Accounting Asset Depreciation Analysis

Asset Depreciation signifies an integral component of Accounting that acknowledges wear and tear, decay, or simply aging of an asset over its useful life. It provides an accurate measure of the periodic consumption of fixed assets that are used in business operations. This analysis provides a critical examination of asset depreciation, its implications, methodologies, and the actionable recommendations based on the study.

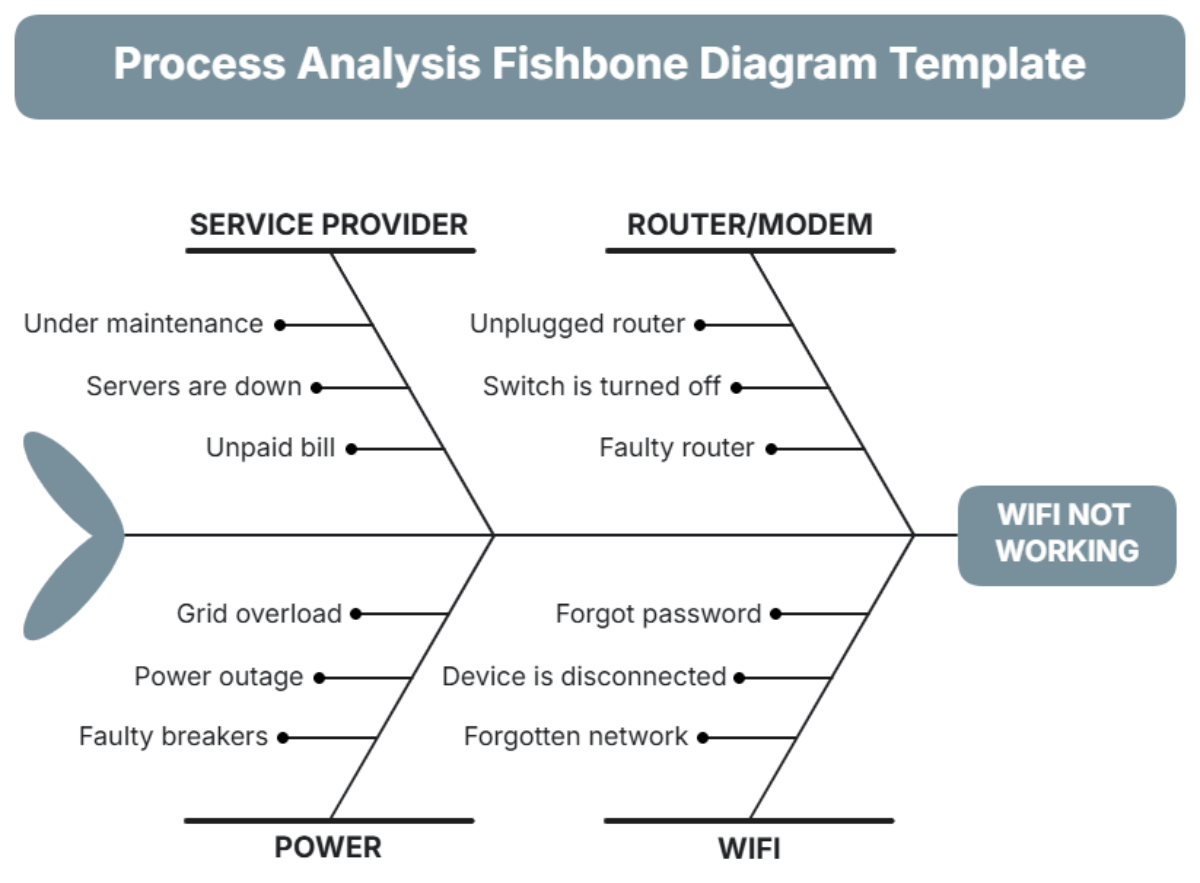

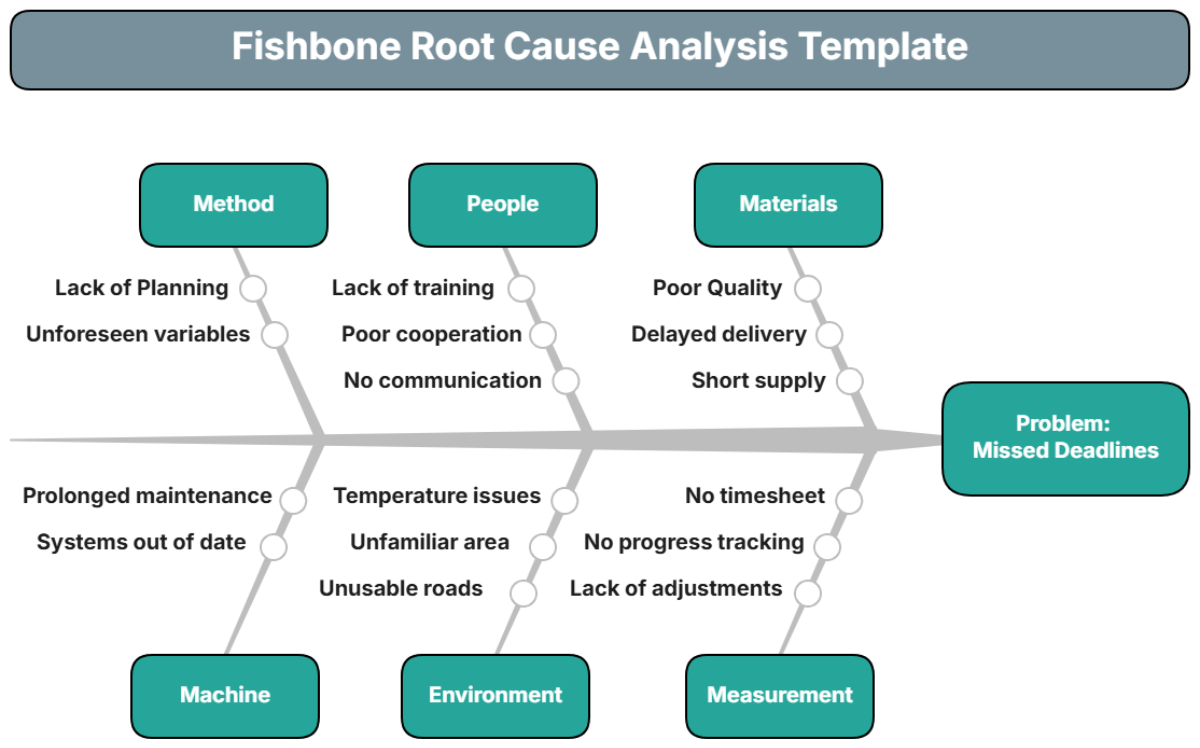

Asset Depreciation Methods

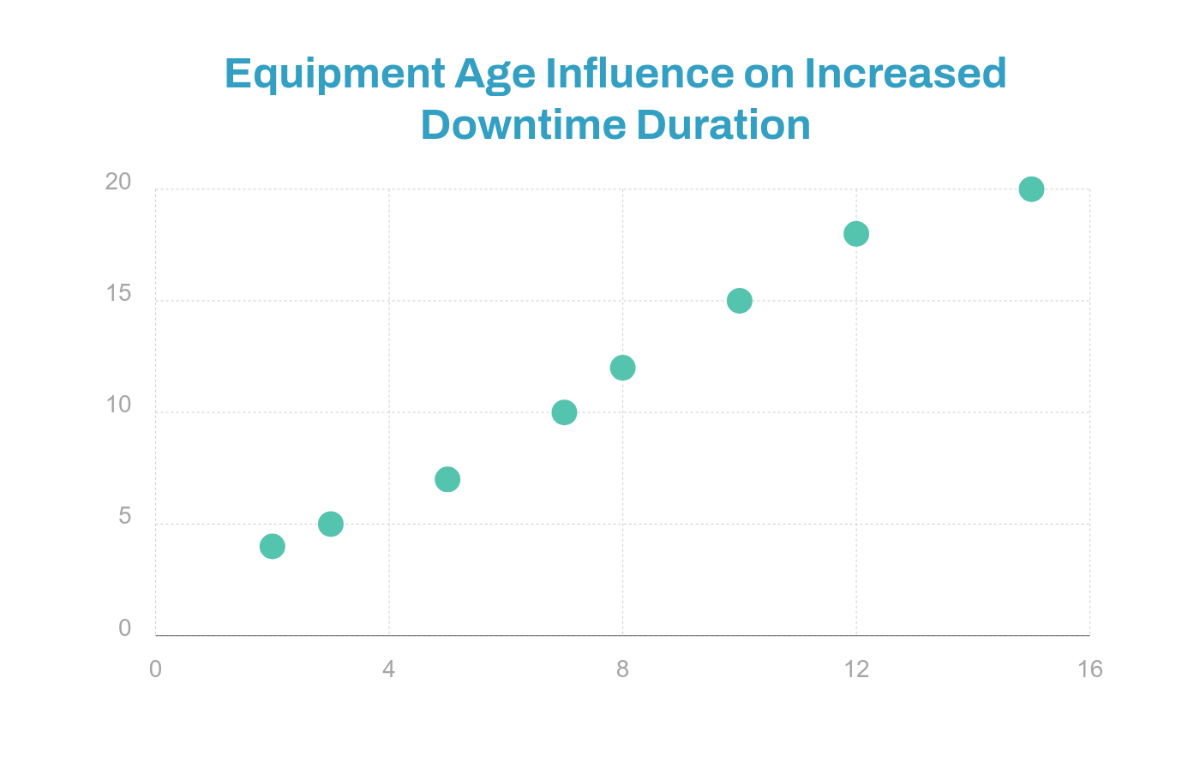

Multiple methods exist for calculating depreciation, with each method serving a specific purpose and practicality in different situations. The most common ones include straight-line, declining balance, and units of production. Correct use of each depreciation method allows for a comprehensive understanding of asset values, useful life, and timing of expenses.

Implications of Asset Depreciation

Depreciation holds direct implications for financial reporting and tax management within the business. Overstating or understating depreciation can distort financial results and affect the financial health and stability of the entity. Therefore, a detailed understanding of asset depreciation is required for accurate financial planning and business performance assessment.

Actionable Recommendations

Companies should maintain an organized, up-to-date fixed asset register documenting all asset purchases, disposals, and depreciation figures for accurate accounting. Additionally, choosing the right depreciation method, as per the nature of the asset and business, plays a crucial role. Lastly, annual reviews of fixed asset values to assess any potential asset impairment is a recommended practice.

Depreciation Method | Description | Application |

|---|---|---|

Straight-Line | Depreciates asset evenly over its useful life | Useful for assets with consistent productivity over their lifespan |

The proper understanding and application of asset depreciation carry significant importance in the realm of accounting. Asset depreciation not only facilitates an accurate picture of financial outcomes but also lays the foundation for a strategic approach towards tax management. By giving due consideration to asset depreciation, businesses can optimize their resources and gain a competitive edge.