Accounting Internal Audit Program Plan

Fiscal Year: [Year]

This Accounting Internal Audit Program Plan outlines the strategic approach our Internal Audit Department will undertake to assess and enhance our organization's financial and operational integrity. Our focus is on key risk areas with the objective of adding value, improving our organization's operations, and ensuring compliance with relevant laws and regulations.

Objective

The primary objective of this plan is to systematically evaluate the effectiveness of our internal control environment, risk management practices, and governance processes. Through this plan, we aim to identify opportunities for improvement and provide recommendations that strengthen our financial and operational performance.

Scope

The scope for the [Year] fiscal year includes, but is not limited to, the following areas:

Revenue and Receivables: Analysis of revenue recognition practices to ensure compliance with accounting standards. We will review a sample of transactions, potentially totaling $[Amount], to verify accuracy and completeness.

Expenses and Payables: Examination of expense recognition and payment processes. A focus will be on ensuring expenses totaling an estimated $[Amount] are appropriately authorized and recorded.

Payroll: Verification of payroll expenses, estimated at $[Amount] for the year, to ensure accurate processing and compliance with tax and labor laws.

Inventory Management: Assessment of inventory controls and valuation for inventory reported at $[Amount], focusing on accuracy and obsolescence.

Fixed Assets: Review of fixed asset acquisitions, disposals, and depreciation methods for assets valued at $[Amount], ensuring compliance with accounting standards.

Cash and Bank Reconciliations: Evaluation of cash handling and reconciliation practices for bank accounts totaling $[Amount] to prevent fraud and ensure accuracy.

Methodology

Our audit methodology will include a mix of analytical reviews, tests of controls, substantive testing, and interviews. We will utilize data analytics tools to identify patterns and anomalies in large datasets.

Risk Assessment

A risk-based approach will guide the audit selection process, focusing on areas with the highest risk of material misstatement or operational inefficiency. Our risk assessment process involves analyzing past audit findings, considering changes in the organizational structure or operations, and staying informed about external factors that could impact our financial position.

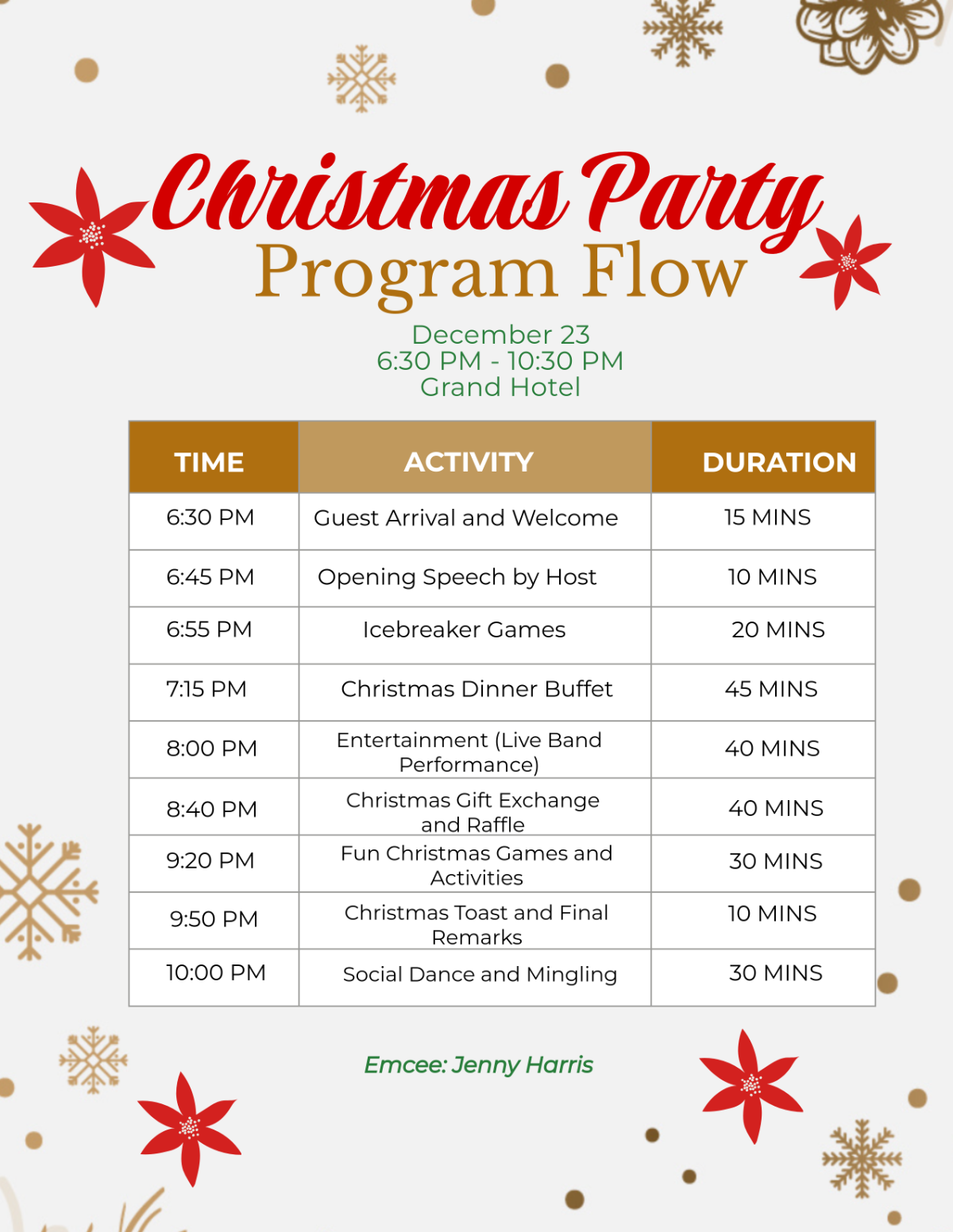

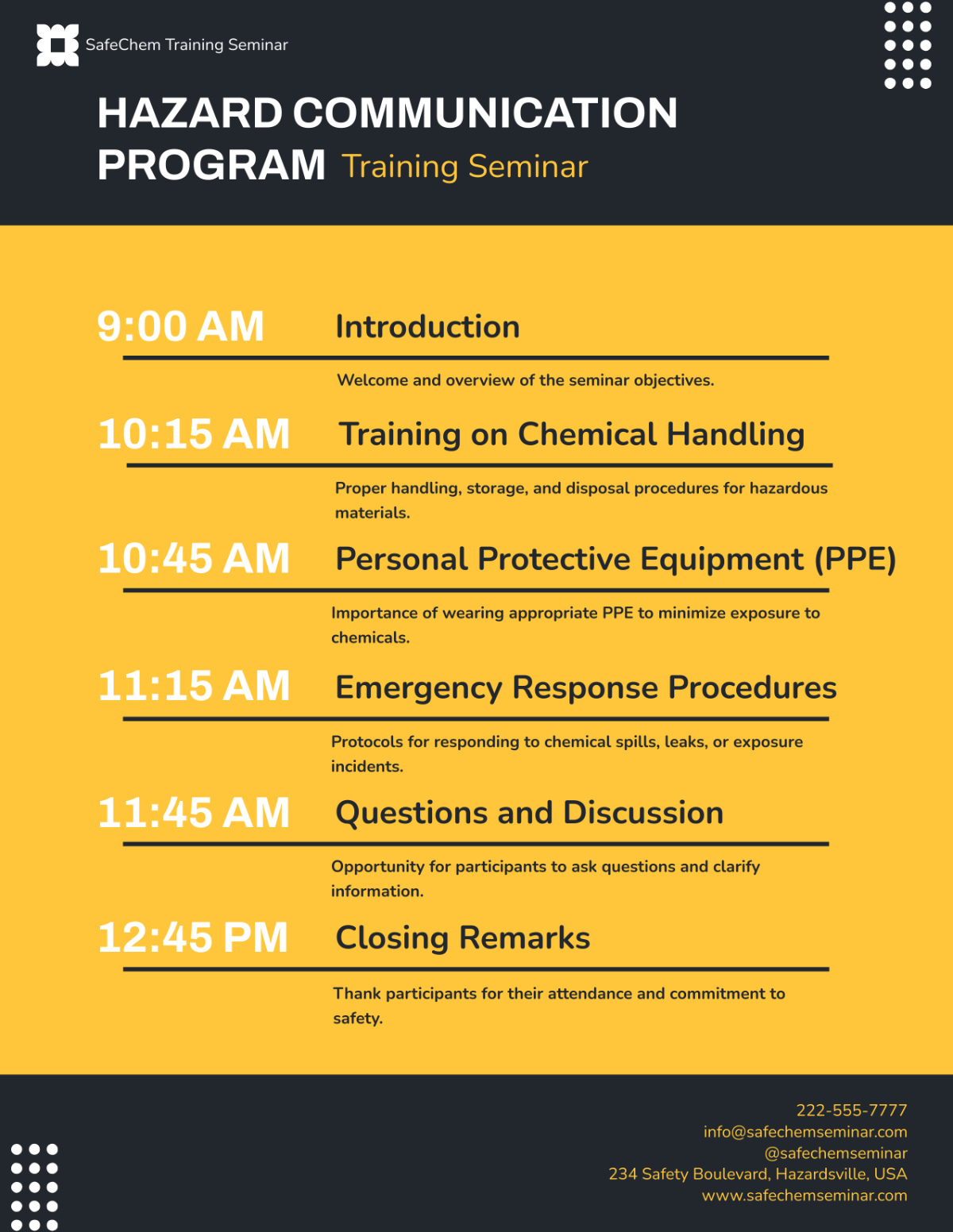

Audit Plan Schedule

Quarter | Description |

|---|---|

Q1 | Revenue and Receivables, Expenses and Payables |

Q2 | |

Q3 | |

Q4 |

Reporting

For each audit, we will prepare a report detailing our findings, the associated risks, and our recommendations. For example, if during the revenue audit we find discrepancies amounting to $[Amount] due to misapplied revenue recognition criteria, our report will highlight this issue, its implications, and suggest corrective actions.

Follow-Up

We will track management's implementation of audit recommendations and perform follow-up audits as necessary to ensure corrective actions have been effectively implemented.

Conclusion

Our Accounting Internal Audit Program Plan for [Year] is designed to support our organization's commitment to financial integrity, operational efficiency, and compliance. Through this comprehensive approach, we aim to enhance our internal controls, mitigate risk, and provide assurance to our stakeholders regarding the reliability of our financial reporting and operational practices.