Finance Payroll SWOT Analysis

I. Introduction to the SWOT Analysis

Purpose and Objectives

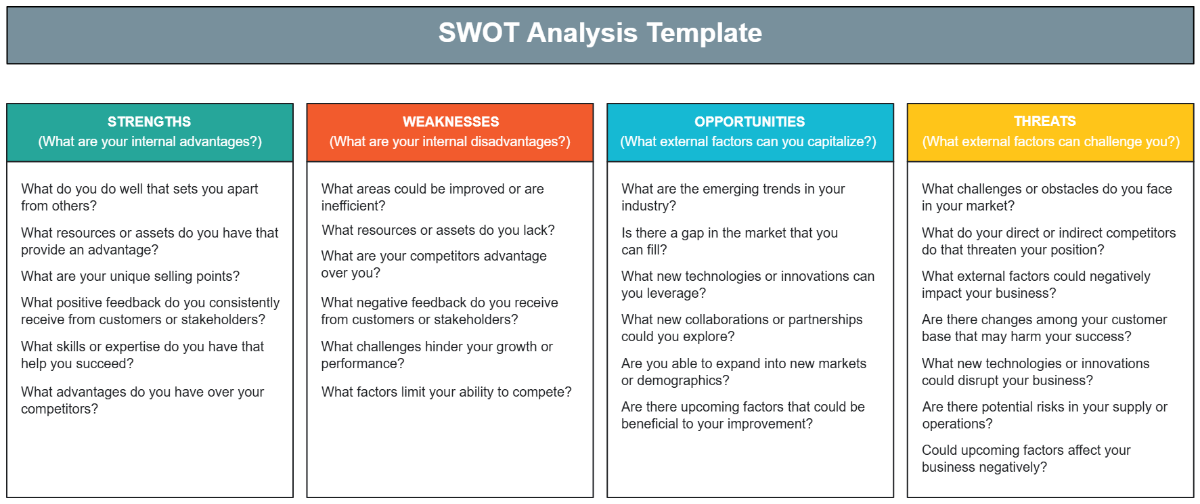

The SWOT Analysis for [Your Company Name]'s payroll system is a strategic exercise aimed at thoroughly evaluating the current payroll framework. Its purpose is to identify and analyze the system’s strengths, weaknesses, opportunities, and threats. The goal is to uncover areas for improvement, potential risks, and untapped avenues for advancement. This analysis is pivotal for shaping a payroll system that not only meets the current needs of the company but is also robust and adaptable enough to evolve with future requirements. By critically assessing our payroll system, we aim to enhance its effectiveness and efficiency, thereby supporting the overall strategic goals of the organization.

Overview of Current Payroll System

The current payroll system at [Your Company Name] is a blend of software automation and manual processing. This hybrid approach is designed to leverage the precision and speed of technology while retaining the adaptability and oversight of manual input. Key functions include automated wage calculations, tax withholdings, and direct deposit facilitations, complemented by manual checks for accuracy and compliance. This system plays a crucial role in ensuring that employee compensation is managed effectively – disbursed timely and accurately while strictly adhering to various legal and regulatory requirements. As such, it is a critical component of our financial operations, directly impacting employee satisfaction and organizational compliance.

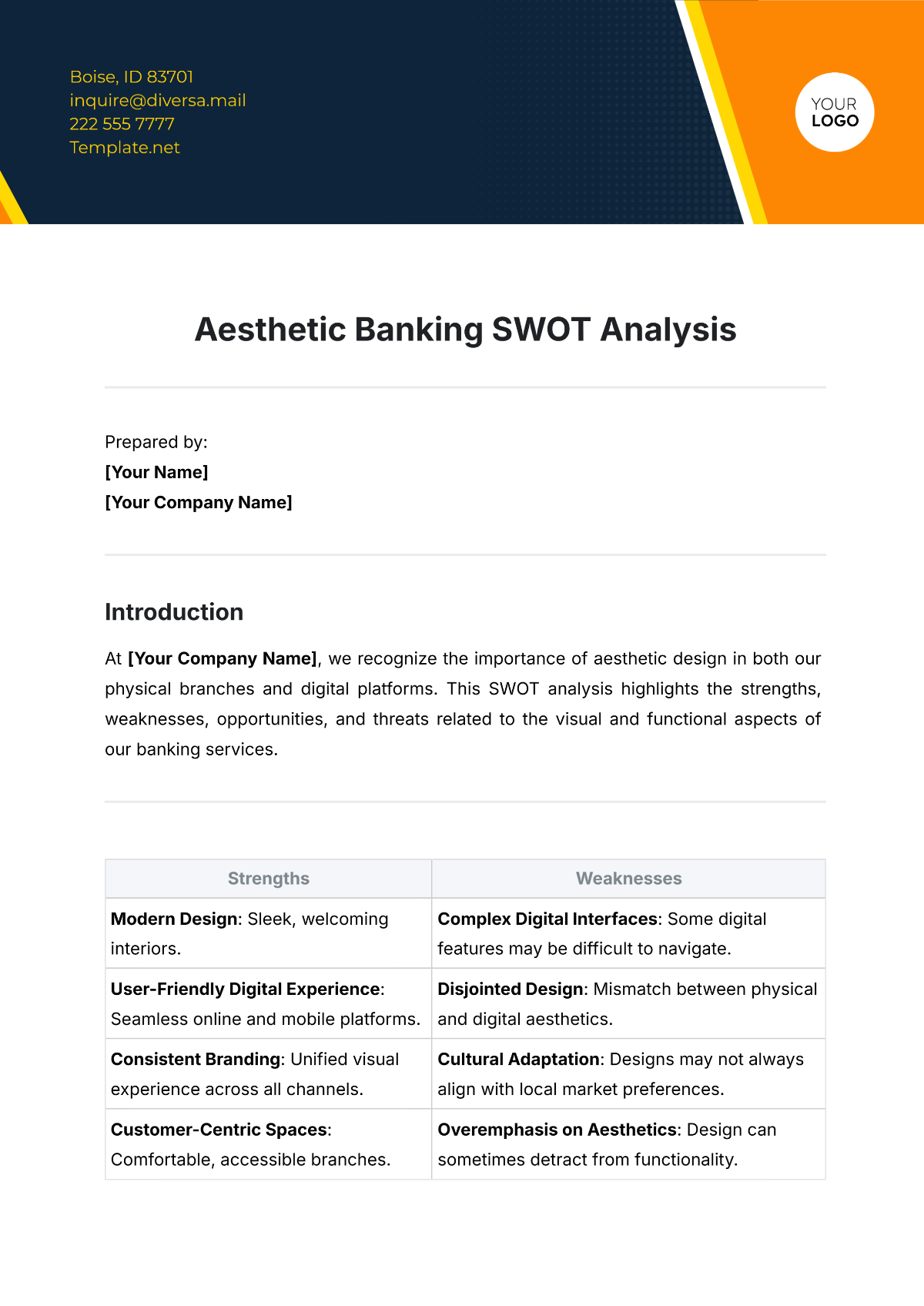

II. Strengths of the Current Payroll System

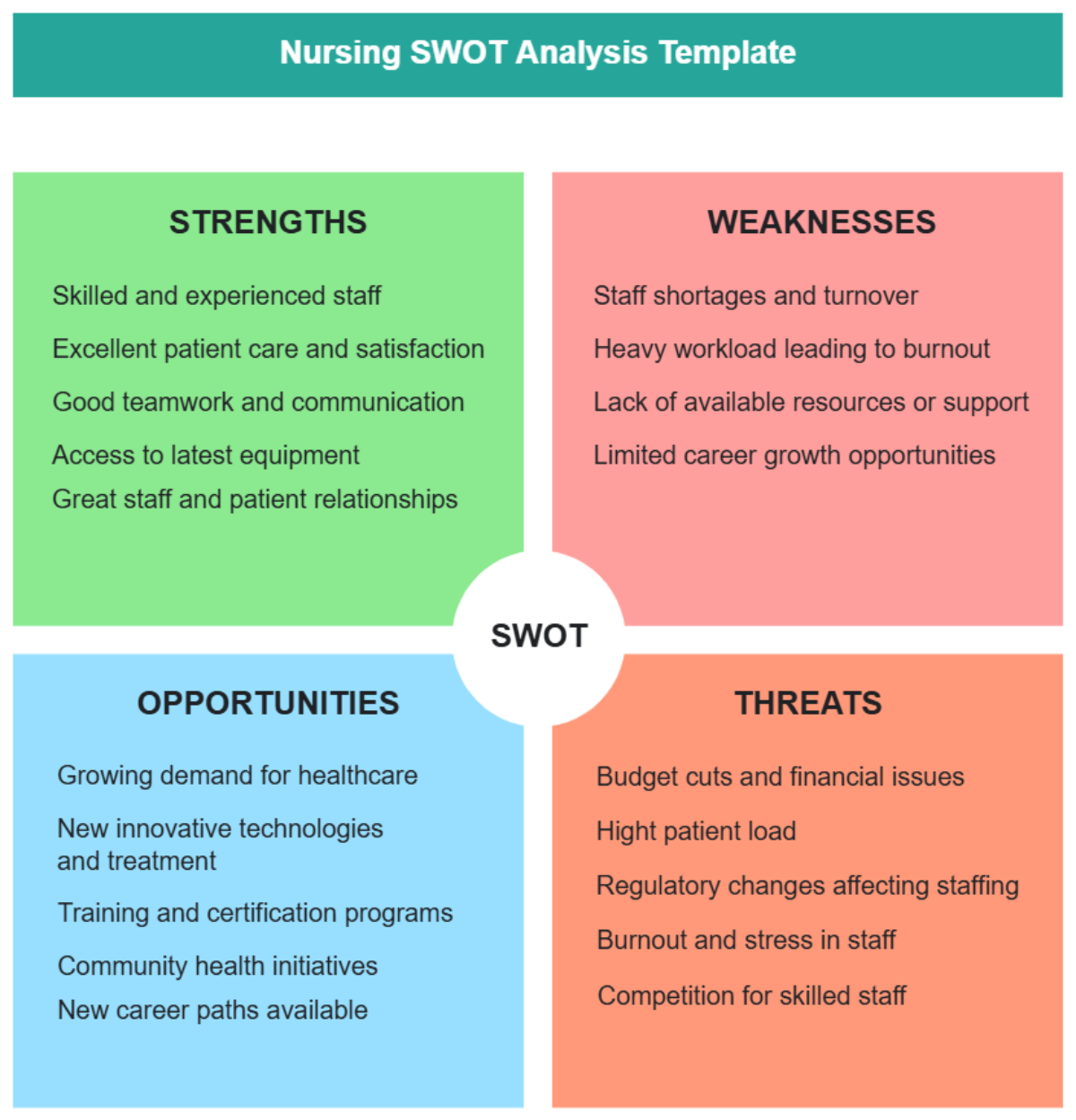

This section highlights the key strengths of [Your Company Name]'s payroll system. It emphasizes the system's high efficiency and accuracy in processing payroll and its user-friendly nature. These strengths contribute significantly to operational effectiveness, employee satisfaction, and the overall trust in the payroll process.

A. Efficiency and Accuracy

One of the most significant strengths of [Your Company Name]'s payroll system lies in its efficiency and accuracy. The integration of automated software has revolutionized our payroll process, substantially cutting down the processing time. This efficiency is particularly evident during the end-of-month rush and fiscal year-end reconciliations, where the potential for errors is typically higher. Automated calculations for wages and tax withholdings have dramatically minimized human errors, ensuring employees receive the correct pay and deductions are accurately processed. This high level of accuracy not only bolsters the trust of our employees in the payroll system but also ensures compliance with tax laws and labor regulations, safeguarding the company from potential financial liabilities.

B. User-Friendliness

Another notable strength is the user-friendliness of our payroll system. Employees consistently report ease in accessing their pay stubs and tax documents, facilitated by an intuitive interface and simple navigation. This accessibility is critical, as it empowers employees to independently verify their payroll information, leading to a reduction in queries to the payroll department and enhancing overall employee satisfaction. Moreover, the ability for employees to easily access and understand their payroll details fosters a sense of transparency and trust in the payroll process, contributing positively to employee morale and confidence in the company’s administrative practices.

III. Weaknesses of the Current Payroll System

This section identifies and analyzes key weaknesses in [Your Company Name]'s payroll system. It focuses on limitations in processing capabilities and compliance challenges, offering insights into areas where the system could be improved to enhance overall effectiveness and legal adherence.

A. Limitations in Processing Capabilities

The current system struggles with handling complex payroll scenarios, such as irregular overtime and bonus allocations, leading to occasional errors that require manual intervention.

Limitation | Impact | Potential Solution |

Handling Complex Overtime Calculations | Errors in calculating irregular overtime lead to payroll discrepancies. | Implement advanced software features or modules that can accurately calculate complex overtime scenarios. |

Bonus Allocation Processing | Difficulty in timely and accurate bonus distributions during peak periods. | Upgrade to a more dynamic system capable of handling variable compensation structures. |

Integration with HR Systems | Lack of seamless integration with HR management systems causes data discrepancies. | Invest in software that offers better integration capabilities with existing HR systems. |

Processing Adjustments and Corrections | Manual interventions for adjustments are time-consuming and error-prone. | Develop automated workflows within the payroll system for common adjustments and corrections. |

Handling Leave and Absence Data | Inaccuracies in reflecting leave and absence in payroll calculations. | Integrate leave management system with payroll software for real-time data synchronization. |

B. Compliance Challenges

While generally compliant, there are areas, particularly in adhering to state-specific tax regulations, where the system could be improved, reducing the risk of potential legal issues.

Compliance Challenge | Description | Solution |

State-Specific Tax Regulations | Difficulty in keeping up-to-date with varying state tax laws. | Regular training for payroll staff on state tax laws and automated tax updates in the payroll software. |

New Labor Law Adherence | Adapting to newly introduced labor laws can be challenging. | Establish a legal review process to regularly update payroll practices in line with new labor laws. |

Accurate Record-Keeping | Maintaining detailed and accurate payroll records as per legal requirements. | Implement a robust documentation management system within the payroll software. |

Data Privacy Compliance | Ensuring compliance with evolving data protection regulations. | Regular audits and updates to data privacy policies and practices, in line with current laws |

International Compliance | For multinational operations, adhering to international payroll regulations. | Use of global payroll management systems that are designed to handle international payroll complexities. |

Identifying these weaknesses is a crucial step in enhancing [Your Company Name]'s payroll system. Addressing these limitations and compliance challenges will lead to a more robust, efficient, and compliant payroll process, aligning with the company's commitment to operational excellence and legal adherence.

IV. Opportunities for Payroll System Improvement

This section explores significant opportunities for enhancing [Your Company Name]'s payroll system. Focusing on leveraging technology and adapting to regulatory changes, it outlines how these opportunities can lead to greater efficiency, enhanced compliance, and a strengthened reputation for the company.

A. Leveraging Technology

Emerging payroll technologies offer opportunities for further automation and efficiency. Implementing cloud-based solutions could streamline operations and enhance data security.

Technology | Benefits | Potential Impact on Payroll System |

Cloud-Based Payroll Systems | Remote access, scalability, and real-time updates. | Facilitates flexible payroll management and scalability as the company grows. |

Automated Time Tracking | Reduces manual errors and saves time in timesheet management. | Improves accuracy in payroll calculations and efficiency in processing. |

AI and Machine Learning | Intelligent processing of complex payroll tasks and predictive analysis. | Enhances decision-making with predictive analytics and automates complex payroll scenarios. |

Integration Platforms | Seamless integration with HR and finance software. | Streamlines data flow and reduces discrepancies between payroll and other business systems. |

Mobile Payroll Apps | Enables employees to access payroll information on-the-go. | Increases transparency and accessibility for employees, improving satisfaction and trust in the payroll process. |

B. Adapting to Regulatory Changes

Staying ahead of changes in payroll-related laws and regulations presents an opportunity to be a leader in compliance, thereby enhancing the company's reputation.

Regulatory Change | Description | Opportunity for [Your Company Name] |

Updates in Federal Tax Laws | Changes in tax brackets or withholding requirements. | Ensures compliance and accuracy in tax withholdings, avoiding penalties. |

State-specific Labor Laws | Variations in minimum wage and overtime regulations by state. | Enhances the company’s ability to manage a diverse workforce across different states. |

Data Protection Regulations | Evolving standards in data privacy (e.g., GDPR, CCPA). | Positions the company as a leader in protecting employee data, building trust and compliance. |

International Payroll Compliance | Requirements for multinational payroll operations. | Prepares the company for global expansion and managing international employees effectively. |

Industry-specific Regulations | Special payroll reporting or processing requirements in certain industries. | Keeps the company compliant and competitive in its specific industry sector. |

V. Threats to the Payroll System

This section identifies critical external threats to [Your Company Name]'s payroll system, focusing on market dynamics and regulatory risks. Understanding these threats is essential for proactive risk management and maintaining the integrity and compliance of our payroll operations.

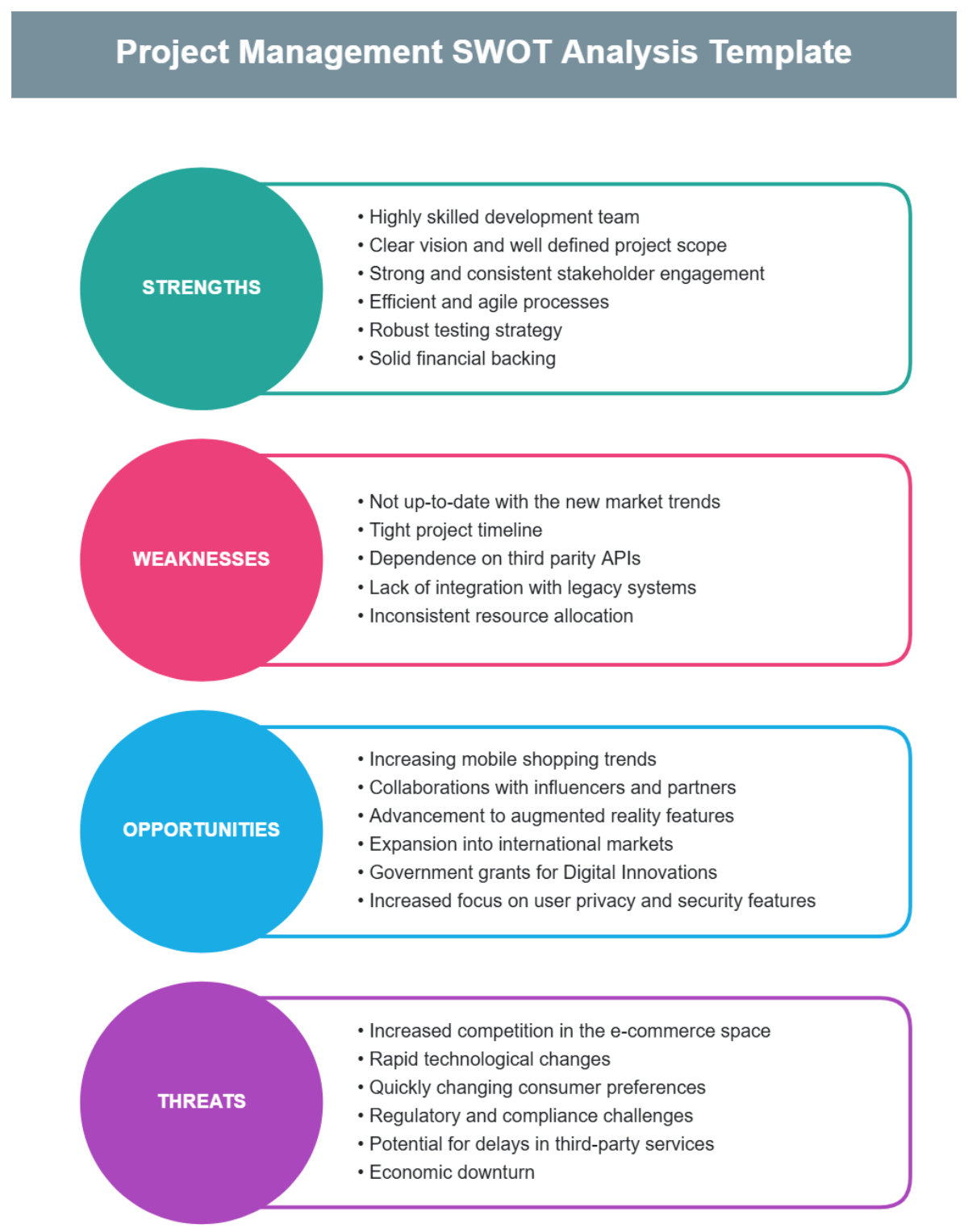

A. Market Changes and Competition

The payroll industry is continually evolving, influenced by technological advancements and emerging market players. This rapid evolution presents a significant challenge to our current payroll system. Staying competitive requires constant vigilance and a willingness to adapt to new technologies and methodologies. Emerging competitors often introduce innovative payroll solutions, pushing us to continually upgrade and improve our systems.

Failure to keep pace with these market changes could lead to inefficiencies and a potential loss of competitive advantage. Therefore, it's crucial for [Your Company Name] to invest in continuous system improvements and technology monitoring to remain relevant and efficient in the dynamic payroll services market.

B. Regulatory Risks

The payroll function is heavily regulated, with frequent changes in labor and tax laws at both federal and state levels. These legislative shifts pose a substantial risk to our payroll compliance. Staying updated with these changes is imperative to avoid legal complications and financial penalties that can arise from non-compliance. This challenge is amplified for businesses operating in multiple states or countries, where the complexity of legal requirements increases significantly.

To mitigate these risks, [Your Company Name] must prioritize legal compliance, invest in regular training for payroll staff, and possibly seek partnerships with legal experts to navigate the intricate landscape of payroll regulations. Proactive management of these regulatory risks is vital to safeguard the company against potential legal and financial repercussions.

VI. Conclusion and Recommendations

The SWOT analysis of [Your Company Name]'s payroll system has illuminated several areas ripe for strategic enhancements. Firstly, adopting more advanced payroll technologies is crucial. This involves not only upgrading our current software systems but also exploring new tools that incorporate AI and machine learning for improved efficiency and accuracy. Such technological advancements can address current limitations in processing complex payroll scenarios and ensure our system stays ahead of market trends.

Secondly, there's a clear need for enhancing our compliance protocols. Regular, comprehensive training for payroll staff on the latest tax laws and labor regulations is essential. This training should be supplemented by periodic reviews and updates of our compliance procedures to adapt to regulatory changes swiftly.

Investing in these areas will not only address the identified weaknesses and threats but also build upon our existing strengths. By enhancing our technology infrastructure, we can maintain our competitive edge in the market, while rigorous compliance training will solidify our reputation as a responsible and law-abiding employer. Such improvements are not only necessary for the functional success of our payroll system but are also strategically aligned with the broader goals of operational excellence and risk management at [Your Company Name].

This SWOT analysis provides a holistic view of our payroll system, underlining the importance of a comprehensive approach in managing payroll operations. The recommended strategic enhancements are designed to fortify our payroll system against external threats, leverage emerging opportunities, and rectify internal weaknesses, thereby ensuring a robust, compliant, and efficient payroll process.