Free Accounting Asset Assessment Review

This document provides a comprehensive review of [Your Company Name]'s asset portfolio as of [Month, Day, Year]. The purpose of this Asset Assessment Review is to evaluate the current status, performance, and efficiency of the company's assets, ensuring alignment with strategic objectives and financial optimization.

Asset Assessment Objectives

Evaluate the accuracy and completeness of the asset register.

Assess the current value and performance of the company's assets.

Identify underperforming or obsolete assets for potential disposition.

Recommend strategies for asset optimization and reinvestment.

Methodology

The review was conducted through a combination of physical verification, financial analysis, and performance evaluation of assets across all departments. Assets were categorized for detailed analysis into fixed assets and current assets.

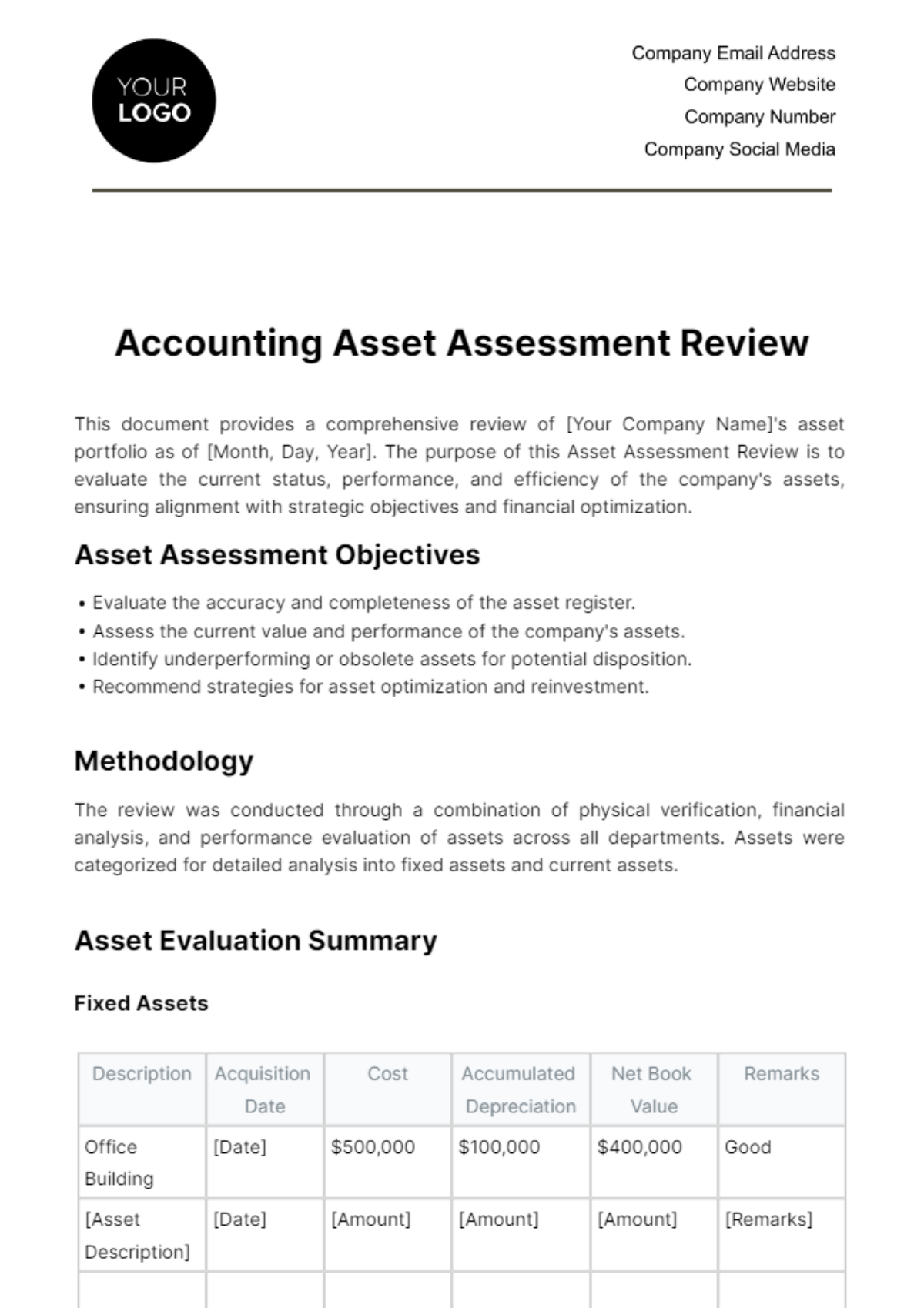

Asset Evaluation Summary

Fixed Assets

Description | Acquisition Date | Cost | Accumulated Depreciation | Net Book Value | Remarks |

|---|---|---|---|---|---|

Office Building | [Date] | $500,000 | $100,000 | $400,000 | Good |

[Asset Description] | [Date] | [Amount] | [Amount] | [Amount] | [Remarks] |

Current Asset

Description | Category | Balance as of [Date] | Remarks |

|---|---|---|---|

Cash on Hand | Cash | $25,000 | |

[Asset Description] | [Category] | [Amount] | [Remarks] |

Key Findings

Fixed Assets: The overall condition of fixed assets is satisfactory.

Current Assets: Cash levels are within expected ranges.

Recommendations

Fixed Assets: Plan for the phased replacement of older assets to avoid operational disruptions and maintain efficiency.

Current Assets: Implement a stricter credit control process to reduce the amount of doubtful accounts in Receivables.

Conclusion

The Accounting Asset Assessment Review highlights the overall health and performance of [Your Company Name]'s asset portfolio. By taking proactive steps to address the areas identified for improvement, the company can enhance its asset efficiency and contribute to long-term financial stability and growth.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Accounting Asset Assessment Review Template from Template.net is a meticulously designed resource for conducting thorough evaluations of your organization's assets. This editable and customizable template ensures a comprehensive review process, facilitating accurate assessments to maintain financial integrity. Ideal for finance teams, it can be edited using an Ai Editor Tool to aid with management and reporting.