Account SWOT Analysis

TABLE OF CONTENTS

Introduction...........................................................................................................3

Impact of Technological Advancements.............................................................4

Training and Development Initiatives..................................................................5

Strengths................................................................................................................6

Weaknesses...........................................................................................................7

Opportunities.........................................................................................................8

Threats...................................................................................................................9

Recommendations and Implementation Timeline...............................................10

Conclusion..............................................................................................................11

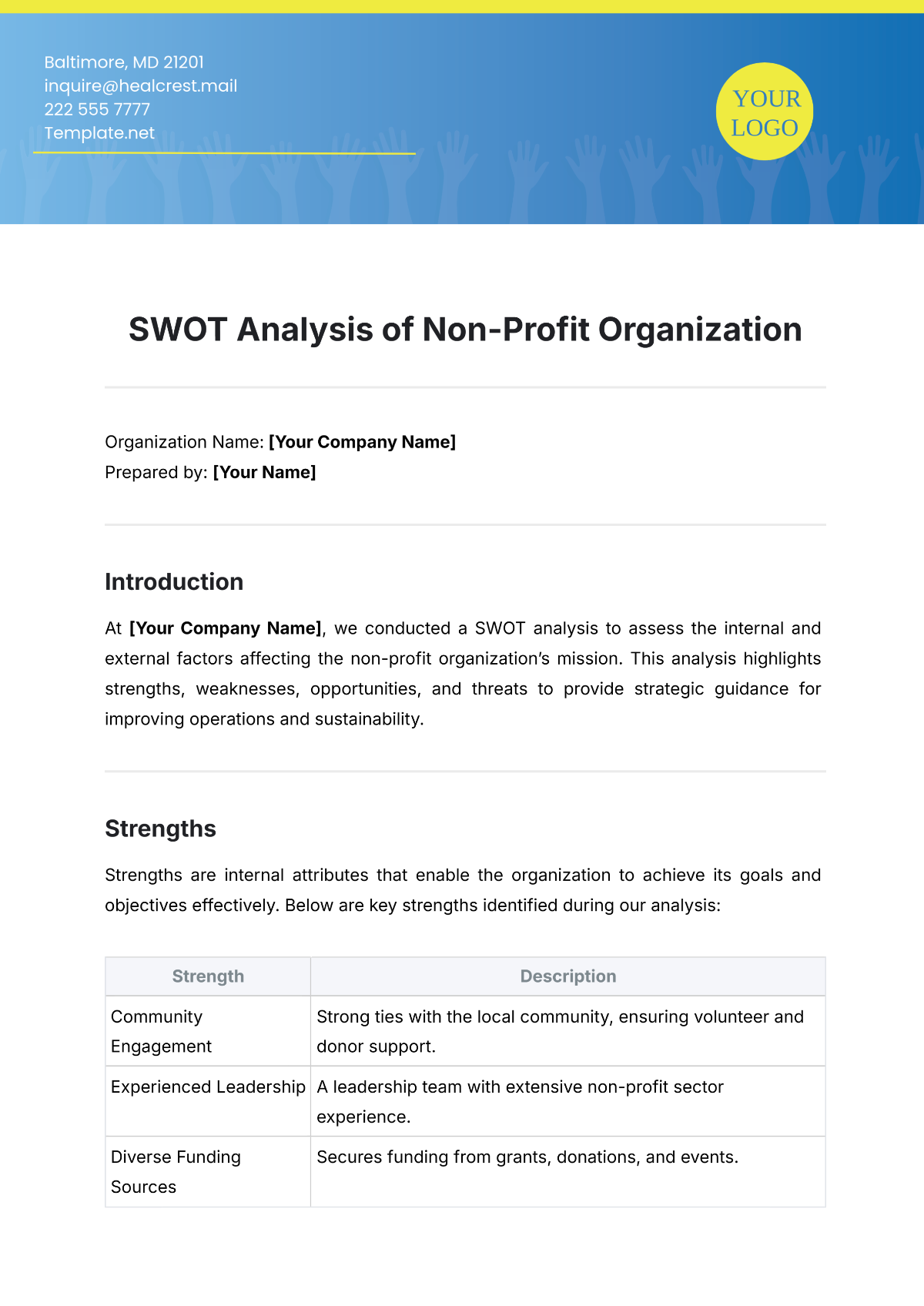

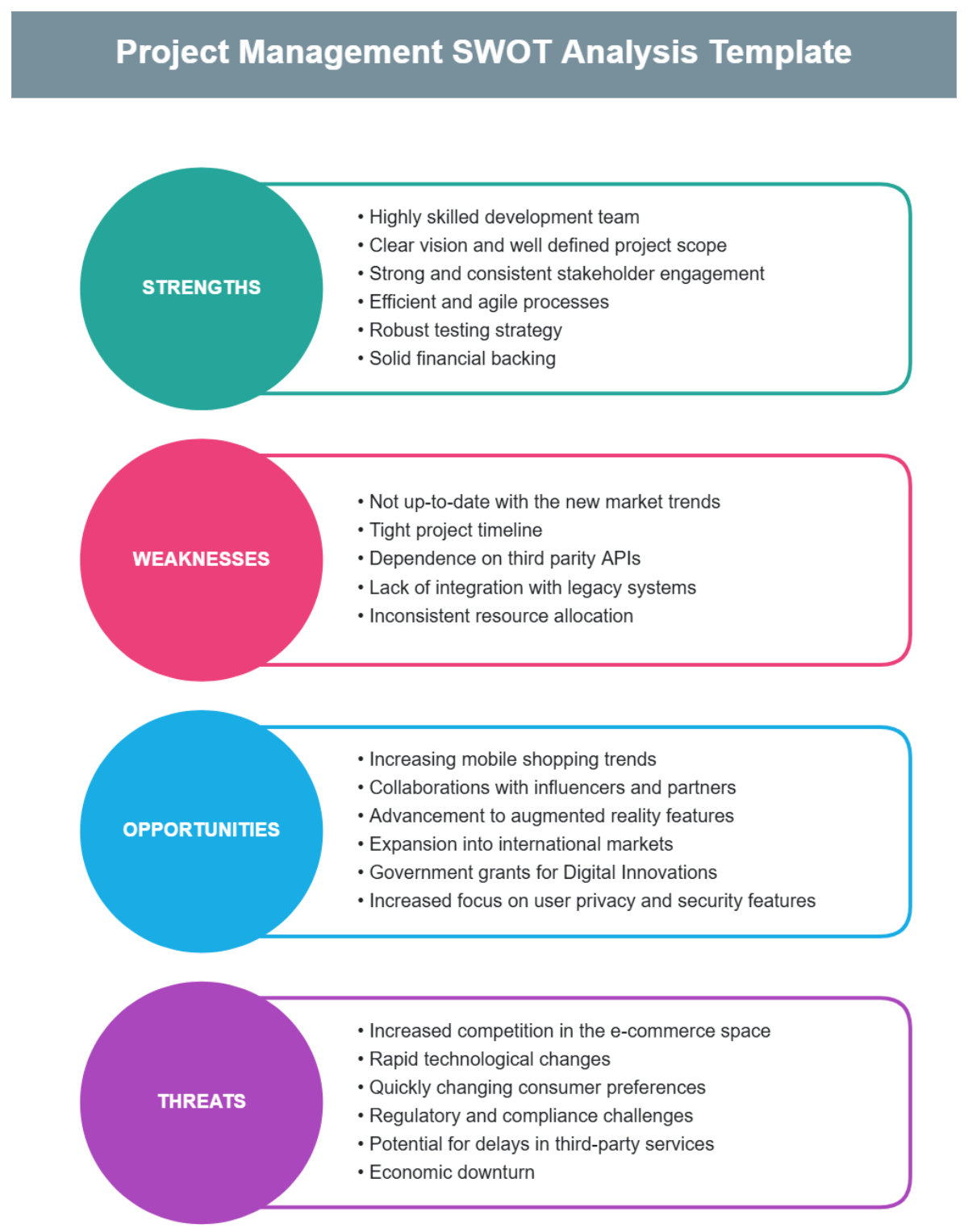

Introduction

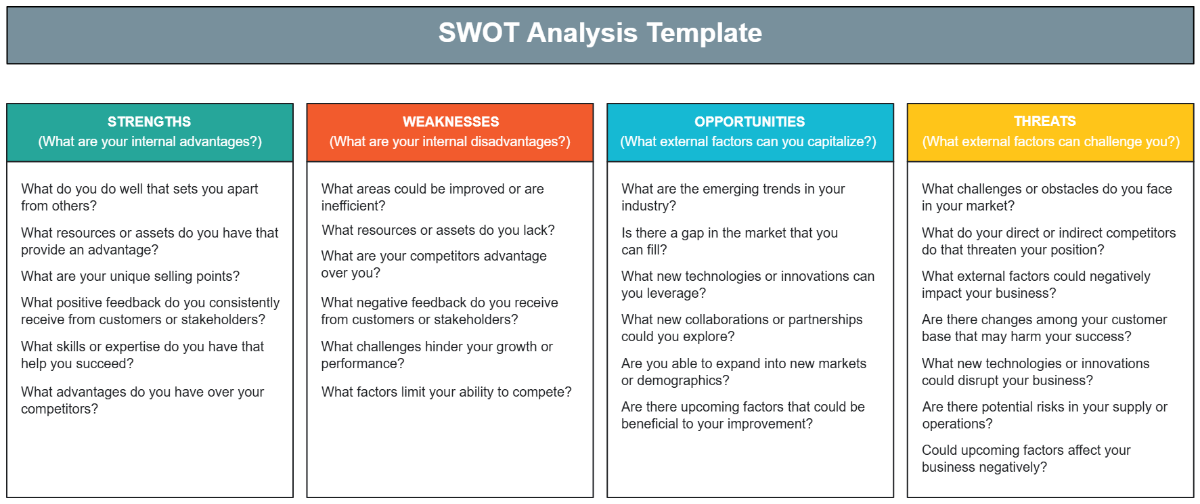

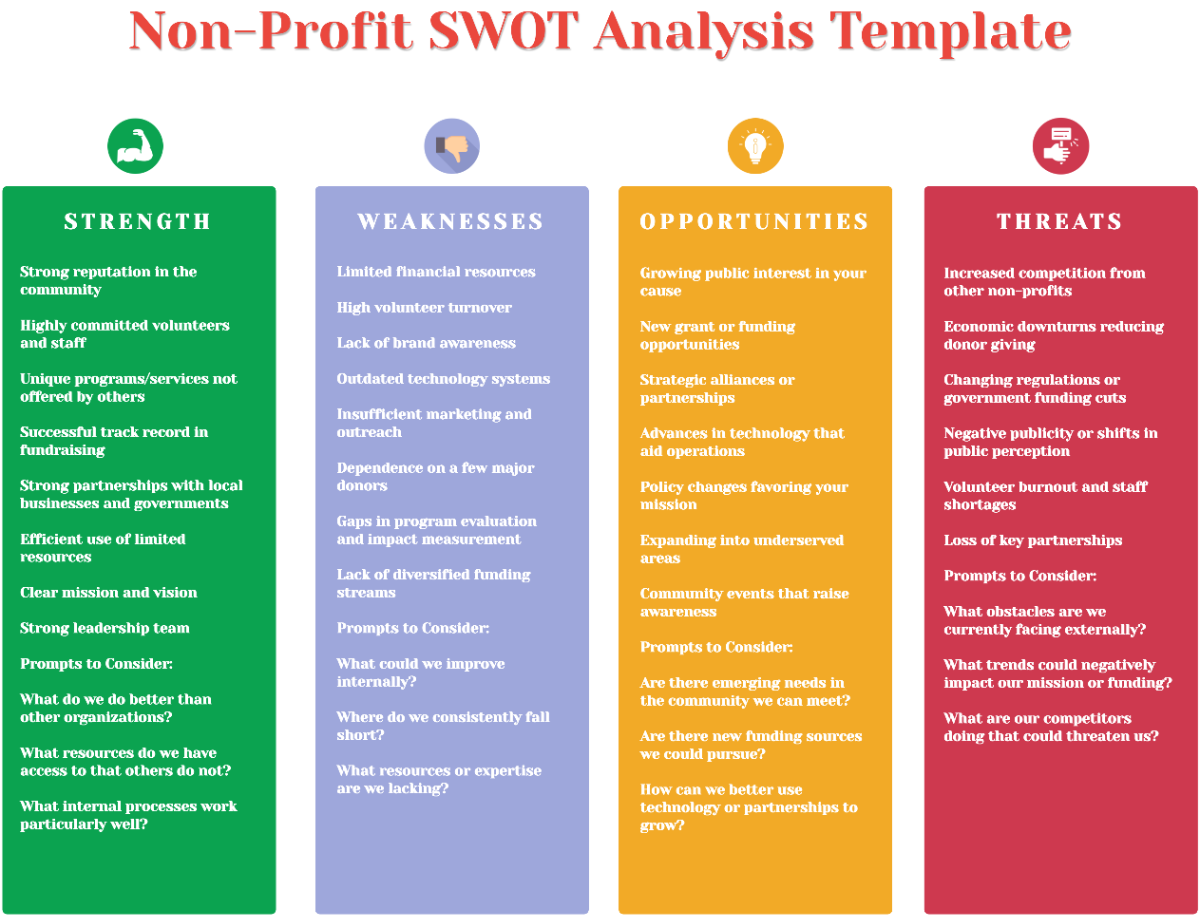

This SWOT analysis provides a detailed examination of the strengths, weaknesses, opportunities, and threats pertaining to the accounting department of [Your Company Name]. It serves as a critical tool for identifying key areas requiring improvement and strategic development. The analysis is intended to guide decision-making processes and support the long-term financial objectives of the company.

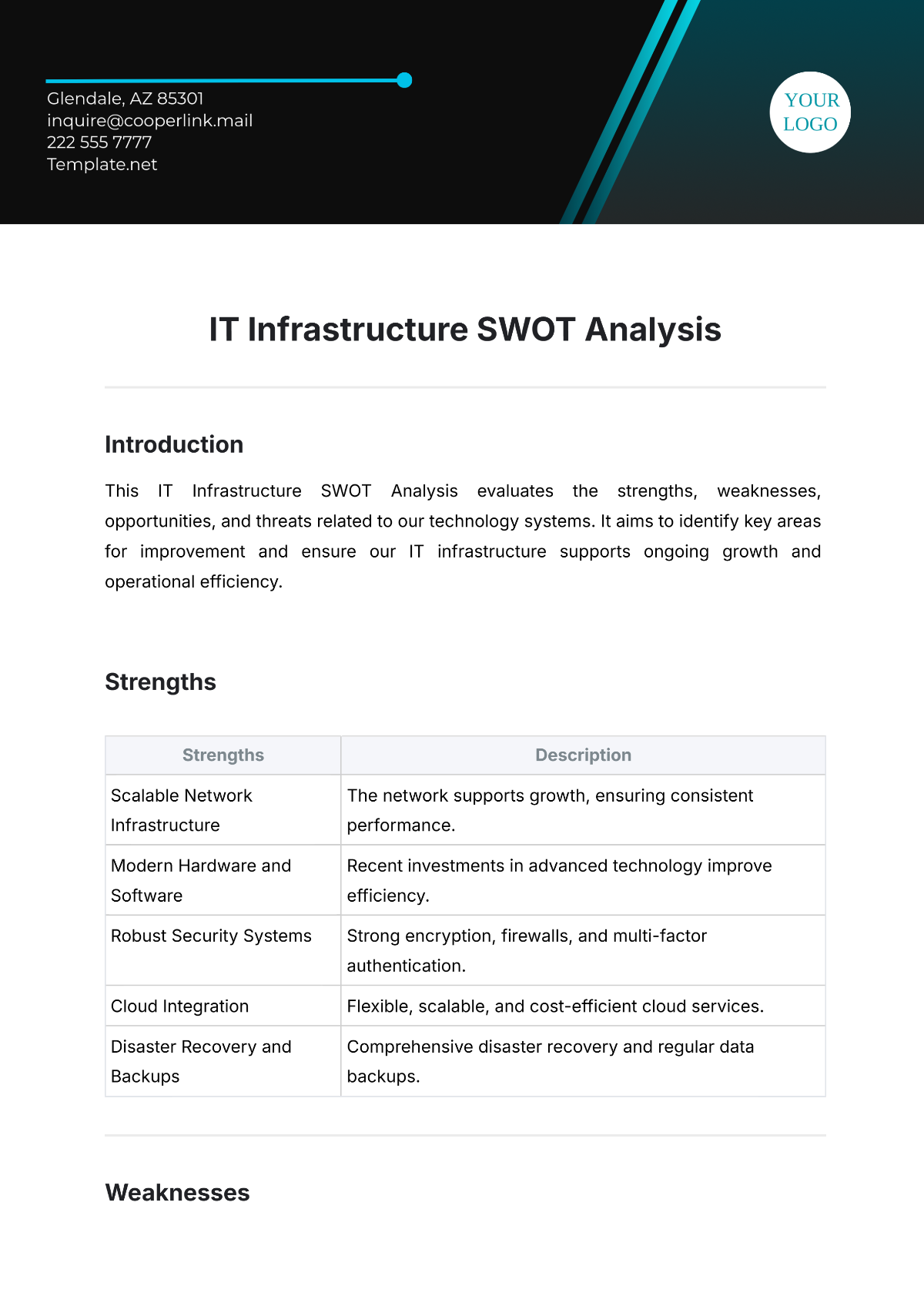

Impact of Technological Advancements

The focus will be on how the integration of advanced technologies like AI, machine learning, and blockchain can significantly enhance the efficiency and accuracy of the accounting processes in [Your Company Name]. The potential for automation, real-time data analysis, and secure transaction processing will be explored, along with the associated challenges and implementation strategies.

Training and Development Initiatives

We examine the prevailing constraints in the training and development process within the accounting department of [Your Company Name]. It is evident that the existing framework for staff development inadequately addresses the demands of the accounting profession, particularly on the technological advancements and global financial complexities. To remedy this, a comprehensive suite of initiatives is proposed, aimed at substantially augmenting the proficiency and adaptability of the accounting personnel. Key components of these initiatives include:

Integration of Advanced Accounting Technologies: Implementing specialized training programs to familiarize staff with the latest accounting software and tools, including AI-driven analytics and blockchain technology. This training will enable staff to efficiently handle automated processes, data analysis, and ensure the security and integrity of financial transactions.

Compliance with International Financial Standards: Given the global expansion of business operations, it is imperative to train accountants in international financial reporting standards (IFRS) and cross-border tax regulations. This training will equip them to manage financial operations seamlessly across different regulatory environments, thus facilitating the company's international growth.

Strategic Financial Planning and Analysis: Developing advanced skills in strategic planning and financial analysis to enable accountants to contribute more significantly to business strategy and decision-making processes. This includes training in scenario analysis, risk management, and predictive financial modeling.

Continuous Professional Development (CPD) Programs: Establishing ongoing CPD programs to ensure that the accounting staff remains abreast of the latest developments in accounting standards, regulations, and best practices. These programs will include workshops, seminars, and e-learning modules, allowing for flexible and continuous learning.

Collaborative Learning and Knowledge Sharing: Creating a culture of collaborative learning and knowledge sharing within the department. This could involve setting up in-house training sessions led by experienced staff members, encouraging mentorship programs, and providing platforms for team members to share insights and solutions to complex accounting challenges.

The overarching aim of these initiatives is to cultivate a highly skilled, technologically adept, and strategically oriented accounting team. This team will not only excel in traditional accounting practices but also drive innovation and efficiency, positioning [Your Company Name] at the forefront of financial management excellence.

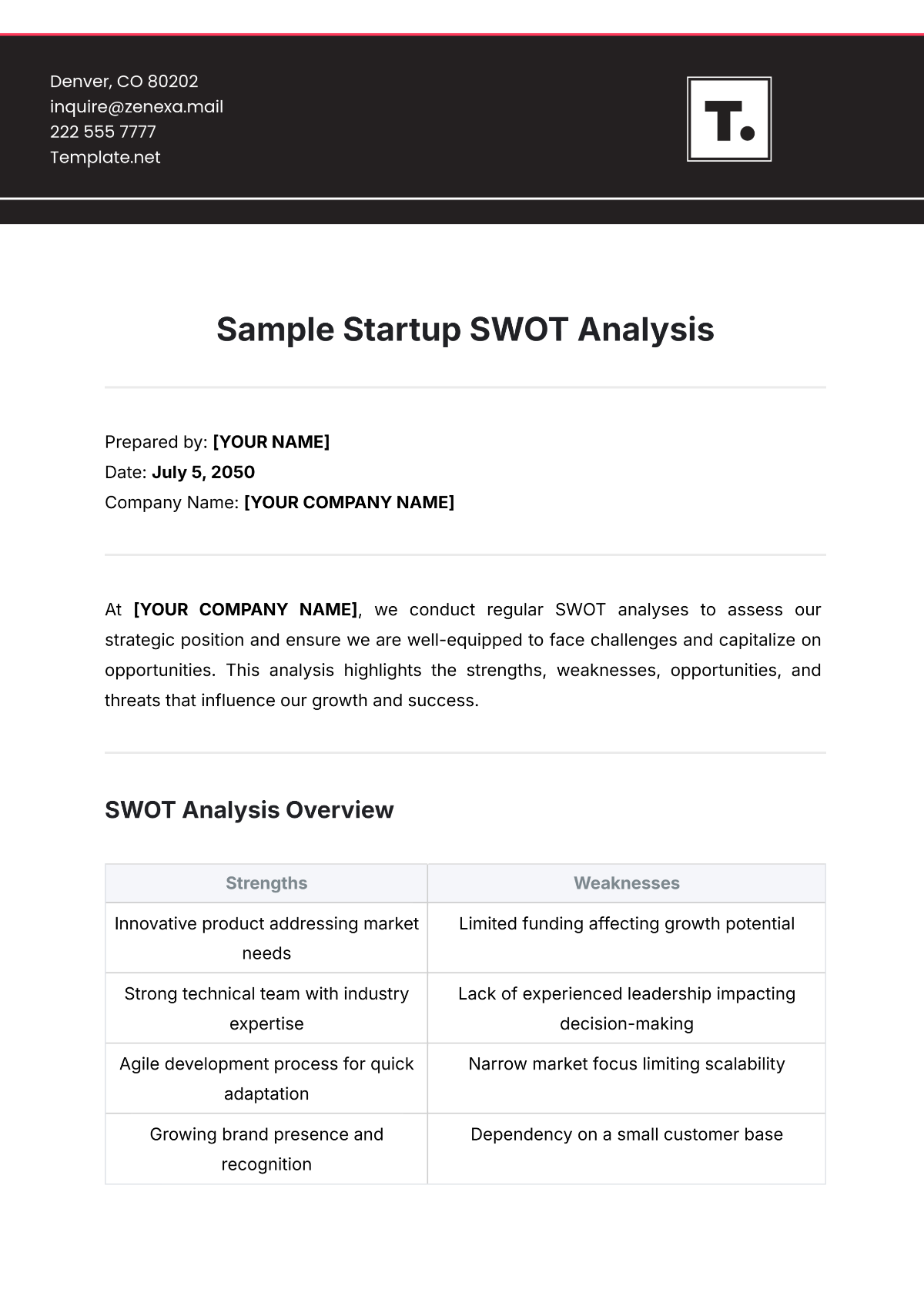

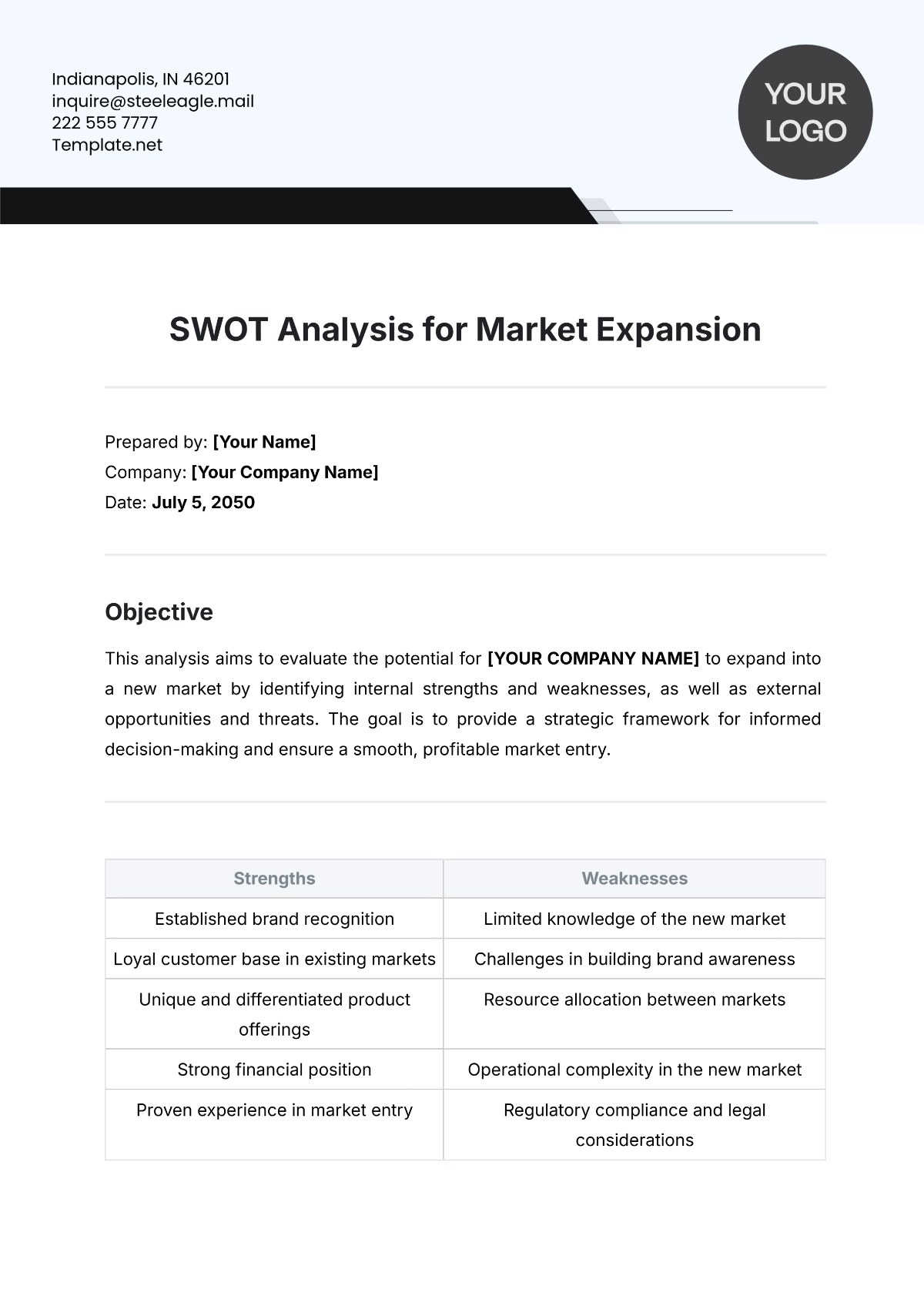

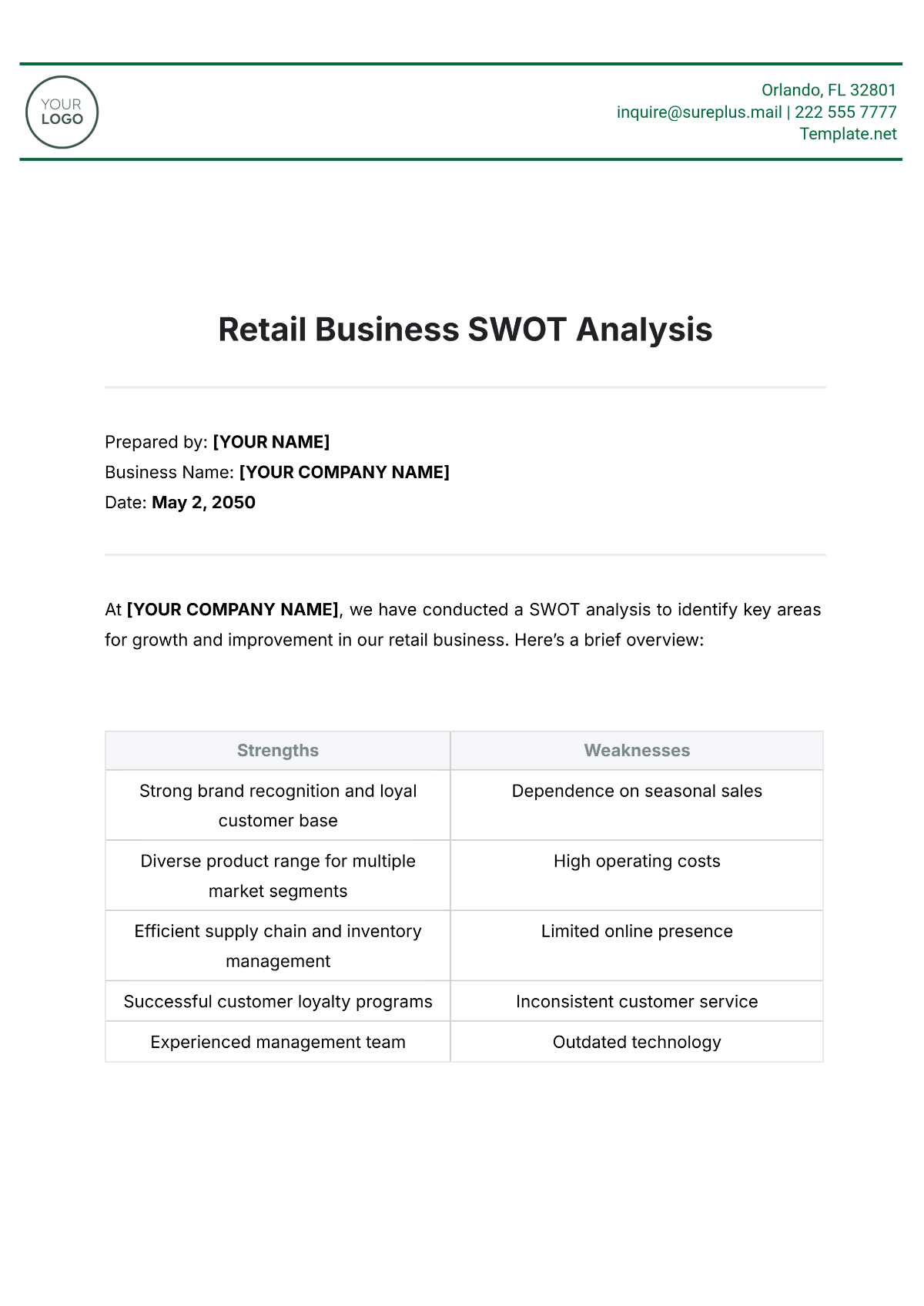

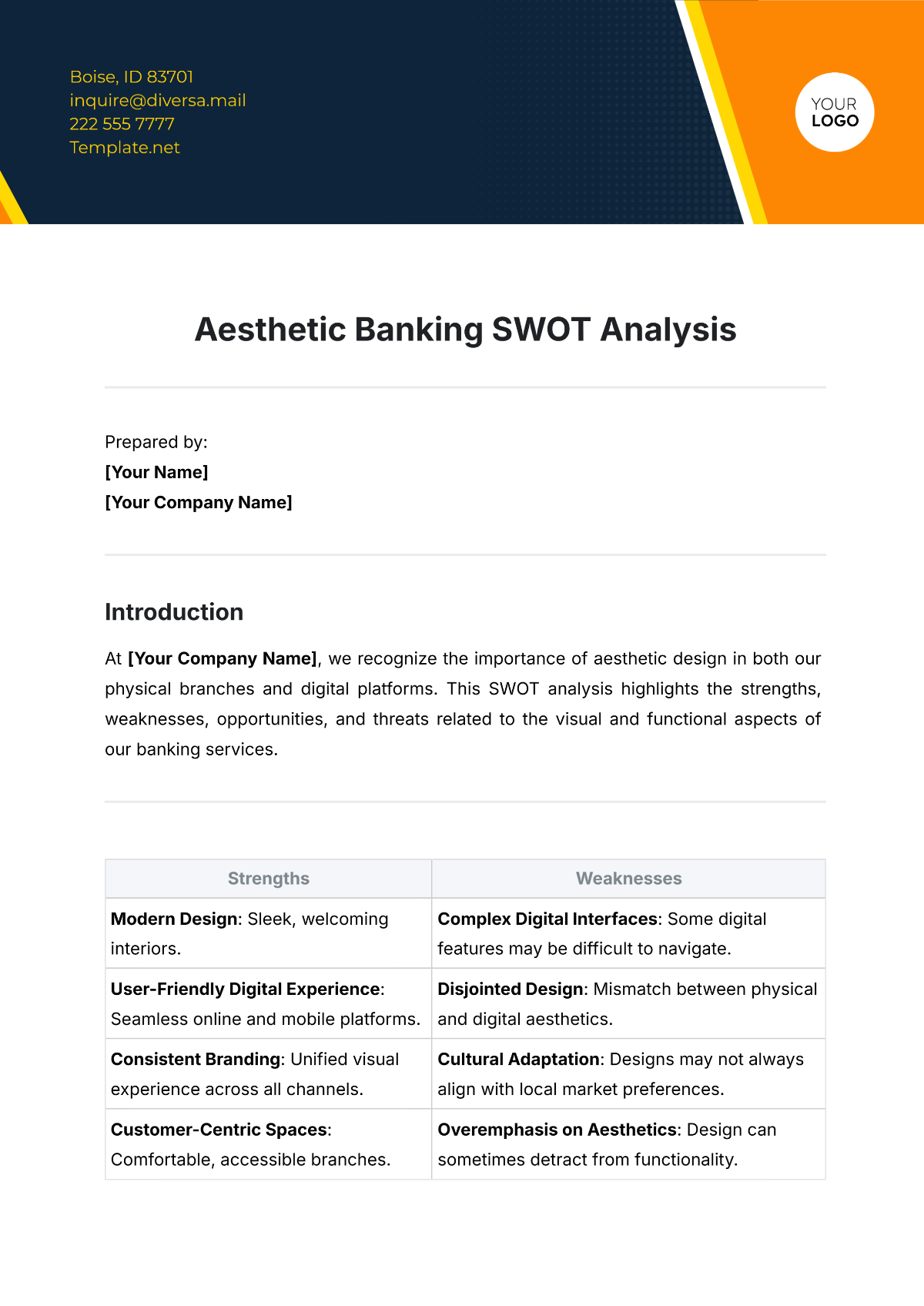

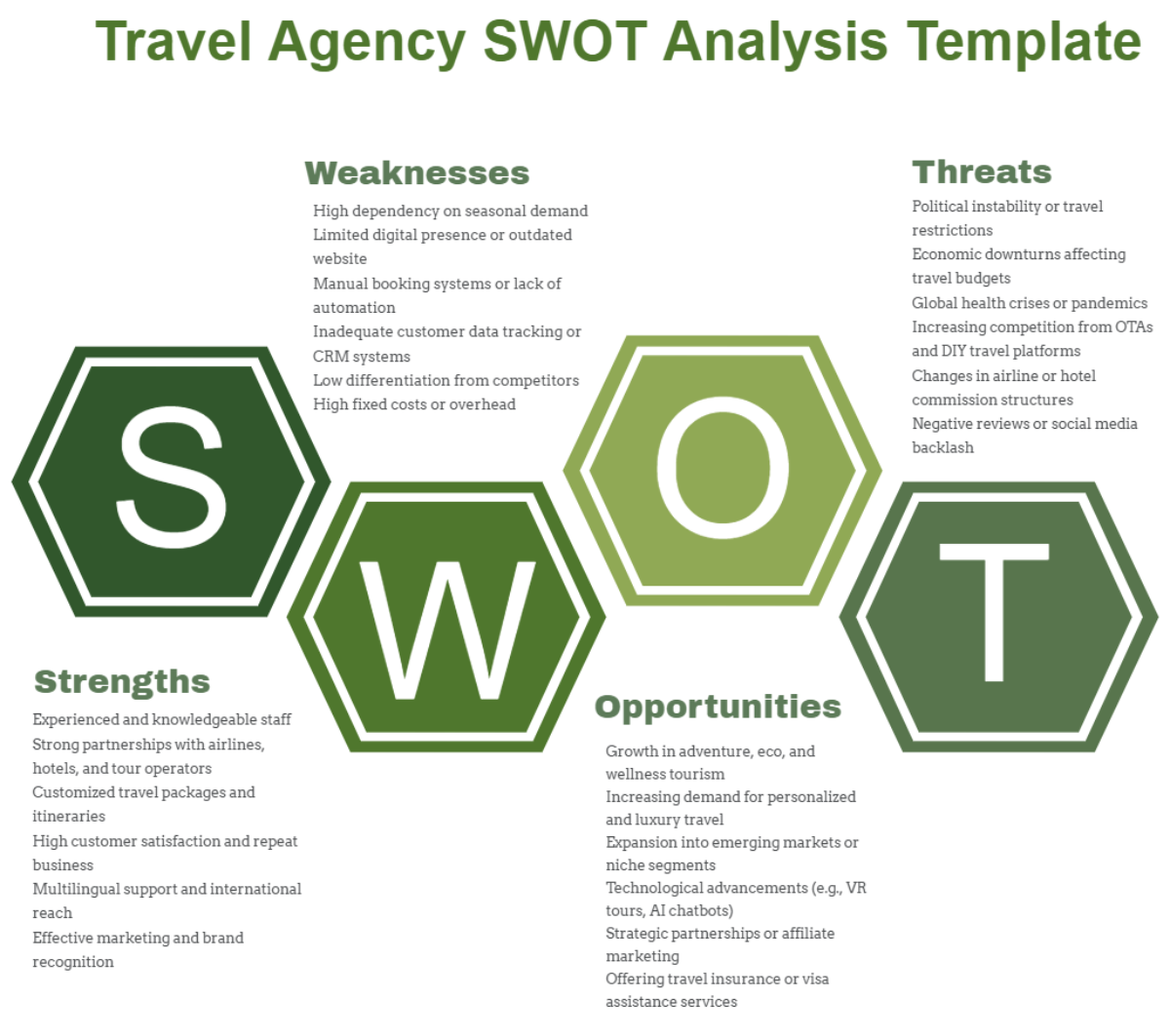

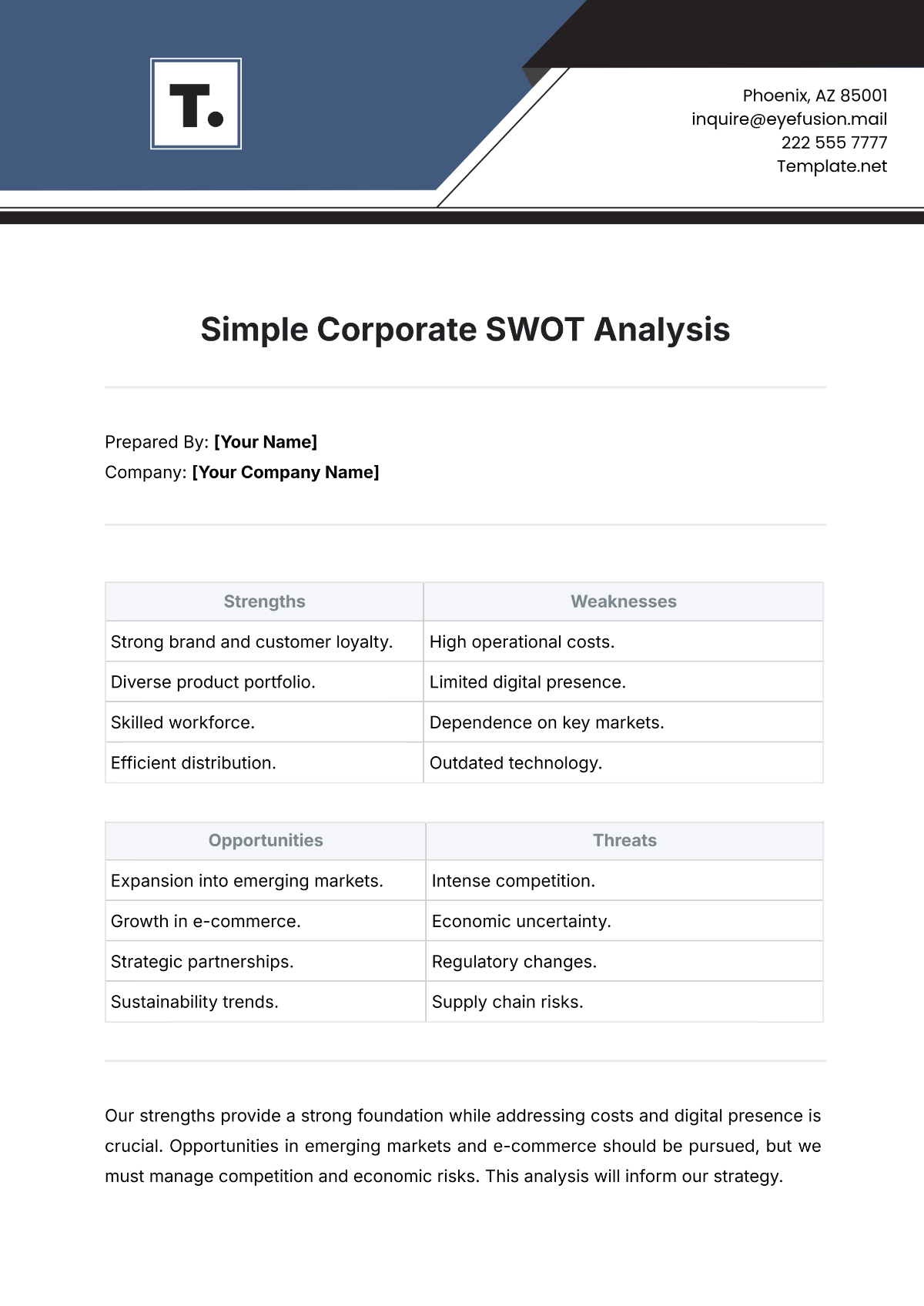

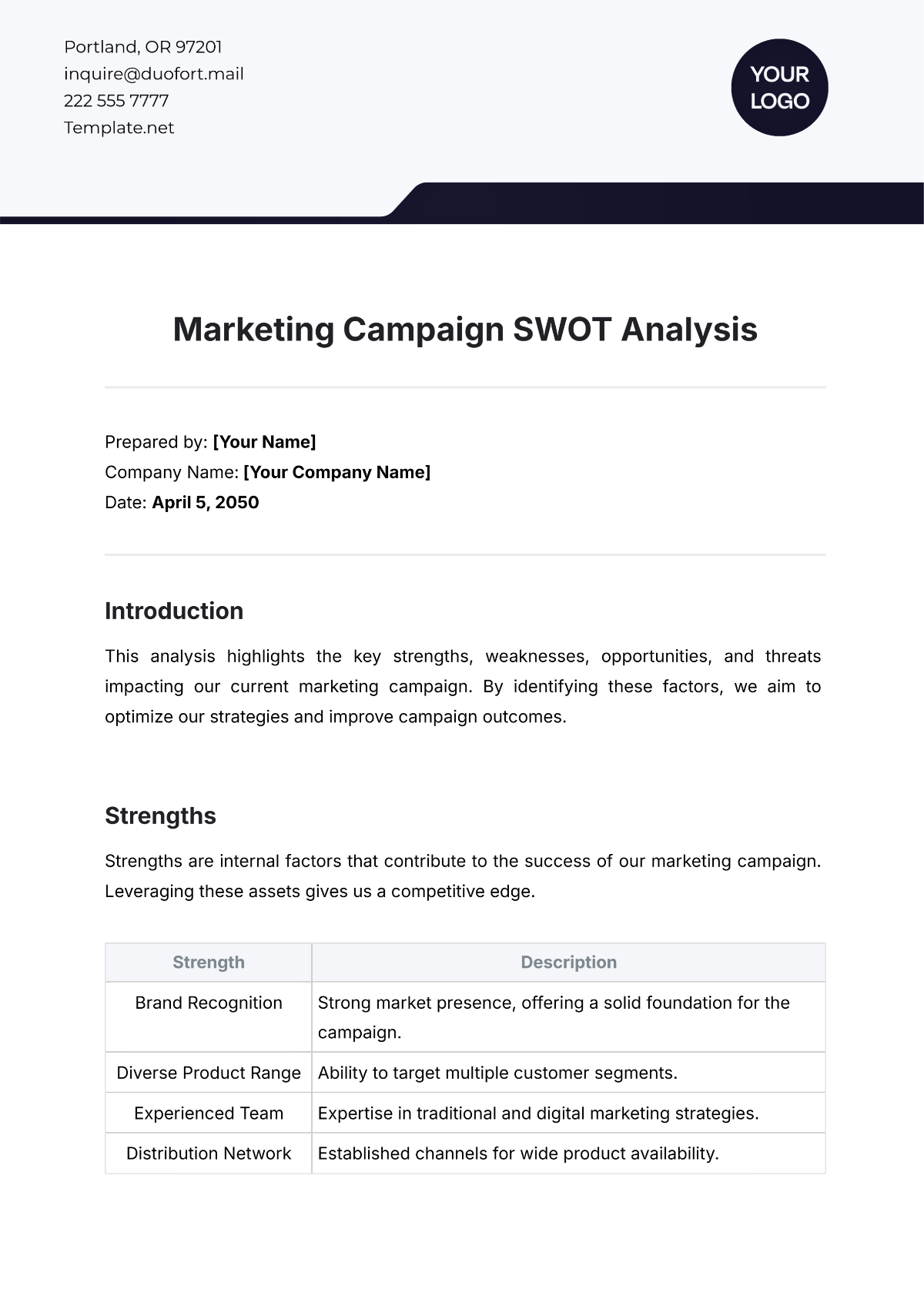

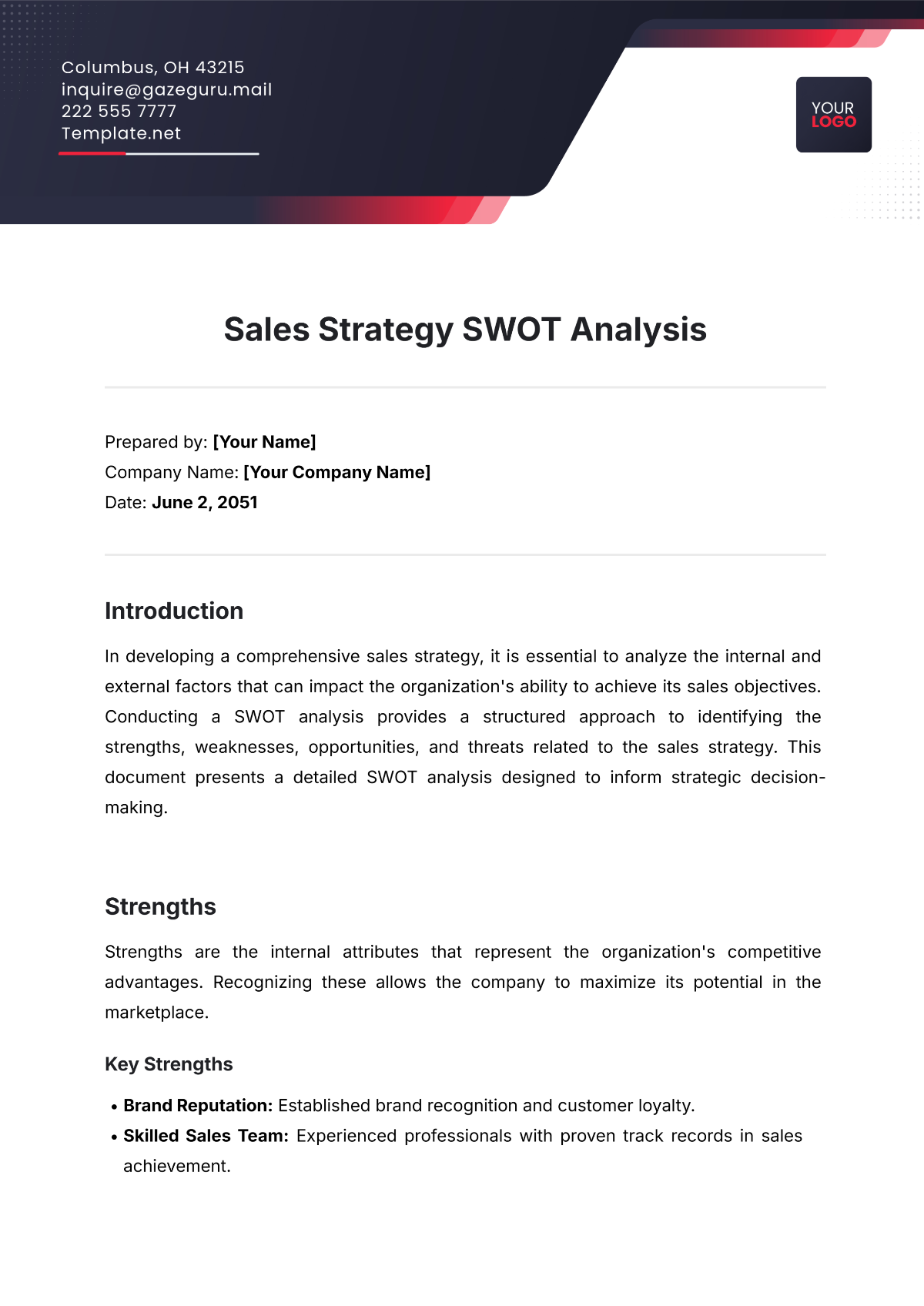

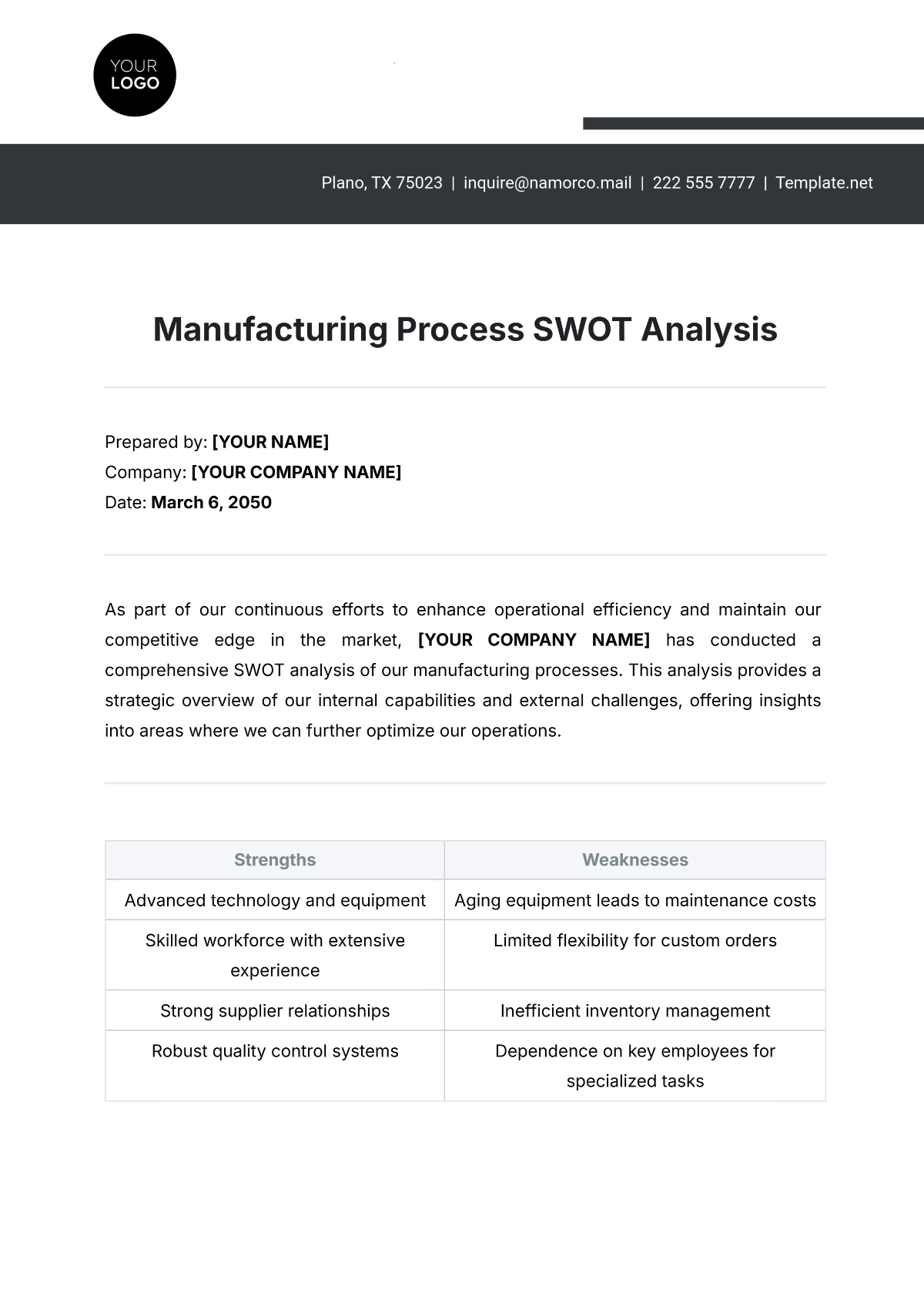

Strengths

The accounting department of [Your Company Name] exhibits several key strengths that significantly contribute to the company's overall financial health and stability. These strengths have been instrumental in establishing the department as a reliable and efficient component of the organization.

Advanced Financial Reporting Systems: The department employs sophisticated financial reporting systems, ensuring accuracy, transparency, and timeliness in financial disclosures. These systems are integrated with the latest accounting software, facilitating seamless financial management.

Highly Qualified Accounting Personnel: The team comprises individuals with exceptional qualifications, including CPAs and experts in various accounting fields. Their expertise spans critical areas like tax, audit, and corporate finance, ensuring comprehensive financial oversight.

Exemplary Compliance and Audit Track Record: The department has consistently demonstrated adherence to financial regulations and standards. This is evidenced by a history of successful audits and compliance checks, reflecting the team's commitment to regulatory requirements and ethical practices.

Innovative Financial Strategies: The department has been pivotal in implementing innovative financial strategies that have positively impacted the company’s bottom line. These include cost-saving measures, investment in profitable ventures, and efficient capital allocation.

Strong Internal Controls: Robust internal control mechanisms are in place, safeguarding against financial inaccuracies and fraud. This includes regular internal audits, checks and balances, and a transparent reporting system.

This section provides a clear overview of the key strengths of the accounting department, illustrating how each element contributes to the overall efficiency and reliability of financial operations within [Your Company Name]. These strengths are foundational to the department’s ability to support the company’s financial objectives and strategic goals.

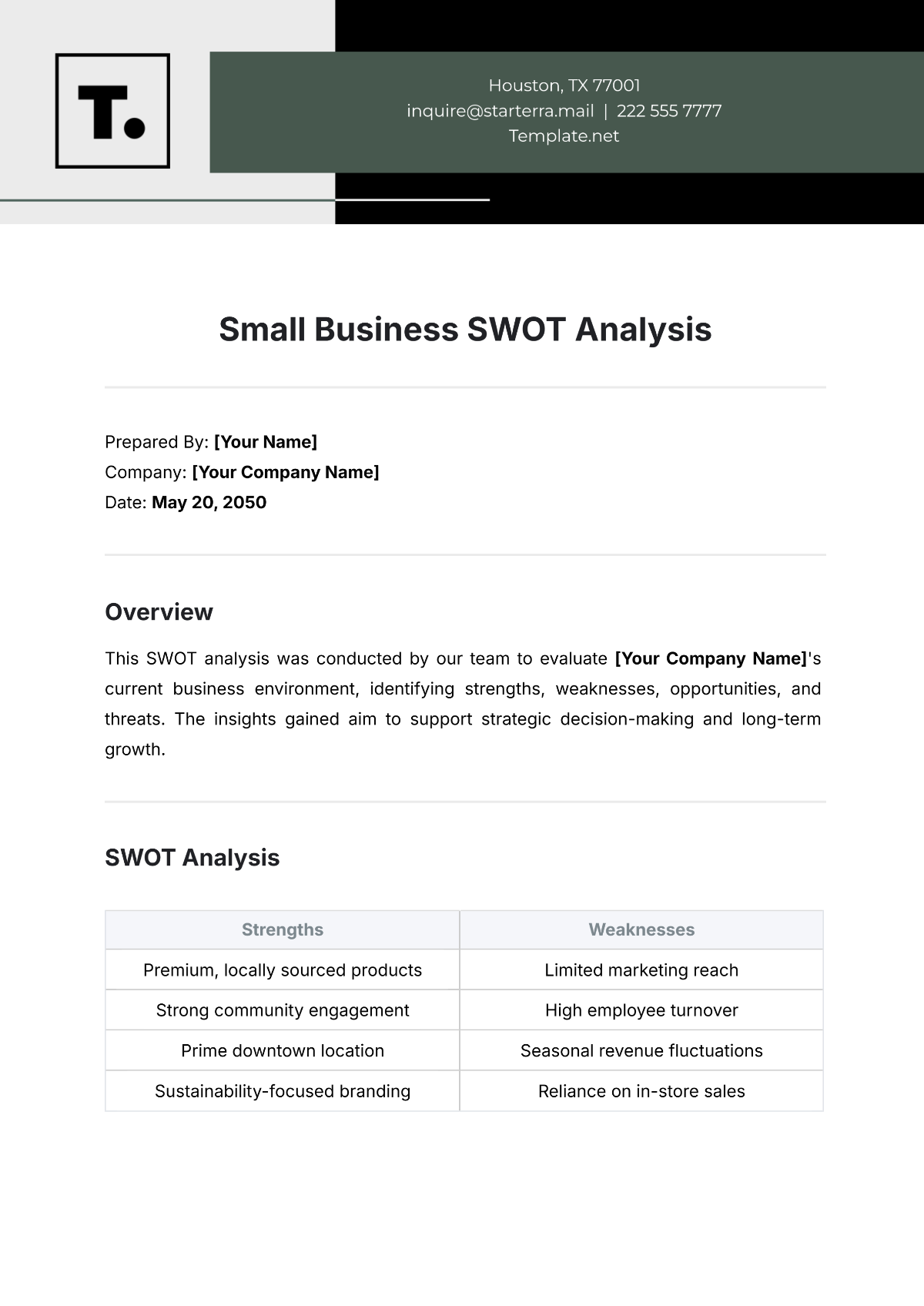

Weaknesses

The accounting department of [Your Company Name], while demonstrating notable strengths, also faces certain weaknesses that could potentially impede its efficiency and effectiveness. Acknowledging and addressing these weaknesses is crucial for the department to improve its operations and support the company's broader financial goals.

Dependence on Traditional Methods: Despite advancements in financial technology, the department shows a significant reliance on traditional accounting methods. This reliance limits the potential for automation and real-time data analysis, which are vital in today's fast-paced business environment.

Limited Adoption of Emerging Technologies: The department has been slow in adopting newer technologies such as AI, machine learning, and blockchain. This lag hinders the efficiency and accuracy of financial processes and reduces the department's ability to stay competitive in the field of modern accounting.

Vulnerability to Staff Turnover: The department's operations are heavily reliant on a few key personnel. This over-reliance creates a risk of operational disruption in the event of staff turnover, especially if these key members possess unique skills or institutional knowledge that is not easily transferable.

Inadequate Training and Development: Current training and development programs for staff are not sufficient to keep pace with evolving accounting standards and technologies. This inadequacy can lead to gaps in expertise and a workforce that is not fully equipped to handle complex financial challenges.

Budget Constraints Affecting Technological Upgrades: The department faces budgetary limitations that restrict its ability to invest in the latest accounting technologies and infrastructure. This financial constraint can impede the department's ability to improve its processes and maintain a competitive edge.

These weaknesses, if not addressed, could have significant implications for the overall performance and strategic capabilities of the accounting department. It is essential for [Your Company Name] to recognize these areas of improvement and develop strategies to mitigate these challenges, thereby ensuring the department's alignment with the company's future growth and success.

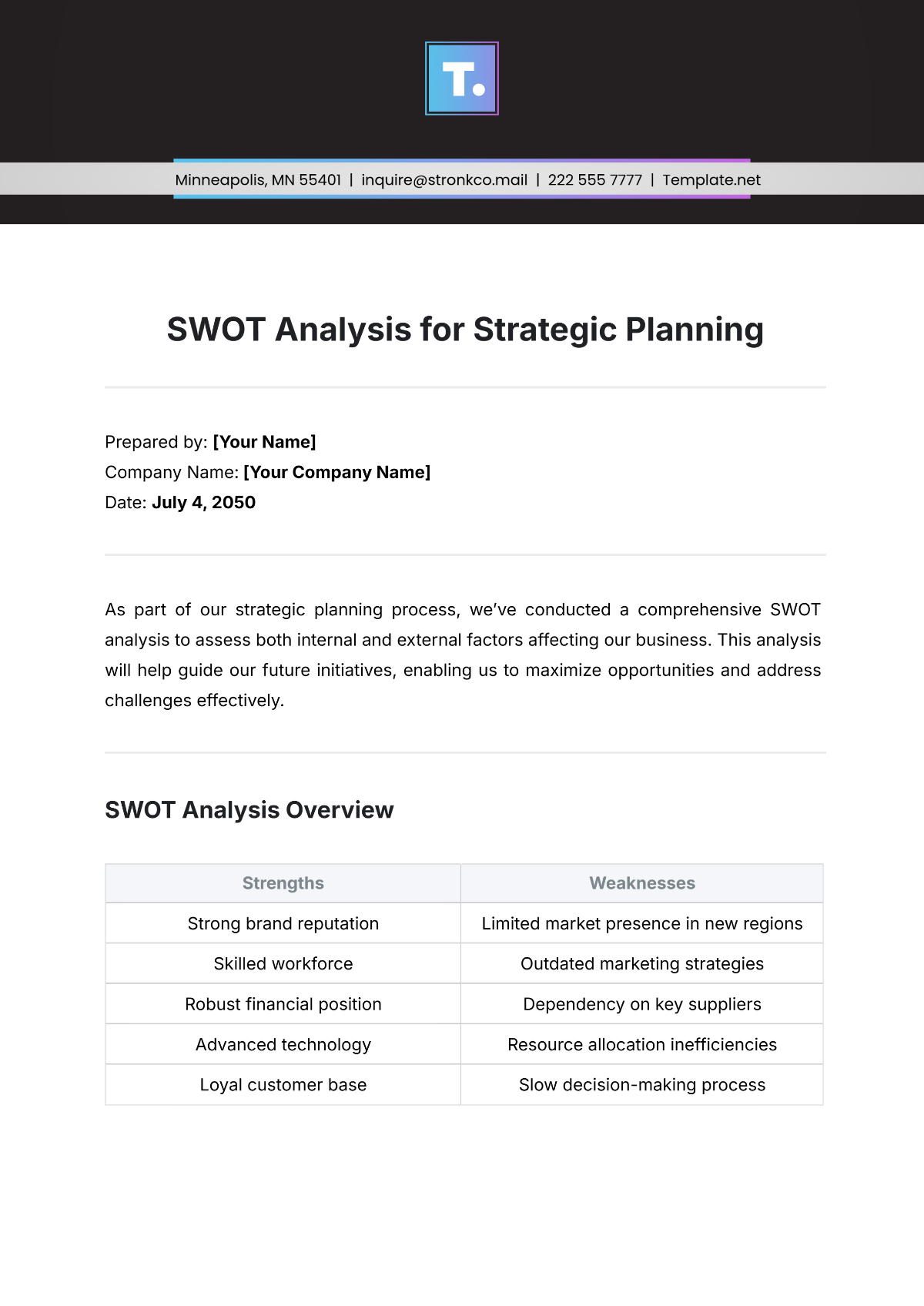

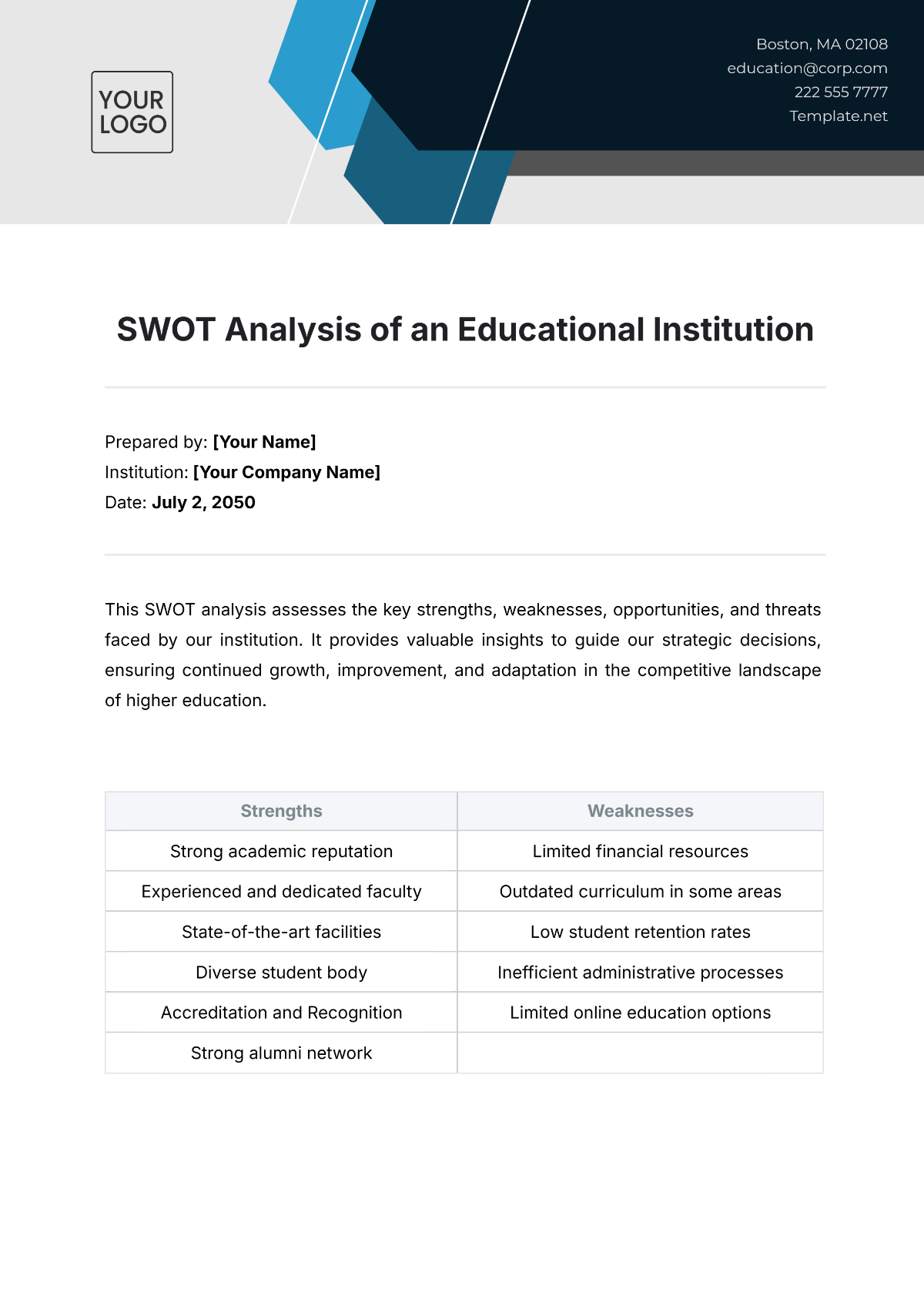

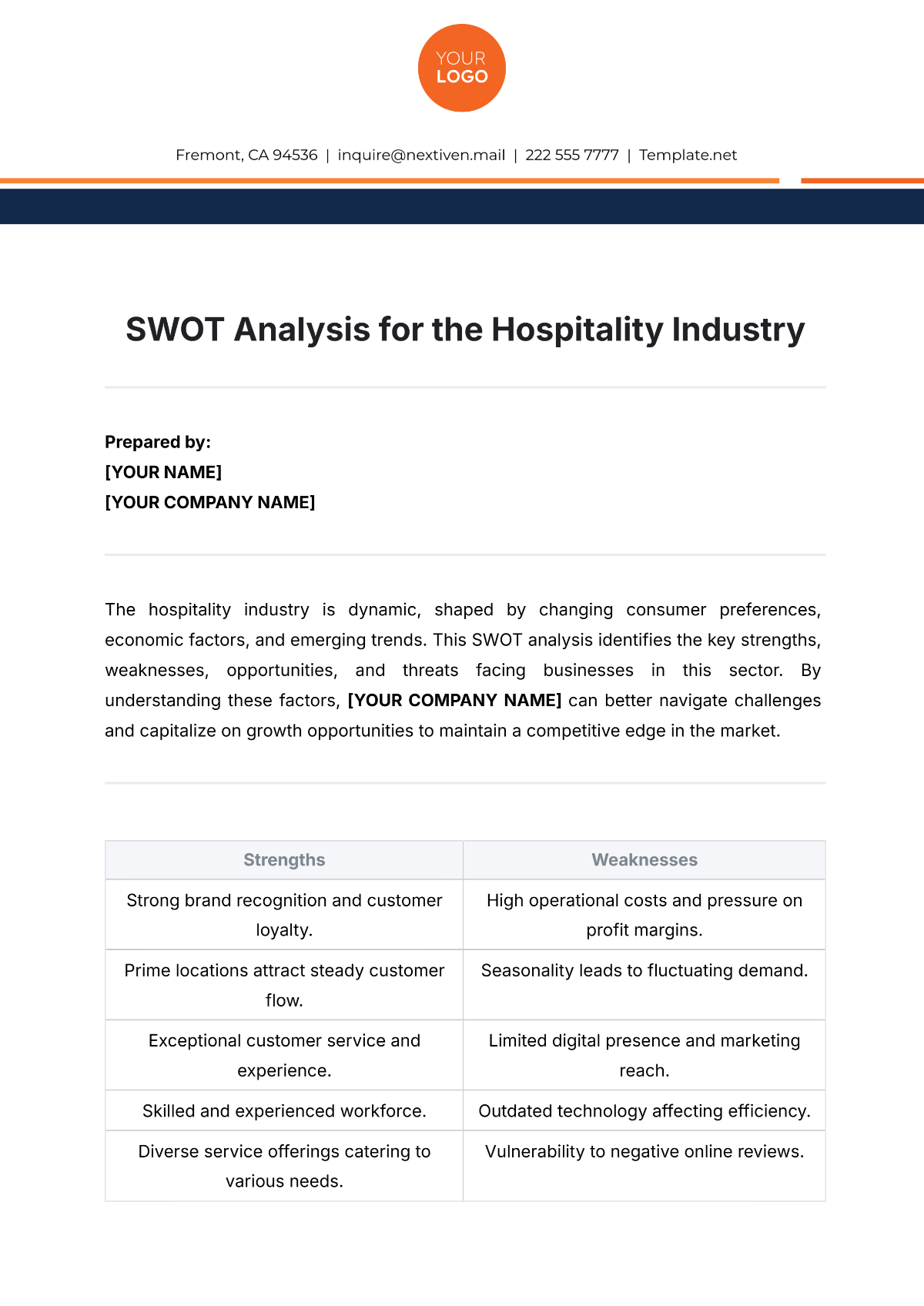

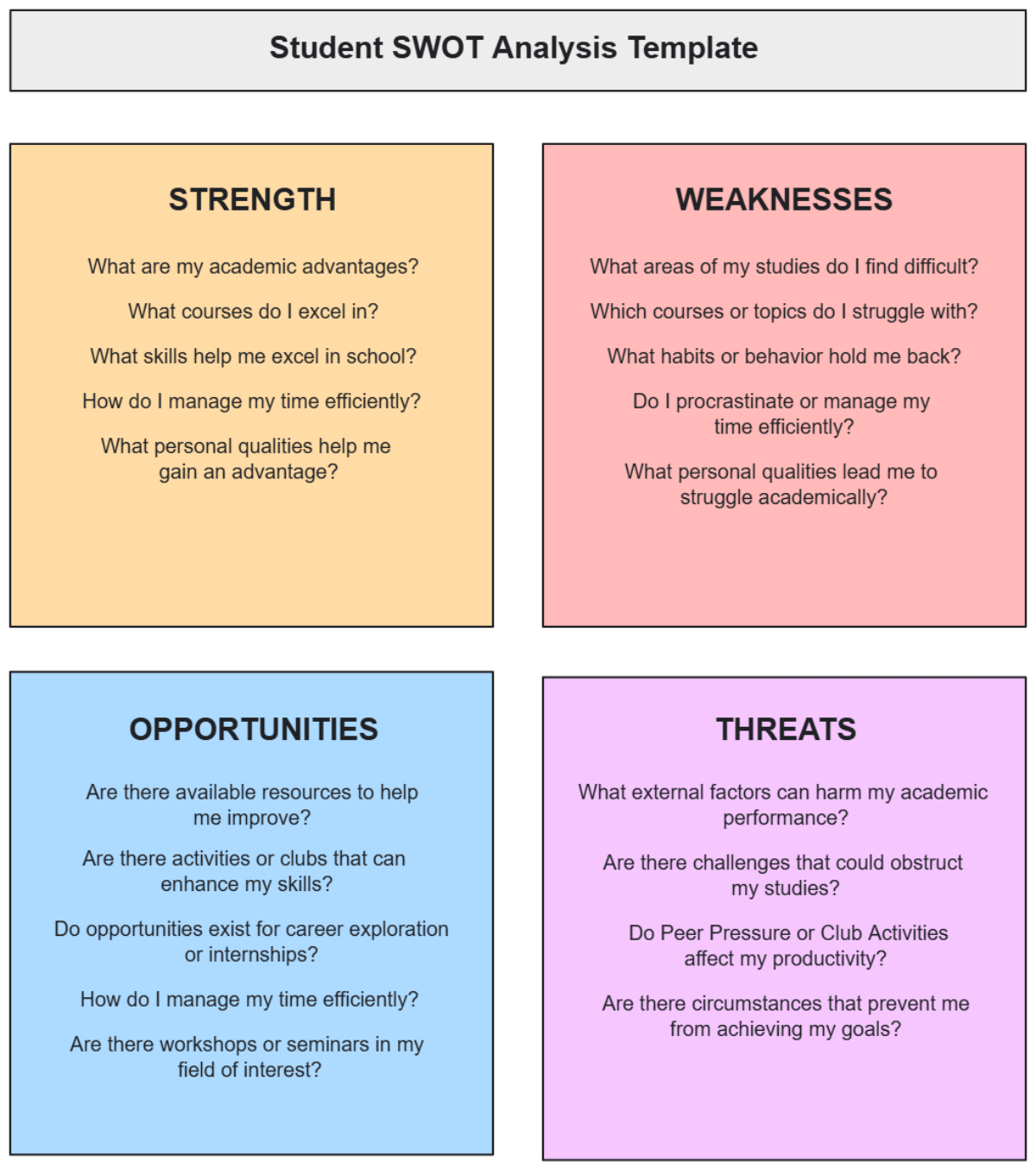

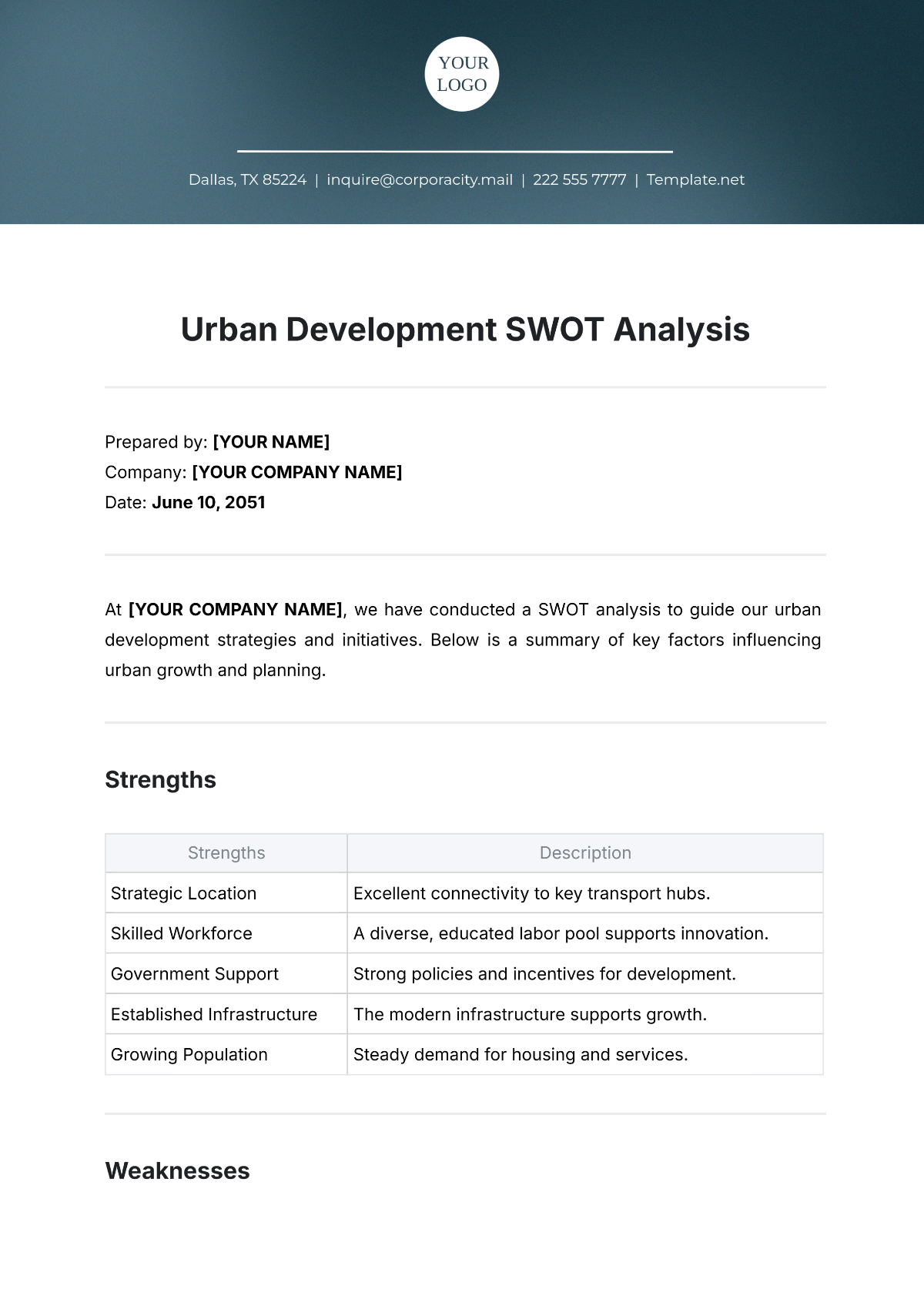

Opportunities

The accounting department of [Your Company Name] is presented with several opportunities that, if leveraged effectively, can significantly enhance its operational efficiency and strategic contribution to the company. These opportunities are pivotal in adapting to the evolving financial landscape and meeting the future demands of the business.

Technological Advancements and Digital Transformation: Embracing cutting-edge technologies such as AI, machine learning, cloud computing, and blockchain presents a significant opportunity. This transformation can lead to more efficient processing, enhanced data analytics capabilities, real-time financial reporting, and improved accuracy and security in transactions.

Global Market Expansion and Diverse Financial Practices: As [Your Company Name] explores opportunities in new markets, the accounting department has the chance to adapt and manage diverse financial practices. This includes dealing with various international financial regulations, currency exchange complexities, and global tax compliance, thereby enriching the team’s expertise and versatility.

Sustainability and ESG Reporting: There is a growing emphasis on environmental, social, and governance (ESG) factors in business operations. The accounting department can play a crucial role in developing frameworks for ESG reporting and sustainability audits, positioning the company as a responsible corporate entity.

Strategic Financial Leadership and Decision Support: Moving beyond traditional roles, the department can evolve into a strategic partner within the company. This involves playing a key role in financial planning, advising on investment decisions, and providing insights that drive business strategy and innovation.

Professional Development and Continuous Learning: Implementing continuous learning programs and professional development opportunities for the accounting staff aligns with the need for ongoing education in new accounting standards, technologies, and best practices. This not only enhances individual skill sets but also elevates the department’s collective expertise.

Collaborations and Partnerships: Forming strategic partnerships with fintech companies, academic institutions, and professional accounting bodies can provide access to new resources, tools, and knowledge. These collaborations can foster innovation, improve operational processes, and keep the department at the forefront of accounting trends.

By capitalizing on these opportunities, the accounting department of [Your Company Name] can significantly improve its operational capabilities and strategic value, ensuring that it not only keeps pace with but also anticipates and shapes the future dynamics of corporate finance.

Threats

The accounting department of [Your Company Name] faces various external threats that could impact its performance and efficiency. Recognizing and preparing for these threats is essential to safeguard the department's operations and the company's financial integrity.

Rapid Regulatory Changes: The accounting field is subject to frequent regulatory changes at both national and international levels. Adapting to these changes requires agility and continuous updates to accounting practices. Failure to comply with new regulations can lead to legal repercussions and reputational damage.

Technological Disruptions and Cybersecurity Risks: As the department integrates more technology into its operations, it becomes increasingly susceptible to cybersecurity threats. Data breaches, hacking, and other forms of cyber-attacks can compromise sensitive financial information, leading to significant financial losses and damage to the company's reputation.

Economic Instability and Market Volatility: Fluctuations in the global economy and financial markets can pose significant risks. Economic downturns, inflation, and currency fluctuations can impact the company’s financial planning and performance. The department must be equipped to navigate through these economic challenges effectively.

Talent Acquisition and Retention Challenges: In a competitive job market, attracting and retaining skilled accounting professionals is increasingly challenging. The scarcity of talent with the necessary skills and experience can hinder the department’s ability to operate efficiently and adapt to new challenges.

Technological Obsolescence: The rapid pace of technological advancement can render current systems and processes obsolete. Staying updated with the latest technologies is crucial but can be hindered by budget constraints or a delay in adopting new systems, leading to inefficiencies and a competitive disadvantage.

Complexities in International Operations: As the company expands globally, managing the complexities of international accounting, including compliance with multiple tax jurisdictions and handling diverse financial practices, becomes more challenging. These complexities require specialized knowledge and can increase the risk of errors and compliance issues.

Increasing Expectations for Transparency and Accountability: There is a growing demand from stakeholders for greater transparency and accountability in financial reporting. Meeting these expectations requires the department to maintain high standards in reporting and disclosures, adding to its workload and operational complexity.

By proactively addressing these threats, the accounting department of [Your Company Name] can strengthen its risk management strategies, ensuring resilience and adaptability in the face of these challenges, and thereby securing the company's financial health and reputation.

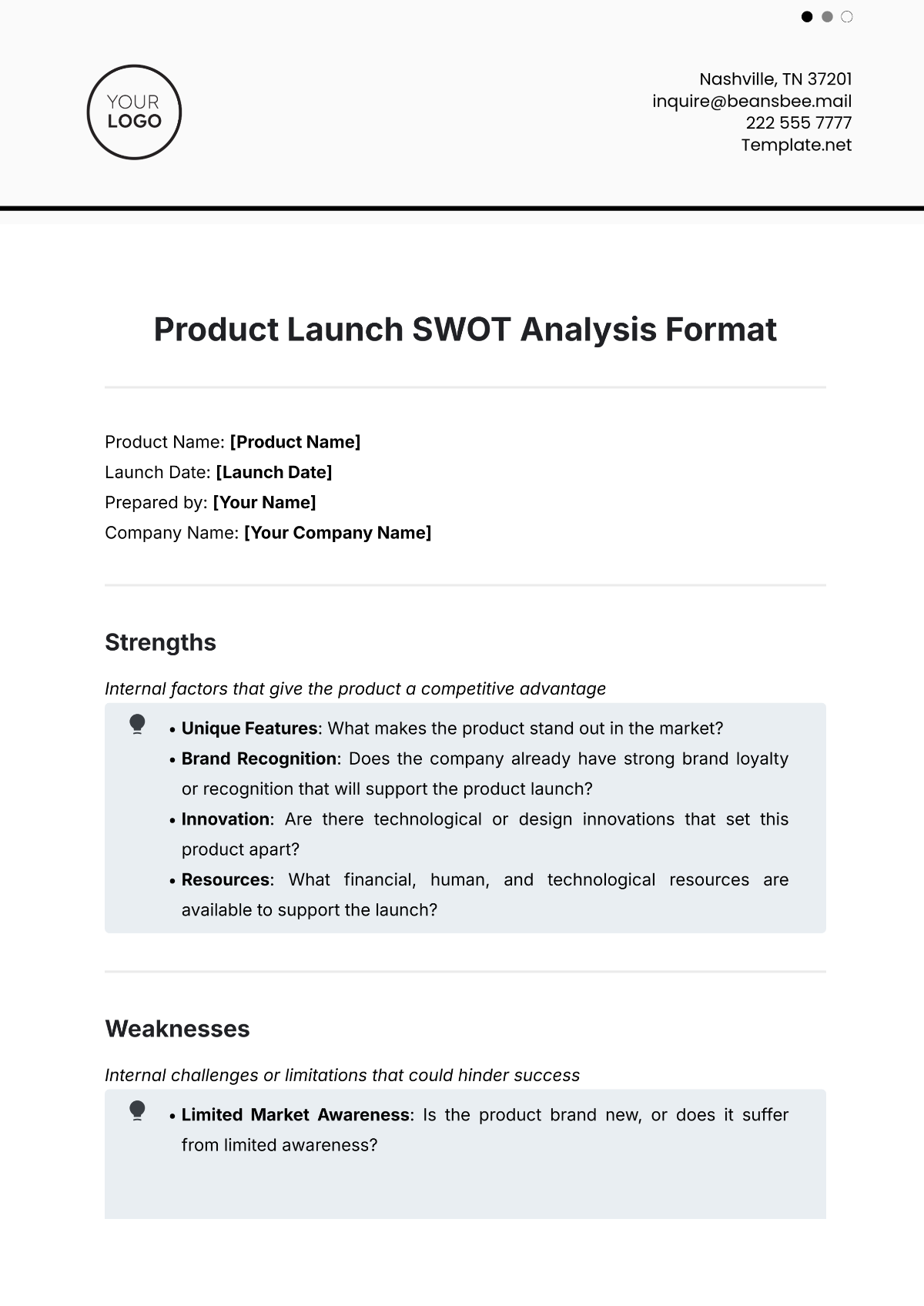

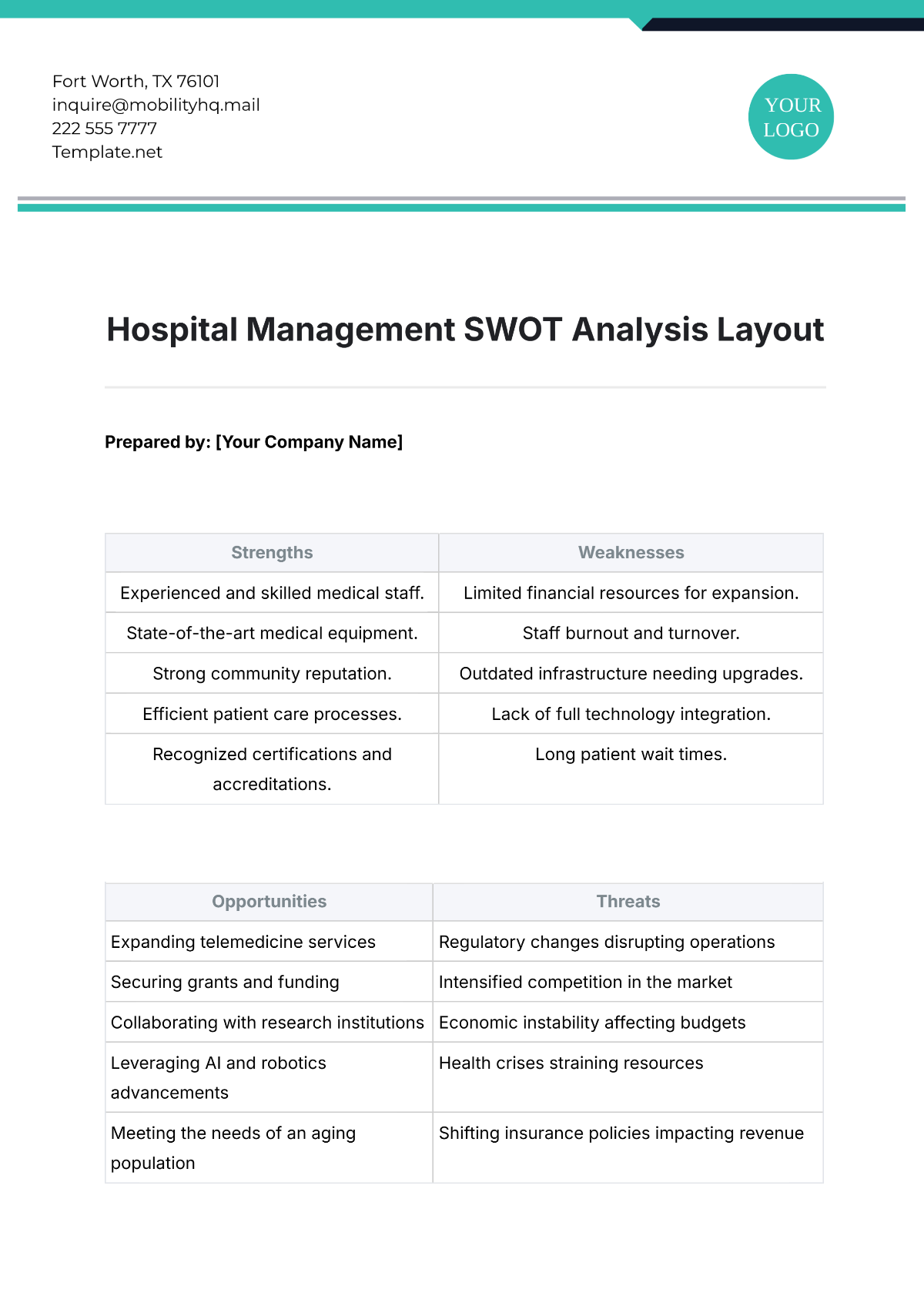

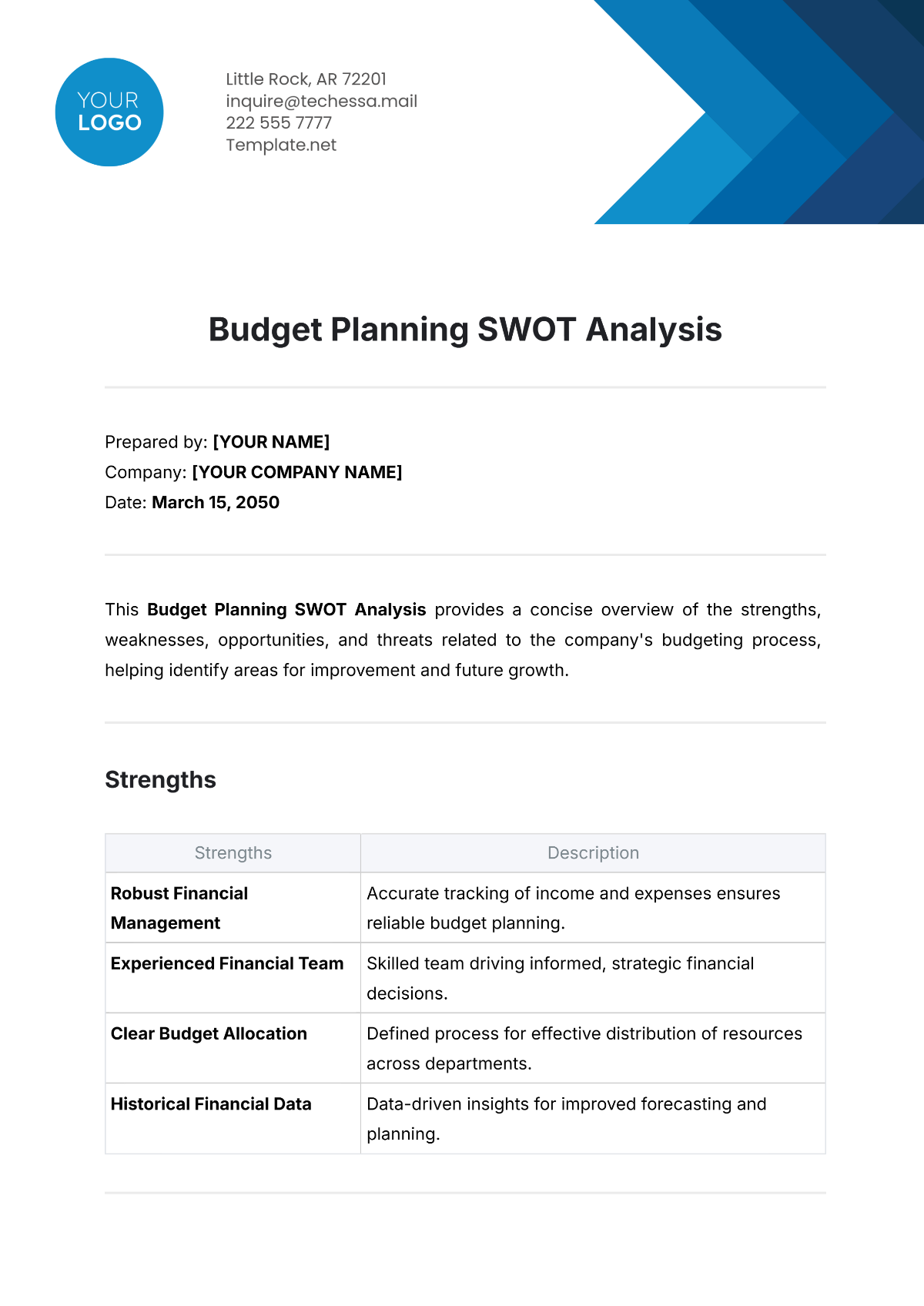

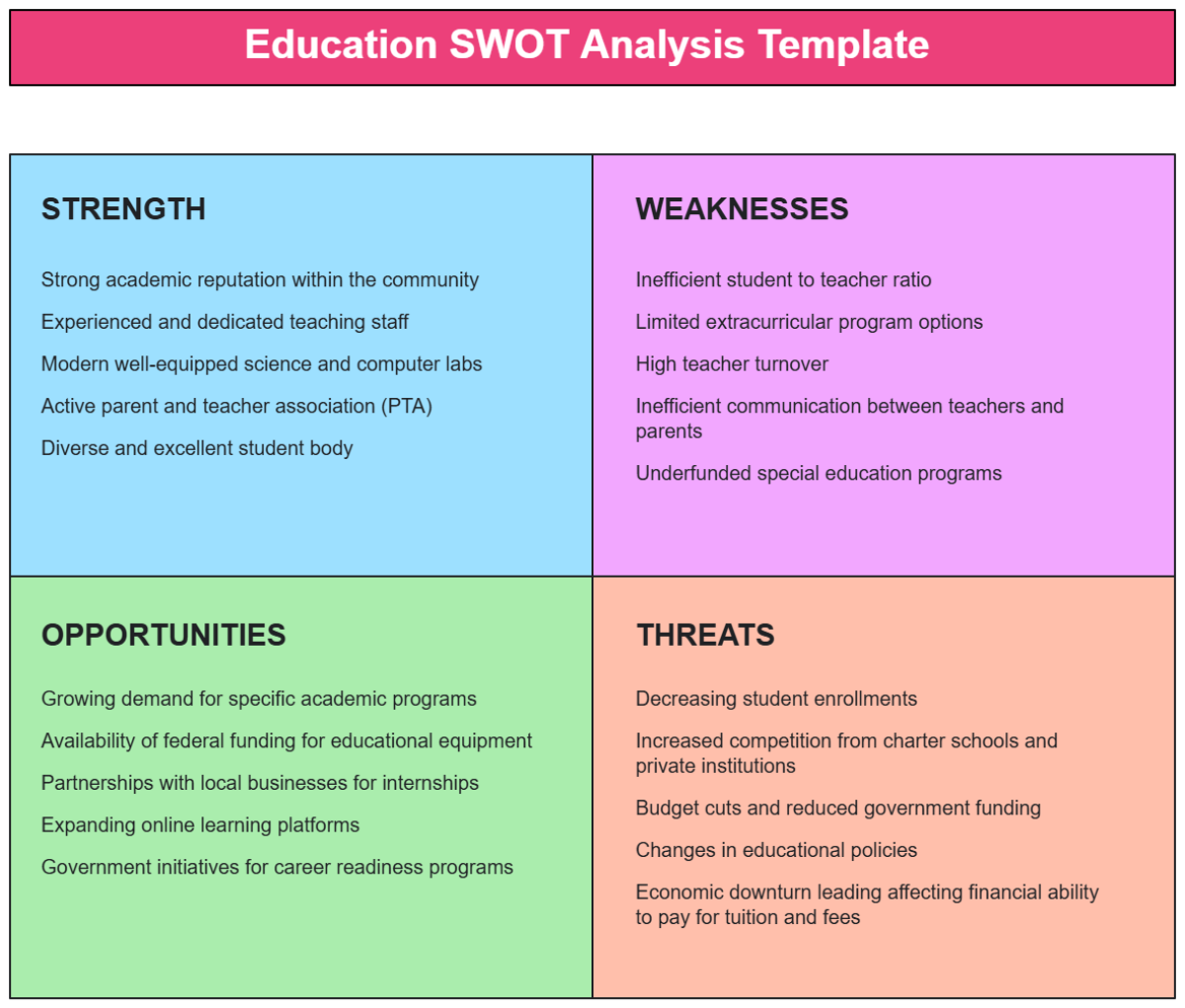

Recommendations and Implementation Timeline

To address the identified strengths, weaknesses, opportunities, and threats in the SWOT analysis, the following recommendations are proposed for the accounting department of [Your Company Name]. Accompanying these recommendations is a conceptual timeline for implementation, ensuring a structured and timely approach to enhancing the department's capabilities.

Recommendations:

Upgrade to Advanced Accounting Technologies: Implement cutting-edge accounting software and technologies, such as AI-driven financial analysis tools, blockchain for secure transactions, and cloud-based accounting solutions. This upgrade aims to not only enhance operational efficiency and accuracy but also bolster financial data security. The integration of these technologies will automate routine tasks, facilitate real-time financial reporting, and improve overall financial decision-making.

Expand Training and Development Programs: Develop a comprehensive training program focusing on international financial standards, such as IFRS (International Financial Reporting Standards), and emerging technologies in the accounting sector. This initiative will include regular workshops, e-learning modules, and hands-on training sessions, designed to keep the accounting team updated with global financial trends and technological advancements.

Strengthen Cybersecurity Measures: Establish a robust cybersecurity framework to safeguard sensitive financial information. This includes implementing advanced security protocols, regular cybersecurity training for staff, and conducting frequent audits to detect and mitigate vulnerabilities. The goal is to ensure the integrity and confidentiality of financial data against increasing cyber threats.

Develop Global Accounting Competencies: Initiate a specialized program to prepare the accounting team for the intricacies of international finance and tax regulations. This program will cover cross-border taxation, currency exchange management, and compliance with varying international accounting standards, equipping the team to handle the financial aspects of global operations efficiently.

Foster a Culture of Continuous Improvement: Create an environment that encourages continuous learning and adaptation to evolving accounting standards and practices. This involves setting up a knowledge-sharing platform within the department, encouraging participation in industry seminars and conferences, and supporting professional development initiatives.

Enhance Strategic Financial Planning Capabilities: Elevate the accounting department's role in strategic decision-making by developing its capabilities in financial analysis and planning. This will involve training in advanced financial modeling, budgeting strategies, and financial forecasting, enabling the team to provide valuable insights and recommendations that inform the company’s strategic directions.

Establish Strategic Partnerships and Collaborations: Form alliances with fintech companies and professional accounting organizations to gain access to the latest tools, research, and industry insights. These partnerships will facilitate the exchange of ideas, adoption of best practices, and staying abreast of technological innovations, thereby enhancing the department’s overall competence and strategic influence.

Implement Data-Driven Decision-Making Processes: Introduce advanced data analytics tools and techniques to the accounting department. This initiative involves the utilization of big data, predictive analytics, and data visualization tools to analyze financial trends, forecast future financial scenarios, and make data-driven decisions. Training the accounting team in these analytical methods will enable them to extract meaningful insights from complex financial data, leading to more informed and strategic financial planning.

These refined recommendations are aimed at transforming [Your Company Name]'s accounting department into a more dynamic, technologically advanced, and strategically focused unit, capable of driving the company's financial performance and supporting its long-term objectives.

Conceptual Timeline for Implementation:

Timeframe | Activity |

|---|---|

[Date] - [Date] | Begin integration of advanced accounting technologies. Initiate first phase of enhanced training programs. |

This timeline provides a structured approach to implementing the recommendations, ensuring that the accounting department evolves in alignment with the latest industry trends and the strategic objectives of [Your Company Name]. Regular reviews and adjustments will be necessary to ensure the effectiveness of these initiatives and to respond to any emerging challenges or opportunities.

Conclusion

This SWOT analysis has provided an overview of the current state and future prospects of the accounting department at [Your Company Name]. While the department boasts considerable strengths such as robust financial systems and skilled personnel, it also faces weaknesses including limited technological integration and vulnerability to staff turnover. The opportunities, ranging from the adoption of emerging technologies to strategic partnerships, presents pathways for significant growth and advancement. However, the department must also navigate threats like rapid regulatory changes and cybersecurity risks.

The recommended actions are designed to address these weaknesses and threats while capitalizing on the strengths and opportunities. By adhering to this strategic plan, [Your Company Name]'s accounting department can enhance its efficiency, adaptability, and strategic value, thus contributing significantly to the overall success and sustainability of the company.