Free In-Depth Internal Audit Accounting Guide Template

In-Depth Internal Audit Accounting Guide

Introduction

This guide details the process to commence, implement, conduct, conclude and troubleshoot an internal audit of [Your Company Name]'s financial accounts. This guide provides you with a successful integrated approach to enhance your understanding and efficiently perform internal audits to contribute to your business's unique identity.

Internal audit accounting aims for systematic examination, inspection, and evaluation of [Your Company Name]'s financial systems, processes, and practices. This process ensures compliance with industry requirements, identifies scopes for improvement, and contributes in the avoidance of financial discrepancies.

Getting Started

This section outlines in careful detail the initial steps that are fundamental to beginning activities related to internal auditing within the broader context of accounting process.

Delineate Your Objectives: Begin by establishing clear, measurable goals for the audit. This crucial first step involves identifying the specific outcomes you aim to achieve, such as assessing financial integrity, identifying areas of risk and inefficiency, and ensuring compliance with applicable regulations and standards.

Assemble Your Audit Team: Select a group of individuals who are proficient in accounting and familiar with audit procedures. The team should consist of professionals with a comprehensive understanding of accounting principles, as well as expertise in various audit methodologies. Diversity in skills and experience among team members will enhance the thoroughness and effectiveness of the audit.

Adopt a Structured Audit Plan: Implement a well-organized plan to guide the audit process. This plan should outline the audit's scope, objectives, and timeline, detailing the specific procedures and techniques to be used for data collection and analysis. A structured audit plan ensures a methodical approach, facilitating a detailed examination of the organization's financial operations and promoting the identification of potential improvements.

Conduct Preliminary Risk Assessment: Before diving into the detailed audit procedures, perform a preliminary risk assessment to identify and prioritize areas of highest financial risk. This assessment should consider historical data, recent organizational changes, and external factors that might impact financial statements. By focusing on high-risk areas, the audit can be more efficiently directed towards those aspects of the organization's finances that are most susceptible to misstatement or fraud.

Establish Clear Communication Channels: Ensure that there is an open and effective line of communication between the audit team and management, as well as other key stakeholders within the organization. Clear communication is essential for facilitating the smooth execution of the audit process, addressing any concerns or questions that may arise, and ensuring that findings and recommendations are accurately conveyed and understood. This fosters a cooperative environment and supports the successful implementation of audit recommendations.

Step-by-Step Instruction

The internal audit function is a critical component of an organization's governance, risk management, and control processes. It provides independent assurance that an organization's risk management, governance, and internal control processes are operating effectively. Implementing a structured and comprehensive internal audit process is vital for identifying areas of potential improvement, enhancing operational efficiency, and ensuring compliance with relevant laws and regulations.

Pre-Audit Engagement:

Conduct Preliminary Risk Assessment: Initiate the audit process by identifying areas with the highest risk of financial misstatement or non-compliance with regulations. This involves analyzing historical financial data, understanding recent organizational changes, and considering external factors that may influence financial accuracy. The aim is to prioritize audit efforts towards the most critical areas.

Schedule Audit Timing: Determine an appropriate timeline for the audit that accommodates both the audit team's availability and the organization's operational calendar. Effective scheduling ensures that the audit is conducted during a period that is conducive to thorough examination without disrupting the organization's normal business activities.

Conduct the Audit:

Inspect Financial Transactions and Records: Examine the organization's financial transactions and supporting documents in detail to verify their accuracy and compliance with applicable accounting standards and regulations. This scrutiny helps in identifying discrepancies, inefficiencies, or instances of non-compliance.

Evaluate Internal Control Systems: Assess the effectiveness of the organization's internal controls in preventing and detecting errors and fraud. This involves reviewing the design and operation of controls, testing their effectiveness, and identifying areas where these controls could be improved.

Post-Audit Tasks:

Present Audit Findings: Compile the audit findings into a comprehensive report that clearly outlines observed discrepancies, inefficiencies, and areas of non-compliance. This report should be structured to provide a clear understanding of the audit's scope, methodology, findings, and implications.

Make Recommendations: Based on the audit findings, propose actionable recommendations for addressing identified issues and enhancing the organization's financial management practices. Recommendations should be practical, tailored to the organization's context, and aimed at strengthening internal controls, improving operational efficiency, and ensuring regulatory compliance.

Follow-Up: Establish a mechanism for monitoring the implementation of audit recommendations. This may involve setting timelines for corrective actions and conducting follow-up audits to assess the effectiveness of implemented changes.

Implementing Audit Recommendations:

Setting Timelines: For each recommendation, establish a realistic and achievable timeline. This includes identifying short-term actions that can be implemented immediately, as well as mapping out longer-term initiatives that may require more extensive planning and resources. Timelines should be flexible enough to accommodate unforeseen challenges while remaining firm to ensure accountability.

Assigning Responsibility: Clearly define who within the organization will be responsible for implementing each recommendation. This involves assigning specific tasks to individuals or teams, ensuring they have the necessary authority and resources to carry out these tasks. Clear assignment of responsibilities helps in avoiding ambiguity and ensures direct accountability for the outcomes.

Audit Follow-Up and Continuous Improvement:

Conducting Follow-Up Audits: Schedule and perform follow-up audits to review the progress of recommendation implementation. These audits should examine whether the recommendations have been fully implemented, partially implemented, or not implemented at all, and assess their effectiveness in addressing the original audit findings.

Assessing Impact: Evaluate the impact of the implemented recommendations on the organization. This involves analyzing operational improvements, risk mitigation, and any enhancements in governance and compliance. The assessment should provide insights into the value added by the audit recommendations.

Feedback and Refinement: Gather feedback from key stakeholders on the implementation process and the outcomes of the recommendations. Use this feedback to refine future audits and the implementation process itself. This step is crucial for identifying lessons learned and opportunities for improvement.

By following these steps, organizations can execute a successful internal audit that not only identifies current financial management issues but also contributes to the continual improvement of financial processes and controls.

Leveraging Technology in Audit Processes

The integration of technology into internal audit processes presents an opportunity for [Your Company Name] to enhance the efficiency, accuracy, and comprehensiveness of its audits. This section delves into the strategic adoption of technological tools and methodologies that can transform the internal audit function.

Automating Routine Processes: Automation plays a pivotal role in streamlining repetitive and time-consuming tasks within the audit process. By implementing audit software that automates data collection, analysis, and reporting, auditors can focus more on complex areas that require judgment and expertise. Automated workflows can also ensure that audit procedures are consistently followed, reducing the risk of errors and omissions.

Advanced Data Analytics: The use of advanced data analytics enables auditors to examine large datasets more effectively, identifying trends, anomalies, and patterns that might indicate areas of risk or opportunities for improvement. Tools such as predictive analytics and machine learning algorithms can forecast potential future risks based on historical data, allowing the organization to take preemptive actions.

Enhancing Audit Reporting: Technology also transforms how audit findings are reported and communicated to stakeholders. Interactive dashboards and visualization tools can present complex data in an accessible and understandable format, making it easier for management and the board to make informed decisions. These tools also facilitate real-time reporting, allowing for quicker responses to audit findings.

Ensuring Data Security and Compliance: With the increasing reliance on technology, ensuring the security and integrity of audit data is paramount. Adopting secure audit platforms that comply with regulatory standards and best practices in data protection is essential. This includes ensuring end-to-end encryption, access controls, and regular security assessments to mitigate the risk of data breaches.

Continuous Monitoring and Risk Assessment: Technology enables the continuous monitoring of organizational processes and controls, providing an ongoing assessment of risk. This proactive approach allows the internal audit function to identify and address issues as they arise, rather than at scheduled audit intervals. Continuous monitoring systems can alert auditors to significant changes or deviations in real-time, enabling more dynamic risk management.

The strategic integration of technology into internal audit processes offers significant benefits, including improved efficiency, enhanced analytical capabilities, and more effective communication of findings. Embracing these technological advancements will be crucial in maintaining a robust and forward-looking internal audit function that not only safeguards the organization but also contributes to its strategic objectives.

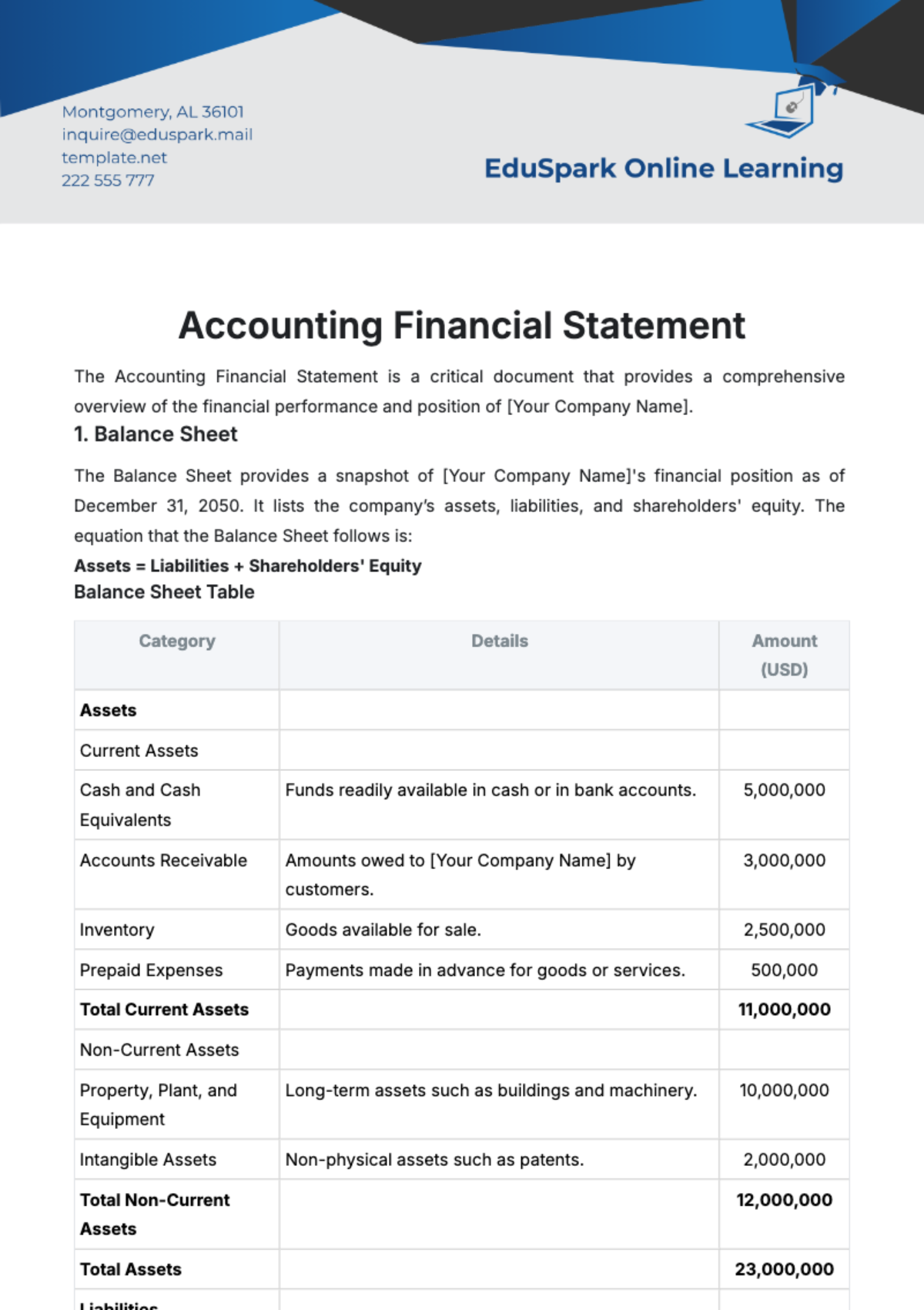

Internal Audit Through Data Analysis

Incorporating data analysis into the internal audit process can significantly increase the audit's efficiency, accuracy, and value to [Your Company Name]. By analyzing trends, identifying anomalies, and tracking performance over time, auditors can gain deeper insights into the organization's financial health and operational risks. Below are examples of tables that could be utilized to organize and present audit data effectively.

Risk Assessment Summary

Risk Category | Description | Impact Level | Mitigation Strategies |

|---|---|---|---|

Financial Reporting | Inaccuracies in financial documentation | High | Regular reviews, staff training |

This table provides an overview of potential risk areas within the organization, categorizing them by type, describing their nature, assessing their impact and likelihood, and suggesting mitigation strategies.

Audit Schedule for the Fiscal Year

Quarter | Department | Audit Focus Area | Status |

|---|---|---|---|

Q1 | Finance | Revenue Recognition | Completed |

This table outlines the audit schedule, organizing audits by quarter, department, focus area, lead auditor, and current status. It helps in planning and tracking the progress of audits throughout the fiscal year.

Audit Findings and Recommendations

Department | Finding Summary | Recommendation | Implementation Deadline |

|---|---|---|---|

Finance | Discrepancy in expense reporting | Revise reporting procedures and conduct training | 2024-03-31 |

These tables serve as templates to structure data effectively for internal audit purposes. They can be customized to fit the specific needs and findings of [Your Company Name]'s audit team, providing a clear, organized way to present audit information, track progress, and drive actionable outcomes. For implementation, these templates would need to be recreated in a document or spreadsheet software, allowing for dynamic updating and customization.

Troubleshooting and FAQs

In the rigorous and detail-oriented field of internal auditing, encountering challenges such as inconsistencies in audit results or significant oversights post-audit is not uncommon. These issues can stem from a variety of factors, including but not limited to computational errors, overlooked transactions, or misinterpretations of data. Addressing these challenges promptly and effectively is crucial to maintaining the integrity and reliability of the audit process. This section provides a structured approach to troubleshooting common audit issues, accompanied by a selection of frequently asked questions (FAQs) that aim to assist audit professionals in refining their practices and mitigating potential errors.

Inconsistencies in Audit Results: Causes and Solutions

If you encounter inconsistencies in your audit findings, several factors could be at play. Inconsistencies might arise from computational mistakes, transactions that were missed during the initial review, or incorrect interpretation of financial data. To address this issue, it is advisable to undertake the following steps:

Re-evaluate the Audit Process: Carefully examine the audit procedures to identify any steps that may have been executed incorrectly or inefficiently. This re-evaluation should involve a thorough review of the audit methodology to ensure that all relevant transactions have been included and accurately assessed.

Conduct a Secondary Review: Engage another audit professional or team to re-examine the audit work. This secondary review should be performed by individuals who were not involved in the initial audit process to ensure an unbiased reassessment of the audit findings and procedures.

Implement Corrective Measures: Based on the outcomes of the re-evaluation and secondary review, take appropriate corrective actions. This may involve revising the audit findings, adjusting the audit methodology for future audits, or implementing additional controls to prevent similar inconsistencies.

Discovering Significant Errors Post-Audit: Steps to Take

Uncovering a significant error after an audit has been completed can be a daunting situation. However, it is critical to address such findings transparently and promptly:

Inform Your Superiors: Immediately report the discovery of the error to your superiors or the audit committee. Full disclosure is essential for maintaining the integrity of the audit process and the trust of stakeholders.

Assess the Impact: Evaluate the magnitude of the overlooked error and its impact on the audit conclusions and the organization's financial statements. This assessment will guide the necessary corrective actions.

Communicate the Error: Openly communicate the error and its implications to all relevant parties, including management, the board of directors, and possibly external stakeholders, depending on the severity of the oversight.

Take Corrective Action: Work collaboratively with the relevant departments to rectify the error. This may involve adjusting financial statements, implementing additional controls, or revising processes to prevent future oversights.

Review and Strengthen Audit Processes: Finally, review the audit process to understand how the error was missed. Strengthen audit procedures, training, or oversight to minimize the risk of similar mistakes occurring in the future.

Mistakes in the audit process, while unfortunate, provide valuable learning opportunities. By addressing these issues head-on and taking steps to prevent their recurrence, audit professionals can enhance the reliability, accuracy, and integrity of future audits.

Frequently Asked Questions (FAQs)

What should I do if I find inconsistencies in audit results? |

|---|

Revisit the audit methodology, ensure all transactions have been accurately accounted for, and consider a secondary review by an independent auditor to verify the findings. |

I've discovered a significant error after the audit report was finalized. How should I proceed? |

|---|

Immediately inform your superiors or the audit committee, assess the error's implications, transparently communicate the oversight, and take necessary corrective measures. |

How can I prevent inconsistencies and errors in future audits? |

|---|

Enhance your audit procedures by incorporating more rigorous checks and balances, continuous training for audit staff, and adopting advanced auditing technologies to improve accuracy and efficiency. |

Is it necessary to inform external stakeholders about discovered errors post-audit? |

|---|

Depending on the significance of the error and its impact on the financial statements, it may be necessary to inform external stakeholders, including regulatory bodies, in accordance with legal and ethical standards. |

What steps can be taken to improve the reliability of audit findings? |

|---|

Implement a structured audit methodology, utilize data analytics tools for more in-depth analysis, and ensure ongoing professional development for audit staff to keep abreast of the latest auditing standards and technologies. |

By addressing these common questions and following the outlined troubleshooting guide, audit professionals can enhance their ability to navigate challenges effectively, thereby improving the overall quality and reliability of the audit process.

Conclusion

The role of internal audit accounting is a pivotal component of [Your Company Name]'s operational framework. Through diligent adherence to established procedures and a commitment to thoroughness, the practice of internal auditing will evolve into an integral and streamlined aspect of the company's routine activities. It is through this consistent application and a keen focus on detail that internal audit accounting can significantly contribute to enhancing the organization's financial integrity. Embracing this function not only safeguards the company's assets but also fortifies its reputation and ensures sustainable growth and success in the long term.