Finance Accounts Case Study

Introduction

[Your Company], a well-established technology firm, specializes in providing innovative solutions to its clients. However, despite its strong market presence, the company has encountered significant challenges in managing its financial operations, specifically in the areas of accounts payable and receivable. This has led to cash flow issues, affecting overall financial health and operational efficiency. This case study provides a comprehensive analysis of [Your Company]'s current financial processes, identifies the primary issues in accounts management, and proposes actionable strategies to address these challenges. By improving these key financial areas, [Your Company] aims to enhance its financial stability and operational efficiency.

Situation Analysis

Current Financial Position

[Your Company]'s financial position is currently strained due to inefficient management of accounts payable and receivable. The key financial figures are as follows:

Financial Aspect | Value | Description |

Accounts Receivable | $1.5M | High, with slow collection rate |

Accounts Payable | $1.2M | Substantial, with early payment trend |

Cash Flow | Strained | Due to imbalanced AR and AP cycles |

Accounts Receivable Analysis

The company's accounts receivable (AR) amount to $1.5 million, with an average collection period of 60 days, which is significantly higher than the industry average. This delay in collection is primarily due to lenient credit terms offered to clients and a lack of a systematic approach to collections. The extended collection period has resulted in a considerable amount of capital being tied up in receivables, thereby affecting the liquidity and cash flow of the business.

Accounts Payable Analysis

In contrast, the accounts payable (AP) stand at $1.2 million, with the company adhering to an average payment period of 45 days. This is an early payment trend compared to the agreed-upon credit terms with suppliers. This approach, while maintaining good supplier relationships, has contributed to the cash flow issues by depleting cash reserves quicker than necessary.

Cash Flow Situation

The mismatch between the AR collection period and the AP payment period has led to a strained cash flow situation. The company often finds itself in a position where it is waiting for receivables to be collected while having already paid its payables, leading to short-term liquidity challenges.

Key Challenges

The primary challenges faced by [Your Company] in its financial operations include:

Delayed Collections: Due to extended credit terms and ineffective collection strategies, receivables are collected much later than they should be.

Inefficient Payment Strategies: The company pays its suppliers earlier than required, leading to unnecessary cash outflows.

Lack of Automation: Current processes are predominantly manual, leading to inefficiencies, errors, and delays in both accounts receivable and payable management.

Strategic Plan

The strategic plan aims to address the inefficiencies in [Your Company]'s accounts payable and receivable management. The goal is to streamline processes, improve cash flow, and ultimately contribute to the financial stability of the company. This plan is divided into two main areas: enhancing accounts receivable management and streamlining accounts payable management.

Improving Accounts Receivable Management

To address the delayed collections and high accounts receivable, the following strategies will be implemented:

Optimizing Credit Policy

Credit Analysis and Approval Process

Enhanced Credit Assessment: Strengthening the credit vetting process by implementing more rigorous credit checks.

Approval Authority: Establishing clear guidelines for who can approve credit and under what conditions.

Revised Credit Terms

Credit Period: Reducing the standard credit period from 60 to 45 days.

Customized Terms: Evaluating each client's creditworthiness to offer customized credit terms.

Strategy | Action Item | Expected Outcome |

Credit Assessment | Implement stricter checks | Reduced credit risk |

Approval Authority | Set clear approval guidelines | Controlled credit extension |

Credit Period | Reduce to 45 days | Faster receivable turnover |

Customized Terms | Based on client's creditworthiness | Tailored risk management |

Enhancing Collection Efforts

Collection Strategies

Prompt Invoicing: Ensuring invoices are sent immediately upon delivery of goods/services.

Follow-up System: Implementing a systematic follow-up process for overdue accounts.

Incentives for Prompt Payment

Early Payment Discounts: Offering small discounts for payments made before due dates.

Penalties for Late Payment: Implementing late payment fees to discourage delays.

Strategy | Action Item | Expected Outcome |

Prompt Invoicing | Invoice immediately after delivery | Reduced lag in billing |

Follow-up System | Systematic process for overdue accounts | Timely collection follow-ups |

Early Payment | Discounts for early payments | Incentivize faster payment |

Late Payment Fees | Penalties for delays | Discourage late payments |

Streamlining Accounts Payable Management

Efficient management of accounts payable is crucial for maintaining good supplier relationships and optimizing cash flow.

Payment Term Negotiation

Vendor Analysis

Critical Supplier Identification: Identifying key suppliers and prioritizing them for extended payment terms negotiations.

Term Extension: Working with suppliers to extend payment terms where feasible.

Payment Prioritization

Payment Scheduling: Categorizing suppliers based on importance and aligning payment schedules accordingly.

Strategy | Action Item | Expected Outcome |

Critical Supplier ID | Identify and prioritize key suppliers | Better terms with crucial suppliers |

Term Extension | Negotiate extended terms | Improved cash flow management |

Payment Scheduling | Align payments with supplier importance | Strategic cash outflows |

Leveraging Technology

Automated Accounts Payable System

Implementation: Introducing an automated system for invoice processing to reduce errors and increase efficiency.

Electronic Payment Methods: Transitioning to electronic payments to streamline the process and reduce processing time.

Strategy | Action Item | Expected Outcome |

Automated AP System | Implement an automated invoice system | Reduced processing time and errors |

Electronic Payments | Transition to electronic payments | Faster and more efficient payments |

The implementation of this strategic plan will lead to improved cash flow management, more efficient financial operations, and a stronger financial position for XYZ Corporation. Regular reviews and adjustments will be necessary to ensure the strategies remain effective and aligned with the company's evolving needs.

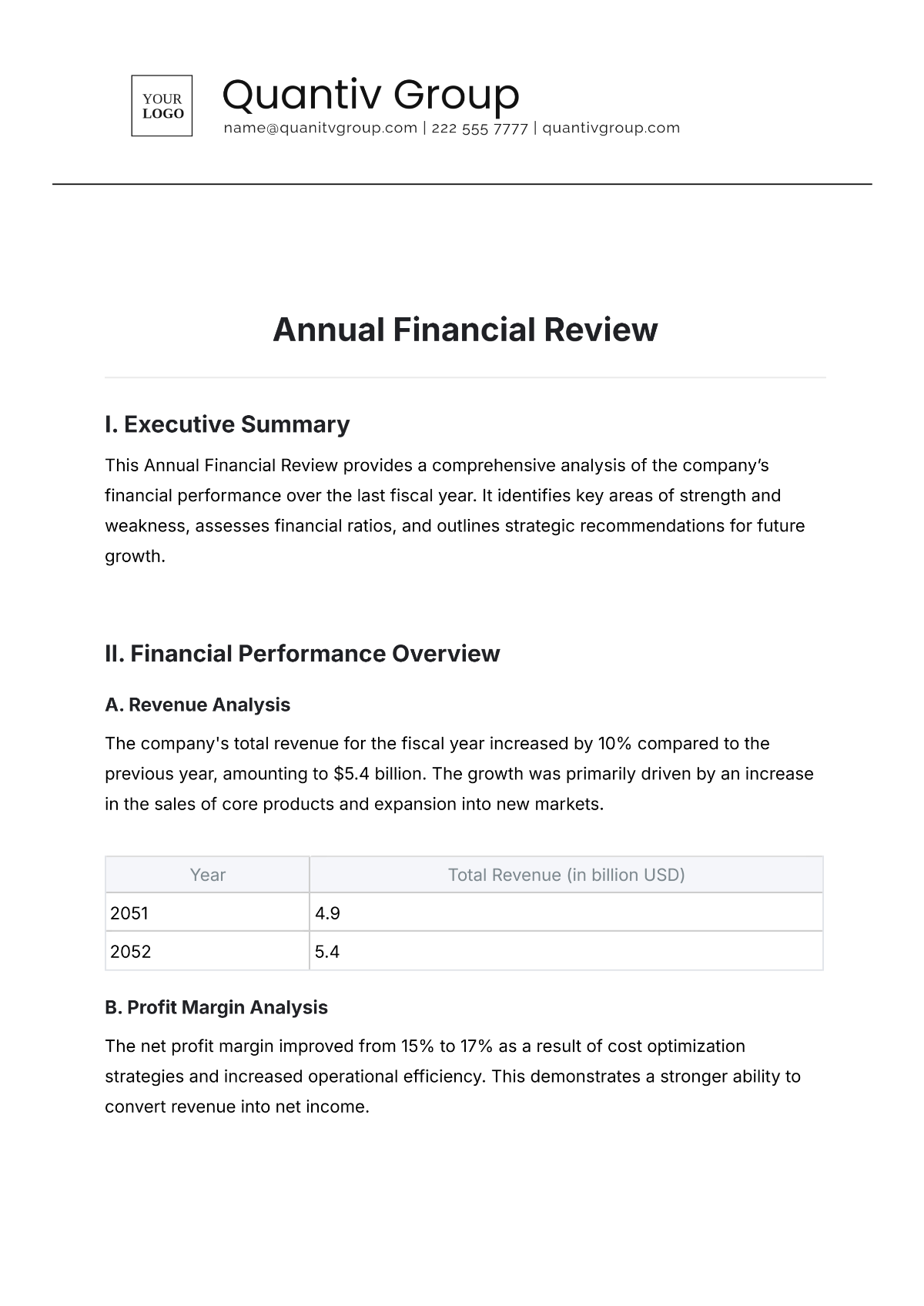

Financial Projections

The financial projections section of the strategic plan provides an estimated outlook of XYZ Corporation's financial performance following the implementation of the proposed strategies. These projections are crucial for understanding the potential impact of the changes on the company's cash flow and overall financial health.

Post-Implementation Scenario

Expected Accounts Receivable Improvements

Reduction in AR Collection Period: The initiatives aimed at improving accounts receivable management are expected to reduce the average collection period from 60 to 45 days.

Increased Cash Inflow: Quicker collection will lead to an increased rate of cash inflow, improving liquidity.

Expected Accounts Payable Adjustments

Extension in AP Payment Period: Negotiations with suppliers and efficient payable management should extend the average payment period from 45 to 60 days.

Optimized Cash Outflow: Delayed payments will conserve cash, leading to better cash flow management.

Cash Flow Improvement

Balancing of Cash Inflow and Outflow: By aligning the inflow (from AR) and outflow (through AP), cash flow is expected to stabilize.

Enhanced Liquidity: Improved cash flow will boost liquidity, allowing for better handling of operational and investment needs.

Key Financial Metrics (Projected)

The following table provides an overview of the expected changes in key financial metrics:

Metric | Current Status | Post-Implementation | Change (%) |

AR Collection Period | 60 Days | 45 Days | -25% |

AP Payment Period | 45 Days | 60 Days | +33% |

Cash Flow Position | Strained | Stable | Significantly Improved |

Detailed Financial Projections

Yearly Cash Flow Projections

Year 1: The initial year may still show some strain as the strategies begin to take effect. However, gradual improvement in cash flow is expected towards the end of the year.

Year 2: With the full implementation of strategies, a significant improvement in cash flow is expected, aligning with the reduced AR collection period and extended AP payment period.

Year 3 and Beyond: The company expects to maintain a stable cash flow, barring unforeseen circumstances, with continual adjustments and improvements in financial management strategies.

Year | Cash Flow Projection | Note |

Year 1 | Moderate Improvement | Transition phase, strategies taking effect |

Year 2 | Significant Improvement | Full impact of strategies visible |

Year 3+ | Stable and Sustained Improvement | Ongoing optimization and adjustments |

Conclusion

The financial projections demonstrate the potential positive impact of the strategic plan on [Your Company]’s financial performance. The key lies in the meticulous implementation of the strategies and the ongoing evaluation of their effectiveness. Regular financial reviews will be essential to ensure that the company remains on track to achieving its financial goals and adapting to any changes in the business environment.