Free Multi-Year Finance Budget Document

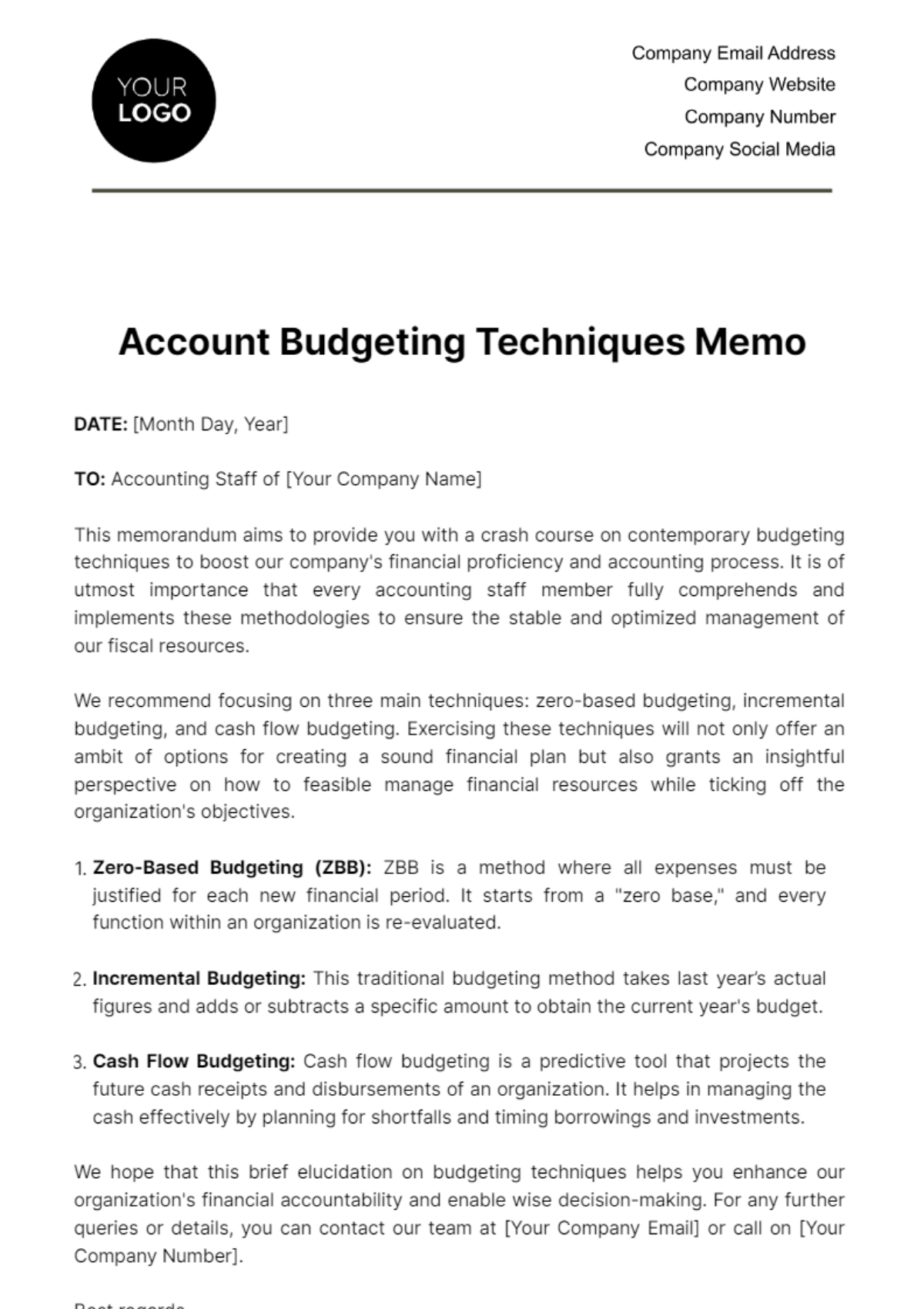

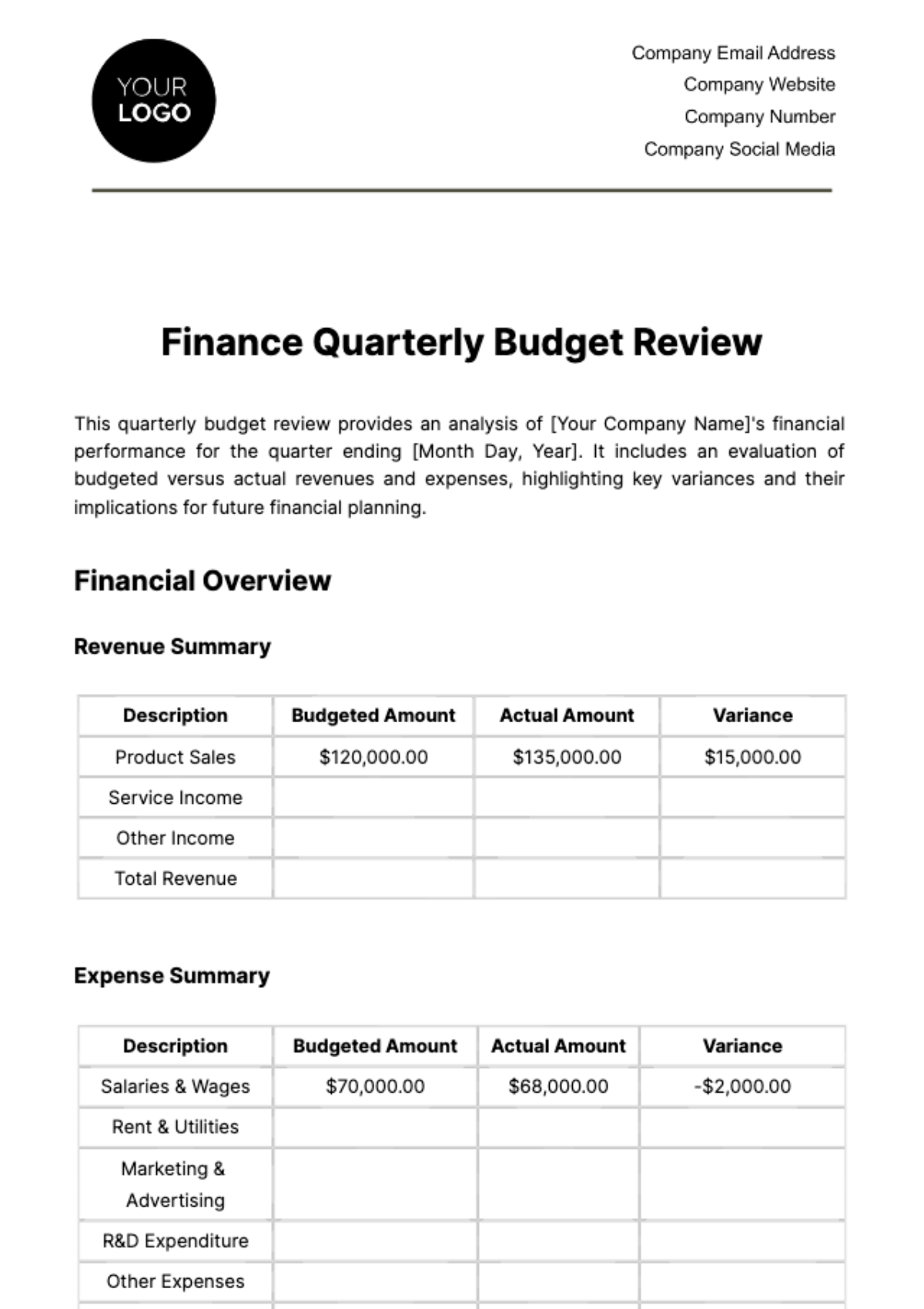

Template.net's Multi-Year Finance Budget Document Template offers a comprehensive, editable solution for businesses planning their financial future. With detailed sections on revenue forecasts, expenditures, and capital budgeting, it's designed for strategic clarity and fiscal precision. Streamline your multi-year financial planning with this user-friendly, professionally crafted template, adaptable to your specific business needs with help from our AI editor tool for full customization.