Free Account Budget Policy

Introduction

This document outlines the Account Budget Policy for [Your Company Name], effective as of [Effective Date]. It establishes the principles, procedures, and responsibilities for the planning, allocation, utilization, and monitoring of budgets within the company. This policy is designed to ensure fiscal discipline, transparency, and accountability in financial management to support the company's strategic objectives.

Scope

This policy applies to all departments, units, and employees involved in budget preparation, approval, execution, and monitoring within [Your Company Name].

Budget Planning and Allocation

Principles

Strategic Alignment: Budget allocations shall be guided by the company's strategic priorities and objectives.

Efficiency: Resources shall be allocated to maximize value and minimize waste.

Flexibility: Budgets shall be adaptable to changing circumstances and unforeseen challenges.

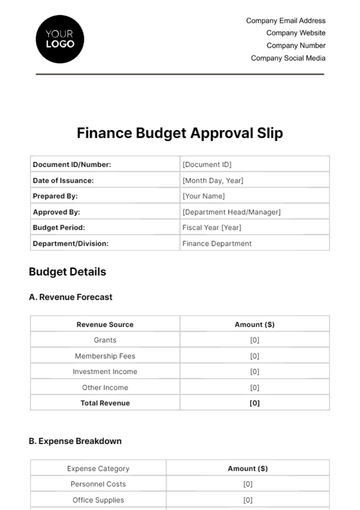

Process

Preparation: Each department must submit an annual budget request, detailing projected revenues, expenses, and justifications for allocations, by [Submission Deadline].

Review: The Finance Department will review budget requests for completeness, accuracy, and alignment with strategic goals.

Approval: The Executive Management Team will approve final budgets after review and adjustments.

Department | Budget Allocation | Notes |

|---|---|---|

Marketing | $[Amount] | Based on Marketing Plan |

Sales | $[Amount] | Includes sales incentives. |

Product Development | $[Amount] | For new product initiatives. |

Operations | $[Amount] | Operational efficiency focus. |

Human Resources | $[Amount] | Includes training programs. |

IT & Infrastructure | $[Amount] | For technology upgrades. |

Customer Support | $[Amount] | To enhance service quality. |

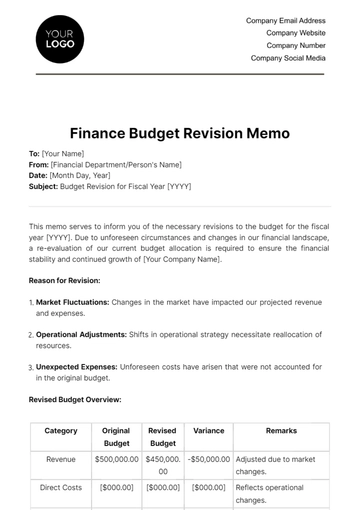

Budget Utilization

Guidelines

Authorization: Expenditures must be authorized by the respective department heads within the allocated budget.

Documentation: All expenditures must be supported with proper documentation and receipts.

Monitoring: Departments must monitor their spending and remain within budget limits.

Budget Monitoring and Reporting

Responsibilities

Department Heads: Responsible for monthly monitoring of their budgets, identifying variances, and taking corrective actions.

Finance Department: Provides quarterly budget performance reports to management, highlighting variances and areas of concern.

Compliance and Enforcement

Audit

Regular audits will be conducted to ensure compliance with budget policies and procedures.

Violations

Violations of this policy may result in disciplinary action, including but not limited to reprimand, suspension, or termination.

Amendments

This policy may be amended from time to time to reflect changes in regulatory requirements, strategic direction, or financial practices of [Your Company Name].

Approval

This policy is hereby approved by the Board of Directors of [Your Company Name] and is effective as of [Effective Date].

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Account Budget Policy Template from Template.net, your essential tool for establishing clear financial guidelines. This fully editable and customizable template is designed to help professionals draft comprehensive budget policies that ensure fiscal discipline and governance. It provides a structured framework for creating policies that are editable using an Ai Editor Tool only made available at Template.net.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising