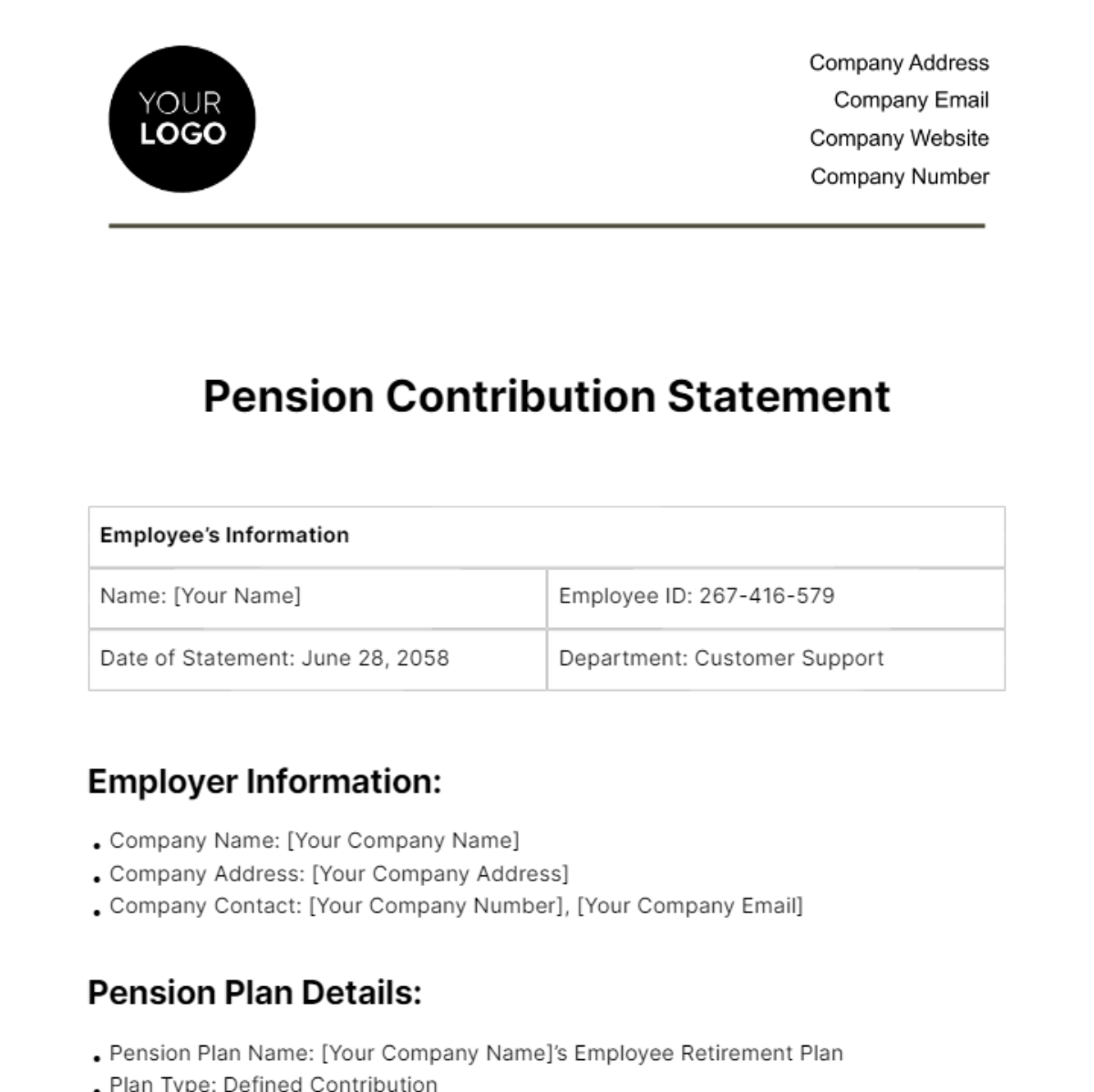

Free Pension Contribution Statement HR

Elevate your HR efficiency with Template.net's Pension Contribution Statement HR Template. This editable and customizable template, crafted for precision, streamlines pension reporting. Seamlessly edit in our AI Editor Tool for unparalleled ease. Ensure accuracy and professionalism in documenting contributions with this essential resource, exclusively designed to meet your HR needs.