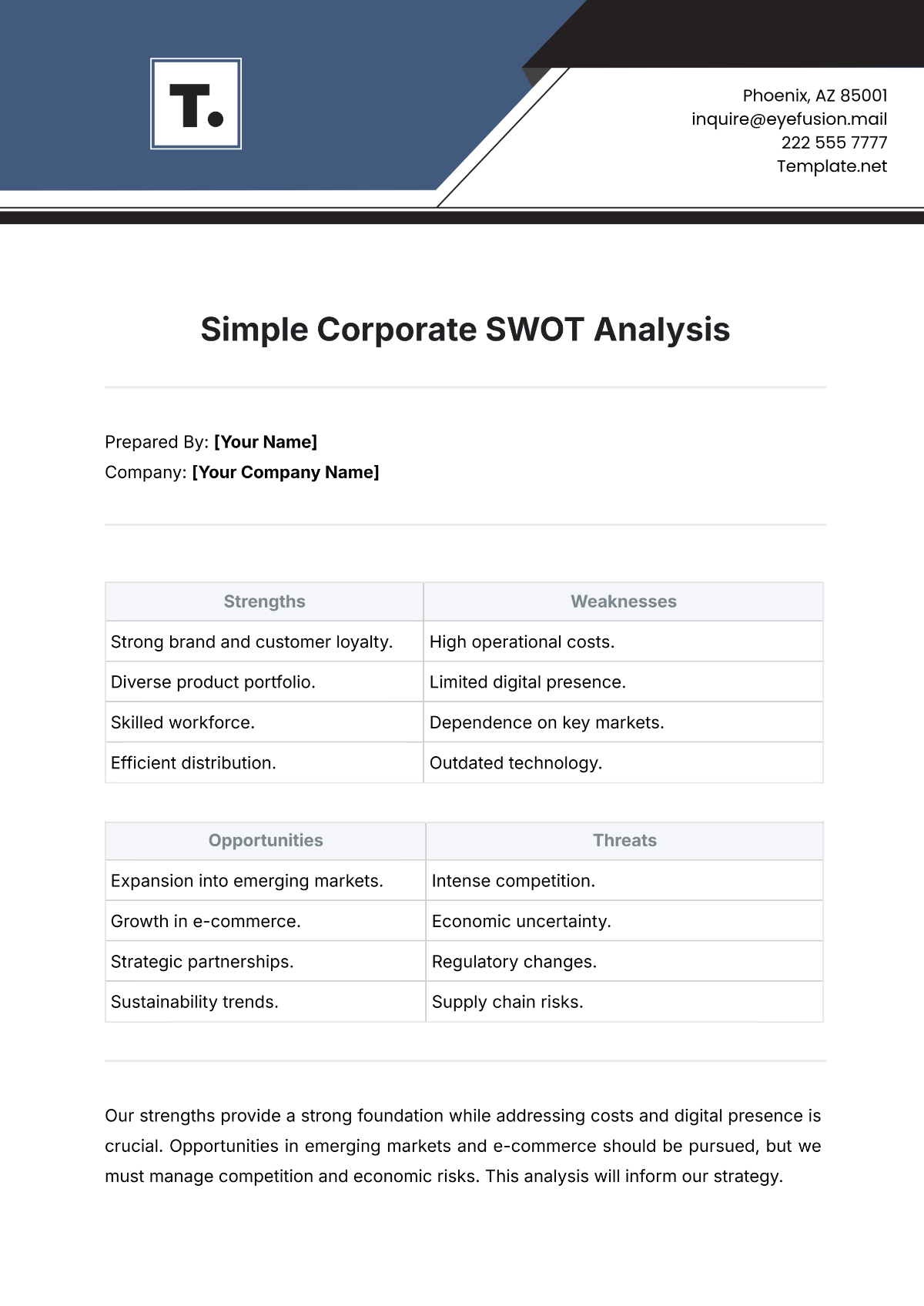

Accounting Policy SWOT Analysis

TABLE OF CONTENTS

Introduction...........................................................................................................3

Strengths...............................................................................................................4

Weaknesses...........................................................................................................5

Opportunities.........................................................................................................6

Threats....................................................................................................................7

Analysis Overview..................................................................................................8

Recommendations.................................................................................................9

Strategic Implications............................................................................................10

Conclusion..............................................................................................................11

Introduction

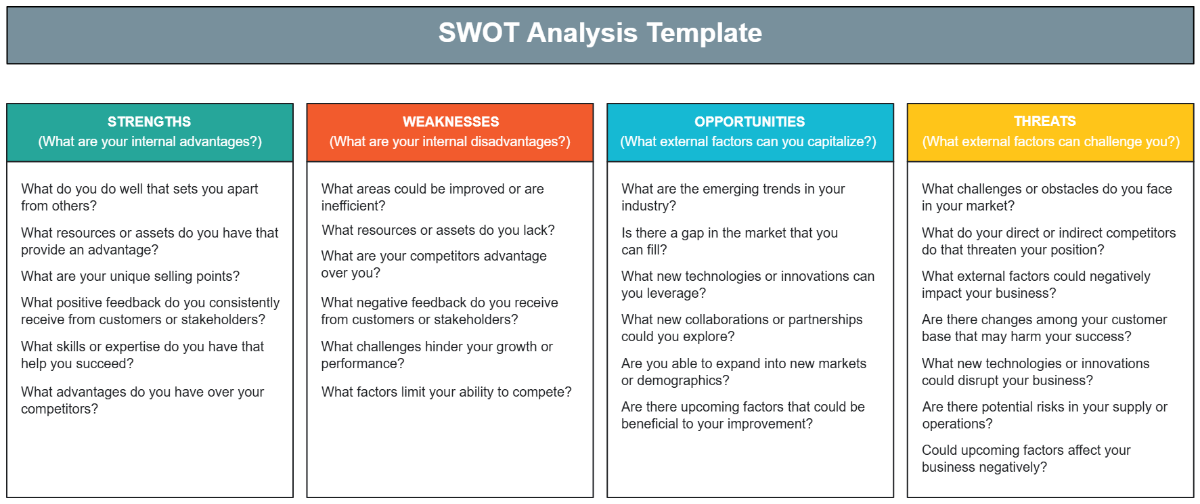

This document presents a detailed SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the accounting policy at [Your Company Name]. The purpose of this analysis is to evaluate the internal and external factors influencing the accounting practices of the company. This assessment aims to identify areas of excellence, potential risks, growth opportunities, and external challenges that could impact the company's financial reporting and decision-making processes.

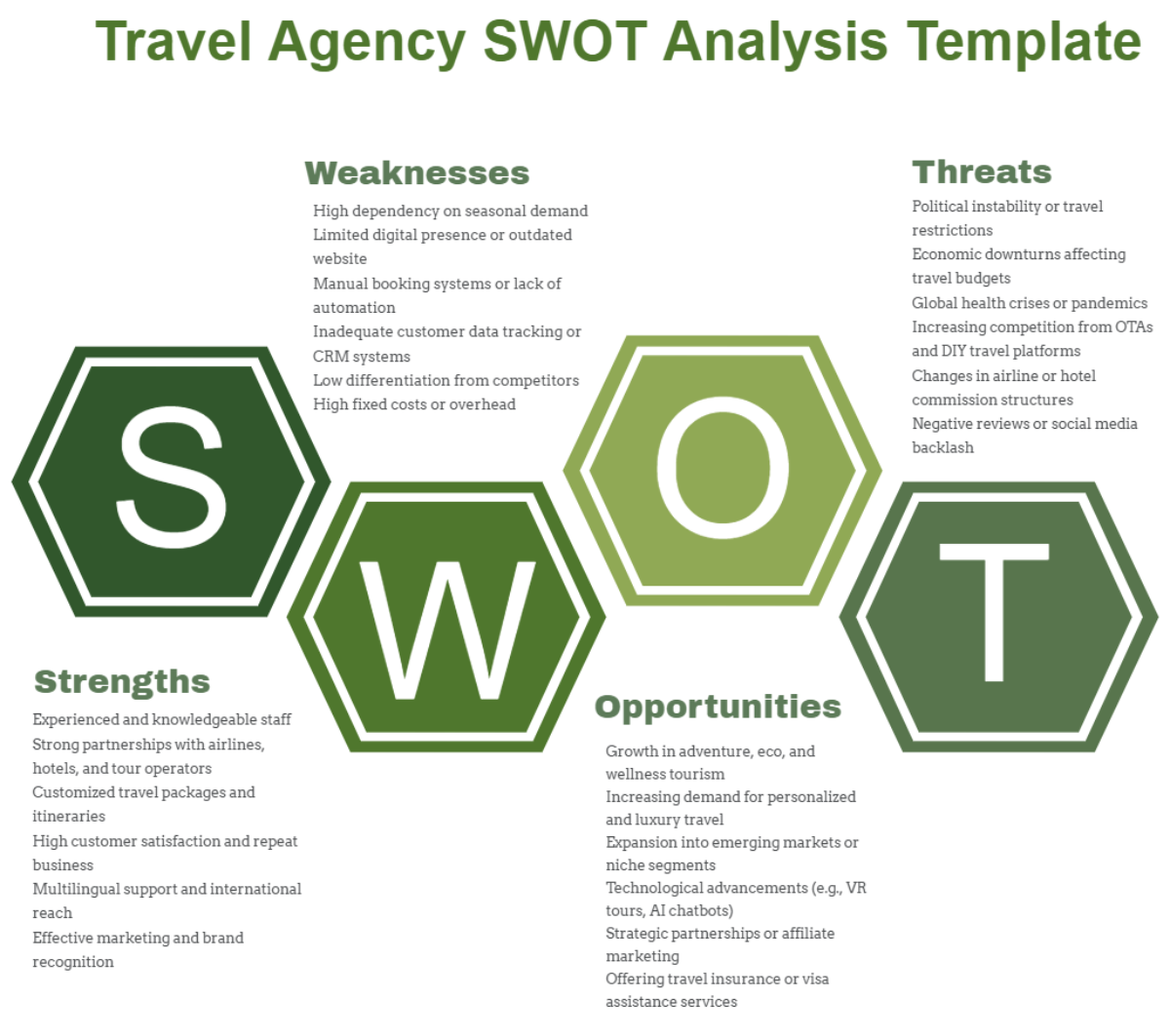

Overview of [Your Company Name]'s Accounting Policy:

[Your Company Name]'s accounting policies and practices reveals the complexities of the company's financial management systems. This analysis includes an examination of the accounting frameworks, Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which govern the company's financial reporting.

The role of advanced software tools and technologies in automating and enhancing financial processes is highlighted, along with methodologies for budgeting, forecasting, auditing, and compliance. Understanding these foundational aspects is crucial for appreciating how [Your Company Name]'s accounting policies align with its broader strategic objectives and for laying the groundwork for the subsequent SWOT analysis.

Methodology:

The methodology used to conduct the SWOT analysis of [Your Company Name]'s accounting policy is based on an evaluation of internal and external factors. This includes an assessment of strengths and weaknesses through internal metrics such as financial performance, process efficiency, and audit results. Opportunities and threats are identified in relation to external influences like technological advancements, market trends, regulatory shifts, and economic changes.

This approach ensures a balanced and objective analysis, combining qualitative and quantitative data. The methodology's thoroughness guarantees that the SWOT analysis is strategically aligned with the company's objectives and the broader industry context, thus enhancing its validity for strategic planning and decision-making.

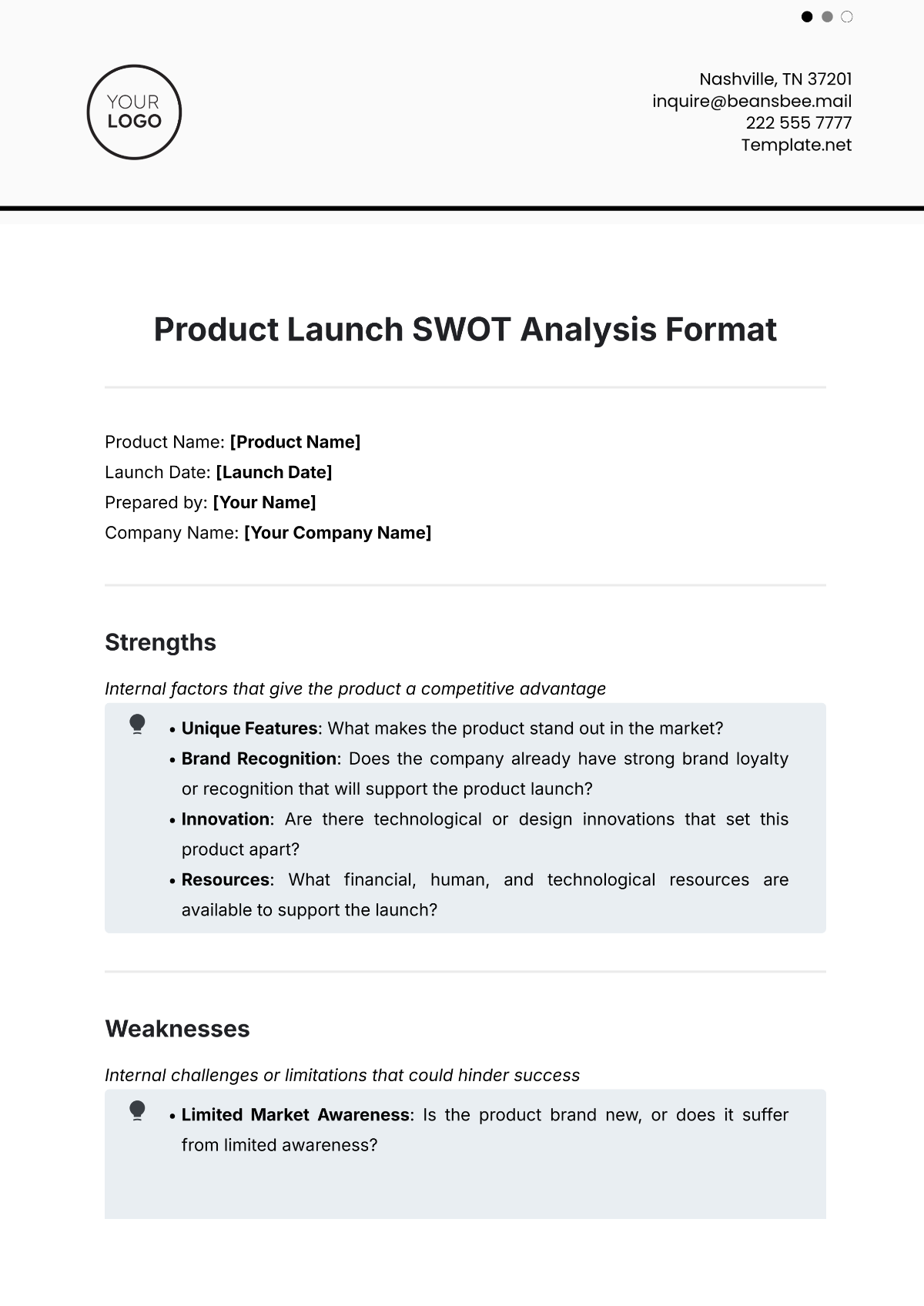

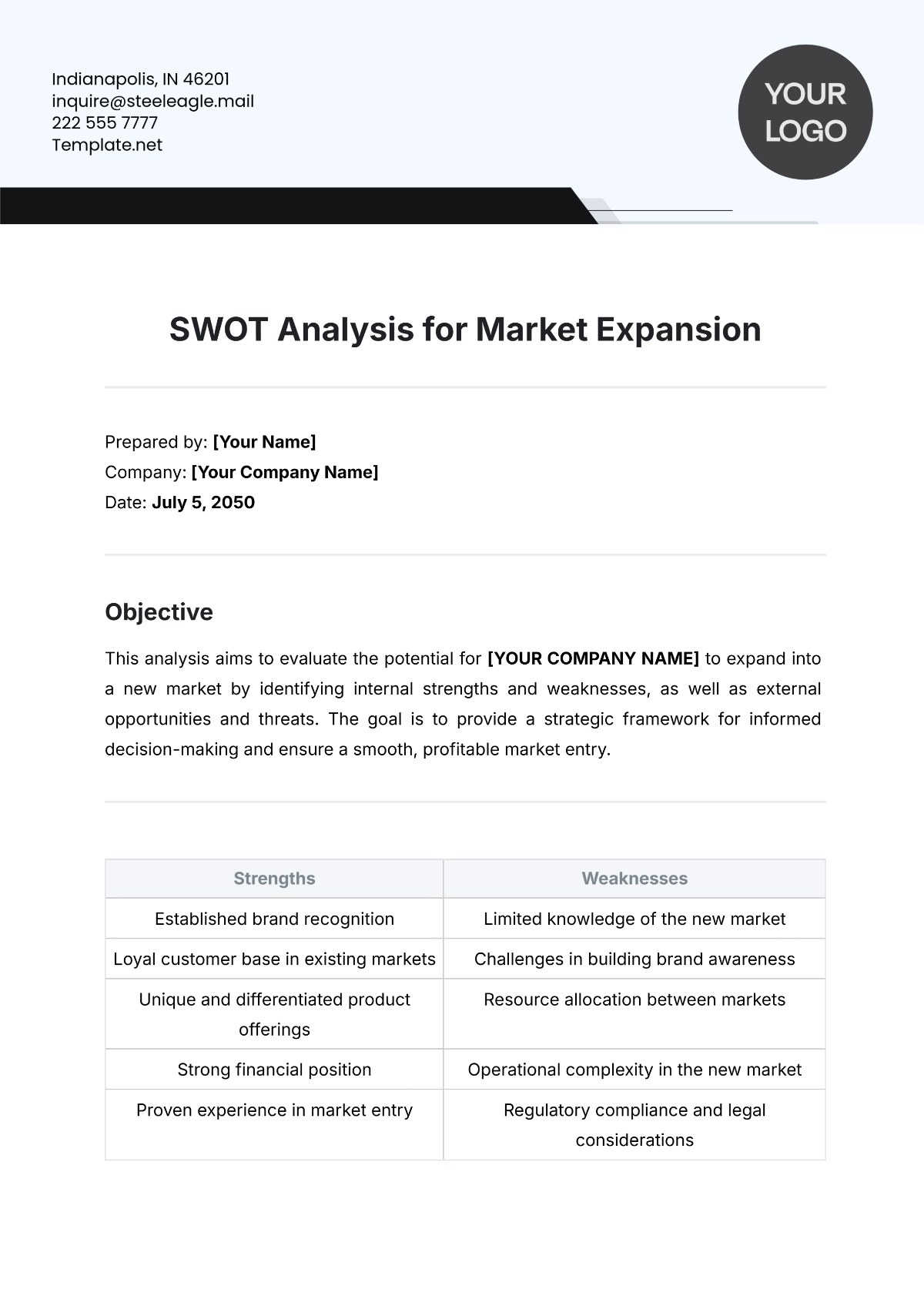

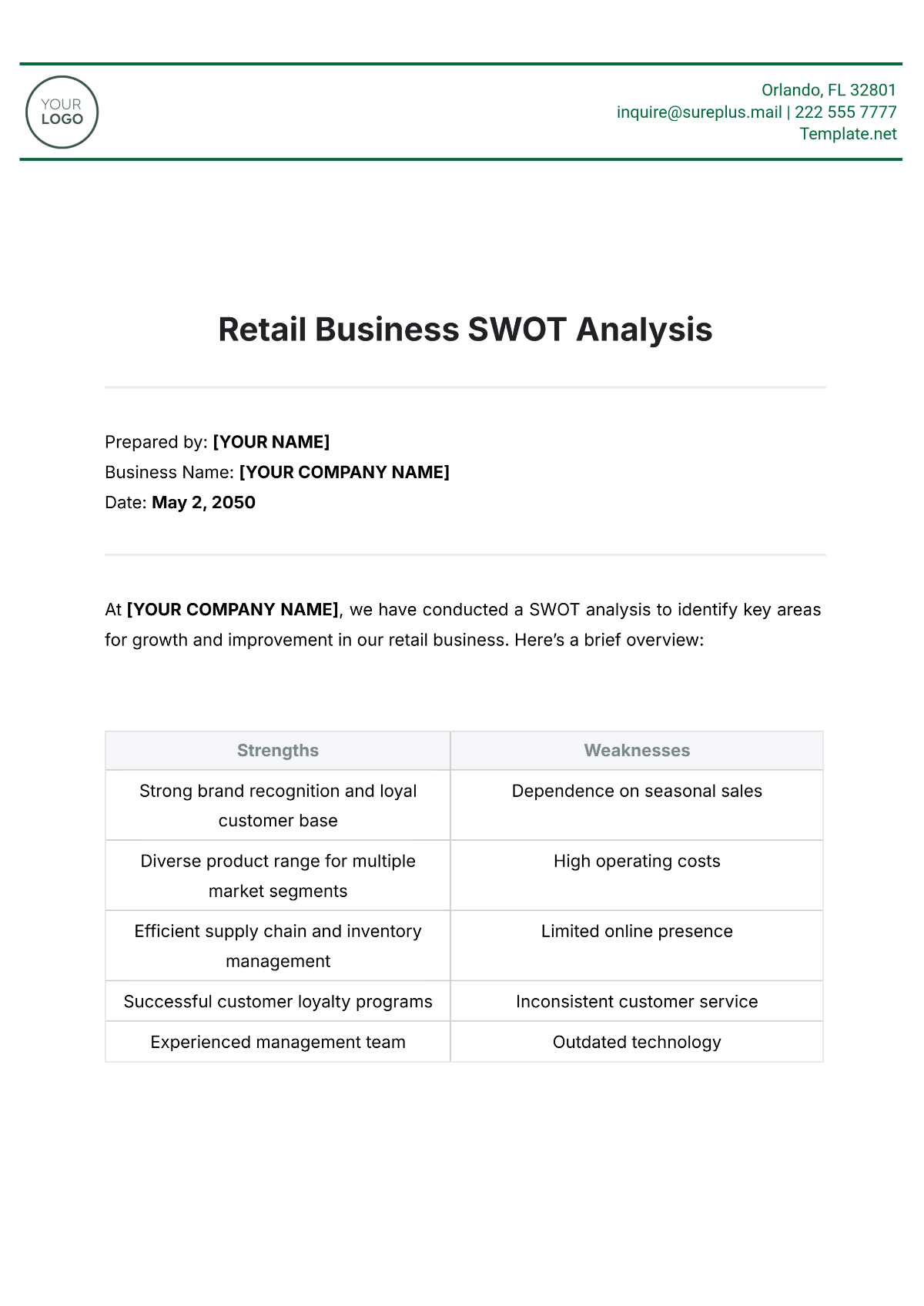

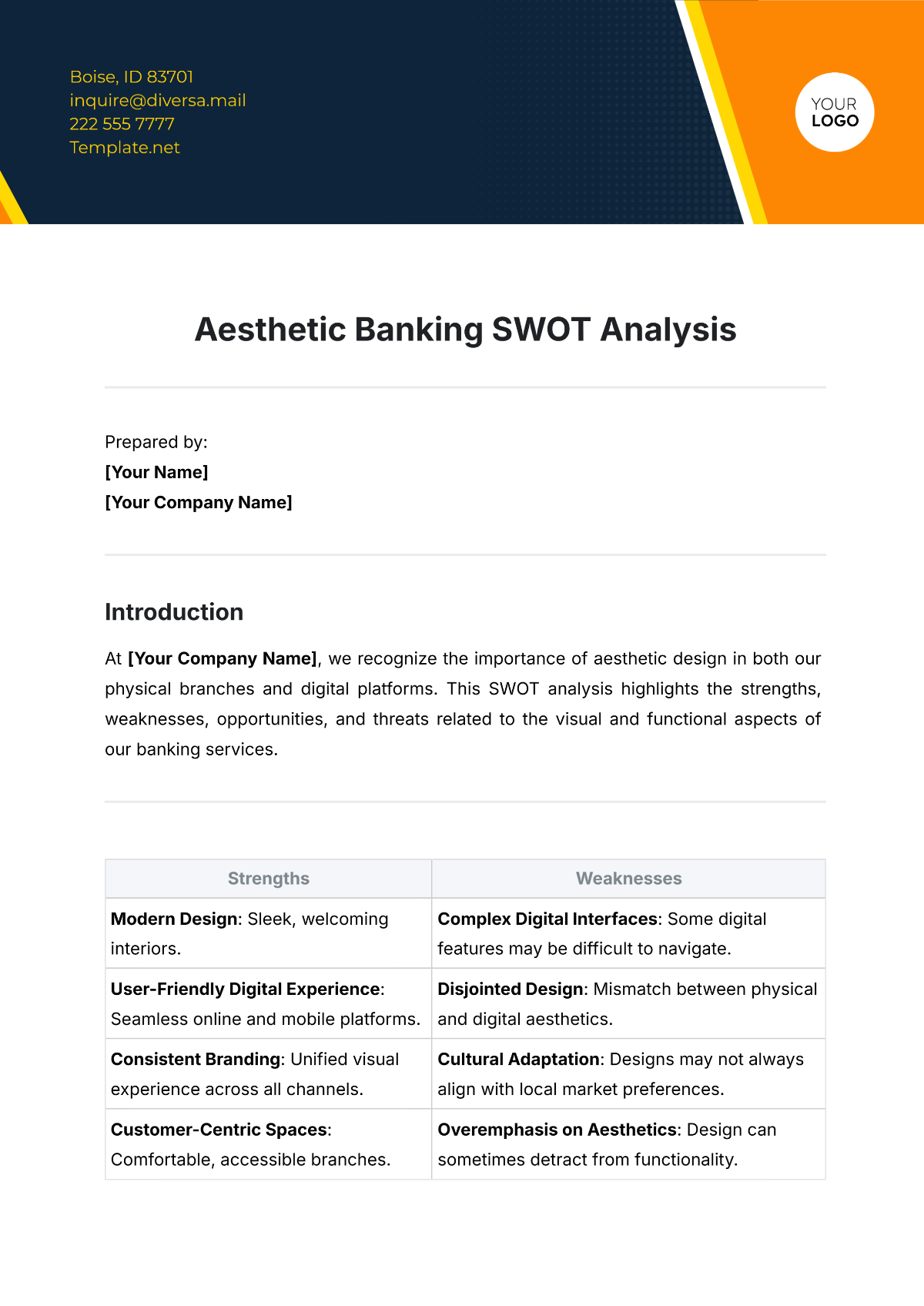

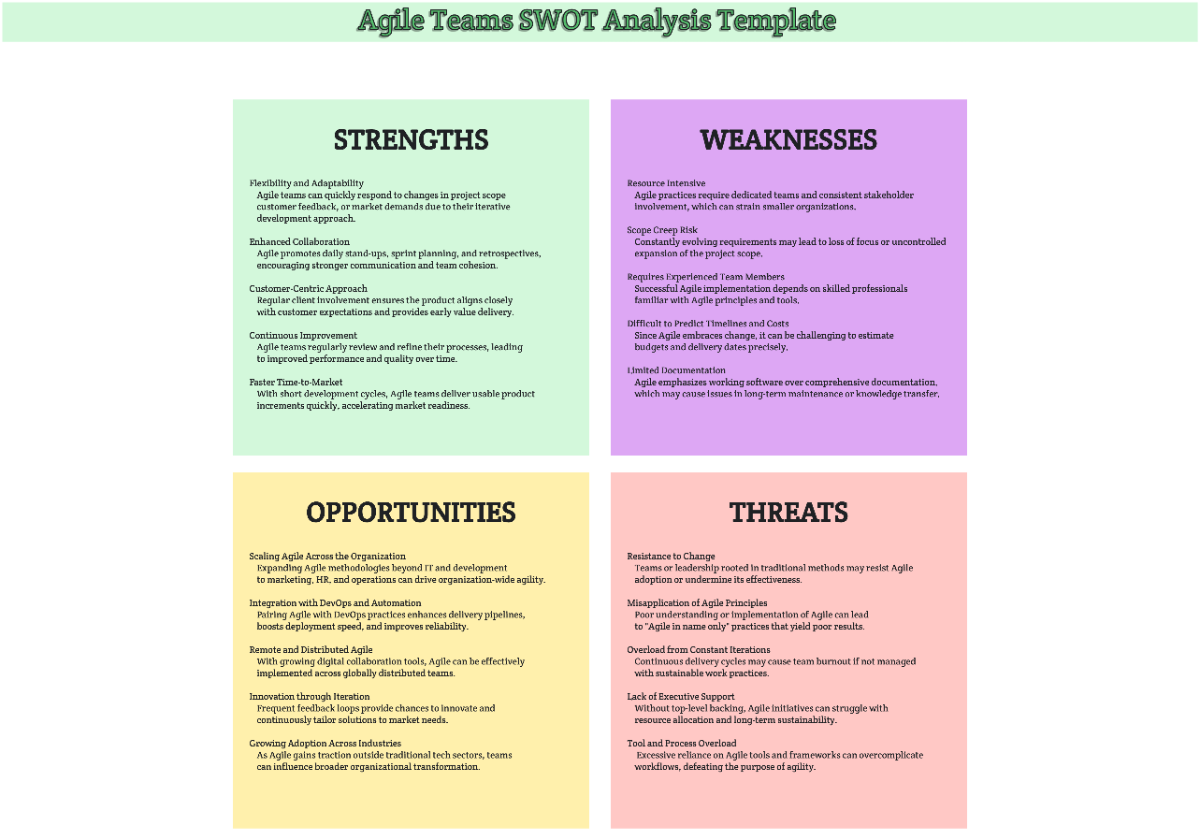

Strengths

The Strengths section of the SWOT analysis for [Your Company Name]’s accounting policy highlights the company’s key advantages and robust capabilities in financial management and reporting. These strengths not only differentiate the company from its competitors but also provide a solid foundation for its financial stability and strategic growth.

Advanced Technological Integration in Accounting Systems:

[Your Company Name] has integrated state-of-the-art technology into its accounting systems. This includes the deployment of sophisticated software for financial management, which offers features like real-time data processing, automated report generation, and advanced analytics. These technological advancements have led to significant improvements in efficiency, accuracy, and the ability to make data-driven decisions.

Technology Feature

Impact on Operations

Automated Data Entry

Reduces manual errors, saves time.

Exceptional Compliance and Internal Control Mechanisms:

The company prides itself on its stringent compliance with financial regulations and its robust internal control systems. This adherence to high standards minimizes risks associated with financial reporting and ensures the integrity of financial data.

Compliance Aspect

Benefit

Regular Audits

Ensures ongoing adherence to financial standards.

Expertise and Professional Development in Accounting Staff:

[Your Company Name] has invested in hiring and continuously training a highly skilled accounting workforce. This commitment to professional development ensures that the team is well-versed in the latest accounting practices and is capable of handling complex financial scenarios.

Staff Development Strategy

Resulting Advantage

Regular Training Programs

Keeps staff updated with current accounting trends.

Efficient Financial Planning and Forecasting:

The company’s accounting policy has laid a strong foundation for efficient financial planning and forecasting. The ability to accurately predict financial trends and prepare for future financial needs has positioned the company for sustained growth and stability.

Planning Aspect

Strategic Benefit

Long-term Financial Projections

Aids in strategic business planning.

These strengths form the cornerstone of [Your Company Name]’s financial management strategy, providing it with a competitive edge in the marketplace. They contribute significantly to the company’s ability to manage financial challenges effectively and to capitalize on new opportunities.

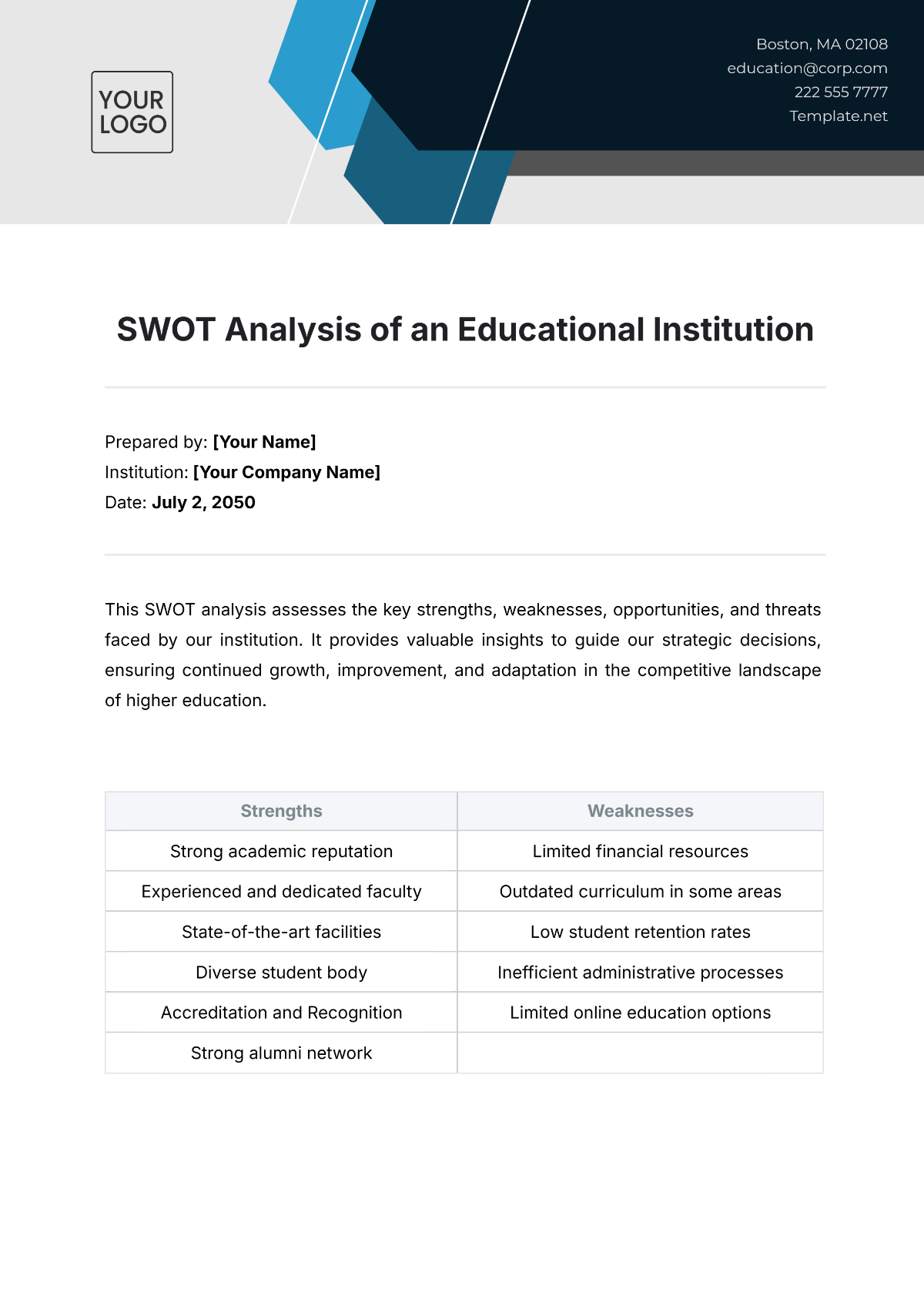

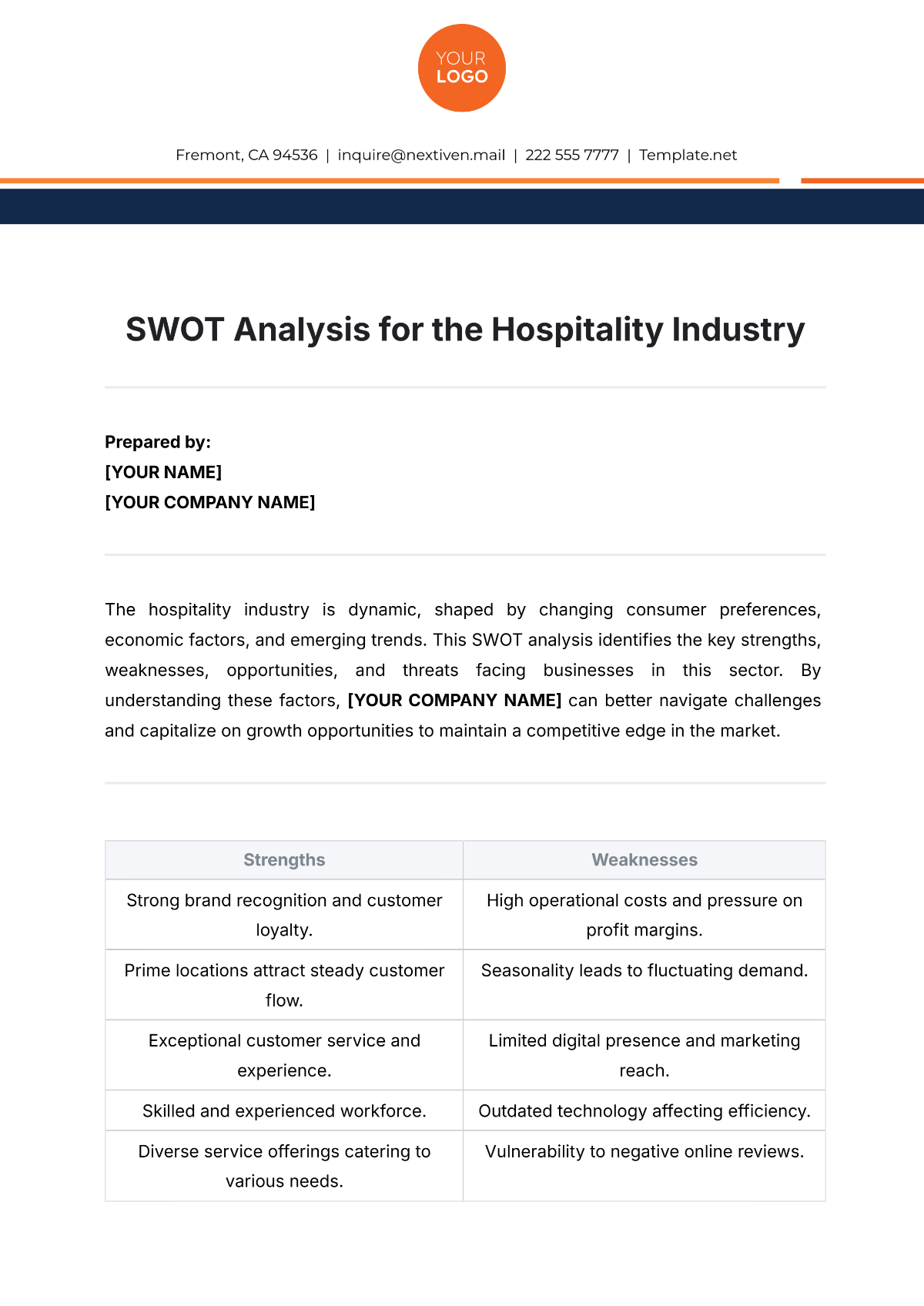

Weaknesses

The Weaknesses segment of the SWOT analysis identifies areas where the company’s financial management practices might be vulnerable or less effective. Recognizing these weaknesses is crucial for developing strategies to mitigate potential risks and enhance overall financial performance.

Over-reliance on Specific Accounting Software:

The company's heavy dependence on a particular accounting software could pose significant risks in scenarios of technical failures or software obsolescence. This reliance limits flexibility and increases vulnerability to software-specific issues.

Dependency Aspect

Potential Risk

Software Downtime

Delays in financial processing and reporting.

Rigidity in Accounting Procedures:

[Your Company Name]’s strict adherence to certain accounting procedures, while ensuring consistency, may also limit its ability to adapt quickly to new financial reporting standards or evolving industry practices.

Procedure

Limitation

Inflexible Budgeting Practices

May not accommodate unexpected financial changes.

Challenges in Integrating Emerging Accounting Trends

While the company has made strides in technology adoption, there is room for improvement in integrating emerging accounting trends like blockchain or AI-driven analytics.

Emerging Trend

Integration Challenge

Blockchain in Accounting

Delay in adopting decentralized ledger technology.

Potential Skill Gaps in Emerging Financial Practices:

As the financial world evolves, there may be a skill gap in the accounting team regarding new practices and regulations. Continuous training and professional development are required to keep the team abreast of these changes.

Emerging Practice

Potential Skill Gap

New Tax Regulations

Understanding and implementation of updated tax laws.

By acknowledging these weaknesses, [Your Company Name] can formulate strategic initiatives to address these areas. This might involve investing in more versatile software solutions, updating internal procedures, embracing new accounting technologies, and enhancing staff training programs. Addressing these weaknesses is vital for maintaining the company's financial robustness and competitive advantage in the market.

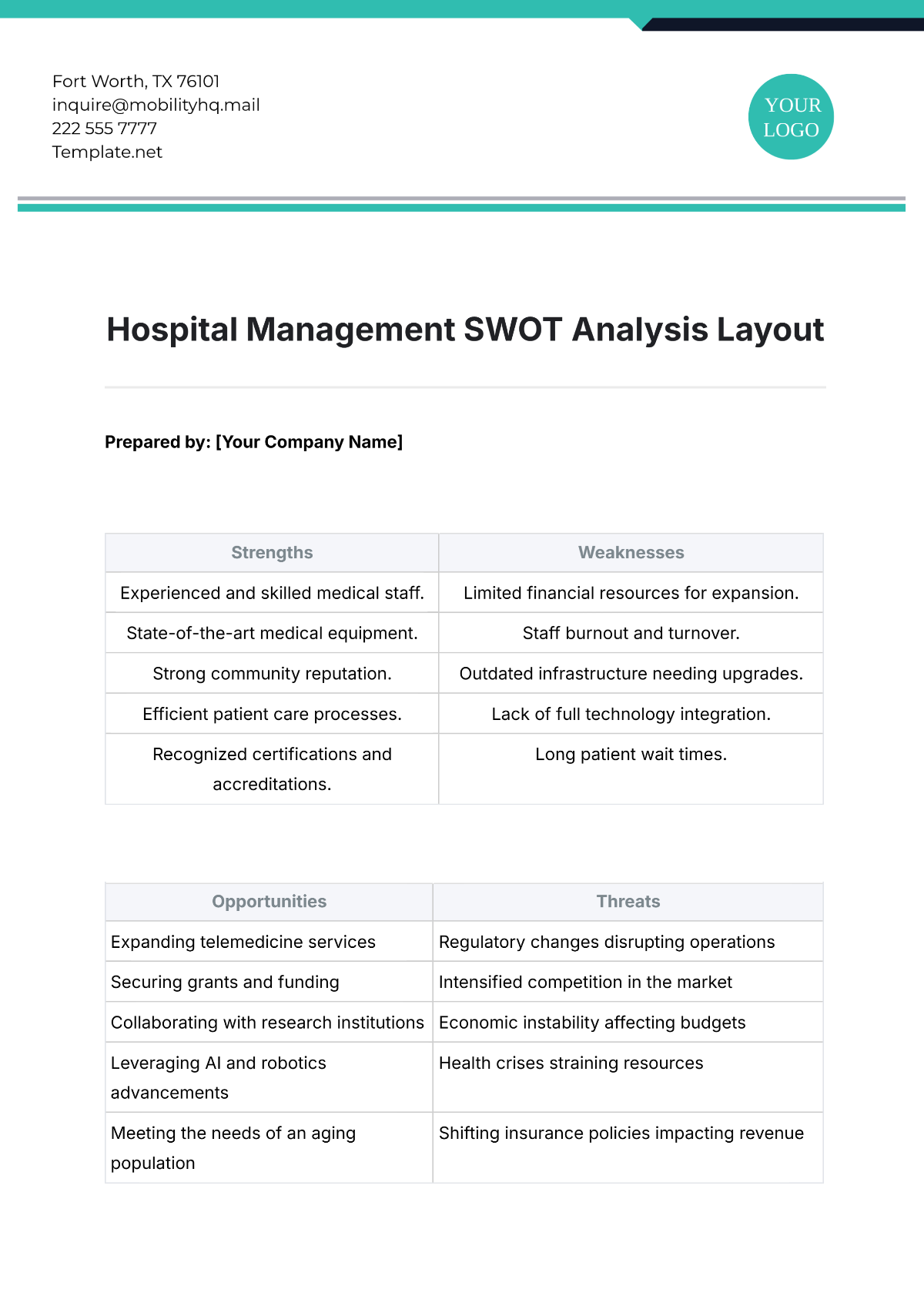

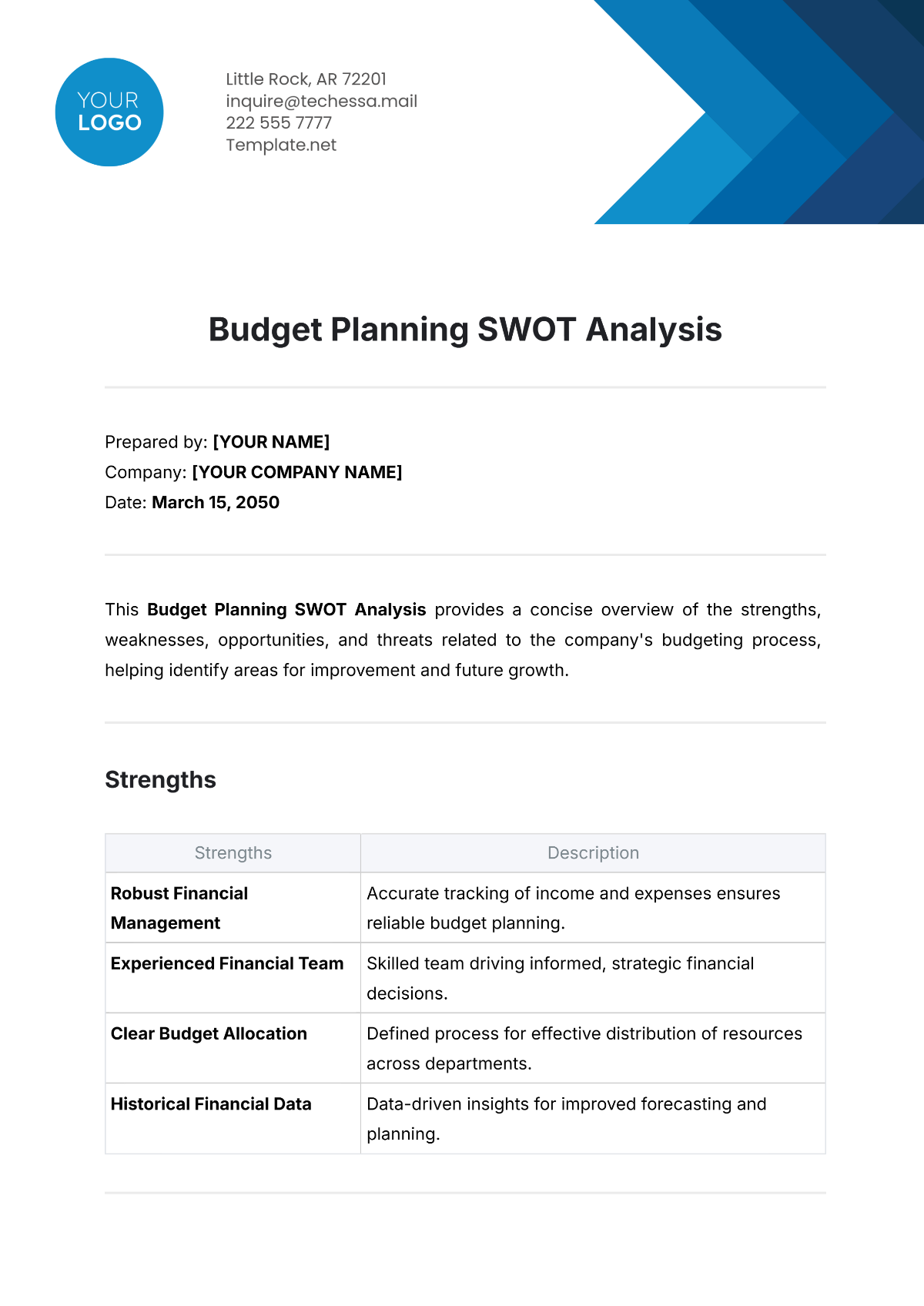

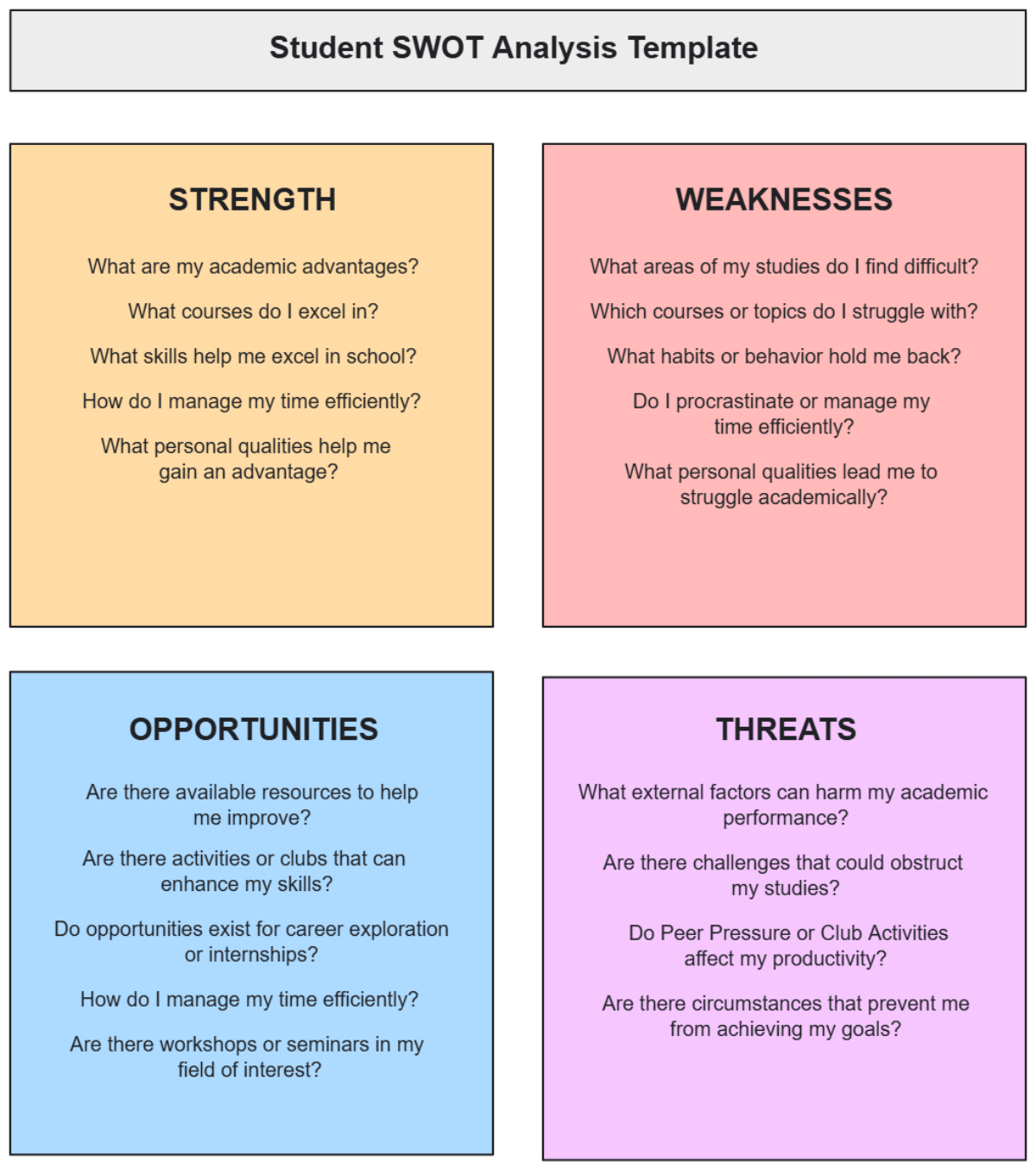

Opportunities

The Opportunities section of the SWOT analysis for [Your Company Name]’s accounting policy identifies potential areas for growth and improvement. These opportunities, if leveraged effectively, can significantly enhance the company’s financial management capabilities and strategic positioning in the market.

Adoption of Emerging Technologies in Accounting:

Technology in the financial sector presents opportunities for [Your Company Name] to adopt new tools such as AI, blockchain, and cloud computing. These technologies can revolutionize financial processes, from automating routine tasks to providing more secure and efficient ways of handling transactions.

Technology

Potential Impact

AI and Machine Learning

Enhanced predictive analytics for better financial forecasting.

Global Accounting Standards Alignment:

As businesses increasingly operate on a global scale, aligning with international accounting standards like IFRS can open doors to new markets and create opportunities for cross-border ventures. This alignment can also simplify financial reporting and compliance for multinational operations.

Standard

Strategic Advantage

IFRS Compliance

Facilitates expansion into international markets.

Sustainability and Social Responsibility Reporting:

There is a growing trend towards integrating sustainability and social responsibility into corporate reporting. By adopting these practices, [Your Company Name] can enhance its corporate image, meet investor and consumer expectations, and potentially tap into new customer segments.

Reporting Aspect

Business Benefit

Sustainability Reporting

Aligns with investor and consumer focus on environmental responsibility.

Continuous Professional Development and Training:

Investing in the ongoing education and training of accounting personnel ensures that the team stays abreast of the latest industry developments and best practices. This can lead to improved efficiency, innovation, and overall performance in financial management.

Development Initiative

Expected Outcome

Regular Training Programs

Ensures staff competency in the latest financial practices.

By capitalizing on these opportunities, [Your Company Name] can not only enhance its accounting practices and financial reporting capabilities but also position itself strategically for future growth and success in an increasingly competitive and globalized business environment.

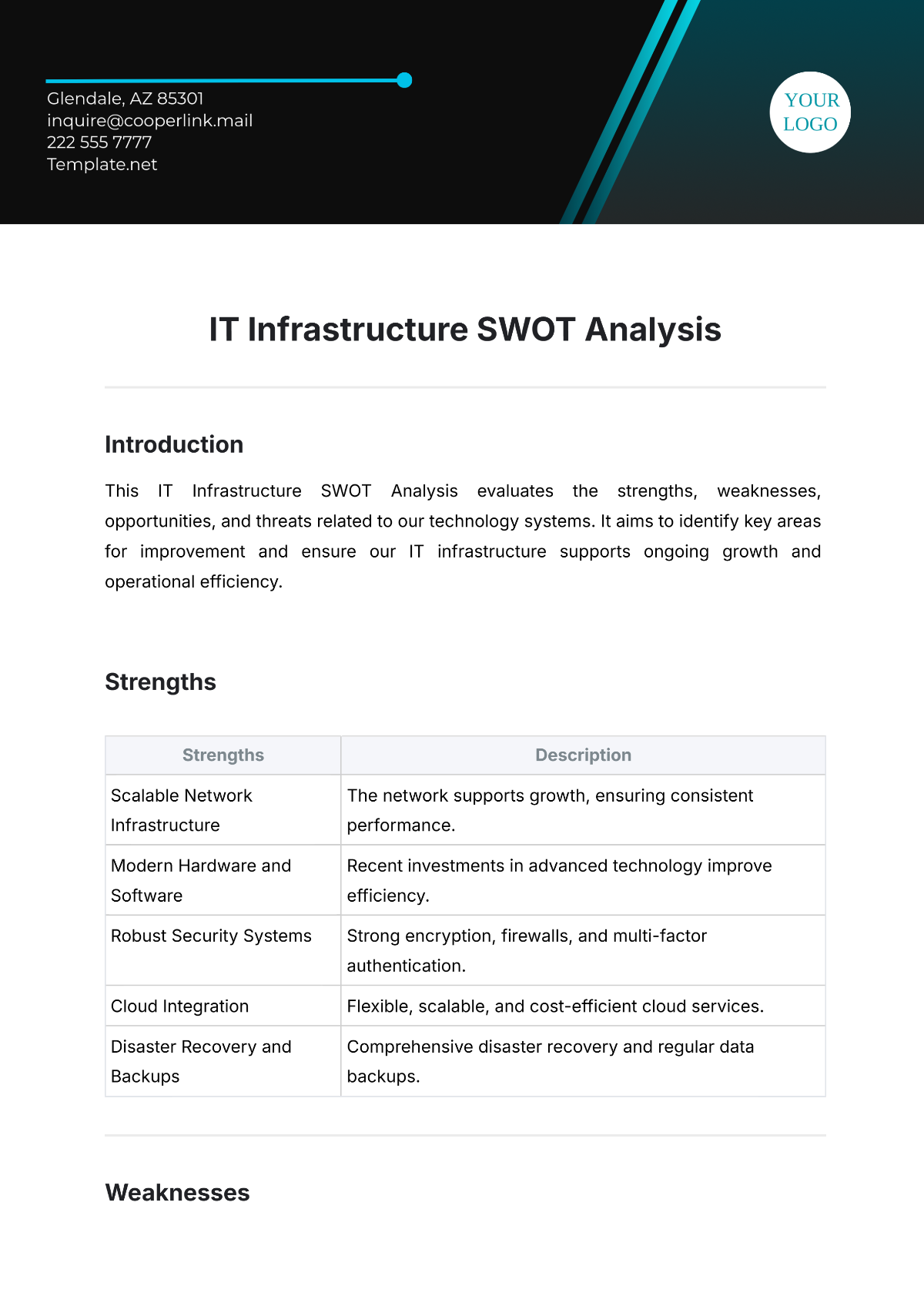

Threats

The Threats section of the SWOT analysis for [Your Company Name]’s accounting policy focuses on external challenges and risks that could adversely impact the company's financial management and strategic planning. Identifying these threats is essential for developing robust contingency plans and safeguarding the company’s financial stability.

Regulatory Changes:

The constant changes in financial regulations poses a significant challenge. Changes in tax laws, reporting standards, and compliance requirements can necessitate sudden adjustments in accounting practices, potentially leading to increased costs and operational complexities.

Regulatory Change

Implication

New Tax Legislation

Potential increase in tax liabilities and complexities in tax planning.

Economic Volatility:

Fluctuations in the global and domestic economies, such as interest rate changes, inflation, and currency fluctuations, can significantly impact the company’s financial planning and reporting.

Economic Factor

Impact on Financial Management

Interest Rate Fluctuations

Affects borrowing costs and investment decisions.

Technological Disruptions

Rapid advancements in technology, while offering opportunities, also pose threats in terms of cybersecurity risks and the need for continual upgrades. Failure to keep pace with technological innovations can result in operational inefficiencies and vulnerabilities.

Technological Aspect

Challenge

Cybersecurity Threats

Risks to the integrity and confidentiality of financial data.

Competitive Pressure in the Financial Sector:

Increasing competition in the financial sector, particularly with the rise of fintech and alternative financial service providers, can pose threats to the company’s market position and necessitate continuous innovation in financial strategies.

Competitive Factor

Implication

Emerging Fintech Companies

Increased competition in financial services and innovation.

By being aware of these external threats, [Your Company Name] can proactively implement measures to mitigate their impact. This might include diversifying its economic risk exposure, enhancing cybersecurity measures, staying updated with regulatory changes, and fostering a culture of continual learning and innovation. Effectively managing these threats is crucial for the company's long-term financial resilience and success in the competitive marketplace.

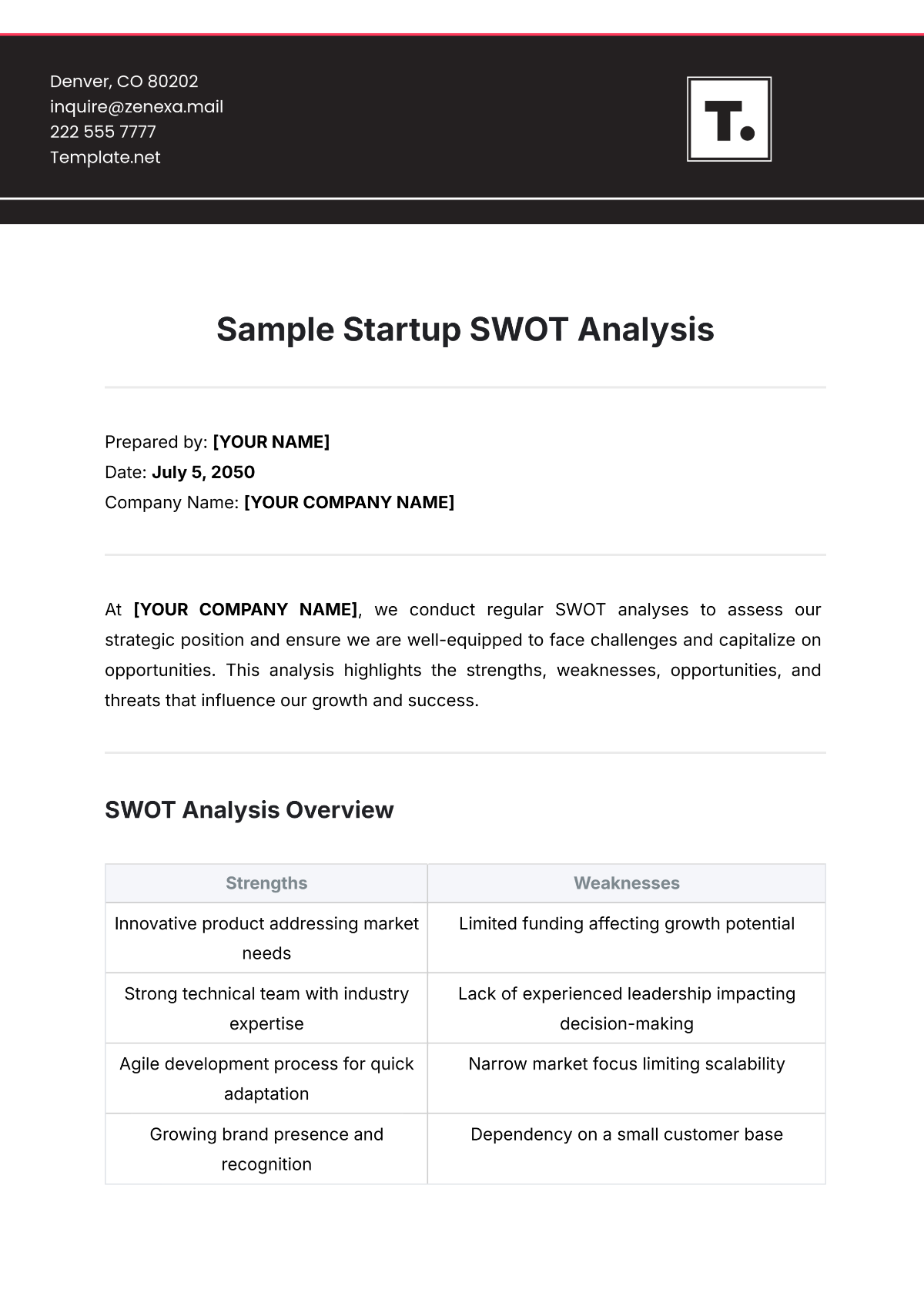

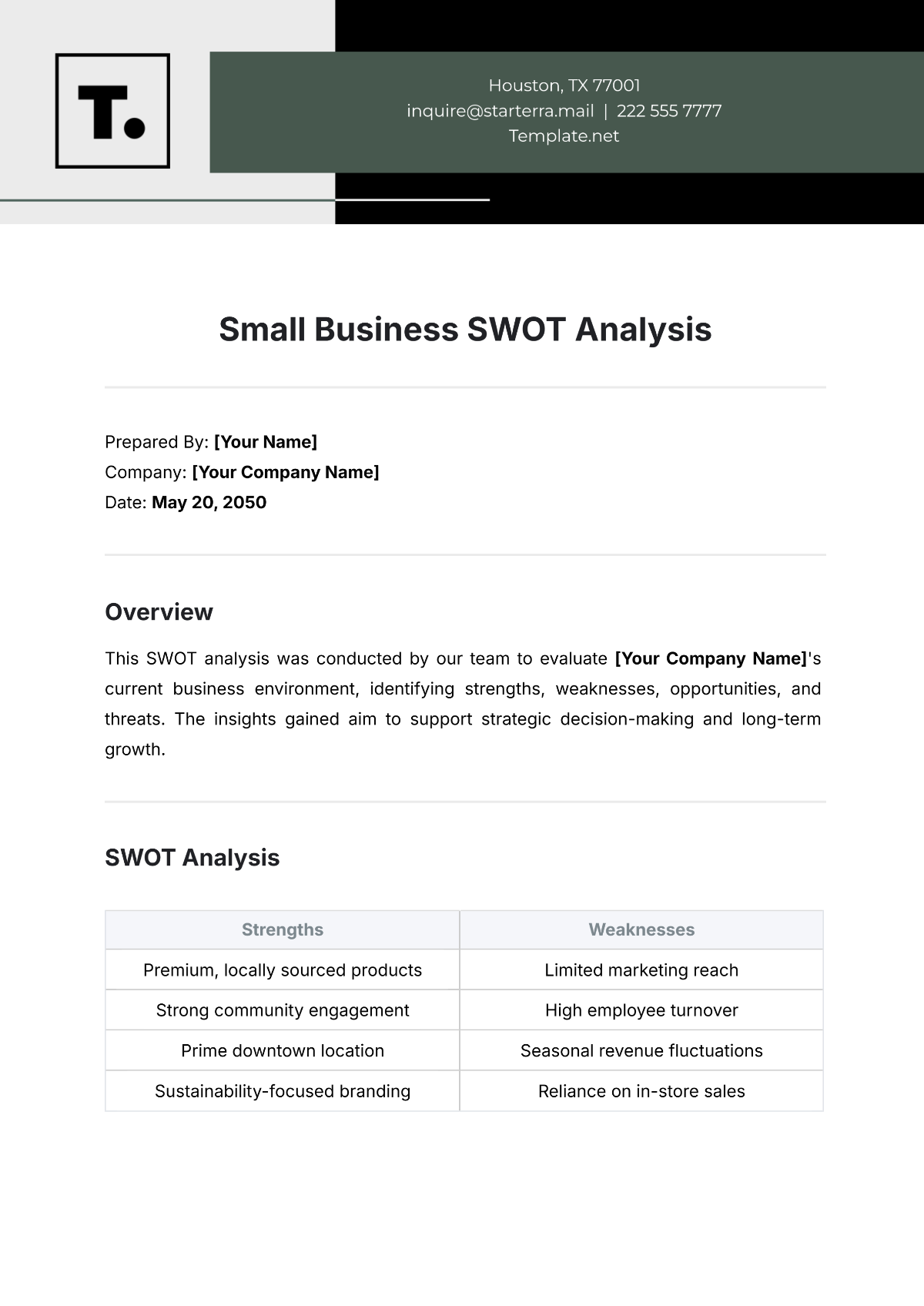

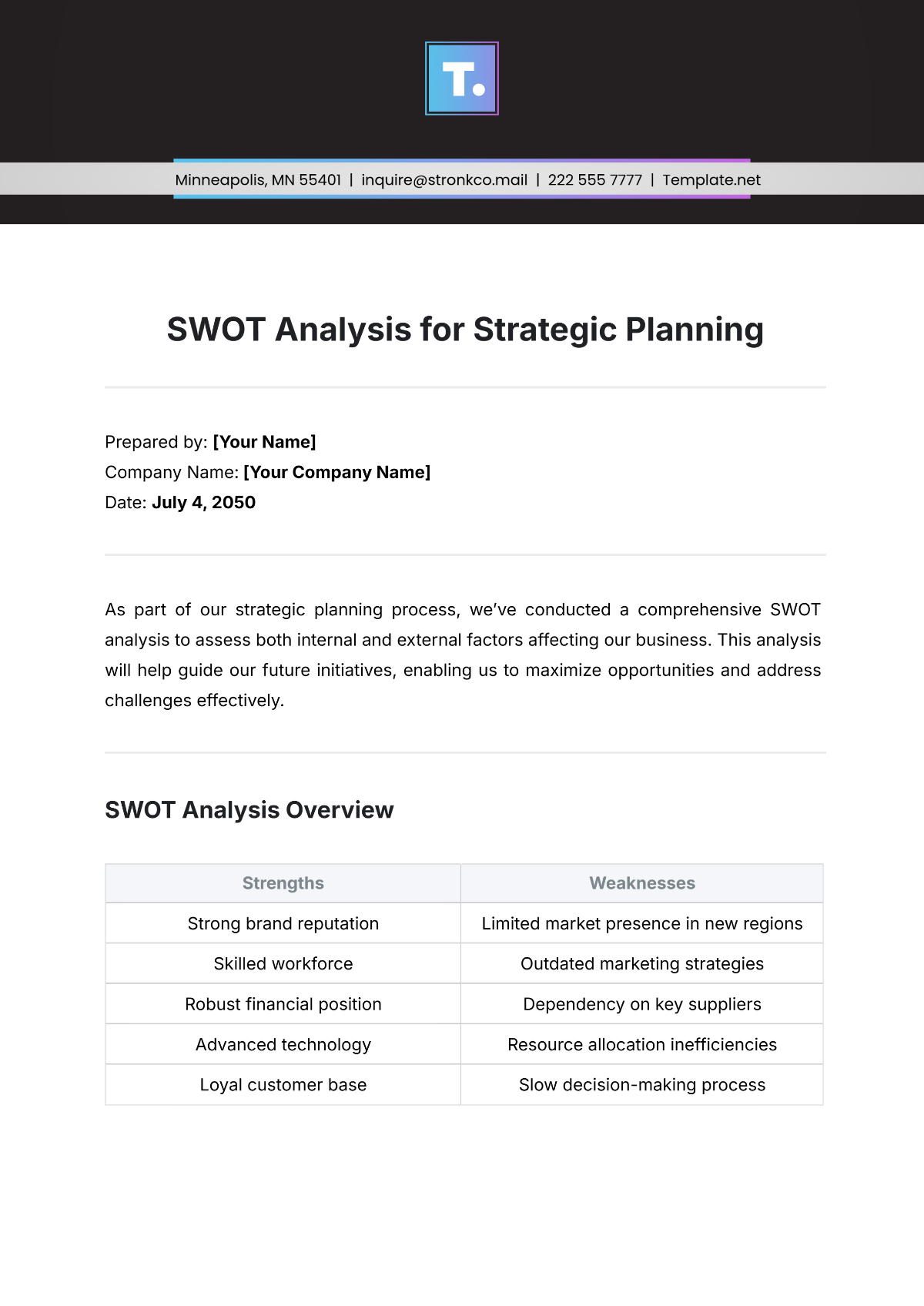

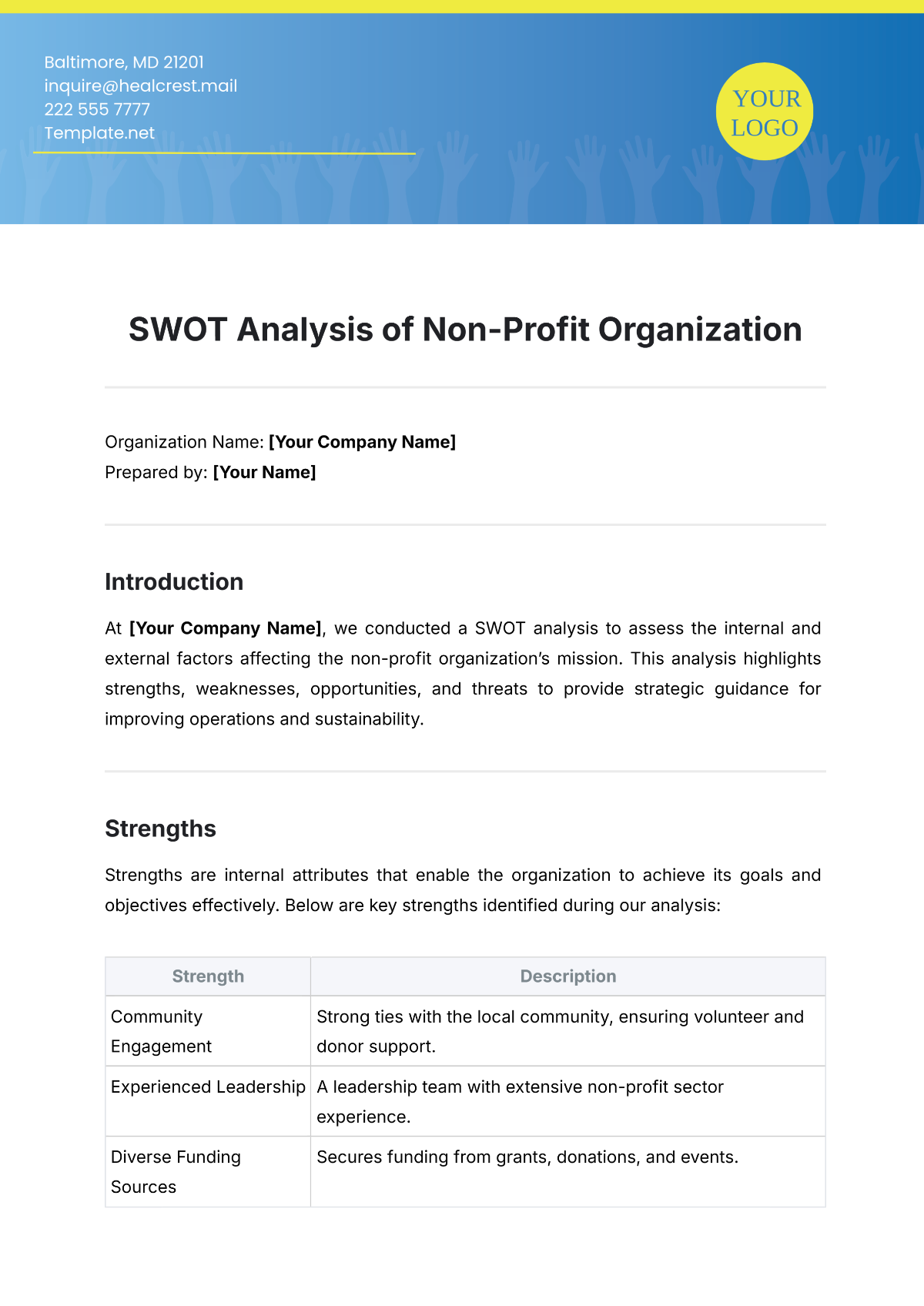

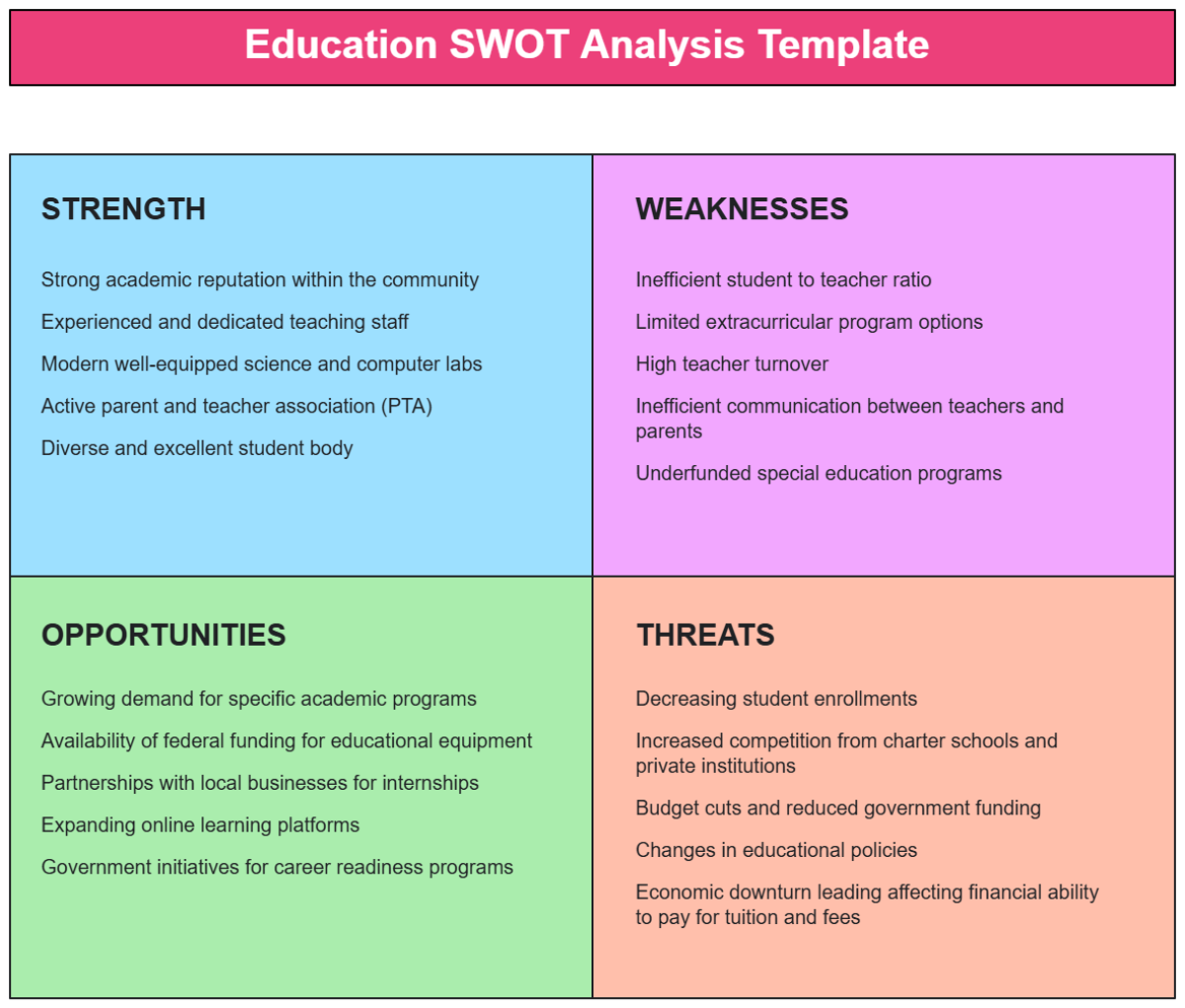

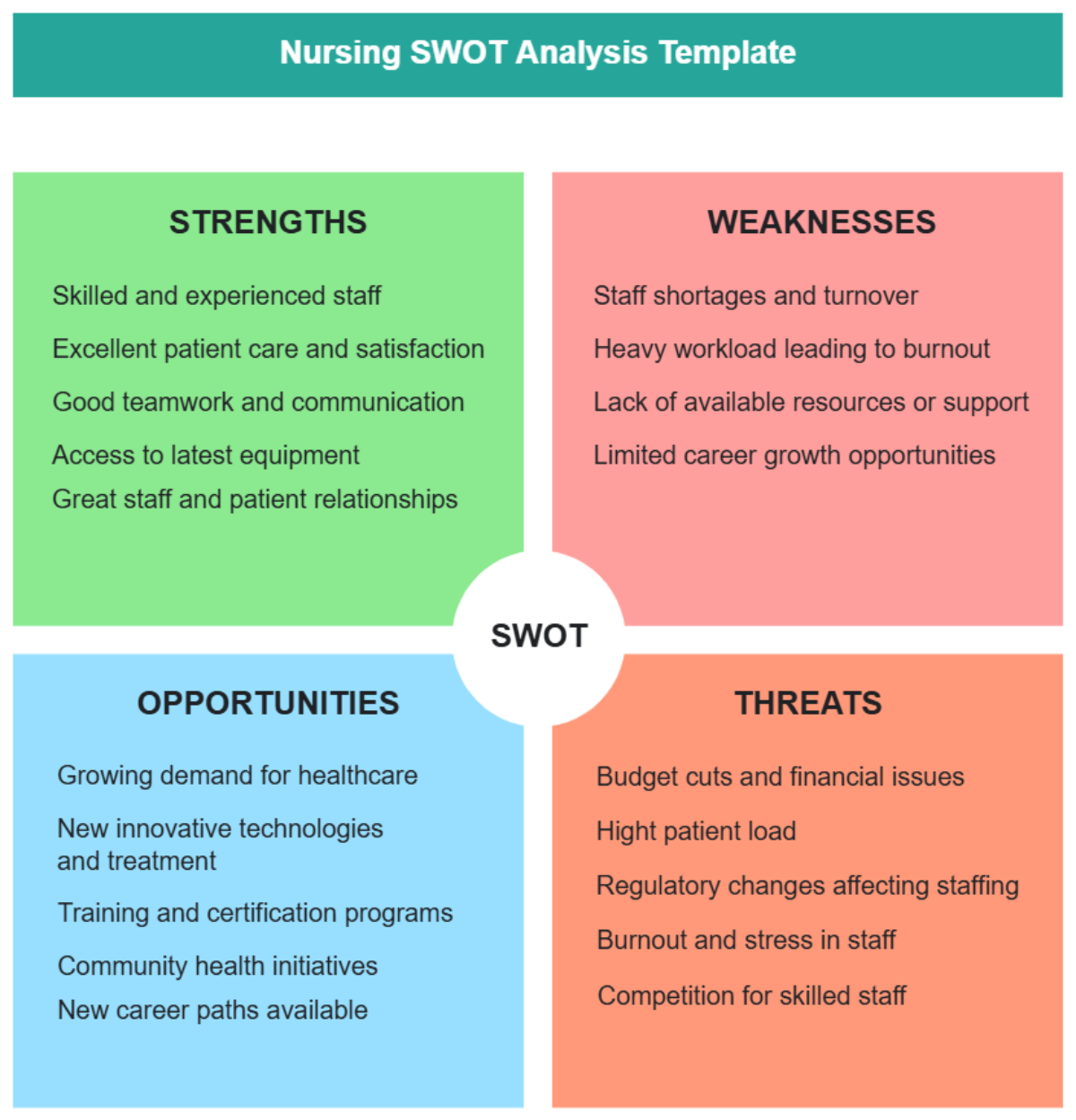

Analysis Overview

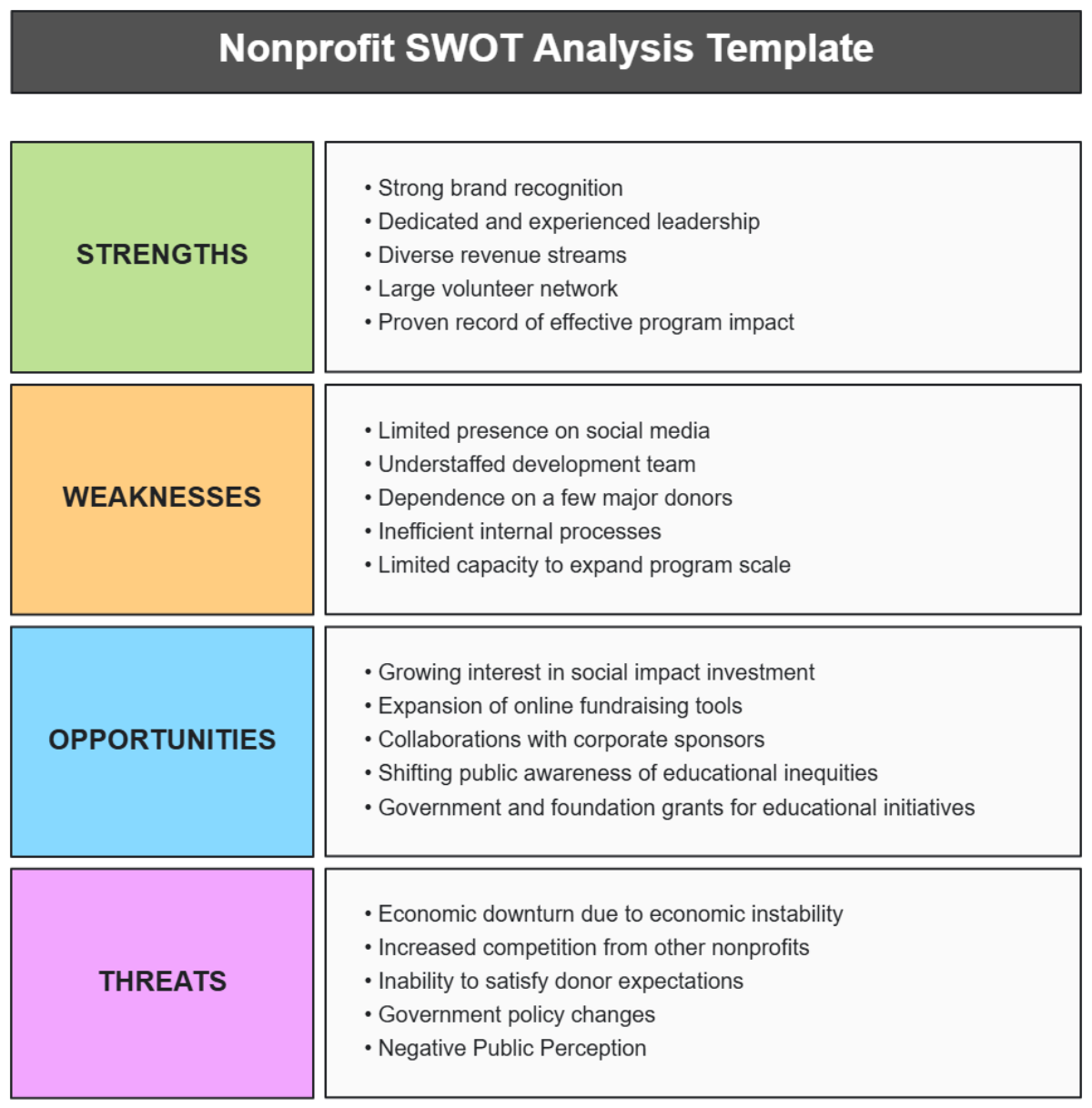

The analysis began by identifying the Strengths of [Your Company Name]'s accounting policy, which include advanced technological integration, exceptional compliance and internal control mechanisms, expertise in the accounting team, and efficient financial planning and forecasting capabilities. In contrast, the Weaknesses identified highlight areas of potential vulnerability, such as over-reliance on specific accounting software, rigidity in accounting procedures, challenges in integrating emerging accounting trends, and potential skill gaps in new financial practices.

The analysis then explored the Opportunities available to [Your Company Name], which present pathways for growth and improvement. These opportunities include embracing emerging technologies, aligning with global accounting standards, incorporating sustainability in reporting, and investing in continuous professional development. Finally, the analysis addressed the Threats that could potentially impact the company’s accounting practices. These include the dynamic regulatory environment, economic volatility, technological disruptions, and competitive pressures in the financial sector.

This SWOT analysis offers a strategic framework for [Your Company Name] to refine its accounting policies, adapt to the changing business environment, and position itself for sustained success. By taking a comprehensive and proactive approach to financial management, the company can navigate challenges effectively and capitalize on opportunities to achieve its business objectives.

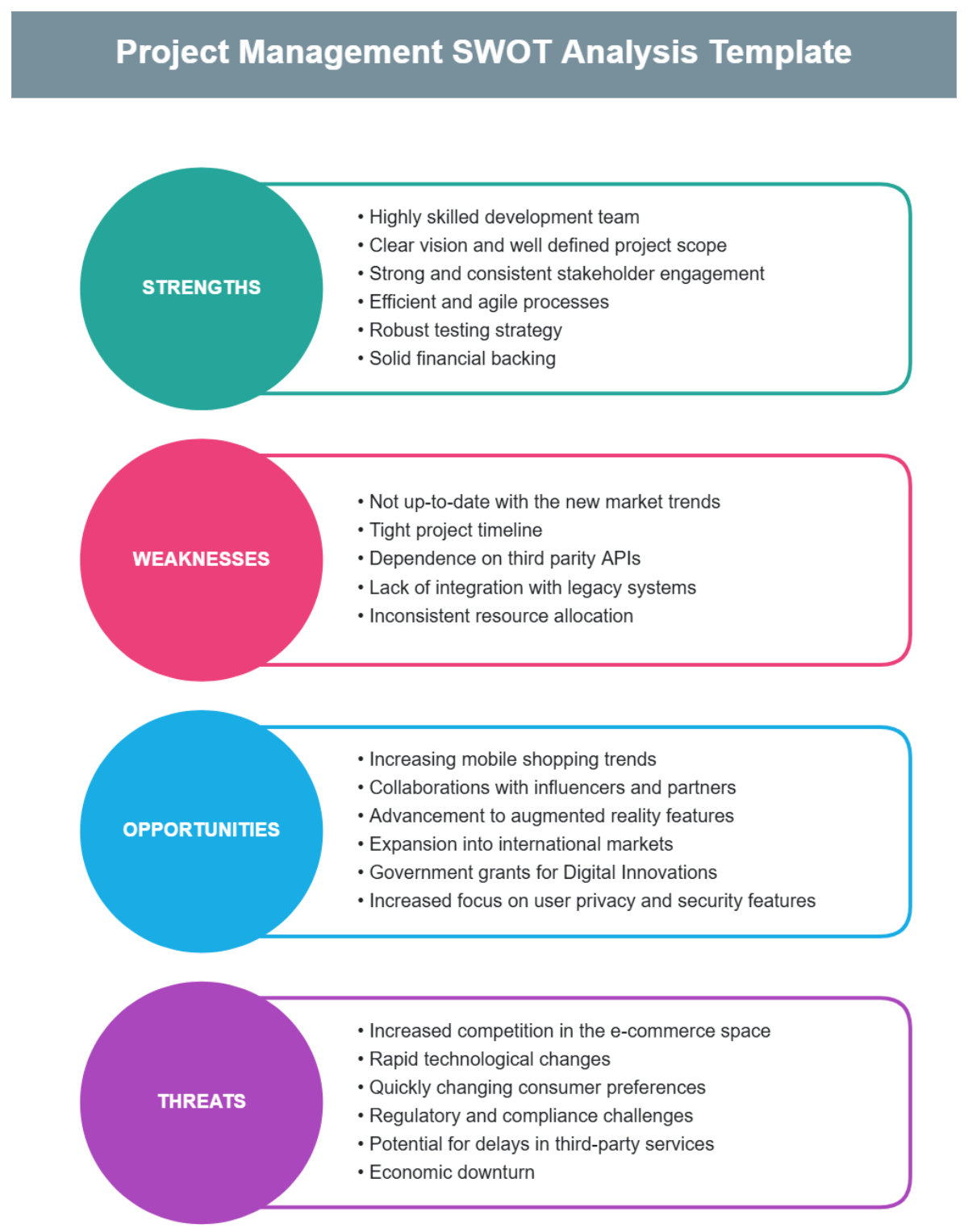

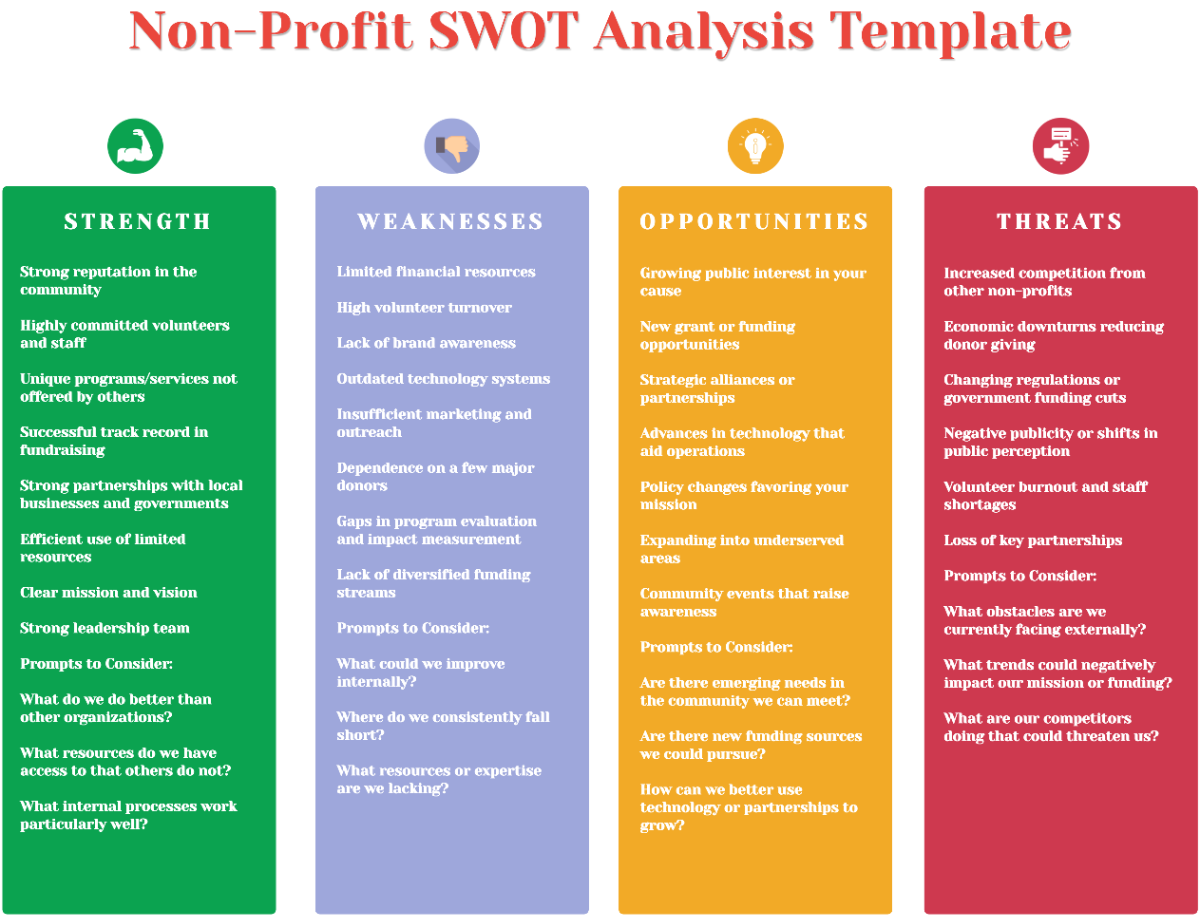

Recommendations

Based on the SWOT analysis, the following recommendations are proposed to strengthen [Your Company Name]'s accounting policy, mitigate risks, and capitalize on identified opportunities for growth and improvement.

Diversify Accounting Software and Systems:

To address the over-reliance on specific accounting software, it is recommended that [Your Company Name] invests in alternative software solutions. This diversification can provide backup options, reduce downtime risks, and increase flexibility in adapting to new technologies.

Enhance Flexibility in Accounting Procedures:

Updating and making accounting procedures more flexible can help the company adapt more readily to changing financial environments and standards. This includes revisiting budgeting practices and reporting formats to allow for more dynamic responses to financial changes.

Embrace Emerging Accounting Trends and Technologies:

Integrating advanced technologies like AI, blockchain, and cloud computing into accounting practices can significantly enhance efficiency and accuracy. This can also position the company as a leader in innovative financial management.

Align with Global Accounting Standards:

Moving towards international accounting standards such as IFRS can open up new opportunities for global business ventures and simplify multinational operations. This alignment also makes the company’s financial reporting more globally acceptable.

Invest in Sustainability and Social Responsibility Reporting:

Incorporating sustainability and social responsibility into the company’s financial reporting can enhance its corporate image and appeal to a broader range of stakeholders, including environmentally and socially conscious investors and consumers.

Continuous Professional Development for Accounting Staff:

Regular training and development opportunities for the accounting team will ensure they are well-equipped to handle emerging trends and complex financial scenarios. This investment in human capital will pay dividends in terms of improved performance and innovation.

Implement Advanced Data Analytics Tools:

Utilize advanced data analytics tools to gain deeper insights into financial data. This can aid in identifying trends, potential risks, and opportunities for cost savings. These tools can transform raw financial data into strategic business insights, aiding in more informed decision-making.

Strengthen Cybersecurity Measures:

With the increase of digitalization in financial processes, enhancing cybersecurity measures is critical. Implement robust security protocols and regular audits to protect sensitive financial data against cyber threats, ensuring the integrity and confidentiality of financial information.

Expand Financial Reporting to Include Non-Financial Metrics:

Broaden the scope of financial reporting to include non-financial metrics such as customer satisfaction, employee engagement, and corporate social responsibility initiatives. This holistic approach to reporting can provide a more comprehensive view of the company’s performance and impact.

Enhance Cross-Departmental Collaboration:

Foster stronger collaboration between the accounting department and other departments such as sales, marketing, and operations. This can lead to more integrated and efficient financial planning, budgeting, and forecasting, aligning financial goals with overall business objectives.

Implementing these recommendations will enable [Your Company Name] to not only address current weaknesses and threats but also to take full advantage of the opportunities presented, ensuring a robust and forward-looking accounting policy.

Strategic Implications

The Strategic Implications segment moves past the present scope of the SWOT analysis, projecting into the potential growth of [Your Company Name]'s accounting practices in the upcoming years.

Anticipating Market and Technological Trends:

[Your Company Name] must remain vigilant and responsive to emerging market trends and technological advancements in the financial sector. This includes staying ahead in digital finance technologies, adopting more sophisticated data analytics tools, and anticipating changes in consumer and business financial behaviors. By staying attuned to these trends, the company can preemptively adjust its accounting strategies to maintain a competitive edge.

Regulatory Changes and Global Expansion:

As the company grows, particularly in international markets, it will need to navigate an increasingly complex regulatory process. This involves not only compliance with diverse financial regulations but also adapting accounting practices to various international standards and tax regimes. Strategic foresight in regulatory alignment will be essential for smooth global operations and expansion.

Sustainability and Ethical Financial Practices:

There will be a growing emphasis on sustainability and ethical considerations in financial reporting and practices. [Your Company Name] should integrate environmental, social, and governance (ESG) factors into its accounting policies. This shift will not only align with global trends towards sustainability but also cater to the evolving expectations of stakeholders and investors.

Investing in Future-Ready Talent:

The future of accounting will demand a workforce skilled in new technologies and adaptable to changing financial environments. [Your Company Name] should focus on nurturing talent that is not only proficient in contemporary accounting practices but also forward-thinking and innovative. This involves continuous training, recruitment of diverse skill sets, and fostering a culture of lifelong learning.

Enhancing Financial Resilience and Agility:

[Your Company Name] needs to build financial resilience and agility. This includes maintaining robust risk management practices, diversifying financial portfolios, and developing agile financial planning and forecasting models that can quickly adapt to changing circumstances.

By focusing on these implications, [Your Company Name] will be better equipped to handle the challenges and opportunities in their financial operations. This proactive and strategic approach will be key to the company’s sustained growth, financial health, and competitive positioning in the years ahead.

Conclusion

The SWOT analysis of [Your Company Name]'s accounting policy has provided an overview of the internal strengths and weaknesses, as well as the external opportunities and threats that impact the company's financial practices. The insights gained from this analysis highlight the importance of evolving and adapting in the dynamic field of accounting. By capitalizing on emerging technological trends and aligning with global accounting standards, the company can seize opportunities for growth and enhance its competitive edge in the market. The recommendations provided aim to guide [Your Company Name] towards strategic improvements in its accounting practices, positioning it for sustained success and resilience in the business sector.