Payroll Accounting Risk Management Document

I. Introduction

At [YOUR COMPANY NAME], we understand the importance of a solid payroll accounting risk management to enhance our financial operations and protect our reputation. Ensuring a reliable process, we aim to manage the risks associated with payroll accounting. This policy provides guidance on duties, responsibility distribution, decision making, ethics, communication, risk management, budgeting, and conflict resolution.

II. Organizational Structure and Responsibilities

Position | Responsibilities |

|---|---|

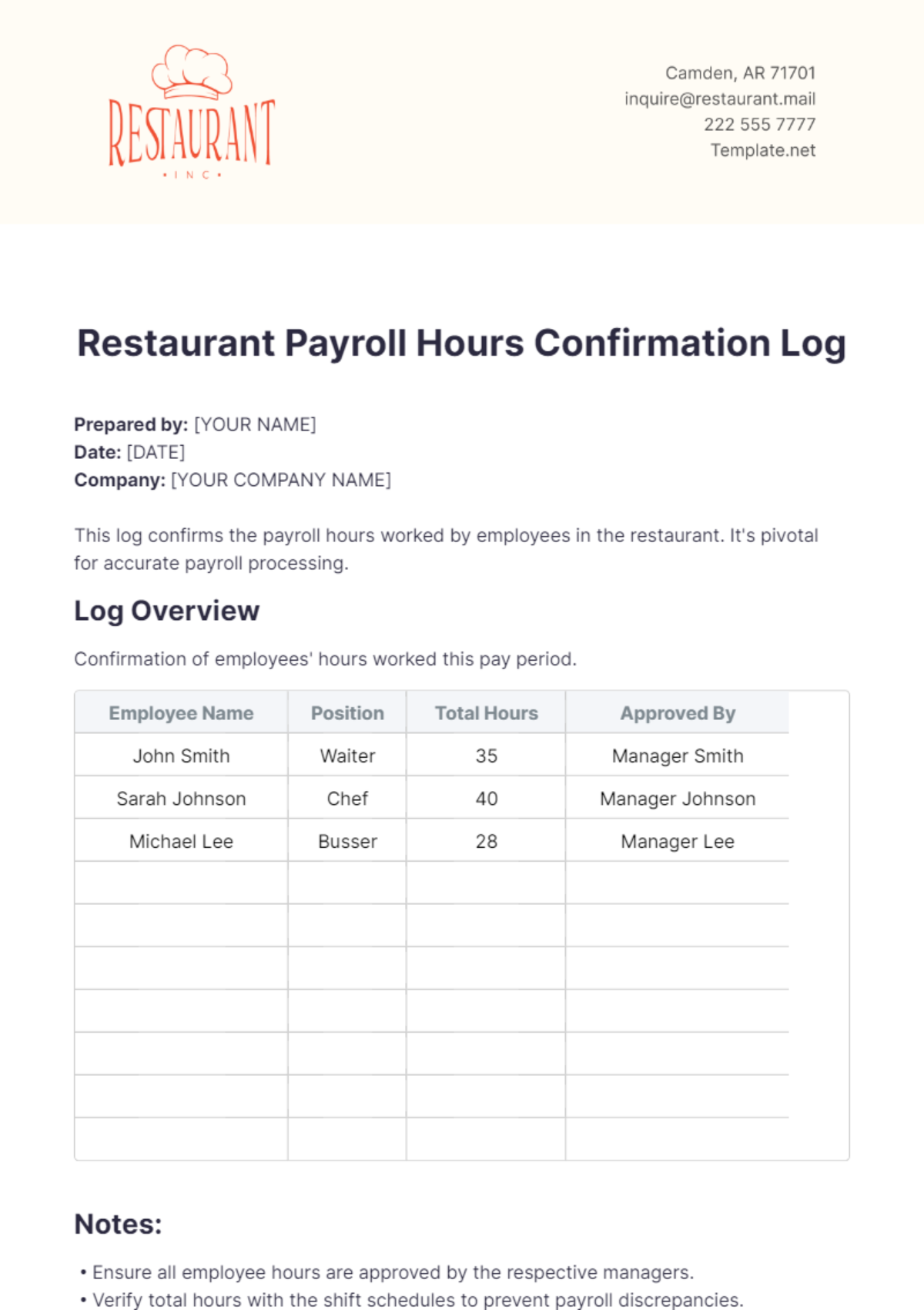

Payroll Accounting Manager | Overseeing all payroll accounting processes and risk control measures. |

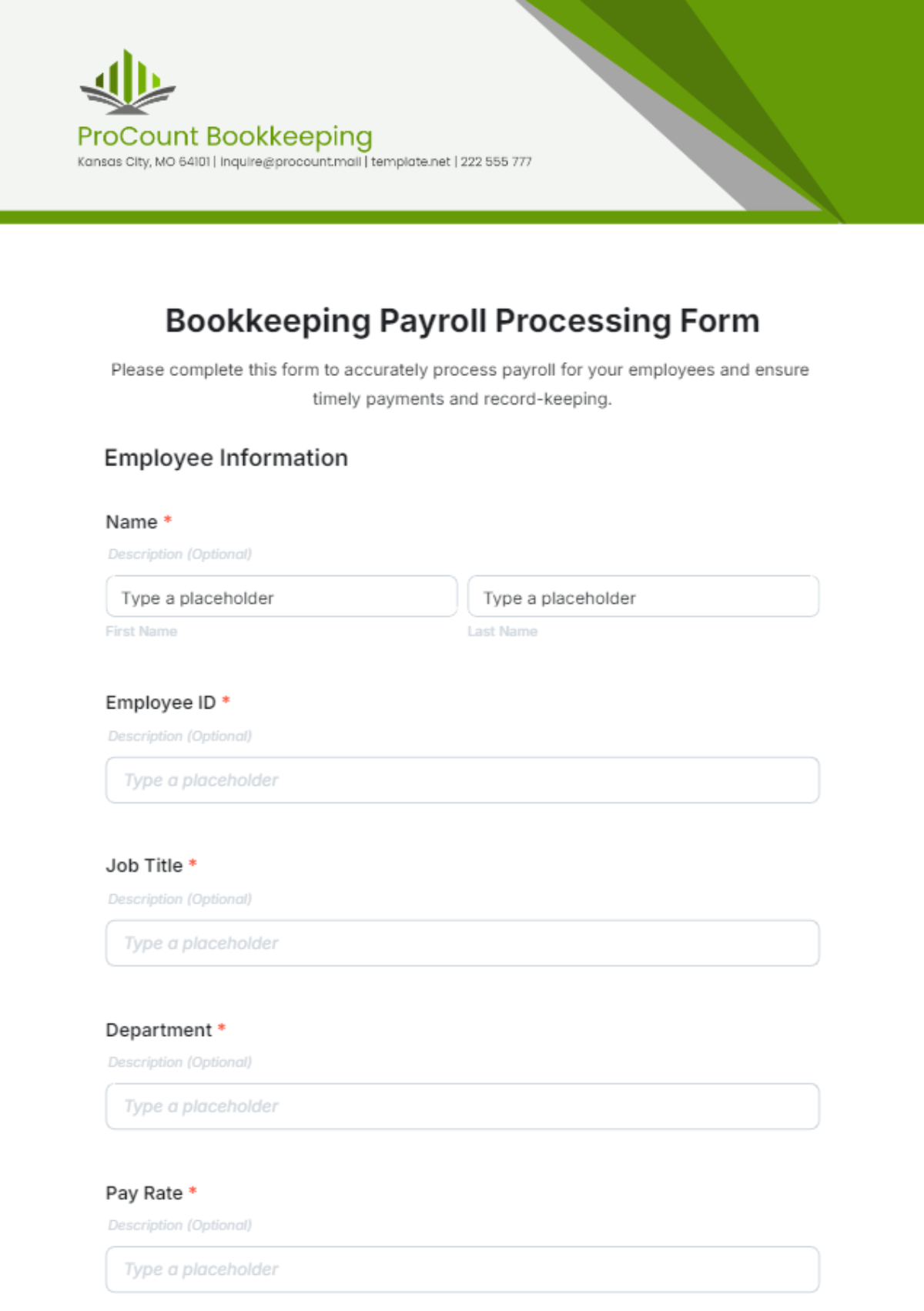

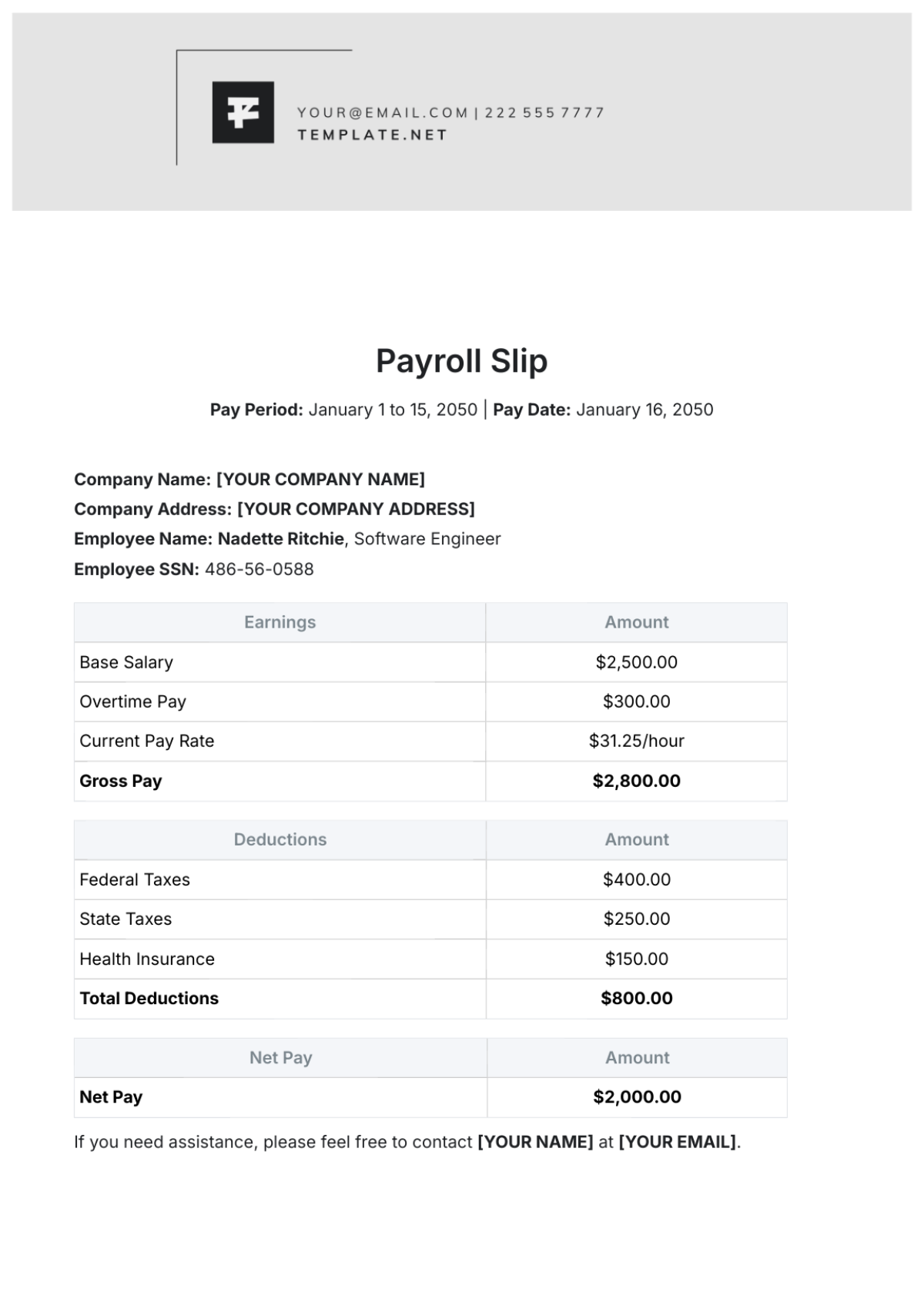

Payroll Officers | Administering payrolls, checking timesheets, updating records, and managing disputes. |

III. Decision-Making Process

Decisions are based on data analysis and informed projections.

All significant decisions require a team consensus.

Disagreements are managed with our conflict resolution process.

IV. Ethical Standards and Conduct

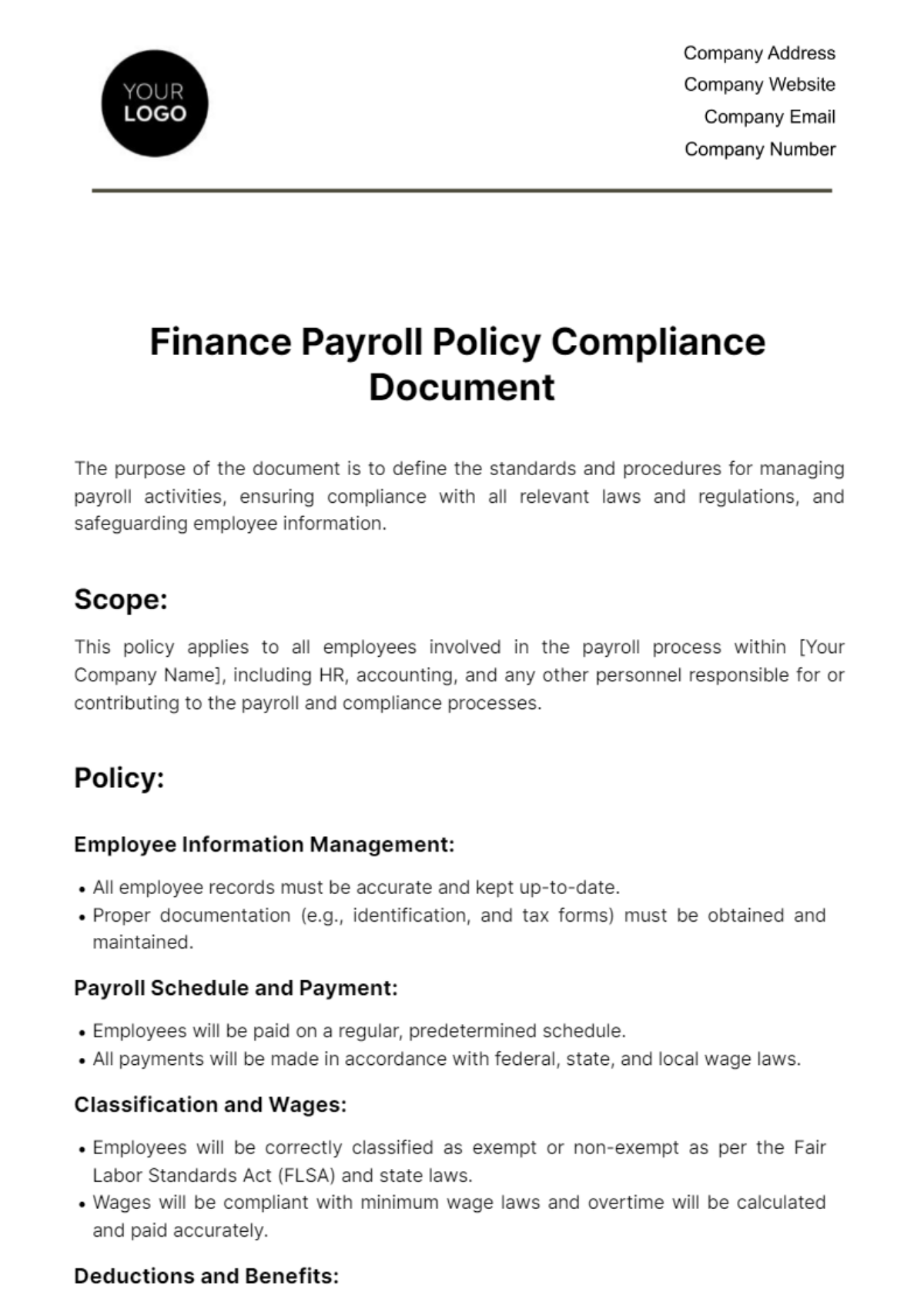

Ensuring all payroll accounting processes comply with relevant laws and regulations.

All payroll discrepancies are to be reported immediately and resolved efficiently.

V. Communication and Information Management

Utilize secure channels for financial communication.

Ensure confidentiality of sensitive payroll information.

VI. Risk Management

Consistently follow accounting standards to minimize the risk.

Conduct regular risk assessment of the payroll accounting process.

VII. Resource Allocation and Budgeting

Area | Allotted Budget |

|---|---|

Payroll processing | Determined based on the size and complexity of operations. |

Risk assessment | Allocated based on recommendations of the payroll accounting team. |

VIII. Conflict Resolution

Identify the conflict and the parties involved.

Ensure open dialogue between conflicting parties, encouraging them to express their perspectives.

Reach an agreement that respects individual positions and meets company objectives.

IX. Conclusion

In conclusion, this payroll accounting risk management document enhances accountability, efficiency, and transparency in handling payroll processes at [YOUR COMPANY NAME]. We appreciate adherence to this policy to mitigate payroll accounting risks and ensure financial stability.