Free Account Budget Review

Expenditure vs Budget

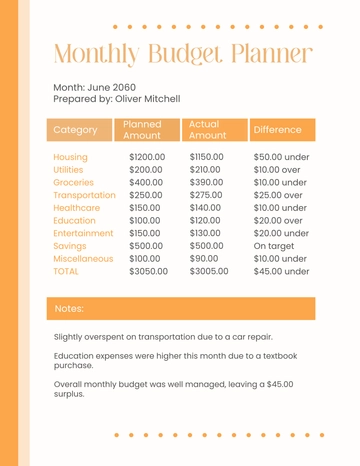

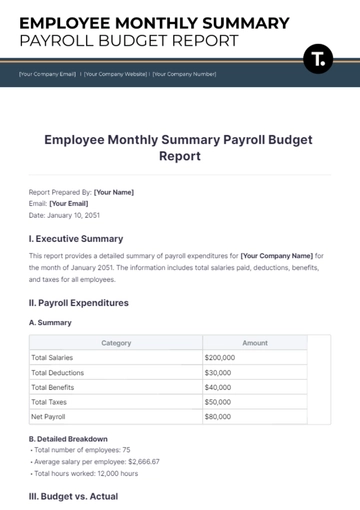

Having observed and analyzed the year's actual expenditures compared to the budgeted amounts, there are both noteworthy variances and minor discrepancies. The fact that some departments managed to keep their spending within their budgeted amounts portrays commendable financial discipline. Nonetheless, other departments significantly overspent, requiring a careful scrutiny of the causes. Going forward, it'd be beneficial to establish clear communication between all departments—this could help identify and alleviate spending discrepancies more efficiently.

Revenue Sources

Our various revenue sources, which include income from sales, services, grants, and investments, have collectively contributed to a satisfactory overall budget performance. Sales income has consistently been the key contributor to the revenue stream, demonstrating the capability of our sales teams in securing high profits while maintaining competitive pricing.

Our services sector also showed a strong performance in terms of revenue generation, indicating our ability to offer high-quality, value-added services to our clients. However, while the revenue from grants and investments contributed to the overall performance, their contribution was somewhat inconsistent and requires further analysis to ascertain whether this variance is a trend or an anomaly.

Performance Review

Assessing performances, the Sales Department stood out with its impressive revenue contribution. Their consistent surplus in the performance chart exhibits a strong connection between goal-setting and achieving high sales numbers. Nevertheless, the Production Department has a slight disadvantage, with higher actual costs against the budget—not necessarily an indictment on their performance but an indication that a re-evaluation of their budgeting process is necessary.

Department | Budgeted | Actual | Variance |

|---|---|---|---|

Sales | $500,000 | $620,000 | $120,000 |

Production |

Conclusion

Overall, the annual budget performance has been satisfactory with room for improvement. To enhance our financial efficiency and performance, we need to focus on effectively managing our expenditures, especially in areas where costs tend to run over the budget. This commitment to prudent financial management, in alignment with our revenue generation resources, should guarantee improved future budget performance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Uncover financial insights effortlessly with the Account Budget Review Template from Template.net. This editable and customizable template, equipped with an AI Editor Tool, streamlines budget analysis. Effortlessly compare actuals against forecasts, spot variances, and craft informed strategies for resource optimization. Take control of your finances with this powerful tool, tailored to suit your needs.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

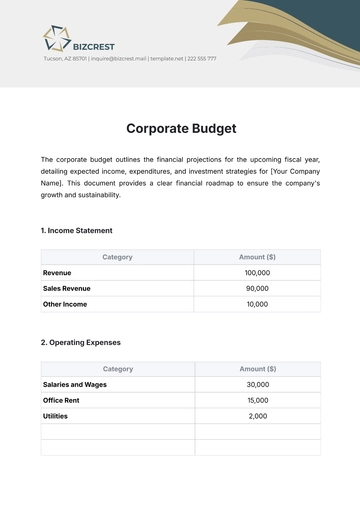

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

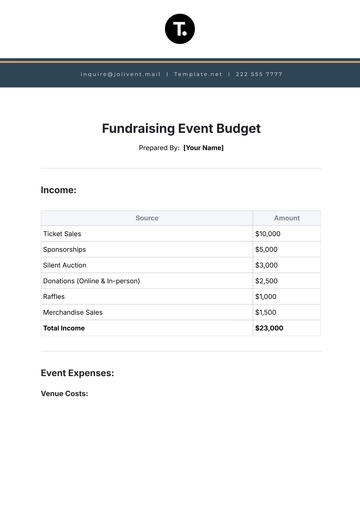

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising