed to a comprehensive technology integration strategy. This involves continuous investment in research and development to explore emerging technologies such as artificial intelligence and machine learning. By enhancing our systems with predictive analytics, [Your Company Name] aims to optimize credit risk assessments, improve decision-making processes, and stay at the forefront of innovation within the finance credit sector.

B. Customer-Centric Solutions

In response to evolving customer expectations, [Your Company Name] is dedicated to developing customer-centric financial solutions. This includes personalized credit products tailored to individual needs, streamlined application processes through user-friendly interfaces, and enhanced digital experiences. By prioritizing customer satisfaction and understanding their unique requirements, [Your Company Name] aims to strengthen customer loyalty, drive positive reviews, and increase market share.

Environmental, Social, and Governance (ESG) Considerations

A. Sustainable Practices

With an increasing emphasis on environmental responsibility, [Your Company Name] is integrating sustainable practices into its finance credit operations. This involves implementing green financing options, supporting environmentally friendly initiatives, and adopting responsible lending practices. By aligning with ESG principles, [Your Company Name] not only contributes to a sustainable future but also enhances its brand reputation and attracts socially conscious customers.

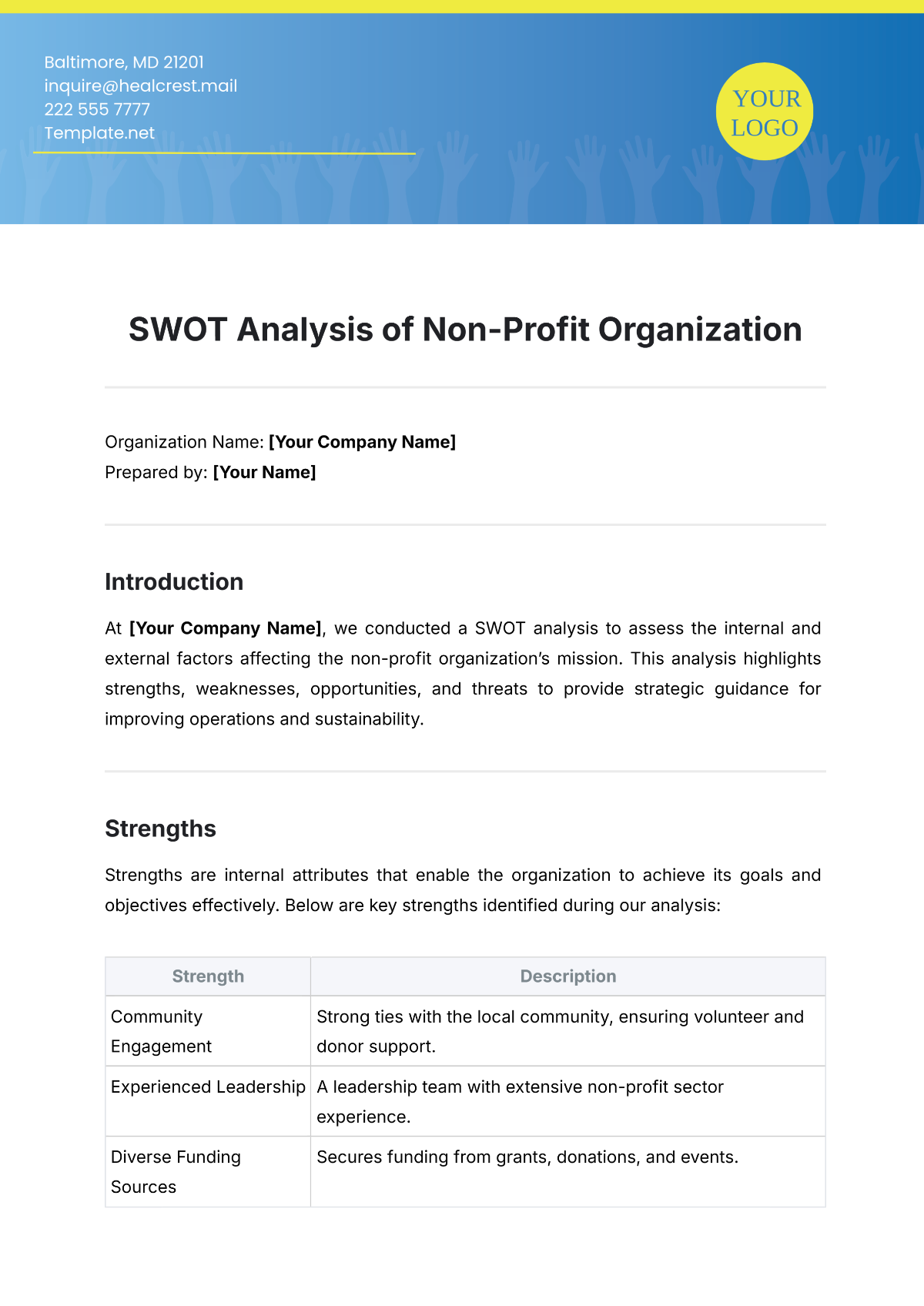

B. Financial Inclusion Initiatives

[Your Company Name] recognizes the importance of promoting financial inclusion. To address this, [Your Company Name] is actively developing initiatives to expand access to finance credit services to underserved populations. This includes partnerships with community organizations, innovative credit scoring models for individuals with limited credit history, and financial education programs. By fostering inclusivity, [Your Company Name] aims to tap into new markets and contribute to societal well-being.

Cybersecurity and Data Protection

A. Robust Cybersecurity Framework

Given the increasing threats in the digital landscape, [Your Company Name] places a high priority on maintaining a robust cybersecurity framework. This involves regular cybersecurity audits, employee training on cyber hygiene, and the adoption of the latest security technologies. By safeguarding customer data and financial transactions, [Your Company Name] aims to build trust, protect its reputation, and ensure the confidentiality and integrity of sensitive information.

B. Compliance with Data Protection Regulations

As data protection regulations continue to evolve globally, [Your Company Name] is committed to ensuring compliance with these standards. This includes the implementation of stringent data protection policies, secure data storage practices, and regular compliance assessments. By prioritizing data privacy, [Your Company Name] not only mitigates legal risks but also demonstrates a commitment to ethical business practices, reinforcing trust with customers and stakeholders.

Crisis Management and Business Continuity

A. Risk Assessment and Scenario Planning

In anticipation of unforeseen crises, [Your Company Name] is dedicated to conducting comprehensive risk assessments and scenario planning. This involves identifying potential threats to the finance credit sector, ranging from economic downturns to global pandemics. By proactively assessing risks and developing contingency plans, [Your Company Name] aims to minimize the impact of crises on its operations and ensure a swift and effective response.

B. Business Continuity Protocols

To safeguard against disruptions, [Your Company Name] has established robust business continuity protocols. This includes the development of contingency facilities, secure data backups, and remote working infrastructure. In the event of a crisis, [Your Company Name] is prepared to seamlessly transition its finance credit operations to ensure uninterrupted service to clients. Regular drills and simulations are conducted to validate the effectiveness of these protocols.

C. Communication and Stakeholder Engagement

Transparent communication is paramount during times of crisis. [Your Company Name] emphasizes effective communication strategies to keep stakeholders, including clients, employees, and regulatory bodies, informed about the steps being taken during a crisis. This involves the establishment of dedicated communication channels, regular updates, and responsiveness to inquiries. By maintaining open lines of communication, [Your Company Name] aims to build trust and confidence in its crisis management capabilities.

D. Post-Crisis Evaluation and Improvement

Following any crisis, [Your Company Name] conducts a thorough post-crisis evaluation to assess the effectiveness of its response and identify areas for improvement. This includes analyzing the timeliness of decision-making, the efficacy of communication strategies, and the overall resilience of business continuity measures. The insights gained from these evaluations are used to refine crisis management protocols and enhance [Your Company Name]'s preparedness for future challenges.

Conclusion

The SWOT analysis provides a comprehensive understanding of [Your Company Name]'s finance credit operations. Leveraging established strengths such as reputation, advanced technology, and a diverse product portfolio positions [Your Company Name] as a key player in the market. Addressing weaknesses, including limited geographic presence and customer service challenges, through strategic initiatives will enhance overall competitiveness.

Opportunities in market expansion, technological advancements, and collaborations with [Your Partner Company Name] present exciting avenues for growth. Simultaneously, [Your Company Name] remains vigilant to potential threats, including regulatory changes, economic downturns, and intense competition. By proactively addressing these factors, [Your Company Name] is poised for sustained success in the dynamic finance credit landscape.