Account Risk Management Checklist

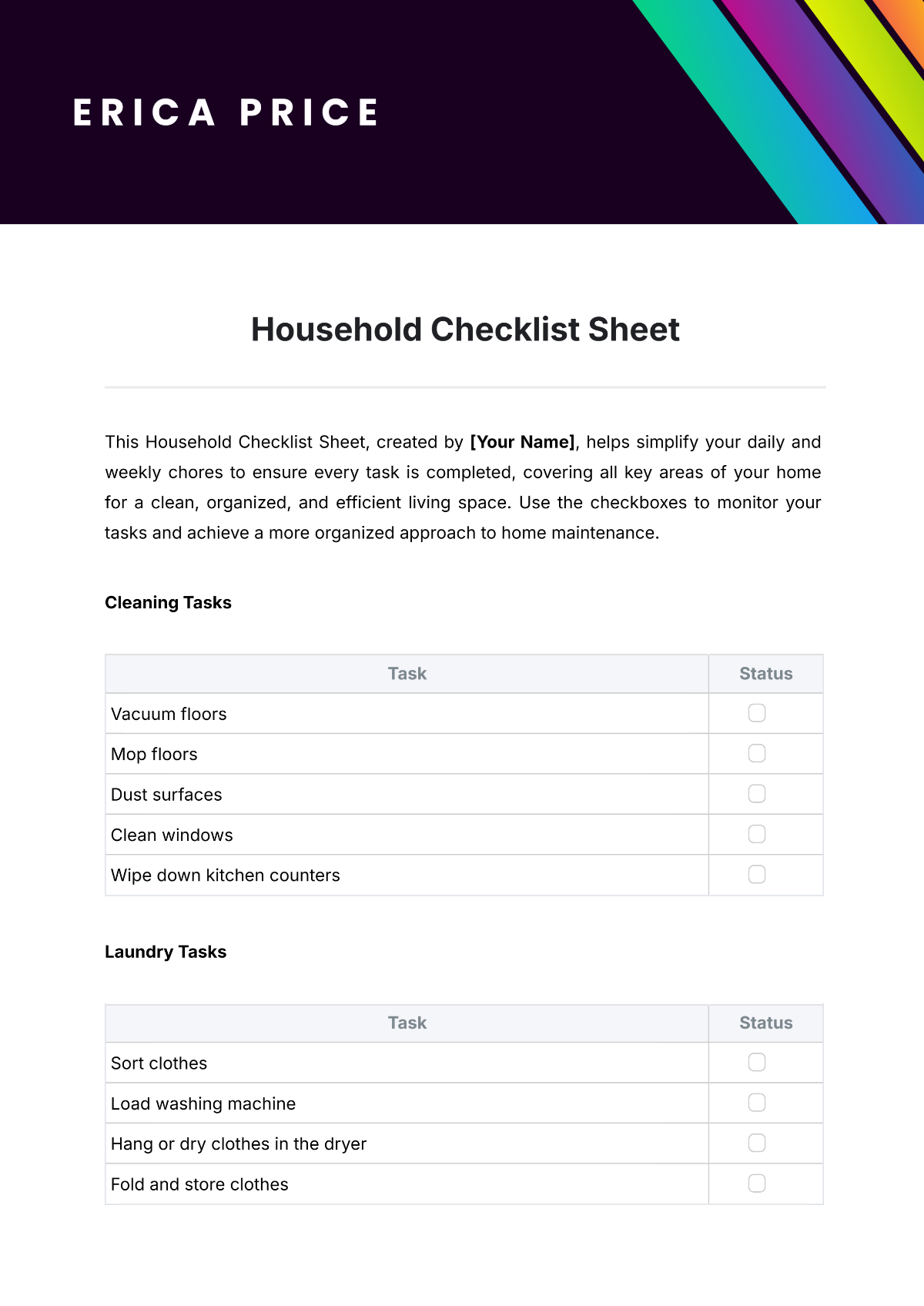

Follow the steps accordingly and check the box once a step has been completed.

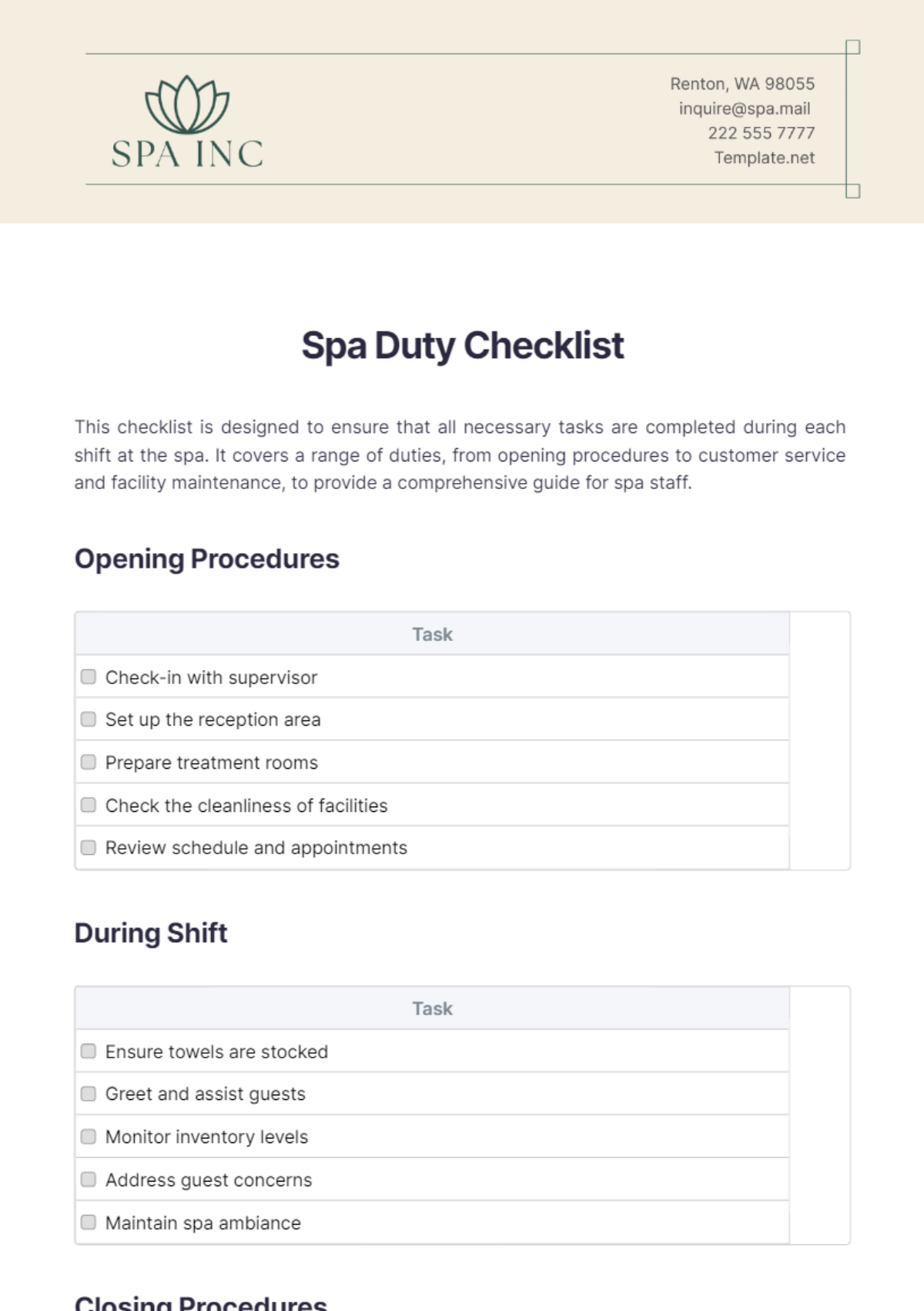

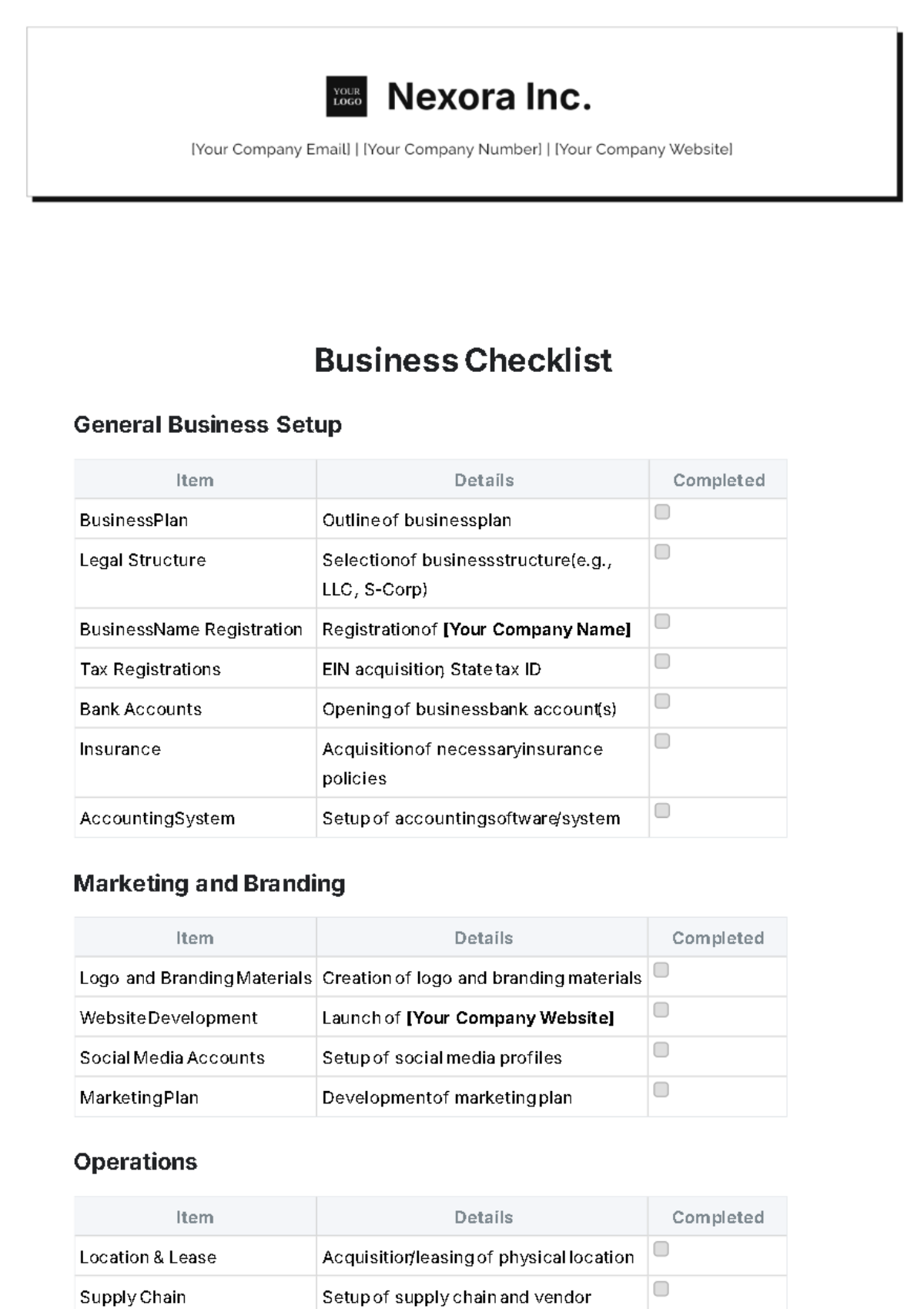

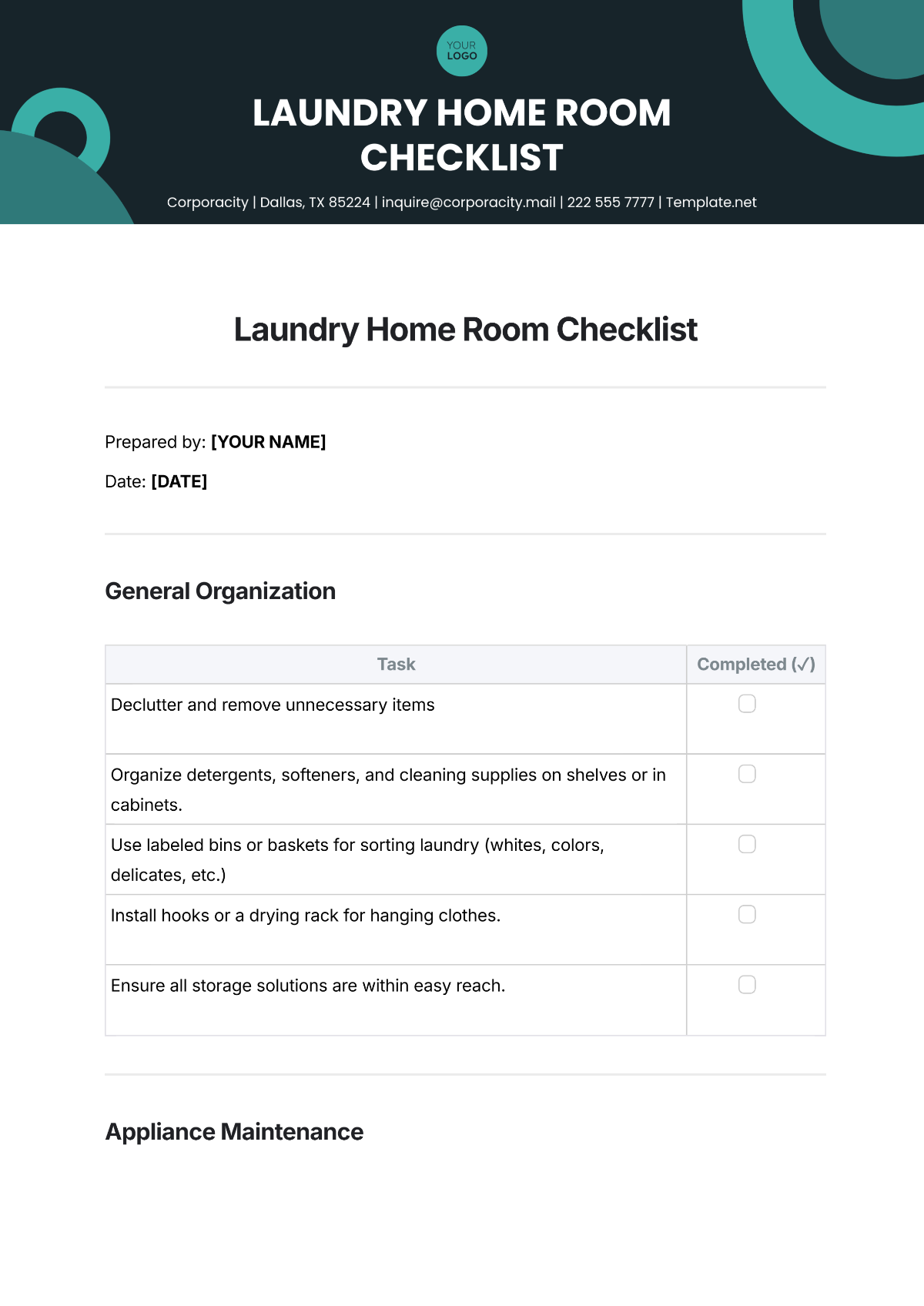

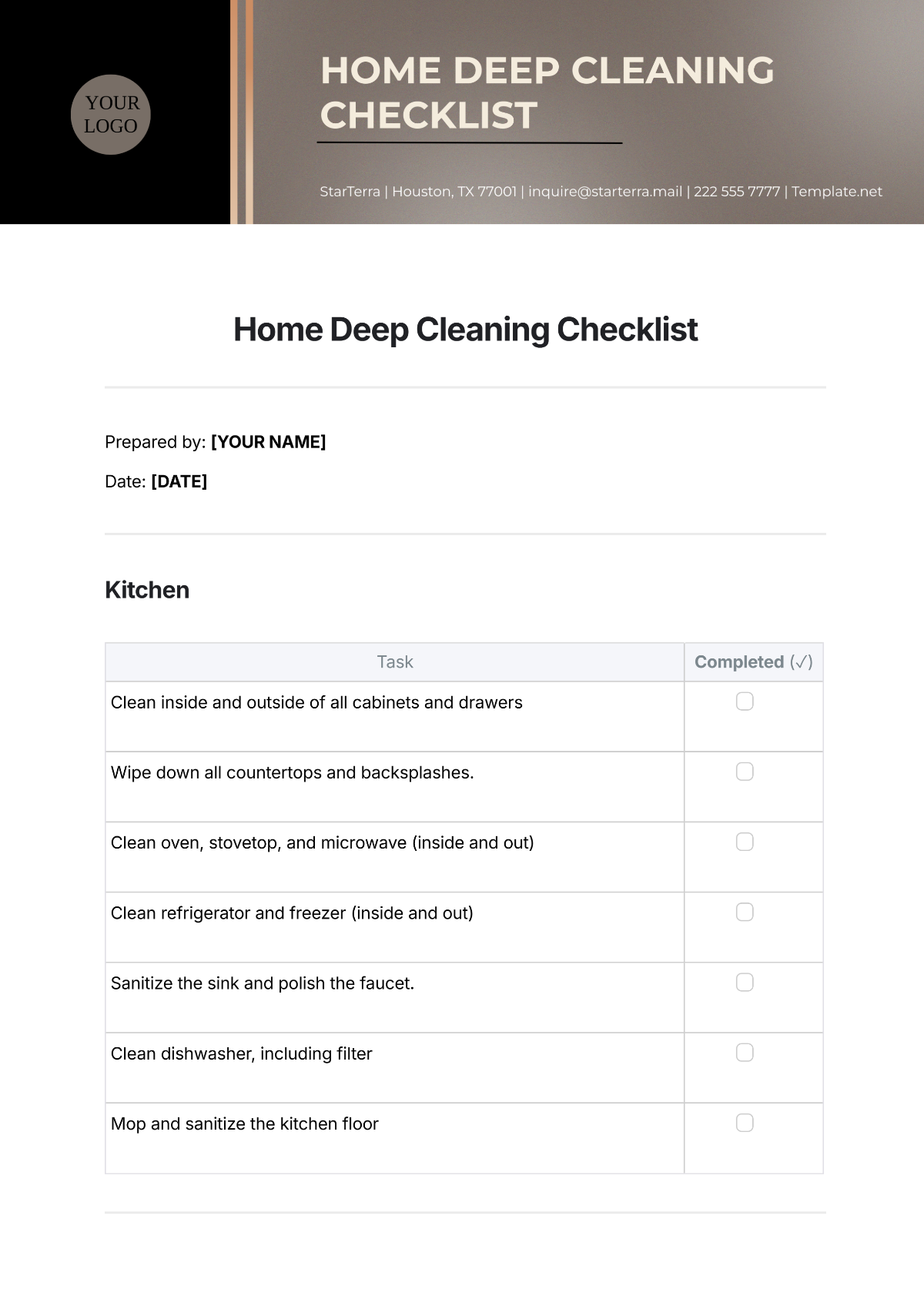

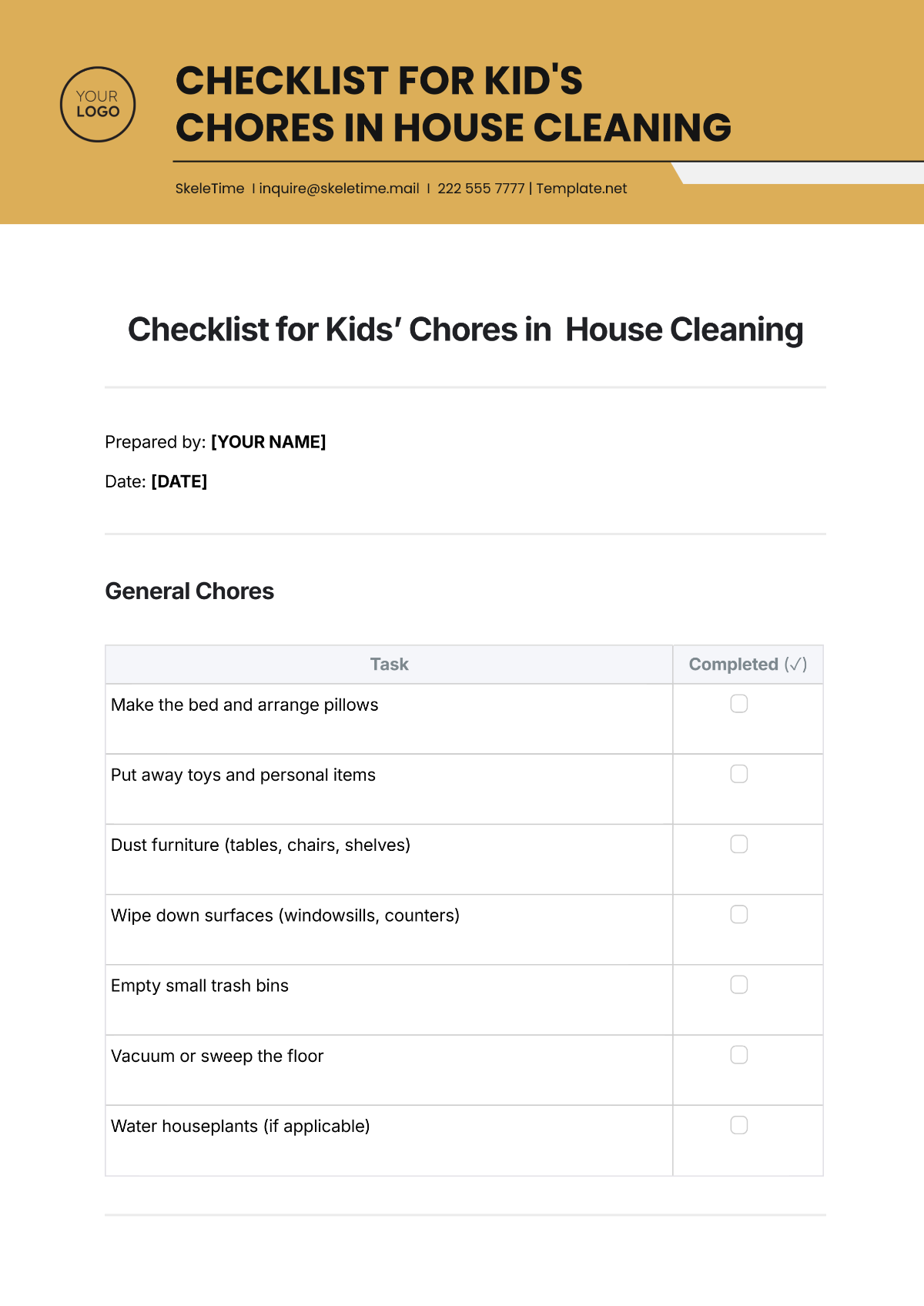

DONE | TASK |

|---|---|

✔ | Identify potential financial risks including liquidity and legal risks. |

Assess new risks emerging due to technological advancements. | |

Evaluate the likelihood and impact of identified risks on financial statements. | |

Consider the effectiveness of existing control measures in mitigating these risks. | |

Develop strategies to mitigate, accept, transfer, or avoid risks. | |

Establish thresholds for risk tolerance and define actions for risks exceeding these thresholds. | |

Execute risk response plans through policy changes, process adjustments, and allocation of resources. | |

Update risk management strategies based on new information or changes in the organization’s context. | |

Strengthen internal controls to prevent and detect errors and fraud in financial reporting. | |

Ensure compliance with accounting standards and regulations. | |

Maintain comprehensive documentation of risk management policies, assessments, and procedures. | |

Ensure records are securely stored and readily accessible for review and audit. | |

Engage external auditors to review the effectiveness of the risk management process. | |

Continuously explore and integrate technological advancements that can enhance risk detection and management capabilities. |