Free Finance Accounts Audit Manual Template

Finance Accounts Audit Manual

1. Introduction

Purpose:

The Finance Accounts Audit Manual is meticulously crafted to serve as a cornerstone for the systematic and thorough auditing of financial practices within [Your Company Name]. The manual's chief aim is to establish a comprehensive framework that not only guides but standardizes the process of financial auditing. In an environment where financial accuracy is paramount, this manual becomes an indispensable tool, ensuring that every financial transaction and record adheres to the highest standards of accuracy, compliance, and efficiency.

Financial reporting and control are critical aspects of a business's health and integrity. Recognizing this, the manual is designed to be more than just a set of instructions; it's a blueprint for maintaining financial fidelity. It encompasses a wide array of procedures and guidelines, meticulously laid out to assist auditors in navigating the often complex landscape of financial records and transactions. From the intricacies of revenue recognition to the nuances of compliance and regulation, this manual provides clear, actionable guidance.

Scope:

The scope of this manual is both broad and specific, targeting the auditing of all financial transactions and records of [Your Company Name]. It is tailored to span the entire fiscal year, commencing from [Month Day Year] and culminating on [Month Day Year]. This comprehensive coverage ensures that no aspect of the company's finances is left unchecked, offering a holistic view of the company's financial health over a significant period.

The manual is designed to be a living document, adaptable to the evolving needs and complexities of [Your Company Name]. It serves not only as a reference for current financial auditing processes but also as a framework that can be modified and expanded upon as the company grows and its financial structures become more intricate. By embracing both the current and future financial auditing needs, the manual stands as a testament to [Your Company Name]'s commitment to financial integrity and transparency.

2. Audit Planning and Preparation

This section focuses on laying the groundwork for an effective audit process. It encompasses the assessment of potential risks, setting up a detailed audit schedule, and allocating the necessary resources to ensure a thorough and efficient audit.

Risk Assessment

Risk assessment is a critical initial step in audit planning. It involves identifying and evaluating potential risks that could impact financial reporting and operations. This process is conducted through a risk matrix, which categorizes risks based on their likelihood and impact, followed by developing appropriate mitigation strategies.

|

Risk Category |

Likelihood |

Impact |

Mitigation Strategy |

|---|---|---|---|

|

Revenue Recognition Errors |

Medium |

High |

Implement double-checking mechanisms |

|

[Additional Risk Category] |

[Likelihood] |

[Impact] |

[Mitigation Strategy] |

Audit Schedule and Resource Allocation

The audit schedule outlines the timing of the audits, ensuring regular and systematic examination of financial records. The allocation of resources, including the designation of the audit team, is crucial for an efficient and effective audit process.

|

Aspect |

Details |

|---|---|

|

Annual Audit Date |

[Month Day Year] |

|

Interim Audits |

Quarterly basis |

|

Lead Auditor |

[Your Name] |

|

Team Members |

To Be Assigned |

|

Contact Information |

[Your Personal Email], [Your User Phone] |

3. Accounting Policies and Procedures

This section delineates the company's accounting policies and procedures for key financial aspects such as revenue recognition, expense reporting, and asset management. Each policy is accompanied by a detailed procedure to ensure adherence and accuracy.

Revenue Recognition:

|

Aspect |

Details |

|---|---|

|

Policy |

Criteria for revenue recognition |

|

Procedure |

Steps for verifying revenue accuracy |

Expense Reporting:

|

Aspect |

Details |

|---|---|

|

Policy |

Define allowable expenses and reporting requirements |

|

Procedure |

Steps for submission and approval of expenses |

Asset Management:

|

Aspect |

Details |

|---|---|

|

Policy |

Guidelines for asset acquisition, depreciation, and disposal |

|

Procedure |

Process for tracking and auditing assets |

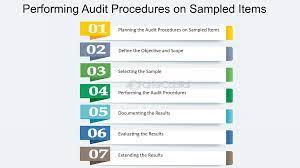

4. Audit Execution

Audit execution involves practical steps in conducting the audit. This includes the methods used for sampling, the tools and period for data collection, and the approach for gathering necessary evidence.

Sampling Method and Data Collection:

(For Illustrative Purposes Only)

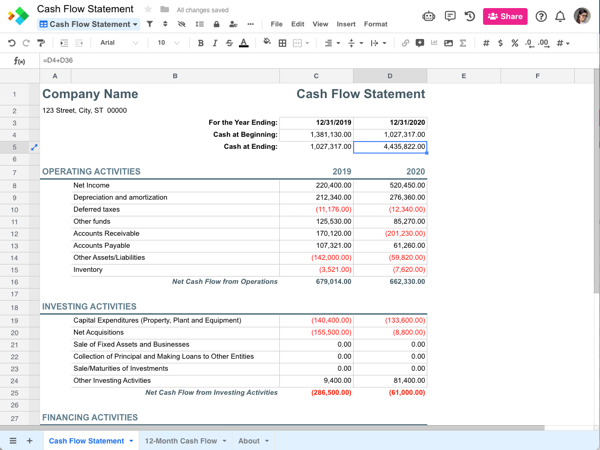

5. Financial Reporting

This section outlines the procedures for auditing the financial company's financial statement:

(Illustration for sampling purposes only)

6. Compliance and Regulations

Local and International Standards

The essence of this chapter is to ensure that [Your Company Name]'s financial practices align with both local and international accounting standards. Adherence to such standards is not just a matter of legal compliance but also a testament to the company's commitment to financial integrity and global best practices.

Standard Compliance:

-

GAAP (Generally Accepted Accounting Principles): This includes conformity to the principles and standards that govern the preparation of financial statements in the United States.

-

IFRS (International Financial Reporting Standards): These are standards for international accounting, facilitating global business affairs and ensuring comparability of financial statements internationally.

-

Other Relevant Standards: Depending on the geographical location and sector of operation, adherence to additional local or specialized accounting standards may be required.

Regular Updates and Training:

To maintain compliance, regular updates on changing standards and continuous training for the finance and audit team are essential.

Regulatory Reporting

Regulatory reporting is a critical component that ensures the company's financial transparency and compliance with legal and regulatory requirements.

Requirement:

-

Tax Compliance: Ensure accurate and timely filing of all tax-related documents.

-

Regulatory Filings: Comply with all financial reporting requirements as per the governing bodies and regulatory authorities.

-

Internal Controls: Maintain robust internal controls to ensure accurate and compliant reporting.

7. Audit Findings and Reporting

Drafting Audit Reports

The preparation of audit reports is a critical phase where the findings of the audit are formally documented. The report not only highlights the areas of concern but also reflects the financial health of the company.

Structure:

-

Executive Summary: A concise overview of the audit findings.

-

Detailed Findings: Comprehensive details of all audit observations, categorized by areas such as revenue, expenses, assets, etc.

-

Recommendations: Constructive suggestions for improvement and rectification.

-

Conclusion: A final assessment of the overall financial practices

Communicating Findings

Internal Communication:

-

Presentation to Management: Detailed findings should be presented to the senior management, highlighting key areas of concern and potential impact on the company.

-

Discussion for Clarification: Allow for a discussion phase where clarifications and additional insights can be sought.

8. Corrective Actions and Follow-Up

Action Plan Development

Following the audit findings, developing an action plan is crucial to address the identified issues effectively.

Responsibility:

-

Task Assignment: Assign specific tasks to relevant departments or individuals for addressing the findings.

-

Timeline and Objectives: Set clear objectives and timelines for the completion of these tasks.

-

Documentation: Document the action plan for reference and accountability.

Follow-Up Audits

Regular follow-up audits are essential to ensure that the corrective actions have been implemented effectively and to assess their impact.

Schedule:

-

Initial Follow-Up: Schedule an initial follow-up audit within a defined period post-implementation of the corrective actions.

-

Ongoing Monitoring: Establish a schedule for ongoing monitoring and re-auditing to ensure continued compliance and improvement.

9. Appendices

Relevant Forms and Templates:

-

Audit Checklist

-

Risk Assessment Matrix

-

Financial Statement Templates

Contact Information:

-

Company Contact: [Your Company Email], [Your Company Phone Number]

-

Social Media: [Your Social Media]

-

Website: [Your Company Website]