Accounts SWOT Analysis

TABLE OF CONTENTS

Introduction............................................................................................................3

Strengths................................................................................................................4

Weaknesses............................................................................................................5

Opportunities..........................................................................................................7

Threats....................................................................................................................9

Recommendations and Implementations............................................................10

Conclusion..............................................................................................................11

Introduction

This comprehensive SWOT analysis meticulously evaluates the accounting department of [Your Company Name], scrutinizing its strengths, weaknesses, opportunities, and threats. This pivotal assessment is designed to pinpoint crucial areas in need of enhancement and strategic advancement. Its primary purpose is to steer the decision-making framework, thereby bolstering the department's alignment with the overarching financial goals of the organization. This analysis is instrumental in fortifying the accounting department's role as a cornerstone of the company's fiscal health and strategic planning.

Contextual Framework

As a preamble to this SWOT analysis, it is imperative to establish a contextual framework that situates the accounting department of [Your Company Name]. This contextual backdrop is essential for understanding the relevance and impact of the strengths, weaknesses, opportunities, and threats identified in the subsequent sections. It provides a lens through which the department’s role, challenges, and potential can be assessed in relation to the company's overarching objectives and market dynamics.

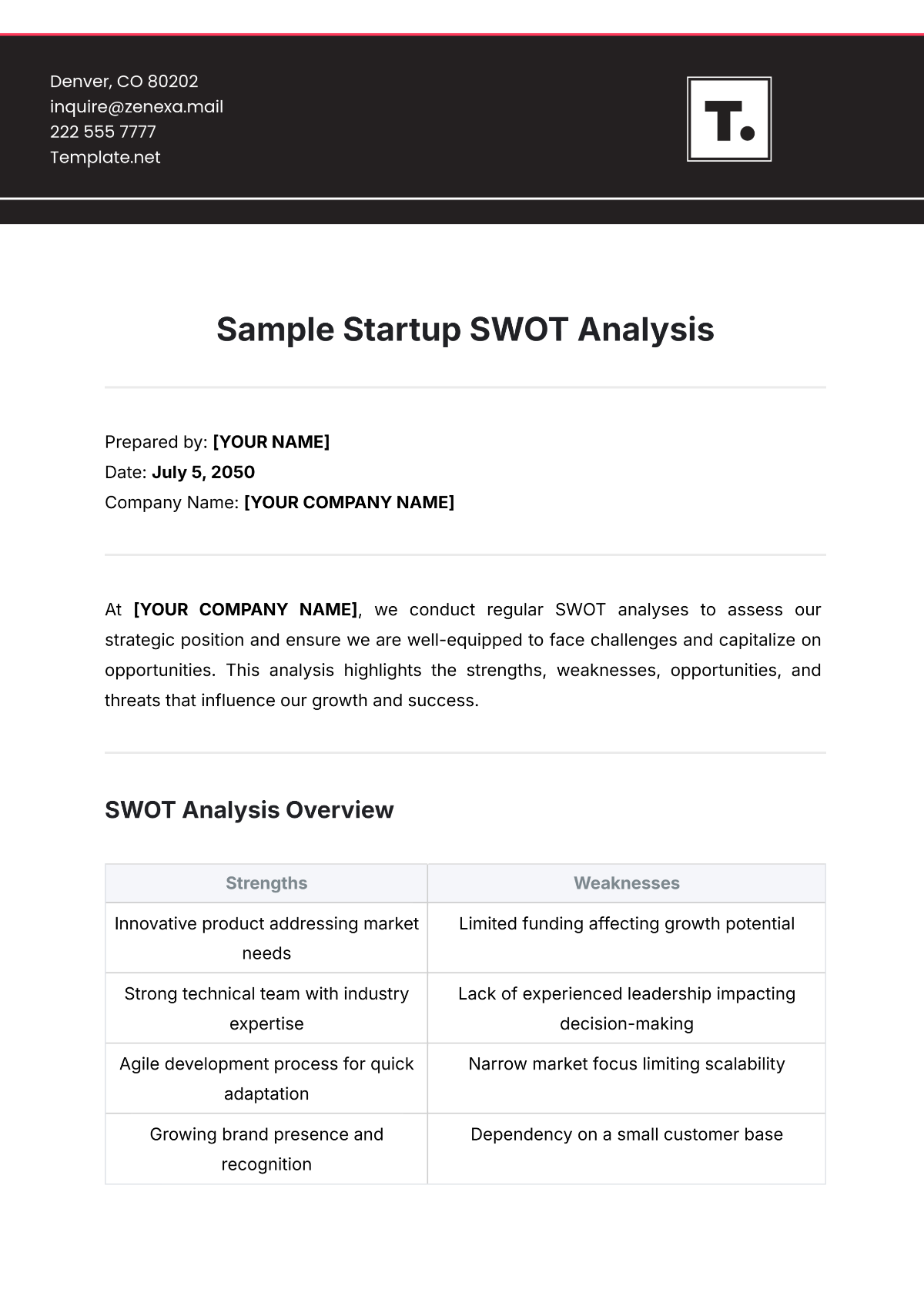

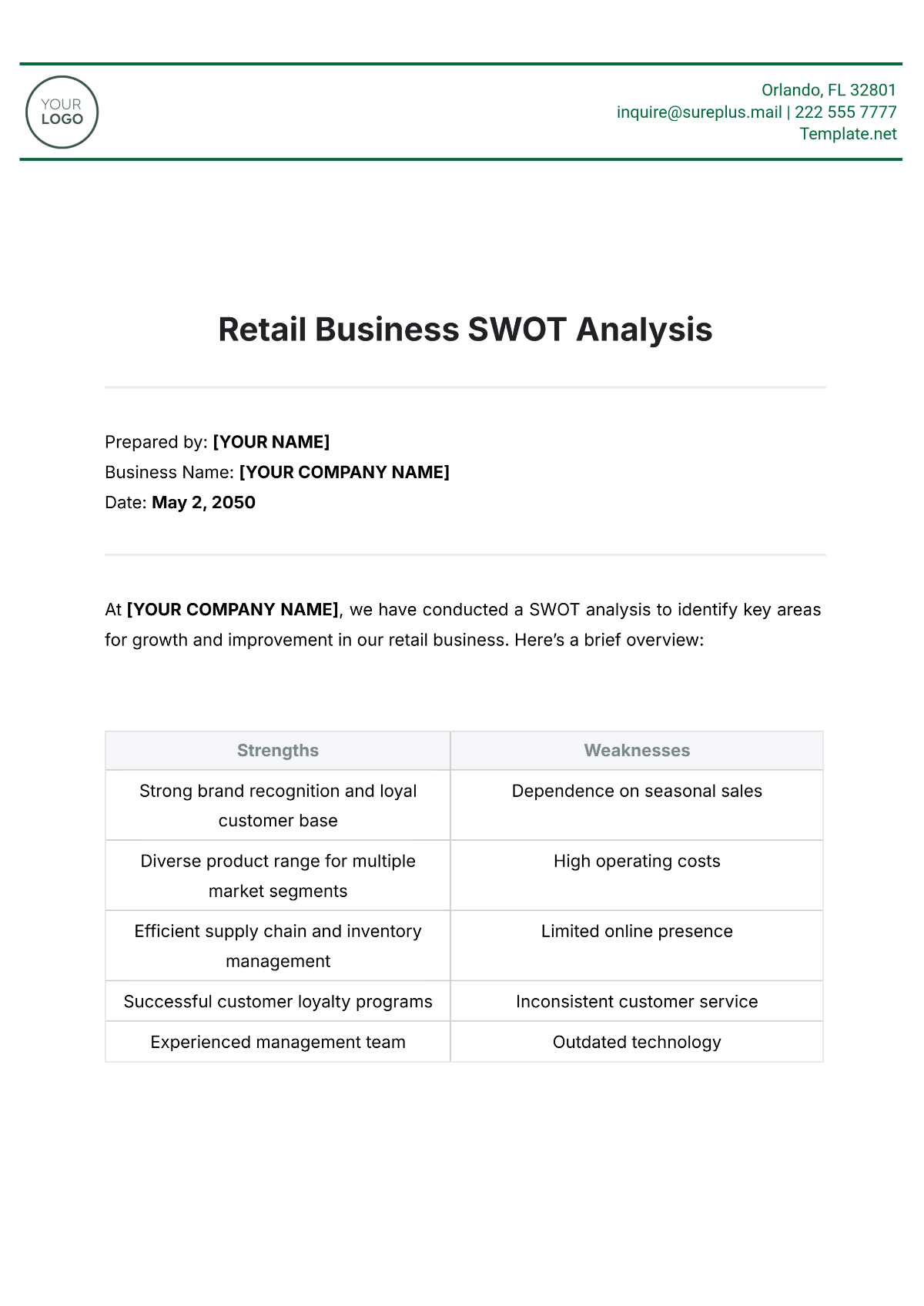

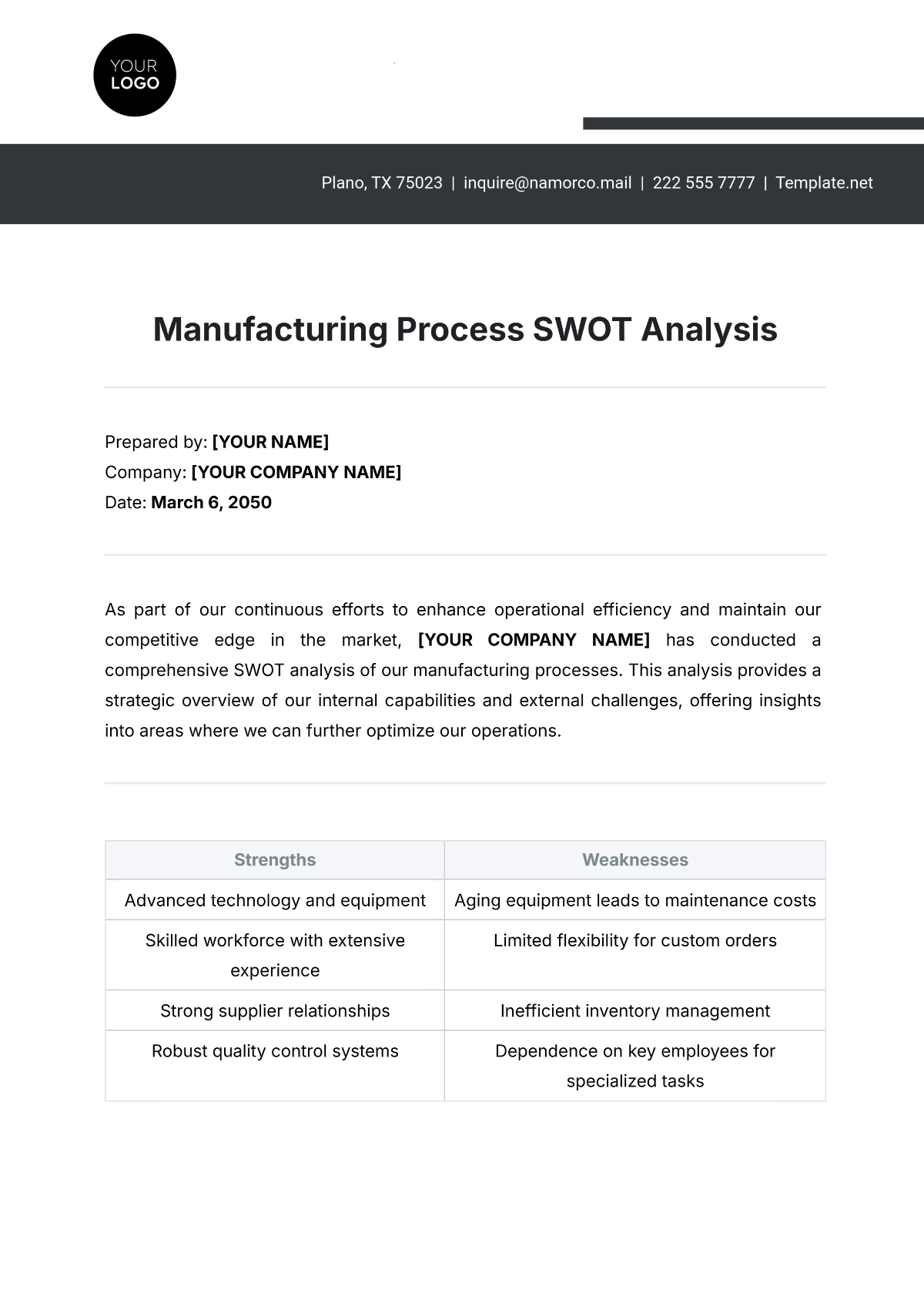

Strengths

In this section, we delve into the strengths of [Your Company Name]'s accounting department, highlighting the key attributes that distinctly position it as an integral component of the organization's success. Through a thorough examination of these core competencies, we can better appreciate how the accounting department contributes to the overall resilience and growth of the company. The following points elucidate the areas where the department excels, underlining its vital role in the organization's financial strategy:

Proficient Financial Management: The accounting department exhibits exceptional prowess in financial management, showcasing robust budgeting, forecasting, and financial planning capabilities. This proficiency ensures the company's financial stability and supports strategic business decisions.

Compliance and Regulatory Expertise: Adherence to regulatory standards and compliance norms is a hallmark of the department. The team's in-depth knowledge of financial regulations and tax laws significantly mitigates risk and fortifies the company's reputation.

Advanced Technological Integration: Leveraging cutting-edge accounting software and technology, the department enhances efficiency, accuracy, and data security. This technological adeptness enables the team to manage complex financial data with precision and facilitates real-time financial analysis.

Skilled and Experienced Personnel: The department is staffed with highly skilled and experienced professionals. Their expertise in various accounting practices contributes to the high-quality financial reporting and insightful fiscal analysis that drive the company's success.

Strong Internal Controls and Audit Procedures: Robust internal controls and comprehensive audit procedures ensure the integrity and reliability of financial reports. These practices are instrumental in preventing errors and fraud, thereby safeguarding the company's assets.

Effective Collaboration and Communication: The department excels in cross-functional collaboration and communication, ensuring that financial insights are effectively integrated into broader business strategies. This collaborative approach enhances the overall decision-making process within the company.

Effective Financial Reporting: The department consistently produces accurate and timely financial reports, which are critical for internal decision-making and external reporting requirements.

Innovative Problem-Solving Abilities: The team demonstrates strong problem-solving skills, effectively addressing complex financial issues and finding innovative solutions.

Weaknesses

In this segment, we turn our attention to the weaknesses within the accounting department of [Your Company Name], offering a candid and critical examination of the areas that require immediate attention and improvement. Identifying these weaknesses is not merely an exercise in pinpointing shortcomings, but rather a crucial step towards fostering a more robust and efficient accounting function. The following points provide an in-depth analysis of these weaknesses, highlighting specific aspects that necessitate strategic intervention and development.

Limited Resource Allocation: The accounting department faces challenges due to constrained resources, including staffing and budget limitations. This scarcity can lead to increased workload, potentially affecting the timeliness and quality of financial reporting and analysis.

Inadequate Training and Development Programs: There is a noticeable gap in ongoing professional development and training for staff members. This lack of continuous learning opportunities may hinder the department's ability to stay abreast of evolving accounting standards and technologies.

Dependency on Legacy Systems: The department's reliance on outdated software and systems can impede operational efficiency. This dependence on legacy technology restricts the ability to adapt to modern, more efficient accounting practices and data management techniques.

Limited Integration with Other Business Units: There exists a disconnect in the integration of financial insights with other departments. This siloed approach can lead to misalignment in organizational strategy and decision-making, affecting the overall effectiveness of the company.

Inconsistency in Risk Management Practices: Inconsistencies in implementing risk management protocols can lead to vulnerabilities in financial control and oversight. This irregularity might increase the risk of errors and compliance issues, impacting the department's reliability.

Insufficient Focus on Strategic Financial Planning: The department's current focus is predominantly on routine accounting tasks, with less emphasis on strategic financial planning and analysis. This imbalance can limit the department's role in shaping long-term business strategies and growth opportunities.

Resistance to Change: A tendency towards resistance to change within the department can hinder the adoption of new processes or technologies that could otherwise improve efficiency and effectiveness.

Limited External Benchmarking: There is a lack of regular benchmarking against industry standards or competitors, which can limit the department's understanding of best practices and areas for improvement.

This introspection is essential for understanding the challenges and limitations that currently hinder the department's performance and effectiveness. By addressing these areas, the department can better align its operations with the company's strategic goals and enhance its overall contribution to the organization's success.

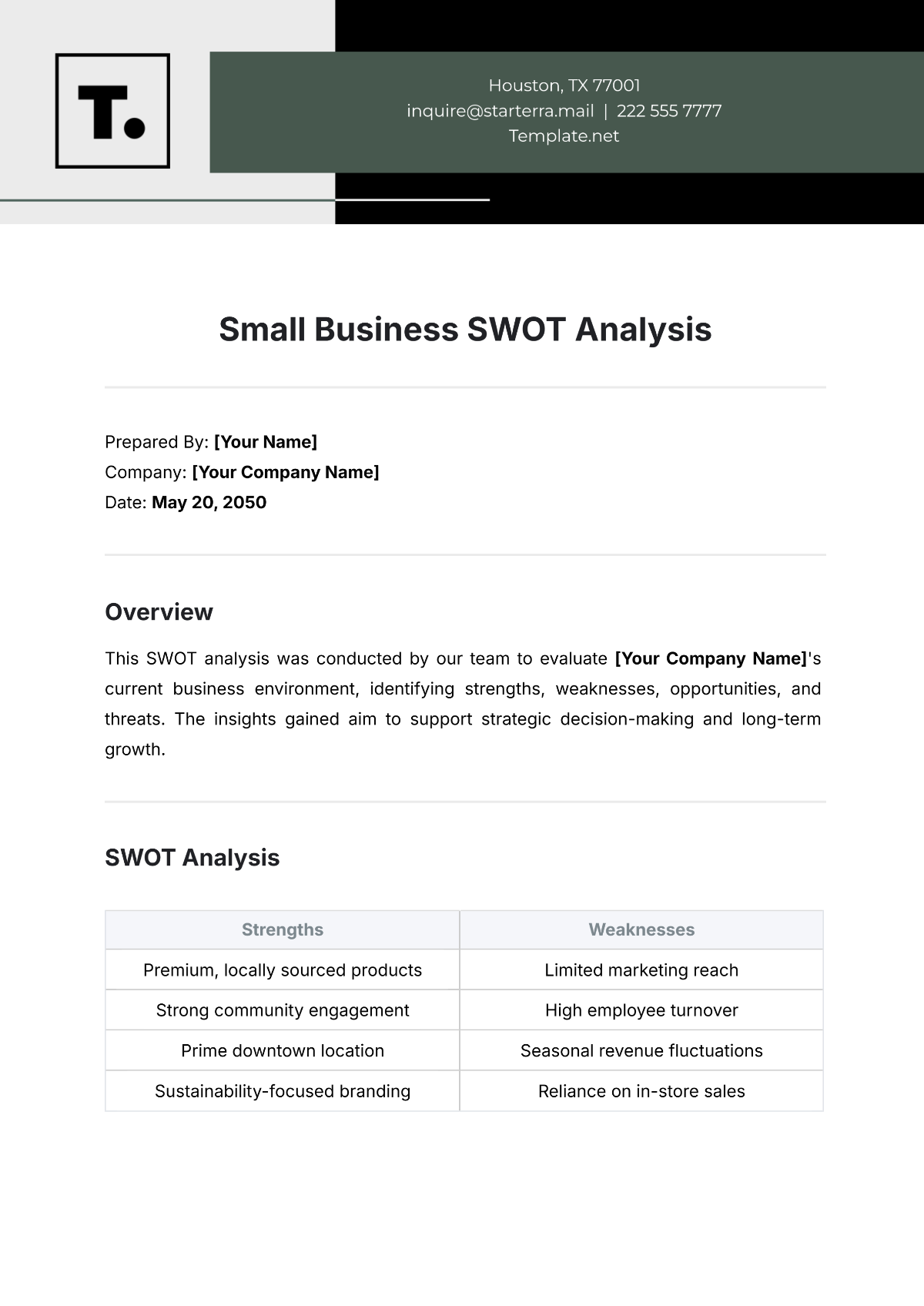

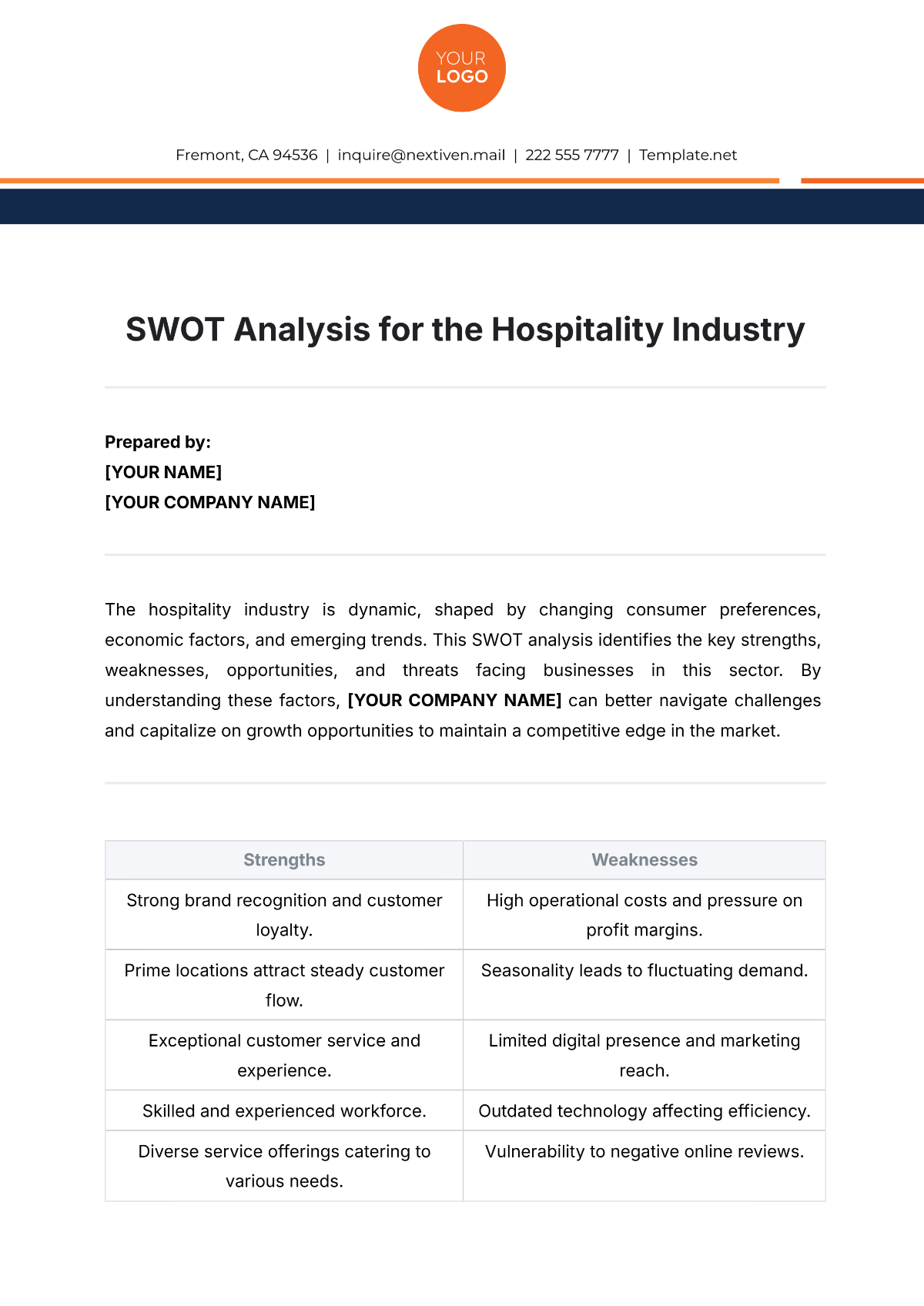

Opportunities

This section is dedicated to exploring the diverse opportunities available to the accounting department of [Your Company Name]. These opportunities, if harnessed effectively, can lead to substantial improvements in the department's operational efficiency, strategic capabilities, and overall contribution to the company's success. By identifying and capitalizing on these prospects, the department can not only overcome its current weaknesses but also set a robust foundation for future growth and innovation.

Implementation of Advanced Accounting Technologies: The department can significantly benefit from the integration of advanced accounting technologies. This transition not only streamlines processes but also enhances accuracy and provides superior data analytics, leading to improved decision-making capabilities.

Expansion of Training and Development Programs: Investing in comprehensive training and professional development programs presents an opportunity to elevate the expertise of the accounting team. This approach ensures that the staff remains adept in contemporary accounting practices and technologies.

Strengthening Interdepartmental Collaboration: Enhancing collaboration with other departments opens avenues for more integrated business strategies. This synergy between accounting and other business units can lead to a more cohesive approach to financial and operational planning.

Embracing Digital Transformation: The department has the opportunity to lead in digital transformation initiatives, optimizing accounting processes through automation and cloud-based solutions. This shift can result in significant efficiency gains and cost reductions.

Strategic Financial Planning and Advisory Role: Expanding the department’s role in strategic financial planning and advisory services allows for a greater impact on the company’s long-term growth and profitability strategies.

Sustainability and Social Responsibility Initiatives: Engaging in sustainability and corporate social responsibility (CSR) initiatives can enhance the company's reputation and compliance with emerging environmental, social, and governance (ESG) standards, providing a competitive edge.

Diversification of Accounting Services: There's an opportunity to expand the range of services offered by the department, such as providing more in-depth financial analyses or advisory services.

Building Stronger Stakeholder Relationships: The department can focus on strengthening relationships with external stakeholders, like investors and regulatory bodies, which can enhance trust and collaboration.

Each of these opportunities represents a potential pathway for the accounting department to elevate its role and effectiveness within [Your Company Name], driving innovation and contributing to the company's overarching strategic objectives.

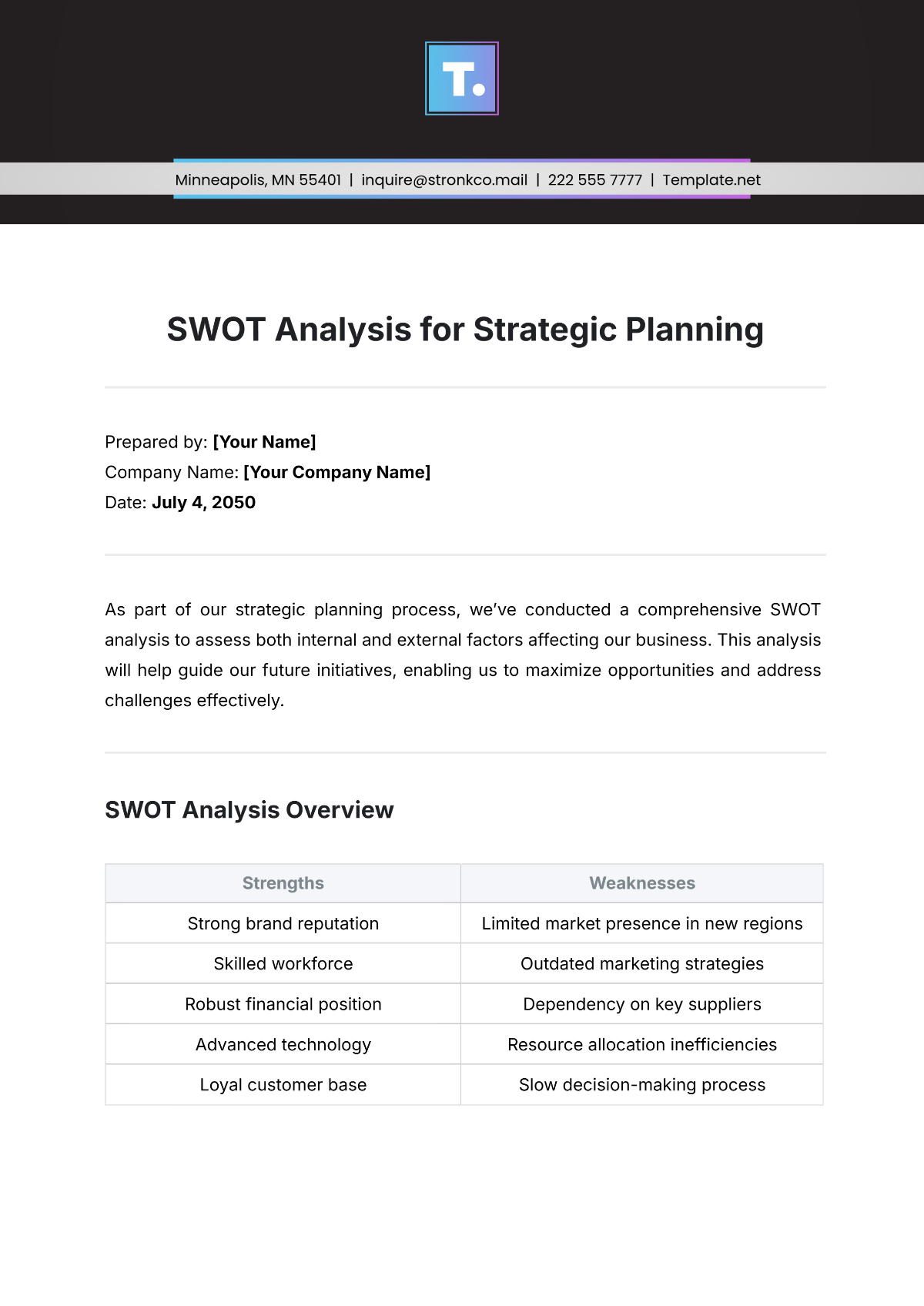

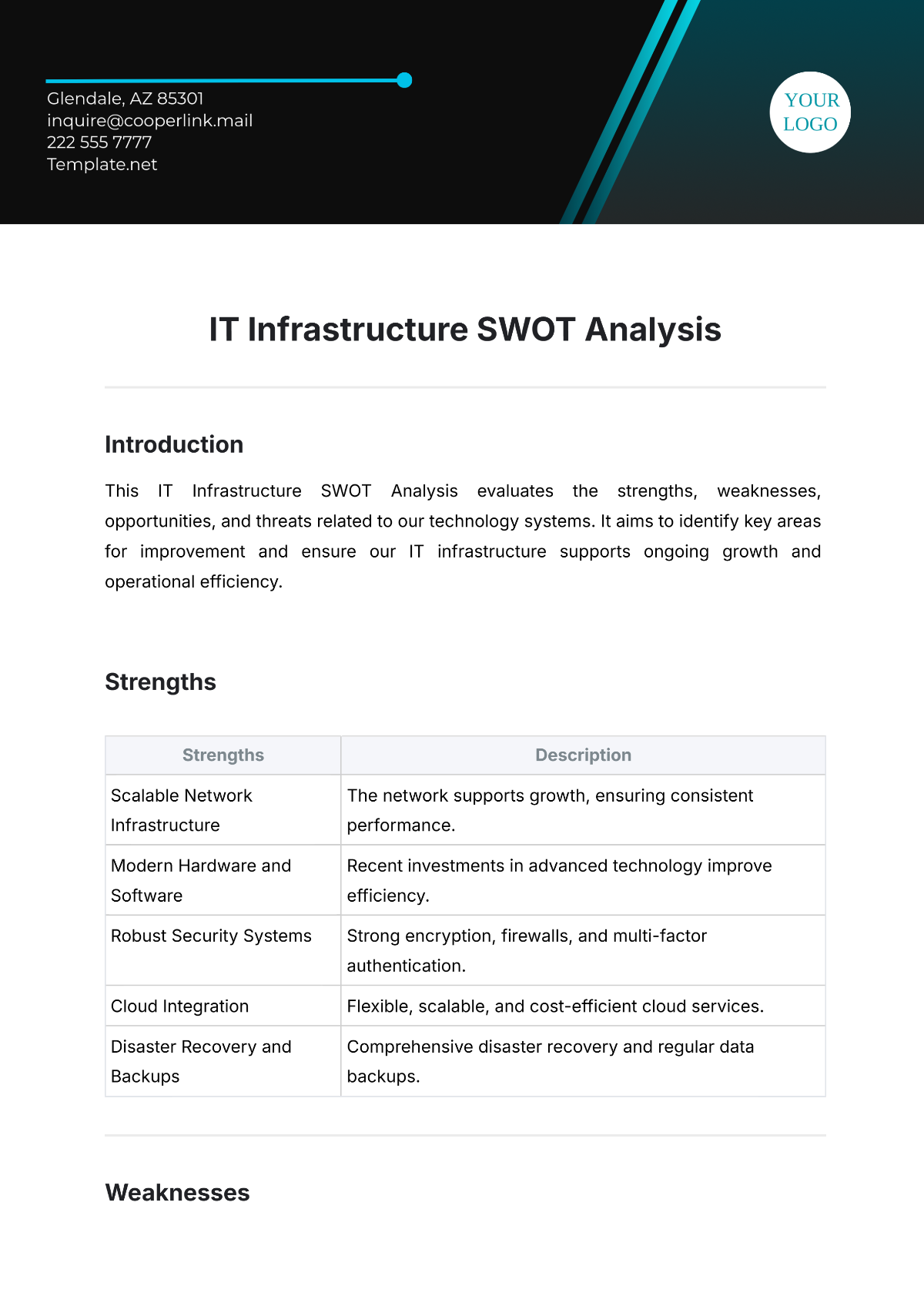

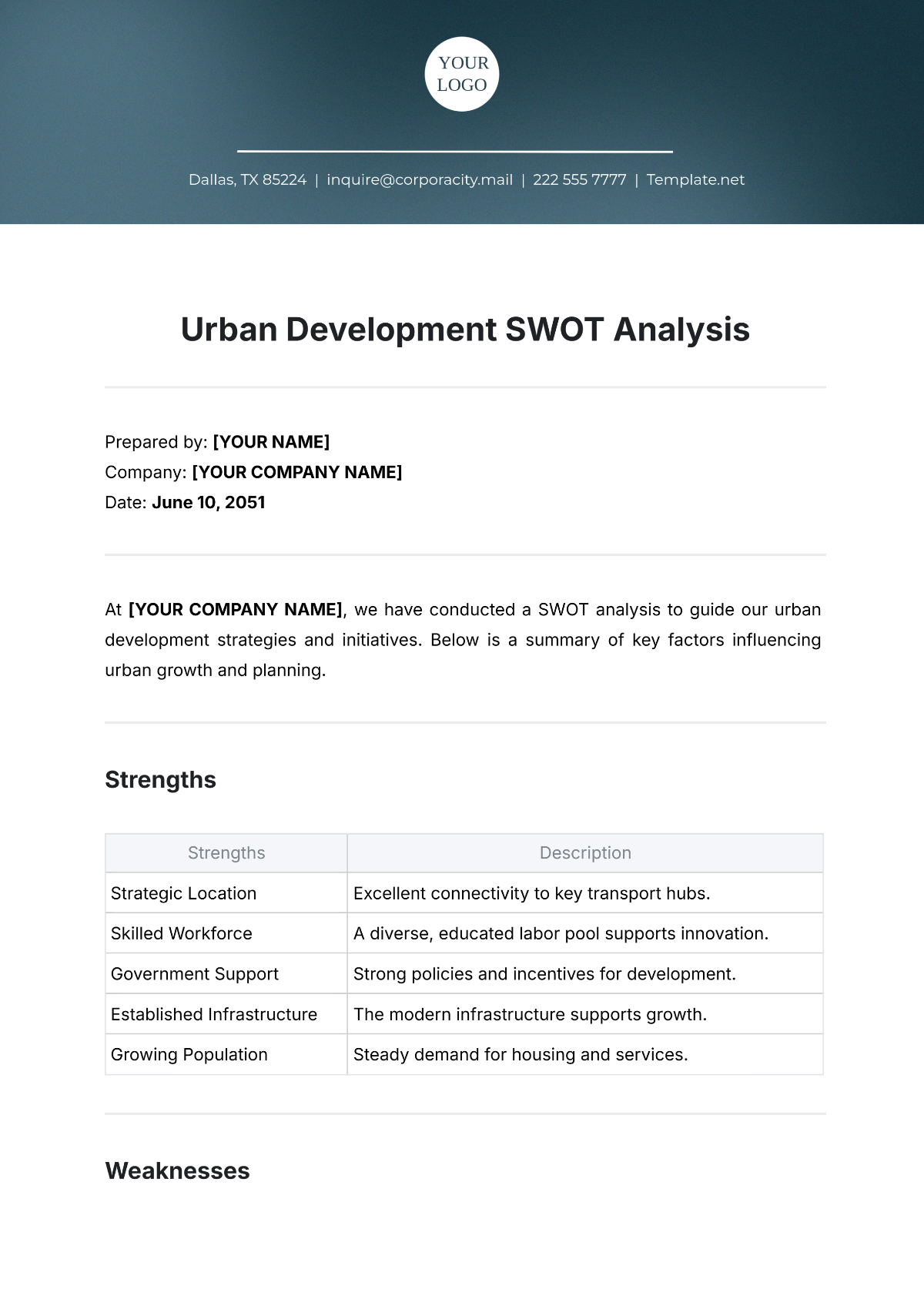

Threats

This section delineates the various threats facing the accounting department of [Your Company Name]. It is crucial to recognize and understand the external and internal factors that pose potential risks to the department's operations and strategic objectives. By identifying these threats, the department can develop proactive measures to mitigate risks and safeguard its functional integrity.

Evolving Regulatory Requirements: The constantly changing landscape of financial regulations and compliance standards presents a significant threat. Staying abreast of these changes requires continuous vigilance and adaptability to avoid compliance risks and potential legal issues.

Technological Disruptions: Rapid advancements in financial technology can render current systems obsolete, posing a threat to operational efficiency. The department must keep pace with technological innovations to remain competitive and secure.

Cybersecurity Risks: With increased digitalization, the department faces heightened risks of cyber attacks and data breaches. Implementing robust cybersecurity measures is essential to protect sensitive financial data.

Economic Fluctuations: Global economic uncertainties can impact the financial stability of the company. The accounting department must be prepared to navigate through economic downturns and market volatility.

Talent Attrition and Skill Shortages: The risk of losing skilled professionals and facing talent shortages in the accounting field is a persistent threat. This can lead to gaps in expertise and operational challenges.

Competition and Market Pressure: Intense competition and market pressures can impact the company’s financial performance. The accounting department needs to adapt to these pressures to ensure effective financial management and strategic support.

Technological Obsolescence: The rapid pace of technological change in accounting software and tools poses a threat of obsolescence, requiring constant updates and adaptations.

Increasing Complexity of Financial Products: The growing complexity and diversity of financial products and services in the market can pose challenges in terms of understanding, managing, and reporting these financial instruments effectively.

Addressing these threats requires strategic foresight and a proactive approach, ensuring that the accounting department remains a robust and agile contributor to [Your Company Name]'s enduring success.

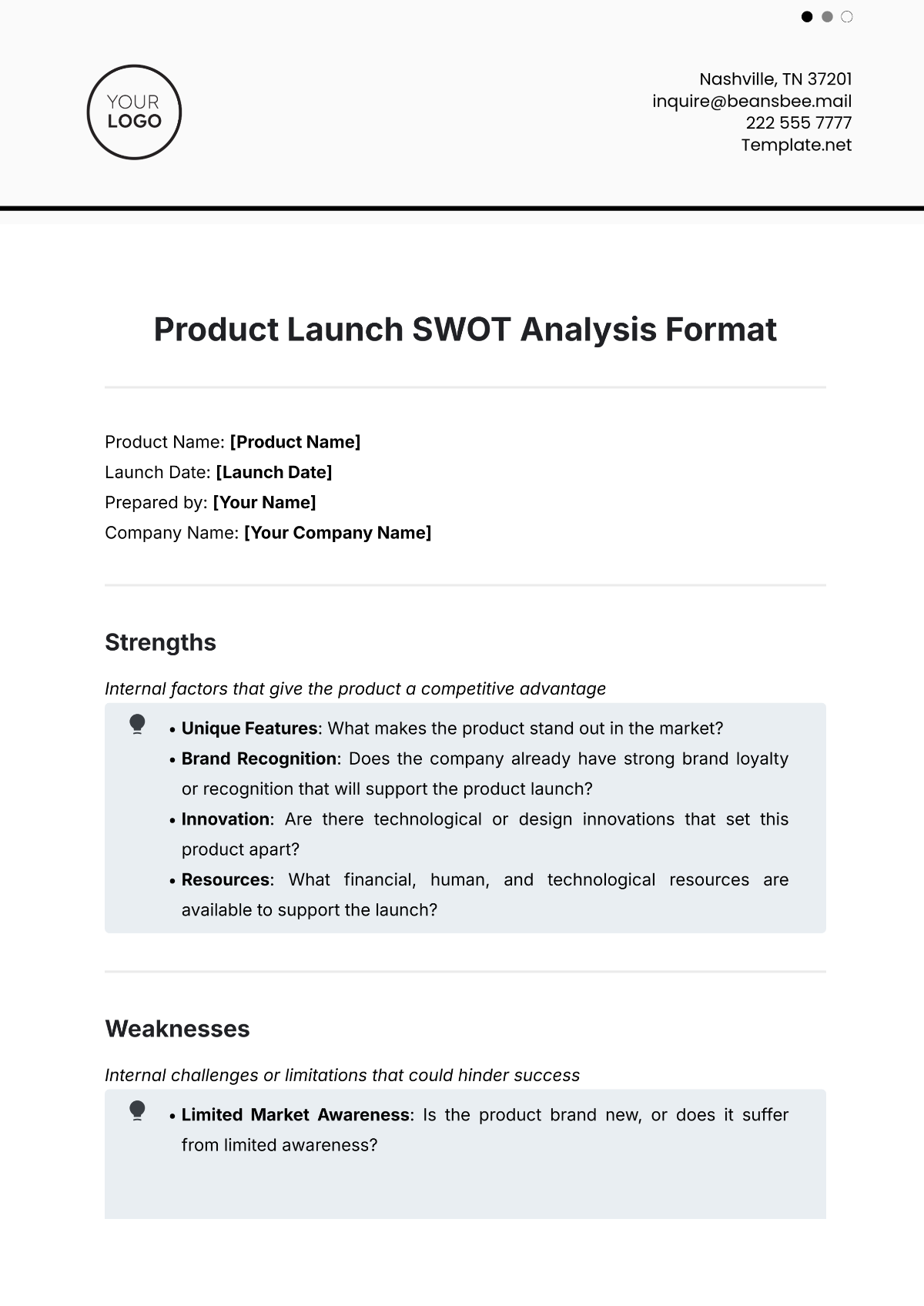

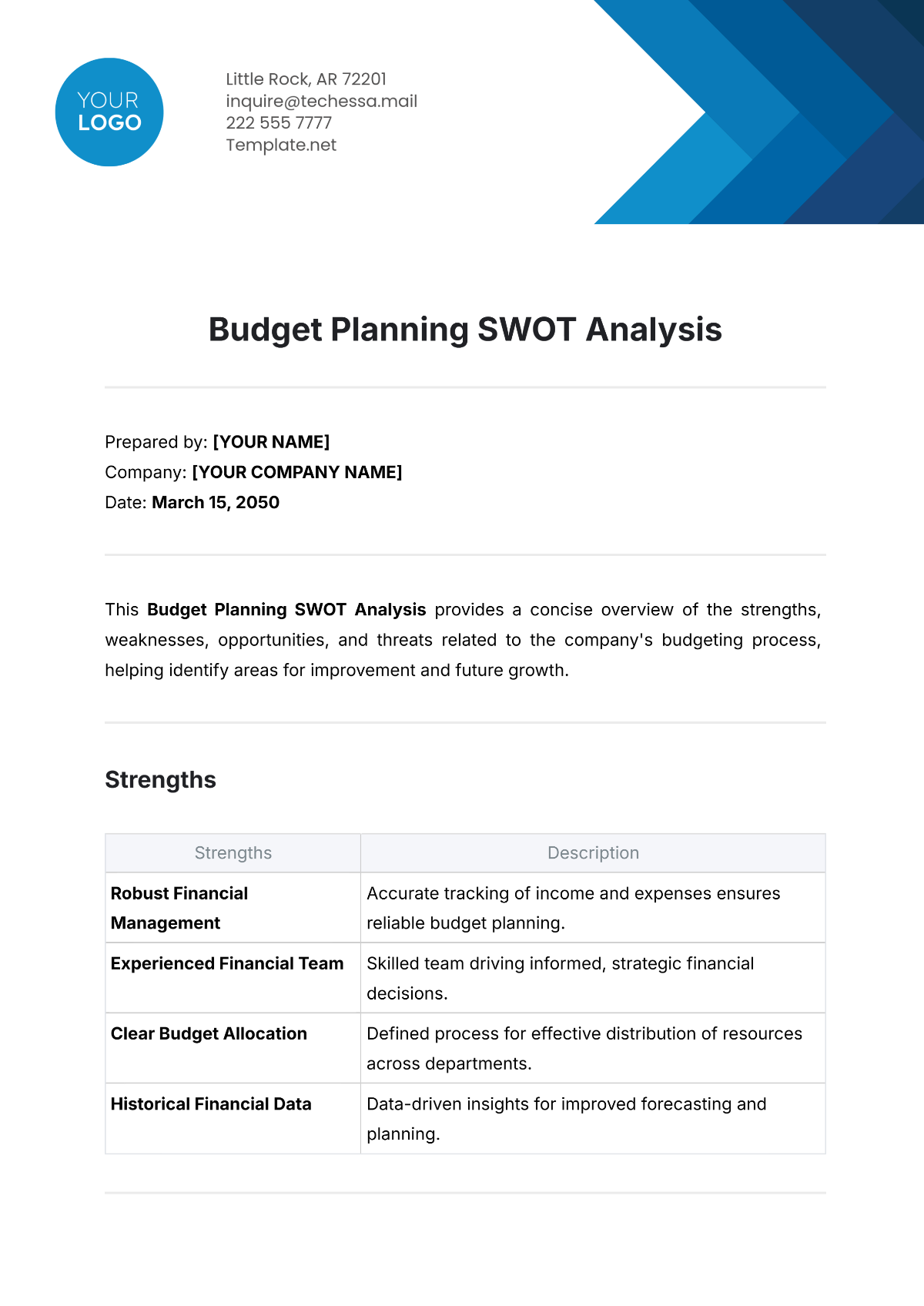

Recommendations and Implementations

his final section presents a series of actionable recommendations for the accounting department of [Your Company Name], aimed at addressing the identified weaknesses and threats while capitalizing on the available opportunities. The focus is on practical, achievable steps that can be implemented to enhance the department's overall effectiveness and alignment with the company's strategic goals.

Upgrade to Advanced Accounting Systems:

Implement state-of-the-art accounting software to enhance efficiency, accuracy, and data analytics capabilities. This should involve a planned transition process, training for staff, and regular evaluations of the technology's impact. Once a system is chosen, a detailed implementation plan should be developed, encompassing data migration, system integration, and a phased rollout to minimize disruptions. Crucial to this upgrade is comprehensive training for staff to ensure they are proficient in using the new system. Regular evaluations should be conducted post-implementation to measure the impact on operational efficiency and data management, allowing for adjustments and optimizations as needed.

Develop Comprehensive Training Programs:

Establish ongoing professional development and training initiatives to keep the team updated on the latest accounting standards and technologies. Partner with external experts or institutions to provide specialized training. Developing a structured training program involves assessing the skill gaps within the department and creating a curriculum that addresses these needs. Collaboration with external experts and educational institutions can bring specialized knowledge and resources to the training programs. These initiatives should not be one-off events but rather an ongoing process with regular updates to the curriculum to reflect the latest industry developments.

Foster Cross-Departmental Collaboration:

Create formal channels for interaction and cooperation between the accounting department and other business units. This can involve regular interdepartmental meetings, shared projects, and collaborative strategic planning sessions. This can be facilitated by establishing formal communication channels, such as scheduled interdepartmental meetings, joint projects, and shared strategic planning sessions. These collaborative efforts should aim to integrate financial insights into broader business decision-making, ensuring that financial considerations are embedded in all aspects of business planning and operations.

Strengthen Cybersecurity Measures:

Prioritize investments in cybersecurity to protect against data breaches and cyber threats. Regularly update security protocols and conduct cybersecurity awareness training for all staff members. This involves not only investing in advanced security software and infrastructure but also in regular training for staff on cybersecurity best practices. Updating security protocols should be a continuous process, adapting to new threats as they emerge. Regular drills and audits can help in identifying vulnerabilities and ensuring preparedness against potential cyber attacks.

Implement Strategic Financial Planning Practices:

Shift the department's focus towards more strategic financial planning. Develop a framework for strategic financial analysis and advisory, aligning with the company's long-term objectives. This can be achieved by developing a framework for strategic financial analysis, which would provide critical insights into business performance, market trends, and growth opportunities. The department should play a key advisory role, contributing to long-term business planning and decision-making processes.

Enhance Talent Retention Strategies:

Address talent attrition by implementing effective employee retention strategies. This can include competitive compensation, career development opportunities, and a positive work environment. Creating a positive and supportive work environment is also key to employee satisfaction and retention. Regular feedback and engagement initiatives can help in understanding employee needs and addressing them effectively.

Adapt to Regulatory Changes:

Establish a system for monitoring and adapting to regulatory changes. This can be managed by forming a dedicated team responsible for monitoring regulatory changes and assessing their impact on the company’s operations. Collaboration with legal and compliance experts can provide additional insights and guidance. Regular training sessions for the accounting team on new regulations will ensure that the entire department is up-to-date and compliant.

Economic Volatility Contingency Planning: Develop robust contingency plans to navigate economic fluctuations. This should involve regular financial health assessments and adaptable budgeting strategies. This should also include stress testing financial models and creating adaptable budgeting strategies that can respond to changing economic conditions. These plans should be reviewed and updated regularly to remain relevant and effective.

Enhance Data Analysis and Reporting Capabilities: Invest in advanced data analysis tools and training. This will enable the accounting department to provide more insightful and detailed financial reports, which can assist in strategic decision-making at the executive level. Focusing on data analytics will allow the department to interpret financial data more effectively, identifying trends and providing forecasts that can shape business strategy.

Establish a Continuous Improvement Program: Implement a continuous improvement program within the department. This program should encourage regular review and refinement of accounting processes and systems. By fostering a culture of continuous improvement, the department can steadily enhance efficiency, accuracy, and service quality. This program can include periodic reviews, feedback mechanisms from internal and external stakeholders, and a system for implementing and tracking improvements over time.

Each recommendation should be accompanied by a clear implementation timeline, designated responsibilities, and metrics for evaluating success. Regular reviews and adjustments to these strategies will be necessary to ensure they remain effective and aligned with the department's and company’s evolving needs.

Implementation Timeline:

Timeframe | Action Steps |

|---|---|

[Date] - [Date] | Select software, Train staff, Implement system |

This table is designed to offer a clear, accountable, and measurable plan for enhancing the operations and strategic impact of the accounting department. It facilitates organized implementation, allowing for regular monitoring and adjustments as needed to ensure alignment with the department’s and company’s goals.

Conclusion

This SWOT analysis has provided an examination of the accounting department at [Your Company Name], identifying its strengths, weaknesses, opportunities, and threats. The analysis highlighted the department’s proficiency in financial management and regulatory compliance, while also acknowledging areas such as resource allocation and technological advancement that require improvement. By capitalizing on opportunities like adopting new technologies and enhancing staff Ultimately, this analysis serves as a strategic guide, aiming to strengthen the accounting department’s contribution to the company’s overall success and resilience in an ever-changing business environment.