Accounting Fixed Asset Policy

Purpose

The purpose of this Accounting Fixed Asset Policy is to establish the principles and framework for the acquisition, valuation, depreciation, and disposal of fixed assets at [Your Company Name]. This policy ensures compliance with relevant accounting standards and provides consistency in the treatment of fixed assets across the organization.

Scope

This policy applies to all employees of [Your Company Name] who are responsible for the acquisition, use, management, and disposal of fixed assets.

Definitions

Fixed Assets: Long-term tangible assets used in the operations of the business that are likely to be used for more than one fiscal year.

Depreciation: The systematic allocation of the depreciable amount of an asset over its useful life.

Useful Life: The period over which a fixed asset is expected to be usable by the organization.

Residual Value: The estimated amount that [Your Company Name] would currently obtain from the disposal of the asset, after deducting the estimated costs of disposal.

Policy Details

1. Asset Classification

Fixed assets include, but are not limited to, land, buildings, machinery, vehicles, furniture, and office equipment.

2. Asset Recognition

An item is recognized as a fixed asset if it meets the following criteria:

The cost of the item exceeds $5,000.

The item has a useful life of more than one year.

3. Asset Valuation

Fixed assets are initially recorded at cost, including purchase price and any costs directly attributable to bringing the asset to its working condition.

4. Depreciation

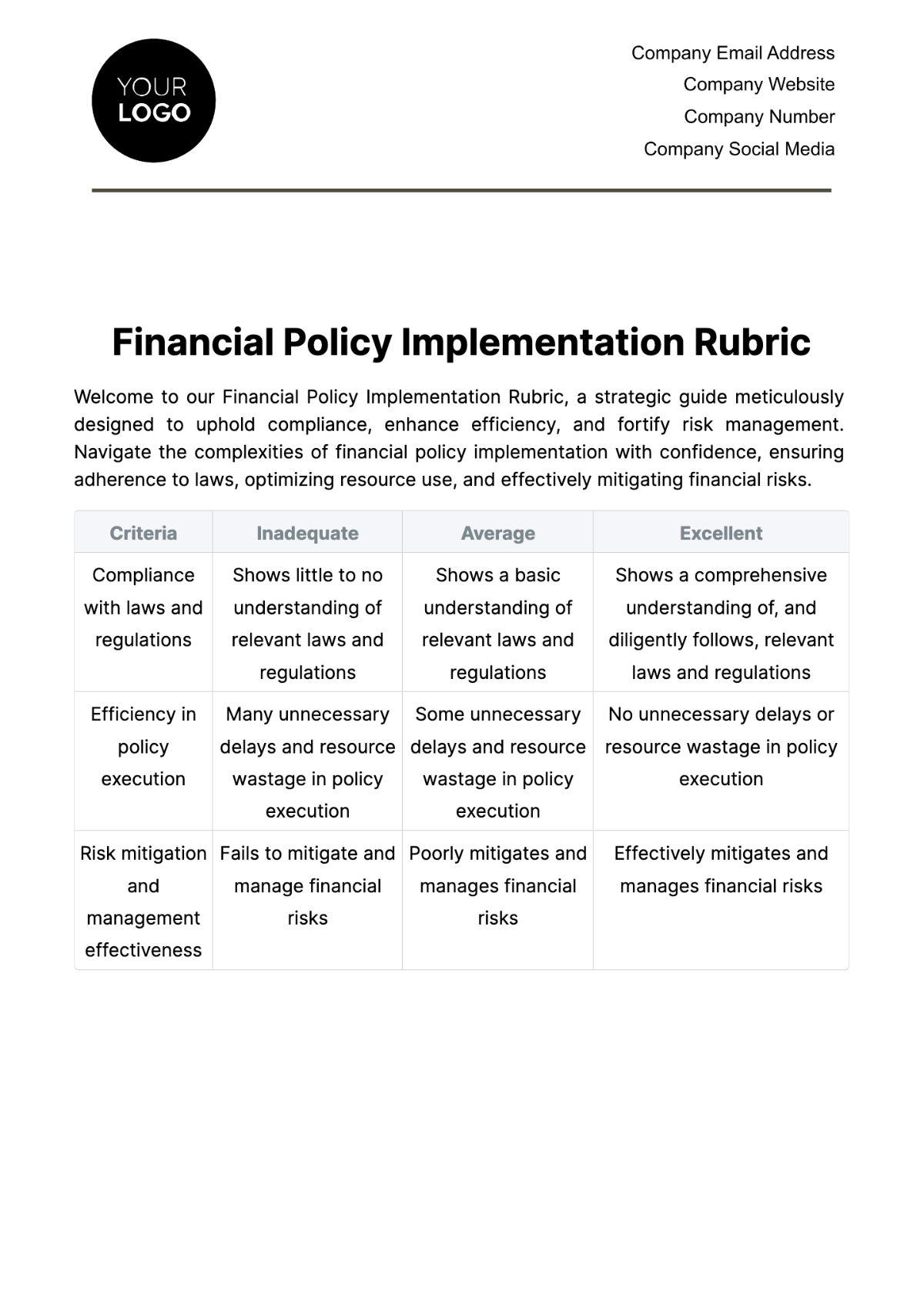

Depreciation is calculated using the straight-line method over the estimated useful life of the asset. The following table provides the standard useful life for different categories of fixed assets:

Asset Category | Useful Life (Years) |

|---|---|

Buildings | 30 |

Machinery | 10 |

Vehicles | 5 |

Office Equipment | 5 |

Furniture | 7 |

5. Asset Disposal

When a fixed asset is retired or disposed of, the asset's carrying value is removed from the books, and any gain or loss on disposal is recognized in the income statement.

6. Policy Review and Updates

This policy shall be reviewed annually and updated as necessary to ensure that it remains comprehensive and aligned with current accounting standards and regulations.

Procedures

Acquisition of Assets:

Complete an Asset Acquisition Form.

Obtain approval from the designated authority.

Asset Tagging and Recording:

Assign a unique identification number to each asset.

Record the asset details in the Fixed Asset Register.

Depreciation:

Calculate depreciation annually.

Update the Fixed Asset Register accordingly.

Disposal of Assets:

Complete an Asset Disposal Form.

Obtain approval from the designated authority.

Remove the asset from the Fixed Asset Register.

Fixed Asset Register

The Fixed Asset Register shall include the following information for each asset:

Asset ID

Description

Category

Acquisition Date

Cost

Accumulated Depreciation

Net Book Value

Location

Responsible Person

Compliance

Failure to comply with this policy may result in disciplinary action, up to and including termination of employment. All employees are responsible for understanding and adhering to this policy.

Conclusion

This Accounting Fixed Asset Policy outlines the principles and procedures for managing fixed assets at [Your Company Name]. It is designed to ensure accuracy, compliance, and consistency in the accounting treatment of fixed assets across the organization.