Accounts Audit Review

Audit Period: | Date of Report: |

|---|---|

[Specify Period, e.g., Q1 2024] | [Month, Day, Year] |

Audit Objective:

The objective of this audit is to assess the accuracy and completeness of [Your Company Name]'s financial records, ensuring compliance with accounting standards and regulatory requirements.

Audit Scope:

The audit covers the following areas:

Revenue and Receivables

Expenses and Payables

Asset Management

Liability and Equity Accounts

Internal Controls and Procedures

Audit Methodology:

The audit was conducted through a combination of financial statement reviews, transaction sampling, and internal control evaluations.

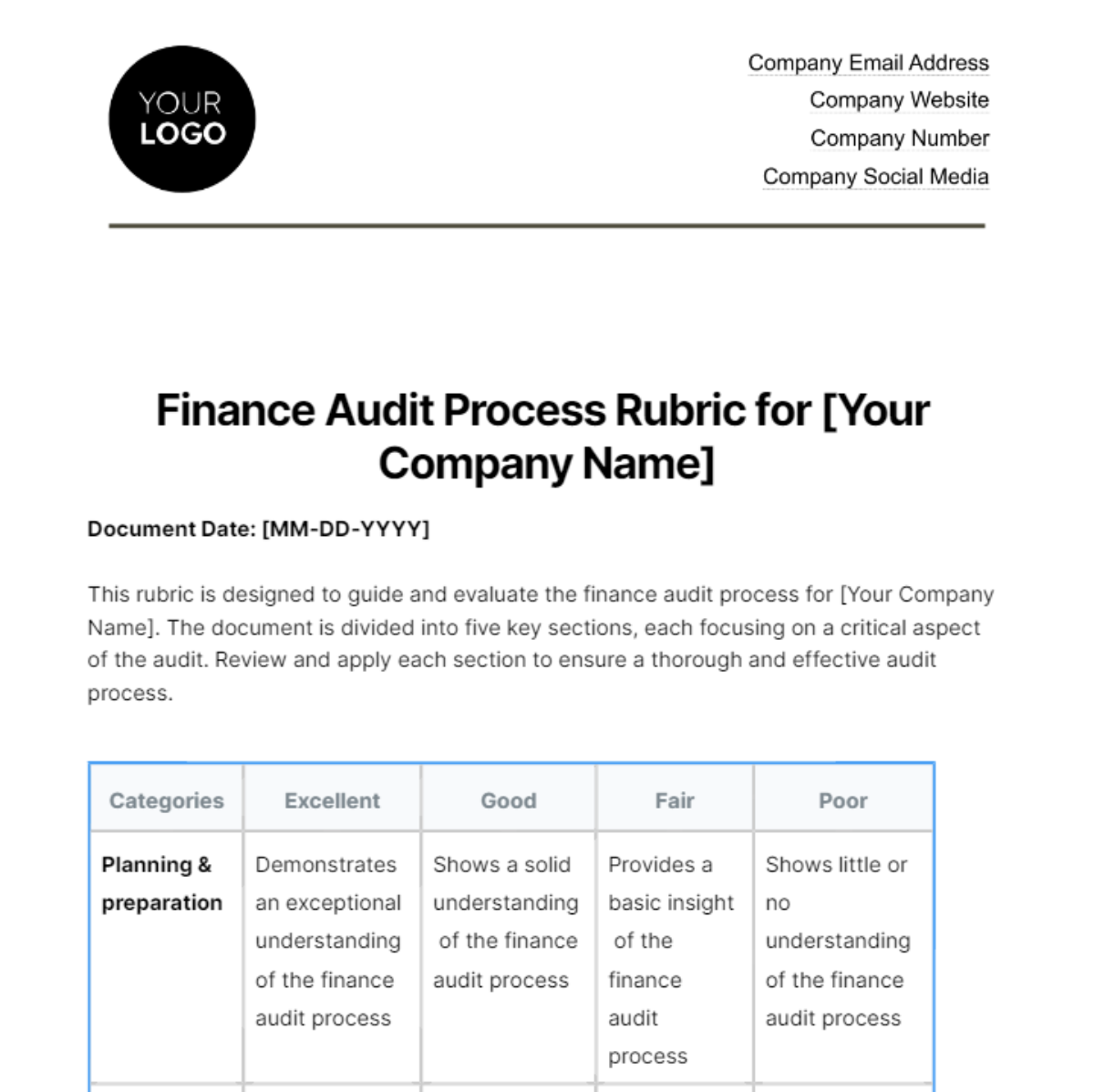

Table 1: Summary of Audit Areas and Findings

Audit Area | Compliance Status | Key Findings | Recommendations |

|---|---|---|---|

Revenue and Receivables | Compliant | No significant discrepancies found. | Continue current practices. |

Expenses and Payables | Partially Compliant | Minor discrepancies in invoice processing. | Improve invoice verification process. |

Asset Management | Compliant | Asset valuation accurately recorded. | Maintain current asset management procedures. |

Liability & Equity | Non-Compliant | Issues in long-term debt classification. | Review and correct debt classification. |

Internal Controls | Partially Compliant | Some weaknesses in internal audit mechanisms. | Strengthen internal audit processes. |

Table 2: Detailed Transaction Review

Date | Description | Amount (USD) | Auditor's Notes |

|---|---|---|---|

[Month, Day, Year] | Sale to Client A | 5,000 | Compliant with revenue recognition standards. |

[Month] | [Description[ | [Amount] | [Notes] |

Conclusions and Recommendations:

Overall, [Your Company Name] exhibits a strong adherence to accounting standards and practices, with a few areas requiring attention. The audit findings suggest the need for improvements in invoice processing and internal controls. Immediate action on the recommendations will enhance financial accuracy and compliance.

Strengthen the invoice verification process to ensure all expenses are accurately recorded.

Review the classification of long-term debts to ensure compliance with accounting standards.

Enhance internal audit mechanisms to identify and rectify procedural weaknesses promptly.

Auditor's Statement:

This report is prepared by [Your Name], a certified auditor, and represents a fair and accurate review of [Your Company Name]'s accounts for the specified period. It is intended to provide management with insights for improving financial practices and compliance.