Accounting Asset Management Program

Objective

The objective of this program is to adopt efficient and effective accounting asset management to optimize the financial operations. This will positively impact profitability and return on investment.

Content and Activities

Session 1: An Overview of Accounting Asset Management

On January 1, 2050, this session will discuss what Accounting Asset Management is, why it's essential, and how it can help companies increase their overall profit margin.

Session 2: Understanding Asset Lifecycle

On March 1, 2050, we will dive deeper into the lifecycle of an asset, from procurement to disposal, making sure to include every step in between.

Session 3: Best Accounting Practices for Asset Management

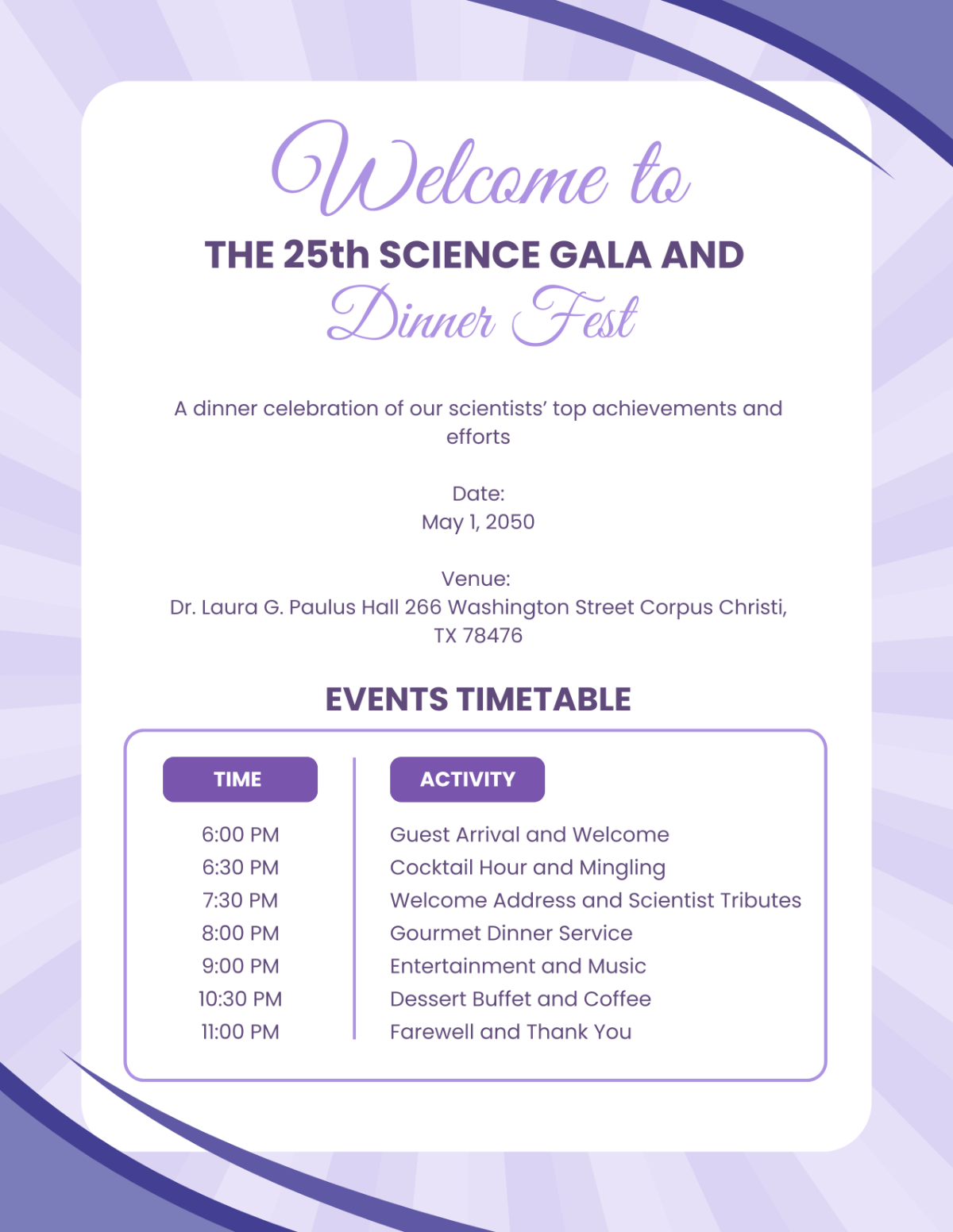

On May 1, 2050, we will outline and discuss some best accounting practices to ensure efficient asset management. This session includes topics like Cost Control, Depreciation, Amortization, and Revaluation.

Session 4: Case Studies and Real-World Applications

Date: November 1, 2050

The final session will look at various case studies that demonstrate the application of concepts covered in previous sessions. Participants will analyze real-world scenarios, discuss different strategies used by companies, and learn from successes and challenges in asset management.

Evaluation and Feedback

Post-session, participants will be required to complete an evaluation form. Feedback will be used to assess the effectiveness of the program and identify areas for improvement in future sessions.

Certificate of Completion

Participants who successfully complete all sessions and assessments will be awarded a Certificate of Completion, recognizing their proficiency in Accounting Asset Management.

Reference Materials

Title | Author | Year of Publication |

|---|---|---|

Asset Accounting & Valuation Handbook | Jonathan Wilkins | 2050 |

Guide to Calculate Depreciation | [Name] | [Year] |